Key Insights

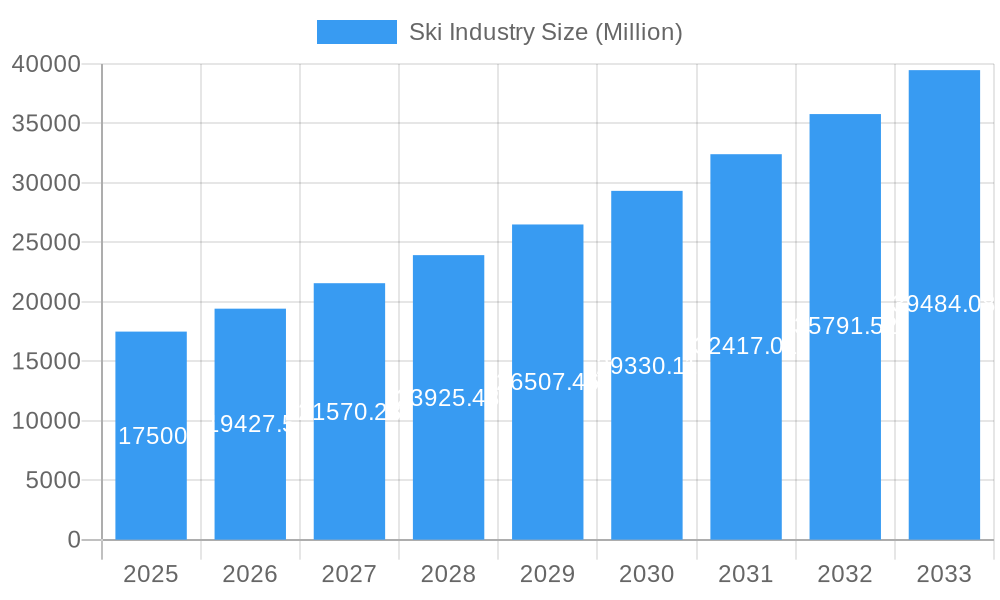

The global ski industry is poised for significant expansion, with a projected market size of $17.5 billion in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 10.9%. This impressive growth trajectory is underpinned by several key factors. Rising disposable incomes globally are empowering more individuals to invest in winter sports, a trend particularly evident in emerging economies. Furthermore, a growing emphasis on health and wellness, coupled with the inherent appeal of outdoor recreational activities, is drawing new participants to skiing. The industry also benefits from continuous innovation in ski equipment, including lighter, more durable materials and advanced boot fitting technologies, which enhance performance and comfort, thus encouraging increased adoption. The resurgence of interest in winter tourism, spurred by improved infrastructure at ski resorts and a desire for experiential travel, further fuels market demand.

Ski Industry Market Size (In Billion)

The ski market's expansion is not without its challenges, though. Climate change and the subsequent unpredictability of snow conditions in traditional ski regions present a significant restraint, prompting investment in artificial snowmaking and a diversification of offerings by resorts. However, the market is strategically addressing these issues through technological advancements and a focus on sustainability. The industry is segmented into core product categories: Skis and Poles, Ski Boots, and Ski Protective Gear and Accessories. Within distribution channels, both Offline Retail Stores and Online Retail Stores play crucial roles, with e-commerce platforms demonstrating particularly strong growth due to their convenience and wider reach. Key players like Amer Sports Oyj (including Atomic and Salomon), Vista Outdoor Inc., and Decathlon are actively shaping the market landscape through product development, strategic partnerships, and market expansion initiatives across major regions such as North America, Europe, and the Asia Pacific.

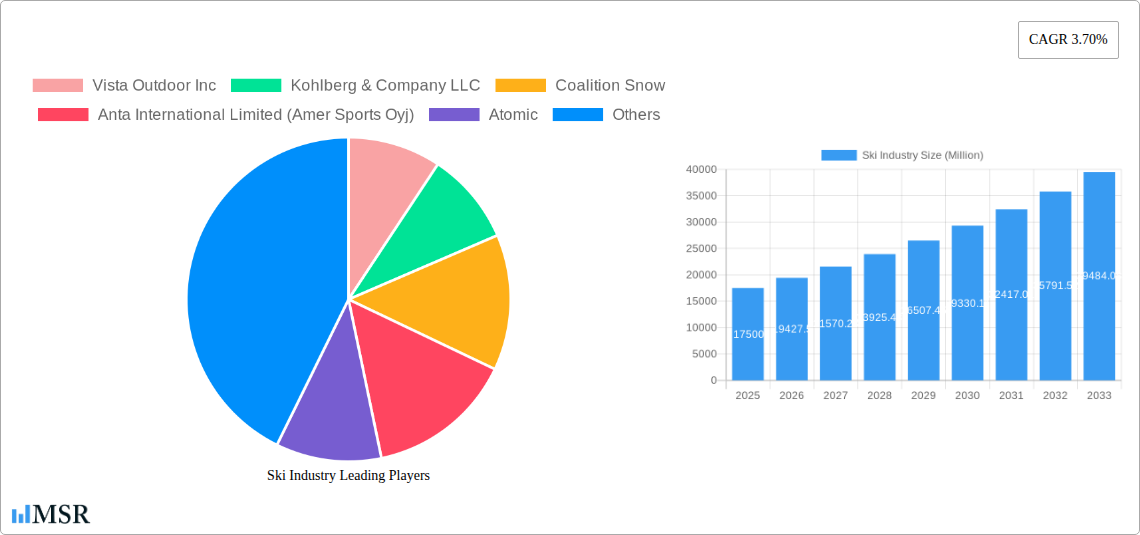

Ski Industry Company Market Share

Here is the SEO-optimized and engaging report description for the Ski Industry:

Report Title: Ski Industry Market Analysis: Global Opportunities, Trends, and Forecasts (2019–2033)

Report Description:

Uncover the colossal potential of the global ski industry with our comprehensive market analysis, spanning the historical period of 2019–2024 and forecasting through 2033. This in-depth report, with a base year of 2025, estimates the skiing market size to be valued at over $50 billion, projecting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Delve into the intricate dynamics of the global ski market, driven by increasing participation in winter sports, technological advancements in ski equipment, and evolving consumer preferences for premium ski gear. We meticulously analyze key segments including skis and poles, ski boots, and ski protective gear and accessories, alongside distribution channels like offline retail stores and online retail stores. This report is an essential resource for stakeholders seeking to capitalize on the booming winter sports market and understand the competitive landscape shaped by industry leaders.

Ski Industry Market Concentration & Dynamics

The ski industry market exhibits a moderate concentration, with several prominent players dominating key product categories and regional markets. While the global ski market is shaped by established multinational corporations, niche brands and emerging players contribute to a dynamic innovation ecosystem. The market's trajectory is influenced by evolving skiing trends, including the growing popularity of backcountry skiing and a surge in demand for sustainable and technologically advanced ski equipment. Regulatory frameworks primarily focus on safety standards and environmental impact, which can influence product development and market entry. The threat of substitute products, such as snowboarding and other winter recreational activities, is present but generally mitigated by the distinct appeal and technical requirements of skiing. Mergers and acquisitions (M&A) remain a significant driver of market concentration. For instance, the acquisition of Amer Sports Oyj by Anta International Limited has reshaped the competitive landscape, consolidating market share. The ski industry has witnessed numerous M&A deals, with an estimated count of XX significant transactions in the historical period, significantly impacting market dynamics and brand portfolios. End-user trends are increasingly leaning towards personalized experiences and performance-driven gear, fueling innovation and investment in research and development.

Ski Industry Industry Insights & Trends

The ski industry is experiencing a period of sustained growth, propelled by a confluence of economic, technological, and social factors. The estimated market size of the global ski market is projected to reach over $50 billion by 2025, with an anticipated CAGR of XX% from 2025 to 2033. This expansion is primarily driven by the increasing disposable income in developed and emerging economies, leading to higher participation rates in winter sports. Technological disruptions are revolutionizing ski equipment, with innovations in material science leading to lighter, stronger, and more responsive skis and boots. The integration of smart technology in ski gear, such as embedded sensors for performance tracking and customizable fit systems in ski boots, is a growing trend. Evolving consumer behaviors are also shaping the market. There's a discernible shift towards experience-driven purchases, with consumers seeking authentic and adventurous skiing experiences. This is further amplified by the growth of adventure tourism and the increasing popularity of specialized skiing disciplines like freeride and ski touring. The direct-to-consumer (DTC) model is gaining traction, as exemplified by Amer Sports' strategy to concentrate on this channel and expand its presence in developed markets like China and the United States. This trend is impacting traditional offline retail stores and bolstering the growth of online retail stores for ski equipment. Furthermore, a growing awareness of environmental sustainability is influencing purchasing decisions, with consumers showing a preference for eco-friendly materials and manufacturing processes in ski apparel and ski equipment. The influence of social media and influencer marketing is also playing a crucial role in driving skiing trends and product adoption. The overall industry is poised for robust growth, fueled by a combination of improved product offerings, expanding accessibility, and a persistent passion for winter sports.

Key Markets & Segments Leading Ski Industry

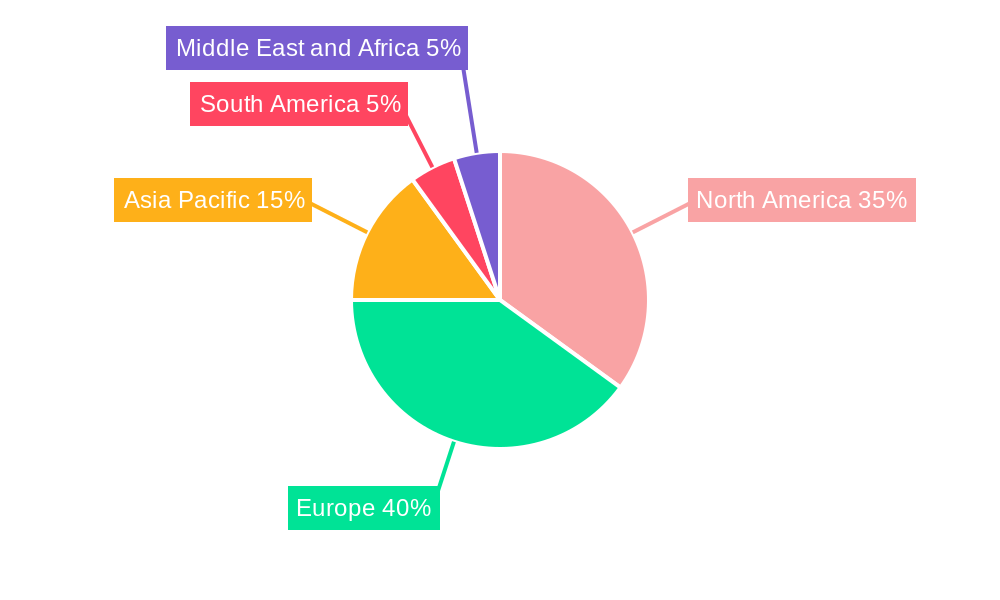

The ski industry is characterized by distinct regional strengths and segment dominance. North America and Europe remain the primary revenue generators for the global ski market, owing to well-established infrastructure, a strong skiing culture, and significant disposable income. Countries like the United States, Canada, France, Switzerland, and Austria consistently lead in terms of both market share and consumer spending on ski equipment.

- Dominant Region: North America & Europe

- Drivers: Mature ski resort infrastructure, high consumer spending power, established winter sports culture, government support for tourism and recreational activities.

- Detailed Dominance: These regions boast a high density of ski resorts, catering to a broad spectrum of skiers, from beginners to elite athletes. The strong brand loyalty and propensity for purchasing high-performance ski gear contribute significantly to market value. Economic stability and a focus on lifestyle expenditure further bolster the demand for premium skis and poles, ski boots, and ski protective gear and accessories.

In terms of product type, skis and poles and ski boots represent the largest segments, accounting for a substantial portion of the global ski market revenue.

- Dominant Product Type: Skis and Poles & Ski Boots

- Drivers: Essential components for skiing, constant innovation in materials and design, demand for specialized equipment for different disciplines (alpine, cross-country, backcountry).

- Detailed Dominance: The market for skis and poles is driven by continuous technological advancements, offering enhanced performance, reduced weight, and improved maneuverability. Similarly, ski boots are crucial for comfort and control, with innovations in fit customization, insulation, and responsiveness leading the segment's growth. Brands like Fischer, Atomic, and Rossignol are key players in these categories.

The distribution channel landscape is undergoing a significant transformation, with a dual dominance of offline retail stores and the rapidly growing online retail stores.

- Dominant Distribution Channel: Offline Retail Stores & Online Retail Stores

- Drivers: Traditional retail offers expert advice and try-on opportunities; online retail provides convenience, wider selection, and competitive pricing.

- Detailed Dominance: While offline retail stores continue to be vital for providing personalized customer service, product expertise, and the opportunity to physically assess ski equipment, online retail stores are witnessing exponential growth. The ease of browsing, comparing prices, and having products delivered directly to consumers is a major driver for online sales, especially for established brands and repeat buyers. This hybrid approach caters to diverse consumer preferences.

Ski Industry Product Developments

Product innovation in the ski industry is a continuous pursuit, driven by the quest for enhanced performance, comfort, and safety. Recent developments include advanced material composites in skis and poles for lighter weight and improved dampening, such as the use of carbon fiber and graphene. In ski boots, thermo-moldable liners and custom-fit technologies are becoming more prevalent, offering unparalleled comfort and precision. The integration of smart technology, like integrated sensors for performance analytics and adjustable flex systems, is emerging as a significant trend. Furthermore, there's a growing emphasis on sustainable materials and manufacturing processes in ski apparel and equipment, reflecting consumer demand for eco-friendly ski gear. These innovations not only provide a competitive edge for brands but also significantly enhance the skiing experience for enthusiasts.

Challenges in the Ski Industry Market

The ski industry faces several challenges that can restrain market growth. Regulatory hurdles, including stringent safety standards for ski equipment and environmental regulations for resort operations, can increase manufacturing and operational costs. Supply chain disruptions, as observed in recent years, can lead to material shortages and delayed product launches, impacting revenue. Competitive pressures from established players and the threat of alternative winter sports, like snowboarding, necessitate continuous innovation and marketing efforts. The global ski market also contends with the cyclical nature of weather patterns and the impact of climate change on snow reliability, which can deter investment and participation. Furthermore, the significant upfront cost of high-quality ski gear can be a barrier for new entrants into the sport, limiting market expansion to certain demographic segments. The estimated impact of these challenges on market growth is significant, potentially reducing the projected CAGR by XX%.

Forces Driving Ski Industry Growth

Several key forces are driving the substantial growth of the ski industry. Technological advancements are paramount, with ongoing innovations in material science and design leading to lighter, more durable, and higher-performing skis and poles, ski boots, and ski protective gear and accessories. Economic factors, including rising disposable incomes in emerging economies and a growing middle class globally, are increasing the affordability of winter sports holidays and ski equipment. The burgeoning adventure tourism sector, coupled with the increasing popularity of winter sports as a lifestyle choice, further fuels demand. Favorable government policies and investments in snow tourism infrastructure in various countries also contribute significantly. The ski industry is also benefiting from improved accessibility to resorts and a growing trend towards health and wellness, positioning skiing as a desirable recreational activity.

Challenges in the Ski Industry Market

Looking ahead, the ski industry is poised for long-term growth, catalyzed by strategic advancements and market expansions. Innovations in sustainable materials and manufacturing processes for ski gear will attract environmentally conscious consumers and create new market opportunities. Partnerships between ski resorts and technology providers can enhance the overall skiing experience through smart infrastructure and personalized services. Furthermore, the expansion into emerging markets, particularly in Asia, presents a significant growth avenue. The increasing focus on developing accessible and inclusive skiing programs will also broaden the sport's appeal, leading to sustained demand for ski equipment and accessories. Strategic investments in research and development for advanced ski technology will ensure that the industry remains at the forefront of performance and innovation.

Emerging Opportunities in Ski Industry

The ski industry is ripe with emerging opportunities. The burgeoning demand for electric and hybrid ski lifts and sustainable resort operations presents a significant avenue for growth in eco-friendly solutions. The rise of indoor ski resorts and artificial snow technologies is making skiing more accessible year-round and in non-traditional climates, opening up new markets. The integration of virtual reality (VR) and augmented reality (AR) for training and entertainment purposes in skiing offers novel engagement platforms. Furthermore, the increasing popularity of niche skiing disciplines, such as ski touring and telemarking, creates demand for specialized ski equipment and accessories. The growing influence of digital platforms for community building and direct-to-consumer sales presents opportunities for brands to connect directly with their customer base and foster brand loyalty in the winter sports market.

Leading Players in the Ski Industry Sector

- Vista Outdoor Inc

- Kohlberg & Company LLC

- Coalition Snow

- Anta International Limited (Amer Sports Oyj)

- Atomic

- Alpina DOO

- Black Diamond Equipment Ltd

- Skis Rossignol SA

- Amer Sports Oyj

- Decathlon

- Clarus Corporation

- Fischer Beteiligungsverwaltungs GmbH

Key Milestones in Ski Industry Industry

- May 2022: Amer Sports finalized a deal with Liesheng, divesting Suunto. This move signals Amer Sports' strategic focus on direct-to-consumer channels and expansion in developed markets like China and the United States, concentrating on globally renowned sporting goods brands in lifestyle, apparel, and footwear.

- November 2021: Fischer Sports announced a year of successful Alpine product lineups, winning accolades in both resort and backcountry ski and boot categories. Notable awards included SKI Magazine Best in Test for women's all-mountain (Ranger 94 FR WS) and deep powder snow (Ranger 115 FR), alongside other official selections.

- March 2021: NuORDER, a B2B e-commerce platform, partnered with Black Diamond Equipment. This collaboration means Black Diamond will conduct all its wholesale practices through NuORDER's digital platform, beginning with the FW21 buying season, streamlining wholesale operations.

Strategic Outlook for Ski Industry Market

The strategic outlook for the ski industry is exceptionally positive, driven by continuous innovation and expanding market reach. Future growth will be accelerated by the development of smart ski equipment that enhances performance and safety, and the increasing adoption of sustainable practices throughout the value chain. Strategic partnerships between ski gear manufacturers, resorts, and technology providers will create integrated experiences for consumers. The growing interest in adventure tourism and the lifestyle appeal of winter sports will continue to fuel demand for all categories of ski equipment, from high-performance skis to essential ski protective gear and accessories. The expanding consumer base in emerging economies, coupled with a strong DTC strategy, positions the global ski market for sustained and significant expansion over the forecast period.

Ski Industry Segmentation

-

1. Product Type

- 1.1. Skis and Poles

- 1.2. Ski Boots

- 1.3. Ski Protective Gear and Accessories

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Ski Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East

Ski Industry Regional Market Share

Geographic Coverage of Ski Industry

Ski Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Growing Number of Resorts Drives the Ski-Gear & Equipments Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ski Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Skis and Poles

- 5.1.2. Ski Boots

- 5.1.3. Ski Protective Gear and Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Ski Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Skis and Poles

- 6.1.2. Ski Boots

- 6.1.3. Ski Protective Gear and Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Ski Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Skis and Poles

- 7.1.2. Ski Boots

- 7.1.3. Ski Protective Gear and Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Ski Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Skis and Poles

- 8.1.2. Ski Boots

- 8.1.3. Ski Protective Gear and Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Ski Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Skis and Poles

- 9.1.2. Ski Boots

- 9.1.3. Ski Protective Gear and Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Ski Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Skis and Poles

- 10.1.2. Ski Boots

- 10.1.3. Ski Protective Gear and Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Vista Outdoor Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kohlberg & Company LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Coalition Snow

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anta International Limited (Amer Sports Oyj)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atomic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alpina DOO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Black Diamond Equipment Ltd *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Skis Rossignol SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Amer Sports Oyj

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Decathlon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Clarus Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fischer Beteiligungsverwaltungs GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Vista Outdoor Inc

List of Figures

- Figure 1: Global Ski Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Ski Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Ski Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Ski Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Ski Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Ski Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Ski Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Ski Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 9: Europe Ski Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Ski Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 11: Europe Ski Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Ski Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Ski Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Ski Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Ski Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Ski Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Ski Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Ski Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Ski Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Ski Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: South America Ski Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Ski Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: South America Ski Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Ski Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Ski Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Ski Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Ski Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Ski Industry Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Ski Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Ski Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Ski Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Ski Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Ski Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 12: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Ski Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Russia Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Italy Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Spain Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Ski Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: China Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: India Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Australia Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: South Korea Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 31: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 32: Global Ski Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Ski Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 37: Global Ski Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 38: Global Ski Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Ski Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ski Industry?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Ski Industry?

Key companies in the market include Vista Outdoor Inc, Kohlberg & Company LLC, Coalition Snow, Anta International Limited (Amer Sports Oyj), Atomic, Alpina DOO, Black Diamond Equipment Ltd *List Not Exhaustive, Skis Rossignol SA, Amer Sports Oyj, Decathlon, Clarus Corporation, Fischer Beteiligungsverwaltungs GmbH.

3. What are the main segments of the Ski Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Growing Number of Resorts Drives the Ski-Gear & Equipments Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

May 2022: A deal between Amer Sports and Liesheng, in which Amer Sports divests Suunto to Liesheng, was finalized. With a strong emphasis on direct-to-consumer channels and an expanded presence in developed markets like China and the United States, Amer Sports claims to concentrate on establishing globally renowned sporting goods brands within the lifestyle, apparel, and footwear segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ski Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ski Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ski Industry?

To stay informed about further developments, trends, and reports in the Ski Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence