Key Insights

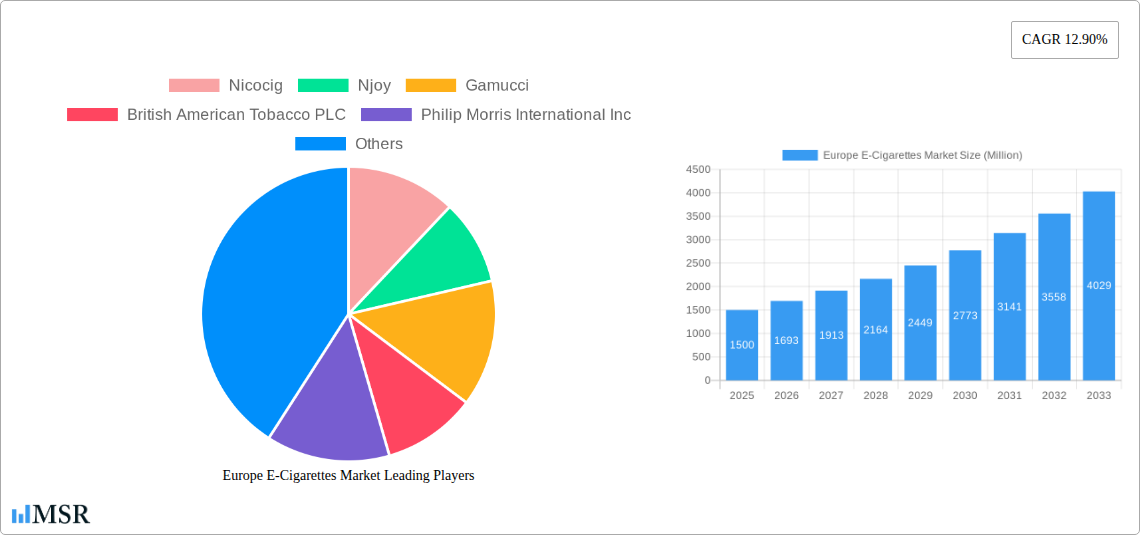

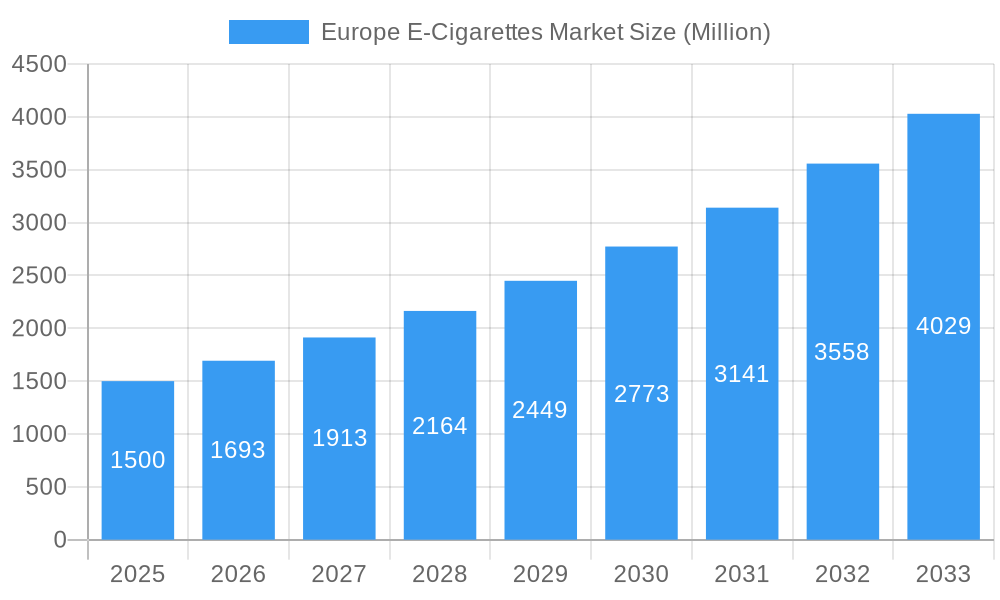

The European e-cigarette market, valued at approximately 27.691 billion in 2025, is projected for substantial growth, forecasting a Compound Annual Growth Rate (CAGR) of 12.9% from 2025 to 2033. This expansion is propelled by heightened awareness of harm reduction benefits over traditional cigarettes and a rising preference for vaping among younger demographics seeking smoking alternatives. Market innovation in product design and technology, including enhanced battery life, diverse flavor options, and device aesthetics, is attracting a wider consumer base. The market encompasses disposable, rechargeable, and personalized vaporizers, catering to varied preferences and budgets. Key industry players include established tobacco companies and specialized e-cigarette brands, navigating an evolving regulatory environment.

Europe E-Cigarettes Market Market Size (In Billion)

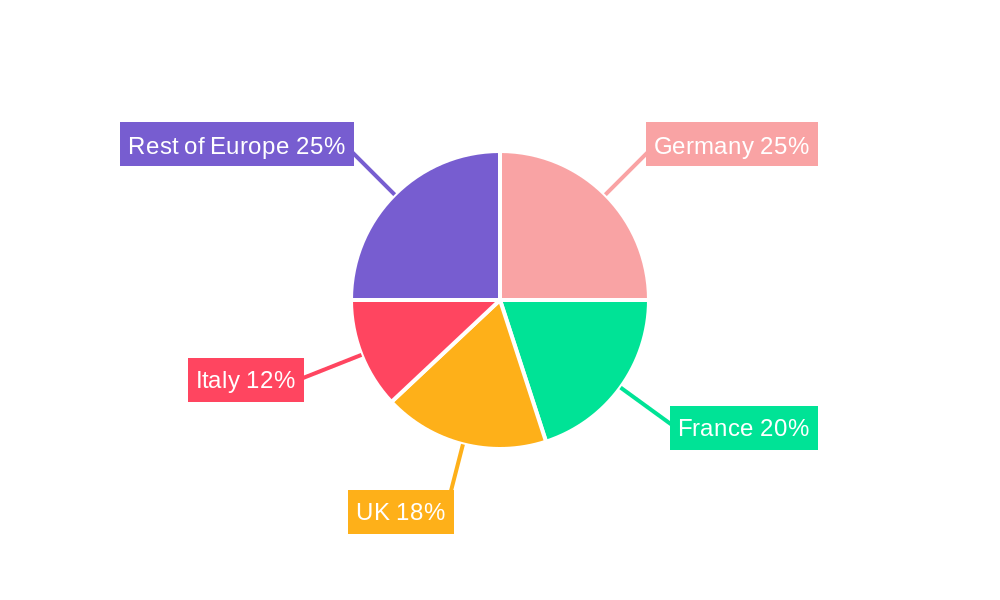

Leading markets within Europe include Germany, France, the United Kingdom, and Italy, attributed to significant populations and established vaping cultures. Growth is also anticipated in other European nations with increasing consumer awareness and improved product accessibility. Market growth is subject to evolving regulations targeting youth vaping and public health concerns regarding long-term effects. Despite these challenges, the market is set for continued expansion, driven by innovation, consumer demand, and harm reduction potential. Factors like rising disposable income, evolving lifestyles, and the growing social acceptance of vaping will further fuel this growth.

Europe E-Cigarettes Market Company Market Share

Europe E-Cigarettes Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European e-cigarettes market, offering invaluable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report dissects market dynamics, growth drivers, and emerging trends to equip businesses with the knowledge needed to thrive in this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe E-Cigarettes Market Concentration & Dynamics

The European e-cigarette market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. However, the presence of numerous smaller players and regional brands contributes to competitive intensity. Innovation is a crucial factor, with companies constantly developing new product types, battery technologies, and flavors to cater to evolving consumer preferences. Regulatory frameworks vary across European nations, creating both opportunities and challenges for businesses. The market also faces competition from substitute products, such as traditional cigarettes and heated tobacco devices. End-user trends, particularly among younger demographics and those seeking harm reduction, significantly influence market growth. Mergers and acquisitions (M&A) activity has been moderate, with larger players strategically acquiring smaller innovative companies to expand their product portfolios and market reach.

- Market Share: Top 5 players account for approximately xx% of the market (2024 data).

- M&A Deal Counts: An estimated xx deals occurred between 2019 and 2024.

- Innovation Ecosystems: Strong focus on flavor innovation, battery technology, and device design.

- Regulatory Frameworks: Vary significantly across European countries, impacting product availability and marketing.

- Substitute Products: Traditional cigarettes and heated tobacco products present significant competition.

Europe E-Cigarettes Market Industry Insights & Trends

The European e-cigarette market demonstrates robust growth fueled by several key factors. The increasing awareness of the health risks associated with traditional cigarettes is driving consumer adoption of e-cigarettes as a potential harm reduction strategy. Technological advancements, such as improved battery life and innovative flavor profiles, further enhance the appeal of e-cigarettes. Changing consumer behaviors, including a preference for convenience and personalized vaping experiences, are also significant drivers. The market is witnessing a shift towards disposable e-cigarettes, driven by their ease of use and affordability. Meanwhile, the segment of personalized vaporizers continues to grow steadily due to its customizability. The market experienced a growth of xx Million from 2019 to 2024, reflecting the dynamic nature of this sector. Significant technological disruptions, such as the development of water-based e-cigarette technology, hold immense promise for the future. The European market is expected to maintain its growth trajectory, driven by increased adoption and ongoing product innovation.

Key Markets & Segments Leading Europe E-Cigarettes Market

The United Kingdom, Germany, and France represent the largest markets within Europe. The completely disposable model segment is experiencing the most significant growth due to its convenience and affordability. However, the personalized vaporizer segment continues to hold considerable appeal among consumers who prioritize customization and control over their vaping experience.

Dominant Segments:

- Product Type: Completely Disposable Model (Largest Market Share)

- Battery Mode: Automatic E-Cigarette (Most Popular)

Drivers for Key Markets:

- United Kingdom: High disposable income, strong regulatory framework (relatively speaking), high awareness of health risks associated with traditional cigarettes.

- Germany: Large population, growing awareness of harm reduction strategies.

- France: Significant consumer base, evolving regulatory landscape.

Europe E-Cigarettes Market Product Developments

Recent years have witnessed significant product innovations in the European e-cigarette market. The introduction of water-based e-cigarette technology represents a major advancement, offering a potentially healthier vaping experience. Companies are continuously focusing on enhancing battery technology for longer lasting devices and introducing new flavors to cater to a wider range of consumer preferences. The development of compact, all-in-one devices contributes to the overall convenience factor for consumers. The constant drive for innovation ensures a competitive edge in the market.

Challenges in the Europe E-Cigarettes Market Market

The European e-cigarette market faces several challenges, including stringent regulations varying across countries and significant supply chain disruptions. Intense competition among established players and new entrants poses ongoing pressure. These factors can impact market expansion, production capacity, and ultimately consumer access. Further, negative public perception and evolving health concerns related to long-term vaping effects influence the industry's trajectory. It's estimated that these challenges cost the market an estimated xx Million in lost revenue annually (2024).

Forces Driving Europe E-Cigarettes Market Growth

Several factors drive the growth of the European e-cigarette market, primarily advancements in battery technology offering longer use and more compact designs. Favorable economic conditions in key markets stimulate consumer spending, leading to higher adoption rates. Regulatory frameworks, while restrictive in some areas, also help to create a more regulated and safer industry, which eventually improves consumer trust. The continued innovation in flavors and product types further fuels market expansion.

Challenges in the Europe E-Cigarettes Market Market (Long-Term Growth Catalysts)

Long-term growth in the European e-cigarette market hinges on addressing existing challenges while capitalizing on emerging opportunities. Strategic partnerships between manufacturers and technology providers can drive innovation and expand product offerings. Expanding into new markets and exploring untapped consumer segments will increase the market's overall reach. Continued efforts on research and development will improve existing products and develop even safer alternatives. Addressing regulatory hurdles and promoting consumer education will build more trust and improve market acceptance.

Emerging Opportunities in Europe E-Cigarettes Market

Emerging opportunities lie in the development of novel e-cigarette technologies, including improved heating mechanisms and advanced flavor delivery systems. The growing demand for personalized vaping experiences opens opportunities for customized devices and tailored e-liquids. Expanding into emerging markets within Europe and leveraging digital marketing strategies effectively can also unlock significant potential.

Leading Players in the Europe E-Cigarettes Market Sector

- Nicocig

- Njoy

- Gamucci

- British American Tobacco PLC

- Philip Morris International Inc

- J Well France SARL

- Japan Tobacco Inc

- Aquios Labs

- BecoVape

- Blu Cigs

- Imperial Brands PLC

- Altria Group Inc

Key Milestones in Europe E-Cigarettes Market Industry

- November 2021: Imperial Blue launched heated cigarette products in the Czech Republic, signaling a shift towards next-generation products.

- March 2022: BAT's test launch of Vuse Go disposable e-cigarettes in the UK highlights the growing disposable segment.

- February 2023: Imperial Brands launched the Pulze 2.0 heated tobacco device, showcasing innovation in this competitive sector.

- March 2023: Aquios Labs' launch of a water-based e-cigarette technology, developed with Innokin, represents a significant technological leap.

Strategic Outlook for Europe E-Cigarettes Market Market

The future of the European e-cigarette market is bright, driven by technological advancements, evolving consumer preferences, and the increasing focus on harm reduction strategies. Companies that strategically invest in research and development, adapt to evolving regulations, and cultivate strong brand identities will be well-positioned for continued success. Expansion into new markets and strategic partnerships represent significant opportunities for growth and market share expansion. The market’s potential for long-term growth remains substantial.

Europe E-Cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-Cigarette

- 2.2. Manual E-Cigarette

Europe E-Cigarettes Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

Europe E-Cigarettes Market Regional Market Share

Geographic Coverage of Europe E-Cigarettes Market

Europe E-Cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Dual-Use E-Cigarette Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-Cigarette

- 5.2.2. Manual E-Cigarette

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-Cigarette

- 6.2.2. Manual E-Cigarette

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-Cigarette

- 7.2.2. Manual E-Cigarette

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-Cigarette

- 8.2.2. Manual E-Cigarette

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-Cigarette

- 9.2.2. Manual E-Cigarette

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-Cigarette

- 10.2.2. Manual E-Cigarette

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-Cigarette

- 11.2.2. Manual E-Cigarette

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Completely Disposable Model

- 12.1.2. Rechargeable but Disposable Cartomizer

- 12.1.3. Personalized Vaporizer

- 12.2. Market Analysis, Insights and Forecast - by Battery Mode

- 12.2.1. Automatic E-Cigarette

- 12.2.2. Manual E-Cigarette

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nicocig

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Njoy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gamucci

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 British American Tobacco PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philip Morris International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 J Well France SARL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Japan Tobacco Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aquios Labs

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BecoVape*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Blu Cigs

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Imperial Brands PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Altria Group Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nicocig

List of Figures

- Figure 1: Europe E-Cigarettes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 4: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 5: Europe E-Cigarettes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe E-Cigarettes Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 10: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 11: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 16: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 17: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 22: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 23: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 28: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 29: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 34: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 35: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 40: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 41: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 45: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 46: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 47: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Cigarettes Market?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Europe E-Cigarettes Market?

Key companies in the market include Nicocig, Njoy, Gamucci, British American Tobacco PLC, Philip Morris International Inc, J Well France SARL, Japan Tobacco Inc, Aquios Labs, BecoVape*List Not Exhaustive, Blu Cigs, Imperial Brands PLC, Altria Group Inc.

3. What are the main segments of the Europe E-Cigarettes Market?

The market segments include Product Type, Battery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.691 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Dual-Use E-Cigarette Among Consumers.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2023: Aquios Labs, a Britain-based company, announced its new innovation, where it developed a water-based technology and launched a commercial product in cooperation with Innokin Technology to offer smokers a better smoking experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Cigarettes Market?

To stay informed about further developments, trends, and reports in the Europe E-Cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence