Key Insights

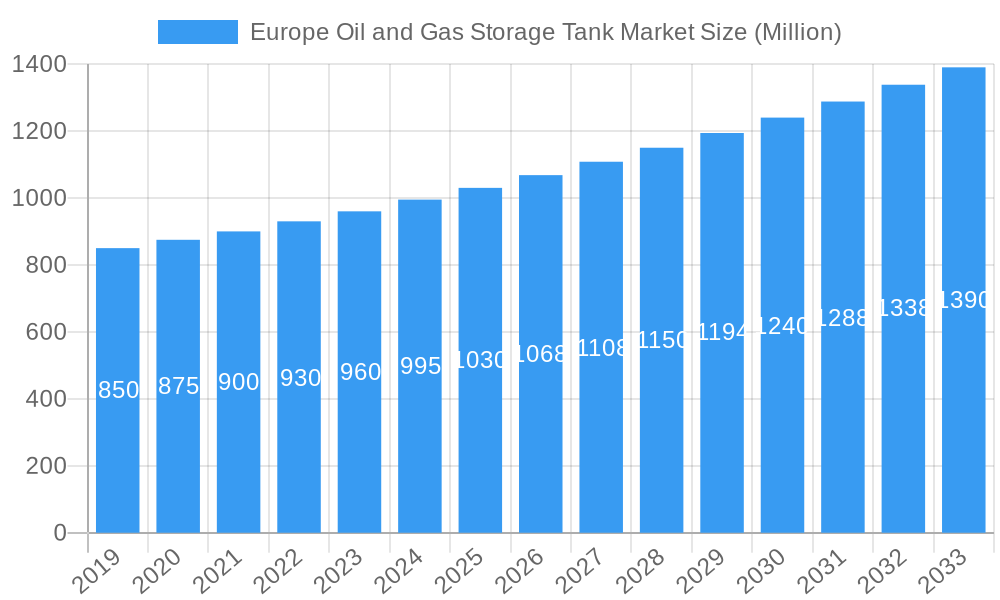

The Europe Oil and Gas Storage Tank Market is forecast to achieve a significant Compound Annual Growth Rate (CAGR) of 4.4% between 2025 and 2033. The market size is estimated at 2315.2 million in the base year 2025. This expansion is propelled by consistent energy demand across Europe and the essential need for secure and efficient storage solutions. Key growth catalysts include ongoing upstream exploration and production investments, requiring expanded crude oil and gas storage. Midstream operations, vital for transportation and storage, and the downstream sector, supporting refining and distribution to meet end-user needs, also drive demand. Emerging trends, such as smart technology integration for enhanced monitoring and safety, alongside a growing emphasis on environmental compliance and specialized products like biofuels, are actively shaping market evolution.

Europe Oil and Gas Storage Tank Market Market Size (In Billion)

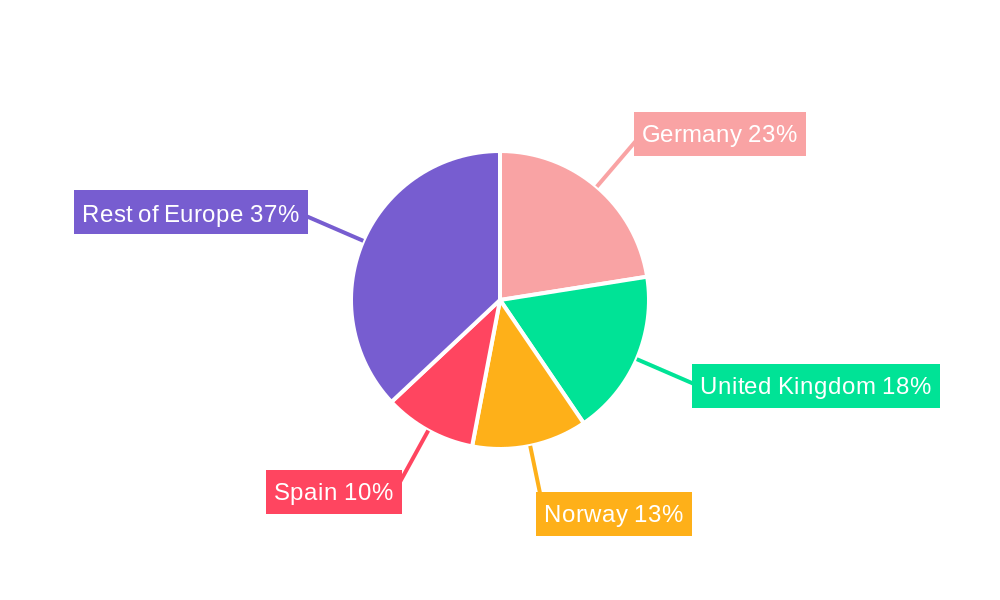

Potential restraints include stringent environmental regulations and the increasing adoption of renewable energy sources, which could impact demand for traditional oil and gas storage infrastructure. High initial capital expenditures for new tank construction and ongoing maintenance of existing facilities also present significant financial considerations for industry players. The market is segmented into Upstream, Midstream, and Downstream sectors, each offering distinct opportunities and challenges. Leading companies including HOYER GmbH, Royal Vopak NV, and Oiltanking GmbH are instrumental in defining the competitive landscape. Key geographic markets driving demand and innovation are Germany, the United Kingdom, Norway, and Spain, alongside the broader Rest of Europe.

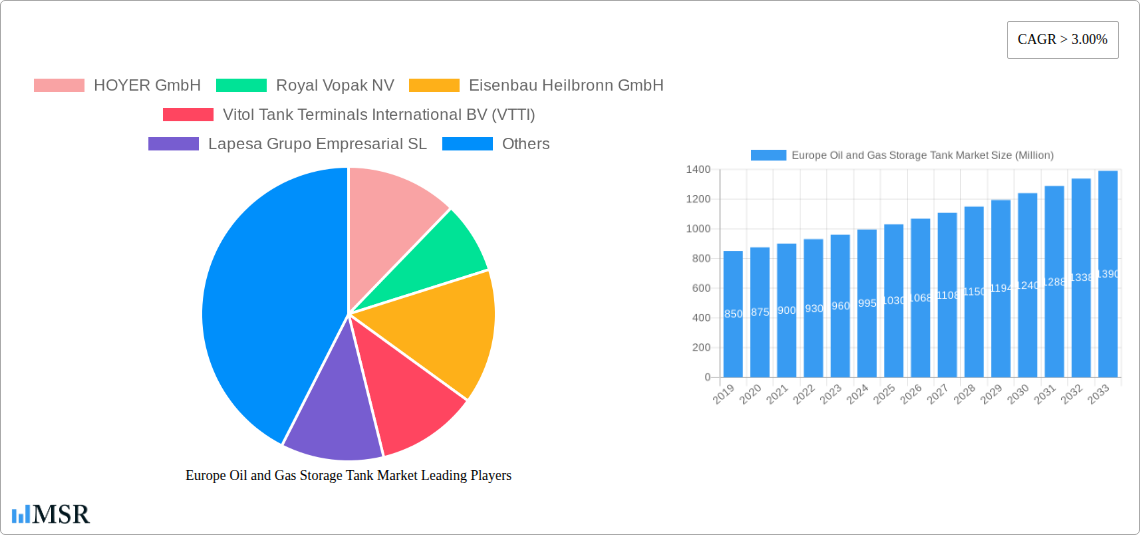

Europe Oil and Gas Storage Tank Market Company Market Share

This comprehensive report offers an essential analysis of the Europe Oil and Gas Storage Tank Market, providing critical insights for stakeholders navigating the dynamic energy infrastructure sector. Covering the forecast period up to 2033, with a base year of 2025, this report details market dynamics, growth drivers, emerging trends, and competitive strategies. Gain a competitive advantage with detailed market size, segmentation, and regional performance data, empowering strategic decision-making in the vital oil and gas storage solutions sector. The report includes in-depth analysis of oil storage tanks, gas storage tanks, LNG storage, crude oil storage, refined products storage, petrochemical storage, and more, with specific focus on upstream, midstream, and downstream segments.

Europe Oil and Gas Storage Tank Market Market Concentration & Dynamics

The Europe Oil and Gas Storage Tank Market exhibits a moderate to high degree of concentration, with a few key players dominating significant market share, estimated to be around 65-75% held by the top 5 companies. Innovation ecosystems are driven by advancements in materials science, safety technologies, and automation. Regulatory frameworks, particularly concerning environmental protection and safety standards, play a crucial role in shaping market entry and operational practices. While substitute products are limited in core oil and gas storage, advancements in alternative energy storage solutions may present long-term competition. End-user trends indicate a growing demand for flexible and expandable storage capacities, driven by fluctuating supply and demand dynamics and the increasing adoption of LNG. Mergers and acquisitions (M&A) activities have been moderate, with approximately 3-5 significant deals annually over the historical period, primarily focused on consolidating regional presence and expanding service portfolios. Key M&A targets often involve smaller, specialized tank manufacturers or service providers.

Europe Oil and Gas Storage Tank Market Industry Insights & Trends

The Europe Oil and Gas Storage Tank Market is projected to witness substantial growth, estimated to reach USD 12,500 Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 4.2% during the forecast period of 2025–2033. This growth is propelled by several critical factors. The ongoing geopolitical instability and the imperative for energy security are significantly boosting investments in storage infrastructure to ensure a stable supply of oil and natural gas. Europe's commitment to diversifying its energy sources, particularly through increased reliance on Liquefied Natural Gas (LNG), necessitates the expansion and upgrade of existing LNG storage facilities and the construction of new terminals. Technological disruptions are transforming the sector, with a growing emphasis on smart tank monitoring systems, advanced corrosion detection technologies, and the use of high-performance materials for increased durability and safety. Industry 4.0 principles are being integrated, leading to predictive maintenance and enhanced operational efficiency. Evolving consumer behaviors, particularly the demand for cleaner energy sources and more resilient supply chains, are indirectly influencing the need for robust and well-managed storage networks. The drive towards decarbonization, while a long-term challenge, is also spurring innovation in storage solutions for biofuels and hydrogen, which are expected to gain traction in the latter half of the forecast period. The market size in 2025 is estimated to be USD 8,700 Million. Furthermore, regulatory mandates for minimum storage levels, especially for natural gas, provide a consistent demand stream for storage capacity. The expansion of petrochemical industries across Europe also contributes to the demand for specialized storage tanks. The need for efficient and safe storage of refined oil products, driven by transportation and industrial demands, remains a cornerstone of market growth.

Key Markets & Segments Leading Europe Oil and Gas Storage Tank Market

The Midstream sector is currently the dominant segment in the Europe Oil and Gas Storage Tank Market, accounting for an estimated 55% of the total market share. This dominance is driven by the critical role of storage terminals in the transportation and distribution of crude oil, refined products, and natural gas.

- Drivers of Midstream Dominance:

- Strategic Location of Terminals: Europe boasts a well-established network of ports and pipelines, making midstream storage facilities crucial for logistical operations.

- Energy Security Imperatives: The need to maintain strategic reserves of oil and gas to mitigate supply disruptions directly fuels demand for midstream storage capacity.

- LNG Import Infrastructure: Significant investments in LNG regasification terminals and associated storage are bolstering the midstream segment.

- Regulatory Requirements: Mandates for maintaining specific levels of stored energy resources contribute to sustained demand.

Geographically, Germany stands out as a key market within Europe, driven by its substantial industrial base and its strategic importance in gas supply routes.

- Germany's Dominance:

- High Natural Gas Storage Capacity: Germany has been proactive in ensuring high levels of natural gas storage, demonstrating resilience against supply shocks. As highlighted in the industry developments, Germany's natural gas storage facilities reached over 85% capacity by September 2022, exceeding its target.

- Infrastructure Development: Significant investments in pipeline networks and storage facilities, including LNG terminals, underpin Germany's leading position.

- Industrial Demand: The country's robust manufacturing sector requires a consistent and reliable supply of oil and gas products, necessitating extensive storage solutions.

- Bilateral Cooperation: Germany's agreement with Austria to accelerate gas storage filling underscores its commitment to regional energy security and storage capacity utilization.

The Downstream sector also represents a significant and growing market, driven by the increasing demand for refined products and the expansion of retail and industrial consumption.

Europe Oil and Gas Storage Tank Market Product Developments

Innovations in the Europe Oil and Gas Storage Tank Market are increasingly focused on enhancing safety, environmental performance, and operational efficiency. Advanced materials such as high-strength steel alloys and composite materials are being utilized to extend tank lifespan and improve resistance to corrosion and extreme temperatures. Smart monitoring technologies, incorporating IoT sensors and AI-driven analytics, are revolutionizing tank management, enabling predictive maintenance, leak detection, and real-time inventory management. Furthermore, the development of modular and pre-fabricated tank solutions offers greater flexibility and faster deployment for storage projects. These advancements are crucial for meeting stringent regulatory requirements and adapting to evolving market demands for more sustainable and reliable energy infrastructure.

Challenges in the Europe Oil and Gas Storage Tank Market Market

The Europe Oil and Gas Storage Tank Market faces several significant challenges that temper its growth trajectory. Regulatory hurdles, particularly evolving environmental standards and stringent safety compliances, can lead to increased project costs and longer approval times. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of raw materials and specialized components, leading to project delays. Furthermore, the increasing societal and political pressure for decarbonization presents a long-term challenge, potentially reducing demand for traditional fossil fuel storage infrastructure in the distant future, although the transition period will likely see continued investment. Competitive pressures among a growing number of specialized manufacturers and service providers can also lead to pricing challenges and pressure on profit margins.

Forces Driving Europe Oil and Gas Storage Tank Market Growth

Several key forces are propelling the growth of the Europe Oil and Gas Storage Tank Market. The paramount driver is the escalating demand for energy security across Europe, particularly in light of geopolitical uncertainties, necessitating robust storage capabilities for crude oil and natural gas. The strategic shift towards diversifying energy imports, with a significant increase in Liquefied Natural Gas (LNG) imports, is a major catalyst for the expansion and construction of LNG storage terminals. Technological advancements, including the adoption of smart monitoring systems and advanced materials, are improving the efficiency and safety of storage operations, making new installations and upgrades more attractive. Regulatory frameworks that mandate minimum storage levels for strategic reserves also provide a consistent demand for storage capacity. Economic recovery and industrial growth across various European nations further contribute to the demand for refined products and petrochemical storage.

Challenges in the Europe Oil and Gas Storage Tank Market Market

The long-term growth of the Europe Oil and Gas Storage Tank Market is bolstered by several evolving factors. The increasing integration of renewable energy sources, while a long-term decarbonization goal, presents an opportunity for the development of storage solutions for emerging energy carriers like hydrogen and biofuels, requiring specialized tank designs. Strategic partnerships and collaborations between storage providers, technology developers, and energy companies are fostering innovation and expanding market reach. Furthermore, the ongoing modernization and upgrade of existing, aging infrastructure offer a continuous stream of demand for advanced and compliant storage solutions. The persistent need for reliable energy supply during the energy transition ensures a sustained role for conventional oil and gas storage, albeit with a growing emphasis on efficiency and environmental responsibility.

Emerging Opportunities in Europe Oil and Gas Storage Tank Market

Emerging opportunities within the Europe Oil and Gas Storage Tank Market are multifaceted. The rapid growth of the Liquefied Natural Gas (LNG) sector, driven by Europe's efforts to secure diverse energy supplies, presents significant opportunities for the construction and expansion of LNG storage terminals and related infrastructure. The increasing focus on hydrogen as a future energy carrier is creating a nascent but rapidly developing market for hydrogen storage tanks, requiring specialized materials and safety protocols. Furthermore, the growing demand for biofuels necessitates dedicated storage solutions, offering a pathway for diversification. The ongoing digitalization of the energy sector is driving demand for smart storage solutions equipped with advanced monitoring and control systems, enhancing operational efficiency and safety. Investments in repurposing or upgrading existing conventional storage facilities for new energy applications also represent a significant opportunity.

Leading Players in the Europe Oil and Gas Storage Tank Market Sector

- HOYER GmbH

- Royal Vopak NV

- Eisenbau Heilbronn GmbH

- Vitol Tank Terminals International BV (VTTI)

- Lapesa Grupo Empresarial SL

- Virtor Oy

- GLS Tanks International GmbH

- Oiltanking GmbH

- ROSEN Group

- Dyer Gas GmbH

Key Milestones in Europe Oil and Gas Storage Tank Market Industry

- September 2022: Germany's natural gas storage facilities reached more than 85%, displaying steady progress despite a drastic reduction in deliveries from Russia amid the war in Ukraine. The government's target to reach 85% storage capacity by October was achieved at the beginning of September, showcasing strategic preparedness and rapid response in the gas storage segment.

- July 2022: Germany and Austria signed a deal to accelerate filling gas storage facilities. With the signing of a bilateral solidarity agreement, the two countries agreed to cooperate on the use of liquefied natural gas (LNG) infrastructure and storage filling, underscoring a collaborative approach to energy security and shared storage resource management.

Strategic Outlook for Europe Oil and Gas Storage Tank Market Market

The strategic outlook for the Europe Oil and Gas Storage Tank Market is characterized by robust growth, driven by the imperative for energy security, diversification of supply, and technological advancements. Investments in LNG infrastructure will continue to be a primary growth accelerator, alongside a burgeoning interest in storage solutions for hydrogen and biofuels. The market will witness a heightened focus on smart technologies, automation, and sustainability, enabling more efficient and environmentally conscious operations. Strategic partnerships, technological innovation, and the ongoing modernization of existing infrastructure will be key to capitalizing on future market potential. Companies that can offer integrated solutions, from design and manufacturing to maintenance and digital monitoring, will be best positioned for success in this dynamic and evolving sector.

Europe Oil and Gas Storage Tank Market Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Europe Oil and Gas Storage Tank Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Norway

- 4. Spain

- 5. Rest of Europe

Europe Oil and Gas Storage Tank Market Regional Market Share

Geographic Coverage of Europe Oil and Gas Storage Tank Market

Europe Oil and Gas Storage Tank Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Midstream to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. Norway

- 5.2.4. Spain

- 5.2.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Germany Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. United Kingdom Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Norway Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Spain Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Rest of Europe Europe Oil and Gas Storage Tank Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 HOYER GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Royal Vopak NV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eisenbau Heilbronn GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vitol Tank Terminals International BV (VTTI)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lapesa Grupo Empresarial SL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Virtor Oy

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GLS Tanks International GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oiltanking GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ROSEN Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dyer Gas GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 HOYER GmbH

List of Figures

- Figure 1: Europe Oil and Gas Storage Tank Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Oil and Gas Storage Tank Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 2: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 3: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 6: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 7: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 10: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 11: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 14: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 15: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 18: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 19: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 20: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Sector 2020 & 2033

- Table 22: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Sector 2020 & 2033

- Table 23: Europe Oil and Gas Storage Tank Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Europe Oil and Gas Storage Tank Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oil and Gas Storage Tank Market?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Europe Oil and Gas Storage Tank Market?

Key companies in the market include HOYER GmbH, Royal Vopak NV, Eisenbau Heilbronn GmbH, Vitol Tank Terminals International BV (VTTI), Lapesa Grupo Empresarial SL, Virtor Oy, GLS Tanks International GmbH, Oiltanking GmbH, ROSEN Group, Dyer Gas GmbH.

3. What are the main segments of the Europe Oil and Gas Storage Tank Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 2315.2 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Midstream to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

September 2022: Germany's natural gas storage facilities reached more than 85%, displaying steady progress despite a drastic reduction in deliveries from Russia amid the war in Ukraine. The government's target to reach 85% storage capacity by October was achieved at the beginning of September.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oil and Gas Storage Tank Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oil and Gas Storage Tank Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oil and Gas Storage Tank Market?

To stay informed about further developments, trends, and reports in the Europe Oil and Gas Storage Tank Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence