Key Insights

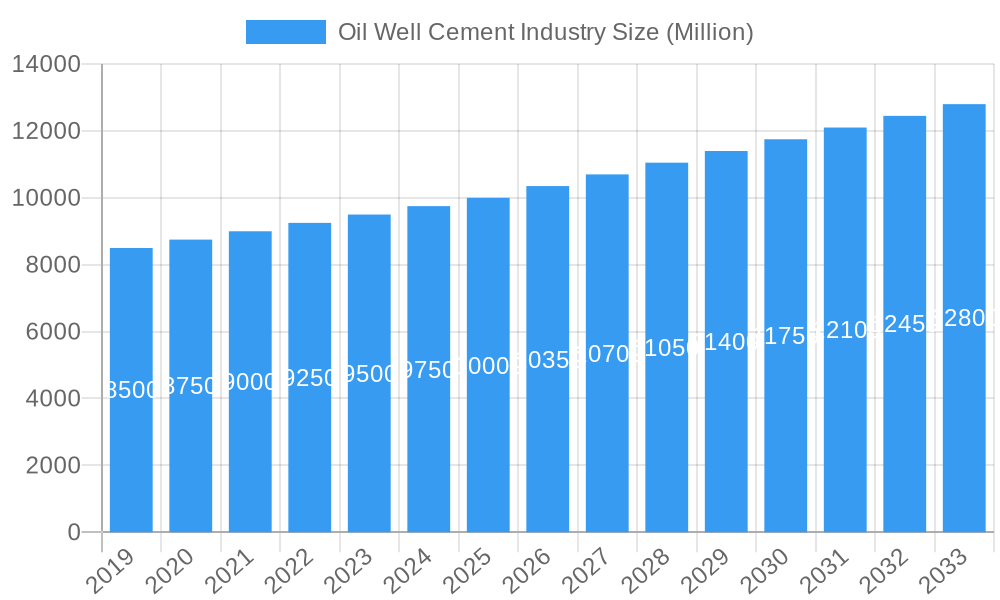

The global oil well cementing market is poised for robust expansion, projected to reach a significant market size and achieve a Compound Annual Growth Rate (CAGR) exceeding 3.55% over the study period of 2019-2033. This growth is primarily fueled by the increasing global demand for energy, necessitating sustained exploration and production activities across conventional and unconventional oil and gas reserves. The market is driven by critical factors such as ongoing upstream investments in mature fields requiring remedial cementing to maintain production integrity, as well as the development of new exploration projects, particularly in regions with substantial untapped hydrocarbon potential. Furthermore, advancements in cementing technologies, including the development of specialized additives and slurries designed for extreme downhole conditions, are enhancing operational efficiency and wellbore integrity, thereby stimulating market demand. The continued reliance on fossil fuels for the foreseeable future underpins the enduring importance of oil well cementing services for safe and efficient hydrocarbon extraction.

Oil Well Cement Industry Market Size (In Billion)

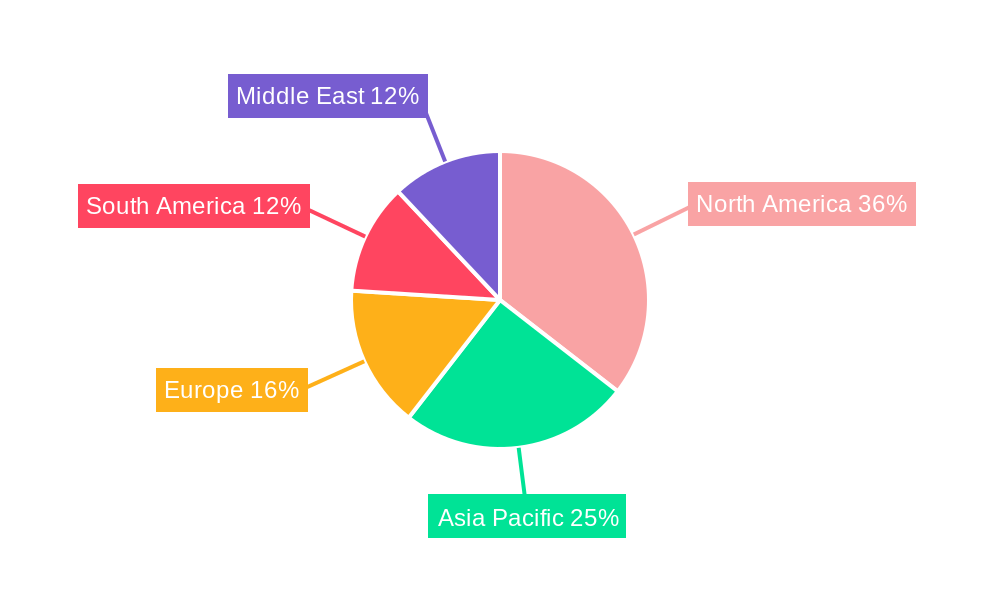

Geographically, North America and Asia Pacific are expected to represent substantial market shares due to their active oil and gas exploration and production landscapes. However, emerging economies in South America and the Middle East present significant growth opportunities, driven by increasing investments in their domestic energy sectors and the ongoing efforts to boost production capacity. The market is segmented by location of deployment, with onshore operations currently dominating, while offshore operations are gaining traction due to the exploration of deeper and more complex reservoirs. The primary cementing segment, crucial for new well construction, is expected to remain a key revenue generator, complemented by the growing demand for remedial cementing services to ensure the longevity and productivity of existing wells. Despite positive growth prospects, the market faces challenges from the increasing global focus on renewable energy sources and stringent environmental regulations, which may influence long-term investment trends in the oil and gas sector. Nonetheless, the essential role of well cementing in ensuring operational safety, environmental protection, and production efficiency will continue to drive its market trajectory.

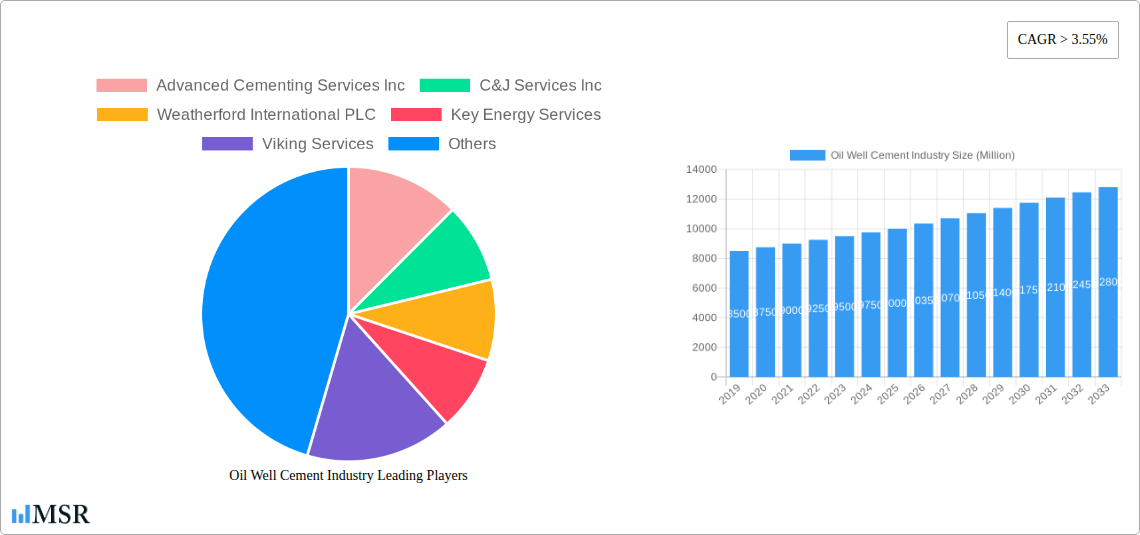

Oil Well Cement Industry Company Market Share

This comprehensive Oil Well Cement Industry Report provides an in-depth analysis of the global market, covering market concentration, industry dynamics, key segments, product innovations, challenges, growth drivers, emerging opportunities, leading players, and strategic outlook. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. This report is crucial for oilfield services companies, cement manufacturers, drilling contractors, and investment firms seeking to understand the evolving landscape of well cementing, primary cementing, remedial cementing, and offshore cementing applications.

Oil Well Cement Industry Market Concentration & Dynamics

The Oil Well Cement Industry exhibits moderate market concentration, with a few major players holding significant market share. The innovation ecosystem is driven by oilfield services providers focusing on enhanced performance, environmental sustainability, and cost efficiency. Regulatory frameworks, particularly concerning emissions and well integrity, are increasingly influencing product development and operational practices. The threat of substitute products, such as alternative wellbore construction materials, remains a factor, though the established reliability of oil well cement limits widespread adoption. End-user trends indicate a growing demand for specialized cement slurries for challenging environments, including deepwater wells and unconventional resource plays. Mergers and acquisitions (M&A) activities, with xx deal counts historically and xx projected, are shaping the competitive landscape as companies seek to consolidate capabilities and expand geographic reach. Key M&A activities will be detailed within the report, highlighting strategic consolidations in the oil and gas cementing services sector.

Oil Well Cement Industry Insights & Trends

The global Oil Well Cement Market is projected to experience significant growth, driven by robust exploration and production activities worldwide. The oil and gas cementing market size was valued at approximately USD XXX Million in 2025 and is anticipated to reach USD XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX%. Key market growth drivers include the increasing demand for energy, particularly from emerging economies, and the ongoing need to maintain and enhance production from mature fields. Technological disruptions are playing a pivotal role, with advancements in specialty cements, additive technologies, and downhole monitoring systems enhancing wellbore integrity and operational efficiency. Evolving consumer behaviors, interpreted as operator demands, are leaning towards environmentally friendly solutions and cements that offer improved performance under extreme temperature and pressure conditions. The increasing complexity of drilling operations, including horizontal and extended-reach wells, necessitates sophisticated cementing solutions. Furthermore, global energy policies and investments in new exploration projects will significantly impact demand for oil well cementing services. The development of novel cement slurries with tailored properties, such as resistance to gas migration and improved fluid loss control, is a critical trend. The oil well cementing equipment market is also experiencing innovation, with advanced pumping and mixing systems enhancing precision and reliability.

Key Markets & Segments Leading Oil Well Cement Industry

The Oil Well Cement Industry is segmented by Location of Deployment into Onshore and Offshore, and by Type into Primary, Remedial, and Other Types. The Onshore segment currently dominates the market, driven by extensive exploration and production activities in major oil and gas producing regions. Economic growth and infrastructure development in these regions directly translate to increased demand for onshore oil well cementing. Factors such as a higher number of drilling rigs deployed onshore and the economic viability of developing onshore reserves contribute to its leading position.

Onshore Deployment:

- Drivers: Growing energy demand in developing economies, significant shale gas and tight oil reserves, established infrastructure for onshore operations.

- Dominance Analysis: Onshore operations benefit from lower operational complexity and cost compared to offshore. The sheer volume of wells drilled onshore, including those for unconventional resources, ensures consistent demand for oil well cement and associated services. Regions like North America, Asia-Pacific, and the Middle East are major contributors to the onshore market.

Offshore Deployment:

- Drivers: Maturing onshore reserves, discovery of significant deepwater reserves, technological advancements in offshore drilling and completion.

- Dominance Analysis: While smaller in volume than onshore, the Offshore segment is characterized by higher value due to the complexity and specialized nature of operations. The development of deepwater and ultra-deepwater fields, particularly in the Gulf of Mexico, the North Sea, and off the coast of Brazil, requires advanced offshore cementing solutions capable of withstanding extreme pressures and temperatures. Environmental regulations also play a significant role in shaping the demand for specialized offshore well cement.

Primary Cementing:

- Drivers: New well construction, expansion of production capacity, exploration activities.

- Dominance Analysis: Primary cementing is the foundational stage of well construction, involving the sealing of the annulus between the casing and the formation. Its demand is directly correlated with the number of new wells drilled, making it a core segment of the market.

Remedial Cementing:

- Drivers: Wellbore integrity issues, production optimization, P&A (Plug and Abandonment) operations.

- Dominance Analysis: Remedial cementing addresses issues in existing wells, such as leaks or poor zonal isolation. The need to maintain production, extend the life of mature fields, and decommission aging wells drives demand for remedial cementing services.

Oil Well Cement Industry Product Developments

The Oil Well Cement Industry is witnessing a surge in product innovations aimed at enhancing well integrity, improving operational efficiency, and reducing environmental impact. Halliburton Company's introduction of NeoCem E+ and EnviraCem cement barrier systems exemplifies this trend, offering high-performance, reduced Portland cement systems that combine specialized materials with Portland cement for synergistic benefits. These systems achieve high compressive strength and ductility at a lower density than conventional options, thereby bolstering barrier reliability. Other key developments include advanced additive technologies for controlling slurry properties, such as fluid loss, rheology, and setting time, tailored for diverse downhole conditions, from high-temperature/high-pressure environments to sour gas formations. The market relevance of these innovations lies in their ability to reduce non-productive time, minimize operational risks, and support the economic viability of challenging drilling projects.

Challenges in the Oil Well Cement Industry Market

The Oil Well Cement Industry faces several challenges that can hinder growth. Regulatory hurdles, particularly concerning environmental impact and waste disposal, require significant investment in compliance and the development of eco-friendly solutions. Supply chain disruptions, exacerbated by geopolitical instability and global logistics issues, can lead to material shortages and price volatility for key components of oil well cement. Intense competitive pressures, characterized by price wars and the constant need for technological differentiation, impact profit margins. Furthermore, the fluctuating price of crude oil directly influences exploration and production budgets, subsequently affecting the demand for cementing services. The growing emphasis on ESG (Environmental, Social, and Governance) factors necessitates the development of sustainable cementing solutions that reduce carbon footprint and minimize environmental risks, posing a significant challenge for existing product portfolios.

Forces Driving Oil Well Cement Industry Growth

Several key forces are driving the growth of the Oil Well Cement Industry. Technological advancements in drilling techniques, such as extended-reach drilling and managed pressure drilling, necessitate advanced cementing solutions to ensure wellbore integrity. The increasing global demand for energy, coupled with the need to maximize production from existing and newly discovered reserves, fuels the demand for primary cementing and remedial cementing. Government policies and incentives supporting domestic energy production also play a crucial role. Furthermore, the ongoing development of offshore oil and gas fields, particularly in deepwater environments, requires specialized and high-performance cementing materials and expertise. The drive towards enhanced oil recovery (EOR) techniques often involves specialized cementing applications to improve sweep efficiency and reservoir management.

Challenges in the Oil Well Cement Industry Market

Long-term growth catalysts for the Oil Well Cement Industry are rooted in continuous innovation and strategic market expansion. The development of advanced cementing additives that offer improved performance in extreme well conditions, such as ultra-high temperatures and pressures, will be critical. Partnerships and collaborations between oilfield service providers and cement manufacturers will foster the co-creation of bespoke solutions for emerging unconventional plays and challenging geological formations. Market expansion into regions with untapped hydrocarbon potential and the increasing focus on well decommissioning and abandonment present significant long-term opportunities. The growing demand for integrated well construction services, where cementing is a crucial component, will also drive sustained growth.

Emerging Opportunities in Oil Well Cement Industry

Emerging opportunities in the Oil Well Cement Industry are significantly influenced by the global energy transition and technological advancements. The development of low-carbon cement alternatives and geopolymer cements tailored for oil and gas applications presents a substantial opportunity to address environmental concerns and meet stringent ESG mandates. The increasing focus on well plugging and abandonment (P&A) operations, driven by aging infrastructure and environmental regulations, will create a consistent demand for specialized abandonment cements and related services. Furthermore, the exploration of unconventional resources in new geographies and the application of advanced digitalization and AI in cementing operations for real-time monitoring and optimization offer avenues for innovation and market differentiation. The growing demand for geothermal energy also opens up new applications for specialized cementing technologies.

Leading Players in the Oil Well Cement Industry Sector

- Advanced Cementing Services Inc

- BJ Services Company

- Baker Hughes Company

- C&J Services Inc

- Calfrac Well Services Ltd

- China Oilfield Services Limited

- Halliburton Company

- Key Energy Services

- NESR Energy Services

- Schlumberger Limited

- Sanjel Energy Services

- Superior Oilfield Services Inc

- Trican Well Services Corporation

- Viking Services

- Weatherford International PLC

Key Milestones in Oil Well Cement Industry Industry

- November 2022: Halliburton Company introduced NeoCem E+ and EnviraCem cement barrier systems, offering high-performance, reduced Portland cement systems designed to enhance barrier reliability in oil and gas applications. These innovative systems utilize specialized materials in synergy with Portland cement, achieving superior compressive strength and ductility at a lower density than conventional options.

- March 2022: The Abu Dhabi National Oil Company (ADNOC) signed framework agreements valued at USD 658 million for cementing services, aimed at facilitating drilling growth and expanding crude oil production. These agreements, awarded through a competitive process, were granted to Halliburton Worldwide Limited Abu Dhabi, Baker Middle East, Emirates Western Oil Well Drilling & Maintenance Co., NESR Energy Services, and Emjel Oil Field Services.

Strategic Outlook for Oil Well Cement Industry Market

The strategic outlook for the Oil Well Cement Industry is characterized by a strong emphasis on innovation, sustainability, and operational excellence. Future market potential lies in developing specialized cementing solutions that address the complexities of unconventional resource extraction and deepwater exploration. Growth accelerators will stem from the adoption of digital technologies for real-time monitoring and predictive analytics in cementing operations, leading to enhanced efficiency and reduced non-productive time. Strategic opportunities include expanding service offerings in well decommissioning and P&A, catering to the growing global need for safe and environmentally sound well closure. Furthermore, forging strategic alliances to develop and deploy environmentally friendly cement formulations will be crucial for long-term success and market leadership in a landscape increasingly driven by ESG considerations.

Oil Well Cement Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Type

- 2.1. Primary

- 2.2. Remedial

- 2.3. Other Types

Oil Well Cement Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East

Oil Well Cement Industry Regional Market Share

Geographic Coverage of Oil Well Cement Industry

Oil Well Cement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Energy Demand4.; Government Support for Power Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Financial Viability

- 3.4. Market Trends

- 3.4.1. Onshore Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Primary

- 5.2.2. Remedial

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. North America Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Primary

- 6.2.2. Remedial

- 6.2.3. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Asia Pacific Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Primary

- 7.2.2. Remedial

- 7.2.3. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Europe Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Primary

- 8.2.2. Remedial

- 8.2.3. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. South America Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Primary

- 9.2.2. Remedial

- 9.2.3. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Middle East Oil Well Cement Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Primary

- 10.2.2. Remedial

- 10.2.3. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Advanced Cementing Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 C&J Services Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Weatherford International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Key Energy Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Viking Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baker Hughes Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 China Oilfield Services Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Halliburton Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BJ Services Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Schlumberger Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Superior Oilfield Services Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sanjel Energy Services*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Calfrac Well Services Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Trican Well Services Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Advanced Cementing Services Inc

List of Figures

- Figure 1: Global Oil Well Cement Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 3: North America Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 4: North America Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 9: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 10: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 15: Europe Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 16: Europe Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 21: South America Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 22: South America Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 23: South America Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: South America Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Oil Well Cement Industry Revenue (undefined), by Location of Deployment 2025 & 2033

- Figure 27: Middle East Oil Well Cement Industry Revenue Share (%), by Location of Deployment 2025 & 2033

- Figure 28: Middle East Oil Well Cement Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East Oil Well Cement Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Oil Well Cement Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Oil Well Cement Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 2: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Oil Well Cement Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 5: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 8: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 11: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 14: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Oil Well Cement Industry Revenue undefined Forecast, by Location of Deployment 2020 & 2033

- Table 17: Global Oil Well Cement Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Oil Well Cement Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil Well Cement Industry?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Oil Well Cement Industry?

Key companies in the market include Advanced Cementing Services Inc, C&J Services Inc, Weatherford International PLC, Key Energy Services, Viking Services, Baker Hughes Company, China Oilfield Services Limited, Halliburton Company, BJ Services Company, Schlumberger Limited, Superior Oilfield Services Inc, Sanjel Energy Services*List Not Exhaustive, Calfrac Well Services Ltd, Trican Well Services Corporation.

3. What are the main segments of the Oil Well Cement Industry?

The market segments include Location of Deployment, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Energy Demand4.; Government Support for Power Sector.

6. What are the notable trends driving market growth?

Onshore Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Financial Viability.

8. Can you provide examples of recent developments in the market?

November 2022: Halliburton Company introduced NeoCem E+ and EnviraCem cement barrier systems for oil and gas applications as part of its portfolio of high-performance, reduced Portland cement systems. These new systems combine specialized materials with Portland cement to achieve synergies between their chemical and physical properties. These reduced Portland systems were engineered by Halliburton using an innovative tailoring process to deliver high performance, compressive strength, and ductility at a lower density than conventional systems, thus enhancing barrier reliability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil Well Cement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil Well Cement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil Well Cement Industry?

To stay informed about further developments, trends, and reports in the Oil Well Cement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence