Key Insights

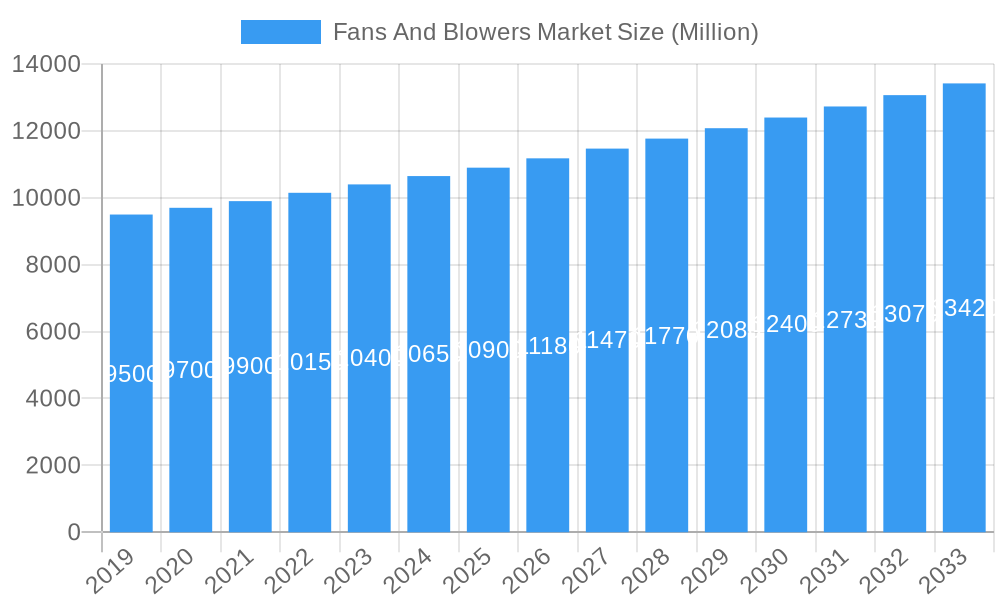

The global Fans and Blowers Market is poised for steady growth, projected to reach a substantial XX Million by the end of 2025, and is anticipated to maintain a Compound Annual Growth Rate (CAGR) exceeding 2.50% through 2033. This expansion is primarily fueled by robust demand across various industrial sectors, including power generation, oil and gas, construction, chemicals, and mining. These industries rely heavily on efficient ventilation and air movement systems for critical processes such as cooling, dust removal, material handling, and air pollution control. The increasing emphasis on energy efficiency and the adoption of advanced, technologically superior fans and blowers are key drivers of this market growth. Furthermore, the ongoing industrialization and infrastructure development in emerging economies are significantly contributing to the sustained demand for these essential components.

Fans And Blowers Market Market Size (In Billion)

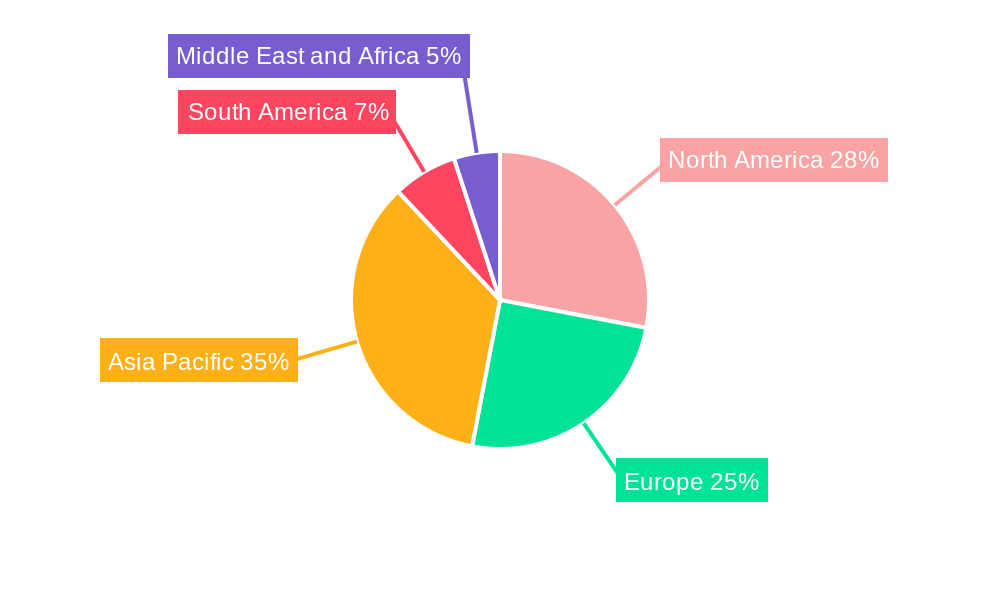

The market is segmented by technology into Centrifugal and Axial fans and blowers, with both segments witnessing consistent demand. Geographically, the Asia Pacific region is expected to emerge as a dominant force, driven by rapid industrial expansion and substantial investments in manufacturing and infrastructure projects. North America and Europe also represent significant markets, characterized by a strong focus on upgrading existing industrial facilities with more energy-efficient and environmentally compliant ventilation solutions. Restraints such as increasing raw material costs and intense competition among market players are present, but the overarching demand from expanding industrial footprints and the continuous need for optimized air management systems are expected to outweigh these challenges, ensuring a positive trajectory for the Fans and Blowers Market.

Fans And Blowers Market Company Market Share

This in-depth report provides a definitive analysis of the global fans and blowers market, a critical sector supporting diverse industrial and commercial operations. Leveraging extensive data from the historical period (2019-2024), base year (2025), and projecting through the forecast period (2025-2033), this research offers unparalleled insights for industry stakeholders. Discover market dynamics, growth drivers, key trends, and emerging opportunities within this robust and expanding industry.

Fans And Blowers Market Market Concentration & Dynamics

The fans and blowers market exhibits a moderate to high concentration, with key players like Greenheck Fan Corp, Continental Blower LLC, and Howden Group Ltd dominating significant market share. Innovation is driven by advancements in energy efficiency, noise reduction, and smart control systems. Regulatory frameworks, particularly concerning environmental standards and safety certifications, are increasingly shaping product development and market access. The threat of substitute products, such as general ventilation systems with integrated fan components, exists but is often offset by specialized performance requirements for dedicated fans and blowers. End-user trends point towards a growing demand for customized solutions, predictive maintenance capabilities, and integration with IoT platforms. Mergers and acquisitions (M&A) activities, evidenced by several recent strategic acquisitions aimed at expanding product portfolios and geographical reach, are a key dynamic in consolidating market power. The market has witnessed approximately 15-20 significant M&A deals in the past five years, indicating a consolidation phase.

- Key Market Drivers: Increasing industrialization, stringent environmental regulations, rising energy efficiency demands.

- Competitive Landscape: Characterized by a mix of large, established manufacturers and specialized niche players.

- Innovation Focus: Energy-efficient designs, smart controls, aerodynamic advancements.

Fans And Blowers Market Industry Insights & Trends

The fans and blowers market is poised for substantial growth, driven by a confluence of factors including rapid industrial expansion, infrastructure development, and a global push for energy efficiency. The market size is projected to reach an estimated USD 35,000 Million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). Technological disruptions are at the forefront, with advancements in materials science leading to lighter, more durable fan blades, and the integration of variable frequency drives (VFDs) significantly enhancing energy savings. Evolving consumer behaviors, particularly within the industrial sector, emphasize lifecycle cost analysis, leading to a preference for high-efficiency, low-maintenance equipment. The growing adoption of smart technologies, including IoT-enabled monitoring and predictive maintenance solutions, is transforming how fans and blowers are operated and maintained, further fueling market expansion. The industrial segment, encompassing power generation, oil and gas, construction, iron and steel, chemicals, and mining, is the largest contributor to market revenue, accounting for over 60% of the total market size. Within this, the oil and gas sector is witnessing a surge in demand due to ongoing exploration and production activities and the construction of new refineries and petrochemical plants, as highlighted by recent industry developments. The increasing focus on sustainable manufacturing practices and the need to comply with increasingly stringent emission standards are also significant growth drivers. Furthermore, the commercial sector, driven by the need for efficient HVAC systems in growing urban centers and rising investments in commercial real estate, presents a significant and steadily expanding market. The demand for specialized blowers in applications like material handling, dust collection, and ventilation in confined spaces further bolsters the market's resilience and growth trajectory. The overall trend is towards intelligent, energy-efficient, and application-specific solutions.

Key Markets & Segments Leading Fans And Blowers Market

The Industrial segment stands as the paramount driver of the fans and blowers market, spearheading growth and innovation across diverse sub-sectors. Within this broad category, Power Generation requires robust ventilation solutions for turbines and cooling systems, while the Oil and Gas sector necessitates specialized blowers for processing, refining, and safety applications. The Construction industry's demand for air purification, dust control, and temporary ventilation systems contributes significantly. Furthermore, the Iron and Steel and Chemicals industries rely on high-performance fans and blowers for process heating, cooling, and fume extraction, often under extreme conditions. The Mining sector utilizes these products for underground ventilation and material handling.

- Dominant Technology: Centrifugal Fans: These fans are preferred for applications requiring high pressure and moderate airflow, making them indispensable in industrial processes like material conveying, HVAC systems, and exhaust ventilation in manufacturing plants. Their robust design and efficiency in handling dust-laden air make them a staple in heavy industries.

- Key Sub-Segment: Oil and Gas Industry: Driven by global energy demands and significant investments in new projects, this sector exhibits a strong and consistent demand for high-capacity and specialized blowers for various stages of exploration, extraction, refining, and petrochemical production.

- Regional Leadership: Asia Pacific: This region dominates the global fans and blowers market due to rapid industrialization, burgeoning infrastructure projects, and increasing manufacturing output. China, in particular, is a major hub for both production and consumption, fueled by extensive investments in sectors like power generation, chemicals, and construction.

- Emerging Sub-Segments: The Commercial sector is experiencing accelerated growth, fueled by the construction of modern office buildings, retail spaces, and hospitality establishments, all requiring efficient and reliable HVAC and ventilation systems.

The dominance of the Industrial segment stems from its critical role in enabling core manufacturing and processing activities, where the performance and reliability of fans and blowers directly impact operational efficiency and safety. The continuous expansion of industrial infrastructure globally, coupled with upgrades to existing facilities, ensures a sustained demand for these essential components. The Asia Pacific region's leadership is a direct consequence of its status as a manufacturing powerhouse and its ongoing economic development, necessitating large-scale industrial and infrastructural investments.

Fans And Blowers Market Product Developments

Recent product developments in the fans and blowers market focus on enhancing energy efficiency, reducing noise pollution, and integrating smart technologies. Manufacturers are introducing advanced aerodynamic designs, utilizing lightweight composite materials, and incorporating variable speed drives (VSDs) to optimize energy consumption. Smart capabilities, including remote monitoring, predictive maintenance alerts, and integration with building management systems (BMS), are becoming standard features, offering enhanced operational control and cost savings. These innovations cater to the growing demand for sustainable and intelligent ventilation solutions across industrial, commercial, and residential applications, providing a competitive edge in the market.

Challenges in the Fans And Blowers Market Market

The fans and blowers market faces several challenges that can impede its growth trajectory. High initial capital investment for advanced, energy-efficient models can be a deterrent for some end-users, particularly in price-sensitive markets or for smaller enterprises. Stringent and evolving regulatory compliance, especially regarding emissions and noise levels, necessitates continuous research and development, adding to production costs and potentially slowing down product launches. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and increased lead times for critical components, impacting production schedules and order fulfillment. Furthermore, intense price competition among numerous manufacturers, especially in the commodity segments, can put pressure on profit margins.

- Regulatory Hurdles: Compliance with diverse international and national standards.

- Supply Chain Volatility: Dependence on raw material availability and logistics.

- Cost Sensitivity: Balancing advanced features with affordability for certain applications.

Forces Driving Fans And Blowers Market Growth

Several powerful forces are propelling the fans and blowers market forward. The escalating global demand for energy efficiency is a primary catalyst, pushing manufacturers to develop and adopt advanced technologies like VFDs and aerodynamic designs. Rapid industrialization and infrastructure development worldwide, particularly in emerging economies, create a continuous need for ventilation and air movement solutions in sectors such as power generation, manufacturing, and construction. Growing awareness of indoor air quality (IAQ) and environmental regulations is also driving demand for better ventilation systems in both commercial and industrial settings. Technological advancements, leading to more durable, reliable, and intelligent fans and blowers, further enhance their appeal.

- Energy Efficiency Mandates: Driving innovation in low-power consumption designs.

- Industrial Expansion: Increased manufacturing and processing activities require robust ventilation.

- IAQ Awareness: Growing demand for healthier and safer indoor environments.

Challenges in the Fans And Blowers Market Market

While the market is robust, long-term growth will depend on overcoming certain intrinsic challenges. The need for continuous investment in research and development to keep pace with technological advancements and evolving environmental standards is significant. Skilled labor shortages in manufacturing and specialized installation can also pose a constraint. The market must also adapt to the increasing demand for customized solutions, which can complicate mass production and increase lead times. Furthermore, managing the lifecycle costs for end-users, including maintenance and energy consumption, will be crucial for sustained adoption of premium products.

Emerging Opportunities in Fans And Blowers Market

The fans and blowers market is ripe with emerging opportunities. The burgeoning field of smart manufacturing and Industry 4.0 presents a significant avenue for growth, with opportunities in developing IoT-enabled fans and blowers offering predictive maintenance, remote diagnostics, and integration with automated systems. The increasing global focus on sustainability and renewable energy is driving demand for specialized ventilation in renewable energy infrastructure, such as wind farms and solar panel manufacturing. Expansion into developing regions with rapidly growing industrial bases offers untapped market potential. Furthermore, the rising demand for specialty fans and blowers for niche applications, like medical equipment, data centers, and advanced HVAC systems, provides lucrative avenues for market players.

- Smart Technology Integration: IoT-enabled devices for optimized performance and maintenance.

- Renewable Energy Sector: Ventilation solutions for sustainable energy infrastructure.

- Niche Applications: Growing demand in specialized industries like healthcare and data centers.

Leading Players in the Fans And Blowers Market Sector

- Continental Blower LLC

- Flakt Woods Group SA

- Pollrich GmbH

- Greenheck Fan Corp

- Acme Engineering & Manufacturing Corp

- Airmaster Fan Company Inc

- CG Power and Industrial Solutions Limited

- Gardner Denver Inc

- DongKun Industrial Co Ltd

- Loren Cook Company

- Howden Group Ltd

Key Milestones in Fans And Blowers Market Industry

- March 2023: Saudi Aramco and its Chinese partners announced their aim to start full operations of a refinery and petrochemical project in northeast China in 2026. The project in Liaoning province's city of Panjin is expected to cost USD 10 billion, signifying substantial future demand for industrial fans and blowers in the petrochemical sector.

- December 2022: Saudi Arabian Oil Company and TotalEnergies took the final investment decision for the construction of a petrochemical facility in Saudi Arabia. The 'Amiral' complex, integrated with the existing SATORP refinery in Jubail, will require significant airflow and ventilation solutions, impacting the industrial fans and blowers market.

Strategic Outlook for Fans And Blowers Market Market

The strategic outlook for the fans and blowers market is exceptionally positive, fueled by ongoing technological advancements and robust global industrial expansion. Growth accelerators will include further integration of AI and machine learning for predictive maintenance and operational optimization, catering to the Industry 4.0 paradigm. Continued emphasis on developing highly energy-efficient solutions, compliant with stringent environmental regulations, will be critical. Strategic partnerships and collaborations, especially for expanding into underserved geographical markets and developing application-specific products, will be key to capturing market share. The increasing demand for intelligent, connected, and sustainable ventilation systems presents significant opportunities for market leaders to innovate and expand their product portfolios, solidifying their positions in this vital industry.

Fans And Blowers Market Segmentation

-

1. Technology

- 1.1. Centrifugal

- 1.2. Axial

-

2. Deployment

-

2.1. Industrial

- 2.1.1. Power Generation

- 2.1.2. Oil and Gas

- 2.1.3. Construction

- 2.1.4. Iron and Steel

- 2.1.5. Chemicals

- 2.1.6. Mining

- 2.1.7. Other Industries

- 2.2. Commercial

-

2.1. Industrial

Fans And Blowers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Fans And Blowers Market Regional Market Share

Geographic Coverage of Fans And Blowers Market

Fans And Blowers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Recycling Operations

- 3.4. Market Trends

- 3.4.1. Industrial Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Centrifugal

- 5.1.2. Axial

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Industrial

- 5.2.1.1. Power Generation

- 5.2.1.2. Oil and Gas

- 5.2.1.3. Construction

- 5.2.1.4. Iron and Steel

- 5.2.1.5. Chemicals

- 5.2.1.6. Mining

- 5.2.1.7. Other Industries

- 5.2.2. Commercial

- 5.2.1. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Centrifugal

- 6.1.2. Axial

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Industrial

- 6.2.1.1. Power Generation

- 6.2.1.2. Oil and Gas

- 6.2.1.3. Construction

- 6.2.1.4. Iron and Steel

- 6.2.1.5. Chemicals

- 6.2.1.6. Mining

- 6.2.1.7. Other Industries

- 6.2.2. Commercial

- 6.2.1. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Centrifugal

- 7.1.2. Axial

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Industrial

- 7.2.1.1. Power Generation

- 7.2.1.2. Oil and Gas

- 7.2.1.3. Construction

- 7.2.1.4. Iron and Steel

- 7.2.1.5. Chemicals

- 7.2.1.6. Mining

- 7.2.1.7. Other Industries

- 7.2.2. Commercial

- 7.2.1. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Centrifugal

- 8.1.2. Axial

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Industrial

- 8.2.1.1. Power Generation

- 8.2.1.2. Oil and Gas

- 8.2.1.3. Construction

- 8.2.1.4. Iron and Steel

- 8.2.1.5. Chemicals

- 8.2.1.6. Mining

- 8.2.1.7. Other Industries

- 8.2.2. Commercial

- 8.2.1. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. South America Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Centrifugal

- 9.1.2. Axial

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Industrial

- 9.2.1.1. Power Generation

- 9.2.1.2. Oil and Gas

- 9.2.1.3. Construction

- 9.2.1.4. Iron and Steel

- 9.2.1.5. Chemicals

- 9.2.1.6. Mining

- 9.2.1.7. Other Industries

- 9.2.2. Commercial

- 9.2.1. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East and Africa Fans And Blowers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Centrifugal

- 10.1.2. Axial

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Industrial

- 10.2.1.1. Power Generation

- 10.2.1.2. Oil and Gas

- 10.2.1.3. Construction

- 10.2.1.4. Iron and Steel

- 10.2.1.5. Chemicals

- 10.2.1.6. Mining

- 10.2.1.7. Other Industries

- 10.2.2. Commercial

- 10.2.1. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Continental Blower LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flakt Woods Group SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pollrich GmbH*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Greenheck Fan Corp

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acme Engineering & Manufacturing Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airmaster Fan Company Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CG Power and Industrial Solutions Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gardner Denver Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DongKun Industrial Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Loren Cook Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Howden Group Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Continental Blower LLC

List of Figures

- Figure 1: Global Fans And Blowers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 11: Europe Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 12: Europe Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 17: Asia Pacific Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Asia Pacific Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 21: South America Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: South America Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 23: South America Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 24: South America Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Fans And Blowers Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Fans And Blowers Market Revenue (Million), by Deployment 2025 & 2033

- Figure 29: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 30: Middle East and Africa Fans And Blowers Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Fans And Blowers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Fans And Blowers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 6: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 12: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 15: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Fans And Blowers Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global Fans And Blowers Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Fans And Blowers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fans And Blowers Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Fans And Blowers Market?

Key companies in the market include Continental Blower LLC, Flakt Woods Group SA, Pollrich GmbH*List Not Exhaustive, Greenheck Fan Corp, Acme Engineering & Manufacturing Corp, Airmaster Fan Company Inc, CG Power and Industrial Solutions Limited, Gardner Denver Inc, DongKun Industrial Co Ltd, Loren Cook Company, Howden Group Ltd.

3. What are the main segments of the Fans And Blowers Market?

The market segments include Technology, Deployment.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption Of Electric Vehicles4.; Growing Concern for Battery Waste Disposal and Stringent Government Policies.

6. What are the notable trends driving market growth?

Industrial Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Recycling Operations.

8. Can you provide examples of recent developments in the market?

March 2023: Saudi Aramco and its Chinese partners announced that they aim to start full operations of a refinery and petrochemical project in northeast China in 2026. The project is located in Liaoning province's city of Panjin and is expected to cost USD 10 billion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fans And Blowers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fans And Blowers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fans And Blowers Market?

To stay informed about further developments, trends, and reports in the Fans And Blowers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence