Key Insights

The Indian Herbal Shampoo market is projected for significant expansion, with an estimated market size of $474.11 million in the base year 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 9.57% through 2033. This growth is driven by increasing consumer awareness of natural ingredient benefits and a rising demand for chemical-free personal care. Growing concern over synthetic chemicals in conventional shampoos, combined with a cultural preference for traditional herbal remedies, are key factors. Rising disposable incomes and a growing middle class in urban and semi-urban areas are also contributing to the adoption of premium herbal formulations, aligning with the deep-rooted "Ayurveda" and "natural" trends in India.

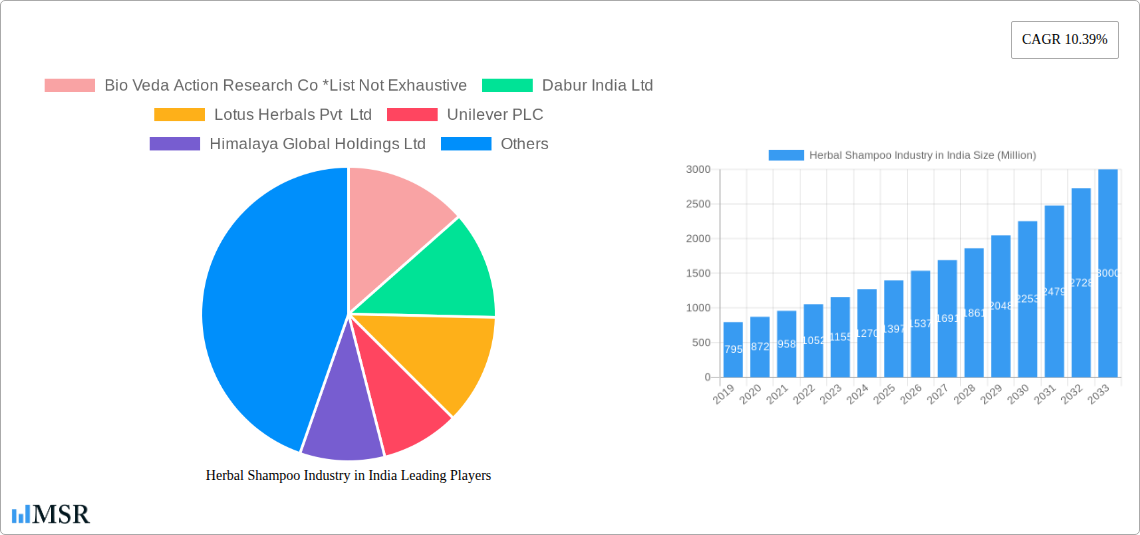

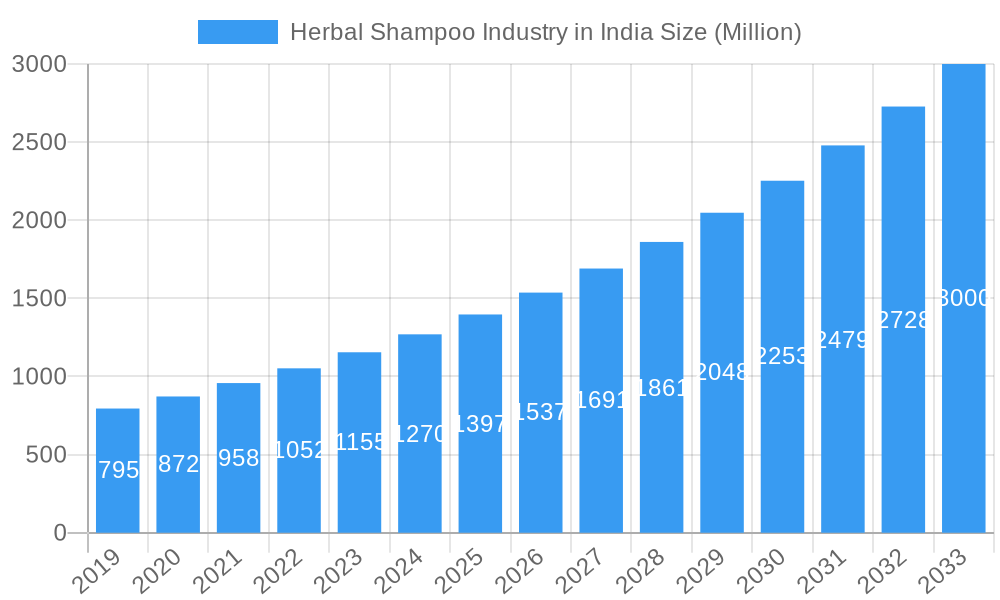

Herbal Shampoo Industry in India Market Size (In Million)

The competitive landscape features established FMCG companies and agile homegrown brands. Distribution is led by supermarkets and hypermarkets, with online retail showing rapid growth due to convenience and product accessibility. Specialty stores serve niche markets. While growth is strong, potential challenges include the premium pricing of some herbal shampoos and the need for ongoing product innovation. Nevertheless, the overarching shift towards holistic wellness and sustainable consumption is expected to fuel market growth, attracting both domestic and international investment.

Herbal Shampoo Industry in India Company Market Share

India's Thriving Herbal Shampoo Market: A Comprehensive Industry Report

This in-depth report provides an indispensable analysis of the Herbal Shampoo Industry in India, offering critical insights for stakeholders seeking to capitalize on this rapidly expanding sector. Covering the Study Period 2019–2033, with Base Year 2025 and a Forecast Period 2025–2033, this report delves into market dynamics, growth drivers, product innovations, and challenges within the Indian herbal shampoo market. Discover actionable strategies and understand the competitive landscape driven by consumer demand for natural and organic hair care solutions.

Herbal Shampoo Industry in India Market Concentration & Dynamics

The Herbal Shampoo Industry in India exhibits a moderate to high market concentration, with a few dominant players holding significant market share, estimated at 60-70% for the top 5 companies. The innovation ecosystem is vibrant, fueled by extensive R&D in Ayurvedic shampoo formulations and natural hair care products. Regulatory frameworks, governed by bodies like the FSSAI, ensure product safety and quality, though compliance can be a barrier for smaller manufacturers. Substitute products, primarily conventional shampoos, still command a considerable market, but the shift towards organic herbal shampoos is a pronounced end-user trend. Mergers and acquisitions (M&A) activity is on the rise, with an estimated 15-20 M&A deals in the past five years, indicating consolidation and strategic expansion within the sector.

- Market Share Distribution: Top 5 players estimated to hold 60-70% of the market.

- Innovation Ecosystem: Focus on Ayurvedic ingredients, sustainable sourcing, and scientific validation of traditional remedies.

- Regulatory Environment: FSSAI compliance for product safety and labelling of natural shampoo India.

- Substitute Products: Conventional chemical-based shampoos remain a competitor, but market share is gradually eroding.

- End-User Trends: Increasing consumer preference for chemical-free shampoo, paraben-free shampoo, and sulfate-free shampoo.

- M&A Activity: Steady increase in strategic acquisitions and partnerships to enhance market reach and product portfolios.

Herbal Shampoo Industry in India Industry Insights & Trends

The Herbal Shampoo Industry in India is poised for substantial growth, driven by a confluence of factors including rising disposable incomes, increasing health and wellness consciousness, and a growing preference for natural and organic products over synthetic alternatives. The market size for herbal shampoos in India is projected to reach approximately INR 7,500 Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of around 12-15% during the forecast period. Technological disruptions are evident in advanced extraction techniques for botanical ingredients and the development of specialized herbal shampoo for hair fall, anti-dandruff herbal shampoo, and herbal shampoo for dry hair. Evolving consumer behaviors are marked by a greater demand for transparency in ingredient sourcing, eco-friendly packaging, and products aligned with an ethical consumption lifestyle. The quest for effective yet gentle hair care solutions continues to fuel innovation and market expansion.

Key Markets & Segments Leading Herbal Shampoo Industry in India

The Herbal Shampoo Industry in India is witnessing significant growth across various distribution channels, with Online Stores emerging as a dominant force, accounting for an estimated 35-40% of market sales. This surge is attributed to convenience, wider product availability, and attractive discounts offered by e-commerce platforms. Supermarkets/Hypermarkets follow closely, capturing approximately 30-35% of the market share due to their widespread reach and accessibility for everyday purchases. Specialty Stores, focusing on natural and organic products, are also gaining traction, holding around 15-20% of the market. The economic growth in Tier 1 and Tier 2 cities, coupled with increased internet penetration and digital literacy, underpins the dominance of online sales. Furthermore, a growing consumer awareness about the benefits of natural ingredients for hair care encourages patronage of specialized retail environments.

- Online Stores:

- Drivers: Convenience, wide selection, competitive pricing, ease of comparison, targeted marketing campaigns, last-mile delivery networks.

- Dominance Analysis: The ease of purchasing herbal shampoo online India for specific concerns like herbal shampoo for oily hair or herbal shampoo for colored hair has made it a preferred channel. The reach of platforms like Amazon and Flipkart extends to remote areas, democratizing access to a diverse range of Ayurvedic hair products.

- Supermarkets/Hypermarkets:

- Drivers: High foot traffic, impulse purchases, brand visibility, bundled offers, accessibility for mass consumer base.

- Dominance Analysis: These outlets cater to the daily needs of a large population, making herbal shampoos a common addition to grocery baskets. The presence of major brands alongside niche herbal options provides consumers with choices.

- Specialty Stores:

- Drivers: Curated product selections, knowledgeable staff, focus on niche and premium natural brands, ethical sourcing emphasis.

- Dominance Analysis: These stores attract a discerning consumer base actively seeking high-quality organic herbal shampoos and are willing to pay a premium for perceived purity and efficacy.

- Convenience Stores:

- Drivers: Localized availability, quick purchase decisions for immediate needs.

- Dominance Analysis: While smaller in overall market share, convenience stores play a role in ensuring natural shampoos are readily available in local neighborhoods.

- Other Distribution Channels:

- Drivers: Direct-to-consumer (D2C) websites, salon partnerships, pharmacies.

- Dominance Analysis: D2C brands are increasingly leveraging their own online platforms to build direct relationships with consumers, offering exclusive products and personalized experiences.

Herbal Shampoo Industry in India Product Developments

The Herbal Shampoo Industry in India is characterized by continuous product innovation aimed at addressing specific hair concerns and catering to evolving consumer demands. Companies are focusing on harnessing the power of traditional Indian botanicals like Amla, Reetha, Shikakai, Bhringraj, and Aloe Vera to create formulations that offer superior efficacy and are free from harsh chemicals. Recent developments include the launch of specialized anti-hair fall shampoos, herbal shampoos for dandruff, and natural hair growth shampoos. The emphasis on sustainable packaging and eco-friendly production processes is also a significant trend, enhancing the appeal of eco-friendly herbal shampoos. These advancements provide a competitive edge and drive consumer loyalty.

Challenges in the Herbal Shampoo Industry in India Market

The Herbal Shampoo Industry in India faces several challenges. Regulatory hurdles for product approvals and ingredient claims can be complex and time-consuming. Supply chain issues, particularly for sourcing authentic and high-quality natural ingredients consistently, can impact production volumes and costs. Intense competitive pressures from established players and new entrants, often employing aggressive pricing strategies, pose a significant barrier to market entry and growth for smaller businesses. Limited consumer awareness about the specific benefits of certain herbal ingredients can also hinder adoption.

- Regulatory Compliance: Navigating stringent approval processes for natural claims.

- Ingredient Sourcing: Ensuring consistent quality and availability of botanical extracts.

- Competitive Landscape: Price wars and market saturation by numerous brands.

- Consumer Education: Communicating the nuanced benefits of specific herbal ingredients.

Forces Driving Herbal Shampoo Industry in India Growth

Several key forces are propelling the Herbal Shampoo Industry in India. The growing consumer preference for natural and organic products, driven by increased awareness of health and wellness, is a primary catalyst. The rise of the Ayurvedic and natural personal care segment, supported by government initiatives promoting traditional medicine, is another significant driver. Economic growth, leading to higher disposable incomes, allows consumers to opt for premium, natural products. Furthermore, the increasing availability of herbal shampoos online and in retail stores makes them more accessible.

- Consumer Preference for Natural: Growing demand for chemical-free shampoos.

- Ayurvedic Revival: Government and consumer support for traditional Indian remedies.

- Economic Factors: Increased purchasing power leading to premium product adoption.

- Distribution Expansion: Wider availability through online and offline channels.

Challenges in the Herbal Shampoo Industry in India Market

Long-term growth in the Herbal Shampoo Industry in India will be influenced by continuous innovation in product formulations and the development of scientifically validated herbal hair care solutions. Strategic partnerships between traditional Ayurvedic manufacturers and modern R&D facilities can unlock new product categories and enhance efficacy. Market expansion into semi-urban and rural areas, coupled with effective consumer education campaigns, will be crucial. Moreover, adopting sustainable sourcing practices and eco-friendly packaging will resonate with the environmentally conscious consumer base, ensuring sustained growth and brand loyalty.

Emerging Opportunities in Herbal Shampoo Industry in India

Emerging opportunities in the Herbal Shampoo Industry in India are abundant. The burgeoning demand for personalized hair care solutions presents a niche market for customized herbal shampoo formulations. The increasing interest in vegan and cruelty-free products opens avenues for brands adhering to these ethical standards. Furthermore, the growing popularity of D2C herbal shampoo brands offers a direct channel to engage with consumers and build brand loyalty. Exploring untapped rural markets with affordable yet effective herbal options also presents significant growth potential. Technological advancements in ingredient extraction and encapsulation can lead to more potent and targeted natural hair treatment shampoos.

Leading Players in the Herbal Shampoo Industry in India Sector

- Bio Veda Action Research Co

- Dabur India Ltd

- Lotus Herbals Pvt Ltd

- Unilever PLC

- Himalaya Global Holdings Ltd

- Fit & Glow Healthcare Pvt Ltd

- Cavinkare Pvt Ltd

- The Procter & Gamble Company

- Khadi Natural

- Patanjali Ayurved Limited

Key Milestones in Herbal Shampoo Industry in India Industry

- June 2023: The Himalaya Wellness Company introduced two new shampoos, namely Dandruff Control Aloe Vera Shampoo and Hair Fall Control Bhringaraja Shampoo, in INR 2 sachet form. The company claims these shampoos are infused with natural ingredients carefully selected to provide effective hair care solutions. This new launch is a part of the brand's effort to reach a larger audience and increase its penetration in the market.

- May 2022: Medimix, the renowned AVA group's flagship brand, announced its new hair care product, Total Care Shampoo, enriched with natural ingredients and suitable for all hair types.

- February 2022: HonasaConsumer, the parent company of D2C unicorn Mama Earth, acquired BBLUNT, a premium hair care, hair color, and styling products brand from Godrej Consumer Products Limited. The brand's product portfolio includes hair colors, dry shampoos, conditioners, styling products, serums, and temporary hair colors.

Strategic Outlook for Herbal Shampoo Industry in India Market

The strategic outlook for the Herbal Shampoo Industry in India is highly optimistic, driven by sustained consumer demand for natural and effective hair care. Future growth will be accelerated by continued investment in R&D to develop innovative herbal shampoo for hair growth and natural anti-dandruff solutions. Companies that prioritize sustainability, ethical sourcing, and transparent ingredient labeling will gain a significant competitive advantage. Expanding distribution networks, particularly through robust e-commerce strategies and strategic offline partnerships, will be vital for market penetration. Focusing on niche segments like baby care and men's grooming with specialized herbal offerings presents untapped potential for market expansion and revenue growth.

Herbal Shampoo Industry in India Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience Stores

- 1.3. Specialty Stores

- 1.4. Online Stores

- 1.5. Other Distribution Channels

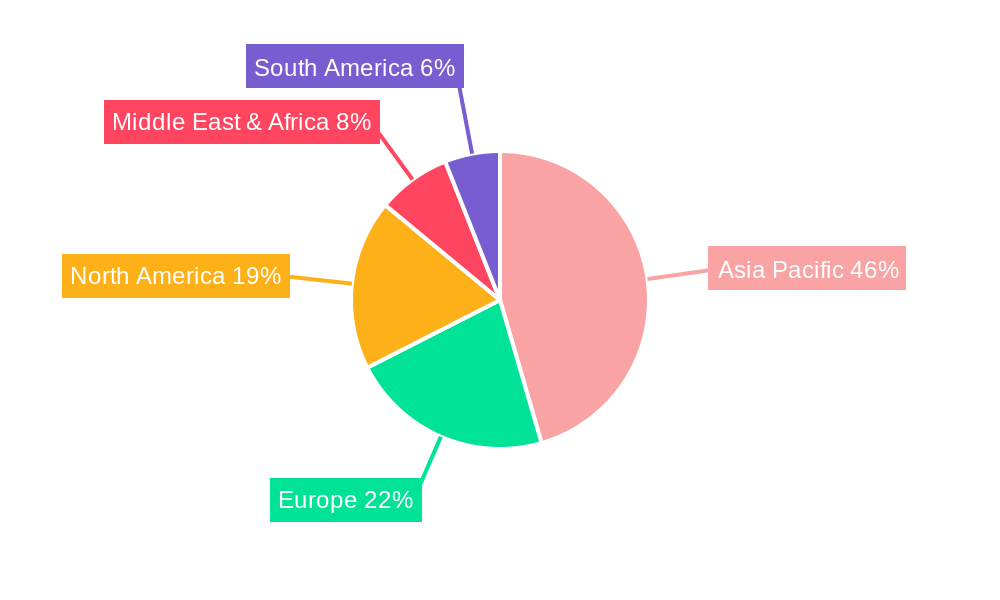

Herbal Shampoo Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Herbal Shampoo Industry in India Regional Market Share

Geographic Coverage of Herbal Shampoo Industry in India

Herbal Shampoo Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Personal Care Products with Natural Ingredients; Innovations in Product Development by Manufacturers

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products And Regulatory Loopholes

- 3.4. Market Trends

- 3.4.1. Inclination Towards Personal Care Products with Natural Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience Stores

- 5.1.3. Specialty Stores

- 5.1.4. Online Stores

- 5.1.5. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Supermarkets/Hypermarkets

- 6.1.2. Convenience Stores

- 6.1.3. Specialty Stores

- 6.1.4. Online Stores

- 6.1.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Supermarkets/Hypermarkets

- 7.1.2. Convenience Stores

- 7.1.3. Specialty Stores

- 7.1.4. Online Stores

- 7.1.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Supermarkets/Hypermarkets

- 8.1.2. Convenience Stores

- 8.1.3. Specialty Stores

- 8.1.4. Online Stores

- 8.1.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Supermarkets/Hypermarkets

- 9.1.2. Convenience Stores

- 9.1.3. Specialty Stores

- 9.1.4. Online Stores

- 9.1.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific Herbal Shampoo Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Supermarkets/Hypermarkets

- 10.1.2. Convenience Stores

- 10.1.3. Specialty Stores

- 10.1.4. Online Stores

- 10.1.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bio Veda Action Research Co *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dabur India Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lotus Herbals Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilever PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Himalaya Global Holdings Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fit & Glow Healthcare Pvt Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cavinkare Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Procter & Gamble Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Khadi Natural

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Patanjali Ayurved Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bio Veda Action Research Co *List Not Exhaustive

List of Figures

- Figure 1: Global Herbal Shampoo Industry in India Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 3: North America Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 4: North America Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 5: North America Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 7: South America Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: South America Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 9: South America Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 13: Europe Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 15: Middle East & Africa Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Middle East & Africa Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Herbal Shampoo Industry in India Revenue (million), by Distribution Channel 2025 & 2033

- Figure 19: Asia Pacific Herbal Shampoo Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Asia Pacific Herbal Shampoo Industry in India Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific Herbal Shampoo Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 2: Global Herbal Shampoo Industry in India Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Herbal Shampoo Industry in India Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Herbal Shampoo Industry in India Revenue million Forecast, by Country 2020 & 2033

- Table 34: China Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Herbal Shampoo Industry in India Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Herbal Shampoo Industry in India?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Herbal Shampoo Industry in India?

Key companies in the market include Bio Veda Action Research Co *List Not Exhaustive, Dabur India Ltd, Lotus Herbals Pvt Ltd, Unilever PLC, Himalaya Global Holdings Ltd, Fit & Glow Healthcare Pvt Ltd, Cavinkare Pvt Ltd, The Procter & Gamble Company, Khadi Natural, Patanjali Ayurved Limited.

3. What are the main segments of the Herbal Shampoo Industry in India?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 474.11 million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Personal Care Products with Natural Ingredients; Innovations in Product Development by Manufacturers.

6. What are the notable trends driving market growth?

Inclination Towards Personal Care Products with Natural Ingredients.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products And Regulatory Loopholes.

8. Can you provide examples of recent developments in the market?

June 2023: The Himalaya Wellness Company introduced two new shampoos, namely Dandruff Control Aloe Vera Shampoo and Hair Fall Control Bhringaraja Shampoo, in INR 2 sachet form. The company claims these shampoos are infused with natural ingredients carefully selected to provide effective hair care solutions. This new launch is a part of the brand's effort to reach a larger audience and increase its penetration in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Herbal Shampoo Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Herbal Shampoo Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Herbal Shampoo Industry in India?

To stay informed about further developments, trends, and reports in the Herbal Shampoo Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence