Key Insights

The Spain luxury brand market is projected to reach €4.8 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 3.62% from 2025 to 2033. This growth is propelled by a thriving tourism sector attracting affluent international visitors and an expanding domestic high-net-worth individual (HNWI) population. Demand is robust across luxury apparel, footwear, jewelry, watches, bags, and accessories. Furthermore, the increasing adoption of e-commerce and omnichannel strategies by luxury brands enhances accessibility and market reach.

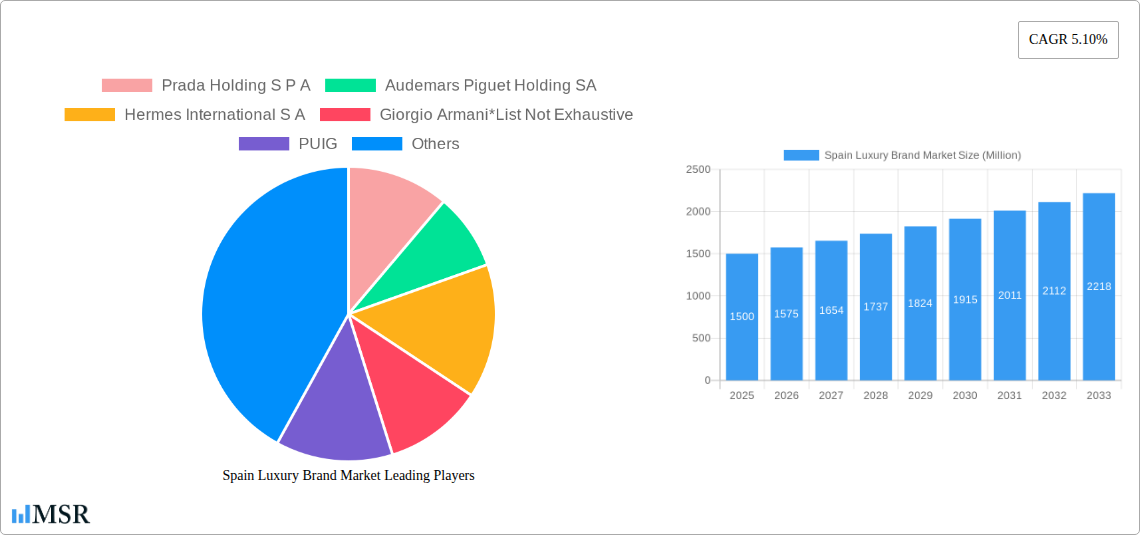

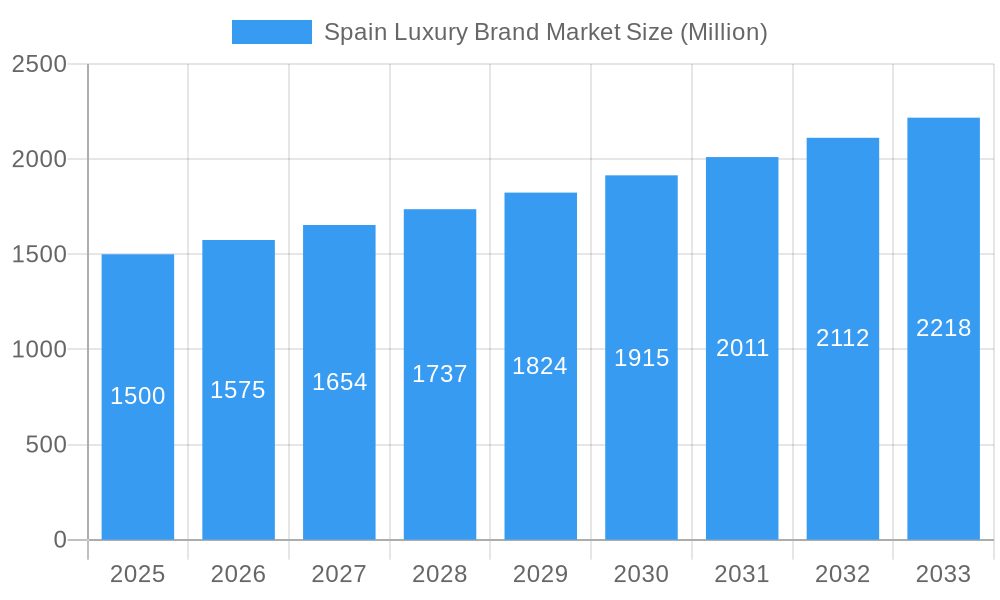

Spain Luxury Brand Market Market Size (In Billion)

Potential market restraints include economic volatility impacting discretionary spending and challenges from emerging brands and counterfeit products. The market, segmented across single-brand, multi-brand, and online channels, presents both opportunities and complexities. Leading brands must adapt to evolving consumer preferences, embrace digital channels, and maintain exclusivity to sustain success. The Spain luxury market is expected to remain a significant economic contributor.

Spain Luxury Brand Market Company Market Share

Spain Luxury Brand Market Report: 2019-2033

Uncover the lucrative landscape of Spain's luxury market with our comprehensive report, offering in-depth analysis and actionable insights for industry stakeholders. This report provides a detailed examination of the Spain Luxury Brand Market, covering the period 2019-2033, with a focus on 2025. We analyze market dynamics, key segments, leading players, and emerging opportunities, equipping you with the knowledge to navigate this high-growth sector.

Spain Luxury Brand Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the Spanish luxury brand market, encompassing market concentration, innovation, regulatory factors, and market trends impacting the sector. The study period is 2019-2024, with 2025 as the base and estimated year. The forecast period extends to 2033.

The market demonstrates a high level of concentration, with key players like LVMH Moët Hennessy Louis Vuitton, Kering Group, and others holding significant market shares (estimated xx%). This concentration is driven by strong brand recognition, established distribution networks, and substantial marketing budgets. However, emerging brands and innovative business models are challenging the established players. The Spanish luxury market is characterized by a dynamic innovation ecosystem, fueled by both domestic and international brands.

- Market Share: LVMH (xx%), Kering (xx%), others (xx%).

- M&A Activity: An average of xx M&A deals annually were recorded during the historical period (2019-2024). This trend is expected to continue, driven by consolidation and expansion strategies.

- Regulatory Framework: Spain's regulatory environment for luxury goods is relatively stable, although evolving regulations concerning sustainability and ethical sourcing could impact operations.

- Substitute Products: The primary substitute products are high-end mass-market brands, presenting a competitive threat. However, the unique value proposition of luxury brands (e.g., craftsmanship, exclusivity) largely mitigates this.

- End-User Trends: Growing consumer preference for experiences over material possessions, a heightened awareness of sustainability, and digitalization are shaping demand within the luxury market.

Spain Luxury Brand Market Industry Insights & Trends

The Spanish luxury brand market experienced significant growth during the historical period (2019-2024), with an estimated Compound Annual Growth Rate (CAGR) of xx% and a market size reaching approximately €xx Million in 2024. This growth is fueled by several factors, including a robust tourism sector, rising disposable incomes among affluent consumers, and increasing demand for luxury goods from both domestic and international buyers. Technological advancements such as personalization and omnichannel strategies are disrupting traditional business models, driving market expansion. Changing consumer preferences, emphasizing ethical and sustainable practices, are also shaping the future of the market. The forecast for the period 2025-2033 predicts continued growth at a CAGR of xx%, reaching an estimated market size of €xx Million by 2033.

Key Markets & Segments Leading Spain Luxury Brand Market

The Spanish luxury brand market is segmented by distribution channel (Single-brand Stores, Multi-brand Stores, Online Stores, Other Distribution Channels) and product type (Clothing and Apparel, Footwear, Jewellery, Watches, Bags, Other Luxury Goods).

By Distribution Channel: Single-brand stores currently dominate the market, owing to their ability to create a controlled brand experience. However, multi-brand stores and online channels are experiencing significant growth, driven by convenience and accessibility. The growth of online channels has been accelerated by the entry of major e-commerce platforms such as Amazon.

By Type: Watches and Jewellery segments are leading in terms of revenue, exhibiting higher average transaction values compared to clothing and apparel.

Drivers for Growth:

- Economic Growth: Spain's economic recovery and rising disposable incomes have fuelled increased luxury spending.

- Tourism: The influx of tourists, particularly from high-spending markets, fuels significant sales.

- Infrastructure: Well-developed infrastructure in major cities, particularly Madrid and Barcelona, supports high-end retail.

Spain Luxury Brand Market Product Developments

Product innovation is a key driver within the Spanish luxury brand market. Brands are focusing on sustainability, personalization, and technological integration. For instance, the introduction of new materials and manufacturing techniques, including 3D printing, are improving product quality and reducing production time. Furthermore, the use of augmented and virtual reality is enhancing customer experience and offering new ways to interact with luxury products. These innovations, coupled with a focus on unique and exclusive designs, provide brands with a crucial competitive advantage.

Challenges in the Spain Luxury Brand Market Market

The Spanish luxury brand market faces several challenges, including increased competition, supply chain disruptions, and the ongoing impact of economic uncertainty. These factors pose significant constraints on market growth, especially supply chain challenges contributing to increased production costs and affecting product availability. Furthermore, evolving consumer preferences, demanding greater sustainability and transparency, put pressure on brands to adapt to new market demands. The estimated impact of these challenges on market growth is a reduction in CAGR by approximately xx% in the forecast period.

Forces Driving Spain Luxury Brand Market Growth

Several key factors are driving the growth of the Spanish luxury brand market. These include:

- Technological Advancements: E-commerce platforms and digital marketing strategies enhance brand reach.

- Economic Growth: A growing economy increases disposable incomes and luxury spending.

- Tourism: The tourism sector contributes significantly to market revenue.

- Favorable Regulatory Environment: The existing regulatory framework supports the growth of the industry.

Challenges in the Spain Luxury Brand Market Market

Long-term growth is contingent on continued innovation, fostering strategic partnerships, and expansion into new markets. Brands must maintain creativity and adaptation to ever-evolving consumer preferences. Furthermore, developing strong digital channels and emphasizing sustainability will prove critical for future success.

Emerging Opportunities in Spain Luxury Brand Market

The Spanish luxury market presents several attractive opportunities. The expansion of e-commerce, the growing influence of social media, and the rising preference for personalized experiences are creating new growth avenues. Furthermore, the increasing focus on sustainability and ethical sourcing provides opportunities for brands that align with these values.

Leading Players in the Spain Luxury Brand Market Sector

Key Milestones in Spain Luxury Brand Market Industry

- June 2022: Amazon launches its luxury fashion vertical in Spain, expanding online luxury retail.

- July 2021: Carner Barcelona launches its hair perfume collection, diversifying luxury offerings.

- February 2021: Hoss Intropia relaunches, indicating renewed confidence in the Spanish fashion market.

Strategic Outlook for Spain Luxury Brand Market Market

The Spanish luxury brand market shows strong potential for continued growth. Brands should focus on digital transformation, sustainable practices, and personalized customer experiences. Strategic partnerships and expansion into new markets will be critical for achieving long-term success. The market's resilience and adaptability position it for enduring growth despite ongoing economic and geopolitical challenges.

Spain Luxury Brand Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Jewellery

- 1.4. Watches

- 1.5. Bags

- 1.6. Other Luxury Goods

-

2. Distribution Channel

- 2.1. Single-brand Store

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Spain Luxury Brand Market Segmentation By Geography

- 1. Spain

Spain Luxury Brand Market Regional Market Share

Geographic Coverage of Spain Luxury Brand Market

Spain Luxury Brand Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization

- 3.3. Market Restrains

- 3.3.1. High Operational Costs and Competitive Pricing of Memberships

- 3.4. Market Trends

- 3.4.1. Rise in Fashion and Cultural Tourism

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Luxury Brand Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Jewellery

- 5.1.4. Watches

- 5.1.5. Bags

- 5.1.6. Other Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-brand Store

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Prada Holding S P A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Audemars Piguet Holding SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hermes International S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Giorgio Armani*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PUIG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chanel SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rolex SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kering Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Patek Philippe

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LVMH Moët Hennessy Louis Vuitton

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Prada Holding S P A

List of Figures

- Figure 1: Spain Luxury Brand Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Luxury Brand Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Luxury Brand Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Spain Luxury Brand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Spain Luxury Brand Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain Luxury Brand Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Spain Luxury Brand Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Spain Luxury Brand Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Luxury Brand Market?

The projected CAGR is approximately 3.62%.

2. Which companies are prominent players in the Spain Luxury Brand Market?

Key companies in the market include Prada Holding S P A, Audemars Piguet Holding SA, Hermes International S A, Giorgio Armani*List Not Exhaustive, PUIG, Chanel SA, Rolex SA, Kering Group, Patek Philippe, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Spain Luxury Brand Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Prevalence of Obesity Among Consumers; Demand for Online and Hybrid Models with Customization and Personalization.

6. What are the notable trends driving market growth?

Rise in Fashion and Cultural Tourism.

7. Are there any restraints impacting market growth?

High Operational Costs and Competitive Pricing of Memberships.

8. Can you provide examples of recent developments in the market?

In June 2022, Amazon launches its luxury fashion vertical in Spain. The e-commerce platform will include luxury fashion and beauty labels such as Christopher Kane, Dundas, Mira Mikati, Rianna+Nina and Altuzarra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Luxury Brand Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Luxury Brand Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Luxury Brand Market?

To stay informed about further developments, trends, and reports in the Spain Luxury Brand Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence