Key Insights

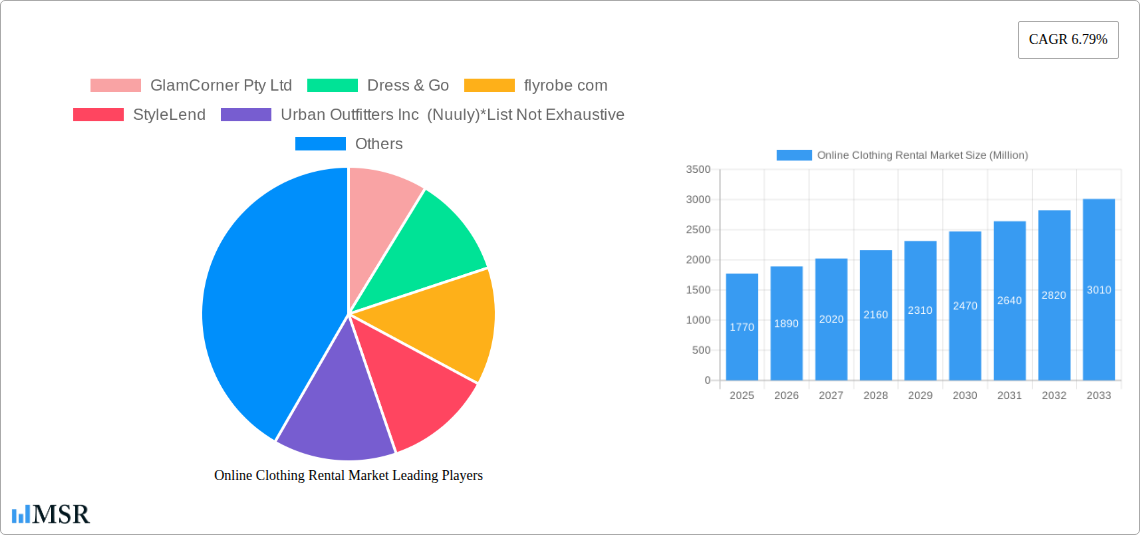

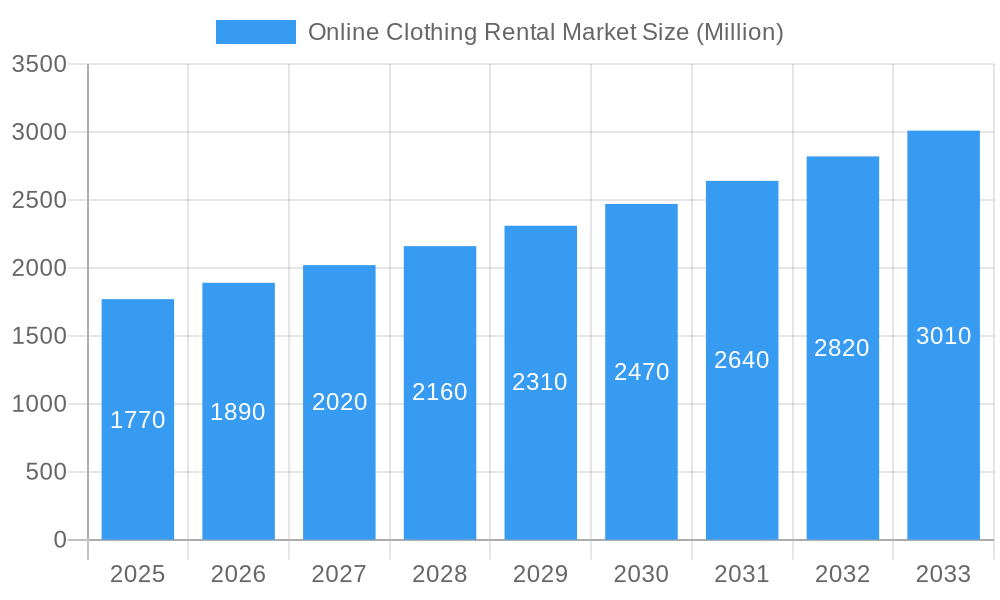

The online clothing rental market, valued at $1.77 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.79% from 2025 to 2033. This surge is driven by several key factors. Increasing consumer awareness of sustainability and the desire for diverse wardrobes without the commitment of purchasing contribute significantly. The convenience factor – accessing trendy styles without the long-term ownership burden – is another major driver. Furthermore, the rise of subscription-based services and sophisticated online platforms offering personalized styling recommendations are fueling market expansion. The market is segmented by end-user demographics (men, women, children) and dress codes (formal, casual, partywear, traditional), allowing for targeted marketing and specialized service offerings. Competition is intensifying, with established players like Rent the Runway and newcomers vying for market share through innovative business models and technological advancements. While challenges remain, such as managing logistics and ensuring garment quality, the overall market outlook is highly positive.

Online Clothing Rental Market Market Size (In Billion)

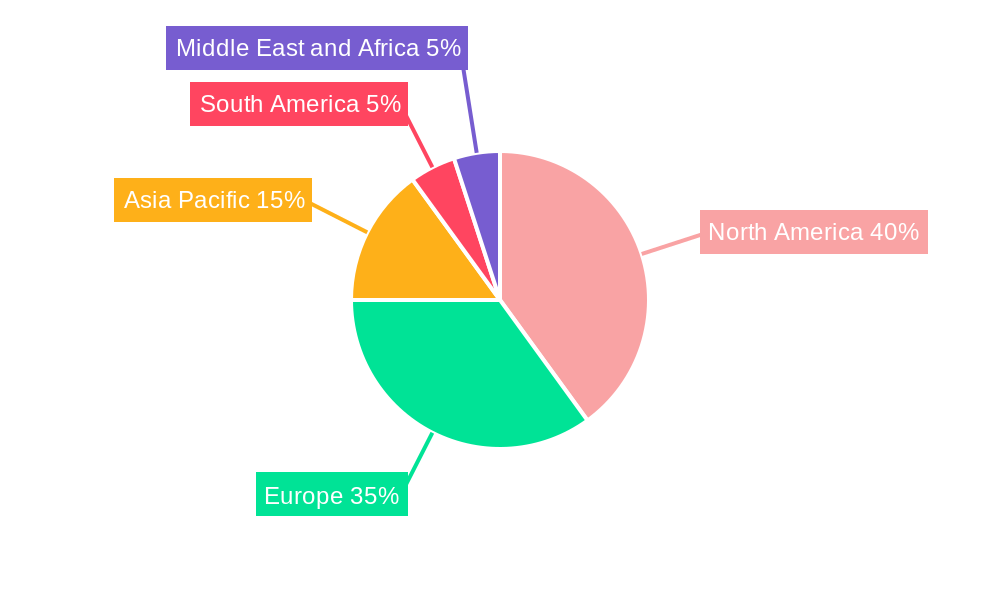

The geographical distribution of the online clothing rental market shows a significant presence in North America and Europe, with these regions expected to maintain considerable market share throughout the forecast period. However, the Asia-Pacific region is demonstrating rapid growth potential due to increasing disposable incomes and changing fashion preferences. The market’s future growth will depend on effective marketing strategies that emphasize sustainability, affordability, and convenience. Innovation in areas such as virtual styling tools, advanced logistics, and environmentally friendly garment cleaning will play a crucial role in shaping the market's trajectory. Furthermore, addressing consumer concerns related to hygiene and garment condition will be critical to maintaining trust and driving sustained growth in the years to come.

Online Clothing Rental Market Company Market Share

Online Clothing Rental Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Online Clothing Rental Market, covering the period 2019-2033. It offers actionable insights into market dynamics, growth drivers, key players, and emerging opportunities, equipping industry stakeholders with the knowledge needed to navigate this rapidly evolving sector. The report projects a market value exceeding xx Million by 2033, presenting a compelling investment landscape. This in-depth study analyzes key segments, including end-users (men, women, children), dress codes (formal, casual, partywear, traditional), and leading players like Rent the Runway, GlamCorner, and Nuuly. The report also examines the impact of significant industry developments and strategic partnerships.

Online Clothing Rental Market Market Concentration & Dynamics

The online clothing rental market is characterized by a moderately concentrated landscape, with several major players vying for market share. While Rent the Runway and GlamCorner hold significant positions, numerous smaller players and niche operators contribute to the overall market dynamism. The market exhibits a robust innovation ecosystem, driven by technological advancements in e-commerce, logistics, and personalization. Regulatory frameworks, particularly concerning data privacy and consumer protection, significantly influence market operations. Substitute products, including traditional clothing retail and secondhand clothing markets, exert competitive pressure. End-user trends, particularly towards sustainability and conscious consumption, are key growth drivers. M&A activities, as evidenced by Rent the Runway's partnership with Saks Off 5th and GlamCorner's collaboration with David Jones, are reshaping the competitive landscape.

- Market Share (2024 Estimate): Rent the Runway: xx%; GlamCorner: xx%; Nuuly (Urban Outfitters): xx%; Others: xx%

- M&A Deal Count (2019-2024): xx

Online Clothing Rental Market Industry Insights & Trends

The online clothing rental market experienced significant growth during the historical period (2019-2024), fueled by the rising popularity of the sharing economy, increasing consumer awareness of sustainability, and the convenience offered by online platforms. The market size reached xx Million in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during this period. Technological disruptions, such as advancements in mobile applications and personalized recommendations, are enhancing user experience and driving market expansion. Evolving consumer behaviors, including a preference for experience over ownership and a growing emphasis on ethical and sustainable consumption, further bolster market growth. The forecast period (2025-2033) anticipates continued growth, driven by these factors and expanding market penetration across various demographics and geographic regions. Market size is projected to reach xx Million by 2025 and xx Million by 2033, with a CAGR of xx%.

Key Markets & Segments Leading Online Clothing Rental Market

The women's segment dominates the online clothing rental market, driven by a higher propensity for fashion experimentation and diverse wardrobe needs. The casual wear segment exhibits strong growth, reflecting the everyday demand for versatile clothing options. Geographically, North America and Europe represent key markets, characterized by high internet penetration, strong consumer purchasing power, and established e-commerce infrastructure.

Key Drivers:

- Women's Segment: High fashion interest, diverse wardrobe needs, event-based rentals.

- Casual Wear: Everyday demand, convenience, cost-effectiveness.

- North America/Europe: High internet penetration, strong e-commerce infrastructure, affluent consumer base.

The dominance of these segments is explained by higher fashion consciousness among women, a trend that pushes rental services as a cost-effective and sustainable alternative to traditional purchasing. The convenience of online platforms and established e-commerce networks also significantly benefit these regions.

Online Clothing Rental Market Product Developments

Recent product innovations focus on enhancing personalization, expanding inventory, and improving the overall user experience. Technological advancements, such as AI-powered styling tools and virtual try-on capabilities, are key differentiators. The integration of pre-owned designer items, as seen with Rent the Runway's partnership with Saks Off 5th, adds a premium offering and caters to growing demand for luxury goods in a sustainable way. This integration provides a competitive edge by offering a wider selection and caters to various price points.

Challenges in the Online Clothing Rental Market Market

The online clothing rental market faces several challenges, including intense competition, logistics complexities (including cleaning and maintenance of garments), regulatory hurdles related to data privacy and consumer protection, and potential supply chain disruptions impacting the availability of clothing items. These factors can contribute to higher operational costs and reduce profitability.

Forces Driving Online Clothing Rental Market Growth

Key growth drivers include the increasing adoption of sustainable consumption practices, the rise of the sharing economy, technological advancements in personalized styling and virtual try-on, and expanding online retail infrastructure. Furthermore, favorable regulatory environments and government incentives promoting sustainable businesses contribute to market expansion. The expansion into new geographic markets and demographic segments also provides significant growth opportunities.

Challenges in the Online Clothing Rental Market Market

Long-term growth is fueled by continuous innovation in technology, strategic partnerships expanding market reach, and tapping into new customer demographics. The integration of advanced technologies like AI for improved customer experience and sustainable supply chain management solutions are crucial elements in ensuring continued market expansion.

Emerging Opportunities in Online Clothing Rental Market

Emerging opportunities include expanding into untapped geographic markets, offering specialized rental services (e.g., occasion wear or maternity clothing), and integrating augmented reality (AR) and virtual reality (VR) technologies for enhanced virtual try-on experiences. Catering to diverse customer preferences through personalized recommendations and curated collections is also an important strategy. Furthermore, exploring subscription models and loyalty programs can drive customer retention and increase revenue streams.

Leading Players in the Online Clothing Rental Market Sector

- GlamCorner Pty Ltd

- Dress & Go

- flyrobe.com

- StyleLend

- Urban Outfitters Inc (Nuuly)

- The Clothing Rental

- Gwynnie Bee

- Rent the Runway

- Powerlook

- Rent It Bae

Key Milestones in Online Clothing Rental Market Industry

- May 2022: Nuuly unveiled its newest ready-to-rent collection, expanding its offerings and building on previous collaborations. This strengthened its position as a key player in the market.

- April 2022: David Jones partnered with GlamCorner via Reloop, promoting circular economy practices and enhancing customer engagement. This collaboration boosted GlamCorner's brand awareness and market presence.

- July 2022: Rent the Runway partnered with Saks Off 5th, integrating a pre-owned section, expanding its product offerings and reaching a new customer segment. This move diversified the business model and broadened the appeal to luxury consumers.

Strategic Outlook for Online Clothing Rental Market Market

The online clothing rental market shows immense growth potential, driven by consumer demand for sustainable and convenient fashion solutions. Strategic opportunities lie in technological innovation, strategic partnerships, and expansion into new markets and customer segments. Companies that effectively leverage data analytics to personalize offerings and optimize operations will be best positioned for success in this dynamic market. The focus on sustainability and ethical sourcing will increasingly influence consumer choices, creating a competitive advantage for companies aligning with these values.

Online Clothing Rental Market Segmentation

-

1. End -User

- 1.1. Men

- 1.2. Women

- 1.3. Children

-

2. Dress Code

- 2.1. Formal

- 2.2. Casual

- 2.3. Partywear

- 2.4. Traditional

Online Clothing Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Online Clothing Rental Market Regional Market Share

Geographic Coverage of Online Clothing Rental Market

Online Clothing Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Adoption of Subscription-based Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 5.1.1. Men

- 5.1.2. Women

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Dress Code

- 5.2.1. Formal

- 5.2.2. Casual

- 5.2.3. Partywear

- 5.2.4. Traditional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End -User

- 6. North America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 6.1.1. Men

- 6.1.2. Women

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Dress Code

- 6.2.1. Formal

- 6.2.2. Casual

- 6.2.3. Partywear

- 6.2.4. Traditional

- 6.1. Market Analysis, Insights and Forecast - by End -User

- 7. Europe Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 7.1.1. Men

- 7.1.2. Women

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Dress Code

- 7.2.1. Formal

- 7.2.2. Casual

- 7.2.3. Partywear

- 7.2.4. Traditional

- 7.1. Market Analysis, Insights and Forecast - by End -User

- 8. Asia Pacific Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 8.1.1. Men

- 8.1.2. Women

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Dress Code

- 8.2.1. Formal

- 8.2.2. Casual

- 8.2.3. Partywear

- 8.2.4. Traditional

- 8.1. Market Analysis, Insights and Forecast - by End -User

- 9. South America Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 9.1.1. Men

- 9.1.2. Women

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Dress Code

- 9.2.1. Formal

- 9.2.2. Casual

- 9.2.3. Partywear

- 9.2.4. Traditional

- 9.1. Market Analysis, Insights and Forecast - by End -User

- 10. Middle East and Africa Online Clothing Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 10.1.1. Men

- 10.1.2. Women

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Dress Code

- 10.2.1. Formal

- 10.2.2. Casual

- 10.2.3. Partywear

- 10.2.4. Traditional

- 10.1. Market Analysis, Insights and Forecast - by End -User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GlamCorner Pty Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dress & Go

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 flyrobe com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 StyleLend

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Urban Outfitters Inc (Nuuly)*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Clothing Rental

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gwynnie Bee

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rent the Runway

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Powerlook

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rent It Bae

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 GlamCorner Pty Ltd

List of Figures

- Figure 1: Global Online Clothing Rental Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 3: North America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 4: North America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 5: North America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 6: North America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 9: Europe Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 10: Europe Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 11: Europe Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 12: Europe Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 15: Asia Pacific Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 16: Asia Pacific Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 17: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 18: Asia Pacific Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 21: South America Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 22: South America Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 23: South America Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 24: South America Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Online Clothing Rental Market Revenue (Million), by End -User 2025 & 2033

- Figure 27: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by End -User 2025 & 2033

- Figure 28: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Dress Code 2025 & 2033

- Figure 29: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Dress Code 2025 & 2033

- Figure 30: Middle East and Africa Online Clothing Rental Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Online Clothing Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 2: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 3: Global Online Clothing Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 5: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 6: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 12: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 13: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 22: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 23: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 30: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 31: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Online Clothing Rental Market Revenue Million Forecast, by End -User 2020 & 2033

- Table 36: Global Online Clothing Rental Market Revenue Million Forecast, by Dress Code 2020 & 2033

- Table 37: Global Online Clothing Rental Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Online Clothing Rental Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Clothing Rental Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Online Clothing Rental Market?

Key companies in the market include GlamCorner Pty Ltd, Dress & Go, flyrobe com, StyleLend, Urban Outfitters Inc (Nuuly)*List Not Exhaustive, The Clothing Rental, Gwynnie Bee, Rent the Runway, Powerlook, Rent It Bae.

3. What are the main segments of the Online Clothing Rental Market?

The market segments include End -User, Dress Code.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Adoption of Subscription-based Services.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

July 2022: Rent the Runway joined forces with Saks Off 5th, integrating a dedicated "pre-owned" section on its website, enabling customers to access pre-owned designer items.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Clothing Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Clothing Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Clothing Rental Market?

To stay informed about further developments, trends, and reports in the Online Clothing Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence