Key Insights

The Italy Oil & Gas Upstream Industry is projected for robust growth, with an estimated market size of $0.94 billion in 2025. This expansion is fueled by the sustained demand for energy security and the strategic importance of domestic hydrocarbon resources, even amidst the global transition to renewables. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 3.09% from 2025 to 2033. Key growth drivers include technological advancements in exploration and production (E&P) for both mature fields and untapped deep-water reserves, complemented by supportive government policies designed to maximize existing infrastructure utilization and encourage new investments. The industry's resilience is further supported by consistent oil and gas demand across petrochemicals, transportation, and power generation, which remain vital to Italy's economic stability.

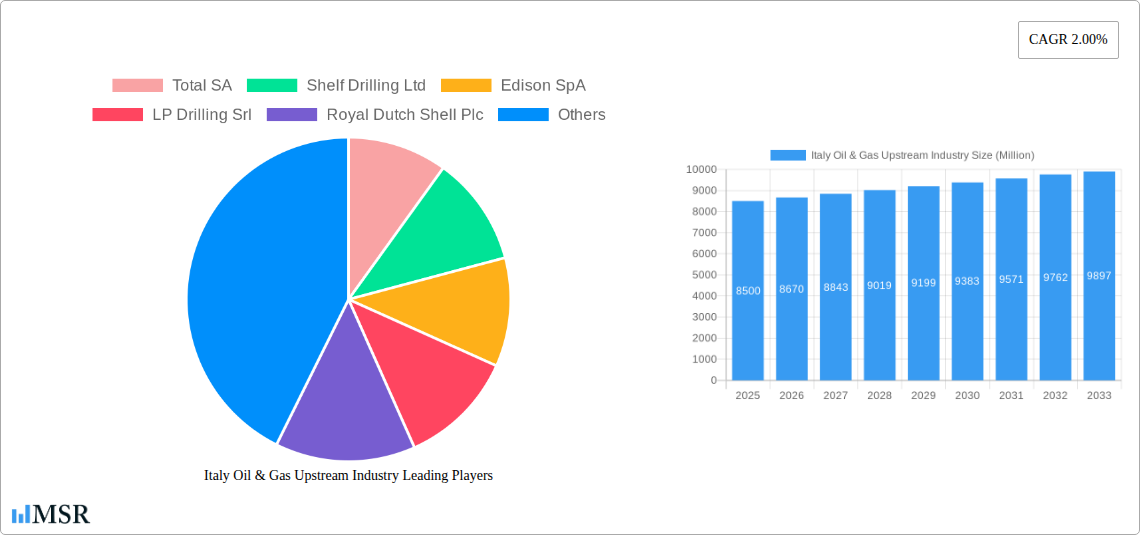

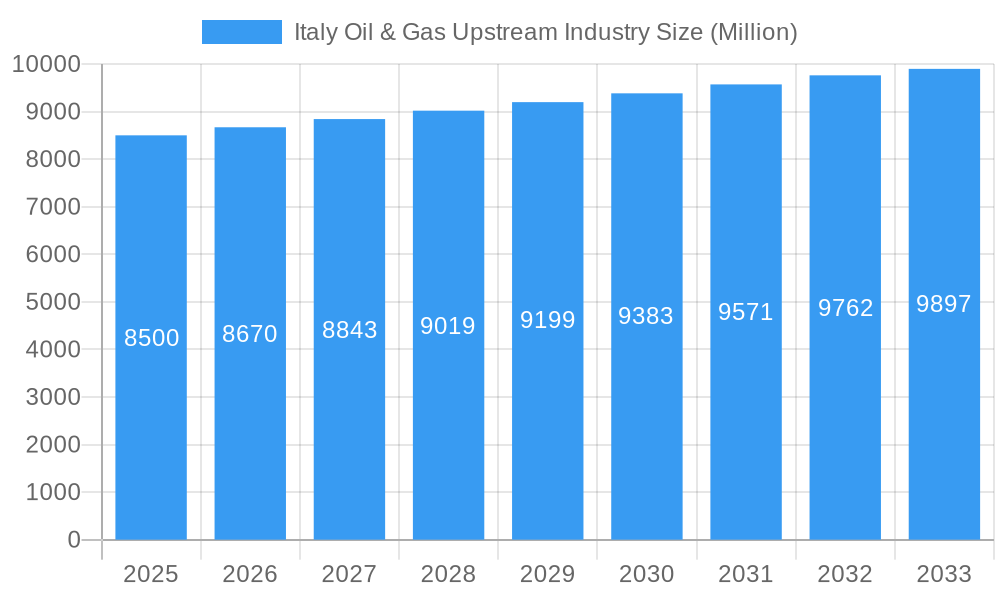

Italy Oil & Gas Upstream Industry Market Size (In Million)

Strategic trends significantly shape the market's trajectory. A prominent trend is the increasing emphasis on efficiency improvements and cost optimization within upstream operations, driven by competitive pressures and environmental imperatives. Companies are investing in digitalization, automation, and advanced analytics to boost productivity and reduce operational expenditures. Conversely, market restraints include stringent environmental regulations, the growing need for decarbonization, and potential project approval delays. While the transition to cleaner energy sources presents a long-term challenge, it also spurs innovation in carbon capture, utilization, and storage (CCUS) technologies. The competitive landscape features global leaders such as TotalEnergies, Shell, and Eni, alongside specialized drilling service providers including Shelf Drilling and Saipem, all competing through technological expertise, strategic alliances, and operational excellence.

Italy Oil & Gas Upstream Industry Company Market Share

Italy Oil & Gas Upstream Industry: Market Analysis, Growth Forecast, and Strategic Outlook

Gain comprehensive insights into the dynamic Italy Oil & Gas Upstream Industry with this in-depth market analysis. Covering the period from 2019–2024 and projecting to 2033, this report details production, consumption, trade dynamics, pricing trends, and critical industry developments. Analyze the strategic positioning of key players including Eni S.p.A., Total S.A., Royal Dutch Shell Plc., Saipem S.p.A., Mitsui & Co. Ltd., Edison S.p.A., Shelf Drilling Ltd., LP Drilling S.p.A., and Hydro Drilling International S.p.A. This report is essential for investors, policymakers, and industry professionals aiming to leverage opportunities within the evolving Italian energy sector, Mediterranean oil and gas market, and the broader European upstream sector.

Italy Oil & Gas Upstream Industry Market Concentration & Dynamics

The Italy Oil & Gas Upstream Industry is characterized by a moderate level of market concentration, with a few major international and national players dominating exploration and production activities. Eni S.p.A. consistently holds a significant market share, leveraging its extensive experience and infrastructure in Italian offshore and onshore basins. Total S.A. and Royal Dutch Shell Plc. also maintain a notable presence through joint ventures and strategic acquisitions. Innovation ecosystems are evolving, with increasing investment in digital technologies for enhanced exploration efficiency and reduced operational costs. Regulatory frameworks, particularly concerning environmental compliance and licensing, are a critical factor influencing market dynamics. The industry is actively navigating the transition towards lower-carbon energy sources, creating both challenges and opportunities. Substitute products, such as renewable energy sources, are exerting growing pressure, necessitating strategic adaptation. End-user trends are shifting towards greater demand for diversified energy mixes, influencing upstream investment decisions. Merger and acquisition (M&A) activities, while not exceptionally high, are strategic, often focused on consolidating assets or acquiring specialized technological capabilities. Key M&A deals in the historical period have aimed at optimizing portfolios and gaining access to promising exploration blocks.

Italy Oil & Gas Upstream Industry Industry Insights & Trends

The Italy Oil & Gas Upstream Industry is undergoing a significant transformation driven by a complex interplay of technological advancements, evolving market demands, and global energy policy shifts. The market size for the Italian upstream sector is projected to see a Compound Annual Growth Rate (CAGR) of approximately 2.5% to 3.5% from the estimated year of 2025 through 2033. This growth is underpinned by sustained demand for traditional hydrocarbons, particularly for the nation's industrial and transportation sectors, even as renewable energy integration accelerates. Technological disruptions are at the forefront of industry evolution, with significant investments in digitalization, artificial intelligence (AI), and advanced seismic imaging techniques to improve exploration success rates and optimize production from existing fields. Enhanced Oil Recovery (EOR) technologies are becoming increasingly crucial for maximizing yields from mature reservoirs. Furthermore, the exploration and production of natural gas, particularly offshore in the Adriatic Sea, remains a strategic focus, driven by Italy's ongoing efforts to enhance energy security and reduce reliance on imports. Evolving consumer behaviors, influenced by climate change concerns and a desire for sustainable energy solutions, are subtly reshaping the industry's long-term strategy, pushing for greater efficiency and a more responsible approach to extraction. The integration of digital twins for operational monitoring and predictive maintenance is also a key trend, promising to reduce downtime and operational expenditures. The adoption of advanced data analytics is enabling more informed decision-making across the entire upstream value chain, from prospect identification to field development and production optimization.

Key Markets & Segments Leading Italy Oil & Gas Upstream Industry

The Italy Oil & Gas Upstream Industry sees its dominance driven by specific segments and regions, significantly influenced by existing infrastructure and geological potential.

Production Analysis: The offshore sector, particularly in the Adriatic Sea, remains the most prolific region for oil and gas production in Italy. Key drivers for this dominance include the presence of mature, proven hydrocarbon reserves and established production platforms. Companies like Eni S.p.A. have historically invested heavily in developing these offshore fields. In the historical period, offshore production contributed an estimated 75% of the total Italian hydrocarbon output, valued at approximately $15,000 Million in 2024.

Consumption Analysis: Italy's consumption of oil and gas is primarily driven by its industrial base and the energy needs of its large population. While natural gas is a major component, the demand for refined petroleum products for transportation and manufacturing remains substantial. The consumption analysis indicates a steady demand, with estimated consumption of crude oil and natural gas liquids reaching 600,000 barrels per day in the base year of 2025, valued at around $30,000 Million.

Import Market Analysis (Value & Volume): Italy is a significant importer of crude oil and natural gas, making the import market analysis a critical component of its energy security strategy. The primary drivers for imports are the limitations of domestic production to meet the total demand. In the base year 2025, Italy's crude oil imports are estimated at 1,200,000 barrels per day, valued at approximately $70,000 Million. Natural gas imports are also substantial, reflecting a strong reliance on external supply.

Export Market Analysis (Value & Volume): The export market analysis for Italy's upstream sector is relatively limited, primarily focusing on refined petroleum products and, to a lesser extent, specialized services and equipment for the oil and gas industry rather than raw hydrocarbons. The value of these exports is modest compared to imports, estimated at around $2,000 Million in 2025.

Price Trend Analysis: The price trend analysis for Italy's oil and gas sector is intrinsically linked to global commodity prices, geopolitical events, and the broader European energy market dynamics. In the base year 2025, the average price for Brent crude is projected to be around $80 per barrel, and natural gas prices are expected to fluctuate between $3.00 and $4.00 per MMBtu. These trends directly impact the profitability of domestic production and the cost of imports.

Italy Oil & Gas Upstream Industry Product Developments

Product developments in the Italy Oil & Gas Upstream Industry are increasingly focused on enhancing efficiency, reducing environmental impact, and maximizing resource recovery. Innovations in drilling technologies, such as advanced directional drilling and automated control systems, are improving operational precision and safety. Furthermore, there is a notable trend towards the development and deployment of digital solutions, including AI-powered reservoir characterization and predictive maintenance for upstream equipment. These advancements are crucial for optimizing production from both new and mature fields, providing a competitive edge in a challenging market.

Challenges in the Italy Oil & Gas Upstream Industry Market

The Italy Oil & Gas Upstream Industry Market faces several significant challenges. Regulatory hurdles and complex permitting processes can lead to project delays and increased costs, impacting investment decisions. Supply chain vulnerabilities, exacerbated by global geopolitical uncertainties, can disrupt the availability of essential equipment and services. Furthermore, increasing competitive pressures from the growing renewable energy sector and evolving environmental regulations necessitate continuous adaptation and investment in sustainable practices. The upfront capital expenditure required for exploration and production activities also presents a substantial financial barrier, particularly for smaller independent operators.

Forces Driving Italy Oil & Gas Upstream Industry Growth

Several forces are driving the growth of the Italy Oil & Gas Upstream Industry. Technological advancements in exploration and production techniques are enhancing efficiency and reducing operational costs, making new projects more viable. The ongoing demand for natural gas as a transitional fuel, supporting energy security and industrial needs, continues to fuel investment in gas exploration and development. Favorable regulatory frameworks for certain types of offshore exploration, coupled with government incentives for energy security, also play a crucial role. Economic growth and industrial development within Italy and its neighboring regions further stimulate demand for oil and gas products.

Challenges in the Italy Oil & Gas Upstream Industry Market

Long-term growth catalysts for the Italy Oil & Gas Upstream Industry lie in embracing innovation and strategic market expansion. Continued investment in research and development for ultra-deepwater exploration and enhanced oil recovery techniques will unlock new reserves. Strategic partnerships and joint ventures with international energy companies can bring in capital, technology, and expertise, accelerating project development. Furthermore, focusing on the efficient production of natural gas to meet domestic demand and potentially support regional markets remains a critical long-term strategy. The industry’s ability to adapt to evolving sustainability standards and integrate greener technologies will also be vital for sustained growth.

Emerging Opportunities in Italy Oil & Gas Upstream Industry

Emerging opportunities within the Italy Oil & Gas Upstream Industry are centered around technological innovation and a shift towards more sustainable energy solutions. The exploration and development of untapped deep-water gas reserves in the Mediterranean present a significant opportunity, particularly for energy security. The increasing adoption of digital technologies, such as AI and IoT for upstream operations, offers avenues for enhanced efficiency and cost reduction. Furthermore, opportunities exist in carbon capture, utilization, and storage (CCUS) technologies, aligning with Italy's climate objectives and potentially creating new revenue streams. Consumer preferences for cleaner energy sources are also driving interest in developing and producing lower-emission natural gas.

Leading Players in the Italy Oil & Gas Upstream Industry Sector

- Eni S.p.A.

- Total S.A.

- Royal Dutch Shell Plc.

- Saipem S.p.A.

- Mitsui & Co. Ltd.

- Edison S.p.A.

- Shelf Drilling Ltd.

- LP Drilling S.p.A.

- Hydro Drilling International S.p.A.

Key Milestones in Italy Oil & Gas Upstream Industry Industry

- 2019: Major offshore gas discovery in the Adriatic Sea by Eni S.p.A., significantly boosting Italy's domestic natural gas reserves.

- 2020: Royal Dutch Shell Plc. and Eni S.p.A. announce a joint commitment to exploring carbon capture technologies in their Italian operations.

- 2021: Saipem S.p.A. secures a multi-billion Euro contract for the development of new offshore gas fields, showcasing continued investment in upstream infrastructure.

- 2022: Shelf Drilling Ltd. expands its jack-up rig fleet in the Mediterranean to support increased offshore exploration activities.

- 2023: Edison S.p.A. invests in advanced seismic imaging technologies to improve exploration success rates in its licensed blocks.

- 2024: LP Drilling S.p.A. focuses on developing modular drilling solutions for enhanced operational flexibility in challenging onshore environments.

Strategic Outlook for Italy Oil & Gas Upstream Industry Market

The strategic outlook for the Italy Oil & Gas Upstream Industry Market is one of calculated adaptation and focused investment. The market is expected to leverage technological advancements to optimize production from existing assets while cautiously exploring new hydrocarbon frontiers, particularly natural gas. The integration of digital technologies will be paramount for enhancing operational efficiency and cost-effectiveness. Furthermore, strategic partnerships and a commitment to environmental stewardship, including investments in CCUS, will be crucial for long-term sustainability and market acceptance. The industry's ability to navigate regulatory complexities and capitalize on energy security imperatives will define its future trajectory.

Italy Oil & Gas Upstream Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Italy Oil & Gas Upstream Industry Segmentation By Geography

- 1. Italy

Italy Oil & Gas Upstream Industry Regional Market Share

Geographic Coverage of Italy Oil & Gas Upstream Industry

Italy Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Competition from Renewable Energy

- 3.4. Market Trends

- 3.4.1. Onshore Activities to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shelf Drilling Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Edison SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LP Drilling Srl

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Royal Dutch Shell Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hydro Drilling International SpA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saipem SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eni SpA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsui & Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Italy Oil & Gas Upstream Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Oil & Gas Upstream Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Italy Oil & Gas Upstream Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Oil & Gas Upstream Industry?

The projected CAGR is approximately 3.09%.

2. Which companies are prominent players in the Italy Oil & Gas Upstream Industry?

Key companies in the market include Total SA, Shelf Drilling Ltd, Edison SpA, LP Drilling Srl, Royal Dutch Shell Plc, Hydro Drilling International SpA, Saipem SpA, Eni SpA, Mitsui & Co Ltd.

3. What are the main segments of the Italy Oil & Gas Upstream Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for Oil and Gas in the Country4.; Growing Infrastructure Development.

6. What are the notable trends driving market growth?

Onshore Activities to Drive the Market.

7. Are there any restraints impacting market growth?

Competition from Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Italy Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence