Key Insights

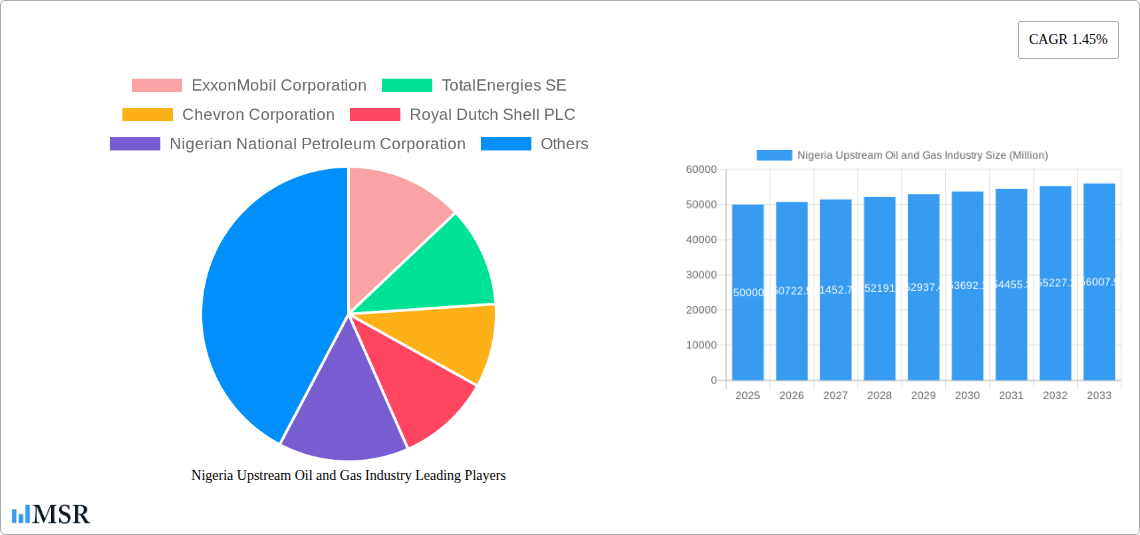

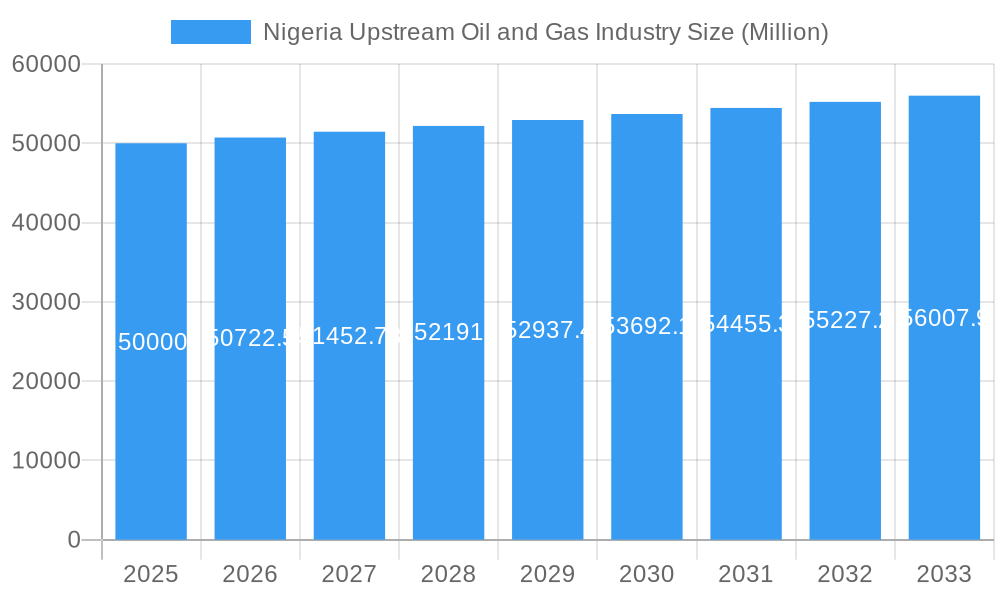

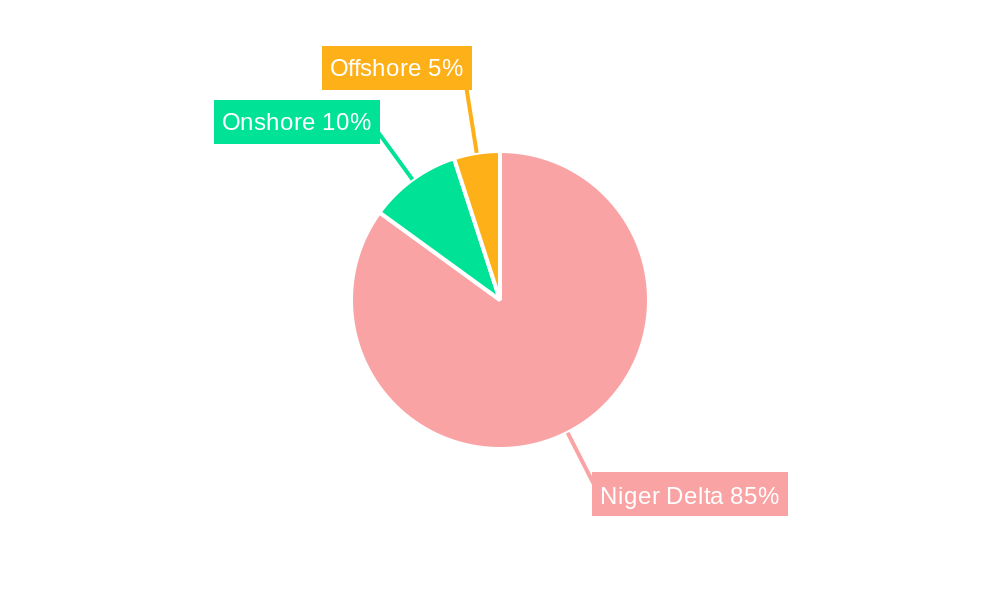

The Nigerian upstream oil and gas sector, predominantly located in the Niger Delta, offers substantial opportunities alongside significant operational hurdles. Projecting a market size of $6.2 billion for 2025, with a Compound Annual Growth Rate (CAGR) of 4.05%, this analysis anticipates continued industry expansion from its 2025 base. Key players, including international oil companies (IOCs) such as ExxonMobil, TotalEnergies, Chevron, and Shell, alongside the Nigerian National Petroleum Corporation (NNPC), drive this market. Primary growth catalysts include enduring global energy demand, ongoing exploration and production efforts in onshore and offshore reserves, and government strategies to enhance domestic energy output. Nevertheless, the industry faces considerable restraints, including persistent security challenges in the Niger Delta, intricate regulatory environments, and environmental concerns linked to oil spills. The market is segmented by product type (crude oil, natural gas), geographical location (Niger Delta, onshore, offshore), and operational stage (exploration, drilling, production), requiring strategic, integrated development plans.

Nigeria Upstream Oil and Gas Industry Market Size (In Billion)

The forecast period from 2025 to 2033 presents a dynamic landscape of opportunities and risks. Critical to unlocking growth potential are sustained investments in infrastructure modernization, especially considering aging assets and the global energy transition. Advancements in exploration, drilling, and production technologies, coupled with robust regulatory frameworks addressing environmental and security issues, are vital for long-term sector sustainability. Furthermore, the increasing emphasis on Environmental, Social, and Governance (ESG) principles will shape investment strategies and operational practices, necessitating heightened transparency and accountability from all participants. Successfully navigating these complexities will solidify the Nigerian upstream oil and gas industry's contribution to the national economy over the next decade.

Nigeria Upstream Oil and Gas Industry Company Market Share

Nigeria Upstream Oil and Gas Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Nigerian upstream oil and gas industry, covering market dynamics, key players, growth drivers, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and policymakers. The report leverages extensive data analysis to offer actionable insights and strategic recommendations. Explore the evolving landscape of Nigeria's energy sector and understand the opportunities and challenges that lie ahead. The market is dominated by key players including ExxonMobil Corporation, TotalEnergies SE, Chevron Corporation, Royal Dutch Shell PLC, and the Nigerian National Petroleum Corporation (NNPC), operating across the Niger Delta region (onshore and offshore) in exploration, drilling, and production of crude oil and natural gas.

Nigeria Upstream Oil and Gas Industry Market Concentration & Dynamics

This section analyzes market concentration, innovation, regulations, substitute products, end-user trends, and mergers & acquisitions (M&A) within the Nigerian upstream oil and gas sector. The industry exhibits moderate concentration, with a few major international oil companies (IOCs) and NNPC holding significant market share. Precise market share figures for 2024 are unavailable (xx%), but NNPC likely holds a substantial portion. Innovation is driven by the need for enhanced oil recovery (EOR) techniques and cost reduction strategies in a volatile price environment. Regulatory frameworks, including the anticipated impact of the Petroleum Industry Act (PIA), significantly influence operations. The lack of synergy between public and private institutions remains a challenge. Natural gas, particularly LNG, presents a growing substitute product, while the demand for crude oil remains high. End-user trends reflect global energy consumption patterns with shifts towards cleaner energy options impacting long-term demand. M&A activity has been moderate in recent years, with xx deals recorded in the historical period (2019-2024).

Nigeria Upstream Oil and Gas Industry Industry Insights & Trends

The Nigerian upstream oil and gas market demonstrates fluctuating growth, influenced by global oil prices and domestic policy changes. The market size in 2024 was approximately xx Million USD, with a projected CAGR of xx% during the forecast period (2025-2033). Several factors contribute to market growth: increasing domestic energy demand, efforts to boost production efficiency, and exploration of new reserves. However, challenges include security concerns in the Niger Delta, regulatory uncertainty, and the global transition to renewable energy sources. Technological advancements in exploration and production, such as digitalization and automation, are improving efficiency. Consumer behavior is largely driven by global energy prices and government policies.

Key Markets & Segments Leading Nigeria Upstream Oil and Gas Industry

The Niger Delta region remains the dominant area for upstream oil and gas operations, accounting for xx% of total production in 2024. Both onshore and offshore segments contribute significantly, with offshore operations showcasing larger reserves but higher operational costs. Crude oil represents the primary product, accounting for approximately xx Million barrels per day in 2024.

Drivers for Crude Oil Dominance:

- High global demand

- Existing infrastructure

- Established production capacity

Drivers for Natural Gas Growth:

- Government initiatives promoting gas development

- Growing domestic demand for power generation

- Potential for LNG exports

Nigeria Upstream Oil and Gas Industry Product Developments

Technological advancements focus on improving recovery rates, optimizing production processes, and minimizing environmental impact. Innovation in EOR techniques, digitalization of operations, and exploration of unconventional resources are key themes. These advancements aim to improve competitiveness and sustainability in a challenging market environment.

Challenges in the Nigeria Upstream Oil and Gas Industry Market

The industry faces significant challenges, including security issues in the Niger Delta impacting production, regulatory uncertainties, and infrastructure constraints. These factors lead to increased operational costs and limit investment. The lack of synergy between public and private institutions further complicates operations, hindering efficient resource management and potentially impacting production by approximately xx% annually.

Forces Driving Nigeria Upstream Oil and Gas Industry Growth

Several factors drive industry growth, including increasing domestic energy demand, government incentives for investment, and the ongoing exploration of new reserves. The PIA aims to improve regulatory clarity and attract foreign investment. Technological improvements in exploration and production boost efficiency and output.

Long-Term Growth Catalysts in the Nigeria Upstream Oil and Gas Industry

Long-term growth depends on sustained investment, improving security in the Niger Delta, and the successful implementation of the PIA. Partnerships between IOCs and NNPC are crucial for unlocking the industry's potential. Strategic investments in infrastructure development are necessary for long-term sustainability.

Emerging Opportunities in Nigeria Upstream Oil and Gas Industry

Opportunities lie in gas development, including LNG exports, and the exploration of marginal fields. Investment in renewable energy sources alongside oil and gas presents a crucial aspect of diversification and sustainability. Technological advancements offer opportunities for cost reduction and efficiency improvement.

Leading Players in the Nigeria Upstream Oil and Gas Industry Sector

- ExxonMobil Corporation

- TotalEnergies SE

- Chevron Corporation

- Royal Dutch Shell PLC

- Nigerian National Petroleum Corporation

Key Milestones in Nigeria Upstream Oil and Gas Industry Industry

- February 2021: Government announces plans to overhaul the Nigerian Petroleum Exchange (NIPEX) to improve inventory management and transparency.

- February 2021: Nigeria launches an initiative to cut upstream production costs.

- 2021: Government aims to pass the Petroleum Industry Bill (PIB), now the PIA, to create a more conducive regulatory environment.

Strategic Outlook for Nigeria Upstream Oil and Gas Industry Market

The future of Nigeria's upstream oil and gas industry hinges on addressing security challenges, improving infrastructure, and fostering a more predictable regulatory environment. The successful implementation of the PIA will be critical. Strategic partnerships and investments in technology will unlock further growth potential. Diversification into gas and renewable energy sources will enhance long-term sustainability.

Nigeria Upstream Oil and Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Nigeria Upstream Oil and Gas Industry Segmentation By Geography

- 1. Niger

Nigeria Upstream Oil and Gas Industry Regional Market Share

Geographic Coverage of Nigeria Upstream Oil and Gas Industry

Nigeria Upstream Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector

- 3.4. Market Trends

- 3.4.1. Growing Investments in Gas Infrastructure to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Upstream Oil and Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ExxonMobil Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TotalEnergies SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chevron Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nigerian National Petroleum Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Nigeria Upstream Oil and Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Nigeria Upstream Oil and Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 3: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 12: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Region 2020 & 2033

- Table 13: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 14: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Production Analysis 2020 & 2033

- Table 15: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Nigeria Upstream Oil and Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Nigeria Upstream Oil and Gas Industry Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Upstream Oil and Gas Industry?

The projected CAGR is approximately 4.05%.

2. Which companies are prominent players in the Nigeria Upstream Oil and Gas Industry?

Key companies in the market include ExxonMobil Corporation, TotalEnergies SE, Chevron Corporation, Royal Dutch Shell PLC, Nigerian National Petroleum Corporation.

3. What are the main segments of the Nigeria Upstream Oil and Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Demand for Increaing Refinening Capacity4.; Increasing Investment in Downstream Sector.

6. What are the notable trends driving market growth?

Growing Investments in Gas Infrastructure to Drive the Market.

7. Are there any restraints impacting market growth?

4.; Fluctuating Price of Crude Oil May Impede the Development of the Downstream Sector.

8. Can you provide examples of recent developments in the market?

In February 2021, the government announced its plans to overhaul the Nigerian Petroleum Exchange (NIPEX) to shed more light on inventory management. The country's oil management is plagued by no synergy between different sets of the institution, both public and private. The government is expected to take more proactive steps in this direction in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Upstream Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Upstream Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Upstream Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Nigeria Upstream Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence