Key Insights

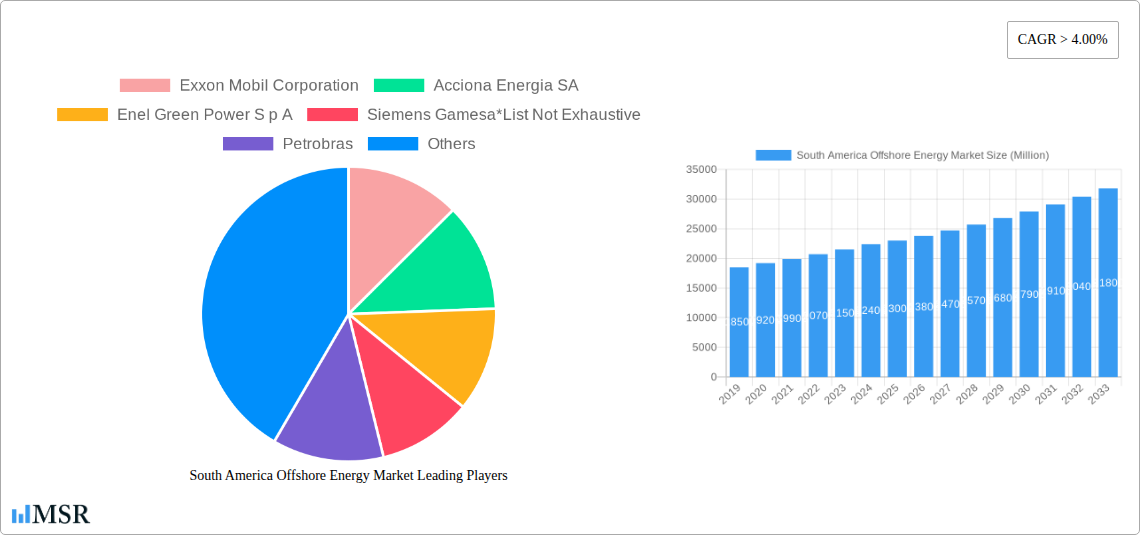

The South America Offshore Energy Market is projected for substantial growth, anticipated to reach approximately USD 7.11 billion by 2025. The market is expected to expand at a robust CAGR of 4.32% between 2025 and 2033. This expansion is driven by the region's significant untapped offshore hydrocarbon reserves and a growing focus on diversifying energy sources with renewables. Key growth catalysts include rising energy demand from expanding populations and industrial sectors, alongside supportive government initiatives to attract foreign investment in offshore exploration and production. Technological advancements in offshore extraction and renewable energy generation are further enhancing the economic viability of these ventures. Global shifts towards cleaner energy sources are also encouraging South American nations to utilize their extensive coastlines for both traditional and renewable offshore energy development.

South America Offshore Energy Market Market Size (In Billion)

While the oil and gas sector remains a dominant segment, there is an accelerating adoption of offshore wind and tidal energy technologies. Brazil is at the forefront of offshore wind exploration, with smaller tidal projects emerging in specific coastal areas. However, the market confronts challenges such as significant capital investment for offshore infrastructure, intricate regulatory environments, and environmental considerations related to offshore operations. Fluctuations in global oil prices also introduce market volatility. Despite these obstacles, the imperative for energy security and the economic advantages of offshore resources are expected to drive market progress. The competitive arena is active, with major multinational oil and gas companies and specialized renewable energy firms competing for market share across key South American countries.

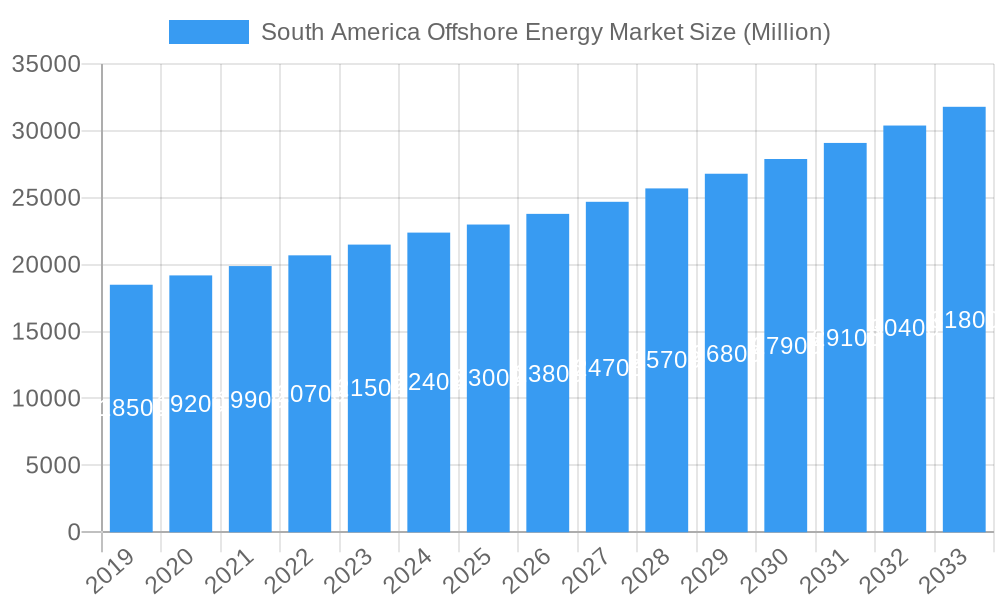

South America Offshore Energy Market Company Market Share

South America Offshore Energy Market: Navigating the Next Decade of Growth (2019-2033)

Unlock the potential of South America's dynamic offshore energy landscape. This comprehensive report provides an in-depth analysis of the South America offshore energy market, encompassing offshore wind, offshore oil and gas, and tidal wave energy across key geographies like Brazil, Argentina, and Venezuela, along with the broader Rest of South America. Driven by significant discoveries and technological advancements, the market is poised for robust growth. Our forecast period (2025-2033) builds upon a strong base year (2025), examining historical trends from 2019-2024. With an estimated market size of over XX Million by 2033 and a projected CAGR of XX%, this report is essential for oil and gas companies, renewable energy developers, investors, and policymakers seeking to capitalize on emerging opportunities in this high-growth sector.

South America Offshore Energy Market Market Concentration & Dynamics

The South America offshore energy market exhibits a moderate level of concentration, with major players like Exxon Mobil Corporation, Petrobras, Chevron Corporation, Acciona Energia SA, Enel Green Power S p A, Siemens Gamesa, Vestas, General Electric Company, and Repsol SA (list not exhaustive) holding significant influence. Innovation ecosystems are rapidly evolving, particularly in offshore wind technology development and pre-salt oil and gas exploration. Regulatory frameworks across the region are becoming more conducive to offshore energy investments, though varying by country. Substitute products are primarily related to onshore energy sources, but the unique advantages of offshore operations in terms of resource availability and energy security are driving demand. End-user trends indicate a growing preference for cleaner energy sources, coupled with the persistent need for hydrocarbons to meet rising energy demands. Mergers and acquisitions (M&A) activities are anticipated to increase as companies seek to consolidate their market position, expand their portfolios, and gain access to new technologies and exploration blocks. The market's dynamic nature necessitates continuous strategic assessment to navigate competitive pressures and capitalize on evolving opportunities.

South America Offshore Energy Market Industry Insights & Trends

The South America offshore energy market is experiencing a transformative period, driven by a confluence of factors including increasing energy demand, technological advancements, and supportive government policies. The market size, estimated to reach over XX Million by 2033, is projected to grow at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). A key growth driver is the exploration and production of vast offshore oil and gas reserves, particularly in Brazil's pre-salt fields. These discoveries represent a significant source of revenue and energy security for the region. Concurrently, the imperative to decarbonize energy systems is fueling substantial investment in offshore wind power. Technological disruptions are playing a pivotal role, with advancements in turbine efficiency, floating wind technology, and subsea infrastructure reducing costs and expanding the feasibility of offshore projects. Evolving consumer behaviors, influenced by environmental consciousness and a demand for reliable energy, are further accelerating the transition towards diversified offshore energy portfolios. The development of tidal wave energy technologies, while nascent, also presents a promising avenue for future growth and sustainable energy generation in specific coastal regions. The ongoing investment in infrastructure, coupled with a growing skilled workforce, are critical enablers for the sustained expansion of this market.

Key Markets & Segments Leading South America Offshore Energy Market

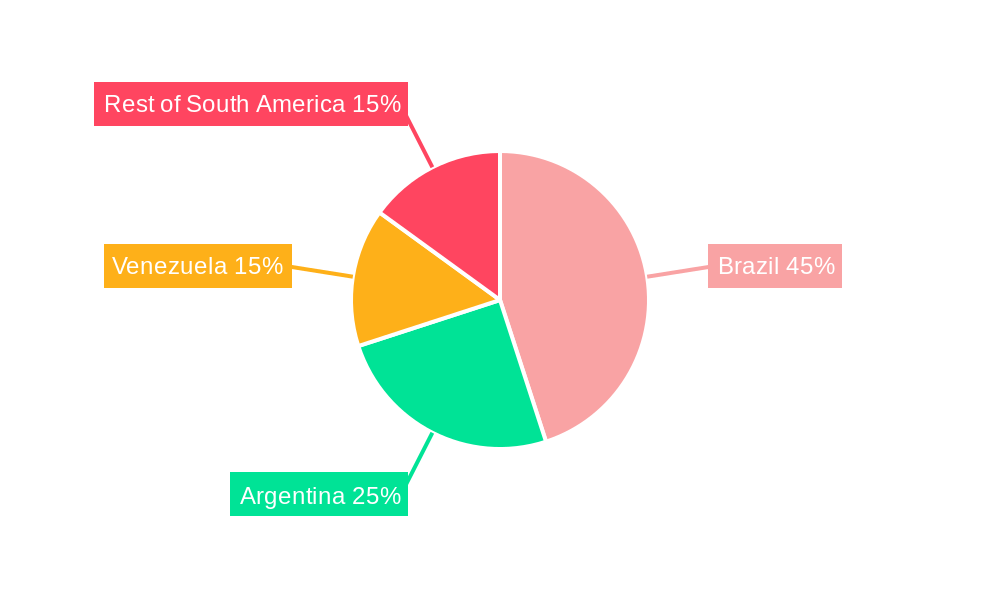

Brazil unequivocally stands as the dominant force in the South America offshore energy market, driven by its colossal offshore oil and gas reserves and burgeoning offshore wind sector. The pre-salt discoveries in the Campos Basin, exemplified by Petrobras's recent exploration efforts, underscore Brazil's unparalleled potential in the hydrocarbons segment. These findings are crucial for meeting both domestic energy needs and export demands, solidifying the nation's position as a major energy producer.

Beyond oil and gas, Brazil's commitment to renewable energy is propelling its offshore wind ambitions. The vast coastline and favorable wind conditions offer immense potential for large-scale wind farm development. Government incentives and the increasing attractiveness of renewable energy investments are spurring significant activity in this segment.

Argentina is also emerging as a significant player, particularly in the offshore wind domain, with projects like those spearheaded by companies such as Acciona Energia SA and Enel Green Power S p A. The Patagonian coast presents excellent wind resources, making it a prime location for both fixed-bottom and floating offshore wind installations. Economic growth and the drive for energy independence are key drivers for Argentina's offshore energy expansion.

While Venezuela possesses substantial offshore oil and gas reserves, its market activity has been influenced by geopolitical and economic factors. However, its inherent resource potential remains a critical consideration for future market dynamics.

The Rest of South America encompasses a mosaic of opportunities across various segments. Countries like Chile are making strides in tidal wave energy, with Enel Green Power Chile's pioneering PB3 PowerBuoy installation highlighting the region's innovative spirit in harnessing marine energy. Colombia and Uruguay are also exploring their offshore wind potential, signaling a diversified regional growth trajectory.

Key Drivers for Segment Dominance:

- Economic Growth & Energy Demand: Rising economies necessitate increased energy supply, with offshore resources offering a reliable solution.

- Resource Abundance: Significant proven reserves of oil and gas, alongside favorable conditions for wind and tidal energy.

- Technological Advancement: Innovations in exploration, extraction, and renewable energy generation are making offshore projects more viable and cost-effective.

- Government Support & Policy Frameworks: Incentives, regulatory clarity, and long-term energy strategies are crucial for attracting investment.

- Infrastructure Development: Investments in ports, transmission networks, and subsea infrastructure are essential enablers.

South America Offshore Energy Market Product Developments

The South America offshore energy market is witnessing significant product developments aimed at enhancing efficiency, sustainability, and cost-effectiveness. In offshore wind, advancements in larger, more powerful turbines, such as those from Siemens Gamesa and Vestas, are increasing energy capture and reducing the levelized cost of electricity. The development of floating offshore wind platforms is opening up deeper waters previously inaccessible for fixed-bottom turbines, expanding the potential for deployment. In oil and gas, innovations in subsea technology, enhanced oil recovery (EOR) techniques, and advanced drilling equipment, utilized by companies like Exxon Mobil Corporation, Chevron Corporation, and Petrobras, are optimizing production from complex reservoirs. The tidal wave energy sector is seeing the emergence of robust and scalable wave energy converters, such as Enel Green Power's PB3 PowerBuoy, demonstrating the potential for reliable marine energy generation. These innovations are crucial for unlocking new reserves, improving operational efficiency, and driving the transition towards a more diversified and sustainable offshore energy future in South America.

Challenges in the South America Offshore Energy Market Market

Navigating the South America offshore energy market presents several significant challenges. Regulatory hurdles and inconsistent policy frameworks across different nations can create uncertainty and deter long-term investment. Supply chain disruptions, exacerbated by logistical complexities inherent in offshore operations and global economic volatility, can lead to project delays and cost overruns. Furthermore, intense competitive pressures from established players and emerging technologies require constant innovation and strategic agility. Environmental concerns and the need for sustainable operational practices also add a layer of complexity, demanding significant investment in eco-friendly technologies and stringent environmental impact assessments. The inherent high capital expenditure associated with offshore projects, coupled with the volatility of commodity prices for oil and gas, presents financial risks that must be carefully managed.

Forces Driving South America Offshore Energy Market Growth

The growth of the South America offshore energy market is propelled by a potent combination of factors. Increasing global energy demand, coupled with the region's significant hydrocarbon reserves, continues to fuel investment in offshore oil and gas. Simultaneously, the global push for decarbonization and renewable energy targets is a major catalyst for the expansion of offshore wind power. Technological advancements, including improvements in turbine efficiency, floating platform designs, and subsea exploration capabilities, are reducing costs and expanding the geographical viability of offshore projects. Supportive government policies and regulatory frameworks that incentivize investment in both traditional and renewable offshore energy sources are crucial growth accelerators. Furthermore, the pursuit of energy independence and security by South American nations is driving the strategic development of their offshore energy resources.

Challenges in the South America Offshore Energy Market Market

Long-term growth catalysts for the South America offshore energy market are deeply rooted in continuous innovation, strategic partnerships, and targeted market expansions. The relentless pursuit of more efficient and cost-effective offshore wind turbine technology, including advancements in floating foundations capable of accessing deeper waters, will unlock vast new potential. In the oil and gas sector, the application of digital technologies like AI and advanced analytics for reservoir management and exploration will optimize production and reduce operational risks. Strategic partnerships between international energy companies and local players are crucial for knowledge transfer, risk sharing, and navigating complex regulatory environments. Furthermore, the development of robust interconnected offshore energy grids will facilitate the integration of diverse energy sources and enhance regional energy security. Expanding the scope of marine energy technologies beyond wind and oil/gas, such as enhanced tidal and wave power solutions, will contribute to a more diversified and resilient energy portfolio for the continent.

Emerging Opportunities in South America Offshore Energy Market

Emerging opportunities in the South America offshore energy market are diverse and promising. The rapid advancement of floating offshore wind technology presents a significant opportunity to tap into deep-water wind resources previously inaccessible. Green hydrogen production powered by offshore wind is another burgeoning area, offering a clean fuel source for various industrial applications and export markets. The potential for offshore carbon capture, utilization, and storage (CCUS) solutions is gaining traction as companies seek to mitigate emissions from existing oil and gas operations. Furthermore, the increasing focus on sustainable maritime infrastructure, including the development of offshore energy hubs and advanced subsea robotics for maintenance and monitoring, creates new market niches. The growing interest in decentralized offshore energy solutions for remote coastal communities and island nations also presents a unique opportunity for smaller-scale, localized projects.

Leading Players in the South America Offshore Energy Market Sector

- Exxon Mobil Corporation

- Acciona Energia SA

- Enel Green Power S p A

- Siemens Gamesa

- Petrobras

- Chevron Corporation

- General Electric Company

- Vestas

- Repsol SA

Key Milestones in South America Offshore Energy Market Industry

- April 2022: Brazilian state-owned giant Petrobras discovered oil in a wildcat well in the pre-salt Campos Basin offshore Brazil. The company aims to resume drilling operations until the final depth is reached to evaluate the discovery.

- April 2021: Enel Green Power Chile, the subsidiary of Enel Green Power S.p. A, installed the PB3 PowerBuoy. It is the first full-scale wave energy converter off the coast of Las Cruces in the Valparaíso Region. The marine energy generator installed by Enel Green Power is the first of its kind installed in Latin America and the fifth in the world.

Strategic Outlook for South America Offshore Energy Market Market

The strategic outlook for the South America offshore energy market is exceptionally bright, characterized by a strong interplay between established hydrocarbon resources and rapidly expanding renewable energy frontiers. Continued exploration and production in offshore oil and gas, particularly in prolific basins like Brazil's pre-salt, will remain a cornerstone of the market. Simultaneously, aggressive investment in offshore wind development, driven by technological advancements and supportive government policies, is set to transform the region's energy mix. Emerging opportunities in areas like green hydrogen production and offshore CCUS present avenues for long-term sustainability and diversification. Companies that can effectively navigate the evolving regulatory landscapes, embrace technological innovation, and foster strategic partnerships will be best positioned to capitalize on the immense growth potential of this dynamic market over the forecast period and beyond. The strategic imperative for South American nations to secure their energy future through diverse offshore sources is a powerful growth accelerator.

South America Offshore Energy Market Segmentation

-

1. Type

- 1.1. Wind

- 1.2. Oil & Gas

- 1.3. Tidal Wave

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Venezuela

- 2.4. Rest of South America

South America Offshore Energy Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Venezuela

- 4. Rest of South America

South America Offshore Energy Market Regional Market Share

Geographic Coverage of South America Offshore Energy Market

South America Offshore Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products

- 3.3. Market Restrains

- 3.3.1. Increase in Adoption of Alternative Fuel Vehicles

- 3.4. Market Trends

- 3.4.1. The Oil and Gas Segment is Expected to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wind

- 5.1.2. Oil & Gas

- 5.1.3. Tidal Wave

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Venezuela

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Venezuela

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wind

- 6.1.2. Oil & Gas

- 6.1.3. Tidal Wave

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Venezuela

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wind

- 7.1.2. Oil & Gas

- 7.1.3. Tidal Wave

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Venezuela

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Venezuela South America Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wind

- 8.1.2. Oil & Gas

- 8.1.3. Tidal Wave

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Venezuela

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Offshore Energy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wind

- 9.1.2. Oil & Gas

- 9.1.3. Tidal Wave

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Venezuela

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Exxon Mobil Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Acciona Energia SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Enel Green Power S p A

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens Gamesa*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Petrobras

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chevron Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 General Electric Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vestas

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Repsol SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Exxon Mobil Corporation

List of Figures

- Figure 1: South America Offshore Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Offshore Energy Market Share (%) by Company 2025

List of Tables

- Table 1: South America Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 3: South America Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2020 & 2033

- Table 5: South America Offshore Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Offshore Energy Market Volume gigawatts Forecast, by Region 2020 & 2033

- Table 7: South America Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 9: South America Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2020 & 2033

- Table 11: South America Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

- Table 13: South America Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 15: South America Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2020 & 2033

- Table 17: South America Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

- Table 19: South America Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 21: South America Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2020 & 2033

- Table 23: South America Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

- Table 25: South America Offshore Energy Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: South America Offshore Energy Market Volume gigawatts Forecast, by Type 2020 & 2033

- Table 27: South America Offshore Energy Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Offshore Energy Market Volume gigawatts Forecast, by Geography 2020 & 2033

- Table 29: South America Offshore Energy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Offshore Energy Market Volume gigawatts Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Offshore Energy Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the South America Offshore Energy Market?

Key companies in the market include Exxon Mobil Corporation, Acciona Energia SA, Enel Green Power S p A, Siemens Gamesa*List Not Exhaustive, Petrobras, Chevron Corporation, General Electric Company, Vestas, Repsol SA.

3. What are the main segments of the South America Offshore Energy Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.11 billion as of 2022.

5. What are some drivers contributing to market growth?

Surge in Demand of Refined Petroleum Products4.; Need for Sustainable Refined Petroleum Products.

6. What are the notable trends driving market growth?

The Oil and Gas Segment is Expected to Dominate the market.

7. Are there any restraints impacting market growth?

Increase in Adoption of Alternative Fuel Vehicles.

8. Can you provide examples of recent developments in the market?

In April 2022, Brazilian state-owned giant Petrobras discovered oil in a wildcat well in the pre-salt Campos Basin offshore Brazil. The company aims to resume the drilling operations until the final depth is reached to evaluate the discovery.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in gigawatts.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Offshore Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Offshore Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Offshore Energy Market?

To stay informed about further developments, trends, and reports in the South America Offshore Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence