Key Insights

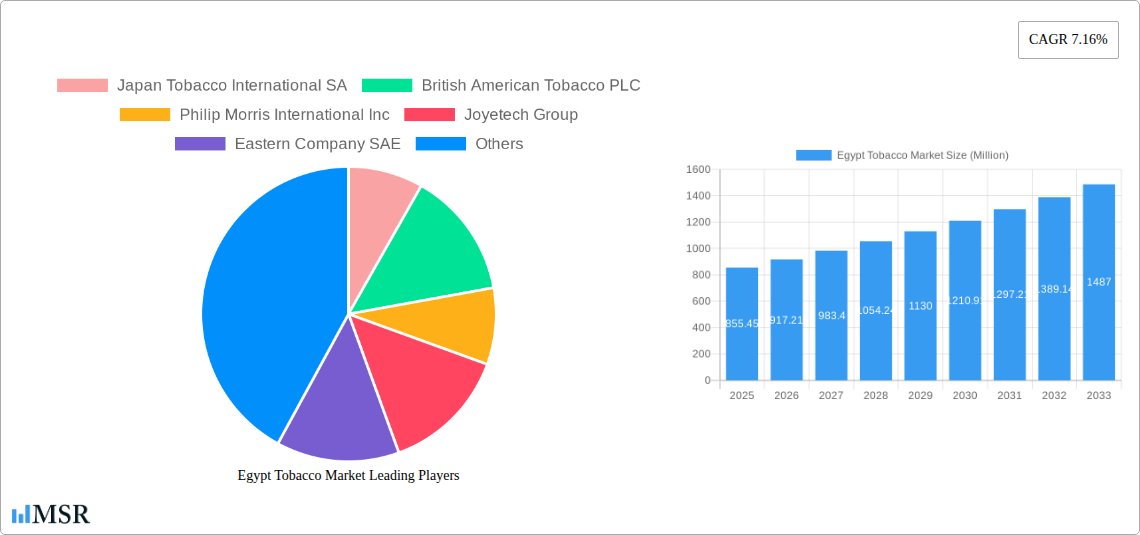

The Egypt Tobacco Market is projected for robust expansion, with an estimated market size of USD 855.45 million in 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 7.16%, indicating a dynamic and evolving landscape for tobacco products and alternatives. While traditional products like cigarettes, cigars, and cigarillos continue to hold a substantial share, the market is witnessing an increasing adoption of e-cigarettes and Heated Tobacco Products (HTPs). This shift is driven by evolving consumer preferences, with a growing segment seeking perceived reduced harm alternatives and innovative vaping experiences. The market's expansion is further fueled by strategic distribution through supermarkets, hypermarkets, and convenience stores, enhancing accessibility for a broad consumer base. Egypt's burgeoning population and a growing disposable income are also contributing factors to the sustained demand for tobacco and related products.

Egypt Tobacco Market Market Size (In Million)

Looking ahead, the market is poised for continued growth throughout the forecast period of 2025-2033. Key drivers include the introduction of new product innovations, particularly in the e-cigarette and HTP segments, aimed at capturing a larger market share. However, the market also faces certain restraints, most notably evolving regulatory landscapes and increasing public health awareness campaigns that advocate for reduced tobacco consumption. Despite these challenges, the inherent demand and the ongoing diversification of product offerings are expected to propel the Egypt Tobacco Market forward. The male demographic remains the primary consumer segment, but there's a noticeable upward trend in female adoption of newer, potentially less harmful alternatives, signaling a subtle but significant shift in consumer behavior. Strategic investments in marketing and product development by major players like Japan Tobacco International, British American Tobacco, and Philip Morris International will be crucial in navigating this competitive and dynamic environment.

Egypt Tobacco Market Company Market Share

Egypt Tobacco Market: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock strategic insights into the dynamic Egypt Tobacco Market, valued in the billions. This in-depth report provides critical analysis for industry stakeholders, covering market concentration, growth drivers, segment dominance, product innovations, challenges, and future opportunities. Essential for businesses navigating the evolving landscape of traditional and next-generation tobacco products in Egypt.

Egypt Tobacco Market Market Concentration & Dynamics

The Egypt Tobacco Market exhibits a moderate level of concentration, characterized by the presence of both established multinational corporations and a significant local player. Japan Tobacco International SA, British American Tobacco PLC, and Philip Morris International Inc. are key international entities vying for market share, alongside Eastern Company SAE, a dominant domestic force. The innovation ecosystem is increasingly influenced by the rise of E-cigarettes/HTP's, pushing companies to invest in research and development for novel product formats. Regulatory frameworks in Egypt are continuously evolving, impacting manufacturing, distribution, and taxation of tobacco products, creating both challenges and opportunities for market participants. The threat of substitute products remains a consideration, though traditional cigarettes continue to hold a substantial consumer base. End-user trends indicate a growing preference for convenience and a nascent but expanding interest in reduced-harm alternatives, particularly among younger demographics. Mergers and acquisitions (M&A) activity, while not currently at peak levels, is anticipated to rise as companies seek to consolidate market positions and expand their product portfolios within the projected growth phases. For instance, the strategic agreement between Philip Morris and the Egyptian government signals a shift towards direct manufacturing presence and deeper market integration.

Egypt Tobacco Market Industry Insights & Trends

The Egypt Tobacco Market is poised for significant growth, projected to reach a valuation in the billions by the end of the forecast period. This expansion is underpinned by a confluence of economic, demographic, and behavioral trends. Robust economic development within Egypt continues to fuel consumer spending power, directly translating into increased demand for tobacco products across various segments. Furthermore, a substantial young adult population entering the legal smoking age represents a consistent consumer base for established products. Technological disruptions are rapidly reshaping the industry, with the proliferation of Electronic Nicotine Delivery Systems (ENDS) and Heated Tobacco Products (HTPs) gaining considerable traction. These innovative alternatives are appealing to a segment of consumers seeking perceived reduced-harm options compared to traditional combustible cigarettes. Market research indicates a growing awareness and acceptance of these new product categories, driving investment and product development from leading companies. Evolving consumer behaviors are also a critical factor; while the established market for cigarettes, cigars, and cigarillos remains substantial, there's a discernible shift towards products offering greater convenience, premiumization, and, increasingly, the allure of novelty presented by e-cigarettes and HTPs. The market size is estimated to have reached approximately $X billion in the base year of 2025, with a projected Compound Annual Growth Rate (CAGR) of Y% between 2025 and 2033, reflecting sustained expansion driven by these multifaceted factors. The strategic focus of major players on securing manufacturing licenses and establishing local production capabilities further underscores the market's promising trajectory and the competitive intensity expected in the coming years.

Key Markets & Segments Leading Egypt Tobacco Market

The Egypt Tobacco Market's dominance is largely dictated by the enduring popularity of Cigarettes, which consistently represent the largest segment by volume and value. This segment's strength is fueled by deep-rooted consumer habits and widespread availability across diverse distribution channels. Economic growth in Egypt has empowered a broad consumer base, particularly the Male demographic, which historically exhibits higher smoking rates, to sustain demand for these traditional products. However, the Female segment, though smaller, presents a significant growth opportunity as societal norms evolve and marketing efforts diversify.

Product Type Dominance:

- Cigarettes: Remain the undisputed leader due to established consumer preferences, extensive distribution networks, and a mature market infrastructure.

- E-Cigarette/HTP's: Exhibit the highest growth potential, driven by innovation, consumer curiosity towards reduced-harm alternatives, and supportive regulatory considerations for new product categories.

End User Dynamics:

- Male: Constitute the majority of current consumers, driving demand for both traditional and emerging product categories.

- Female: Represent a growing segment with increasing adoption rates, particularly for e-cigarettes and HTPs, indicating a future shift in market demographics.

Distribution Channel Influence:

- Convenience/Small Grocery Stores: Pervasive and accessible, these outlets cater to impulse purchases and daily needs, ensuring widespread availability of tobacco products, especially cigarettes.

- Supermarket/Hypermarket: Offer a broader product selection and promotional opportunities, attracting a significant portion of consumers seeking variety and bundled deals.

- Specialty/Tobacco Stores: Cater to connoisseurs and niche product seekers, playing a crucial role in the premiumization of cigars and premium tobacco products, and increasingly, specialized e-cigarette accessories.

- Other Distribution Channels: This includes online sales and direct-to-consumer models, which are emerging, particularly for e-cigarettes and related accessories, offering convenience and specialized offerings.

The ongoing strategic investments by multinational corporations, such as Philip Morris International Inc. securing manufacturing licenses, further solidify the dominance of certain product types and the importance of adapting distribution strategies to capture evolving consumer behavior across all segments.

Egypt Tobacco Market Product Developments

Product innovation within the Egypt Tobacco Market is increasingly focused on the evolution of next-generation products. E-cigarettes and Heated Tobacco Products (HTPs) are at the forefront, with companies like Joyetech Group and Innokin Technology Co Ltd driving advancements in device technology, battery life, and flavor profiles. Philip Morris International Inc. and Japan Tobacco International SA are heavily investing in their HTP portfolios, aiming to capture market share from traditional cigarettes by offering perceived reduced-harm alternatives. Eastern Company SAE, while maintaining a strong presence in traditional tobacco, is also exploring avenues for diversification into these newer categories. This relentless pursuit of technological advancements and user-centric designs is crucial for maintaining competitive edges and appealing to evolving consumer preferences for convenience and potentially reduced health risks.

Challenges in the Egypt Tobacco Market Market

The Egypt Tobacco Market faces significant hurdles, primarily stemming from stringent and evolving regulatory frameworks. These include escalating excise taxes, restrictions on advertising and promotion, and ongoing debates surrounding public health policies. Supply chain disruptions, exacerbated by global economic volatility and import/export complexities, can impact raw material availability and finished product distribution. Furthermore, intense competitive pressures from both established players and emerging brands, particularly in the HTP and e-cigarette segments, demand constant innovation and strategic pricing. Quantifiable impacts include potential declines in cigarette volumes due to tax hikes and shifts in consumer spending towards less regulated or more affordable alternatives.

Forces Driving Egypt Tobacco Market Growth

Several key forces are propelling the Egypt Tobacco Market forward. Technological advancements are a primary driver, with the continuous innovation in e-cigarettes and Heated Tobacco Products (HTPs) attracting new consumer segments and driving product upgrades. Economic growth within Egypt plays a crucial role, increasing disposable incomes and consequently, consumer spending on tobacco products. Furthermore, evolving regulatory landscapes, while presenting challenges, also create opportunities for companies that can adapt and comply with new standards, particularly in the burgeoning HTP and e-cigarette sectors. The large and growing young adult population provides a sustained base of new consumers entering the market.

Challenges in the Egypt Tobacco Market Market

Long-term growth catalysts in the Egypt Tobacco Market are intrinsically linked to adaptation and diversification. The industry's ability to successfully transition consumers from traditional combustible cigarettes to reduced-harm alternatives is a critical long-term growth engine. This necessitates substantial investment in research, development, and marketing of HTPs and e-cigarettes. Strategic partnerships and distribution agreements, such as the one between Eastern Company and Al-Mansour International Distribution Company for Davidoff Evolve cigarettes, are crucial for expanding reach and product penetration. Furthermore, companies that can navigate the complex regulatory environment by investing in compliance and proactively engaging with policymakers will be better positioned for sustained expansion and market leadership.

Emerging Opportunities in Egypt Tobacco Market

Emerging opportunities within the Egypt Tobacco Market are diverse and promising. The burgeoning e-cigarette and HTP market presents a significant avenue for growth, driven by increasing consumer interest in alternative products and perceived health benefits. Expansion into premium segments for cigars and specialized tobacco products, catering to a discerning consumer base, offers higher profit margins. Furthermore, the digitalization of distribution channels, including e-commerce platforms, provides new avenues to reach a wider customer base, particularly younger demographics. Finally, exploring nicotine pouch categories, if regulatory frameworks allow, could tap into a rapidly growing global trend.

Leading Players in the Egypt Tobacco Market Sector

- Japan Tobacco International SA

- British American Tobacco PLC

- Philip Morris International Inc.

- Joyetech Group

- Eastern Company SAE

- Innokin Technology Co Ltd

- J Well France SARL

- Imperial Brands PLC

Key Milestones in Egypt Tobacco Market Industry

- September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

- June 2022: Philip Morris, as part of a deal with the Egyptian government, paid about USD 450 million to obtain a new license to manufacture traditional and electronic cigarettes in Egypt.

- December 2021: Eastern Company and Al-Mansour International Distribution Company signed a distribution agreement to manufacture Davidoff Evolve cigarettes. It is owned and distributed by Imperial Brands, which Al-Mansour has represented in Egypt for many years.

Strategic Outlook for Egypt Tobacco Market Market

The strategic outlook for the Egypt Tobacco Market is characterized by a dual focus on strengthening traditional product portfolios while aggressively pursuing growth in next-generation nicotine products. Companies that can successfully navigate the evolving regulatory landscape, invest in innovative HTP and e-cigarette technologies, and adapt their distribution strategies to encompass both traditional retail and digital channels will be best positioned for success. Strategic alliances and potential M&A activities will likely play a role in consolidating market share and expanding product offerings. The market's inherent growth potential, driven by a young population and increasing disposable incomes, coupled with the global shift towards reduced-harm alternatives, signals a dynamic and promising future for astute market participants.

Egypt Tobacco Market Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigar, Cigarillos, and Cigar Pipes

- 1.3. E-Cigarette/HTP's

-

2. End User

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience/Small Grocery Stores

- 3.3. Specialty/Tobacco Stores

- 3.4. Other Distribution Channels

Egypt Tobacco Market Segmentation By Geography

- 1. Egypt

Egypt Tobacco Market Regional Market Share

Geographic Coverage of Egypt Tobacco Market

Egypt Tobacco Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Cigarettes across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Tobacco Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigar, Cigarillos, and Cigar Pipes

- 5.1.3. E-Cigarette/HTP's

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience/Small Grocery Stores

- 5.3.3. Specialty/Tobacco Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Tobacco International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 British American Tobacco PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philip Morris International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Joyetech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eastern Company SAE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innokin Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 J Well France SARL*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imperial Brands PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Tobacco International SA

List of Figures

- Figure 1: Egypt Tobacco Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Tobacco Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Egypt Tobacco Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Egypt Tobacco Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Tobacco Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Egypt Tobacco Market?

Key companies in the market include Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Joyetech Group, Eastern Company SAE, Innokin Technology Co Ltd, J Well France SARL*List Not Exhaustive, Imperial Brands PLC.

3. What are the main segments of the Egypt Tobacco Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Rising Consumption of Cigarettes across the Country.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Tobacco Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Tobacco Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Tobacco Market?

To stay informed about further developments, trends, and reports in the Egypt Tobacco Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence