Key Insights

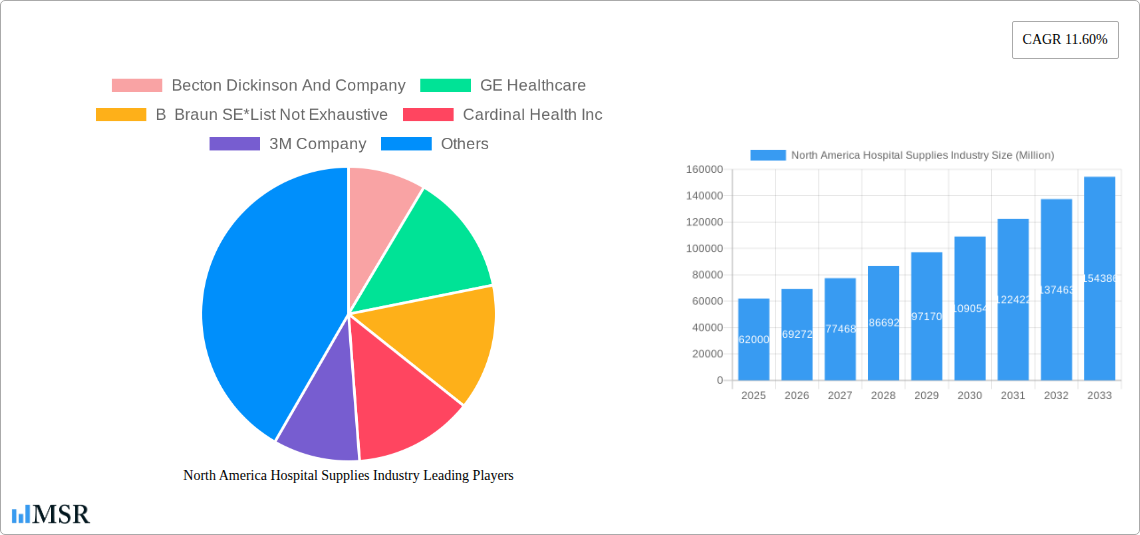

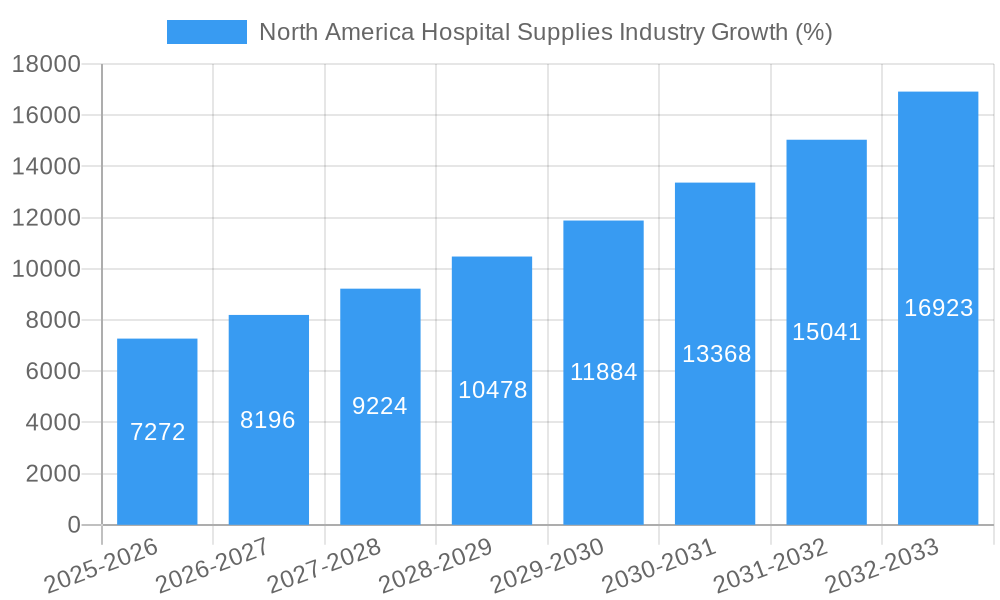

The North American hospital supplies market, valued at $62 billion in 2025, is projected to experience robust growth, driven by a confluence of factors. An aging population leading to increased healthcare demand, coupled with technological advancements in medical devices and supplies, fuels this expansion. The rising prevalence of chronic diseases necessitates greater utilization of hospital supplies, further bolstering market growth. Furthermore, increasing government initiatives focused on improving healthcare infrastructure and access contribute significantly. The market's segmentation reveals strong performance across various product categories. Patient examination devices and operating room equipment are expected to maintain their leading positions due to consistent demand. Growth in the mobility aids and transportation equipment segment is anticipated, driven by an aging population and the rising need for assistive devices. The sterilization and disinfectant equipment segment will likely experience significant growth due to heightened focus on infection control. Disposable hospital supplies, syringes, and needles continue to be crucial components of the market, benefiting from consistent healthcare procedures and advancements in minimally invasive surgeries. While supply chain disruptions and fluctuating raw material prices present challenges, the long-term outlook remains positive, driven by the fundamental factors outlined above. The consistent CAGR of 11.6% indicates a trajectory of sustained and significant market expansion through 2033.

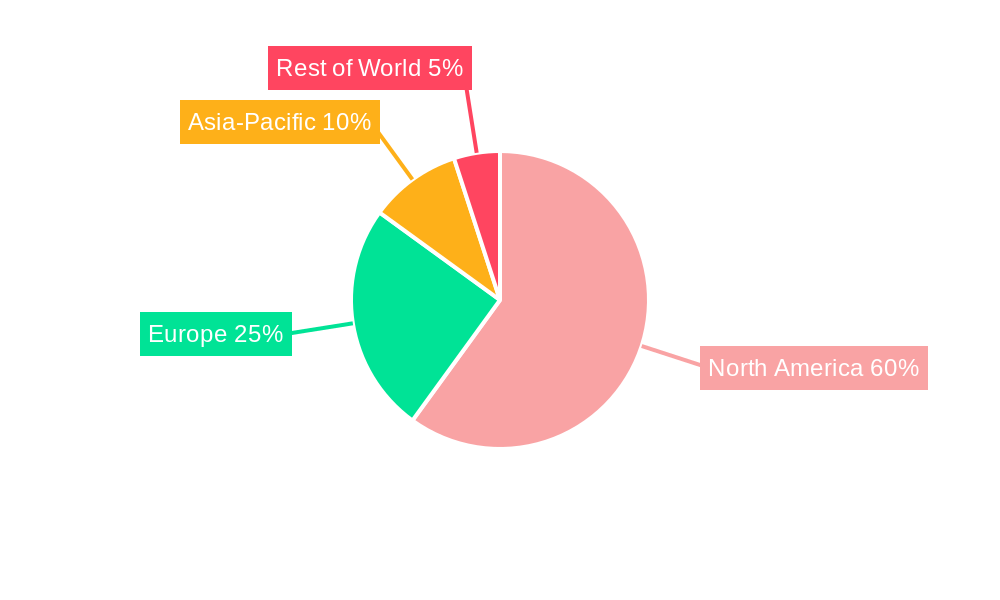

The competitive landscape is characterized by a mix of established multinational corporations and specialized players. Major companies like Becton Dickinson, GE Healthcare, B. Braun, Cardinal Health, 3M, Medtronic, Johnson & Johnson, and Stryker Corporation hold substantial market share, leveraging their extensive product portfolios and global distribution networks. However, smaller, specialized companies are also gaining traction by focusing on niche segments or innovative product offerings. This dynamic environment fosters competition and innovation, further enhancing the overall market growth. The United States, as the largest market within North America, will continue to drive the majority of regional growth, followed by Canada and Mexico. Future growth will largely depend on regulatory changes, technological breakthroughs in medical devices, and overall healthcare spending trends. The market's resilience and growth potential are significant, presenting lucrative opportunities for investors and businesses operating within this sector.

North America Hospital Supplies Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America hospital supplies industry, offering valuable insights for stakeholders across the value chain. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data analysis to illuminate market trends, growth drivers, and emerging opportunities. The study encompasses key segments, leading players like Becton Dickinson And Company, GE Healthcare, B Braun SE, Cardinal Health Inc, 3M Company, Medtronic PLC, Johnson & Johnson, Stryker Corporation, and Baxter International (list not exhaustive), and crucial industry developments. The report's findings will enable strategic decision-making and informed investment strategies.

North America Hospital Supplies Industry Market Concentration & Dynamics

The North American hospital supplies market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. While precise figures for market share require proprietary data, estimates suggest the top 10 companies collectively control approximately XX% of the market in 2025. This concentration is driven by economies of scale, strong brand recognition, and extensive distribution networks. However, the market also accommodates a considerable number of smaller niche players specializing in specific product segments or geographical areas.

Innovation Ecosystems: The industry is characterized by continuous innovation, fueled by substantial R&D investments in advanced medical technologies. This leads to a dynamic landscape with frequent product launches and upgrades.

Regulatory Frameworks: Stringent regulatory requirements, particularly from the FDA, govern the manufacturing, distribution, and use of hospital supplies, ensuring safety and efficacy. These regulations significantly impact industry players' operational costs and strategies.

Substitute Products: Limited direct substitutes exist for many specialized hospital supplies. However, cost-effectiveness and technological advancements continuously drive the search for alternative materials and manufacturing processes.

End-User Trends: Increasing healthcare expenditure, aging populations, and rising prevalence of chronic diseases drive demand for hospital supplies. Furthermore, a growing focus on minimally invasive procedures and ambulatory care settings impacts product demand.

M&A Activities: The North American hospital supplies market has witnessed a steady stream of mergers and acquisitions in recent years. The number of M&A deals averaged approximately XX per year during the historical period (2019-2024), driven by companies' efforts to expand their product portfolios, geographic reach, and market share.

North America Hospital Supplies Industry Industry Insights & Trends

The North American hospital supplies market is projected to experience robust growth during the forecast period (2025-2033). The market size is estimated to reach $XX Million in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, reaching $XX Million by 2033. Several factors drive this growth: a rapidly aging population requiring more healthcare services, rising prevalence of chronic diseases demanding advanced medical technologies, and technological advancements in medical devices and supplies. These trends, coupled with increased healthcare spending and government initiatives to improve healthcare infrastructure, are key catalysts. Technological disruptions are reshaping the industry through advancements in materials science, automation, and digital health technologies. Evolving consumer behavior, including a growing preference for home healthcare and telehealth solutions, is influencing product development and distribution strategies.

Key Markets & Segments Leading North America Hospital Supplies Industry

While precise market share data for individual product segments is proprietary, disposable hospital supplies and syringes and needles are expected to command considerable market share due to their high consumption rates. The United States constitutes the largest market within North America, owing to its robust healthcare infrastructure and substantial healthcare expenditure.

Dominant Segments and Drivers:

- Disposable Hospital Supplies: Driven by the rising number of surgical procedures, increased patient volumes, and the preference for single-use disposables to minimize infection risks.

- Syringes and Needles: Fueled by the rising prevalence of chronic diseases requiring regular injections and advancements in drug delivery systems.

- Operating Room Equipment: Driven by the increasing demand for technologically advanced equipment and the rising number of complex surgical procedures.

- Patient Examination Devices: Driven by demand for improved diagnostic accuracy and efficiency.

- Sterilization and Disinfectant Equipment: Driven by the stringent infection control protocols and the rising awareness of healthcare-associated infections.

- Mobility Aids and Transportation Equipment: Driven by the rising elderly population and the increasing need for patient mobility solutions.

Regional Dominance: The United States dominates the North American market due to its higher healthcare expenditure, advanced healthcare infrastructure, and substantial population size.

North America Hospital Supplies Industry Product Developments

Recent product innovations focus on improving the efficiency, safety, and efficacy of hospital supplies. Examples include the development of minimally invasive surgical instruments, advanced wound dressings with improved healing properties, and smart medical devices integrating digital technologies for real-time monitoring and data analysis. These advancements provide competitive advantages by enhancing patient outcomes and improving operational efficiencies in healthcare settings.

Challenges in the North America Hospital Supplies Industry Market

The industry faces several challenges, including stringent regulatory requirements which increase development and approval costs. Supply chain disruptions, particularly exacerbated by global events, can impact product availability and pricing. Furthermore, intense competition from both domestic and international players necessitates continuous innovation and cost optimization strategies. These factors collectively can constrain overall market growth.

Forces Driving North America Hospital Supplies Industry Growth

Several factors contribute to the industry's growth. Technological advancements in areas like minimally invasive surgery and advanced medical devices drive demand for specialized supplies. The economic factor of rising healthcare expenditure fuels market expansion. Furthermore, government regulations promoting healthcare access and quality further enhance market growth.

Long-Term Growth Catalysts in the North America Hospital Supplies Industry

Long-term growth will be driven by ongoing innovation, fostering strategic partnerships to expand market reach and product portfolios. The expansion into new and emerging markets will further fuel industry growth.

Emerging Opportunities in North America Hospital Supplies Industry

Emerging opportunities lie in the development of innovative products catering to the growing home healthcare market and telehealth solutions. The increasing adoption of digital health technologies also presents opportunities for integrating smart medical devices and data analytics platforms into hospital supply chains.

Leading Players in the North America Hospital Supplies Industry Sector

- Becton Dickinson And Company

- GE Healthcare

- B Braun SE

- Cardinal Health Inc

- 3M Company

- Medtronic PLC

- Johnson & Johnson

- Stryker Corporation

- Baxter International

Key Milestones in North America Hospital Supplies Industry Industry

- September 2023: UC San Diego Health's acquisition of Alvarado Hospital Medical Center signals consolidation within the healthcare sector, potentially impacting the demand for hospital supplies in the region.

- March 2022: Datasea's launch of ultrasonic sterilization equipment and its expansion into the US market introduce new technologies and competition within the industry.

Strategic Outlook for North America Hospital Supplies Industry Market

The North America hospital supplies market presents considerable future potential driven by continued technological advancements, aging demographics, and rising healthcare spending. Companies focusing on innovation, strategic partnerships, and efficient supply chain management are well-positioned to capitalize on the market's growth trajectory.

North America Hospital Supplies Industry Segmentation

-

1. Product

- 1.1. Patient Examination Devices

- 1.2. Operating Room Equipment

- 1.3. Mobility Aids and Transportation Equipment

- 1.4. Sterilization and Disinfectant Equipment

- 1.5. Disposable Hospital Supplies

- 1.6. Syringes and Needles

- 1.7. Other Products

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Hospital Supplies Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Hospital Supplies Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Spending On Healthcare; Increasing Prevalence of Infectious Diseases

- 3.3. Market Restrains

- 3.3.1. Emergence of Home Care Services; Drop in Private Health Insurance

- 3.4. Market Trends

- 3.4.1. Disposable Hospital Supplies Segment is Projected to Have Significant Growth Rate During the Forecast Period of the Study

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Patient Examination Devices

- 5.1.2. Operating Room Equipment

- 5.1.3. Mobility Aids and Transportation Equipment

- 5.1.4. Sterilization and Disinfectant Equipment

- 5.1.5. Disposable Hospital Supplies

- 5.1.6. Syringes and Needles

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Patient Examination Devices

- 6.1.2. Operating Room Equipment

- 6.1.3. Mobility Aids and Transportation Equipment

- 6.1.4. Sterilization and Disinfectant Equipment

- 6.1.5. Disposable Hospital Supplies

- 6.1.6. Syringes and Needles

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Patient Examination Devices

- 7.1.2. Operating Room Equipment

- 7.1.3. Mobility Aids and Transportation Equipment

- 7.1.4. Sterilization and Disinfectant Equipment

- 7.1.5. Disposable Hospital Supplies

- 7.1.6. Syringes and Needles

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Patient Examination Devices

- 8.1.2. Operating Room Equipment

- 8.1.3. Mobility Aids and Transportation Equipment

- 8.1.4. Sterilization and Disinfectant Equipment

- 8.1.5. Disposable Hospital Supplies

- 8.1.6. Syringes and Needles

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Hospital Supplies Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson And Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 GE Healthcare

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 B Braun SE*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cardinal Health Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 3M Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Medtronic PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Johnson & Johnson

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Stryker Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Baxter International

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson And Company

List of Figures

- Figure 1: North America Hospital Supplies Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Hospital Supplies Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Hospital Supplies Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Hospital Supplies Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 11: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Hospital Supplies Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 17: North America Hospital Supplies Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Hospital Supplies Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Hospital Supplies Industry?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the North America Hospital Supplies Industry?

Key companies in the market include Becton Dickinson And Company, GE Healthcare, B Braun SE*List Not Exhaustive, Cardinal Health Inc, 3M Company, Medtronic PLC, Johnson & Johnson, Stryker Corporation, Baxter International.

3. What are the main segments of the North America Hospital Supplies Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Spending On Healthcare; Increasing Prevalence of Infectious Diseases.

6. What are the notable trends driving market growth?

Disposable Hospital Supplies Segment is Projected to Have Significant Growth Rate During the Forecast Period of the Study.

7. Are there any restraints impacting market growth?

Emergence of Home Care Services; Drop in Private Health Insurance.

8. Can you provide examples of recent developments in the market?

September 2023: UC San Diego Health's request has been approved by the Regents of the University of California for acquiring Alvarado Hospital Medical Center from Prime Healthcare. The acquisition of the 302-bed medical campus is expected to be completed in late 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Hospital Supplies Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Hospital Supplies Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Hospital Supplies Industry?

To stay informed about further developments, trends, and reports in the North America Hospital Supplies Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence