Key Insights

The Bangladesh hair oil market is projected to reach $280 million by 2024, exhibiting a CAGR of 7.2%. This expansion is fueled by increasing disposable incomes, growing awareness of specialized hair care, and the cultural importance of hair oiling. Consumers are increasingly favoring natural and herbal formulations due to perceived health and safety benefits. Brands are innovating with premium ingredients and therapeutic benefits, driving demand for key segments such as Almond Oil and Coconut Oil.

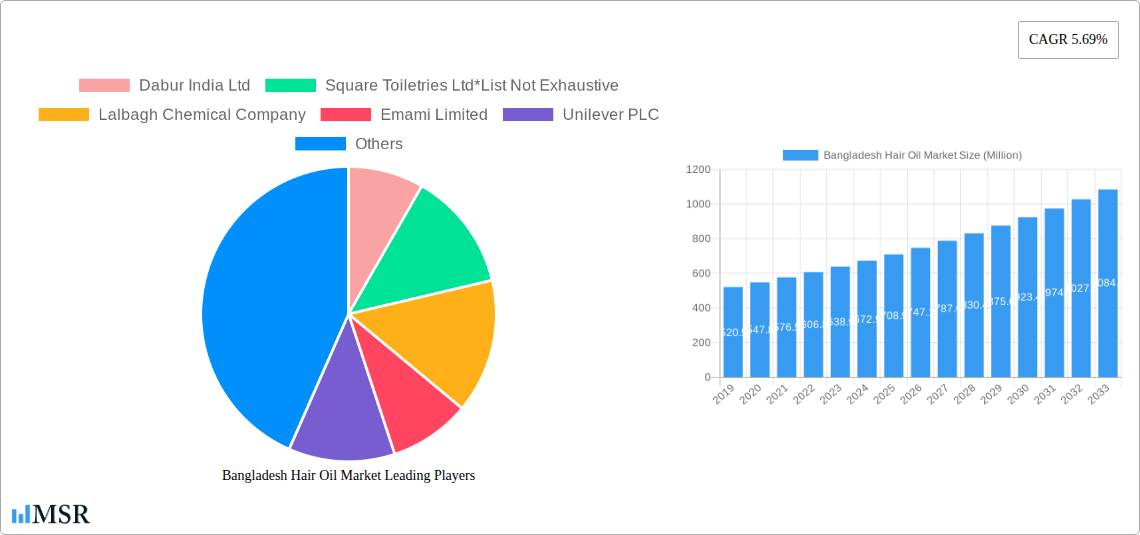

Bangladesh Hair Oil Market Market Size (In Million)

Online retail channels are experiencing significant growth, complementing traditional distribution networks like hypermarkets/supermarkets and convenience stores. Intensifying competition and potential raw material price fluctuations present challenges. However, the sustained demand for effective and culturally relevant hair care solutions ensures a positive market outlook. Leading players, including Dabur India Ltd, Marico Limited, and Unilever PLC, are focusing on product innovation and market penetration.

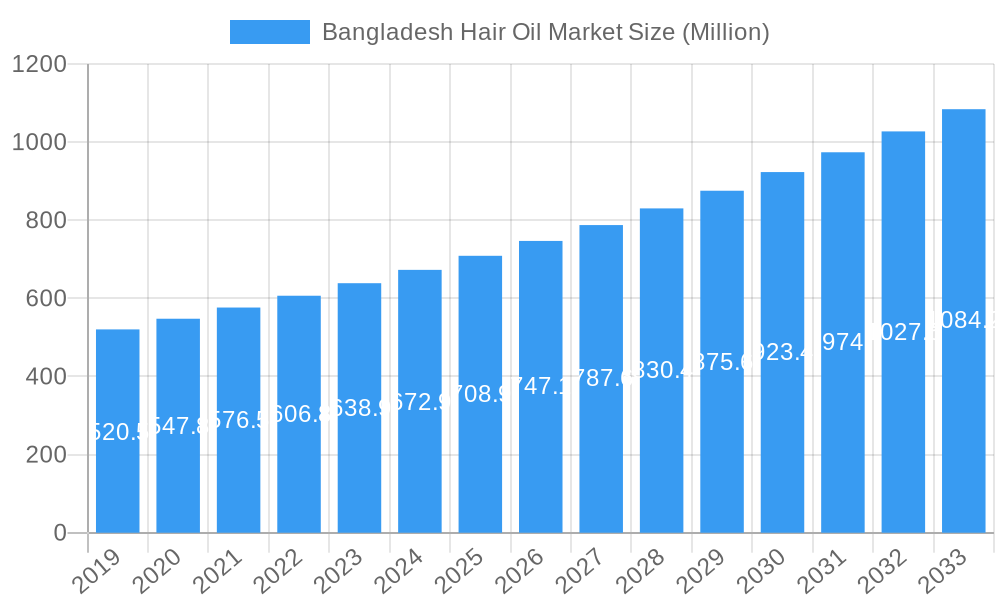

Bangladesh Hair Oil Market Company Market Share

This report offers a comprehensive analysis of the Bangladesh hair oil market from 2019 to 2033, with a base year of 2024. It covers market size, CAGR, growth drivers, segmentation, key players, and emerging opportunities. Product types analyzed include Almond Oil, Coconut Oil, and Olive Oil. Distribution channels examined are Hypermarket/Supermarket, Convenience Store, and Online Retail Stores. This report is essential for stakeholders navigating the dynamic Bangladeshi hair care market.

Bangladesh Hair Oil Market Market Concentration & Dynamics

The Bangladesh hair oil market exhibits a moderately concentrated landscape, with a few dominant players holding significant market share. Leading companies such as Dabur India Ltd, Square Toiletries Ltd, Emami Limited, and Unilever PLC are at the forefront, continually innovating to capture consumer attention and increase their footprint. The innovation ecosystem is robust, driven by the demand for specialized hair care solutions, including herbal hair oils, anti-hair fall oils, and fragrant hair oils. Regulatory frameworks, while evolving, generally support market growth by ensuring product safety and quality standards. Substitute products, primarily hair serums and conditioners, present a competitive challenge, but the cultural significance and efficacy of traditional hair oils ensure their sustained demand. End-user trends lean towards natural ingredients, long-term hair health, and enhanced fragrance. Mergers and acquisitions (M&A) are infrequent but can significantly reshape market dynamics, consolidating market share and introducing new technologies. For instance, the market has witnessed xx M&A deal counts in the historical period (2019-2024), indicating a strategic consolidation approach by larger entities.

- Market Share Distribution: Leading players command an estimated combined market share of xx%, highlighting a degree of concentration.

- Innovation Focus: Key innovations revolve around natural ingredients, advanced formulations for specific hair concerns, and premium fragrance offerings.

- Regulatory Landscape: Compliance with local health and safety regulations is paramount for market entry and sustained operations.

- Substitute Product Impact: The market share of substitute products is estimated at xx%, posing a moderate competitive threat.

- M&A Activity: While infrequent, strategic acquisitions by major players can lead to significant shifts in market control.

Bangladesh Hair Oil Market Industry Insights & Trends

The Bangladesh hair oil market is experiencing robust growth, driven by several pivotal factors. The estimated market size for the base year 2025 stands at USD xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This impressive expansion is fueled by an increasing disposable income among the Bangladeshi population, leading to greater consumer spending on personal care products. The rising awareness about hair health and the desire for natural remedies are further propelling the demand for specialized hair oils. Technological disruptions are manifesting in the form of enhanced product formulations, incorporating advanced ingredients and therapeutic properties to address specific hair concerns like hair fall, dandruff, and premature graying. The shift towards premiumization in personal care also plays a significant role, with consumers willing to invest in higher-quality hair oils offering superior benefits and sensory experiences. Evolving consumer behaviors are marked by a preference for natural and herbal ingredients, driven by a growing understanding of their benefits and a desire to move away from chemical-laden products. The online retail channel is witnessing significant growth, offering convenience and wider product accessibility, which further contributes to market expansion. The emphasis on traditional remedies, combined with modern scientific advancements, creates a fertile ground for innovative product development in the Bangladesh hair oil sector. The market is also influenced by the growing influence of social media and beauty influencers, who are shaping consumer preferences and product adoption rates. Furthermore, the increasing urbanization and the subsequent exposure to diverse beauty trends contribute to the demand for a wider variety of hair oil formulations catering to different hair types and styling needs.

Key Markets & Segments Leading Bangladesh Hair Oil Market

The Bangladesh hair oil market is experiencing dominance across specific product types and distribution channels, underscoring key consumer preferences and market dynamics. Coconut Oil stands out as the most dominant product type, owing to its long-standing tradition in Bangladeshi households for hair nourishment and conditioning. Its affordability and perceived effectiveness in promoting hair growth and strength make it a staple in many consumers' routines. Almond Oil is also gaining significant traction, driven by its recognized benefits for hair conditioning, shine, and reducing breakage. While Olive Oil holds a smaller but growing market share, its appeal lies in its moisturizing properties and its association with premium hair care.

The Hypermarket/Supermarket segment leads in terms of distribution channels, offering consumers a wide array of brands and product choices under one roof. This channel benefits from high foot traffic and strategic product placement, facilitating impulse purchases. Online Retail Stores are rapidly emerging as a powerful force, driven by the convenience they offer, especially in urban areas, and the ability to compare prices and read reviews before making a purchase. This channel is crucial for reaching a younger, tech-savvy demographic and for showcasing niche or specialized hair oil products.

- Dominant Product Type:

- Coconut Oil: Its traditional use and affordability make it the largest segment.

- Almond Oil: Growing popularity due to perceived benefits for hair health and shine.

- Olive Oil: Increasing market share driven by its moisturizing properties and premium appeal.

- Dominant Distribution Channel:

- Hypermarket/Supermarket: Offers wide product selection and convenience for bulk purchases.

- Online Retail Stores: Rapidly growing due to convenience, price comparison, and accessibility.

- Drivers of Dominance:

- Economic Growth: Increased disposable income fuels demand for personal care products across all segments.

- Consumer Habits: Deep-rooted preference for traditional remedies like coconut oil in the hair care regimen.

- Digital Penetration: The rise of e-commerce is transforming how consumers access and purchase hair oils.

- Urbanization: Increased exposure to diverse beauty trends and product innovations in urban centers.

Bangladesh Hair Oil Market Product Developments

Product development in the Bangladesh hair oil market is characterized by a focus on enhancing natural formulations and addressing specific consumer needs. Companies are introducing herbal hair oils infused with traditional Ayurvedic ingredients like Amla, Bhringraj, and Shikakai, aimed at promoting hair growth and reducing hair fall. Innovations also include the development of specialized oils for different hair types, such as anti-dandruff oils, anti-graying oils, and oils designed to protect hair from heat styling. The incorporation of exotic fragrances and premium ingredients like argan oil and keratin is also a growing trend, catering to consumers seeking a more luxurious hair care experience. These advancements aim to provide competitive edges by offering superior efficacy and sensory appeal.

Challenges in the Bangladesh Hair Oil Market Market

The Bangladesh hair oil market faces several challenges that could impede its growth trajectory. Intense competition among both domestic and international players leads to price wars and pressure on profit margins. Regulatory hurdles, particularly regarding product approvals and ingredient sourcing, can sometimes slow down innovation and market entry for new products. Supply chain disruptions, exacerbated by logistical complexities and infrastructure limitations, can affect product availability and distribution efficiency. Furthermore, the fluctuating cost of raw materials, especially natural oils, can impact manufacturing costs and final product pricing.

- Intense Competition: A crowded marketplace leads to aggressive pricing strategies.

- Regulatory Compliance: Navigating evolving regulations can be time-consuming and costly.

- Supply Chain Inefficiencies: Logistical challenges can impact product delivery and availability.

- Raw Material Volatility: Fluctuations in the cost of natural ingredients affect profitability.

Forces Driving Bangladesh Hair Oil Market Growth

Several key forces are propelling the growth of the Bangladesh hair oil market. The increasing disposable income of the Bangladeshi population translates to higher consumer spending on premium and specialized personal care products. A growing awareness of hair health issues, such as hair fall and dandruff, is driving demand for targeted hair oil solutions. Technological advancements in product formulation allow for the creation of more effective and differentiated hair oils. Furthermore, the strong cultural tradition of using hair oils for nourishment and conditioning provides a stable foundation for market growth. The expanding reach of e-commerce platforms also democratizes access to a wider range of hair oil products across the country.

Challenges in the Bangladesh Hair Oil Market Market

Long-term growth catalysts in the Bangladesh hair oil market are deeply intertwined with ongoing innovation and strategic market expansion. Companies are increasingly focusing on research and development to create advanced formulations that cater to specific hair concerns, such as hair thinning, scalp health, and protection against environmental damage. Partnerships and collaborations between local and international brands can introduce novel technologies and expand market reach. The exploration of untapped rural markets and the development of affordable yet effective product lines will be crucial for sustained growth. Moreover, a continued emphasis on natural and organic ingredients is expected to resonate with a growing segment of health-conscious consumers.

Emerging Opportunities in Bangladesh Hair Oil Market

Emerging opportunities in the Bangladesh hair oil market lie in the growing demand for specialized and premium hair care products. The "natural and organic" trend presents a significant avenue for brands that can leverage ethically sourced ingredients and sustainable packaging. The burgeoning e-commerce sector offers a powerful platform for direct-to-consumer sales and for reaching a wider customer base, particularly in remote areas. Furthermore, the development of gender-specific hair oils, catering to the unique needs of men and women, represents an untapped market segment. The increasing adoption of digital marketing strategies and influencer collaborations can also effectively engage younger consumers and drive product awareness.

Leading Players in the Bangladesh Hair Oil Market Sector

- Dabur India Ltd

- Square Toiletries Ltd

- Lalbagh Chemical Company

- Emami Limited

- Unilever PLC

- Hemas Holdings PLC

- Marico Limited

- Kumarika

- Mousumi Industries

- Bajaj Consumer Care Limited

- Kohinoor Chemical Company

Key Milestones in Bangladesh Hair Oil Market Industry

- March 2022: Marico Bangladesh Limited launched its new Arabian perfumed hair oil, Nihar Lovely. The oil is infused with an Arabian perfume that keeps hair fragrant all day long. Nihar Lovely Hair Oil is non-sticky and is enriched with the nourishment of coconut oil and castor oil that controls hair fall and makes hair strong.

- September 2021: Dabur launched a new hair oil brand named Dabur Gold beliphool coconut hair oil. Dabur Gold beliphool coconut hair oil is the first hair oil in Bangladesh that contains coconut, almond, and beliphool, which strengthens the hair, and its vitamin E controls hair damage.

- July 2021: Marico Bangladesh launched a new hair oil brand, Red King men's cooling oil, in the Bangladeshi market. Red King Men's cooling oil comes in a unique bottle with a power tube and cooling crystals. It is enriched with the goodness of 18 ingredients, including natural herb extracts.

Strategic Outlook for Bangladesh Hair Oil Market Market

The strategic outlook for the Bangladesh hair oil market is exceptionally promising, driven by a confluence of factors poised to accelerate growth. The increasing consumer preference for natural and herbal ingredients presents a significant opportunity for brands that can effectively highlight the efficacy and safety of their formulations. Expansion into untapped rural markets, coupled with the development of affordable product lines, will be crucial for achieving widespread market penetration. Furthermore, the growing influence of digital platforms and e-commerce necessitates a strong online presence and targeted digital marketing strategies. Strategic partnerships and potential acquisitions among key players could further consolidate the market and foster innovation, leading to a more dynamic and competitive landscape in the coming years.

Bangladesh Hair Oil Market Segmentation

-

1. Product Type

- 1.1. Almond Oil

- 1.2. Coconut Oil

- 1.3. Olive Oil

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Convenience Store

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Bangladesh Hair Oil Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Hair Oil Market Regional Market Share

Geographic Coverage of Bangladesh Hair Oil Market

Bangladesh Hair Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Organic/Herbal Oils are Gaining Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Hair Oil Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Oil

- 5.1.2. Coconut Oil

- 5.1.3. Olive Oil

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Convenience Store

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dabur India Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Square Toiletries Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lalbagh Chemical Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emami Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unilever PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hemas Holdings PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marico Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kumarika

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mousumi Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bajaj Consumer Care Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kohinoor Chemical Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dabur India Ltd

List of Figures

- Figure 1: Bangladesh Hair Oil Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Bangladesh Hair Oil Market Share (%) by Company 2025

List of Tables

- Table 1: Bangladesh Hair Oil Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Bangladesh Hair Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Bangladesh Hair Oil Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Bangladesh Hair Oil Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Bangladesh Hair Oil Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Bangladesh Hair Oil Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Bangladesh Hair Oil Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Bangladesh Hair Oil Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: Bangladesh Hair Oil Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Bangladesh Hair Oil Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Bangladesh Hair Oil Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Bangladesh Hair Oil Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Hair Oil Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Bangladesh Hair Oil Market?

Key companies in the market include Dabur India Ltd, Square Toiletries Ltd*List Not Exhaustive, Lalbagh Chemical Company, Emami Limited, Unilever PLC, Hemas Holdings PLC, Marico Limited, Kumarika, Mousumi Industries, Bajaj Consumer Care Limited, Kohinoor Chemical Company.

3. What are the main segments of the Bangladesh Hair Oil Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 280 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Organic/Herbal Oils are Gaining Popularity.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2022: Marico Bangladesh Limited launched its new Arabian perfumed hair oil, Nihar Lovely. The oil is infused with an Arabian perfume that keeps hair fragrant all day long. Nihar Lovely Hair Oil is non-sticky and is enriched with the nourishment of coconut oil and castor oil that controls hair fall and makes hair strong.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Hair Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Hair Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Hair Oil Market?

To stay informed about further developments, trends, and reports in the Bangladesh Hair Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence