Key Insights

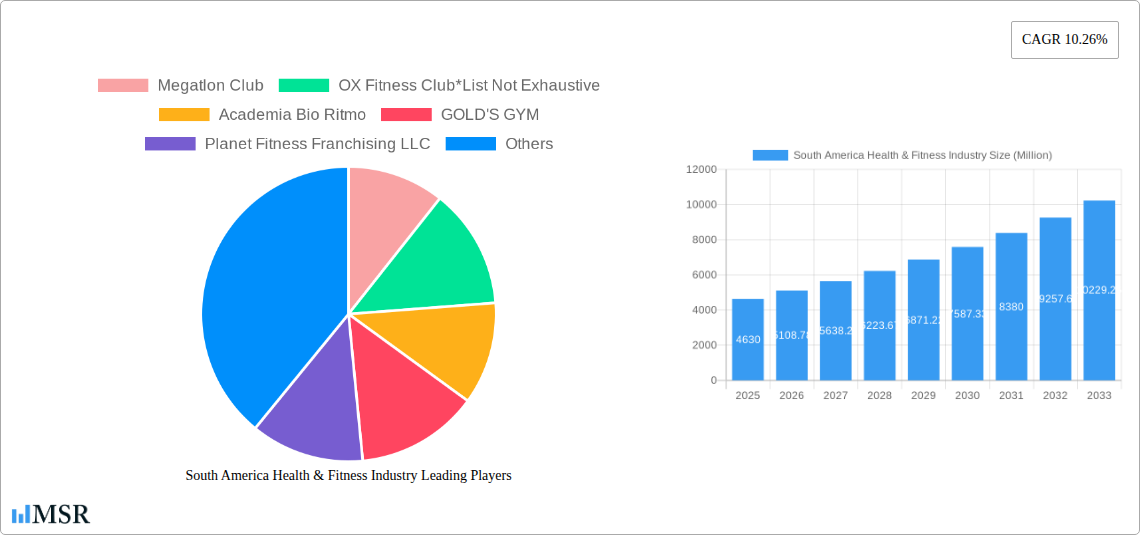

The South American health and fitness industry, currently valued at $4.63 billion (2025), is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 10.26% from 2025 to 2033. This expansion is driven by several key factors. Increasing health consciousness among the burgeoning middle class is fueling demand for fitness services. The rise of digital fitness platforms and personalized training options caters to diverse preferences and lifestyles. Furthermore, government initiatives promoting wellness and the increasing prevalence of lifestyle diseases are contributing to market growth. The industry's segmentation reveals significant opportunities within membership fees, total admission fees, and personal training and instruction services. Brazil and Argentina are leading the market, driven by higher disposable incomes and a growing awareness of health and fitness benefits. The remaining South American countries represent a considerable growth potential, particularly as infrastructure improves and consumer spending increases. However, economic instability in certain regions and the high cost of premium fitness facilities present challenges to sustained growth. The competitive landscape is dynamic, featuring both international players like Gold's Gym and Anytime Fitness, alongside regional chains and independent gyms.

South America Health & Fitness Industry Market Size (In Billion)

The forecast for the South American health and fitness market indicates continued expansion throughout the 2025-2033 period. The 10.26% CAGR suggests substantial growth opportunities for investors and businesses in the sector. Successful players will likely focus on adapting to the diverse consumer needs across different countries within South America, offering affordable options while maintaining quality services. Innovations in fitness technology, personalized workout plans, and community building within fitness spaces will be crucial for attracting and retaining customers in a competitive market. Strategic partnerships with local businesses and community organizations can enhance market penetration and brand visibility. A focus on affordability, accessibility, and customized offerings will be key to capturing the expanding market share in the years to come.

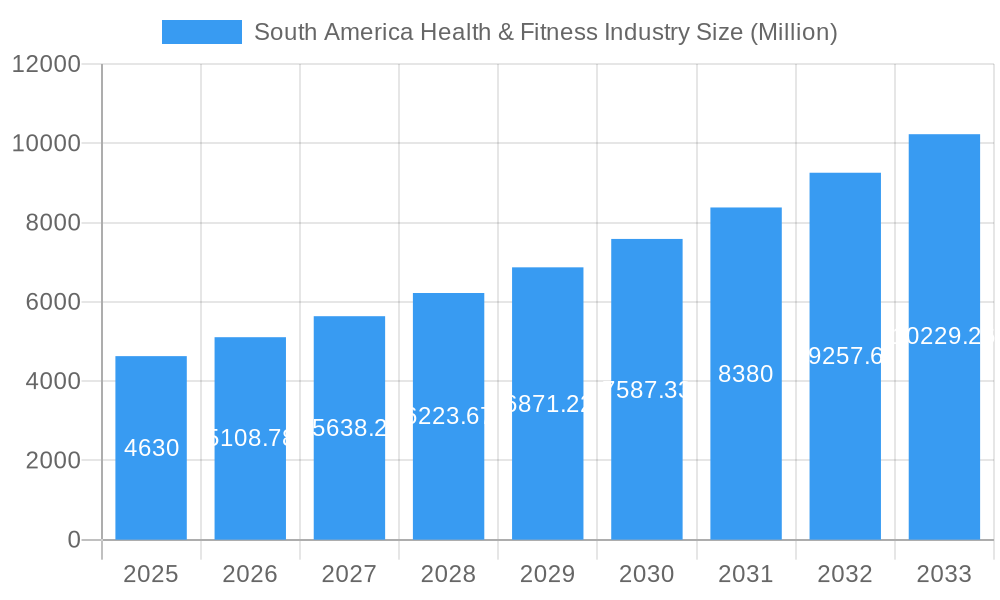

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America health and fitness industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current dynamics, future trends, and lucrative opportunities. The market size is projected to reach xx Million by 2025 and xx Million by 2033, showcasing a compelling CAGR of xx%.

South America Health & Fitness Industry Market Concentration & Dynamics

The South America health and fitness industry exhibits a moderately concentrated market structure, with key players like Megatlon Club, OX Fitness Club, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, and AYO Fitness Club commanding significant market share. However, the presence of numerous smaller, regional players indicates a dynamic and competitive landscape.

Market concentration is further shaped by the following factors:

- Innovation Ecosystems: The industry witnesses consistent innovation in fitness technologies, equipment, and service offerings. This drives both competition and market expansion.

- Regulatory Frameworks: Varying regulations across South American countries influence market entry and operational costs for businesses.

- Substitute Products: The availability of home-based fitness solutions and outdoor activities presents a degree of substitution, impacting market growth.

- End-User Trends: Growing health consciousness, increasing disposable incomes, and a shift towards wellness lifestyles are driving market demand.

- M&A Activities: The number of M&A deals in the sector has seen an upward trend in recent years (xx deals in 2024, projected xx in 2025), indicating consolidation and expansion strategies among key players. Market share estimations show Megatlon Club holding approximately xx% and GOLD'S GYM at approximately xx%.

South America Health & Fitness Industry Industry Insights & Trends

The South American health and fitness market is experiencing robust growth, fueled by several key factors. Rising health awareness, increasing disposable incomes in urban areas, and the growing adoption of fitness technology are driving market expansion. The market value is projected to reach xx Million USD by 2025, with a significant increase projected throughout the forecast period. Technological advancements, such as virtual fitness platforms and wearable fitness trackers, are transforming consumer experiences and driving engagement. Evolving consumer preferences, including demand for personalized training programs, group fitness classes, and hybrid fitness models (combining online and in-person experiences), are shaping the industry's trajectory. The shift toward preventative healthcare and the increasing integration of technology in fitness solutions are also influencing market trends. Furthermore, an expanding middle class and increasing urbanization in South America are fueling the growth trajectory.

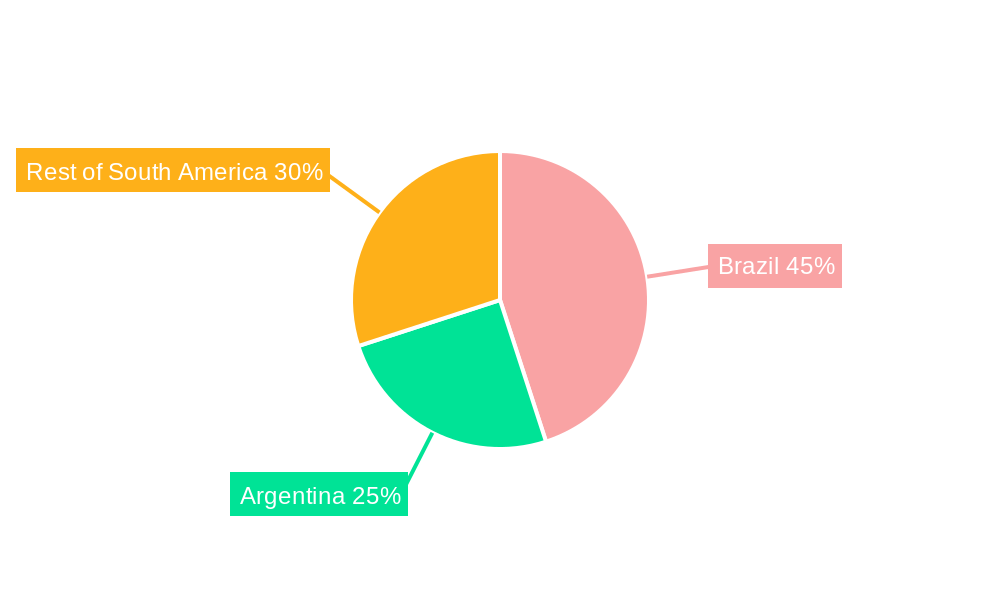

Key Markets & Segments Leading South America Health & Fitness Industry

Brazil and Argentina represent the largest and fastest-growing markets within South America's health and fitness sector. This dominance is primarily attributed to:

- Brazil: Larger population size, higher disposable incomes in urban centers, and a growing awareness of health and wellness.

- Argentina: Strong adoption of fitness culture, coupled with a developing health-conscious middle class.

Dominant Segments by Service Type:

- Membership Fees: This segment holds the largest market share due to the popularity of gym memberships and recurring revenue models.

- Personal Training and Instruction Services: This segment is experiencing rapid growth due to increased demand for personalized fitness guidance.

- Total Admission Fees: This segment provides significant revenue but may experience growth fluctuations depending on economic conditions and individual fitness choices.

Drivers for Growth:

- Economic Growth: Rising disposable incomes in key markets directly correlate with increased spending on health and fitness services.

- Infrastructure Development: The expansion of fitness facilities and related infrastructure in major cities fuels market expansion.

- Government Initiatives: Government policies promoting health and wellness contribute to the growth of the sector.

South America Health & Fitness Industry Product Developments

Recent years have witnessed significant innovations in fitness technology and equipment, significantly impacting the South American market. Smart fitness wearables, personalized training apps, virtual and augmented reality fitness programs, and sophisticated gym equipment incorporating technological integration have gained substantial traction. These advancements provide enhanced user experiences, personalized training, data-driven insights, and increased accessibility to fitness solutions. Furthermore, companies are integrating fitness technology into existing platforms, thus enhancing consumer engagement and creating a competitive edge.

Challenges in the South America Health & Fitness Industry Market

The South America health and fitness industry faces various challenges, including regulatory hurdles varying across countries, fluctuating economic conditions impacting consumer spending, and intense competition from both established and new entrants. Supply chain disruptions due to geopolitical factors or global crises can also hinder the industry. These challenges collectively impact market expansion and profitability, requiring strategic adaptations from businesses to navigate these obstacles effectively.

Forces Driving South America Health & Fitness Industry Growth

Several factors contribute to the growth of the South American health and fitness industry. These include the rising disposable incomes, increased awareness of health and wellness, and technological advancements in fitness equipment and training methodologies. Government initiatives promoting health and wellness programs add to the positive trajectory of growth. The increasing presence of international fitness brands further expands the market’s scope and accessibility.

Long-Term Growth Catalysts in South America Health & Fitness Industry

Long-term growth in this sector hinges on continued innovation in fitness technology, strategic partnerships between fitness providers and healthcare organizations, and expanding into underserved markets. The development of hybrid fitness models that blend online and offline experiences is also crucial. Investment in professional training and certification programs can enhance service quality and build trust.

Emerging Opportunities in South America Health & Fitness Industry

Emerging opportunities lie in the expansion of niche fitness segments like functional fitness, outdoor fitness activities, and specialized training programs tailored to specific age groups or health conditions. The incorporation of virtual reality and augmented reality fitness experiences opens new avenues for engagement and revenue generation. Expanding into smaller cities and towns outside major metropolitan areas unlocks significant market potential.

Leading Players in the South America Health & Fitness Industry Sector

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

Key Milestones in South America Health & Fitness Industry Industry

- 2020: Increased adoption of virtual fitness platforms due to pandemic restrictions.

- 2021: Expansion of several major fitness chains into new regions within South America.

- 2022: Significant investment in new fitness technology and equipment.

- 2023: Growth in mergers and acquisitions within the sector.

- 2024: Launch of several new boutique fitness studios focusing on specialized training.

Strategic Outlook for South America Health & Fitness Industry Market

The South American health and fitness industry holds substantial long-term growth potential. Strategic opportunities lie in adapting to evolving consumer preferences, leveraging technology to enhance user experiences, and focusing on market expansion into underserved regions. Companies that prioritize innovation, strategic partnerships, and customer-centric approaches are poised to thrive in this dynamic and rapidly growing market. The industry anticipates sustained growth with a strong focus on digital fitness and personalized wellness programs.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence