Key Insights

The European watch market, valued at approximately $6.34 billion in the base year of 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 3.4% through 2033. This expansion is propelled by several significant drivers. The burgeoning demand for smartwatches, particularly among younger consumers, is fostering innovation and broadening the market's scope beyond traditional timepieces. Concurrently, a renewed appreciation for premium analogue watches as symbols of status and enduring heirlooms contributes to market diversification. The evolving e-commerce landscape further fuels this growth by enhancing consumer accessibility and convenience across Europe. Key national markets include Germany, the United Kingdom, France, and Italy, characterized by established consumer bases and strong retail networks. Emerging European economies also present growth opportunities driven by rising disposable incomes and shifting consumer preferences. Market segmentation highlights a dynamic interplay of product categories. While digital watches, especially smartwatches, are gaining popularity, analogue watches retain a substantial market share due to their timeless appeal and association with heritage craftsmanship. The market is also observing a trend towards unisex designs, aligning with evolving gender norms and consumer tastes.

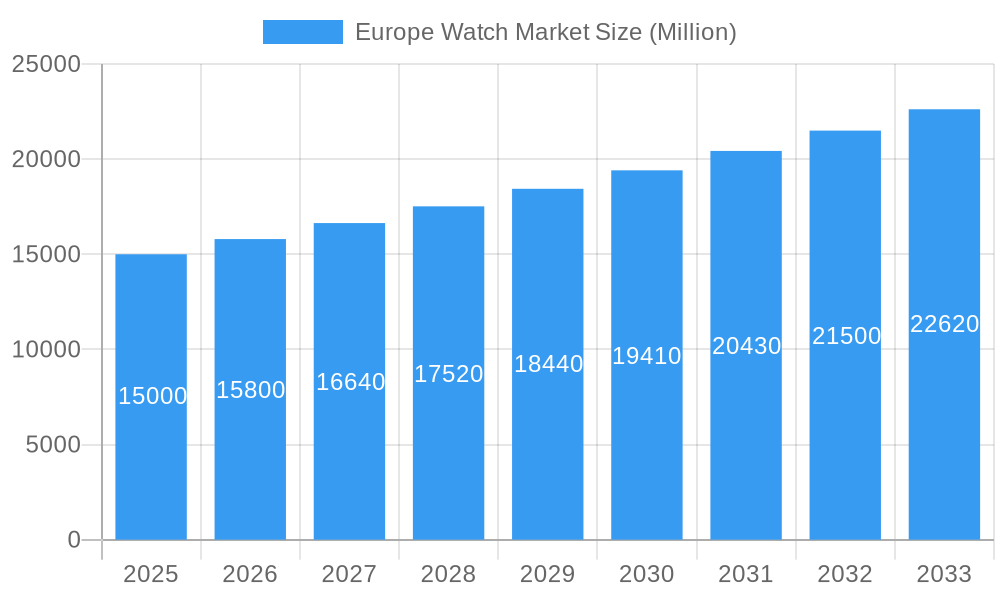

Europe Watch Market Market Size (In Billion)

Market challenges include price sensitivity in certain segments, particularly for entry-level offerings, and intense competition from established brands and new entrants. The luxury segment, led by prominent brands, demonstrates greater resilience to price volatility, underscoring the robustness of high-end watchmaking. The proliferation of counterfeit goods also presents a significant hurdle, impacting brand reputation and consumer confidence. Effective market navigation necessitates a strategic balance of innovation, compelling value propositions, stringent anti-counterfeiting measures, and targeted marketing campaigns across diverse consumer demographics and distribution channels, integrating both online and offline strategies for optimal market penetration.

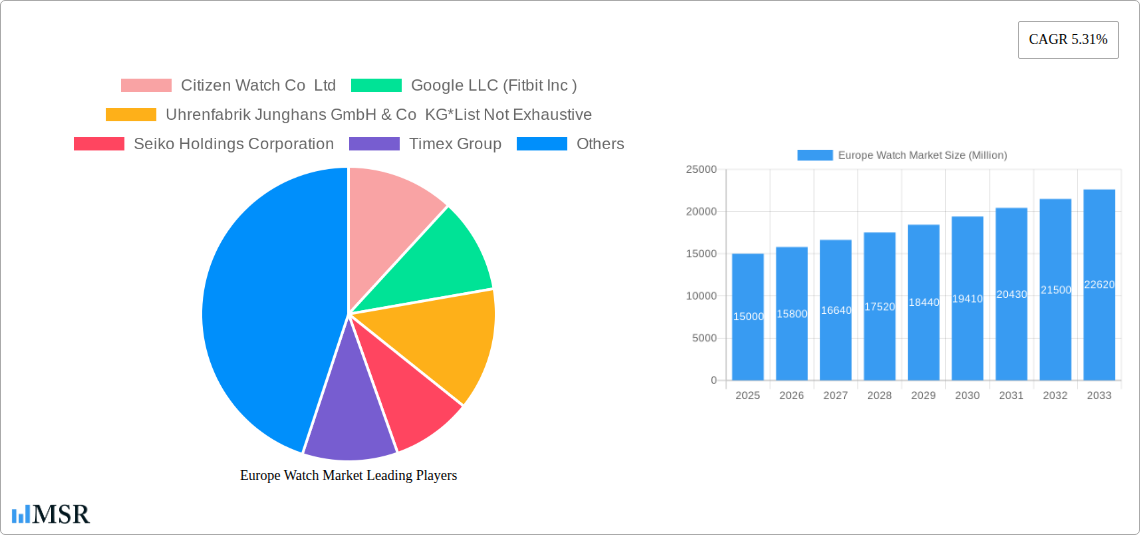

Europe Watch Market Company Market Share

Europe Watch Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe watch market, encompassing market size, growth drivers, key players, and future trends. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is crucial for industry stakeholders, investors, and businesses seeking to understand and navigate this dynamic market. The report covers key segments including analogue and digital watches, various distribution channels, and major European countries.

Europe Watch Market Market Concentration & Dynamics

The European watch market exhibits a moderately concentrated landscape, dominated by established players like The Swatch Group Ltd, Rolex SA, and Citizen Watch Co Ltd. However, the emergence of tech giants like Google LLC (Fitbit Inc) and strong regional players such as Uhrenfabrik Junghans GmbH & Co KG is intensifying competition. Market share data for 2024 reveals that the top 5 players hold approximately xx% of the market, while the remaining xx% is shared among numerous smaller brands.

Innovation ecosystems are thriving, particularly in smartwatches, driven by advancements in sensor technology, connectivity, and health monitoring features. Regulatory frameworks, especially concerning data privacy and product safety, are constantly evolving, posing both challenges and opportunities. Substitute products, such as fitness trackers and smartphones with time-telling functionalities, exert competitive pressure, particularly in the lower price segments. End-user trends show a growing preference for smartwatches, particularly among younger demographics, while the demand for traditional luxury watches remains strong among high-income consumers. Mergers and acquisitions (M&A) activity in the period 2019-2024 saw xx deals, indicating a trend of consolidation and expansion within the sector.

Europe Watch Market Industry Insights & Trends

The European watch market is projected to witness significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily fueled by several factors. The rising disposable incomes in several European countries are driving increased consumer spending on luxury and fashion accessories, including watches. Technological advancements, particularly in smartwatches with advanced health tracking features and connectivity, are attracting new consumer segments. Moreover, changing consumer preferences towards personalized products, unique designs and sustainable materials are shaping the market. The market size in 2025 is estimated to be xx Million, expected to reach xx Million by 2033. Evolving consumer behavior, marked by a shift towards online purchasing, also significantly impacts the market dynamics.

Key Markets & Segments Leading Europe Watch Market

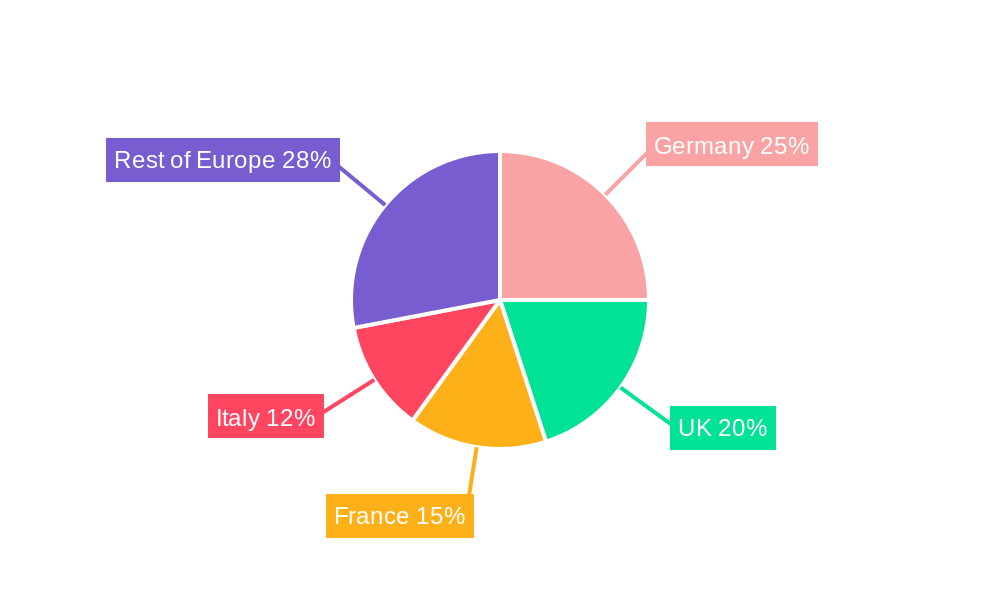

Dominant Region: Western Europe, particularly Germany, United Kingdom, France, and Switzerland, currently dominates the European watch market due to higher purchasing power and established distribution networks.

Dominant Country: Germany leads the pack due to its strong manufacturing base and high consumer demand for both luxury and mid-range watches. The UK shows healthy growth, particularly in the online retail segment.

Dominant Distribution Channel: While offline retail stores still maintain a significant share, online retail stores are experiencing rapid growth, driven by the rising adoption of e-commerce.

Dominant Watch Type: Analogue watches retain a substantial share, driven by their timeless appeal and association with luxury. However, digital watches, particularly smartwatches, are growing faster.

Dominant End-User: Men currently represent the larger segment of watch purchases, but the women's segment is also witnessing robust growth, indicating changing consumer preferences for stylish and functional timepieces. The Unisex segment is emerging as a significant market niche.

Drivers for growth in key markets:

- Germany: Strong domestic manufacturing, high consumer spending, and early adoption of new technologies.

- UK: Robust e-commerce infrastructure, strong consumer demand for luxury watches, and a large, affluent population.

- France: High fashion consciousness, strong luxury goods market, and preference for sophisticated designs.

- Switzerland: Renowned watchmaking heritage, luxury brand presence, and high per capita income.

Europe Watch Market Product Developments

Recent product innovations highlight a focus on smart features integration, such as advanced health monitoring (blood pressure, ECG), contactless payments, and enhanced connectivity. These advancements are crucial for attracting tech-savvy consumers and expanding the market for smartwatches. Improved materials, designs, and manufacturing processes further enhance product appeal and durability. These technological advancements aim to create competitive advantages by delivering a superior user experience and increased brand loyalty.

Challenges in the Europe Watch Market Market

The European watch market faces significant challenges including increasing raw material costs, supply chain disruptions that affect product availability and pricing, and intense competition from both established players and new entrants. Stringent regulatory compliance requirements, especially regarding materials and data security, add to the complexity and increase operational costs. The impact of these challenges is a potentially reduced profit margin and slower market growth in the short term.

Forces Driving Europe Watch Market Growth

Several factors contribute to the long-term growth of the European watch market. Technological advancements continuously enhance the functionality and appeal of watches, creating new market segments. Economic growth in several European countries leads to increased consumer spending and demand for luxury items, including watches. Favorable government policies that support the industry and innovation also contribute to the market expansion. For example, the ongoing development of smartwatches with improved health tracking capabilities fuels significant growth.

Challenges in the Europe Watch Market Market

Long-term growth will depend on continued innovation, strategic partnerships, and expansion into new markets. Investment in R&D to create superior products with enhanced functionalities is vital. Establishing strategic alliances to strengthen distribution networks and access new customer segments will be crucial. Expanding into untapped markets with high growth potential could further accelerate market expansion.

Emerging Opportunities in Europe Watch Market

Emerging opportunities include the rising demand for sustainable and ethically sourced watches, growth in the wearable technology sector, and the potential for personalized watch designs. Furthermore, penetration into developing markets in Eastern Europe represents a significant untapped potential. Expansion of e-commerce platforms and strategic partnerships with technology companies will allow brands to better serve the growing demand for personalized and advanced smartwatches.

Leading Players in the Europe Watch Market Sector

- Citizen Watch Co Ltd

- Google LLC (Fitbit Inc)

- Uhrenfabrik Junghans GmbH & Co KG

- Seiko Holdings Corporation

- Timex Group

- Compagnie Financière Richemont SA

- The Swatch Group Ltd

- Rolex SA

- Casio Computer Co Ltd

- Fossil Group Inc

Key Milestones in Europe Watch Market Industry

- October 2022: Huawei launched the Watch D in Germany, featuring a blood pressure monitor with UK and European regulatory approval. This launch expanded the smart watch market's health features.

- October 2022: Amazfit launched its robust Amazfit Falcon smartwatch in Germany, boosting the market's rugged and feature-rich segment.

- January 2023: Fossil Group launched its 'Katchin' marketplace in the UK, creating a new distribution channel for watches and accessories.

Strategic Outlook for Europe Watch Market Market

The future of the European watch market appears bright, driven by technological innovation, changing consumer preferences, and the continued expansion of online retail. Companies that can effectively leverage these trends, particularly focusing on sustainability, personalization, and technological advancements, are poised to capture significant market share and drive substantial future growth. The market presents significant opportunities for growth and profitability, and strategic actions are necessary to capitalize on its potential.

Europe Watch Market Segmentation

-

1. Type

- 1.1. Analogue Watch

- 1.2. Digital Watch

-

2. End Users

- 2.1. Women

- 2.2. Men

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

Europe Watch Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Watch Market Regional Market Share

Geographic Coverage of Europe Watch Market

Europe Watch Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Blending Adventure Sports With Smarter Wearables; The Preference for Luxury Time

- 3.3. Market Restrains

- 3.3.1. Increased Prevalence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Blending Adventure Sports With Smarter Wearables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Watch Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analogue Watch

- 5.1.2. Digital Watch

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Women

- 5.2.2. Men

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Citizen Watch Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Fitbit Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uhrenfabrik Junghans GmbH & Co KG*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seiko Holdings Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Timex Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Compagnie Financire Richemont SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Swatch Group Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rolex SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Casio Computer Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fossil Group Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Citizen Watch Co Ltd

List of Figures

- Figure 1: Europe Watch Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Watch Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Watch Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Watch Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 3: Europe Watch Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Europe Watch Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Watch Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Watch Market Revenue billion Forecast, by End Users 2020 & 2033

- Table 7: Europe Watch Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Europe Watch Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Watch Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Watch Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Europe Watch Market?

Key companies in the market include Citizen Watch Co Ltd, Google LLC (Fitbit Inc ), Uhrenfabrik Junghans GmbH & Co KG*List Not Exhaustive, Seiko Holdings Corporation, Timex Group, Compagnie Financire Richemont SA, The Swatch Group Ltd, Rolex SA, Casio Computer Co Ltd, Fossil Group Inc.

3. What are the main segments of the Europe Watch Market?

The market segments include Type, End Users, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.34 billion as of 2022.

5. What are some drivers contributing to market growth?

Blending Adventure Sports With Smarter Wearables; The Preference for Luxury Time.

6. What are the notable trends driving market growth?

Blending Adventure Sports With Smarter Wearables.

7. Are there any restraints impacting market growth?

Increased Prevalence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

January 2023: Fossil Group launched a new marketplace, 'Katchin,' in the United Kingdom specifically for jewelry and watches. The company claimed that Katchin aims to offer consumers a new way to shop for accessories, bringing together 'the most sought-after names together in a one-stop-shop' alongside curated content and how-to-style guides.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Watch Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Watch Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Watch Market?

To stay informed about further developments, trends, and reports in the Europe Watch Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence