Key Insights

The passenger vehicle industry is experiencing robust growth, driven by several key factors. A compound annual growth rate (CAGR) of 10.55% from 2019 to 2033 indicates significant expansion. This growth is fueled by rising disposable incomes in emerging markets, increasing urbanization leading to higher vehicle demand, and a global shift towards more fuel-efficient and environmentally friendly vehicles, particularly hybrid and electric options. The segment focusing on LPG passenger cars is also expected to contribute significantly to this expansion due to its relatively lower cost compared to gasoline or diesel, making it attractive to price-sensitive consumers. Technological advancements, such as improved battery technology and advancements in autonomous driving systems, are further driving innovation and market expansion. Key players like Toyota, Volkswagen, and BMW are heavily investing in R&D to enhance their market position and cater to evolving consumer preferences. The market's growth is, however, subject to certain constraints such as fluctuating fuel prices, stringent emission regulations, and the overall economic climate. Supply chain disruptions also continue to play a role in influencing production and ultimately, market growth.

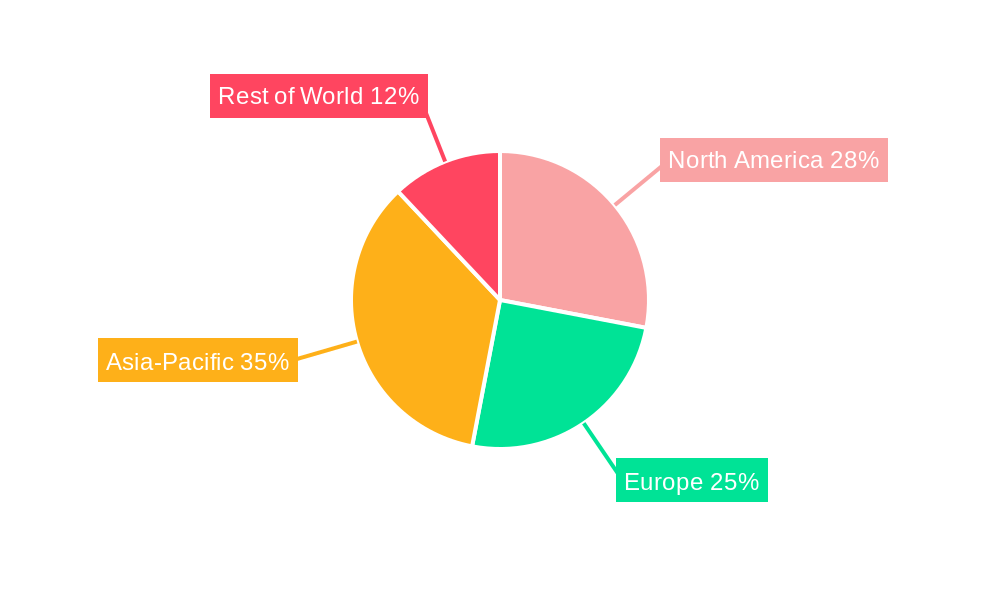

The industry is segmented by vehicle configuration (passenger cars) and propulsion type (hybrid and electric vehicles, with a notable LPG subset). Competition is intense among major automotive manufacturers including BMW, Nissan, GM, Volkswagen, Daimler, Hyundai, Kia, Toyota, Honda, and Ford. These companies are focusing on strategies such as product diversification, strategic partnerships, and mergers and acquisitions to maintain their competitive edge. Regional variations in market growth are likely, with regions like Asia-Pacific expected to witness a faster growth rate due to rapid economic development and a growing middle class. North America and Europe will also maintain significant market share, driven by strong consumer demand and established automotive industries. Understanding these dynamics is crucial for stakeholders in making informed strategic decisions in this rapidly evolving sector.

Passenger Vehicle Industry Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global passenger vehicle industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, key segments (including Passenger Cars and LPG vehicles, Hybrid and Electric Vehicles), leading players, and future growth opportunities. The report leverages data to predict a xx Million market size by 2033, with a Compound Annual Growth Rate (CAGR) of xx%.

Passenger Vehicle Industry Market Concentration & Dynamics

The passenger vehicle industry is characterized by a high degree of concentration, with a few major players commanding significant market share. In 2024, the top five manufacturers—Toyota, Volkswagen, Daimler, General Motors, and Hyundai—held an estimated xx% of the global market. However, increased competition from Chinese and other emerging market players is reshaping the landscape. Innovation ecosystems are evolving rapidly, driven by advancements in electric vehicle (EV) technology, autonomous driving capabilities, and connected car services. Stringent emission regulations and safety standards are creating a complex regulatory framework that impacts manufacturers' strategies. Substitute products, such as public transportation and ride-sharing services, continue to pose a challenge, albeit a slowly growing one, especially in urban areas. Consumer trends favour fuel efficiency and environmentally friendly vehicles, influencing production and marketing. M&A activity remains significant, with xx major deals recorded in 2024, indicating ongoing consolidation and expansion within the industry.

- Market Share: Top 5 players: xx% (2024)

- M&A Deal Count: xx (2024)

- Key Regulatory Factors: Emission standards, safety regulations

Passenger Vehicle Industry Industry Insights & Trends

The global passenger vehicle market experienced a xx Million market value in 2024 and is projected to reach xx Million by 2033, indicating robust growth potential. Several factors contribute to this expansion: rising disposable incomes in developing economies, increasing urbanization, and a preference for personal mobility. Technological disruptions, especially in EV and autonomous driving technologies, are significantly impacting the industry. Consumers are increasingly adopting eco-friendly vehicles, influencing manufacturers to accelerate the development and production of hybrid and fully electric cars. This trend is driven by environmental concerns, government incentives, and improving battery technology. Evolving consumer behaviours are also seen in preferences for connectivity, customization, and shared mobility solutions. The shift towards subscription models and vehicle-as-a-service (VaaS) models also represents a significant disruption.

Key Markets & Segments Leading Passenger Vehicle Industry

The Asia-Pacific region currently dominates the passenger vehicle market, driven by strong economic growth and increasing vehicle ownership. China and India are particularly significant markets. Within vehicle configurations, passenger cars maintain the largest share, while the LPG segment shows moderate growth. The hybrid and electric vehicle (HEV/EV) segment is witnessing the most rapid expansion, spurred by government regulations and technological advancements.

- Dominant Region: Asia-Pacific

- Key Growth Drivers:

- Economic Growth: Rapid economic expansion in emerging markets.

- Infrastructure Development: Improved road networks and charging infrastructure.

- Government Incentives: Subsidies and tax benefits for eco-friendly vehicles.

The dominance of the Asia-Pacific region is further fueled by the increasing affordability of vehicles, robust domestic manufacturing, and burgeoning middle-class populations. However, Europe and North America also present important growth opportunities due to the rapid adoption of EVs and strong environmental regulations.

Passenger Vehicle Industry Product Developments

Significant product innovations are transforming the passenger vehicle market. Advancements in battery technology, improved fuel efficiency, the integration of advanced driver-assistance systems (ADAS), and the rise of connected car features are shaping competitive edges. The introduction of electric all-wheel drive in vehicles like the Mustang Mach-E demonstrates the trend towards performance-oriented EVs. The ongoing development of autonomous driving systems and the focus on vehicle-to-everything (V2X) communication technologies present significant growth potential.

Challenges in the Passenger Vehicle Industry Market

The passenger vehicle industry faces several challenges. Stringent emission regulations are raising manufacturing costs and require significant investments in R&D. Supply chain disruptions, particularly concerning semiconductor chips, continue to impact production and cause uncertainty. Intense competition, both domestically and internationally, necessitates innovation and cost-effectiveness to maintain market share. These factors combine to create significant pressure on profit margins. The overall impact of these challenges reduces profitability by an estimated xx% annually, a figure that could rise without significant adaptation.

Forces Driving Passenger Vehicle Industry Growth

Key growth drivers include technological advancements in battery technology, leading to greater EV range and affordability. Government policies promoting electric mobility and tightening emission standards incentivize the transition to cleaner vehicles. Economic growth in emerging markets fuels increasing demand for passenger vehicles, and the rise of ride-sharing services creates opportunities for collaborative partnerships between automakers and technology companies. The continuing development of connected car features and autonomous driving technologies further enhances the industry’s growth potential.

Long-Term Growth Catalysts in the Passenger Vehicle Industry

Long-term growth will be propelled by continuous innovation in battery technology, leading to longer ranges, faster charging times, and improved affordability. Strategic partnerships between traditional automakers and technology companies will accelerate the development and deployment of autonomous driving systems. Expansion into new markets, especially in developing economies, will unlock significant growth potential. Further government support for the transition to electric mobility will be a key factor in the long-term growth of the industry.

Emerging Opportunities in Passenger Vehicle Industry

Emerging opportunities include the growth of the electric vehicle market, particularly in the development and adoption of battery-electric vehicles (BEVs). The rise of autonomous driving technology presents both challenges and opportunities, opening new avenues in ride-sharing, fleet management, and logistics. The increasing demand for connected cars and the implementation of vehicle-to-infrastructure (V2I) communication is creating an exciting new space for innovation. Subscription models and vehicle-as-a-service (VaaS) offerings are reshaping consumer relationships with automobiles.

Leading Players in the Passenger Vehicle Industry Sector

- Bayerische Motoren Werke AG

- Nissan Motor Co Ltd

- General Motors Company

- Volkswagen A

- Daimler AG (Mercedes-Benz AG)

- Hyundai Motor Company

- Kia Corporation

- Toyota Motor Corporation

- Honda Motor Co Ltd

- Ford Motor Company

Key Milestones in Passenger Vehicle Industry Industry

- December 2023: Ford Mustang Mach-E becomes available with electric all-wheel drive and standard heated seats and steering wheel. This enhances its competitiveness in the EV market.

- December 2023: Hyundai Motor announces its "Strategy 2025," outlining a KRW 61.1 trillion investment in R&D for future technologies. The aim is to electrify a majority of its new vehicles globally by 2035. This signals a significant commitment to the EV transition.

- December 2023: Toyota launches the Corolla GR-S in Brazil, featuring a flex-fuel engine. This signifies Toyota's adaptation to local fuel preferences in emerging markets.

Strategic Outlook for Passenger Vehicle Industry Market

The passenger vehicle industry is poised for continued growth, driven by technological advancements, changing consumer preferences, and supportive government policies. Strategic opportunities lie in the development and adoption of electric and autonomous vehicles, the expansion into new markets, and the creation of innovative mobility solutions. Companies that effectively navigate the challenges of regulation, supply chain management, and competition will be best positioned for success in the years to come. The transition to electric vehicles will be the major determinant of future market share.

Passenger Vehicle Industry Segmentation

-

1. Vehicle Configuration

-

1.1. Passenger Cars

- 1.1.1. Hatchback

- 1.1.2. Sedan

- 1.1.3. Sports Utility Vehicle

-

1.1. Passenger Cars

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Passenger Vehicle Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Passenger Vehicle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 5.1.1. Passenger Cars

- 5.1.1.1. Hatchback

- 5.1.1.2. Sedan

- 5.1.1.3. Sports Utility Vehicle

- 5.1.1. Passenger Cars

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6. North America Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 6.1.1. Passenger Cars

- 6.1.1.1. Hatchback

- 6.1.1.2. Sedan

- 6.1.1.3. Sports Utility Vehicle

- 6.1.1. Passenger Cars

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Hybrid and Electric Vehicles

- 6.2.1.1. By Fuel Category

- 6.2.1.1.1. BEV

- 6.2.1.1.2. FCEV

- 6.2.1.1.3. HEV

- 6.2.1.1.4. PHEV

- 6.2.1.1. By Fuel Category

- 6.2.2. ICE

- 6.2.2.1. CNG

- 6.2.2.2. Diesel

- 6.2.2.3. Gasoline

- 6.2.2.4. LPG

- 6.2.1. Hybrid and Electric Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7. South America Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 7.1.1. Passenger Cars

- 7.1.1.1. Hatchback

- 7.1.1.2. Sedan

- 7.1.1.3. Sports Utility Vehicle

- 7.1.1. Passenger Cars

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Hybrid and Electric Vehicles

- 7.2.1.1. By Fuel Category

- 7.2.1.1.1. BEV

- 7.2.1.1.2. FCEV

- 7.2.1.1.3. HEV

- 7.2.1.1.4. PHEV

- 7.2.1.1. By Fuel Category

- 7.2.2. ICE

- 7.2.2.1. CNG

- 7.2.2.2. Diesel

- 7.2.2.3. Gasoline

- 7.2.2.4. LPG

- 7.2.1. Hybrid and Electric Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8. Europe Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 8.1.1. Passenger Cars

- 8.1.1.1. Hatchback

- 8.1.1.2. Sedan

- 8.1.1.3. Sports Utility Vehicle

- 8.1.1. Passenger Cars

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Hybrid and Electric Vehicles

- 8.2.1.1. By Fuel Category

- 8.2.1.1.1. BEV

- 8.2.1.1.2. FCEV

- 8.2.1.1.3. HEV

- 8.2.1.1.4. PHEV

- 8.2.1.1. By Fuel Category

- 8.2.2. ICE

- 8.2.2.1. CNG

- 8.2.2.2. Diesel

- 8.2.2.3. Gasoline

- 8.2.2.4. LPG

- 8.2.1. Hybrid and Electric Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9. Middle East & Africa Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 9.1.1. Passenger Cars

- 9.1.1.1. Hatchback

- 9.1.1.2. Sedan

- 9.1.1.3. Sports Utility Vehicle

- 9.1.1. Passenger Cars

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Hybrid and Electric Vehicles

- 9.2.1.1. By Fuel Category

- 9.2.1.1.1. BEV

- 9.2.1.1.2. FCEV

- 9.2.1.1.3. HEV

- 9.2.1.1.4. PHEV

- 9.2.1.1. By Fuel Category

- 9.2.2. ICE

- 9.2.2.1. CNG

- 9.2.2.2. Diesel

- 9.2.2.3. Gasoline

- 9.2.2.4. LPG

- 9.2.1. Hybrid and Electric Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10. Asia Pacific Passenger Vehicle Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 10.1.1. Passenger Cars

- 10.1.1.1. Hatchback

- 10.1.1.2. Sedan

- 10.1.1.3. Sports Utility Vehicle

- 10.1.1. Passenger Cars

- 10.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.2.1. Hybrid and Electric Vehicles

- 10.2.1.1. By Fuel Category

- 10.2.1.1.1. BEV

- 10.2.1.1.2. FCEV

- 10.2.1.1.3. HEV

- 10.2.1.1.4. PHEV

- 10.2.1.1. By Fuel Category

- 10.2.2. ICE

- 10.2.2.1. CNG

- 10.2.2.2. Diesel

- 10.2.2.3. Gasoline

- 10.2.2.4. LPG

- 10.2.1. Hybrid and Electric Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Configuration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bayerische Motoren Werke AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nissan Motor Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Motors Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Volkswagen A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Daimler AG (Mercedes-Benz AG)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Motor Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kia Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Toyota Motor Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Honda Motor Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ford Motor Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Global Passenger Vehicle Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Passenger Vehicle Industry Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 3: North America Passenger Vehicle Industry Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 4: North America Passenger Vehicle Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 5: North America Passenger Vehicle Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 6: North America Passenger Vehicle Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Passenger Vehicle Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Passenger Vehicle Industry Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 9: South America Passenger Vehicle Industry Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 10: South America Passenger Vehicle Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 11: South America Passenger Vehicle Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 12: South America Passenger Vehicle Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Passenger Vehicle Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Passenger Vehicle Industry Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 15: Europe Passenger Vehicle Industry Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 16: Europe Passenger Vehicle Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 17: Europe Passenger Vehicle Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 18: Europe Passenger Vehicle Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Passenger Vehicle Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Passenger Vehicle Industry Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 21: Middle East & Africa Passenger Vehicle Industry Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 22: Middle East & Africa Passenger Vehicle Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 23: Middle East & Africa Passenger Vehicle Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 24: Middle East & Africa Passenger Vehicle Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Passenger Vehicle Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Passenger Vehicle Industry Revenue (Million), by Vehicle Configuration 2024 & 2032

- Figure 27: Asia Pacific Passenger Vehicle Industry Revenue Share (%), by Vehicle Configuration 2024 & 2032

- Figure 28: Asia Pacific Passenger Vehicle Industry Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 29: Asia Pacific Passenger Vehicle Industry Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 30: Asia Pacific Passenger Vehicle Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Passenger Vehicle Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Passenger Vehicle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 3: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Global Passenger Vehicle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 6: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 7: Global Passenger Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 12: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 13: Global Passenger Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 18: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 19: Global Passenger Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 30: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 31: Global Passenger Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Passenger Vehicle Industry Revenue Million Forecast, by Vehicle Configuration 2019 & 2032

- Table 39: Global Passenger Vehicle Industry Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 40: Global Passenger Vehicle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Passenger Vehicle Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Vehicle Industry?

The projected CAGR is approximately 10.55%.

2. Which companies are prominent players in the Passenger Vehicle Industry?

Key companies in the market include Bayerische Motoren Werke AG, Nissan Motor Co Ltd, General Motors Company, Volkswagen A, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Kia Corporation, Toyota Motor Corporation, Honda Motor Co Ltd, Ford Motor Company.

3. What are the main segments of the Passenger Vehicle Industry?

The market segments include Vehicle Configuration, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

December 2023: Mustang Mach-E is avaiable with electric all-wheel drive and has standard heated seats and steering wheel.December 2023: Hyundai Motor unveiled its "Strategy 2025" blueprint, outlining KRW 61.1 trillion in investments for future technology research and development (R&D) until 2025. The goal is to electrify the majority of new vehicles in key markets such as Korea, the United States, China, and Europe by 2030, with emerging markets such as India and Brazil following suit by 2035.December 2023: Toyota debuts the Corolla GR-S in Brazil. Its 2.0-liter Dynamic Force Atkinson flex cycle engine generates 177 horsepower when running on ethanol and 169 horsepower when running on gasoline, with 21.4 kgfm of torque in both cases.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Passenger Vehicle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Passenger Vehicle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Passenger Vehicle Industry?

To stay informed about further developments, trends, and reports in the Passenger Vehicle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence