Key Insights

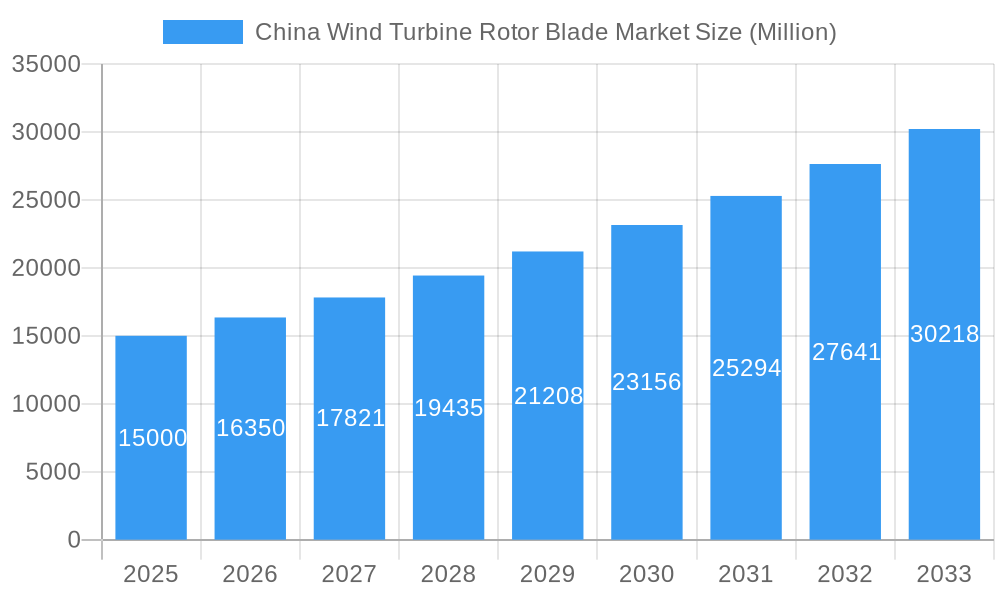

The China Wind Turbine Rotor Blade Market is projected for substantial growth, with an estimated market size of USD 23.6 billion by 2025 and a Compound Annual Growth Rate (CAGR) exceeding 10% through 2033. This expansion is driven by China's strong renewable energy commitments and significant investments in wind power infrastructure. The adoption of larger, more efficient wind turbines necessitates advanced rotor blades, a key growth factor. Technological advancements in materials, including increased use of carbon fiber, and innovative blade designs to optimize energy capture, are further stimulating market dynamics. Supportive government incentives, favorable policies, and growing environmental awareness are accelerating wind energy project deployment in both onshore and offshore regions, directly increasing demand for high-quality rotor blades.

China Wind Turbine Rotor Blade Market Market Size (In Billion)

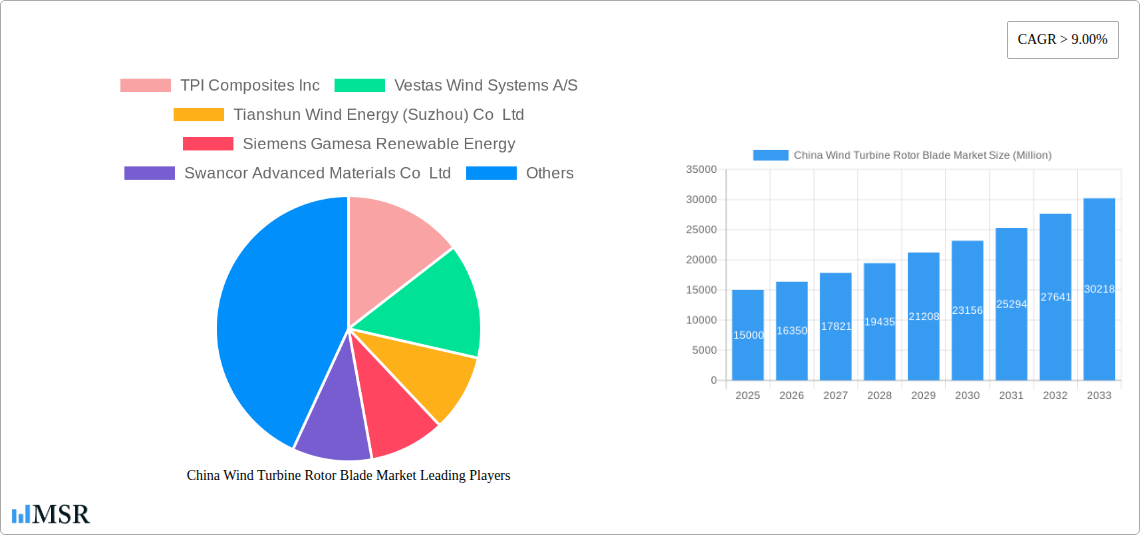

The market features robust competition between established global manufacturers and emerging domestic players. Leading companies such as TPI Composites Inc., Vestas Wind Systems A/S, Siemens Gamesa Renewable Energy, alongside Chinese entities like Tianshun Wind Energy (Suzhou) Co Ltd and Sinoma Wind Power Blade Co Ltd, are actively competing for market share. While growth drivers are strong, the market faces challenges including rising raw material costs for fiberglass and carbon fiber, potential supply chain disruptions, and the continuous need for innovation to meet evolving turbine demands. Nonetheless, China's extensive wind energy ambitions, coupled with the drive for technological leadership and cost-effective blade manufacturing, present a favorable outlook for the China Wind Turbine Rotor Blade Market. The strategic emphasis on domestic production and technological self-sufficiency reinforces its sustained growth trajectory.

China Wind Turbine Rotor Blade Market Company Market Share

China Wind Turbine Rotor Blade Market: Forecast to 2033 - Unlocking the Power of Renewable Energy Innovation

This comprehensive report delves into the dynamic China wind turbine rotor blade market, offering in-depth analysis and actionable insights for industry stakeholders. With the renewable energy sector experiencing unprecedented growth, driven by ambitious decarbonization goals and technological advancements, understanding the intricacies of wind turbine rotor blade manufacturing and deployment is paramount. Our study spans from 2019 to 2033, with a base year of 2025, providing a robust historical context and an insightful forecast period of 2025–2033. Explore market size, CAGR, key growth drivers, emerging trends, competitive landscape, and strategic recommendations for navigating this burgeoning sector.

China Wind Turbine Rotor Blade Market Market Concentration & Dynamics

The China wind turbine rotor blade market exhibits a moderate to high concentration, characterized by the presence of several dominant global and domestic players vying for market share. Innovation ecosystems are rapidly evolving, fueled by substantial investments in research and development, particularly in enhancing blade efficiency, durability, and the adoption of advanced materials like carbon fiber for longer and lighter blades. Regulatory frameworks, driven by national renewable energy targets and environmental policies, play a crucial role in shaping market entry and operational strategies. Substitute products, such as advancements in other renewable energy technologies, represent a potential, albeit limited, threat. End-user trends are overwhelmingly positive, with utilities and independent power producers prioritizing the expansion of both onshore and offshore wind energy capacity to meet escalating power demands. Mergers and acquisitions (M&A) activities, while not overtly frequent, are strategic, often involving collaborations to gain access to new technologies, expand manufacturing capabilities, or secure larger market footprints. For instance, the acquisition of LM Wind Power by GE Renewable Energy signifies a significant consolidation. Market share is largely dictated by the production volume of high-demand rotor blades for large-scale wind turbines. The number of M&A deals, while specific figures require granular data, are indicative of a maturing yet consolidating industry.

China Wind Turbine Rotor Blade Market Industry Insights & Trends

The China wind turbine rotor blade market is on an upward trajectory, driven by a confluence of powerful growth catalysts. The escalating global demand for clean energy solutions, coupled with China's commitment to carbon neutrality, positions the wind energy sector as a cornerstone of its energy strategy. This translates directly into a robust demand for wind turbine rotor blades. Technological disruptions are a constant feature, with manufacturers pushing the boundaries of blade design and material science to achieve higher energy capture efficiencies and greater resilience in diverse environmental conditions. Innovations in composite materials, including the increased utilization of carbon fiber, are enabling the production of longer and lighter blades, crucial for the development of next-generation, higher-capacity wind turbines, especially in the offshore segment. Evolving consumer behaviors, while less direct for rotor blade manufacturers, are influenced by public awareness of climate change and a growing preference for sustainably sourced energy. This societal shift translates into stronger political will and supportive policies for renewable energy expansion.

The market size for China's wind turbine rotor blades is projected to witness substantial growth, with an estimated CAGR of XX% during the forecast period. This growth is underpinned by several key factors:

- Government Support and Policies: Ambitious renewable energy targets, favorable feed-in tariffs, and tax incentives are significantly bolstering the expansion of wind power installations across the country.

- Technological Advancements: Continuous innovation in blade aerodynamics, materials, and manufacturing processes leads to more efficient and cost-effective wind energy generation.

- Cost Competitiveness: The declining cost of wind energy, partly attributed to improvements in turbine technology and economies of scale in blade manufacturing, makes it an increasingly attractive alternative to fossil fuels.

- Grid Modernization: Investments in grid infrastructure are facilitating the integration of large-scale wind power into the national energy mix, thereby increasing the demand for turbines and their components.

- Energy Security Concerns: Diversifying the energy portfolio and reducing reliance on imported fossil fuels are key drivers for renewable energy adoption, including wind power.

The market is witnessing a significant trend towards larger and more powerful wind turbines, necessitating the development of correspondingly longer and more sophisticated rotor blades. This demand is particularly pronounced in the offshore wind sector, where the potential for higher and more consistent wind speeds drives the need for advanced blade designs.

Key Markets & Segments Leading China Wind Turbine Rotor Blade Market

The Offshore segment is emerging as a dominant force in the China wind turbine rotor blade market, driven by strategic government investments and the vast potential of China's extensive coastline. This dominance is further amplified by the increasing deployment of Carbon Fiber in blade manufacturing, enabling the creation of ultra-long and lightweight blades essential for the efficient operation of high-capacity offshore wind turbines.

Offshore Deployment Drivers:

- Vast Coastal Resources: China possesses an extensive coastline with significant offshore wind potential, attracting substantial investment in offshore wind farms.

- Government Policy Support: National strategies and investment plans prioritize offshore wind development due to its higher capacity factor and reduced land use constraints compared to onshore wind.

- Technological Advancements in Blade Design: The development of longer and more robust blades, often utilizing carbon fiber composites, is crucial for capturing stronger offshore winds and maximizing energy generation.

- Reduced Visual and Noise Impact: Offshore wind farms are less susceptible to public opposition regarding visual aesthetics and noise pollution, facilitating faster project deployment.

- Energy Security and Independence: Offshore wind offers a strategic pathway to enhance China's energy security and reduce its reliance on imported fossil fuels.

Carbon Fiber Blade Material Dominance:

- Enhanced Strength-to-Weight Ratio: Carbon fiber composites offer superior strength and stiffness compared to glass fiber, allowing for the design of longer and more slender blades without compromising structural integrity.

- Improved Aerodynamic Performance: Lighter blades require less energy to rotate, leading to increased energy capture and overall turbine efficiency, especially at lower wind speeds.

- Increased Durability and Fatigue Life: Carbon fiber blades exhibit greater resistance to fatigue and environmental degradation, leading to longer service life and reduced maintenance costs, a critical factor for offshore installations.

- Enabling Larger Turbine Capacities: The development of massive offshore wind turbines, such as 16 MW and beyond, is critically dependent on the advanced material properties of carbon fiber to construct blades of unprecedented lengths, like the 123-meter blade unveiled by LZ Blades.

While the Onshore segment continues to be a significant contributor, the rapid scaling up of offshore wind projects, coupled with the technological advancements in carbon fiber blade manufacturing, is propelling the offshore market and the use of carbon fiber to the forefront of China's wind turbine rotor blade industry. Glass Fiber remains a cost-effective and widely used material, particularly for onshore applications, but the trend towards larger turbines and harsher offshore environments is clearly favoring carbon fiber's superior performance characteristics. Other Blade Materials, such as hybrid composites, are also seeing development, offering specialized solutions for niche applications or to further optimize performance.

China Wind Turbine Rotor Blade Market Product Developments

Product development in the China wind turbine rotor blade market is intensely focused on innovation to meet the demands of increasingly powerful and efficient wind turbines. Key advancements include the creation of ultra-long blades, such as the 123-meter blade by Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd (LZ Blades) for 16 MW offshore turbines, and Shanghai Electric's S112, a 112-meter offshore blade. These innovations highlight a strong emphasis on enhanced aerodynamic design, lightweight yet robust composite materials (including advanced carbon fiber applications), and improved manufacturing techniques to ensure durability and performance in challenging offshore environments. The market relevance of these developments lies in their direct impact on increasing energy capture, reducing the levelized cost of energy (LCOE), and enabling the deployment of next-generation wind power technologies.

Challenges in the China Wind Turbine Rotor Blade Market Market

Navigating the China wind turbine rotor blade market presents several significant challenges. Supply chain disruptions, particularly for specialized raw materials like high-grade carbon fiber, can lead to production delays and increased costs. The intense competition among a growing number of domestic and international manufacturers puts pressure on profit margins, necessitating continuous innovation and cost optimization. Regulatory hurdles, though generally supportive of wind energy, can involve complex permitting processes and evolving standards for blade design and safety, particularly for offshore installations. Logistical complexities associated with transporting extremely large rotor blades, especially to remote onshore sites or offshore installation vessels, add another layer of difficulty. Furthermore, the skilled labor shortage for specialized manufacturing and installation roles can impede rapid expansion.

Forces Driving China Wind Turbine Rotor Blade Market Growth

The primary forces driving growth in the China wind turbine rotor blade market are multifaceted. Aggressive government policies and targets aimed at achieving carbon neutrality by 2060 are a monumental catalyst, directly stimulating investment in wind power infrastructure. Technological advancements in blade design, materials science (especially carbon fiber composites), and manufacturing processes are enabling the development of more efficient, reliable, and cost-effective wind turbines. The declining cost of wind energy generation, driven by these advancements and economies of scale, makes it increasingly competitive against traditional energy sources. Growing concerns over energy security and the need for a diversified energy mix further fuel the demand for renewable energy solutions. Finally, increasing environmental awareness and public demand for cleaner energy are creating a supportive socio-political environment for wind power expansion.

Challenges in the China Wind Turbine Rotor Blade Market Market

The long-term growth of the China wind turbine rotor blade market hinges on overcoming persistent challenges. Scaling up domestic manufacturing capabilities to meet the accelerating demand, particularly for ultra-long blades required for high-capacity offshore turbines, is crucial. Ensuring the sustainability and recyclability of composite materials used in blade production is becoming increasingly important due to growing environmental concerns and regulatory scrutiny. Developing robust and efficient transportation and installation infrastructure capable of handling the ever-increasing size of rotor blades is another critical factor. Furthermore, managing the grid integration of large-scale, intermittent wind power requires significant investment in grid modernization and energy storage solutions. Continuous research and development into next-generation blade technologies, such as advanced aerodynamic coatings and smart blade functionalities, will be essential to maintain a competitive edge.

Emerging Opportunities in China Wind Turbine Rotor Blade Market

The China wind turbine rotor blade market is ripe with emerging opportunities. The rapid expansion of offshore wind farms, driven by government incentives and favorable coastal conditions, presents a significant growth avenue for manufacturers specializing in large, robust offshore blades. The increasing adoption of hybrid blade designs, combining different composite materials to optimize performance and cost, offers a niche for specialized manufacturers. The development and deployment of floating offshore wind platforms will create new demands for specialized rotor blades designed to withstand dynamic sea conditions. Furthermore, aftermarket services, including maintenance, repair, and repowering of existing wind farms, represent a growing segment. The push for sustainable manufacturing practices and blade recycling solutions also presents an opportunity for companies that can demonstrate environmental responsibility and innovation in this area.

Leading Players in the China Wind Turbine Rotor Blade Market Sector

- TPI Composites Inc

- Vestas Wind Systems A/S

- Tianshun Wind Energy (Suzhou) Co Ltd

- Siemens Gamesa Renewable Energy

- Swancor Advanced Materials Co Ltd

- Lianyungang Zhongfu Lianzhong Composites Group Co Ltd

- LM Wind Power (a GE Renewable Energy business)

- Sinoma wind power blade Co Ltd

- Zhuzhou Times New Material Technology Co Ltd

- Nordex SE

Key Milestones in China Wind Turbine Rotor Blade Market Industry

- September 2022: Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd (LZ Blades) unveiled a 123-meter-long wind turbine blade, claimed to be the world's longest. This blade is adapted for 16 MW offshore wind turbines, weighing 50 tonnes, with a diameter exceeding five meters and a swept area over 100 sq m., significantly pushing the boundaries of offshore wind technology.

- August 2022: Shanghai Electric group's S112, an ultra-long offshore wind turbine blade, successfully rolled off the production line at Zhongfu Lianzhong. Measuring 112 meters in length, it was recognized as the longest offshore wind turbine blade in China at the time, underscoring the rapid advancements in the nation's offshore wind manufacturing capabilities.

Strategic Outlook for China Wind Turbine Rotor Blade Market Market

The strategic outlook for the China wind turbine rotor blade market is exceptionally bright, fueled by sustained government support for renewable energy and continuous technological innovation. Key growth accelerators include the ongoing transition towards higher-capacity wind turbines, particularly in the offshore segment, which necessitates the development of increasingly longer and more sophisticated rotor blades. Manufacturers that can master the production of large-scale carbon fiber blades and offer advanced aerodynamic designs will be well-positioned to capture significant market share. Strategic partnerships between blade manufacturers, turbine OEMs, and research institutions will be crucial for driving innovation and addressing complex engineering challenges. Furthermore, a focus on establishing robust domestic supply chains for critical raw materials and developing efficient end-of-life recycling solutions for blades will be vital for long-term sustainable growth and maintaining a competitive edge in this dynamic global market.

China Wind Turbine Rotor Blade Market Segmentation

-

1. Location of Deployement

- 1.1. Onshore

- 1.2. Offshore

-

2. Blade Material

- 2.1. Carbon Fiber

- 2.2. Glass Fiber

- 2.3. Other Blade Materials

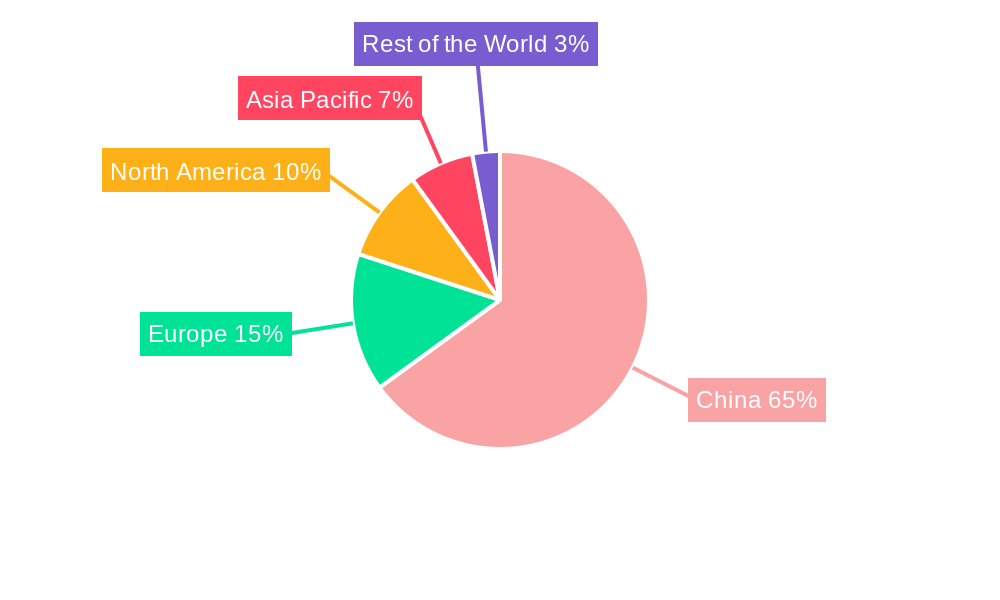

China Wind Turbine Rotor Blade Market Segmentation By Geography

- 1. China

China Wind Turbine Rotor Blade Market Regional Market Share

Geographic Coverage of China Wind Turbine Rotor Blade Market

China Wind Turbine Rotor Blade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Focus on Renewable Power Generation4.; Rising Need for Efficient Power Generation

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Capital Investment

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Wind Turbine Rotor Blade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Blade Material

- 5.2.1. Carbon Fiber

- 5.2.2. Glass Fiber

- 5.2.3. Other Blade Materials

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployement

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 TPI Composites Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vestas Wind Systems A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tianshun Wind Energy (Suzhou) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Gamesa Renewable Energy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Swancor Advanced Materials Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lianyungang Zhongfu Lianzhong Composites Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LM Wind Power (a GE Renewable Energy business)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sinoma wind power blade Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zhuzhou Times New Material Technology Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nordex SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 TPI Composites Inc

List of Figures

- Figure 1: China Wind Turbine Rotor Blade Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Wind Turbine Rotor Blade Market Share (%) by Company 2025

List of Tables

- Table 1: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Location of Deployement 2020 & 2033

- Table 2: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Location of Deployement 2020 & 2033

- Table 3: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Blade Material 2020 & 2033

- Table 4: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Blade Material 2020 & 2033

- Table 5: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Region 2020 & 2033

- Table 7: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Location of Deployement 2020 & 2033

- Table 8: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Location of Deployement 2020 & 2033

- Table 9: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Blade Material 2020 & 2033

- Table 10: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Blade Material 2020 & 2033

- Table 11: China Wind Turbine Rotor Blade Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: China Wind Turbine Rotor Blade Market Volume Meter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Wind Turbine Rotor Blade Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the China Wind Turbine Rotor Blade Market?

Key companies in the market include TPI Composites Inc, Vestas Wind Systems A/S, Tianshun Wind Energy (Suzhou) Co Ltd, Siemens Gamesa Renewable Energy, Swancor Advanced Materials Co Ltd, Lianyungang Zhongfu Lianzhong Composites Group Co Ltd, LM Wind Power (a GE Renewable Energy business), Sinoma wind power blade Co Ltd, Zhuzhou Times New Material Technology Co Ltd, Nordex SE.

3. What are the main segments of the China Wind Turbine Rotor Blade Market?

The market segments include Location of Deployement, Blade Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Focus on Renewable Power Generation4.; Rising Need for Efficient Power Generation.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Capital Investment.

8. Can you provide examples of recent developments in the market?

In September 2022, Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd (LZ Blades), a Chinese company, unveiled a 123-meter-long blade which the company claims is the world's longest wind turbine blade. The blade, which is adapted to be installed on 16 MW offshore wind turbines, weighs 50 tonnes, exceeds five meters in diameter, and has a swept area that exceeds 100 sq m.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Meter.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Wind Turbine Rotor Blade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Wind Turbine Rotor Blade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Wind Turbine Rotor Blade Market?

To stay informed about further developments, trends, and reports in the China Wind Turbine Rotor Blade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence