Key Insights

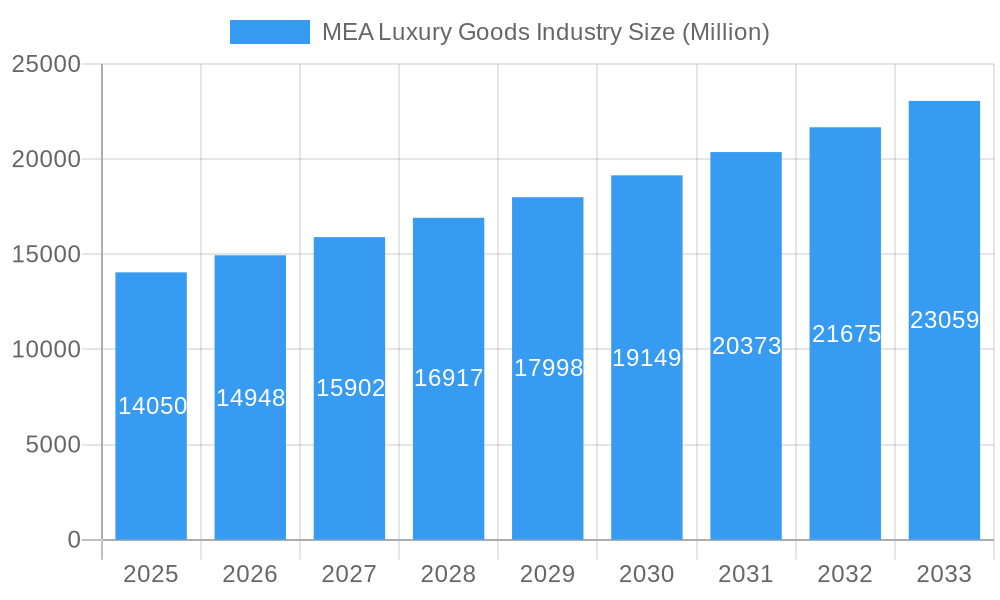

The Middle East and Africa (MEA) luxury goods market, valued at $14.05 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is driven by several key factors. A burgeoning affluent population in key markets like Saudi Arabia and the UAE, characterized by increasing disposable incomes and a penchant for high-end brands, fuels significant demand. Furthermore, the rise of e-commerce platforms and the growing popularity of social media influencer marketing are expanding market reach and accessibility. The increasing tourism influx into the region, particularly in popular destinations known for luxury shopping, also contributes to market growth. However, the market faces potential challenges, including economic volatility in certain MEA countries and fluctuating global exchange rates that can impact consumer spending on luxury goods. The segmentation of the market into various product types—clothing and apparel, footwear, bags, jewelry, watches, and other accessories—and distribution channels—single-branded stores, multi-brand stores, and online retail stores—provides opportunities for targeted marketing strategies. The competitive landscape is dominated by established international luxury brands like LVMH, Kering, and Richemont, alongside regional players and franchise groups. The forecast indicates a continued upward trajectory for the MEA luxury goods market, although careful attention to economic factors and consumer sentiment will be crucial for sustained success.

MEA Luxury Goods Industry Market Size (In Billion)

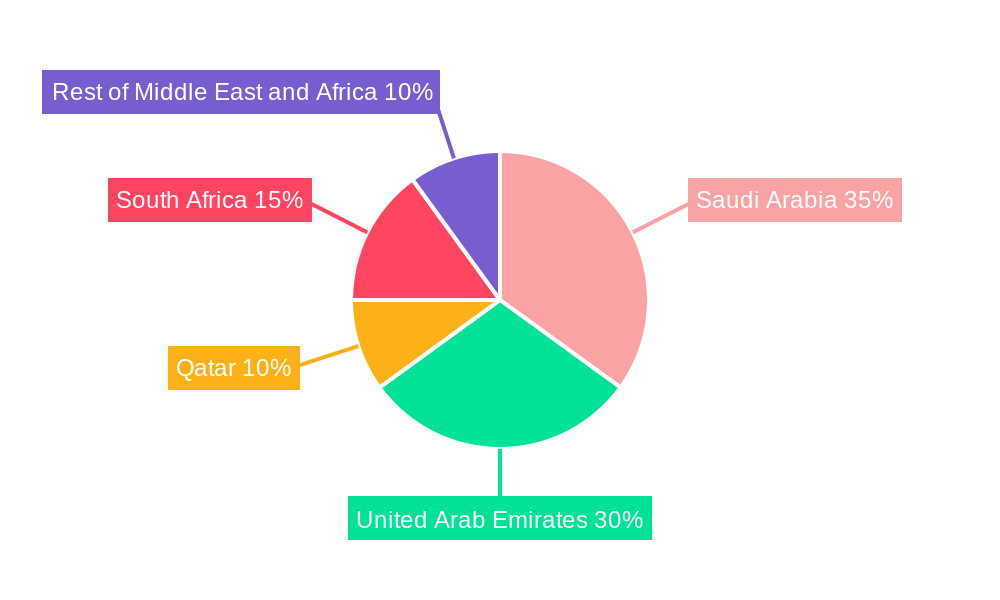

The forecast for the MEA luxury goods market suggests continued growth across all segments. The online retail channel is expected to experience the fastest growth, fueled by increased internet penetration and the convenience it offers. While single-branded stores will continue to hold a significant share, the multi-brand stores are likely to expand their presence through strategic partnerships and curated offerings. Growth in product categories will vary; jewelry and watches, historically strong performers, are expected to maintain robust growth, while clothing and apparel may show slightly slower, yet still positive, expansion depending on evolving fashion trends and consumer preferences. The regional breakdown shows significant contribution from the UAE and Saudi Arabia, but other markets, including Qatar and South Africa, are also poised for considerable growth. The success of luxury brands in this market depends on adapting to local cultural nuances, offering personalized experiences, and effectively leveraging digital platforms to reach and engage consumers.

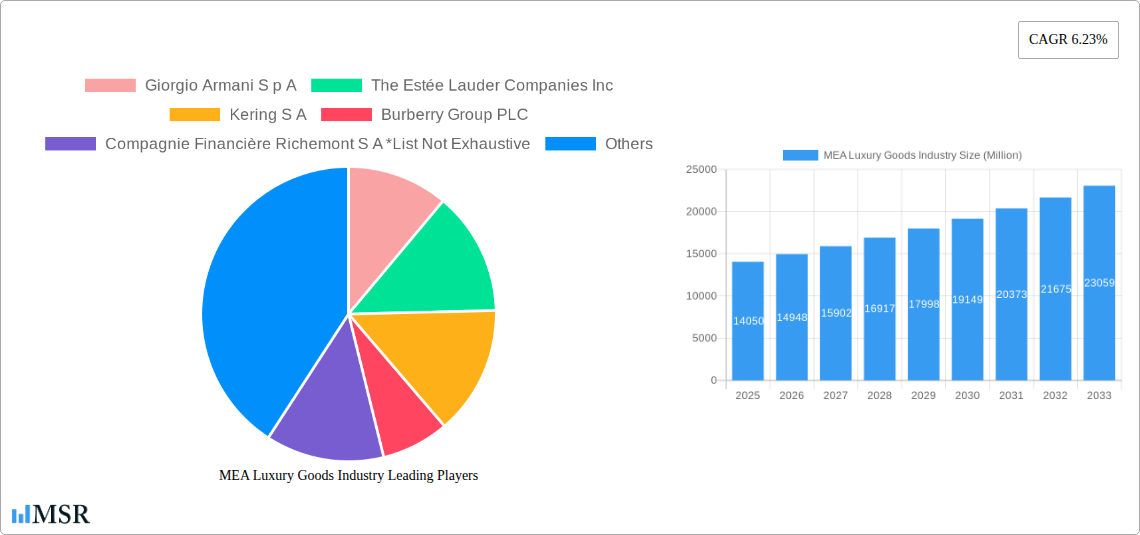

MEA Luxury Goods Industry Company Market Share

MEA Luxury Goods Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa (MEA) luxury goods industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report unveils the market dynamics, growth drivers, and future opportunities within this lucrative sector. The analysis encompasses key segments including clothing and apparel, footwear, bags, jewelry, watches, and other accessories, across various distribution channels. Market size is projected to reach xx Million by 2025. Expect to find detailed data on leading players such as LVMH Moët Hennessy Louis Vuitton, Chanel S A, and Rolex SA, among many others.

MEA Luxury Goods Industry Market Concentration & Dynamics

The MEA luxury goods market exhibits a moderately concentrated structure, dominated by a few global luxury conglomerates and prominent regional players. Key players hold significant market share, with LVMH Moët Hennessy Louis Vuitton and Kering S A consistently ranking among the top contenders. However, the market also features a dynamic landscape with emerging brands and smaller niche players carving out their space. Innovation plays a crucial role, with brands constantly striving for differentiation through unique designs, technological integrations, and sustainable practices.

The regulatory environment in the MEA region varies across countries, impacting import/export regulations, taxation, and labeling requirements. The presence of substitute products, particularly in the apparel and accessories segments, exerts competitive pressure. End-user trends indicate a growing preference for personalized experiences, ethical sourcing, and digital engagement. M&A activity remains a key factor in shaping market dynamics, with a projected xx M&A deals in 2025, mainly focusing on brand acquisition and expansion strategies.

- Market Share: LVMH Moët Hennessy Louis Vuitton (xx%), Kering S A (xx%), Richemont (xx%), others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Innovation Areas: Sustainability, personalization, technological integration (e.g., NFTs, AR/VR experiences).

MEA Luxury Goods Industry Industry Insights & Trends

The MEA luxury goods market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. This growth is propelled by several factors. Rising disposable incomes within the region's burgeoning middle class fuel demand for premium products. Tourism plays a significant role, with significant spending by international luxury shoppers. Technological disruptions are reshaping the consumer experience, with the rise of e-commerce, personalized marketing strategies, and experiential retail formats. Evolving consumer behaviors show a move towards conscious luxury, focusing on quality, craftsmanship, and brand storytelling. This segment shows increased interest in unique, personalized items, often supporting artisan-made products. Increased government investments in infrastructure and tourism further fuel market expansion.

Key Markets & Segments Leading MEA Luxury Goods Industry

The UAE consistently emerges as a leading market within the MEA region, owing to its robust economy, high concentration of affluent consumers, and well-developed infrastructure. Saudi Arabia also represents a significant market, characterized by rapid economic growth and a growing preference for luxury goods.

Dominant Segments:

- Product Type: Watches and Jewelry consistently lead, followed closely by Bags and Apparel.

- Distribution Channel: Single-branded stores maintain the dominant share, while online retail is experiencing rapid growth.

Growth Drivers:

- Economic Growth: Rising disposable incomes and tourism boost demand.

- Infrastructure Development: Improved retail spaces and logistics facilitate market expansion.

- Government Initiatives: Supportive policies promoting tourism and luxury retail.

MEA Luxury Goods Industry Product Developments

Recent product innovations highlight a focus on personalization, sustainability, and technological integration. Brands are incorporating innovative materials, designs, and manufacturing techniques to create unique and desirable products. The emphasis on storytelling and heritage further enhances the value proposition. Technological advancements, such as augmented reality (AR) experiences and personalized online platforms, are enriching the consumer journey.

Challenges in the MEA Luxury Goods Industry Market

The MEA luxury goods market faces challenges such as fluctuating oil prices impacting consumer spending, supply chain disruptions affecting product availability, and intensifying competition from both established and emerging brands. Regulatory complexities and counterfeiting issues pose additional hurdles. These factors, coupled with geopolitical instability in certain regions, can negatively impact market growth.

Forces Driving MEA Luxury Goods Industry Growth

Key growth drivers include the burgeoning middle class with increasing disposable incomes, robust tourism, and substantial government investments in infrastructure. Technological advancements enhancing the customer experience, alongside supportive policies for the luxury sector, play a vital role. The ongoing development of the e-commerce sector also expands market reach.

Long-Term Growth Catalysts in the MEA Luxury Goods Industry

Long-term growth hinges on continuous product innovation, strategic partnerships with local retailers and influencers, and expansion into new and emerging markets within the MEA region. The strategic use of digital platforms will be critical for both marketing and sales growth. Cultivating a strong focus on sustainability will resonate with the increasingly conscious consumer base.

Emerging Opportunities in MEA Luxury Goods Industry

Emerging opportunities lie in tapping into the growing demand for personalized luxury experiences, leveraging e-commerce for increased reach, and catering to the preferences of younger, digitally-savvy consumers. The focus on sustainability and ethical sourcing presents a significant opportunity to capture a growing segment of the luxury market. Expanding into secondary cities within the region presents an additional growth catalyst.

Leading Players in the MEA Luxury Goods Industry Sector

- Giorgio Armani S p A

- The Estée Lauder Companies Inc

- Kering S A

- Burberry Group PLC

- Compagnie Financière Richemont S A

- Alshaya franchise group (Tribe of 6 Aerie)

- Dolce & Gabbana Luxembourg S À R L

- Rolex SA

- Prada S P A

- Roberto Cavalli S P A

- Chanel S A

- LVMH Moët Hennessy Louis Vuitton

- Chopard Group

Key Milestones in MEA Luxury Goods Industry Industry

- May 2021: Opening of a new Rolex Boutique at the Galleria Al Maryah Island in Abu Dhabi, signifying the brand's commitment to the UAE market and enhancing its retail presence.

- May 2022: PRADA Tropico's pop-up boutique launch in Dubai's Mall of Emirates, highlighting the brand's innovative approach to retail and its focus on the region.

- November 2022: Santos de Cartier's new jewelry collection launch, showcasing the brand's continued innovation in design and its appeal to high-end consumers.

Strategic Outlook for MEA Luxury Goods Industry Market

The MEA luxury goods market presents a significant growth opportunity over the forecast period. The combination of a rising affluent population, growing tourism, and continuous innovation in product and retail strategies promises substantial future potential. Strategic partnerships and a focus on enhancing the customer journey will be key success factors for businesses looking to thrive in this dynamic and competitive market.

MEA Luxury Goods Industry Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle East and Africa

MEA Luxury Goods Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

MEA Luxury Goods Industry Regional Market Share

Geographic Coverage of MEA Luxury Goods Industry

MEA Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure

- 3.3. Market Restrains

- 3.3.1. Counterfeit Goods Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giorgio Armani S p A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estée Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kering S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burberry Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compagnie Financière Richemont S A *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alshaya franchise group (Tribe of 6 Aerie)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolce & Gabbana Luxembourg S À R L

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prada S P A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roberto Cavalli S P A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chanel S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LVMH Moët Hennessy Louis Vuitton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chopard Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: MEA Luxury Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: MEA Luxury Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Luxury Goods Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the MEA Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, The Estée Lauder Companies Inc, Kering S A, Burberry Group PLC, Compagnie Financière Richemont S A *List Not Exhaustive, Alshaya franchise group (Tribe of 6 Aerie), Dolce & Gabbana Luxembourg S À R L, Rolex SA, Prada S P A, Roberto Cavalli S P A, Chanel S A, LVMH Moët Hennessy Louis Vuitton, Chopard Group.

3. What are the main segments of the MEA Luxury Goods Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure.

6. What are the notable trends driving market growth?

Rise in Tourism Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Counterfeit Goods Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Santos de Cartier launched new series of jewelry collections that consists of rings, bracelets, and necklaces. The collection consists of a gold chain in two colors, mounted with a single or double row of coffee beans decorated with diamonds of various sizes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the MEA Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence