Key Insights

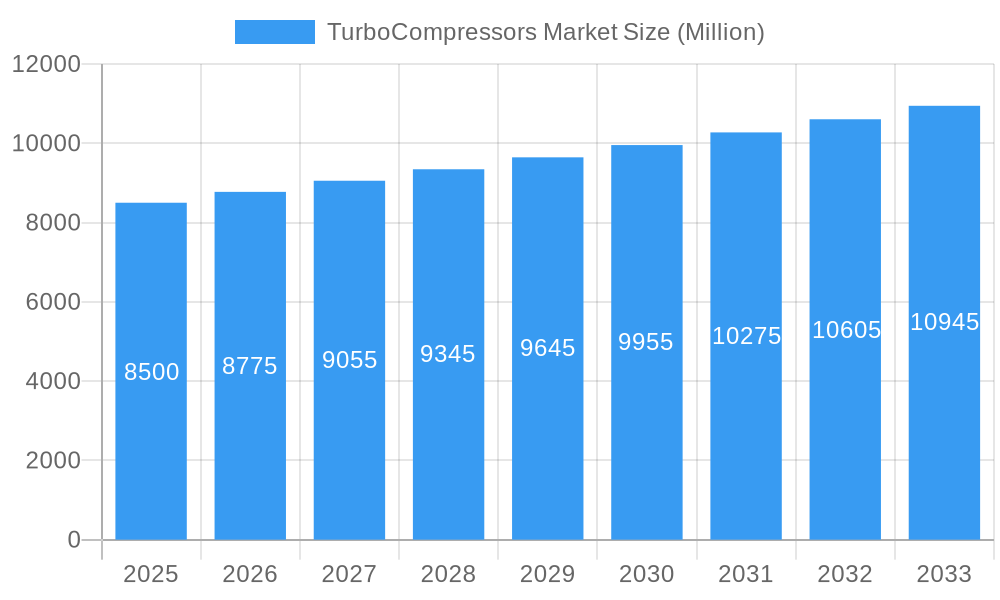

The global TurboCompressors Market is poised for robust expansion, driven by escalating demand across critical industrial sectors such as oil & gas, chemical, and metals & mining. With an estimated market size of approximately USD 8,500 million in 2025, the market is projected to witness a Compound Annual Growth Rate (CAGR) exceeding 3.00% throughout the forecast period of 2025-2033. This sustained growth is underpinned by the imperative need for energy-efficient and high-performance compression solutions to support expanding production capacities and stringent environmental regulations. Key drivers include the ongoing investments in upstream oil and gas exploration and production, the burgeoning petrochemical industry's requirement for advanced processing technologies, and the increasing demand for industrial air and gas compression in the metals and mining sector. The market's trajectory will also be significantly influenced by technological advancements focusing on improved energy efficiency, reduced emissions, and enhanced reliability of turbo-compressor systems.

TurboCompressors Market Market Size (In Billion)

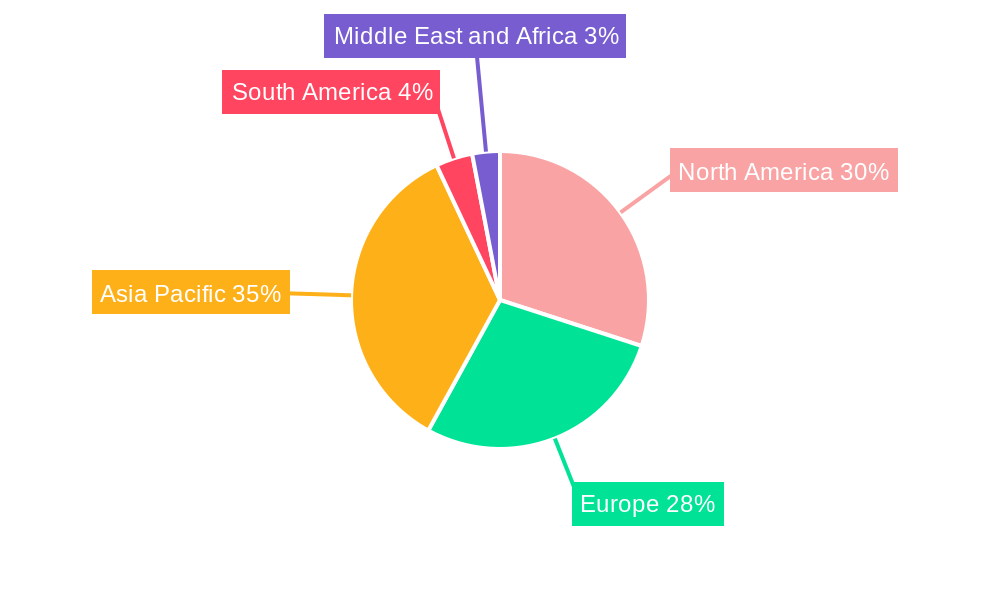

The market's segmentation reveals a dynamic landscape, with centrifugal compressors holding a dominant share due to their suitability for high-volume, low-pressure applications, while axial compressors are gaining traction in specialized high-flow, low-pressure scenarios. End-user industries are a significant determinant of market performance; the oil & gas sector, characterized by its substantial infrastructure and continuous operational demands, represents a primary consumer. The chemical industry's rapid growth and the metals & mining sector's continuous expansion further contribute to the market's vitality. Geographically, Asia Pacific is emerging as a pivotal growth region, fueled by rapid industrialization, increasing energy consumption, and substantial investments in infrastructure and manufacturing. North America and Europe continue to be significant markets, driven by mature industrial bases and a strong emphasis on technological innovation and sustainability. Emerging trends include the adoption of smart technologies for predictive maintenance and operational optimization, alongside a growing preference for customized and modular turbo-compressor solutions tailored to specific industry needs.

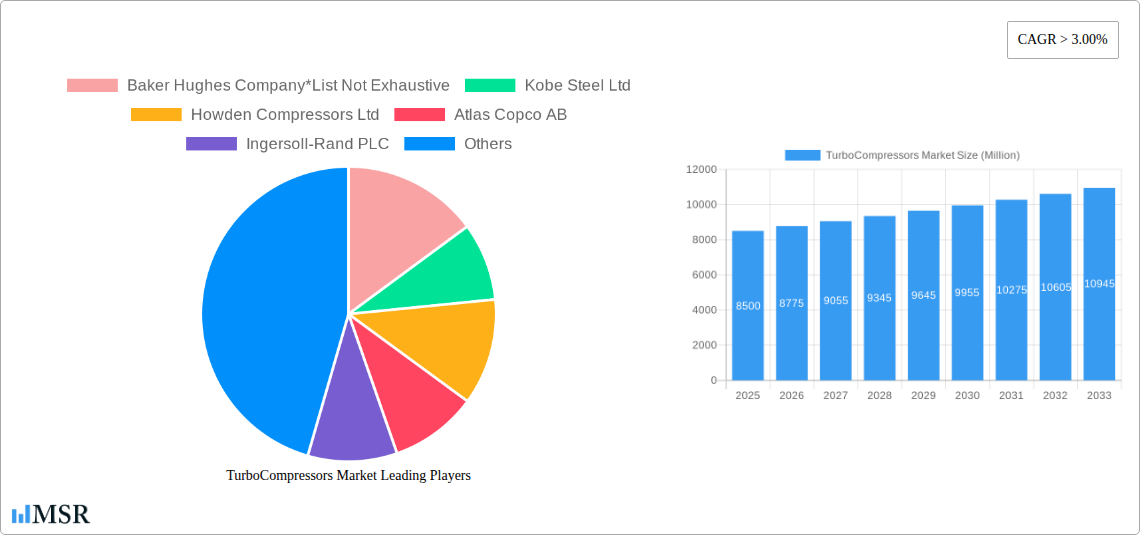

TurboCompressors Market Company Market Share

TurboCompressors Market: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth report provides a detailed analysis of the global TurboCompressors Market, a critical component in various industrial processes. The study covers the historical period from 2019 to 2024, a base year of 2025, and forecasts market dynamics through 2033. With an estimated TurboCompressors Market size projected to reach US$ XX Million in 2025, this research offers invaluable insights for oil & gas turbocompressor, chemical turbocompressor, and metals & mining turbocompressor stakeholders. We delve into centrifugal turbocompressors and axial turbocompressors, exploring market concentration, innovation, and key industry developments shaping the future of this dynamic sector.

TurboCompressors Market Market Concentration & Dynamics

The TurboCompressors Market exhibits a moderate to high degree of concentration, with a few major players dominating a significant portion of the market share. Key companies like Baker Hughes Company, Kobe Steel Ltd, Howden Compressors Ltd, Atlas Copco AB, Ingersoll-Rand PLC, Elliott Group Ltd, Siemens AG, General Electric Company, Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, and MAN SE are at the forefront, driving innovation and catering to the diverse needs of the industrial turboexpander and process gas compressor sectors. The innovation ecosystem is robust, fueled by continuous research and development in areas such as energy efficiency, advanced materials, and smart monitoring solutions. Regulatory frameworks, particularly concerning emissions and safety standards in the energy sector turbocompressor and petrochemical turboexpander industries, play a crucial role in product development and market entry. Substitute products, while present in specific niche applications, face significant challenges in matching the efficiency and reliability of turbo-compressors for large-scale industrial operations. End-user trends are increasingly focused on digitalization, predictive maintenance, and integrated solutions, driving the demand for intelligent turbo-compressor systems. Merger and acquisition (M&A) activities, with approximately XX M&A deal counts observed during the study period, are shaping the competitive landscape, enabling companies to expand their product portfolios and geographical reach within the turboexpander market and compressor technology market.

TurboCompressors Market Industry Insights & Trends

The global TurboCompressors Market is poised for substantial growth, driven by an increasing demand for energy and industrialization across various end-user industries. The estimated market size for the TurboCompressors sector is projected to reach US$ XX Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust growth is underpinned by several key factors. Firstly, the burgeoning oil and gas industry, particularly in emerging economies, continues to be a primary consumer of turbo-compressors for exploration, production, and refining processes. The need for efficient gas compression in liquefied natural gas (LNG) facilities and pipelines is a significant market driver. Secondly, the chemical and petrochemical sectors are witnessing expansion, leading to increased demand for turbo-compressors in various synthesis and separation processes. The development of new chemical plants and the modernization of existing ones are contributing to market expansion. Thirdly, the metals and mining industry relies heavily on turbo-compressors for processes such as smelting, ventilation, and material handling, with ongoing infrastructure development globally fueling this demand. Technological disruptions are also playing a pivotal role. Advancements in materials science have led to the development of lighter, more durable, and corrosion-resistant turbo-compressor components, enhancing performance and extending operational life. Furthermore, the integration of smart technologies, including IoT sensors and AI-powered analytics, is enabling real-time monitoring, predictive maintenance, and optimized operational efficiency, reducing downtime and operational costs for users in the industrial compressor market. Evolving consumer behaviors, primarily driven by a growing emphasis on sustainability and energy efficiency, are pushing manufacturers to develop more energy-efficient turbo-compressor designs, minimizing power consumption and reducing the carbon footprint of industrial operations. The increasing focus on reducing greenhouse gas emissions is further accelerating the adoption of advanced turbo-compressor technologies.

Key Markets & Segments Leading TurboCompressors Market

The TurboCompressors Market is characterized by strong regional dominance and segment-specific growth.

Dominant Region: North America, particularly the United States, is a leading market for turbo-compressors, driven by its extensive oil and gas industry, robust chemical manufacturing sector, and significant investments in infrastructure development. The region's advanced technological adoption and stringent environmental regulations also contribute to the demand for high-efficiency turbo-compressor solutions. Asia Pacific is another rapidly growing market, fueled by rapid industrialization, increasing energy demand, and significant government initiatives supporting manufacturing and infrastructure projects.

Dominant Country: Within North America, the United States stands out due to its vast shale gas reserves, extensive pipeline networks, and a mature refining industry, all of which are major consumers of turbo-compressors. In the Asia Pacific region, China and India are experiencing significant growth, driven by their expanding industrial bases and increasing energy consumption.

Dominant Type:

- Centrifugal Turbocompressors: This type of turbo-compressor holds a dominant position in the market due to its high flow rates, reliability, and suitability for a wide range of applications, including large-scale gas processing, petrochemical production, and power generation. Their efficiency in handling large volumes of gas makes them indispensable for many industrial processes.

- Axial Turbocompressors: While generally used for very high flow rates and lower pressure ratios, axial turbo-compressors are witnessing increasing adoption in specific applications like large-scale air separation units and in some gas turbine applications where their specific performance characteristics are advantageous.

Dominant End-User Industry:

- Oil & Gas: This industry remains the largest consumer of turbo-compressors. The exploration, extraction, transportation, and refining of crude oil and natural gas necessitate robust and high-capacity compression solutions. The increasing demand for liquefied natural gas (LNG) and the expansion of natural gas pipelines are significant growth drivers for turbo-compressors in this sector.

- Chemical: The chemical industry's continuous demand for process gas compression in the production of various chemicals, plastics, and fertilizers makes it a key market. Modernization of chemical plants and the development of new production facilities are contributing to sustained demand.

- Metals & Mining: Turbo-compressors are essential for ventilation in mines, material handling, and industrial furnaces used in metal production. Infrastructure development and the demand for metals in various industries are key drivers for this segment.

- Others: This category includes sectors like power generation, wastewater treatment, and general industrial applications, all of which contribute to the overall market demand, albeit to a lesser extent than the primary segments.

TurboCompressors Market Product Developments

Recent product developments in the TurboCompressors Market are centered around enhancing energy efficiency, improving reliability, and integrating advanced digital capabilities. Manufacturers are investing in lighter materials, aerodynamic optimizations, and advanced sealing technologies to reduce power consumption and increase the lifespan of industrial gas compressors. The integration of IoT sensors and predictive analytics is enabling real-time monitoring of compressor performance, allowing for proactive maintenance and minimizing unplanned downtime. This focus on smart solutions and operational intelligence provides a significant competitive edge and addresses the growing demand for sustainable and cost-effective industrial operations, particularly for process turboexpanders.

Challenges in the TurboCompressors Market Market

Despite robust growth prospects, the TurboCompressors Market faces several challenges. Regulatory hurdles related to emissions and safety standards can increase manufacturing costs and necessitate significant R&D investments for compliance. Supply chain disruptions, as seen in recent global events, can impact the availability of raw materials and critical components, leading to production delays and increased lead times. Intense competitive pressures among established players and emerging manufacturers can lead to price wars and reduced profit margins, especially for standard product offerings. Quantifiable impacts include potential increases in manufacturing costs by XX% and extended delivery times by up to XX weeks due to supply chain issues.

Forces Driving TurboCompressors Market Growth

The TurboCompressors Market is propelled by a confluence of powerful growth forces. Technologically, advancements in aerodynamic design, materials science enabling higher operating temperatures and pressures, and the integration of digitalization and AI for predictive maintenance are significantly enhancing efficiency and reliability. Economically, the sustained global demand for energy, particularly from developing nations, fuels the need for enhanced oil and gas extraction and processing capabilities, driving the demand for oilfield turboexpanders. Regulatory factors, such as increasingly stringent environmental regulations promoting energy efficiency and reduced emissions, are pushing industries to adopt more advanced and sustainable turbo-compressor solutions. The expansion of infrastructure projects worldwide also necessitates efficient gas handling and processing, further contributing to market growth.

Challenges in the TurboCompressors Market Market

Long-term growth catalysts for the TurboCompressors Market lie in continued technological innovation and strategic market expansion. The development of even more energy-efficient compressor designs, potentially leveraging breakthroughs in areas like magnetic bearings and advanced control systems, will be crucial. Strategic partnerships and collaborations between compressor manufacturers and end-users can foster co-development of tailored solutions for specific industry needs. Expanding into emerging markets with growing industrial bases, coupled with a focus on after-sales service and support, will also be vital for sustained long-term growth and securing market share in the global turboexpander industry.

Emerging Opportunities in TurboCompressors Market

Emerging opportunities in the TurboCompressors Market are diverse and promising. The growing emphasis on decarbonization and green energy presents opportunities for turbo-compressors in applications such as carbon capture and storage (CCS) and hydrogen production and transportation. The increasing adoption of renewable energy sources also requires efficient energy storage and conversion solutions, where turbo-compressors play a role. New geographical markets with developing industrial sectors offer significant untapped potential. Furthermore, the demand for specialized, highly customized turbo-compressors for niche applications in sectors like advanced manufacturing and pharmaceuticals presents avenues for innovation and premium pricing, tapping into the demand for specialty turboexpanders.

Leading Players in the TurboCompressors Market Sector

- Baker Hughes Company

- Kobe Steel Ltd

- Howden Compressors Ltd

- Atlas Copco AB

- Ingersoll-Rand PLC

- Elliott Group Ltd

- Siemens AG

- General Electric Company

- Kawasaki Heavy Industries Ltd

- Mitsubishi Heavy Industries Ltd

- MAN SE

Key Milestones in TurboCompressors Market Industry

- 2019: Increased adoption of digital twin technology for predictive maintenance in turbo-compressors.

- 2020: Significant product launches focusing on enhanced energy efficiency and reduced emissions.

- 2021: Growing M&A activity as larger players consolidate market presence.

- 2022: Advancements in materials science leading to lighter and more robust compressor components.

- 2023: Increased demand for turbo-compressors in hydrogen production and carbon capture applications.

- 2024: Focus on AI-driven operational optimization and remote monitoring solutions.

Strategic Outlook for TurboCompressors Market Market

The strategic outlook for the TurboCompressors Market is highly positive, driven by the sustained global demand for energy and the increasing imperative for industrial efficiency and sustainability. Key growth accelerators include continuous innovation in energy-efficient designs, the integration of advanced digital technologies for smart operations, and the expansion into burgeoning markets. Companies that can offer integrated solutions, robust after-sales service, and tailored products for emerging applications like green hydrogen and carbon capture will be well-positioned for future success. The market's future potential lies in its ability to adapt to evolving environmental regulations and to leverage technological advancements to drive down operational costs and improve the environmental footprint of industrial processes, particularly within the industrial gas compression market and the petrochemical sector.

TurboCompressors Market Segmentation

-

1. Type

- 1.1. Centrifugal

- 1.2. Axial

-

2. End-User Industry

- 2.1. Oil & Gas

- 2.2. Chemical

- 2.3. Metals & Mining

- 2.4. Others

TurboCompressors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

TurboCompressors Market Regional Market Share

Geographic Coverage of TurboCompressors Market

TurboCompressors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector

- 3.2.2 Including the Healthcare Industry

- 3.3. Market Restrains

- 3.3.1. 4.; The Growing Demand for Generators Based on Alternative Fuels

- 3.4. Market Trends

- 3.4.1. Oil and Gas Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Centrifugal

- 5.1.2. Axial

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical

- 5.2.3. Metals & Mining

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Centrifugal

- 6.1.2. Axial

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Oil & Gas

- 6.2.2. Chemical

- 6.2.3. Metals & Mining

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Centrifugal

- 7.1.2. Axial

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Oil & Gas

- 7.2.2. Chemical

- 7.2.3. Metals & Mining

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Centrifugal

- 8.1.2. Axial

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Oil & Gas

- 8.2.2. Chemical

- 8.2.3. Metals & Mining

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Centrifugal

- 9.1.2. Axial

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Oil & Gas

- 9.2.2. Chemical

- 9.2.3. Metals & Mining

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa TurboCompressors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Centrifugal

- 10.1.2. Axial

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Oil & Gas

- 10.2.2. Chemical

- 10.2.3. Metals & Mining

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baker Hughes Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kobe Steel Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Howden Compressors Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atlas Copco AB

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ingersoll-Rand PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elliott Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kawasaki Heavy Industries Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mitsubishi Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Man SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Baker Hughes Company*List Not Exhaustive

List of Figures

- Figure 1: Global TurboCompressors Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America TurboCompressors Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America TurboCompressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America TurboCompressors Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: North America TurboCompressors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: North America TurboCompressors Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America TurboCompressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe TurboCompressors Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe TurboCompressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe TurboCompressors Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: Europe TurboCompressors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: Europe TurboCompressors Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe TurboCompressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific TurboCompressors Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific TurboCompressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific TurboCompressors Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Asia Pacific TurboCompressors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Asia Pacific TurboCompressors Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific TurboCompressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America TurboCompressors Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America TurboCompressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America TurboCompressors Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: South America TurboCompressors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: South America TurboCompressors Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America TurboCompressors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa TurboCompressors Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa TurboCompressors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa TurboCompressors Market Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa TurboCompressors Market Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa TurboCompressors Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa TurboCompressors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global TurboCompressors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global TurboCompressors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 9: Global TurboCompressors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: Global TurboCompressors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 15: Global TurboCompressors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global TurboCompressors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global TurboCompressors Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 18: Global TurboCompressors Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the TurboCompressors Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the TurboCompressors Market?

Key companies in the market include Baker Hughes Company*List Not Exhaustive, Kobe Steel Ltd, Howden Compressors Ltd, Atlas Copco AB, Ingersoll-Rand PLC, Elliott Group Ltd, Siemens AG, General Electric Company, Kawasaki Heavy Industries Ltd, Mitsubishi Heavy Industries Ltd, Man SE.

3. What are the main segments of the TurboCompressors Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Increasing Demand for Uninterrupted and Reliable Power Supply4.; Increased Demand from the Commercial Sector. Including the Healthcare Industry.

6. What are the notable trends driving market growth?

Oil and Gas Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growing Demand for Generators Based on Alternative Fuels.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "TurboCompressors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the TurboCompressors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the TurboCompressors Market?

To stay informed about further developments, trends, and reports in the TurboCompressors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence