Key Insights

The Europe E-commerce Apparel Market is projected for substantial growth, with an estimated market size of 375.98 billion in 2024 and a Compound Annual Growth Rate (CAGR) of 4.07% through 2033. This expansion is fueled by increasing internet and smartphone penetration, coupled with a strong consumer preference for the convenience and extensive selection offered by online platforms. Key growth drivers include evolving fashion trends, the integration of social media for fashion discovery, and innovative online retail experiences such as personalization and virtual try-on solutions. Rising disposable incomes among the European middle class are also significantly contributing to increased apparel spending.

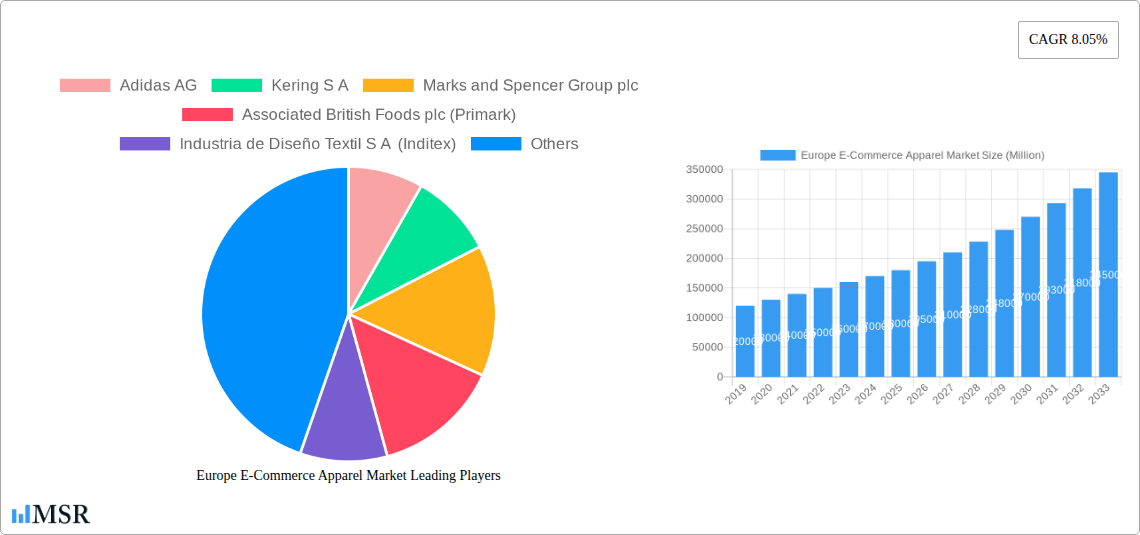

Europe E-Commerce Apparel Market Market Size (In Billion)

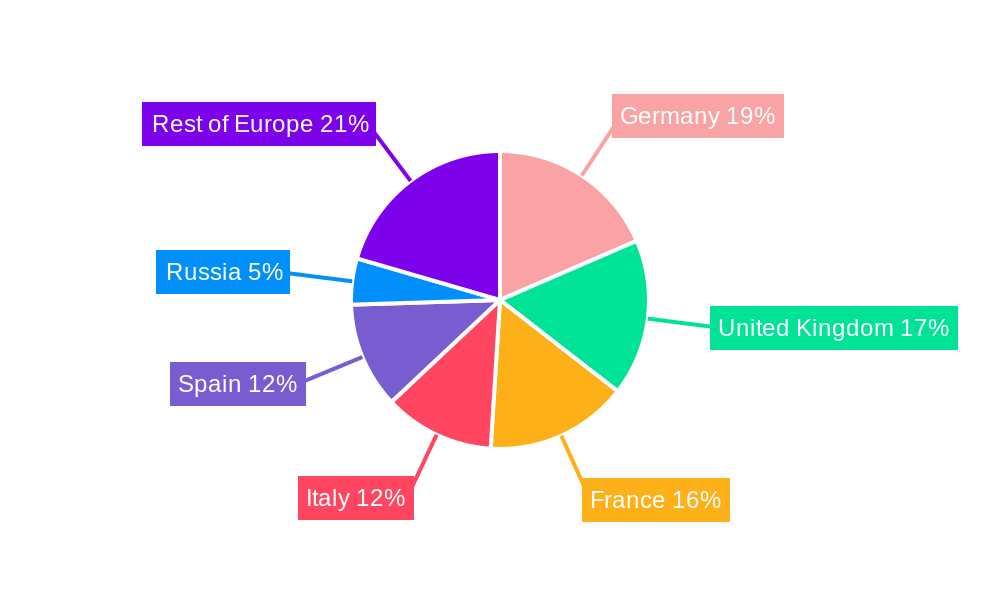

The market is segmented by product type, with formal wear, casual wear, and sportswear demonstrating the highest demand. The end-user demographic spans men, women, and children, underscoring the broad appeal of online apparel shopping. Domination by third-party retailers and direct-to-consumer websites highlights a multi-channel approach to market engagement. Emerging trends such as sustainable and ethically sourced apparel, amplified by e-commerce accessibility, and the influence of online-adapted fast fashion models are gaining traction. While supply chain disruptions, cybersecurity risks, and intense competition pose challenges, technological advancements and strategic collaborations are mitigating these factors. Leading players like Inditex, H&M, and LVMH are strategically enhancing their online presence, shaping a dynamic competitive environment. Western European nations, including Germany, the UK, France, Italy, and Spain, are anticipated to lead market growth due to their robust digital infrastructure and mature e-commerce ecosystems.

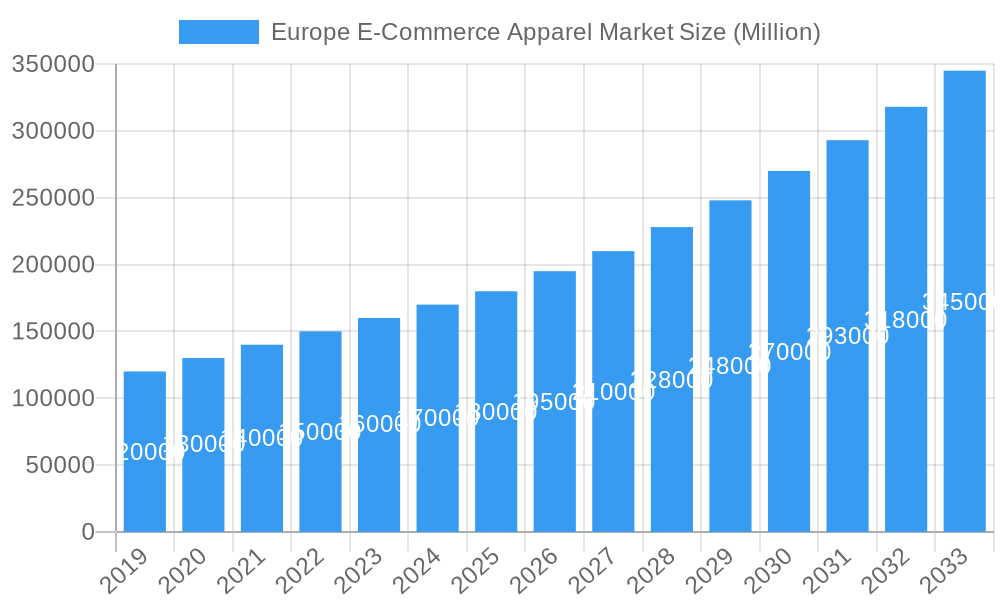

Europe E-Commerce Apparel Market Company Market Share

Gain comprehensive insights into the Europe E-commerce Apparel Market. This report details market evolution from 2019-2024 to its projected trajectory through 2033. With a base year of 2024, it offers an essential guide to the online fashion retail landscape in Europe, identifying key growth drivers, emerging opportunities, and competitive strategies.

This report is designed for apparel brands, fashion retailers, e-commerce platforms, investors, market research firms, and industry consultants seeking to understand and leverage the growth in digital apparel sales across Europe. Acquire actionable intelligence on online fashion trends, consumer purchasing behavior, and market segmentation to inform strategic decision-making.

Base Year: 2024 | Forecast Period: 2025–2033

Europe E-Commerce Apparel Market Market Concentration & Dynamics

The Europe E-Commerce Apparel Market exhibits a moderate to high level of concentration, with a mix of established global players and agile regional brands vying for market share. Innovation is a key differentiator, with companies continuously investing in AI-powered personalization, augmented reality try-on features, and sustainable fashion solutions to enhance the online shopping experience. Regulatory frameworks are evolving, with increasing emphasis on data privacy (GDPR) and environmental compliance, influencing e-commerce strategies. Substitute products, such as fast fashion alternatives and the growing popularity of resale platforms, present both challenges and opportunities. End-user trends are shifting towards convenience, customization, and conscious consumption, driving demand for personalized recommendations and eco-friendly apparel. Mergers & Acquisitions (M&A) activities are expected to intensify as larger players seek to acquire innovative technologies or expand their geographical reach. Estimated M&A deal counts for the forecast period are projected to be in the range of 15-25, indicating strategic consolidation and growth. Key market share indicators will be detailed within the report, showcasing the dominance of leading players in specific segments.

Europe E-Commerce Apparel Market Industry Insights & Trends

The Europe E-Commerce Apparel Market is poised for significant expansion, driven by the widespread adoption of digital technologies and evolving consumer lifestyles. The market size is projected to reach approximately €150 Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). This robust growth is fueled by several key factors. Technological disruptions, including the proliferation of mobile commerce (m-commerce), the integration of social media shopping features, and the advancement of data analytics for personalized marketing, are fundamentally reshaping how consumers discover and purchase clothing online. Evolving consumer behaviors are characterized by a growing preference for convenience, value for money, and a seamless online experience. Consumers are increasingly seeking sustainable and ethically produced apparel, leading to a surge in demand for eco-friendly brands and transparent supply chains. The rise of influencer marketing and user-generated content also plays a crucial role in shaping purchasing decisions and driving brand awareness within the online fashion market. Furthermore, the increasing penetration of high-speed internet and smartphones across all demographics, coupled with the convenience of home delivery and flexible return policies, are further accelerating the shift from brick-and-mortar to online apparel shopping across Europe. The increasing digitalization of retail operations allows businesses to reach a wider customer base and offer a more personalized shopping journey, contributing to overall market growth.

Key Markets & Segments Leading Europe E-Commerce Apparel Market

The Europe E-Commerce Apparel Market is characterized by strong performance across various key markets and segments.

Dominant Regions:

- Western Europe: Continues to lead, driven by higher disposable incomes, advanced digital infrastructure, and established e-commerce ecosystems. Countries like the United Kingdom, Germany, France, and Italy are major contributors to the market's growth.

- Nordic Countries: Exhibit high per capita online spending and a strong inclination towards sustainable fashion, making them lucrative markets for niche and eco-conscious brands.

Leading Segments by Product Type:

- Casual Wear: Dominates the market due to its broad appeal, comfort, and versatility for everyday use. The demand for athleisure wear and streetwear continues to surge.

- Sportswear: Experiencing significant growth, propelled by increasing health consciousness, the rise of fitness culture, and advancements in performance-enhancing apparel.

Dominant Segments by End User:

- Women: Represent the largest consumer segment, influenced by fashion trends, social media, and a wider product variety available online.

- Men: A rapidly growing segment, with increasing engagement in online fashion purchases driven by convenience and access to diverse brands.

- Kids/Children: The online channel is increasingly preferred by parents for its convenience and ability to compare prices and styles easily.

Leading Segments by Platform Type:

- Company's Own Website: Offers greater control over brand experience, customer data, and direct customer relationships, leading to higher customer loyalty and profitability. Many brands are investing heavily in enhancing their DTC (Direct-to-Consumer) online presence.

- Third-Party Retailers: Platforms like Zalando, ASOS, and Amazon continue to be significant players, offering a wide selection and convenience for consumers. Their extensive logistics networks and marketing capabilities drive substantial sales.

Drivers of Dominance:

- Economic Growth and Disposable Income: Higher purchasing power in key European economies directly translates to increased spending on apparel, both online and offline.

- Digital Infrastructure and Internet Penetration: Widespread access to high-speed internet and a high smartphone penetration rate are fundamental enablers of e-commerce growth.

- Logistics and Delivery Networks: Efficient and reliable last-mile delivery services are crucial for customer satisfaction and repeat purchases in the e-commerce apparel sector.

- Consumer Trust and Online Security: Growing consumer confidence in online payment systems and data security further boosts e-commerce adoption.

- Marketing and Social Media Influence: Effective digital marketing campaigns and the impact of social media influencers significantly shape consumer purchasing decisions.

Europe E-Commerce Apparel Market Product Developments

Product innovation in the Europe E-Commerce Apparel Market is increasingly focused on integrating technology and sustainability. Companies are developing smart textiles with enhanced functionality and investing in 3D design and virtual prototyping to reduce waste and accelerate development cycles. The demand for circular fashion models, including rental services and recycled materials, is driving product diversification. Personalized apparel based on individual measurements and style preferences is gaining traction, leveraging data analytics and AI. These developments aim to enhance the online shopping experience, reduce environmental impact, and create a stronger competitive edge in the rapidly evolving digital fashion landscape.

Challenges in the Europe E-Commerce Apparel Market Market

Navigating the Europe E-Commerce Apparel Market presents several challenges. Intense competition from both established global brands and emerging direct-to-consumer (DTC) players puts pressure on pricing and margins. Supply chain complexities and disruptions, exacerbated by geopolitical events and logistical hurdles, can impact product availability and delivery times. Increasing customer expectations for faster delivery and hassle-free returns require significant investment in logistics and customer service infrastructure. Regulatory compliance, including evolving data privacy laws and sustainability mandates, adds operational complexity and costs. Quantifiable impacts include potential revenue losses due to stockouts (estimated at XX% of lost sales annually) and increased operational costs for returns management (projected at XX% of revenue).

Forces Driving Europe E-Commerce Apparel Market Growth

Several key forces are propelling the growth of the Europe E-Commerce Apparel Market. The ongoing digital transformation across industries, with a strong emphasis on omnichannel retail strategies, allows for a seamless customer journey. Technological advancements, including AI-driven personalization, virtual try-ons, and improved search functionalities, are enhancing the online shopping experience. Economic factors, such as rising disposable incomes and increased consumer confidence, are boosting discretionary spending on fashion. Furthermore, evolving consumer preferences towards convenience, wider product selection, and the ability to research and compare products online are significant growth catalysts. The increasing adoption of sustainable fashion and ethical sourcing practices is also creating new market opportunities and driving consumer loyalty.

Challenges in the Europe E-Commerce Apparel Market Market

Long-term growth catalysts in the Europe E-Commerce Apparel Market are multifaceted. The continued innovation in personalization technologies will enable retailers to offer more tailored product recommendations and marketing messages, fostering customer loyalty. Strategic partnerships and collaborations, particularly between fashion brands and technology providers, will drive the development of new digital solutions and enhance operational efficiencies. Market expansions into underserved regions and the development of specific product lines catering to diverse cultural preferences will unlock new revenue streams. Furthermore, the increasing integration of augmented reality (AR) and virtual reality (VR) in the shopping experience holds immense potential to bridge the gap between online and offline retail, offering immersive and interactive product exploration.

Emerging Opportunities in Europe E-Commerce Apparel Market

Emerging opportunities in the Europe E-Commerce Apparel Market are ripe for exploration. The growing demand for sustainable and ethical fashion presents a significant opportunity for brands committed to eco-friendly practices and transparent supply chains. The expansion of resale and circular fashion platforms caters to a growing consumer segment seeking pre-loved items and contributing to a more sustainable fashion ecosystem. Hyper-personalization, driven by advanced data analytics and AI, will enable brands to offer highly tailored product recommendations and experiences. Furthermore, the increasing adoption of live shopping events and social commerce features offers new avenues for engaging consumers and driving impulse purchases. Exploring niche markets and catering to specific demographics with unique fashion needs also presents substantial growth potential.

Leading Players in the Europe E-Commerce Apparel Market Sector

- Adidas AG

- Kering S A

- Marks and Spencer Group plc

- Associated British Foods plc (Primark)

- Industria de Diseño Textil S A (Inditex)

- Punta Na Holding Sa (MANGO)

- Chanel Limited

- PVH Corp

- Ralph Lauren Corporation

- Hennes & Mauritz AB

- LVMH Moët Hennessy Louis Vuitton

- Fast Retailing Co Ltd

Key Milestones in Europe E-Commerce Apparel Market Industry

- February 2023: Marks & Spencers announced the launch of the sports edit platform on its website. The launch included over 200 sportswear and apparel products across women's activewear and apparel from third-party brands, including Beyond Yoga, FP Movement, Girlfriend Collective, and YMO. This move significantly broadened their online sportswear offering and leveraged third-party brands to cater to specific consumer needs.

- April 2022: Associated British Foods plc's retail brand Primark announced the launch of its brand new website, which allows customers to browse their favorite styles. The company claims that the service does not allow shoppers to buy clothes online; it only provides the ability to check the availability of products in its 191 stores across the country. This initiative enhanced customer experience by providing real-time product availability information, aiming to drive in-store traffic.

- March 2021: M&S announced the online launch of its 'Brands at M&S' during spring. The company claims that these new brands will be in addition to the curated offers that are already available on its website. This strategic expansion broadened M&S's online product assortment and catered to consumer demand for a wider variety of brands.

Strategic Outlook for Europe E-Commerce Apparel Market Market

The strategic outlook for the Europe E-Commerce Apparel Market is characterized by a continued focus on innovation, customercentricity, and sustainability. Growth accelerators will include the further integration of AI for personalized shopping experiences, the expansion of circular business models to meet growing consumer demand for eco-friendly options, and the optimization of omnichannel retail strategies to provide a seamless customer journey across online and offline touchpoints. Investments in advanced logistics and fulfillment solutions will be crucial to meet evolving delivery expectations. Furthermore, strategic partnerships with technology providers and influencer collaborations will remain vital for enhancing brand visibility and customer engagement in the competitive digital fashion landscape. Companies that can effectively leverage data analytics to understand consumer preferences and adapt their offerings will be best positioned for long-term success.

Europe E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

Europe E-Commerce Apparel Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Russia

- 7. Rest of Europe

Europe E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Europe E-Commerce Apparel Market

Europe E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion

- 3.3. Market Restrains

- 3.3.1. Limited Sensory Experience

- 3.4. Market Trends

- 3.4.1. Online Retailers Offering Seamless Shopping Experience

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Russia

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Formal Wear

- 10.1.2. Casual Wear

- 10.1.3. Sportswear

- 10.1.4. Nightwear

- 10.1.5. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Kids/Children

- 10.3. Market Analysis, Insights and Forecast - by Platform Type

- 10.3.1. Third Party Retailer

- 10.3.2. Company's Own Website

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Russia Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Formal Wear

- 11.1.2. Casual Wear

- 11.1.3. Sportswear

- 11.1.4. Nightwear

- 11.1.5. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Men

- 11.2.2. Women

- 11.2.3. Kids/Children

- 11.3. Market Analysis, Insights and Forecast - by Platform Type

- 11.3.1. Third Party Retailer

- 11.3.2. Company's Own Website

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Formal Wear

- 12.1.2. Casual Wear

- 12.1.3. Sportswear

- 12.1.4. Nightwear

- 12.1.5. Other Types

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Men

- 12.2.2. Women

- 12.2.3. Kids/Children

- 12.3. Market Analysis, Insights and Forecast - by Platform Type

- 12.3.1. Third Party Retailer

- 12.3.2. Company's Own Website

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Adidas AG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kering S A

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Marks and Spencer Group plc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Associated British Foods plc (Primark)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Industria de Diseño Textil S A (Inditex)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Punta Na Holding Sa (MANGO

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Chanel Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PVH Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ralph Lauren Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hennes & Mauritz AB

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LVMH Moët Hennessy Louis Vuitton

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Fast Retailing Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Adidas AG

List of Figures

- Figure 1: Europe E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Europe E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 8: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 11: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 12: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 16: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 19: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 20: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 27: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 28: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Europe E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Europe E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 31: Europe E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 32: Europe E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Commerce Apparel Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Europe E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Kering S A, Marks and Spencer Group plc, Associated British Foods plc (Primark), Industria de Diseño Textil S A (Inditex), Punta Na Holding Sa (MANGO, Chanel Limited, PVH Corp, Ralph Lauren Corporation, Hennes & Mauritz AB, LVMH Moët Hennessy Louis Vuitton, Fast Retailing Co Ltd.

3. What are the main segments of the Europe E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 375.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion.

6. What are the notable trends driving market growth?

Online Retailers Offering Seamless Shopping Experience.

7. Are there any restraints impacting market growth?

Limited Sensory Experience.

8. Can you provide examples of recent developments in the market?

February 2023: Marks & Spencers announced the launch of the sports edit platform on its website. The launch included over 200 sportswear and apparel products across women's activewear and apparel from third-party brands, including Beyond Yoga, FP Movement, Girlfriend Collective, and YMO.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Europe E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence