Key Insights

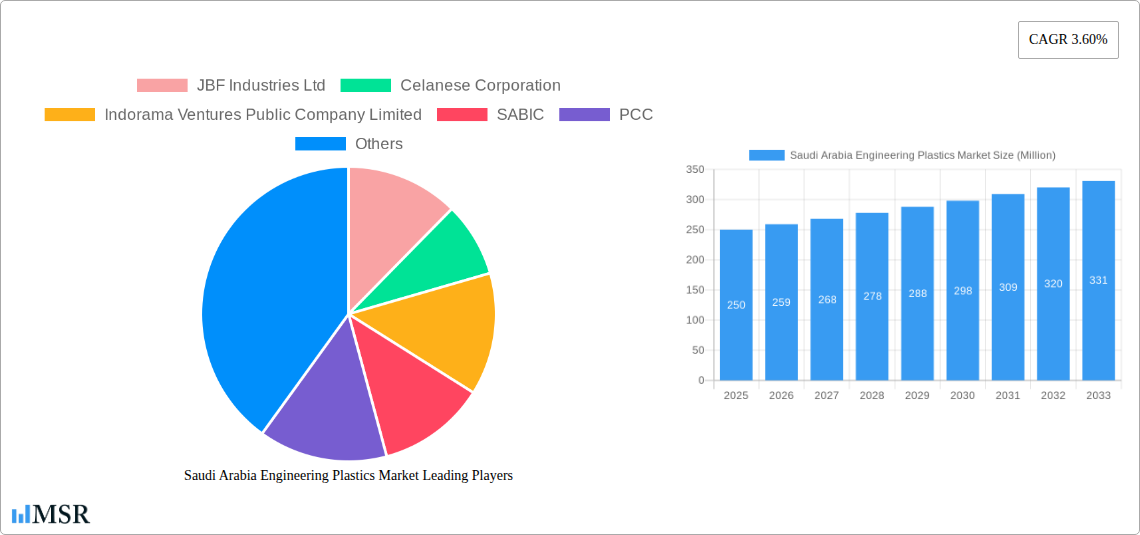

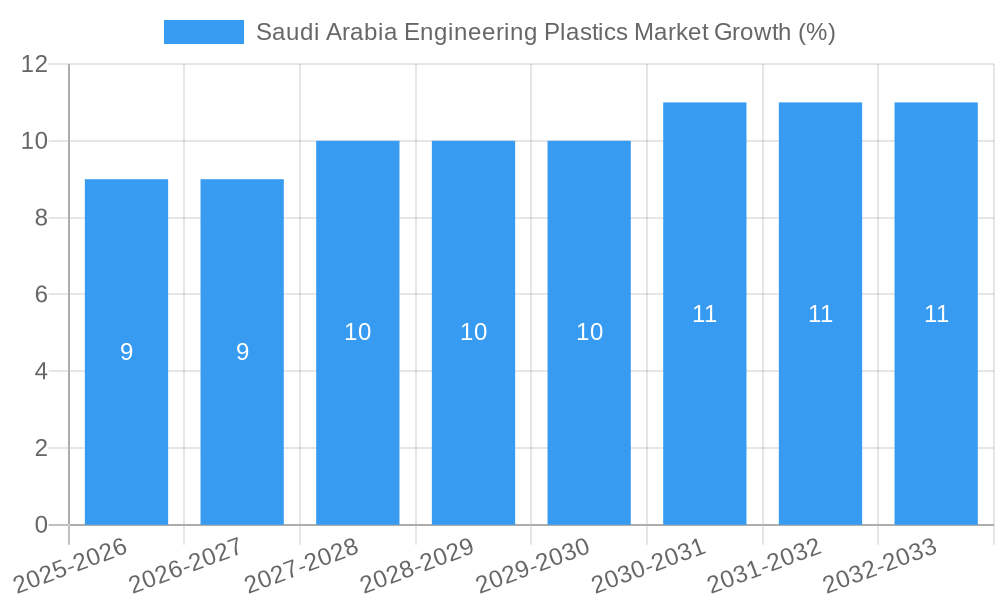

The Saudi Arabian engineering plastics market, valued at approximately $250 million in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.60% from 2025 to 2033. This growth is primarily driven by the burgeoning construction and automotive sectors within the Kingdom, fueled by ambitious infrastructure development projects like Neom and Vision 2030. Increased demand for lightweight, high-performance materials in vehicles and buildings is a key factor. Furthermore, the expansion of the electrical and electronics industry, particularly within renewable energy and technological advancements, contributes significantly to market expansion. The diverse applications of engineering plastics across these industries, including components for machinery, packaging solutions, and aerospace components, fuel the demand for various resin types, such as polybutylene terephthalate (PBT), polycarbonate (PC), and polyether ether ketone (PEEK), each catering to specific performance requirements. While the market faces challenges associated with fluctuating raw material prices and global economic uncertainties, the long-term outlook remains positive, supported by government initiatives promoting industrial diversification and sustainable development.

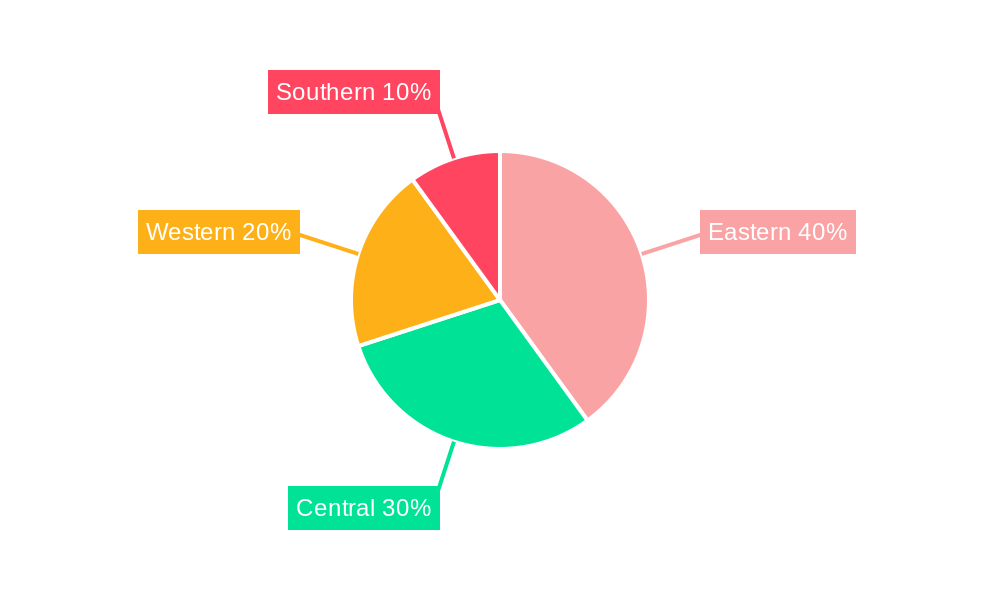

The market segmentation reveals a significant contribution from the automotive and construction sectors, expected to account for over 50% of the total market share in 2025. Fluoropolymers and polyamides hold substantial market share due to their superior properties like high temperature resistance and chemical inertness. Regional variations exist, with the Eastern region, driven by industrial hubs and petrochemical activities, showing higher growth potential than other regions. Key players such as SABIC, Celanese Corporation, and JBF Industries Ltd. are actively contributing to this growth through investments in advanced manufacturing capabilities and product innovation to cater to the increasing demand for high-performance engineering plastics in Saudi Arabia. Competitive strategies focus on technological advancements, supply chain optimization, and catering to specific customer needs within the diverse industrial landscape.

Saudi Arabia Engineering Plastics Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Saudi Arabia engineering plastics market, offering a comprehensive analysis of market size, growth drivers, key players, and future trends. From 2019 to 2033, this study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), equipping stakeholders with crucial data-driven insights for informed decision-making. The report segments the market by resin type (Fluoropolymer, Polyphthalamide, Polybutylene Terephthalate (PBT), Polycarbonate (PC), Polyether Ether Ketone (PEEK), Polyethylene Terephthalate (PET), Polyimide (PI), Polymethyl Methacrylate (PMMA), Polyoxymethylene (POM), Styrene Copolymers (ABS and SAN)) and end-user industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, Packaging, Other End-user Industries), providing granular market intelligence.

Saudi Arabia Engineering Plastics Market Market Concentration & Dynamics

The Saudi Arabia engineering plastics market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market's dynamics are shaped by a complex interplay of factors, including technological advancements, stringent regulatory frameworks, the emergence of substitute materials, evolving end-user preferences, and a flurry of mergers and acquisitions (M&A) activities.

Market share data for 2024 suggests that SABIC holds approximately xx% market share, followed by Celanese Corporation with xx%, and Indorama Ventures Public Company Limited with xx%. Other significant players include JBF Industries Ltd, PCC, Alfa S A B de C V, Rabigh Refining and Petrochemical Company (Petro Rabigh), Saudi Methacrylates Company (SAMAC), Sipchem Company, and The Chemours Company.

- Innovation Ecosystem: The market witnesses continuous innovation in material science, driven by the demand for high-performance plastics with enhanced properties.

- Regulatory Framework: Government regulations regarding material safety and environmental impact play a significant role in shaping market trends.

- Substitute Products: The availability of alternative materials, such as bioplastics and composites, poses a competitive threat.

- End-User Trends: The burgeoning construction and automotive sectors are major drivers of market growth, influencing demand for specific resin types.

- M&A Activities: Recent years have seen several significant M&A activities, notably Celanese Corporation's acquisition of DuPont's Mobility & Materials business in 2022, indicating consolidation within the sector. The estimated number of M&A deals in the Saudi Arabia engineering plastics market between 2019 and 2024 was xx.

Saudi Arabia Engineering Plastics Market Industry Insights & Trends

The Saudi Arabia engineering plastics market is projected to experience robust growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several key factors. The construction boom, driven by mega-projects like NEOM and Vision 2030, significantly boosts demand for engineering plastics in building and infrastructure applications. Similarly, the expansion of the automotive industry, coupled with the government's focus on electric vehicle adoption, creates substantial demand for lightweight and high-performance plastics. Technological disruptions, particularly in additive manufacturing (3D printing) and advanced material science, are further contributing to market expansion. The market size in 2025 is estimated to be $xx Million, expected to reach $xx Million by 2033. Evolving consumer preferences toward sustainable and recyclable materials are also impacting the market, pushing manufacturers to develop eco-friendly solutions. The increasing adoption of advanced technologies in various end-use sectors contributes to the rise of high-performance plastics.

Key Markets & Segments Leading Saudi Arabia Engineering Plastics Market

The Saudi Arabia engineering plastics market shows strong growth across several segments. The automotive and building & construction sectors are leading drivers due to government investments and infrastructure projects. Within resin types, Polycarbonate (PC), Polyethylene Terephthalate (PET), and Polybutylene Terephthalate (PBT) dominate, fueled by their versatility and wide applicability.

Dominant Segments:

- End-user Industry: Automotive and Building & Construction sectors are dominant, accounting for a combined xx% market share in 2024.

- Resin Type: Polycarbonate (PC), Polyethylene Terephthalate (PET), and Polybutylene Terephthalate (PBT) hold the largest market shares due to their wide applications.

Growth Drivers:

- Economic Growth: Sustained economic growth in Saudi Arabia drives demand across various sectors.

- Infrastructure Development: Massive infrastructure projects are creating significant demand for engineering plastics.

- Technological Advancements: Innovations in material science lead to the development of high-performance plastics.

- Government Initiatives: Government policies supporting industrial diversification and sustainability positively influence market growth.

The dominance of these segments is projected to continue throughout the forecast period, driven by consistent demand from these key industries.

Saudi Arabia Engineering Plastics Market Product Developments

Recent product innovations focus on enhancing material properties such as strength, durability, heat resistance, and chemical resistance. New grades of engineering plastics are being developed to meet the stringent requirements of specific applications, particularly in the aerospace and automotive sectors. Companies are also focusing on developing sustainable and recyclable options to address growing environmental concerns. These advancements provide a competitive edge by enabling better performance and reduced environmental impact.

Challenges in the Saudi Arabia Engineering Plastics Market Market

The Saudi Arabia engineering plastics market faces challenges, including volatile raw material prices, fluctuating oil prices impacting production costs, potential supply chain disruptions, and intense competition from both domestic and international players. These factors can affect profitability and market share. Import dependence on certain raw materials increases vulnerability to global price fluctuations. Stringent regulatory compliance requirements also add to the operational costs. The estimated impact of these challenges on market growth in 2024 was a reduction of xx%.

Forces Driving Saudi Arabia Engineering Plastics Market Growth

Key drivers include the Vision 2030 initiative, focusing on economic diversification and infrastructure development, along with increasing industrialization and a growing automotive sector. Technological advancements in material science, such as the development of high-performance composites and bio-based plastics, further stimulate market expansion. The government's emphasis on sustainable development is also driving demand for eco-friendly engineering plastics.

Challenges in the Saudi Arabia Engineering Plastics Market Market

Long-term growth hinges on sustained investment in R&D to develop advanced materials, strategic collaborations to expand market reach and technological expertise, and exploration of new applications in emerging sectors. Continued government support for infrastructure development and industrial diversification is crucial for maintaining market momentum.

Emerging Opportunities in Saudi Arabia Engineering Plastics Market

Significant opportunities exist in the development and adoption of high-performance plastics for specialized applications in aerospace, renewable energy, and medical devices. The growing focus on sustainability creates opportunities for bio-based and recyclable engineering plastics. Expansion into new markets within the region also presents substantial growth potential.

Leading Players in the Saudi Arabia Engineering Plastics Market Sector

- JBF Industries Ltd

- Celanese Corporation

- Indorama Ventures Public Company Limited

- SABIC

- PCC

- Alfa S A B de C V

- Rabigh Refining and Petrochemical Company (Petro Rabigh)

- Saudi Methacrylates Company (SAMAC)

- Sipchem Company

- The Chemours Company

Key Milestones in Saudi Arabia Engineering Plastics Market Industry

- November 2022: Celanese Corporation's acquisition of DuPont's M&M business significantly expanded its engineered thermoplastics portfolio.

- June 2022: Alpek's acquisition of OCTAL increased PET resin capacity, enhancing its market position.

- March 2022: Celanese Corporation's restructuring of KEP granted it access to significant POM production capacity in Asia.

Strategic Outlook for Saudi Arabia Engineering Plastics Market Market

The Saudi Arabia engineering plastics market shows strong potential for growth, driven by consistent government investment, technological advancements, and the expanding industrial landscape. Strategic partnerships, focused R&D initiatives, and the development of sustainable and high-performance materials will be key factors for success in this evolving market. The long-term outlook is positive, with continued growth expected across key segments.

Saudi Arabia Engineering Plastics Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Packaging

- 1.7. Other End-user Industries

-

2. Resin Type

-

2.1. Fluoropolymer

-

2.1.1. By Sub Resin Type

- 2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 2.1.1.3. Polytetrafluoroethylene (PTFE)

- 2.1.1.4. Polyvinylfluoride (PVF)

- 2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 2.1.1.6. Other Sub Resin Types

-

2.1.1. By Sub Resin Type

- 2.2. Liquid Crystal Polymer (LCP)

-

2.3. Polyamide (PA)

- 2.3.1. Aramid

- 2.3.2. Polyamide (PA) 6

- 2.3.3. Polyamide (PA) 66

- 2.3.4. Polyphthalamide

- 2.4. Polybutylene Terephthalate (PBT)

- 2.5. Polycarbonate (PC)

- 2.6. Polyether Ether Ketone (PEEK)

- 2.7. Polyethylene Terephthalate (PET)

- 2.8. Polyimide (PI)

- 2.9. Polymethyl Methacrylate (PMMA)

- 2.10. Polyoxymethylene (POM)

- 2.11. Styrene Copolymers (ABS and SAN)

-

2.1. Fluoropolymer

Saudi Arabia Engineering Plastics Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Engineering Plastics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment

- 3.3. Market Restrains

- 3.3.1. Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Packaging

- 5.1.7. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Resin Type

- 5.2.1. Fluoropolymer

- 5.2.1.1. By Sub Resin Type

- 5.2.1.1.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3. Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4. Polyvinylfluoride (PVF)

- 5.2.1.1.5. Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6. Other Sub Resin Types

- 5.2.1.1. By Sub Resin Type

- 5.2.2. Liquid Crystal Polymer (LCP)

- 5.2.3. Polyamide (PA)

- 5.2.3.1. Aramid

- 5.2.3.2. Polyamide (PA) 6

- 5.2.3.3. Polyamide (PA) 66

- 5.2.3.4. Polyphthalamide

- 5.2.4. Polybutylene Terephthalate (PBT)

- 5.2.5. Polycarbonate (PC)

- 5.2.6. Polyether Ether Ketone (PEEK)

- 5.2.7. Polyethylene Terephthalate (PET)

- 5.2.8. Polyimide (PI)

- 5.2.9. Polymethyl Methacrylate (PMMA)

- 5.2.10. Polyoxymethylene (POM)

- 5.2.11. Styrene Copolymers (ABS and SAN)

- 5.2.1. Fluoropolymer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Central Saudi Arabia Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Engineering Plastics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JBF Industries Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Celanese Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Indorama Ventures Public Company Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SABIC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PCC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alfa S A B de C V

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rabigh Refining and Petrochemical Company (Petro Rabigh)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Saudi Methacrylates Company (SAMAC)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sipchem Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Chemours Compan

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 JBF Industries Ltd

List of Figures

- Figure 1: Saudi Arabia Engineering Plastics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Engineering Plastics Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Engineering Plastics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 12: Saudi Arabia Engineering Plastics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Engineering Plastics Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the Saudi Arabia Engineering Plastics Market?

Key companies in the market include JBF Industries Ltd, Celanese Corporation, Indorama Ventures Public Company Limited, SABIC, PCC, Alfa S A B de C V, Rabigh Refining and Petrochemical Company (Petro Rabigh), Saudi Methacrylates Company (SAMAC), Sipchem Company, The Chemours Compan.

3. What are the main segments of the Saudi Arabia Engineering Plastics Market?

The market segments include End User Industry, Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: Celanese Corporation completed the acquisition of the Mobility & Materials (“M&M”) business of DuPont. This acquisition enhanced the company's product portfolio of engineered thermoplastics through the addition of well-recognized brands and intellectual properties of DuPont.June 2022: Alpek acquired OCTAL, which increased Alpek's PET resin capacity by 576,000 tons, helping it meet customers' increased demand.March 2022: Celanese Corporation announced the completion of the restructuring of Korea Engineering Plastics Co. (KEP), a joint venture owned 50% by Celanese and 50% by Mitsubishi Gas Chemical Company Inc. With the completion, Celanese had access to approximately 70KTA of POM production in Asia and corresponding global marketing rights.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Engineering Plastics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Engineering Plastics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Engineering Plastics Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Engineering Plastics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence