Key Insights

The Middle East and Africa (MEA) deodorant market is projected for robust expansion, expected to reach a market size of 1.14 million by 2024. This growth is driven by a Compound Annual Growth Rate (CAGR) of 6% during the forecast period. Key factors fueling this demand include rising disposable incomes, increasing awareness of personal hygiene, and expanding retail infrastructure across the region. Product innovation, focusing on natural ingredients and specialized formulations, further stimulates consumer interest.

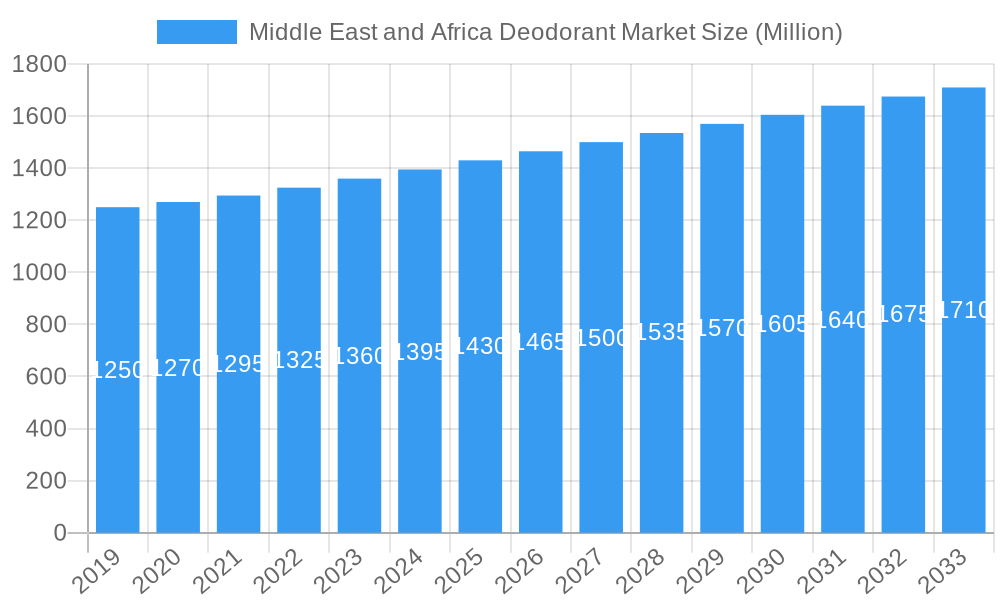

Middle East and Africa Deodorant Market Market Size (In Million)

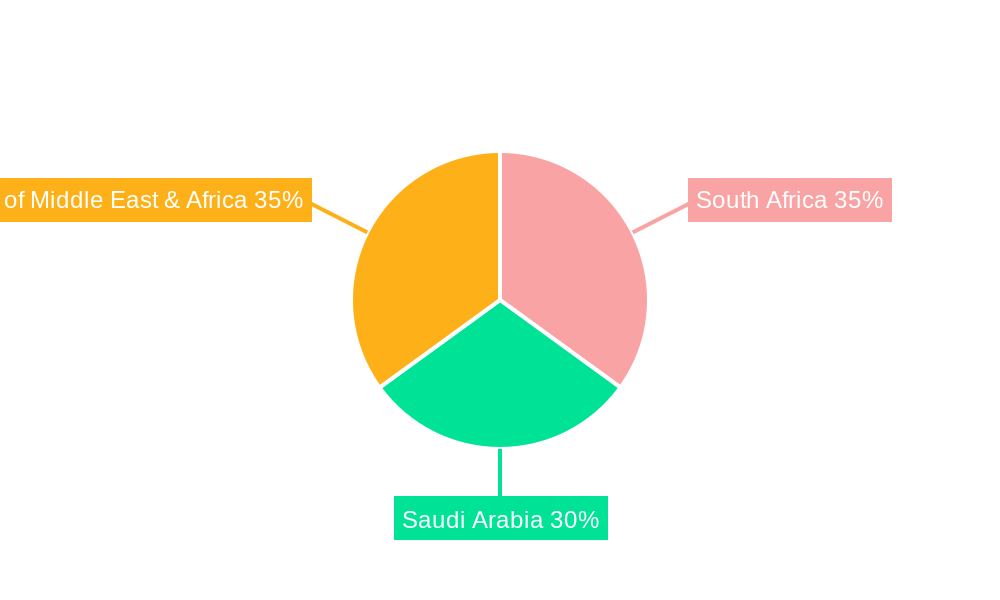

While price sensitivity and cultural preferences may present some challenges, the market is adapting with a diverse range of product types and evolving distribution channels, including a significant shift towards online retail. South Africa and Saudi Arabia are identified as leading markets, with the "Rest of Middle East & Africa" segment also demonstrating considerable growth potential. Major players such as Unilever, Church & Dwight Co. Inc., and Beiersdorf AG are actively engaged in product development and strategic marketing.

Middle East and Africa Deodorant Market Company Market Share

This comprehensive report offers in-depth analysis of the Middle East and Africa deodorant market from 2019 to 2033, with a base year of 2024 and a forecast period extending to 2033. It provides critical insights into product segments including deodorant sprays, roll-ons, sticks, and others, as well as distribution channels such as hypermarkets/supermarkets, convenience stores, specialist retail stores, drug stores/pharmacies, and online retail. Regional analysis covers South Africa, Saudi Arabia, and the Rest of Middle East & Africa.

This report is essential for deodorant manufacturers, personal care brands, retailers, distributors, and investors aiming to leverage the substantial growth opportunities in this dynamic market. Gain a competitive advantage through a detailed understanding of market concentration, innovation, regulatory environments, and consumer behavior.

Middle East and Africa Deodorant Market Market Concentration & Dynamics

The Middle East and Africa deodorant market exhibits a moderate to high level of concentration, with key global players like Unilever and Beiersdorf AG holding substantial market share. However, the presence of regional and niche brands such as Maramii is increasing, fostering a dynamic competitive environment. Innovation ecosystems are evolving, with a growing emphasis on natural ingredients, sustainable packaging, and specialized formulations catering to diverse climatic conditions and consumer sensitivities. Regulatory frameworks are generally supportive of market entry, although varying standards across countries necessitate careful navigation. Substitute products, such as antiperspirants and body sprays, compete for consumer attention, but the core deodorant market remains robust. End-user trends are shifting towards premiumization, increased awareness of hygiene, and a demand for long-lasting efficacy. M&A activities, while not extensive, are strategically focused on expanding product portfolios and geographical reach. The market share of the top 5 players is estimated to be around 60-70% in 2025, with approximately 5-7 significant M&A deals anticipated between 2025 and 2033, primarily involving acquisitions of smaller innovative brands.

Middle East and Africa Deodorant Market Industry Insights & Trends

The Middle East and Africa deodorant market is poised for significant expansion, driven by a confluence of demographic, economic, and socio-cultural factors. The increasing disposable income across many nations in the region fuels consumer spending on personal care products, including deodorants. A rising awareness of personal hygiene and grooming, influenced by global trends and media exposure, is a primary growth catalyst. Urbanization is leading to a greater concentration of consumers with access to modern retail channels and a broader product selection. Technological disruptions are manifesting in the development of advanced formulations offering longer-lasting protection, skin-friendly ingredients, and innovative delivery systems like aerosols and sticks. The e-commerce boom is profoundly impacting distribution, with online retail stores becoming increasingly important for accessibility and convenience, especially for consumers in remote areas.

Key growth drivers include a young and growing population with increasing purchasing power, particularly in countries like Nigeria and Egypt. The demand for deodorants that offer not just odor protection but also skin benefits, such as moisturizing and soothing properties, is on the rise. The premiumization trend is also evident, with consumers willing to spend more on high-quality, specialized deodorants. The market size for the Middle East and Africa deodorant market is projected to reach approximately $1,500 Million in 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 5.5% during the forecast period of 2025–2033. This growth is underpinned by sustained economic development and a deepening penetration of personal care products across diverse consumer segments. The integration of natural and organic ingredients is a significant emerging trend, aligning with growing consumer consciousness about health and environmental impact.

Key Markets & Segments Leading Middle East and Africa Deodorant Market

The Middle East and Africa deodorant market is characterized by distinct leadership across various segments and geographies, driven by economic growth, evolving consumer preferences, and localized market dynamics.

Dominant Geography: Saudi Arabia and South Africa emerge as leading markets within the region due to their relatively higher per capita income, established retail infrastructure, and higher adoption rates of personal care products. The Rest of Middle East & Africa, while diverse, presents significant untapped potential, particularly in populous nations like Nigeria and Egypt, which are expected to witness accelerated growth in the coming years.

- Drivers in Saudi Arabia: High disposable incomes, a strong consumer focus on grooming and appearance, and a well-developed retail network, including hypermarkets and specialist stores.

- Drivers in South Africa: A more mature market with a strong presence of global brands, growing middle class, and increasing demand for premium and natural deodorant options.

- Drivers in Rest of Middle East & Africa: Rapid urbanization, growing disposable incomes in key countries, and increasing penetration of modern retail formats and e-commerce.

Dominant Product Type: Deodorant sprays currently lead the market in terms of volume and value, owing to their ease of use and widespread availability. However, roll-on deodorants are gaining significant traction, particularly among consumers seeking long-lasting protection and a more direct application. Stick deodorants also hold a steady market share, appealing to a segment that prefers a solid format.

- Growth Drivers for Sprays: Perceived convenience, widespread brand availability, and perceived efficacy in warmer climates.

- Growth Drivers for Roll-Ons: Demand for sweat protection, skin-friendly formulations, and a growing preference for targeted application.

- Growth Drivers for Sticks: Consumer preference for solid formats, longer shelf-life, and portability.

Dominant Distribution Channel: Hypermarkets/Supermarkets continue to be the primary distribution channel, offering a wide selection of brands and competitive pricing. However, online retail stores are experiencing rapid growth, driven by convenience, a broader product assortment, and targeted promotions, especially in urban centers. Drug stores/Pharmacies are also gaining importance as consumers increasingly seek specialized or dermatologically tested deodorant options.

- Dominance of Hypermarkets/Supermarkets: High foot traffic, one-stop shopping convenience, and promotional activities.

- Emerging Dominance of Online Retail Stores: Increasing internet penetration, mobile commerce growth, and targeted marketing campaigns.

- Growing Importance of Drug Stores/Pharmacies: Consumer trust in healthcare-adjacent channels, availability of niche and premium products.

Middle East and Africa Deodorant Market Product Developments

Product innovation in the Middle East and Africa deodorant market is increasingly focused on addressing specific consumer needs and evolving preferences. Key developments include the introduction of natural and organic formulations, free from aluminum salts, parabens, and artificial fragrances, catering to a growing health-conscious consumer base. Brands are also innovating with long-lasting protection technologies, offering 24-hour and 48-hour efficacy to combat the region's warm climate. Furthermore, the market is seeing a rise in specialized deodorants designed for sensitive skin, active lifestyles, and specific fragrance profiles. The application of advanced aerosol technology and ergonomic packaging further enhances user experience and product appeal.

Challenges in the Middle East and Africa Deodorant Market Market

The Middle East and Africa deodorant market faces several challenges that can impede its growth trajectory. Regulatory inconsistencies across different countries can lead to increased compliance costs and market entry complexities for new players. Supply chain disruptions, exacerbated by logistical complexities and varying infrastructure quality, can impact product availability and distribution efficiency. Intense competition from both global giants and emerging local brands can pressure profit margins. Furthermore, the prevalence of counterfeit products in some markets poses a significant threat to brand reputation and consumer trust, leading to an estimated loss of revenue between 5% and 10% for legitimate brands due to counterfeiting. Economic volatility in certain nations can also affect consumer spending power, impacting demand for premium or non-essential personal care items.

Forces Driving Middle East and Africa Deodorant Market Growth

Several forces are propelling the growth of the Middle East and Africa deodorant market. Economic development and rising disposable incomes are key drivers, enabling more consumers to purchase personal care products. The increasing awareness of personal hygiene and grooming standards, influenced by global media and urbanization, is boosting demand for effective deodorant solutions. Technological advancements are leading to the development of innovative products with enhanced efficacy, skin benefits, and appealing fragrances. The growing penetration of modern retail channels and the burgeoning e-commerce landscape are improving product accessibility. Furthermore, demographic shifts, with a large youth population, contribute to a robust consumer base for these products.

Challenges in the Middle East and Africa Deodorant Market Market

Long-term growth catalysts for the Middle East and Africa deodorant market are rooted in sustained economic progress, coupled with evolving consumer lifestyles. The continued urbanization across the region will bring more consumers into contact with modern retail environments and a wider array of personal care choices. Investments in research and development to create region-specific formulations, addressing climate and skin types, will foster brand loyalty. Strategic partnerships between global manufacturers and local distributors can unlock untapped potential in smaller markets. Expansion into developing economies within the MEA region, by tailoring product offerings and pricing, represents a significant avenue for sustained expansion.

Emerging Opportunities in Middle East and Africa Deodorant Market

Emerging opportunities within the Middle East and Africa deodorant market are abundant and diverse. The rising demand for natural and organic deodorant options presents a significant niche for brands focusing on sustainable sourcing and chemical-free formulations. The expansion of e-commerce platforms in previously underserved areas offers a gateway to new consumer segments. The growing trend of personalization and customization in beauty products extends to deodorants, creating opportunities for bespoke formulations or scent options. Furthermore, innovative packaging solutions that are environmentally friendly and convenient for travel are gaining traction. Strategic collaborations with local influencers and micro-influencers can effectively penetrate diverse consumer groups.

Leading Players in the Middle East and Africa Deodorant Market Sector

- Unilever

- Church & Dwight Co Inc

- New Avon Company

- Bath & Body Works Direct Inc

- SA Designer Parfums Ltd

- Maramii

- Beiersdorf AG

- The Body Shop South International Plc

Key Milestones in Middle East and Africa Deodorant Market Industry

- 2019: Increased focus on natural ingredients in deodorant formulations by several global brands.

- 2020: Significant surge in online sales of personal care products due to pandemic-related lockdowns.

- 2021: Launch of specialized deodorant lines catering to sensitive skin in key markets like Saudi Arabia.

- 2022: Growing adoption of sustainable packaging initiatives by leading manufacturers.

- 2023: Expansion of regional brands like Maramii into wider distribution networks.

- 2024: Increased investment in e-commerce logistics and last-mile delivery by major players.

Strategic Outlook for Middle East and Africa Deodorant Market Market

The strategic outlook for the Middle East and Africa deodorant market is overwhelmingly positive, characterized by sustained growth accelerators. The market will witness an increasing emphasis on product innovation, particularly in natural and sustainable offerings, aligning with global consumer trends. Digital transformation, through enhanced e-commerce presence and data-driven marketing, will be crucial for market penetration and consumer engagement. Strategic partnerships and potential M&A activities will continue to shape the competitive landscape, with a focus on expanding market reach and product portfolios. Investing in understanding and catering to the diverse cultural nuances and climatic conditions across the MEA region will be paramount for long-term success and capturing the full market potential, estimated to grow beyond $2,000 Million by 2030.

Middle East and Africa Deodorant Market Segmentation

-

1. Product Type

- 1.1. Sprays

- 1.2. Roll-On

- 1.3. Stick

- 1.4. Others

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retail Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. Rest of Middle East & Africa

Middle East and Africa Deodorant Market Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. Rest of Middle East

Middle East and Africa Deodorant Market Regional Market Share

Geographic Coverage of Middle East and Africa Deodorant Market

Middle East and Africa Deodorant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Deodorant Sticks in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sprays

- 5.1.2. Roll-On

- 5.1.3. Stick

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retail Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East and Africa Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Sprays

- 6.1.2. Roll-On

- 6.1.3. Stick

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hypermarkets/Supermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Retail Stores

- 6.2.4. Drug Stores/Pharmacies

- 6.2.5. Online Retail Stores

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East and Africa Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Sprays

- 7.1.2. Roll-On

- 7.1.3. Stick

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hypermarkets/Supermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Retail Stores

- 7.2.4. Drug Stores/Pharmacies

- 7.2.5. Online Retail Stores

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East Middle East and Africa Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Sprays

- 8.1.2. Roll-On

- 8.1.3. Stick

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hypermarkets/Supermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Retail Stores

- 8.2.4. Drug Stores/Pharmacies

- 8.2.5. Online Retail Stores

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Unilever

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Church & Dwight Co Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 New Avon Company*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bath & Body Works Direct Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 SA Designer Parfums Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Maramii

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Beiersdorf AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 The Body Shop South International Plc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Unilever

List of Figures

- Figure 1: Middle East and Africa Deodorant Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Deodorant Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Deodorant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Middle East and Africa Deodorant Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East and Africa Deodorant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: Middle East and Africa Deodorant Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Middle East and Africa Deodorant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 6: Middle East and Africa Deodorant Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Middle East and Africa Deodorant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Deodorant Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Middle East and Africa Deodorant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Middle East and Africa Deodorant Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 11: Middle East and Africa Deodorant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 12: Middle East and Africa Deodorant Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: Middle East and Africa Deodorant Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 14: Middle East and Africa Deodorant Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Middle East and Africa Deodorant Market Revenue million Forecast, by Geography 2020 & 2033

- Table 16: Middle East and Africa Deodorant Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Deodorant Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Middle East and Africa Deodorant Market?

Key companies in the market include Unilever, Church & Dwight Co Inc, New Avon Company*List Not Exhaustive, Bath & Body Works Direct Inc, SA Designer Parfums Ltd, Maramii, Beiersdorf AG, The Body Shop South International Plc.

3. What are the main segments of the Middle East and Africa Deodorant Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.14 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal For Natural and Organic Hair Care Products; Increased Consumer Spending on Hair Care Products.

6. What are the notable trends driving market growth?

Rising Demand for Deodorant Sticks in the Region.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Deodorant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Deodorant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Deodorant Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Deodorant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence