Key Insights

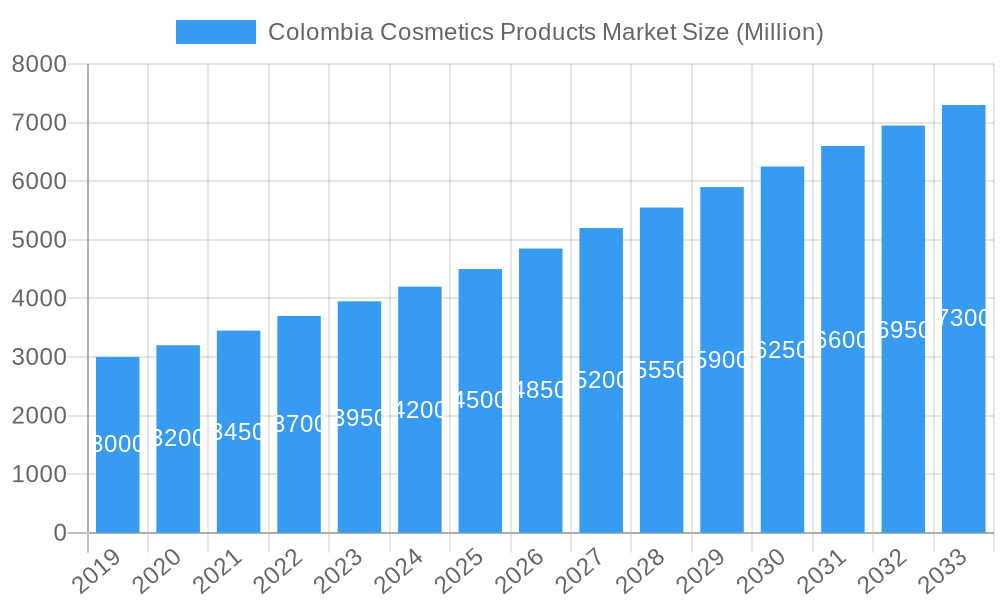

The Colombian cosmetics market is set for substantial growth, projected to reach $264.36 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.2% through 2033. This expansion is driven by rising disposable incomes, heightened consumer awareness of beauty and grooming trends, and a growing demand for premium and innovative cosmetic products. The market shows a strong preference for color cosmetics, particularly facial and eye makeup, influenced by social media and self-expression. Hair styling and coloring products are also in high demand as consumers invest more in their appearance. A growing middle class and a youthful demographic are key contributors, adopting global beauty standards and exploring a wider range of personal care solutions, offering significant opportunities for both international and local brands.

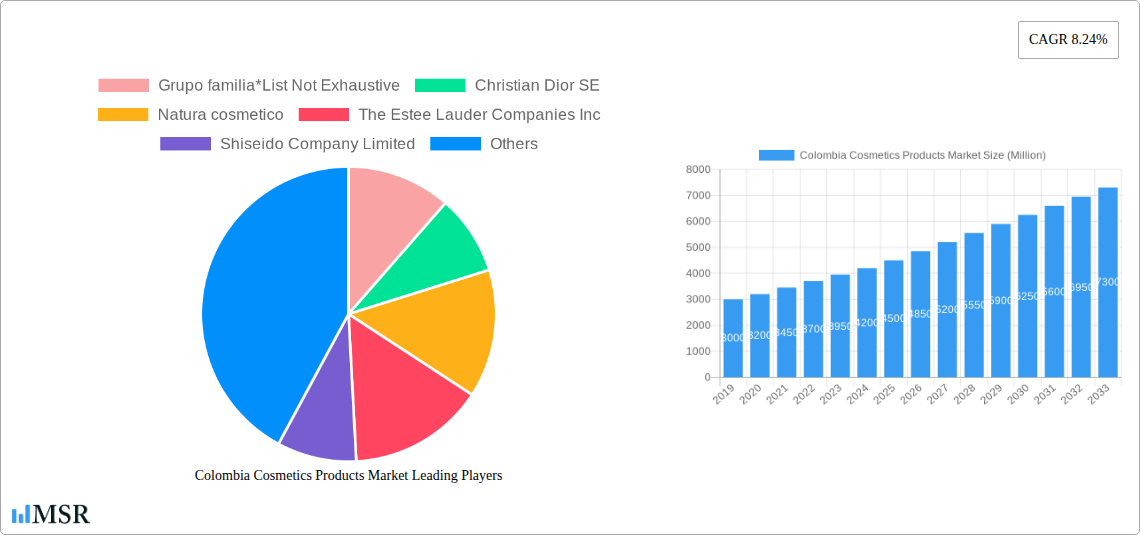

Colombia Cosmetics Products Market Market Size (In Million)

Distribution channels are evolving, with online platforms becoming dominant in reaching a broad consumer base across Colombia. While traditional channels like supermarkets and specialist stores remain relevant, the convenience and accessibility of e-commerce are reshaping purchasing habits, especially among younger consumers. Supermarkets and hypermarkets will likely maintain a significant share due to their wide reach for everyday beauty items. Specialist stores cater to discerning customers seeking high-end or specific product categories. Market growth is further bolstered by increased investments in marketing and product innovation from major players like L'Oreal S.A., Christian Dior SE, and The Estee Lauder Companies Inc., who are customizing their offerings for the Colombian market. Potential challenges include economic volatility and the informal market, though the overall outlook remains highly positive.

Colombia Cosmetics Products Market Company Market Share

Gain critical insights into the Colombian cosmetics market from 2019 to 2033. This report details market size, growth drivers, key segments, competitive dynamics, and emerging opportunities, with a base year of 2025. Essential for stakeholders aiming to capitalize on Colombia's expanding beauty sector.

Colombia Cosmetics Products Market Market Concentration & Dynamics

The Colombia cosmetics products market exhibits a moderate level of concentration, with a blend of global giants and strong local players vying for market share. Innovation ecosystems are flourishing, driven by increasing consumer demand for premium and natural ingredients, alongside advancements in R&D. Regulatory frameworks, overseen by bodies like INVIMA, are evolving to accommodate new product categories, including those with cannabis-based ingredients, while ensuring consumer safety and product quality. Substitute products, primarily from the burgeoning direct-selling and independent beauty creator segments, present a constant challenge to traditional retail channels. End-user trends are heavily influenced by social media influencers, a growing emphasis on sustainability, and a desire for personalized beauty solutions. Mergers and acquisitions (M&A) activities are becoming more strategic, as evidenced by the acquisition of leading natural cosmetics brand Loto del Sur by Puig Group, aiming to expand global reach and product portfolios. Key M&A deal counts are projected to increase as companies seek to consolidate their positions and acquire innovative brands.

Colombia Cosmetics Products Market Industry Insights & Trends

The Colombia cosmetics products market is poised for significant growth, projected to reach an estimated market size of $3,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period of 2025–2033. This robust expansion is fueled by a confluence of factors, including a growing middle class with increased disposable income, a youthful demographic that is highly receptive to beauty trends, and a cultural appreciation for personal grooming and aesthetic enhancement. The rising popularity of e-commerce has revolutionized distribution channels, providing consumers with unprecedented access to a wide array of cosmetic products from both domestic and international brands. Technological disruptions, such as the integration of AI and AR for virtual try-on experiences by companies like Belcorp, are enhancing customer engagement and personalizing the shopping journey, thereby driving sales. Furthermore, a heightened consumer awareness regarding the benefits of natural and organic ingredients is propelling the demand for "clean beauty" products, creating lucrative opportunities for brands focusing on sustainable sourcing and ethical production. The increasing adoption of digital marketing strategies, coupled with the influence of social media influencers, plays a pivotal role in shaping consumer preferences and driving product discovery. The market is also witnessing a trend towards premiumization, with consumers willing to invest in high-quality, efficacy-driven cosmetic solutions.

Key Markets & Segments Leading Colombia Cosmetics Products Market

The Color Cosmetics segment is a dominant force within the Colombia cosmetics products market, driven by strong consumer interest in personal expression and adherence to global beauty trends. Within this segment, Facial Make-Up Products are expected to lead, encompassing foundations, concealers, powders, and blush, fueled by the desire for flawless skin and the influence of contouring and highlighting techniques popularized online. Lip and Nail Make-up Products also represent significant sub-segments, with a consistent demand for vibrant colors and innovative formulations.

The Hair Styling and Coloring Products segment is another critical contributor, with Hair Colors experiencing steady growth as consumers experiment with different looks and embrace bolder shades. Hair Styling Products are also vital, catering to the diverse styling needs and preferences of the Colombian population.

In terms of distribution channels, Online Stores are rapidly emerging as the leading channel, facilitated by increasing internet penetration, widespread smartphone usage, and the convenience of doorstep delivery. This channel offers a vast selection of products and competitive pricing, attracting a significant portion of the digitally-savvy consumer base. Specialist Stores, including dedicated beauty boutiques and brand-owned outlets, also hold considerable sway, offering curated product assortments and expert advice. Supermarket/Hypermarkets continue to be important for mass-market accessibility, while Convenience Stores offer impulse purchases. The growth in online channels, however, is reshaping the landscape for traditional brick-and-mortar retailers.

Colombia Cosmetics Products Market Product Developments

Product innovation in the Colombian cosmetics market is characterized by a strong focus on natural ingredients, advanced formulations, and enhanced consumer experiences. Brands are increasingly leveraging local biodiversity to develop unique, efficacious products that appeal to consumers seeking sustainable and ethically sourced beauty solutions. Technological advancements are evident in the integration of AI and AR for virtual try-on applications, offering personalized recommendations and improving online purchasing decisions. Furthermore, the development of specialized product lines, such as those incorporating cannabis-derived ingredients for their therapeutic and cosmetic benefits, signifies a forward-thinking approach to market diversification and consumer needs.

Challenges in the Colombia Cosmetics Products Market Market

The Colombia cosmetics products market faces several challenges that can impact growth trajectories. Navigating complex and evolving regulatory frameworks, particularly for new ingredient categories like cannabis-based cosmetics, can be time-consuming and costly. Supply chain disruptions, exacerbated by logistical complexities and import/export considerations, can affect product availability and pricing. Intense competition from both established international brands and a growing number of local and independent players necessitates continuous innovation and aggressive marketing strategies. Furthermore, counterfeit products pose a significant threat to brand reputation and consumer trust, requiring robust anti-counterfeiting measures.

Forces Driving Colombia Cosmetics Products Market Growth

Several powerful forces are driving the growth of the Colombia cosmetics products market. An expanding middle class with increased disposable income is fueling demand for a wider range of beauty products. The youthful demographic of Colombia, coupled with a growing social media influence, creates a receptive market for new trends and product launches. Technological advancements in product formulation, packaging, and digital marketing enhance consumer engagement and accessibility. Furthermore, a growing consumer preference for natural, organic, and sustainable beauty products is opening up new market opportunities and driving innovation in ingredient sourcing and product development. Favorable government initiatives supporting local industries and a generally positive economic outlook also contribute to market expansion.

Challenges in the Colombia Cosmetics Products Market Market

Long-term growth catalysts for the Colombia cosmetics products market lie in sustained innovation and strategic market penetration. Continuous investment in research and development to create novel formulations, address specific consumer concerns, and embrace emerging beauty technologies will be crucial. Strategic partnerships and collaborations, both domestically and internationally, can unlock new distribution channels and expand market reach. Furthermore, expanding into untapped geographical regions within Colombia and exploring export opportunities in neighboring Latin American countries will foster sustained growth. A deeper integration of digital technologies, beyond e-commerce, such as personalized customer relationship management and data analytics, will also be vital for future success.

Emerging Opportunities in Colombia Cosmetics Products Market

Emerging opportunities in the Colombia cosmetics products market are abundant, particularly within the realm of sustainable and ethical beauty. The increasing consumer demand for eco-friendly packaging, cruelty-free products, and ethically sourced ingredients presents a significant avenue for growth. The burgeoning interest in personalized beauty, driven by advancements in AI and data analytics, offers scope for customized product recommendations and bespoke formulations. Furthermore, the decriminalization and regulation of cannabis in some forms create a unique opportunity for cannabis-infused cosmetic products, tapping into both the wellness and beauty markets. Expansion into niche markets, such as men's grooming and specialized skincare for specific environmental conditions, also represents untapped potential.

Leading Players in the Colombia Cosmetics Products Market Sector

- Grupo familia

- Christian Dior SE

- Natura cosmetico

- The Estee Lauder Companies Inc

- Shiseido Company Limited

- Avon Products Inc

- L'Oreal S A

- Oriflame Cosmetics Global SA

- Belcorp

Key Milestones in Colombia Cosmetics Products Market Industry

- July 2022: Barcelona-based Puig Group acquired Loto del Sur, Colombia's leading natural cosmetics brand, which offers a range of natural products made from Latin American flora. With this acquisition, the brand will enter the Spanish market with the launch of a new store in Madrid, signaling strategic expansion and consolidation.

- September 2021: Belcorp integrated Perfect Corp.'s artificial intelligence (AI) and augmented reality (AR) powered virtual try-on technology to provide every customer with a personalized online shopping experience. This integration enhances customer engagement and digital sales through innovative personalized shopping.

- April 2021: Ikänik Farms, Inc. announced that its wholly-owned Colombian subsidiary Pideka SAS completed the registration and commercialization process of six cannabis-based cosmetic products through the National Institute of Drug and Food Surveillance (INVIMA), the governing body in Colombia responsible for new product registrations, marking a significant step in the commercialization of cannabis-cosmetic products.

Strategic Outlook for Colombia Cosmetics Products Market Market

The strategic outlook for the Colombia cosmetics products market is one of continued robust growth and diversification. The market is expected to capitalize on the increasing consumer demand for personalized, sustainable, and technologically advanced beauty solutions. Key growth accelerators will include the further expansion of e-commerce platforms, the development of innovative product formulations utilizing local and natural ingredients, and the strategic integration of digital technologies like AI and AR to enhance customer experiences. Companies that focus on building strong brand loyalty through ethical practices, transparent sourcing, and engaging marketing campaigns will be well-positioned for long-term success. Exploring niche markets and potential export opportunities within Latin America will also be crucial for sustained market expansion.

Colombia Cosmetics Products Market Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-Up Products

- 1.1.2. Eye Make-Up Products

- 1.1.3. Lip and Nail Make-up Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair Colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Stores

- 2.5. Other Distribution Channels

Colombia Cosmetics Products Market Segmentation By Geography

- 1. Colombia

Colombia Cosmetics Products Market Regional Market Share

Geographic Coverage of Colombia Cosmetics Products Market

Colombia Cosmetics Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation is Boosting the Market Growth; Increasing Innovation and Upgradation in Merchandizing Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Sports Merchandise Products

- 3.4. Market Trends

- 3.4.1. Escalating Demand for Natural and Sustainable Cosmetic products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Colombia Cosmetics Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-Up Products

- 5.1.1.2. Eye Make-Up Products

- 5.1.1.3. Lip and Nail Make-up Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair Colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Colombia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grupo familia*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Christian Dior SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Natura cosmetico

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shiseido Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Avon Products Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'Oreal S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oriflame Cosmetics Global SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Belcorp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Grupo familia*List Not Exhaustive

List of Figures

- Figure 1: Colombia Cosmetics Products Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Colombia Cosmetics Products Market Share (%) by Company 2025

List of Tables

- Table 1: Colombia Cosmetics Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Colombia Cosmetics Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Colombia Cosmetics Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Colombia Cosmetics Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Colombia Cosmetics Products Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Colombia Cosmetics Products Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Colombia Cosmetics Products Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Colombia Cosmetics Products Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Colombia Cosmetics Products Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Colombia Cosmetics Products Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Colombia Cosmetics Products Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Colombia Cosmetics Products Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Colombia Cosmetics Products Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Colombia Cosmetics Products Market?

Key companies in the market include Grupo familia*List Not Exhaustive, Christian Dior SE, Natura cosmetico, The Estee Lauder Companies Inc, Shiseido Company Limited, Avon Products Inc, L'Oreal S A, Oriflame Cosmetics Global SA, Belcorp.

3. What are the main segments of the Colombia Cosmetics Products Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 264.36 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation is Boosting the Market Growth; Increasing Innovation and Upgradation in Merchandizing Products.

6. What are the notable trends driving market growth?

Escalating Demand for Natural and Sustainable Cosmetic products.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Sports Merchandise Products.

8. Can you provide examples of recent developments in the market?

July 2022: Barcelona-based Puig Group acquired Loto del Sur, Columbia's leading natural cosmetics brand, which offers a range of natural products made from Latin American flora. With this acquisition, the brand will enter the Spanish market with the launch of a new store in Madrid.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Colombia Cosmetics Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Colombia Cosmetics Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Colombia Cosmetics Products Market?

To stay informed about further developments, trends, and reports in the Colombia Cosmetics Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence