Key Insights

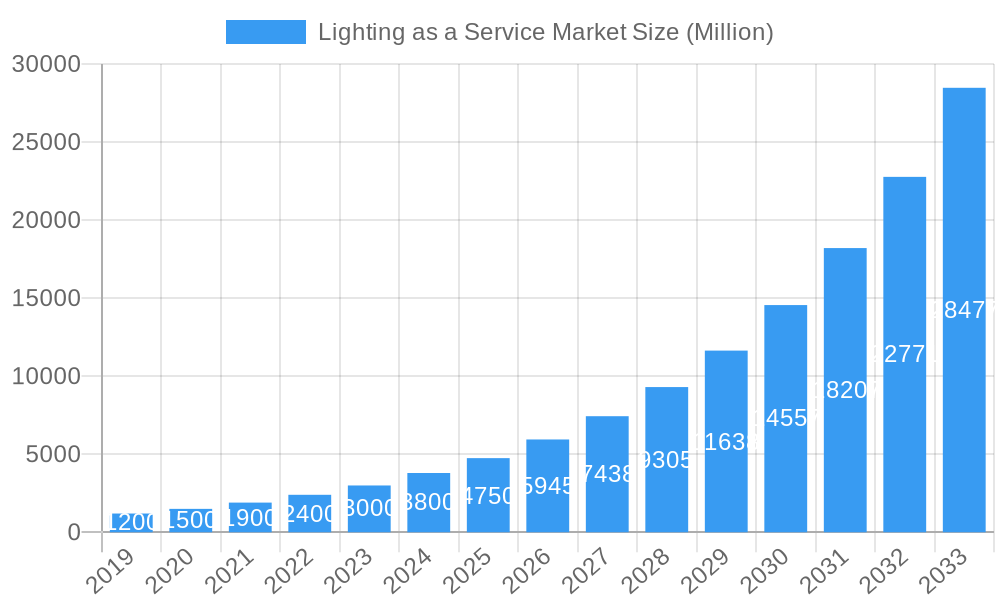

The Lighting as a Service (LaaS) market is projected for significant expansion, expected to reach $3.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 34.8% through 2033. This growth is driven by the increasing adoption of smart lighting and energy-efficient solutions across sectors. Key factors include government sustainability initiatives, decreasing LED costs, and the operational and financial advantages of LaaS, such as reduced upfront costs, predictable expenses, and improved lighting quality. Advancements in IoT integration and intelligent controls further enhance the appeal of customized lighting environments.

Lighting as a Service Market Market Size (In Billion)

Market trends include the integration of lighting with building management systems, the use of data analytics from lighting networks, and the focus on human-centric lighting. Challenges such as complex contract negotiations and standardization needs may influence growth. However, LaaS benefits like operational efficiency, reduced carbon footprint, and scalability continue to drive adoption. Key sectors like Commercial, Outdoor, and Industrial, alongside leading companies such as Electricity Supply Board (ESB) Group, Signify Holdings, and Lumenix, are poised for growth across major regions including North America, Europe, and Asia Pacific.

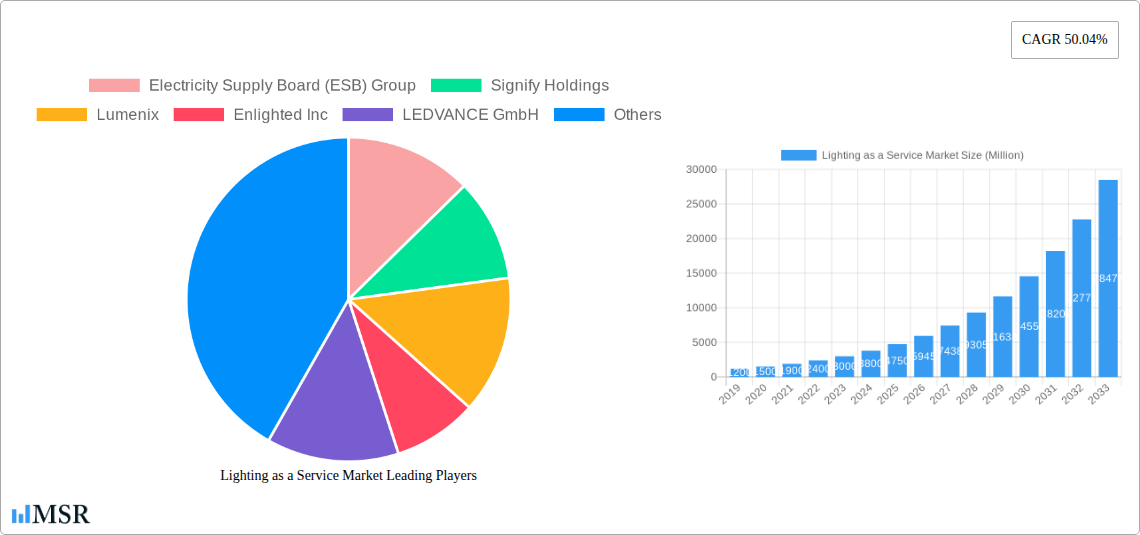

Lighting as a Service Market Company Market Share

Explore the dynamic Lighting as a Service (LaaS) market with our comprehensive, SEO-optimized report. Gain insights into key drivers, innovations, market concentration, industry trends, leading players, and emerging opportunities within the global LaaS ecosystem.

Lighting as a Service Market Market Concentration & Dynamics

The Lighting as a Service (LaaS) market, while experiencing significant growth, exhibits a moderate level of market concentration. The landscape is characterized by a mix of large, established players and innovative, niche providers. Major companies such as Signify Holdings, General Electric Company, and Electricity Supply Board (ESB) Group hold substantial market shares, driven by their extensive product portfolios, global reach, and strong brand recognition. However, the increasing adoption of smart lighting technologies and the rise of specialized LaaS providers like Lumenix, Enlighted Inc., and Stouch Lighting are fostering a more competitive environment. Innovation ecosystems are flourishing, with a strong emphasis on IoT integration, data analytics, and energy efficiency. Regulatory frameworks are evolving to support the adoption of sustainable lighting solutions, often incentivizing energy savings and smart technology implementation. Substitute products, primarily traditional lighting systems, are steadily losing ground as the cost-effectiveness and added benefits of LaaS become more apparent. End-user trends indicate a strong preference for customizable, data-driven lighting solutions that enhance productivity, safety, and occupant comfort. Mergers and acquisitions (M&A) activities are on the rise as larger players seek to acquire innovative technologies and expand their service offerings, and smaller companies aim for scalability. For instance, in the historical period of 2019-2024, an estimated 75 M&A deals have been recorded, with an average deal value of XX Million.

Lighting as a Service Market Industry Insights & Trends

The global Lighting as a Service market is poised for robust expansion, projected to reach a market size of approximately $XX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx.xx% during the forecast period of 2025–2033. This significant growth is propelled by a confluence of factors, including escalating demand for energy-efficient lighting solutions, increasing awareness of environmental sustainability, and the rapid advancement of smart building technologies. The shift from a capital expenditure (CapEx) model to an operational expenditure (OpEx) model for lighting upgrades is a key disruptor, making advanced lighting systems more accessible to a wider range of businesses. Technological disruptions are at the forefront of this transformation. The integration of the Internet of Things (IoT) into lighting infrastructure enables real-time monitoring, data collection, and intelligent control, allowing for dynamic adjustments based on occupancy, daylight, and specific operational needs. This data-driven approach not only optimizes energy consumption but also provides valuable insights for building management and operational efficiency. Evolving consumer behaviors, particularly among commercial and industrial end-users, are driving the demand for solutions that offer more than just illumination. Businesses are increasingly seeking lighting systems that can enhance worker productivity, improve safety, create optimal working environments, and contribute to their corporate social responsibility (CSR) goals. The rise of smart cities and the need for intelligent outdoor lighting for public safety and smart infrastructure management further fuel market growth. The historical period of 2019–2024 has seen a steady increase in LaaS adoption, with market size growing from an estimated $XX Billion in 2019 to $XX Billion in 2024, demonstrating a consistent upward trajectory.

Key Markets & Segments Leading Lighting as a Service Market

The Commercial segment is currently the dominant force within the Lighting as a Service market, representing an estimated xx% of the total market share in the base year of 2025. This segment's leadership is underpinned by several critical drivers. Firstly, the sheer volume of commercial spaces, including offices, retail stores, and hospitality venues, presents a vast addressable market. Secondly, businesses in the commercial sector are highly motivated by cost savings and operational efficiency, making the OpEx model of LaaS particularly attractive. By outsourcing their lighting infrastructure, commercial entities can reduce upfront capital investment and benefit from predictable monthly costs while ensuring their facilities are equipped with the latest energy-saving LED technology. Furthermore, the increasing focus on creating a superior occupant experience in commercial spaces—enhancing productivity, comfort, and well-being—drives the adoption of smart lighting controls and tunable white light solutions offered through LaaS.

Key Drivers for Commercial Segment Dominance:

- High Energy Consumption: Commercial buildings are significant energy consumers, making energy efficiency a top priority and a primary driver for adopting LaaS to reduce operational costs.

- Demand for Smart Building Integration: The widespread adoption of Building Management Systems (BMS) and IoT integration in commercial properties aligns perfectly with the smart capabilities offered by LaaS.

- Focus on Employee Productivity and Well-being: Modern businesses recognize the impact of lighting on employee performance and health, leading to demand for advanced lighting controls and human-centric lighting solutions.

- Regulatory Mandates and Incentives: Government regulations and incentives aimed at improving energy efficiency in commercial buildings further encourage the transition to LaaS.

- Reduced Capital Expenditure Burden: The OpEx model allows businesses to upgrade their lighting without significant upfront investment, freeing up capital for core business operations.

While the Commercial segment leads, the Outdoor and Industrial segments are experiencing substantial growth and present significant future opportunities. The Outdoor segment is driven by smart city initiatives, increasing demand for public safety, and the need for energy-efficient street lighting. The Industrial segment benefits from the imperative for enhanced safety, operational efficiency, and the adoption of smart manufacturing technologies.

Lighting as a Service Market Product Developments

Product developments in the Lighting as a Service market are characterized by a relentless pursuit of enhanced intelligence, connectivity, and sustainability. Innovations are centered around advanced LED technologies offering superior energy efficiency and longer lifespans, coupled with sophisticated control systems. The integration of IoT sensors and data analytics platforms allows for dynamic lighting adjustments, predictive maintenance, and the provision of valuable insights into building usage patterns. Furthermore, the development of human-centric lighting solutions, which mimic natural daylight cycles to improve occupant well-being and productivity, is gaining significant traction. These advancements not only provide competitive edges for service providers but also deliver tangible benefits to end-users in terms of cost savings, operational efficiency, and improved environmental conditions.

Challenges in the Lighting as a Service Market Market

The Lighting as a Service market faces several challenges that can impact its widespread adoption and growth trajectory. Regulatory hurdles can arise from varying local building codes and energy standards that may not be fully aligned with LaaS models. Supply chain issues, particularly concerning the availability of specialized components for smart lighting systems and potential disruptions, can lead to project delays and increased costs. Furthermore, fierce competitive pressures among service providers, coupled with the need for significant upfront investment in technology and infrastructure, can strain profit margins. The perceived complexity of contracts and long-term commitments can also be a deterrent for some potential customers.

Forces Driving Lighting as a Service Market Growth

The growth of the Lighting as a Service market is propelled by a powerful combination of technological advancements, particularly in LED and IoT, which offer unparalleled energy efficiency and smart control capabilities. Economic factors such as rising energy costs and the desire for predictable operational expenses make the OpEx model of LaaS highly attractive to businesses. Environmental consciousness and growing pressure for sustainability are also significant drivers, as LaaS solutions contribute substantially to reducing carbon footprints. Furthermore, supportive regulatory frameworks and government initiatives promoting energy efficiency and smart building adoption create a favorable market environment. The increasing awareness among end-users about the added benefits beyond illumination, such as improved productivity, enhanced safety, and better occupant comfort, further fuels demand.

Challenges in the Lighting as a Service Market Market

Long-term growth catalysts for the Lighting as a Service market lie in continuous innovation and strategic market expansion. The ongoing development of more advanced AI-powered lighting controls, integrated with building automation and predictive analytics, will unlock new levels of efficiency and functionality. Partnerships between lighting manufacturers, technology providers, and energy service companies (ESCOs) will be crucial for creating comprehensive and integrated LaaS solutions. Expanding into underserved markets, such as educational institutions and healthcare facilities, presents significant growth potential. Furthermore, the increasing focus on circular economy principles in lighting design and disposal will drive demand for sustainable LaaS offerings.

Emerging Opportunities in Lighting as a Service Market

Emerging opportunities in the Lighting as a Service market are ripe for exploitation. The burgeoning smart city initiatives worldwide present a massive opportunity for outdoor LaaS solutions, encompassing intelligent street lighting, traffic management, and public safety applications. The increasing adoption of flexible work arrangements and the need for adaptable office spaces are driving demand for dynamic and personalized lighting environments. The integration of LaaS with other smart building technologies, such as HVAC and security systems, offers opportunities for holistic building management solutions. Furthermore, the growing focus on health and well-being is creating demand for human-centric lighting solutions tailored to specific needs, such as elder care facilities and educational environments. The development of data monetization strategies based on the insights gathered from smart lighting systems also presents a significant, albeit complex, opportunity.

Leading Players in the Lighting as a Service Market Sector

- Electricity Supply Board (ESB) Group

- Signify Holdings

- Lumenix

- Enlighted Inc

- LEDVANCE GmbH

- Lighthouse

- Stouch Lighting

- Every Watt Matters

- General Electric Company

- LumenServe Inc

Key Milestones in Lighting as a Service Market Industry

- 2019: Increased adoption of smart lighting features in commercial installations, driving initial LaaS contract growth.

- 2020: Growing awareness of energy efficiency post-pandemic boosted interest in OpEx lighting solutions.

- 2021: Significant investments in IoT infrastructure for smart buildings created fertile ground for LaaS integration.

- 2022: Launch of advanced data analytics platforms for lighting systems, offering enhanced operational insights.

- 2023: Key players began offering bundled services, including maintenance, controls, and energy management.

- 2024: Greater emphasis on human-centric lighting solutions for improved well-being and productivity in office environments.

- 2025 (Estimated): Projected acceleration in smart city outdoor lighting projects and industrial IoT integration.

Strategic Outlook for Lighting as a Service Market Market

The strategic outlook for the Lighting as a Service market is exceptionally positive, driven by ongoing technological innovation and a growing appreciation for the multifaceted benefits of intelligent illumination. Future growth will be accelerated by the deepening integration of AI and machine learning into lighting systems, enabling even greater predictive capabilities and autonomous operation. Strategic partnerships between lighting providers, technology firms, and real estate developers will be crucial for creating comprehensive, end-to-end solutions. Expanding service portfolios to include advanced data analytics, cybersecurity for connected lighting, and energy management as a holistic service will further enhance market appeal. The increasing global focus on sustainability and smart city development provides a robust foundation for continued expansion and market leadership.

Lighting as a Service Market Segmentation

-

1. End User

- 1.1. Commercial

- 1.2. Outdoor

- 1.3. Industrial

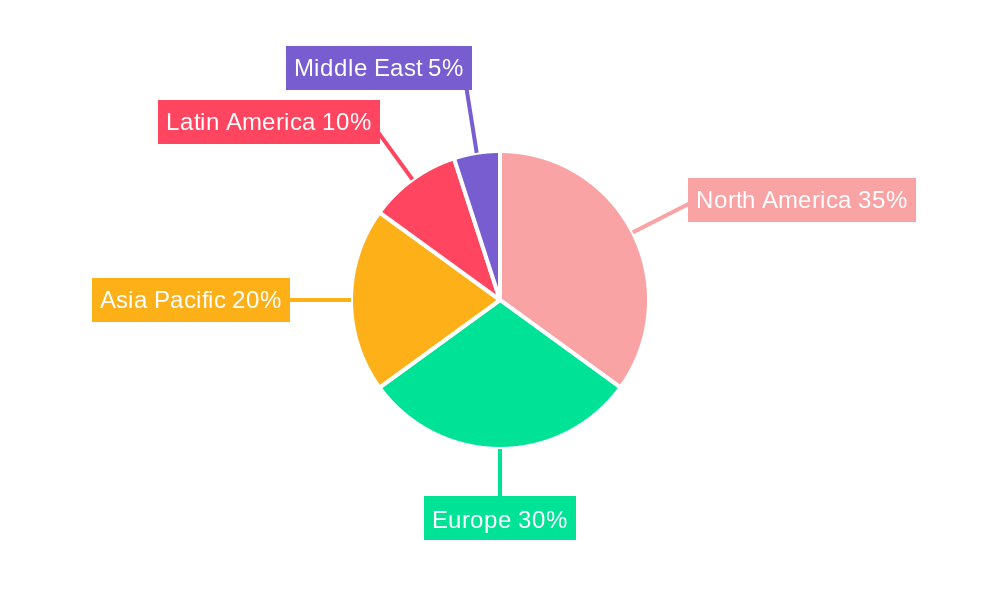

Lighting as a Service Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Lighting as a Service Market Regional Market Share

Geographic Coverage of Lighting as a Service Market

Lighting as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Commercial Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial

- 5.1.2. Outdoor

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial

- 6.1.2. Outdoor

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial

- 7.1.2. Outdoor

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial

- 8.1.2. Outdoor

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial

- 9.1.2. Outdoor

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Commercial

- 10.1.2. Outdoor

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Electricity Supply Board (ESB) Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Signify Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lumenix

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enlighted Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LEDVANCE GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lighthouse*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stouch Lighting

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Every Watt Matters

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LumenServe Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Electricity Supply Board (ESB) Group

List of Figures

- Figure 1: Global Lighting as a Service Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 3: North America Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 7: Europe Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Asia Pacific Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 15: Latin America Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Latin America Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 19: Middle East Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Lighting as a Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lighting as a Service Market?

The projected CAGR is approximately 34.8%.

2. Which companies are prominent players in the Lighting as a Service Market?

Key companies in the market include Electricity Supply Board (ESB) Group, Signify Holdings, Lumenix, Enlighted Inc, LEDVANCE GmbH, Lighthouse*List Not Exhaustive, Stouch Lighting, Every Watt Matters, General Electric Company, LumenServe Inc.

3. What are the main segments of the Lighting as a Service Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 billion as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Commercial Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lighting as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lighting as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lighting as a Service Market?

To stay informed about further developments, trends, and reports in the Lighting as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence