Key Insights

The North American online gambling market is experiencing robust growth, driven by factors such as increasing smartphone penetration, readily available high-speed internet access, and the evolving regulatory landscape in several states. The market's compound annual growth rate (CAGR) of 11.78% from 2019 to 2024 suggests a significant expansion, which is projected to continue through 2033. The increasing legalization and regulation of online gambling in various states, particularly in the US, has been a major catalyst. This has led to increased consumer confidence and participation, fueled by the convenience and variety offered by online platforms. The market is segmented by device (desktop and mobile) and game type (sports betting, casino games, and other casino games), with mobile gaming rapidly gaining traction due to its portability and accessibility. Major players, including Caesars Entertainment, DraftKings, Flutter Entertainment, and 888 Holdings, are strategically investing in technological advancements and marketing efforts to capture market share, further intensifying competition and driving innovation. The robust growth is expected to continue as more states embrace regulated online gambling, and operators refine their offerings to meet evolving consumer preferences.

North America Online Gambling Market Market Size (In Billion)

The North American market dominance is fueled by the relatively mature regulatory landscape in some regions, compared to others globally. While the US market currently leads, significant growth potential exists in Canada and Mexico as regulatory frameworks further develop. However, potential restraints include the ongoing regulatory uncertainties in certain jurisdictions, concerns about responsible gambling practices, and the constant need for operators to adapt to evolving consumer preferences and technological advancements. The segment breakdown reveals that sports betting and casino games are leading revenue generators, but the "Other Casino Games" category is also poised for significant growth, driven by innovation in game design and the expansion of game variety. The future trajectory hinges on sustained regulatory clarity, technological advancements focusing on user experience and security, and effective responsible gambling initiatives. The market’s substantial size and high growth projections indicate a lucrative opportunity for businesses prepared to navigate the evolving legal and technological landscape.

North America Online Gambling Market Company Market Share

North America Online Gambling Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America online gambling market, covering the period 2019-2033. It examines market dynamics, industry trends, key segments, leading players, and future growth opportunities. This detailed analysis is crucial for investors, industry stakeholders, and businesses seeking to understand and navigate this rapidly evolving landscape. The report uses 2025 as the base year and projects the market to 2033, incorporating historical data from 2019-2024. The market is valued at xx Million in 2025 and is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

North America Online Gambling Market Concentration & Dynamics

The North American online gambling market is characterized by a dynamic interplay of established players and emerging entrants. Market concentration is moderate, with a few dominant players holding significant shares, while numerous smaller operators compete for market share. The market is witnessing increased consolidation through mergers and acquisitions (M&A), as evidenced by xx M&A deals in the last five years. Innovation is a key driver, with companies constantly developing new games, platforms, and technologies to enhance user experience and attract new customers. Regulatory frameworks vary significantly across different states and provinces, impacting market access and operations. Substitute products, such as traditional casinos and other forms of entertainment, continue to pose competition. End-user trends indicate a growing preference for mobile gaming and a rising demand for diverse game offerings.

Market Share: Caesars Entertainment and DraftKings hold leading positions, with xx% and xx% respectively in 2025, followed by Flutter Entertainment (xx%), and 888 Holdings (xx%). Other significant players include MGM Resorts International, The Stars Group, and independent online casinos such as Slots Empire Casino, El Royale Casino, BoVegas, and Cherry Gold Casino. The market share is expected to shift in the forecast period due to mergers and acquisitions and new market entrants.

M&A Activity: Recent M&A activity significantly reshaped the landscape. For example, the 888 Holdings acquisition of William Hill's non-US assets and DraftKings' acquisition of Golden Nugget Online Gaming (GNOG) have increased market consolidation.

Regulatory Landscape: The fragmented regulatory environment across different states and provinces is a critical factor in determining the market's expansion rate and player competitiveness.

North America Online Gambling Market Industry Insights & Trends

The North America online gambling market is experiencing robust growth, driven by several key factors. Increasing smartphone penetration, coupled with evolving consumer preferences towards convenient and readily available entertainment, are significant contributors. Technological advancements like enhanced mobile gaming experiences, live dealer games, and virtual reality integration are further fueling market expansion. The legalisation of online gambling in several states and provinces has opened up new markets and led to increased investment and competition. However, challenges remain, including concerns regarding responsible gambling, regulatory uncertainty, and the need to maintain robust security measures. The overall market growth trajectory is positive, with the market size projected to increase from xx Million in 2025 to xx Million by 2033, demonstrating a promising outlook for market participants.

The increasing popularity of sports betting has been particularly significant, attracting millions of users. The rise of eSports betting is also emerging as a potential sub-segment showing significant revenue potential. The market is also seeing a strong growth in mobile gaming, with projections indicating mobile devices holding the majority share in the coming years.

Key Markets & Segments Leading North America Online Gambling Market

The North American online gambling market demonstrates strong growth across various regions and segments. While the US market accounts for the lion's share of revenue, significant growth is also being observed in Canada.

By Device:

Mobile: The mobile segment is witnessing exponential growth, driven by increasing smartphone penetration and the convenience it offers. In 2025, it is projected to hold approximately xx% of the market share, surpassing desktop. This is due to factors such as increased mobile internet penetration and the accessibility of mobile gaming platforms.

Desktop: While desktop gaming still maintains a presence, its share is steadily declining as users increasingly favor the portability and ease of mobile gaming.

By Game Type:

Sports Betting: Sports betting has experienced a surge in popularity, propelled by increased legalisation and enhanced user engagement. It is forecasted to capture a significant share of the market in the coming years. The ease of accessibility via mobile apps, combined with a strong focus on user experience, has resulted in rapid market penetration.

Casino: Online casino games, including slots, table games, and live dealer games, remain a dominant segment, consistently attracting a significant user base.

Other Casino Games: This segment encompasses a range of less dominant games that nevertheless contribute to the overall market growth. This can include skill-based games such as poker and bingo and virtual reality gaming experiences.

The drivers for these segments are multifaceted and include factors such as increased disposable incomes, favorable regulatory environments, and the appeal of convenient and engaging gaming options.

North America Online Gambling Market Product Developments

The North American online gambling market is characterized by continuous product innovation, with companies consistently striving to deliver enhanced user experiences. This involves incorporating advanced technologies, such as AI-powered personalization and augmented reality features, to create more immersive and engaging gaming environments. The development of advanced live dealer games and the integration of virtual reality (VR) and augmented reality (AR) technologies are transforming the landscape, enhancing user engagement and driving market growth. The integration of blockchain technology for secure transactions and the development of innovative betting formats are further enriching the online gaming experience and fostering competitiveness.

Challenges in the North America Online Gambling Market

The North American online gambling market faces several challenges. Regulatory hurdles vary significantly across jurisdictions, hindering market expansion and increasing compliance costs. Concerns around responsible gambling and the potential for addiction require stringent measures and ethical practices. The intense competition among established players and new entrants necessitates significant investment in technology and marketing to gain and retain market share. Supply chain disruptions, while less directly impactful than in other industries, can affect the provision of certain games or services. These challenges, if not properly addressed, could impact the overall market growth rate. Furthermore, consumer protection and anti-money laundering measures remain a constant concern.

Forces Driving North America Online Gambling Market Growth

Several key factors drive growth in the North American online gambling market. The increasing legalization of online gambling across various states and provinces is a primary catalyst, opening up new markets and attracting significant investment. Technological advancements, such as improved mobile gaming experiences and virtual reality integration, enhance the user experience and broaden the appeal. The rising disposable income among consumers provides increased spending power for entertainment, contributing to market expansion. The rise in popularity of sports betting, with many successful partnerships between sports leagues and online betting platforms, has propelled the market's growth further. The increasing use of advanced analytics and data science further aids companies in user acquisition and marketing.

Long-Term Growth Catalysts in the North America Online Gambling Market

Long-term growth will be fueled by the continued expansion of legalized online gambling into new jurisdictions, fostering competition and innovation. Strategic partnerships between established gaming companies and technology providers will enhance product offerings and improve user experience. The integration of new technologies, such as blockchain for secure transactions and artificial intelligence for personalized experiences, will create new opportunities for growth. Expansion into new market segments, such as eSports betting and virtual reality casinos, will also provide significant growth avenues.

Emerging Opportunities in North America Online Gambling Market

Emerging opportunities lie in the expansion into under-penetrated markets and the adoption of innovative technologies. The rise of eSports betting presents a significant growth potential. The integration of virtual and augmented reality technologies can further enhance user engagement and create immersive gaming experiences. Personalized gaming experiences driven by artificial intelligence offer opportunities for improved customer loyalty and retention. Expansion into niche markets, catering to specific demographics and gaming preferences, presents growth potential.

Leading Players in the North America Online Gambling Market Sector

- Caesars Entertainment Corporation

- Flutter Entertainment PLC

- 888 Holding PLC

- DraftKings (Golden Nugget)

- MGM Resorts International (Borgata Hotel Casino & Spa)

- Slots Empire Casino

- El Royale Casino

- The Stars Group Inc

- BoVegas

- Cherry Gold Casino

- Wild Casino

Key Milestones in North America Online Gambling Market Industry

July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. This acquisition significantly strengthened 888 Holdings' market position.

May 2022: DraftKings acquired Golden Nugget Online Gaming (GNOG), expanding its market reach and product offerings. This acquisition provided access to Golden Nugget's established customer base and technological capabilities.

July 2021: Flutter Entertainment's FanDuel Group expanded its FanDuel Casino offerings in New Jersey and Michigan, highlighting market expansion and technological advancements in online casino products.

Strategic Outlook for North America Online Gambling Market

The North American online gambling market presents significant growth potential over the next decade. Continued legalization efforts, technological innovation, and strategic partnerships will fuel market expansion. Companies that embrace responsible gambling practices, invest in cutting-edge technology, and effectively target diverse customer segments will be best positioned to succeed. The market's strategic outlook remains highly positive, offering attractive opportunities for both established players and new entrants. However, regulatory changes and evolving consumer preferences will require companies to adapt swiftly and maintain a focus on innovation to remain competitive.

North America Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Slots

- 1.2.3. Baccarat

- 1.2.4. Blackjack

- 1.2.5. Poker

- 1.2.6. Other Casino Games

- 1.3. Other Game Types

-

2. Device

- 2.1. Desktop

- 2.2. Mobile

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of the North America

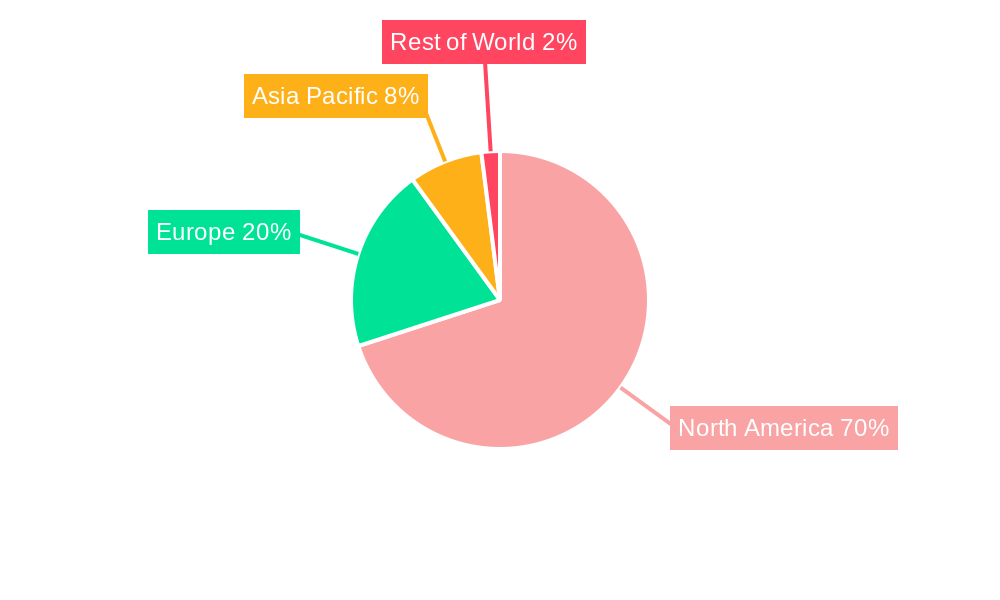

North America Online Gambling Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of the North America

North America Online Gambling Market Regional Market Share

Geographic Coverage of North America Online Gambling Market

North America Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Slots

- 5.1.2.3. Baccarat

- 5.1.2.4. Blackjack

- 5.1.2.5. Poker

- 5.1.2.6. Other Casino Games

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Device

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of the North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of the North America

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. United States North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Slots

- 6.1.2.3. Baccarat

- 6.1.2.4. Blackjack

- 6.1.2.5. Poker

- 6.1.2.6. Other Casino Games

- 6.1.3. Other Game Types

- 6.2. Market Analysis, Insights and Forecast - by Device

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of the North America

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. Canada North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Slots

- 7.1.2.3. Baccarat

- 7.1.2.4. Blackjack

- 7.1.2.5. Poker

- 7.1.2.6. Other Casino Games

- 7.1.3. Other Game Types

- 7.2. Market Analysis, Insights and Forecast - by Device

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of the North America

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Mexico North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Slots

- 8.1.2.3. Baccarat

- 8.1.2.4. Blackjack

- 8.1.2.5. Poker

- 8.1.2.6. Other Casino Games

- 8.1.3. Other Game Types

- 8.2. Market Analysis, Insights and Forecast - by Device

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of the North America

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. Rest of the North America North America Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Slots

- 9.1.2.3. Baccarat

- 9.1.2.4. Blackjack

- 9.1.2.5. Poker

- 9.1.2.6. Other Casino Games

- 9.1.3. Other Game Types

- 9.2. Market Analysis, Insights and Forecast - by Device

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of the North America

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Slots Empire Casino

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 El Royale Casino

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Caesars Entertainment Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Flutter Entertainment PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Stars Group Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BoVegas

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 888 Holding PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cherry Gold Casino*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 MGM Resorts International (Borgata Hotel Casino & Spa)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Wild Casino

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 DraftKings (Golden Nugget

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Slots Empire Casino

List of Figures

- Figure 1: North America Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 3: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 6: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 7: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 10: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 11: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 15: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: North America Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 18: North America Online Gambling Market Revenue Million Forecast, by Device 2020 & 2033

- Table 19: North America Online Gambling Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Online Gambling Market?

The projected CAGR is approximately 11.78%.

2. Which companies are prominent players in the North America Online Gambling Market?

Key companies in the market include Slots Empire Casino, El Royale Casino, Caesars Entertainment Corporation, Flutter Entertainment PLC, The Stars Group Inc, BoVegas, 888 Holding PLC, Cherry Gold Casino*List Not Exhaustive, MGM Resorts International (Borgata Hotel Casino & Spa), Wild Casino, DraftKings (Golden Nugget.

3. What are the main segments of the North America Online Gambling Market?

The market segments include Game Type, Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

The Increasing Adoption of Internet and Internet-based Devices Supports Market Growth..

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

July 2022: 888 Holdings acquired William Hill's non-US business from Caesars Entertainment. William Hill is a popular online gambling platform brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Online Gambling Market?

To stay informed about further developments, trends, and reports in the North America Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence