Key Insights

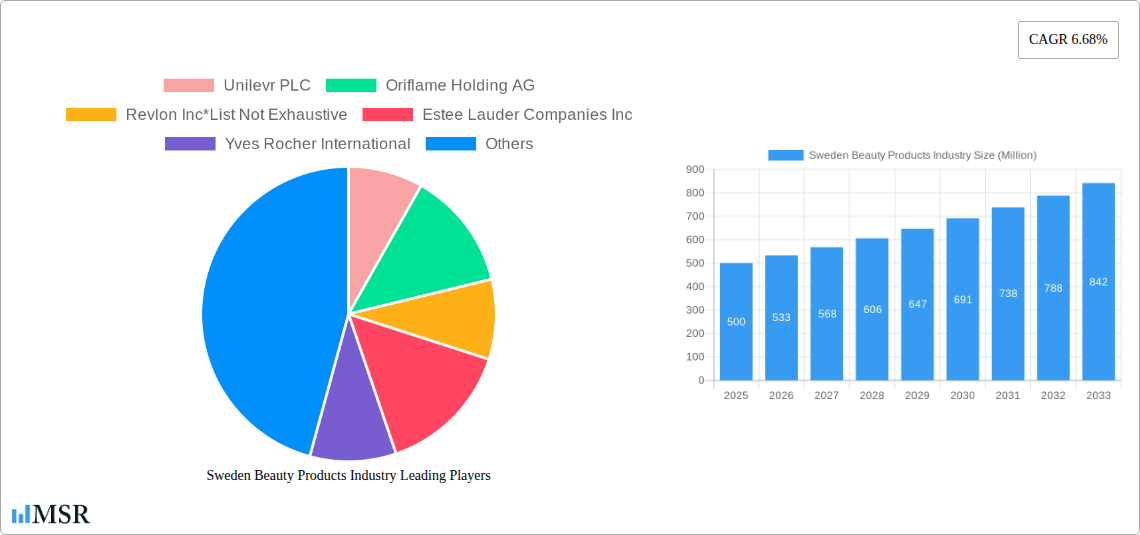

The Swedish beauty products market is projected for substantial growth, estimated at 768.3 million in 2025, with a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 to 2033. Key growth drivers include rising disposable incomes, increasing consumer demand for natural and organic products, and the expanding online retail sector. While competitive pressures and economic volatility present challenges, the market's upward trend is expected to persist.

Sweden Beauty Products Industry Market Size (In Million)

Market segmentation highlights the significant growth of online retail, driven by consumer preference for convenience and product variety. Color cosmetics and lip products continue to be strong performers. The premium segment is anticipated to outperform the mass market due to higher incomes and demand for specialized, high-quality offerings. Leading companies like Unilever PLC, L'Oréal S.A., and Oriflame Holding AG are leveraging established brands and distribution. Emerging niche brands focusing on sustainability and personalized solutions are also gaining traction. Opportunities exist for regional expansion within Sweden. Innovation in sustainable packaging and personalized beauty solutions will be crucial for future success.

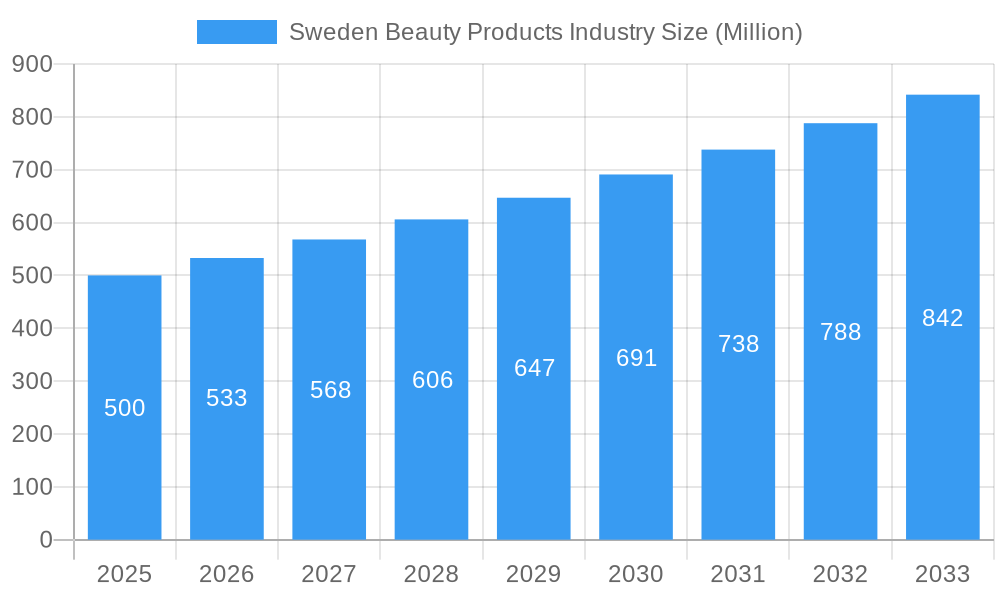

Sweden Beauty Products Industry Company Market Share

Sweden Beauty Products Industry: Market Analysis & Forecast (2025-2033)

This report offers a comprehensive analysis of the Sweden beauty products industry, providing essential insights for stakeholders. Covering the period 2025-2033, it includes historical data, current trends, and future projections. The analysis meticulously examines market size, growth drivers, the competitive landscape, and emerging opportunities, presenting a strategic roadmap for success. Market values are in million.

Sweden Beauty Products Industry Market Concentration & Dynamics

The Swedish beauty products market demonstrates a moderately concentrated landscape, with several multinational corporations holding significant market share. Key players such as L'Oréal S.A., Unilever PLC, and Oriflame Holding AG dominate various segments. However, the presence of numerous smaller, niche players contributes to a vibrant and competitive environment. Market share data for 2024 indicates that L'Oréal holds approximately xx% of the market, followed by Unilever with xx%, and Oriflame with xx%. The remaining xx% is distributed amongst other players.

Innovation within the industry is driven by both established players and emerging startups focusing on natural, organic, and sustainable products. The regulatory framework in Sweden is relatively robust, with stringent regulations concerning product safety and labeling. This necessitates significant investment in research and development, particularly in areas such as sustainable packaging and ingredient sourcing.

Substitute products, particularly those focusing on natural remedies and DIY beauty solutions, pose a moderate challenge to established brands. However, these are often seen as complementary rather than directly competitive. End-user trends show a growing preference for personalized beauty routines, ethical sourcing, and environmentally conscious brands.

Mergers and acquisitions (M&A) activity within the Swedish beauty products sector has been relatively moderate in recent years, with xx M&A deals recorded between 2019 and 2024. These transactions primarily involved smaller companies being acquired by larger multinational players looking to expand their product portfolio and market reach.

Sweden Beauty Products Industry Industry Insights & Trends

The Swedish beauty products market exhibits a robust growth trajectory, driven by several key factors. The market size in 2024 is estimated at $xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fueled by increasing disposable incomes, heightened consumer awareness of beauty and personal care, and the rising influence of social media and digital marketing.

Technological advancements play a pivotal role in shaping industry trends. E-commerce is rapidly expanding, offering consumers a wider range of products and brands. Personalized beauty solutions and AI-driven skin analysis tools are gaining popularity. Sustainability concerns are increasingly impacting consumer purchasing decisions, with brands emphasizing ethical sourcing, eco-friendly packaging, and cruelty-free practices. Consumer behaviors are evolving towards a more holistic approach to beauty, incorporating wellness and self-care routines.

Key Markets & Segments Leading Sweden Beauty Products Industry

By Distribution Channel: Online retail stores are experiencing the fastest growth, driven by convenience and accessibility. Supermarkets/hypermarkets remain a significant distribution channel, offering mass-market products. Specialty stores cater to consumers seeking premium and niche brands. Pharmacy and drug stores represent a significant channel for skincare and personal care products.

By Product Type: Color cosmetics, especially lipstick products, continue to be popular. Hair styling and coloring products also show strong demand, driven by trends and innovation in hair care technologies.

By Category: The premium segment is experiencing considerable growth, with consumers increasingly willing to spend on high-quality, specialized products. However, the mass segment remains a major market force.

The dominant region within Sweden is the urban centers, where purchasing power is higher and consumer awareness of beauty products is more advanced.

Sweden Beauty Products Industry Product Developments

Recent product innovations focus on natural ingredients, sustainable packaging, and personalized formulations. Technological advancements, such as AI-powered skin analysis and personalized skincare routines, are transforming the beauty landscape. Companies are increasingly incorporating smart technologies into their products, creating unique competitive advantages.

Challenges in the Sweden Beauty Products Industry Market

The industry faces challenges such as intense competition, fluctuating raw material prices, and the evolving regulatory landscape. Supply chain disruptions can impact product availability and pricing. Stringent regulations concerning product safety and labeling can increase compliance costs.

Forces Driving Sweden Beauty Products Industry Growth

Key growth drivers include rising disposable incomes, increased consumer awareness of beauty and personal care, and the expanding e-commerce sector. Technological advancements are fueling innovation in product development and marketing strategies.

Challenges in the Sweden Beauty Products Industry Market

Long-term growth is fueled by innovation in product formulation, strategic partnerships, and expansion into new markets. A focus on sustainability and ethical sourcing will drive future growth.

Emerging Opportunities in Sweden Beauty Products Industry

Emerging opportunities lie in personalized beauty solutions, sustainable and ethical products, and the expansion of e-commerce channels. Leveraging social media for marketing and brand building presents significant growth potential.

Leading Players in the Sweden Beauty Products Industry Sector

- Unilever PLC (Unilever PLC)

- Oriflame Holding AG (Oriflame Holding AG)

- Revlon Inc (Revlon Inc)

- Estée Lauder Companies Inc (Estée Lauder Companies Inc)

- Yves Rocher International (Yves Rocher International)

- L'Oréal S.A. (L'Oréal S.A.)

- Shiseido Co Ltd (Shiseido Co Ltd)

- Kao Corporation (Kao Corporation)

- Solstice Holdings Inc

- Kose Corporation (Kose Corporation)

Key Milestones in Sweden Beauty Products Industry Industry

- July 2021: L'Oréal launched its first TikTok beauty channel, leveraging digital platforms for innovation and brand building.

- February 2021: Revlon partnered with MDR Brand Management for global expansion, aiming to increase market reach and consumer engagement.

Strategic Outlook for Sweden Beauty Products Industry Market

The Swedish beauty products market holds significant future potential, driven by ongoing innovation, changing consumer preferences, and the growth of e-commerce. Strategic partnerships and investments in sustainable practices will be crucial for long-term success.

Sweden Beauty Products Industry Segmentation

-

1. Product Type

-

1.1. Color Cosmetics

- 1.1.1. Facial Make-up Products

- 1.1.2. Face Bronzers

- 1.1.3. Lip stick Products

-

1.2. Hair Styling and Coloring Products

- 1.2.1. Hair colors

- 1.2.2. Hair Styling Products

-

1.1. Color Cosmetics

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Pharmacy and Drug Stores

- 3.4. Convenience/Grocery Stores

- 3.5. Online Retail Stores

- 3.6. Other Distribution Channels

Sweden Beauty Products Industry Segmentation By Geography

- 1. Sweden

Sweden Beauty Products Industry Regional Market Share

Geographic Coverage of Sweden Beauty Products Industry

Sweden Beauty Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation

- 3.3. Market Restrains

- 3.3.1. Product Misrepresentation and Counterfeit Concerns

- 3.4. Market Trends

- 3.4.1. Rising Beauty Consciousness to Support Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Beauty Products Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Color Cosmetics

- 5.1.1.1. Facial Make-up Products

- 5.1.1.2. Face Bronzers

- 5.1.1.3. Lip stick Products

- 5.1.2. Hair Styling and Coloring Products

- 5.1.2.1. Hair colors

- 5.1.2.2. Hair Styling Products

- 5.1.1. Color Cosmetics

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Pharmacy and Drug Stores

- 5.3.4. Convenience/Grocery Stores

- 5.3.5. Online Retail Stores

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Unilevr PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oriflame Holding AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Revlon Inc*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Estee Lauder Companies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yves Rocher International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 L'Oreal S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shiseido Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kao Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solstice Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kose Coporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Unilevr PLC

List of Figures

- Figure 1: Sweden Beauty Products Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Sweden Beauty Products Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden Beauty Products Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Sweden Beauty Products Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Sweden Beauty Products Industry Revenue million Forecast, by Category 2020 & 2033

- Table 4: Sweden Beauty Products Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 5: Sweden Beauty Products Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Sweden Beauty Products Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 7: Sweden Beauty Products Industry Revenue million Forecast, by Region 2020 & 2033

- Table 8: Sweden Beauty Products Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Sweden Beauty Products Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: Sweden Beauty Products Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 11: Sweden Beauty Products Industry Revenue million Forecast, by Category 2020 & 2033

- Table 12: Sweden Beauty Products Industry Volume K Units Forecast, by Category 2020 & 2033

- Table 13: Sweden Beauty Products Industry Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Sweden Beauty Products Industry Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 15: Sweden Beauty Products Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Sweden Beauty Products Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Beauty Products Industry?

The projected CAGR is approximately 5.3%.

2. Which companies are prominent players in the Sweden Beauty Products Industry?

Key companies in the market include Unilevr PLC, Oriflame Holding AG, Revlon Inc*List Not Exhaustive, Estee Lauder Companies Inc, Yves Rocher International, L'Oreal S A, Shiseido Co Ltd, Kao Corporation, Solstice Holdings Inc, Kose Coporation.

3. What are the main segments of the Sweden Beauty Products Industry?

The market segments include Product Type, Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 768.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Aging Population drives the Market Growth; Technological Advancement and Product Innovation.

6. What are the notable trends driving market growth?

Rising Beauty Consciousness to Support Market Demand.

7. Are there any restraints impacting market growth?

Product Misrepresentation and Counterfeit Concerns.

8. Can you provide examples of recent developments in the market?

July 2021: L'Oreal group launched its first-ever TikTok beauty channel driven by a progressive vision of the beauty industry's future. The channel uncovers the group's science, innovations, and technologies beyond the world's favorite beauty products. Working in collaboration with experts from L'Oreal, this new channel delivers content that combines science, innovation, and technology behind beauty products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Beauty Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Beauty Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Beauty Products Industry?

To stay informed about further developments, trends, and reports in the Sweden Beauty Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence