Key Insights

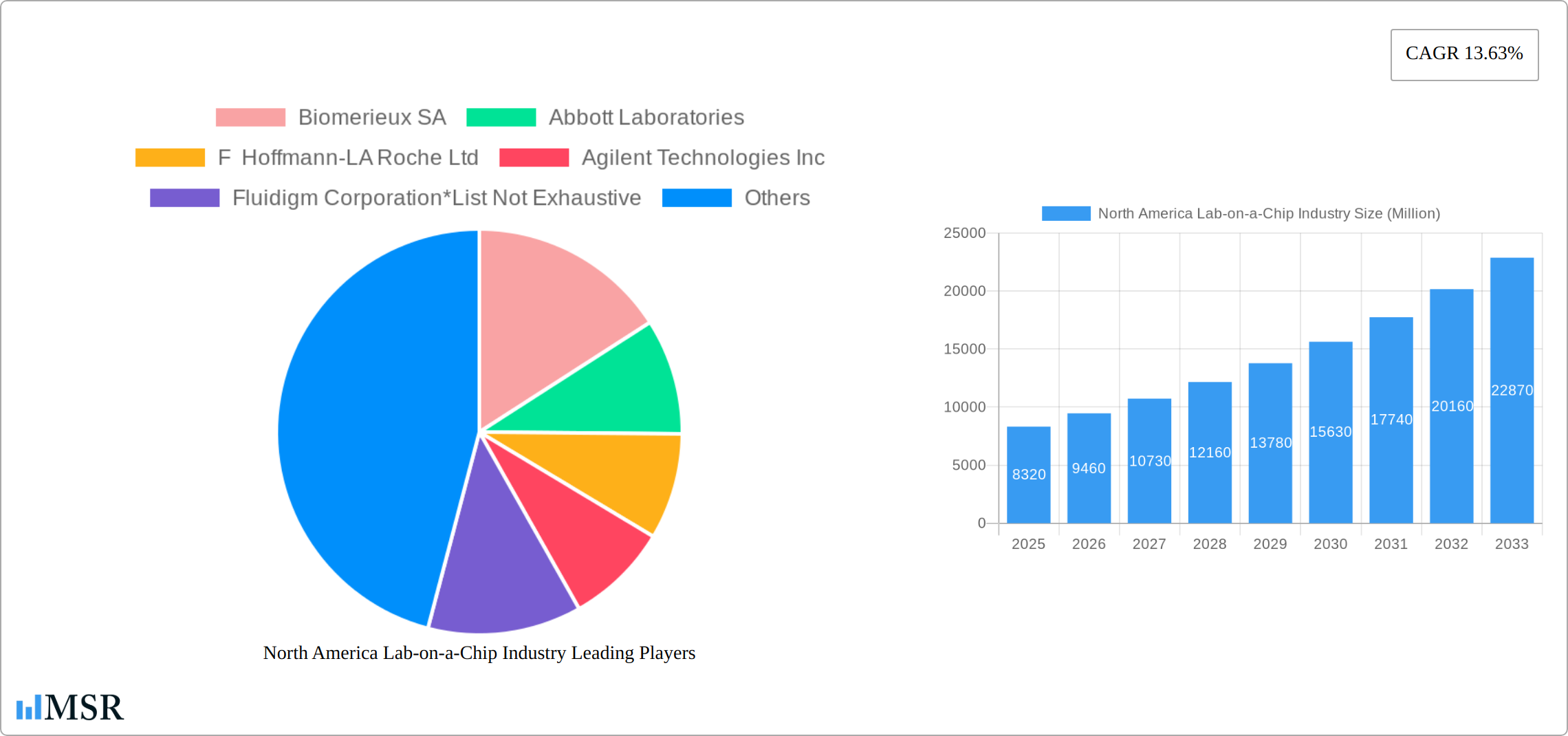

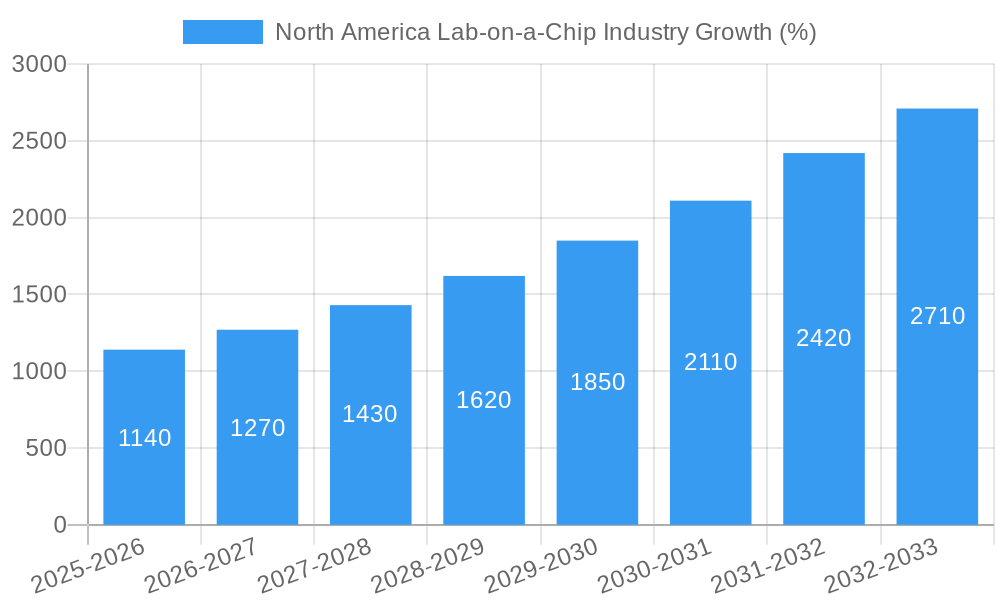

The North American lab-on-a-chip market is experiencing robust growth, driven by the increasing demand for rapid diagnostics, personalized medicine, and point-of-care testing. The market, estimated at $X billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 13.63% from 2025 to 2033, reaching a substantial market value. This growth is fueled by several key factors. Advancements in microfluidics technology are enabling the development of smaller, more efficient, and cost-effective lab-on-a-chip devices. The rising prevalence of chronic diseases necessitates faster and more accurate diagnostic tools, further boosting the demand. Moreover, increasing investments in research and development by both public and private sectors are fostering innovation and accelerating the adoption of lab-on-a-chip technology across various applications. The biotechnology and pharmaceutical sectors are significant contributors to market growth, leveraging lab-on-a-chip for drug discovery and development, while hospitals and diagnostic centers are increasingly integrating these technologies for improved patient care.

Within the North American market, the segments exhibiting the strongest growth include clinical diagnostics and drug discovery. The demand for rapid diagnostic tests for infectious diseases and other critical conditions is a major driver. In drug discovery, lab-on-a-chip technology is utilized for high-throughput screening and analysis, accelerating the drug development process. While the instruments segment currently holds a significant share, the reagents and consumables segment is expected to show considerable growth due to the increasing number of tests performed. Furthermore, the software and services market is also expanding, driven by the need for sophisticated data analysis and integration with existing healthcare information systems. The competition in the North American market is intense, with major players like Thermo Fisher Scientific, Illumina, and Roche continually innovating and expanding their product portfolios to maintain market leadership. Despite the challenges related to regulatory approvals and high initial investment costs, the long-term outlook for the North American lab-on-a-chip market remains positive, with significant opportunities for growth and innovation. (Note: The exact value for 2025 market size ($X billion) is not provided in the prompt, however, it can be estimated using the provided 2019-2024 data and the given CAGR.)

North America Lab-on-a-Chip Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America lab-on-a-chip industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key segments, leading players, and future growth prospects. The report leverages extensive data and analysis to provide actionable intelligence for strategic decision-making. The North American market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Lab-on-a-Chip Industry Market Concentration & Dynamics

The North American lab-on-a-chip market exhibits moderate concentration, with several key players commanding significant market share. Prominent companies like Biomerieux SA, Abbott Laboratories, F. Hoffmann-La Roche Ltd, Agilent Technologies Inc., and Illumina Inc. are at the forefront, although a substantial number of smaller, specialized firms contribute to the market's vibrancy. Market share dynamics are complex and shaped by several interconnected factors: pioneering technological innovations, rigorous regulatory approvals (particularly from the FDA), and strategic mergers and acquisitions (M&A) activity. The interplay of these factors creates a dynamic and ever-evolving competitive landscape.

- Market Concentration: While precise figures fluctuate, the Herfindahl-Hirschman Index (HHI) for the North American lab-on-a-chip market provides a valuable metric for understanding market concentration. Further analysis is needed to provide a definitive 2025 HHI estimate, however, continuous monitoring of market share data is crucial for assessing changes in concentration over time.

- Innovation Ecosystems: Robust collaborations between leading academic institutions, prominent research organizations, and industry players are crucial for driving innovation. These partnerships fuel advancements in microfluidics, biosensors, and advanced materials, constantly pushing the boundaries of lab-on-a-chip technology.

- Regulatory Frameworks: The FDA's regulations governing medical devices and diagnostic tools significantly impact market access and product development strategies. Navigating the complexities of these regulations is a key challenge for manufacturers. Furthermore, variations in regulatory frameworks across different states within North America introduce additional complexities and necessitate a nuanced understanding of regional requirements.

- Substitute Products: Traditional laboratory techniques and alternative diagnostic methods present a degree of competitive pressure. However, the increasing demand for faster, more cost-effective, and efficient diagnostics provides a strong impetus for the continued adoption of lab-on-a-chip technologies, which offer significant advantages in these areas.

- End-User Trends: The growing preference for point-of-care diagnostics and the expanding field of personalized medicine are accelerating market growth. Key end-users include hospitals and diagnostic centers, as well as biotechnology and pharmaceutical companies who leverage lab-on-a-chip technologies for research and development purposes.

- M&A Activities: The frequency of M&A deals in the North American lab-on-a-chip industry offers insights into market dynamics. Analyzing the historical period (e.g., 2019-2024) reveals trends driven by the pursuit of expansion into new markets and the acquisition of cutting-edge technologies. Further investigation is required to provide specific figures regarding the average number of deals per year.

North America Lab-on-a-Chip Industry Insights & Trends

The North American lab-on-a-chip market is experiencing robust growth, driven by several key factors. The increasing prevalence of chronic diseases, rising demand for rapid diagnostics, and the growing adoption of personalized medicine are major catalysts. Technological advancements, such as the development of more sophisticated microfluidic devices and advanced biosensors, are significantly enhancing the capabilities and applications of lab-on-a-chip technologies. Furthermore, decreasing costs of these technologies are making them more accessible to a wider range of end-users. The market size was estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Key Markets & Segments Leading North America Lab-on-a-Chip Industry

The clinical diagnostics application segment currently holds a dominant position in the North American lab-on-a-chip market, propelled by the escalating need for rapid and accurate disease detection. Within the product landscape, the instruments segment commands the largest market share. From an end-user perspective, biotechnology and pharmaceutical companies represent the largest segment, underscoring the importance of lab-on-a-chip technologies in drug discovery and development.

Market Drivers:

- Technological Advancements: The continuous development of increasingly sophisticated microfluidic devices with enhanced functionalities and sensitivities is a primary driver of market expansion.

- Rising Prevalence of Chronic Diseases: The growing burden of chronic diseases globally fuels the demand for early and accurate disease detection, creating a strong market pull for lab-on-a-chip solutions.

- Government Initiatives: Government support for research and development in the field of diagnostics, including funding for innovative projects and initiatives, acts as a catalyst for market growth.

- Economic Growth: Increased investment in healthcare infrastructure, particularly in advanced diagnostic technologies, stimulates market expansion.

- Growing Adoption of Personalized Medicine: The shift towards tailored diagnostic and treatment approaches based on individual patient characteristics is driving demand for the precise and efficient analyses offered by lab-on-a-chip technologies.

Dominance Analysis:

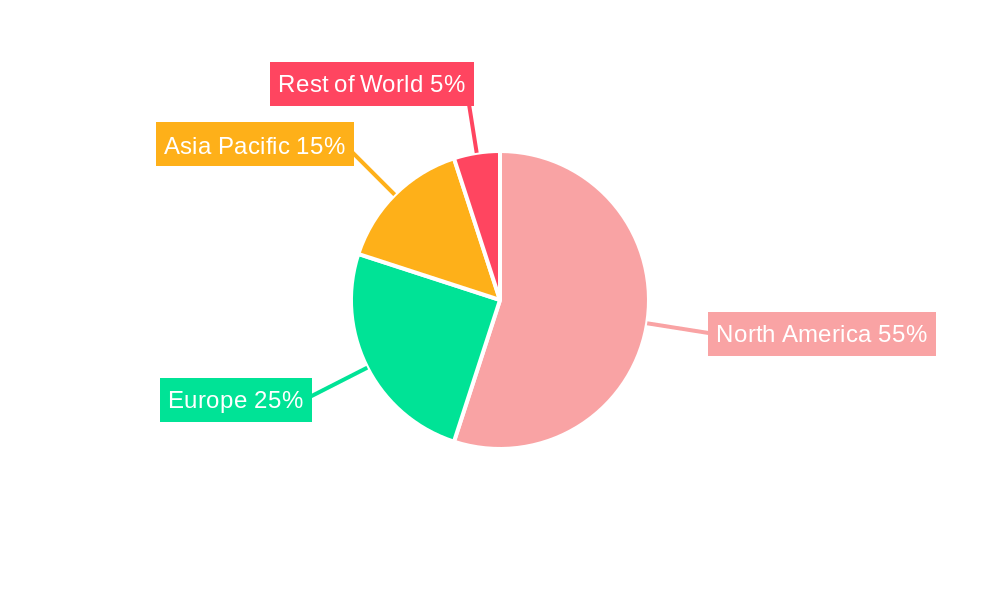

The United States currently holds the largest share of the North American market, attributable to its advanced healthcare infrastructure, substantial healthcare expenditure, and the significant presence of key market players. Canada, however, is also demonstrating notable growth, fueled by government initiatives and increasing healthcare investments, indicating a broader expansion of the market across North America.

North America Lab-on-a-Chip Industry Product Developments

Recent product innovations in the lab-on-a-chip industry have focused on miniaturization, improved sensitivity, and integration with other diagnostic technologies. For example, the development of portable lab-on-a-chip devices is enabling point-of-care diagnostics in resource-limited settings. Integration with AI and machine learning algorithms is improving the accuracy and speed of analysis. These advancements are creating new market opportunities and providing companies with significant competitive advantages.

Challenges in the North America Lab-on-a-Chip Industry Market

The North American lab-on-a-chip market faces several challenges, including stringent regulatory hurdles for medical device approvals, which can significantly impact time to market and increase costs. Supply chain disruptions can affect the availability of critical components, while intense competition from established players and emerging technologies creates pressure on pricing and margins. These factors can cumulatively impact market growth and profitability for companies operating in this sector.

Forces Driving North America Lab-on-a-Chip Industry Growth

Several powerful forces converge to drive the growth of the North American lab-on-a-chip industry. Technological advancements, particularly in the development of sophisticated microfluidic chips and highly sensitive biosensors, are paramount. Moreover, substantial government funding channeled into research and development initiatives focused on diagnostics and personalized medicine fuels innovation and accelerates market expansion. Finally, the escalating prevalence of chronic diseases creates a considerable and ever-increasing demand for faster, more efficient, and cost-effective diagnostic tools, further solidifying the market's growth trajectory.

Challenges in the North America Lab-on-a-Chip Industry Market

Long-term growth in the North American lab-on-a-chip market will depend on continued innovation, particularly in areas such as point-of-care diagnostics and integration with artificial intelligence. Strategic partnerships between technology companies, healthcare providers, and research institutions will also be critical for accelerating market penetration and expanding applications. Successful navigation of regulatory hurdles will be essential for sustained growth.

Emerging Opportunities in North America Lab-on-a-Chip Industry

Emerging opportunities include the development of lab-on-a-chip devices for applications beyond clinical diagnostics, such as environmental monitoring and food safety testing. Integration with mobile technologies and telehealth platforms will expand access to diagnostic testing and create new revenue streams. The development of more sophisticated microfluidic devices with improved functionality and sensitivity will also play a crucial role in opening new applications and markets.

Leading Players in the North America Lab-on-a-Chip Industry Sector

- Biomerieux SA

- Abbott Laboratories

- F Hoffmann-La Roche Ltd

- Agilent Technologies Inc

- Fluidigm Corporation

- Bio-Rad Laboratories

- PerkinElmer Inc

- Sysmex Corporation

- Illumina Inc

- Thermo Fisher Scientific

- Danaher Corporation (Beckman Coulter Inc)

Key Milestones in North America Lab-on-a-Chip Industry Industry

- May 2022: Invitae's launch of a new testing package for neuro-developmental disorders (NDDs) exemplifies the expansion of clinical diagnostic offerings and highlights the growing need for comprehensive genetic testing within the market.

- January 2022: The collaborative research project between Illumina, Inc. and the National Cancer Center Japan, utilizing Illumina's high-throughput DNA sequencing technology, underscores the crucial partnerships between industry players and research institutions in advancing genomic analysis and driving innovation within the field.

- [Add more recent milestones here with details - Company, Date, and a brief description of the milestone's significance to the industry].

Strategic Outlook for North America Lab-on-a-Chip Industry Market

The North American lab-on-a-chip market holds significant future potential, driven by continuous technological advancements, increasing demand for point-of-care diagnostics, and expanding applications beyond clinical diagnostics. Companies can capitalize on this growth by focusing on innovation, strategic partnerships, and addressing regulatory challenges effectively. Investment in research and development, particularly in areas such as AI integration and miniaturization, will be crucial for maintaining a competitive edge and capturing market share.

North America Lab-on-a-Chip Industry Segmentation

-

1. Type

- 1.1. Lab-on-a-chip

- 1.2. Microarray

-

2. Product

- 2.1. Instruments

- 2.2. Reagents and Consumables

- 2.3. Software and Services

-

3. Application

- 3.1. Clinical Diagnostics

- 3.2. Drug Discovery

- 3.3. Genomics and Proteomics

- 3.4. Other Applications

-

4. End User

- 4.1. Biotechnology and Pharmaceutical Companies

- 4.2. Hospitals and Diagnostics Centers

- 4.3. Academic and Research Institutes

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Mexico

North America Lab-on-a-Chip Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Lab-on-a-Chip Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Application of Proteomics And Genomics in Cancer Research; Technological Advances in the Materials in Microfluidics; Growth of Personalized Medicine

- 3.3. Market Restrains

- 3.3.1. Lack of Standardization; Availability of Alternative Technologies

- 3.4. Market Trends

- 3.4.1. Microarray are Anticipated to Hold Significant Share in the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lab-on-a-chip

- 5.1.2. Microarray

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instruments

- 5.2.2. Reagents and Consumables

- 5.2.3. Software and Services

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Clinical Diagnostics

- 5.3.2. Drug Discovery

- 5.3.3. Genomics and Proteomics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Biotechnology and Pharmaceutical Companies

- 5.4.2. Hospitals and Diagnostics Centers

- 5.4.3. Academic and Research Institutes

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lab-on-a-chip

- 6.1.2. Microarray

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Instruments

- 6.2.2. Reagents and Consumables

- 6.2.3. Software and Services

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Clinical Diagnostics

- 6.3.2. Drug Discovery

- 6.3.3. Genomics and Proteomics

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Biotechnology and Pharmaceutical Companies

- 6.4.2. Hospitals and Diagnostics Centers

- 6.4.3. Academic and Research Institutes

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lab-on-a-chip

- 7.1.2. Microarray

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Instruments

- 7.2.2. Reagents and Consumables

- 7.2.3. Software and Services

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Clinical Diagnostics

- 7.3.2. Drug Discovery

- 7.3.3. Genomics and Proteomics

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Biotechnology and Pharmaceutical Companies

- 7.4.2. Hospitals and Diagnostics Centers

- 7.4.3. Academic and Research Institutes

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lab-on-a-chip

- 8.1.2. Microarray

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Instruments

- 8.2.2. Reagents and Consumables

- 8.2.3. Software and Services

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Clinical Diagnostics

- 8.3.2. Drug Discovery

- 8.3.3. Genomics and Proteomics

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Biotechnology and Pharmaceutical Companies

- 8.4.2. Hospitals and Diagnostics Centers

- 8.4.3. Academic and Research Institutes

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Lab-on-a-Chip Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Biomerieux SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Abbott Laboratories

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 F Hoffmann-LA Roche Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Agilent Technologies Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fluidigm Corporation*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bio-Rad Laboratories

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 PerkinElmer Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sysmex Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Illumina Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Thermo Fisher Scientific

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Danaher Corporation (Beckman Coulter Inc )

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Biomerieux SA

List of Figures

- Figure 1: North America Lab-on-a-Chip Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Lab-on-a-Chip Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 6: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 7: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 9: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 10: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 11: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 13: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 15: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 17: United States North America Lab-on-a-Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States North America Lab-on-a-Chip Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Canada North America Lab-on-a-Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Lab-on-a-Chip Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Lab-on-a-Chip Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico North America Lab-on-a-Chip Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 24: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 25: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 26: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 27: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 29: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 31: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 33: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 35: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 37: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 38: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 39: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 40: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 41: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 42: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 43: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 45: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 47: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 48: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 49: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 50: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 51: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 52: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 53: North America Lab-on-a-Chip Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 54: North America Lab-on-a-Chip Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 55: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 57: North America Lab-on-a-Chip Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: North America Lab-on-a-Chip Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lab-on-a-Chip Industry?

The projected CAGR is approximately 13.63%.

2. Which companies are prominent players in the North America Lab-on-a-Chip Industry?

Key companies in the market include Biomerieux SA, Abbott Laboratories, F Hoffmann-LA Roche Ltd, Agilent Technologies Inc, Fluidigm Corporation*List Not Exhaustive, Bio-Rad Laboratories, PerkinElmer Inc, Sysmex Corporation, Illumina Inc, Thermo Fisher Scientific, Danaher Corporation (Beckman Coulter Inc ).

3. What are the main segments of the North America Lab-on-a-Chip Industry?

The market segments include Type, Product, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Application of Proteomics And Genomics in Cancer Research; Technological Advances in the Materials in Microfluidics; Growth of Personalized Medicine.

6. What are the notable trends driving market growth?

Microarray are Anticipated to Hold Significant Share in the Studied Market.

7. Are there any restraints impacting market growth?

Lack of Standardization; Availability of Alternative Technologies.

8. Can you provide examples of recent developments in the market?

May 2022: Invitae, a California-based medical genetics company that plans to open a new laboratory and production facility in Morrisville, commercially launched a new testing package for neuro-developmental disorders (NDDs) in children. The package includes chromosomal microarray analysis, analysis for fragile X-related disorders, and a next-generation-sequencing panel of 200-plus genes in which variants are associated with NDDs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lab-on-a-Chip Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lab-on-a-Chip Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lab-on-a-Chip Industry?

To stay informed about further developments, trends, and reports in the North America Lab-on-a-Chip Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence