Key Insights

The Saudi Arabian fragrance market, valued at $2.12 billion in 2023, is poised for significant expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 5.94% from 2023 to 2030, driven by escalating disposable incomes, a strong focus on personal grooming and self-expression, and the burgeoning tourism sector. The market is segmented by product type, category (mass and premium), and end-user (men, women, and unisex). The premium segment, particularly for women's fragrances, dominates market share, reflecting a demand for high-quality, globally recognized brands.

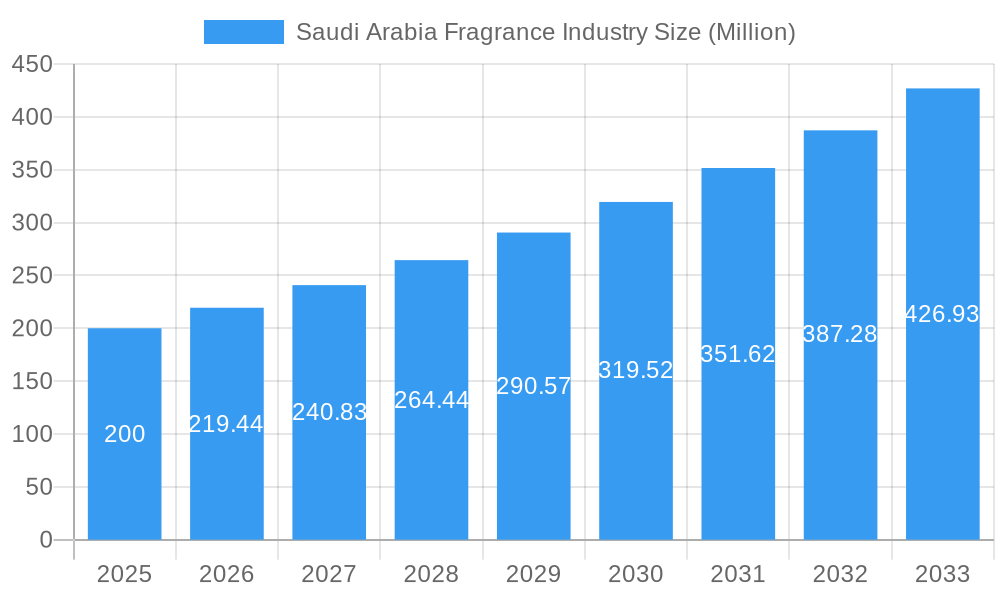

Saudi Arabia Fragrance Industry Market Size (In Billion)

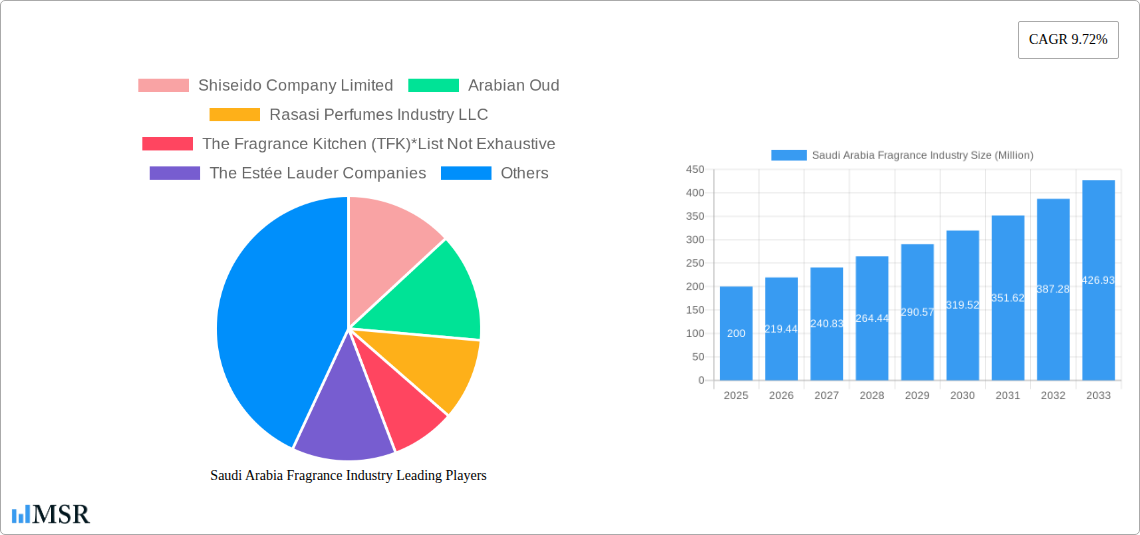

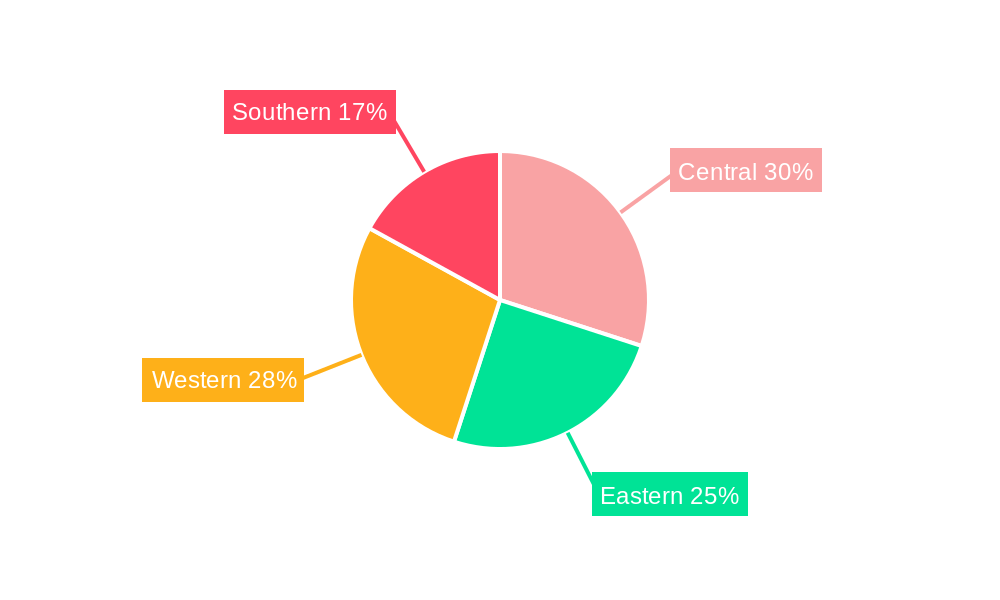

Key market trends include a growing preference for niche and artisanal fragrances, emphasizing unique scents and personalized experiences. Online retail channels are increasingly vital, enhancing consumer accessibility and convenience. Potential challenges include economic volatility and the prevalence of counterfeit products. Leading market players such as Shiseido, Arabian Oud, Rasasi, Estée Lauder, Unilever, and L'Oréal are actively pursuing product innovation, strategic alliances, and targeted marketing to enhance their market presence. Regional variations in demand exist, with urban centers exhibiting higher consumption patterns, influencing localized product strategies across Saudi Arabia's Central, Eastern, Western, and Southern regions.

Saudi Arabia Fragrance Industry Company Market Share

Saudi Arabia Fragrance Industry: Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia fragrance industry, encompassing market size, growth drivers, key players, and future trends. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is crucial for businesses, investors, and stakeholders seeking to navigate this dynamic market. The Saudi Arabia fragrance market, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Saudi Arabia Fragrance Industry Market Concentration & Dynamics

The Saudi Arabian fragrance market presents a complex landscape shaped by a blend of international and domestic players. Market concentration is moderate, with a few major players holding significant shares, while numerous smaller, niche brands contribute to the overall market vibrancy. Innovation is driven by both multinational corporations investing in R&D and local brands focusing on unique regional scents and traditional ingredients. The regulatory framework is relatively stable, though evolving to address evolving consumer safety and labeling standards. The market experiences competition from substitute products like essential oils and personal care items. End-user trends indicate a rising preference for premium and naturally derived fragrances, along with a growing male segment. Mergers and acquisitions (M&A) activity has been moderate, with a total of xx M&A deals recorded between 2019 and 2024.

- Market Share: Major players like Shiseido Company Limited, The Estée Lauder Companies, and Unilever PLC hold a significant portion (xx%) of the market share. Local brands like Arabian Oud and Rasasi Perfumes Industry LLC also command substantial regional presence.

- M&A Activity: The past five years have seen xx M&A deals, indicating a moderate level of consolidation within the industry. These deals primarily involved smaller brands being acquired by larger players seeking to expand their market reach or product portfolio.

- Innovation Ecosystem: Saudi Arabia's fragrance industry benefits from a growing focus on technological advancements, particularly in areas like AI-driven personalization and sustainable sourcing of ingredients.

Saudi Arabia Fragrance Industry Industry Insights & Trends

The Saudi Arabian fragrance market is experiencing robust growth, driven by several factors. Rising disposable incomes, particularly among younger demographics, fuel demand for premium and luxury fragrances. A burgeoning middle class contributes to increased spending on personal care products. The growing popularity of e-commerce channels and social media marketing is also expanding market reach and driving sales. However, the market also faces challenges like economic fluctuations, changes in consumer preferences, and increased competition. Technological advancements, such as AI-powered fragrance creation and personalized scent recommendations, are reshaping consumer experiences. This has led to the introduction of innovative products and marketing strategies catering to the evolving demands of consumers. The market size for fragrances in Saudi Arabia is estimated at xx Million in 2025, projected to reach xx Million by 2033, showing significant growth potential.

Key Markets & Segments Leading Saudi Arabia Fragrance Industry

The Saudi Arabian fragrance market shows strong growth across different segments. While the premium segment demonstrates higher growth due to rising disposable incomes and increasing preference for luxury goods, the mass segment still contributes significantly to overall market volume.

Dominant Segments:

- Type: Fragrances (perfumes, eau de toilettes, eau de parfums) constitute the largest segment due to their widespread appeal and cultural significance.

- Category: Premium fragrances have shown more robust growth, fueled by increased spending on luxury goods, although the mass market remains crucial in terms of volume.

- End-User: Both women and men contribute significantly to fragrance sales, with a notable increase in the demand for unisex fragrances.

Growth Drivers:

- Economic Growth: Rising disposable incomes and increased consumer spending power are key drivers of the market's expansion.

- Infrastructure Development: The growth of retail infrastructure, including e-commerce, allows for greater market penetration.

- Tourism: Increasing tourist arrivals contribute to the growth of the premium fragrance segment.

- Cultural Significance: Fragrances hold significant cultural importance in Saudi Arabia, boosting demand.

Saudi Arabia Fragrance Industry Product Developments

Recent years have witnessed significant product innovations in the Saudi Arabian fragrance industry. The launch of new fragrance lines by established brands and the emergence of niche, artisanal perfume houses reflects a focus on diversifying offerings. Technological advancements have resulted in enhanced fragrance delivery systems, more sophisticated scent formulations, and personalized scent creation tools. This focus on innovation has also led to increased competitiveness and expanded product choices for consumers.

Challenges in the Saudi Arabia Fragrance Industry Market

The Saudi Arabian fragrance market faces several challenges, including stringent regulatory requirements related to ingredient safety and labeling, potential supply chain disruptions impacting raw material availability, and intense competition from both domestic and international players. Economic fluctuations can also influence consumer spending habits and impact the overall market growth. These challenges require strategic planning and adaptability for companies operating in this market.

Forces Driving Saudi Arabia Fragrance Industry Growth

Several factors contribute to the long-term growth of the Saudi Arabian fragrance industry. A growing young population with increasing disposable incomes is a major driver. The rising popularity of e-commerce platforms provides access to wider markets and increases consumer choice. Government initiatives promoting local businesses and investments in the beauty and personal care sector further stimulate growth. Furthermore, an expanding tourism sector introduces diverse consumer preferences and increases demand for luxury fragrances.

Challenges in the Saudi Arabia Fragrance Industry Market

The Saudi Arabian fragrance industry faces some long-term challenges. Maintaining brand loyalty in a highly competitive market with a large array of local and international options is crucial. The industry needs to adapt to changing consumer preferences and evolving trends in sustainability and ethical sourcing of ingredients. Successful players must invest in research and development to create innovative products.

Emerging Opportunities in Saudi Arabia Fragrance Industry

Emerging opportunities exist in developing sustainable and ethically sourced fragrances, focusing on unique local ingredients and traditional scents. The expanding e-commerce market and increasing popularity of social media marketing provide opportunities for greater brand visibility and direct-to-consumer sales. Personalized fragrance creation tools and digital scent experiences could open up new market segments and enhance customer engagement.

Leading Players in the Saudi Arabia Fragrance Industry Sector

- Shiseido Company Limited

- Arabian Oud

- Rasasi Perfumes Industry LLC

- The Fragrance Kitchen (TFK)

- The Estée Lauder Companies

- Unilever PLC

- Zohoor Alreef

- L'Oréal S.A

- Revlon Inc

- The Procter & Gamble Company

Key Milestones in Saudi Arabia Fragrance Industry Industry

- Dec 2021: Arabian Oud launched a new fragrance, Oud07.

- Jan 2023: L'Oréal Groupe unveiled HAPTA, a computerized makeup applicator, and L'Oréal Brow Magic, an electronic eyebrow makeup applicator.

- Jan 2023: The Estée Lauder Companies launched a Voice-Enabled Makeup Assistant (VMA).

Strategic Outlook for Saudi Arabia Fragrance Industry Market

The Saudi Arabian fragrance market presents substantial long-term growth potential driven by evolving consumer preferences, technological advancements, and economic expansion. Strategic opportunities lie in embracing digitalization, focusing on sustainable practices, and catering to the increasing demand for personalized and luxury fragrance experiences. Companies that effectively leverage these trends and address the market challenges will be best positioned for success.

Saudi Arabia Fragrance Industry Segmentation

-

1. Type

- 1.1. Hair Care

- 1.2. Skin Care

- 1.3. Make-up Products

- 1.4. Deodorants

- 1.5. Fragrances

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. End-User

- 3.1. Men

- 3.2. Women

- 3.3. Unsex

Saudi Arabia Fragrance Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fragrance Industry Regional Market Share

Geographic Coverage of Saudi Arabia Fragrance Industry

Saudi Arabia Fragrance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Rising Number of Active Social Media Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hair Care

- 5.1.2. Skin Care

- 5.1.3. Make-up Products

- 5.1.4. Deodorants

- 5.1.5. Fragrances

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Men

- 5.3.2. Women

- 5.3.3. Unsex

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 7. Eastern Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 8. Western Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 9. Southern Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2020-2032

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Shiseido Company Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arabian Oud

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rasasi Perfumes Industry LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Fragrance Kitchen (TFK)*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Estée Lauder Companies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Unilever PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zohoor Alreef

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 L'Oréal S A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Revlon Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Procter & Gamble Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Shiseido Company Limited

List of Figures

- Figure 1: Saudi Arabia Fragrance Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Fragrance Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 4: Saudi Arabia Fragrance Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 5: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Central Saudi Arabia Fragrance Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Eastern Saudi Arabia Fragrance Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Western Saudi Arabia Fragrance Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Southern Saudi Arabia Fragrance Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 13: Saudi Arabia Fragrance Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Saudi Arabia Fragrance Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fragrance Industry?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the Saudi Arabia Fragrance Industry?

Key companies in the market include Shiseido Company Limited, Arabian Oud, Rasasi Perfumes Industry LLC, The Fragrance Kitchen (TFK)*List Not Exhaustive, The Estée Lauder Companies, Unilever PLC, Zohoor Alreef, L'Oréal S A, Revlon Inc, The Procter & Gamble Company.

3. What are the main segments of the Saudi Arabia Fragrance Industry?

The market segments include Type, Category, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Rising Number of Active Social Media Users.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

Jan 2023: At CES 2023, the L'Oréal Groupe revealed two new technological prototypes that open up new avenues for the expression of beauty. The first portable, ultra-precise computerized makeup applicator, called HAPTA, was created to improve the demands of those with restricted hand and arm mobility in terms of aesthetics. The first at-home electronic eyebrow makeup applicator, L'Oréal Brow Magic, was intended to give users custom brows in a matter of seconds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fragrance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fragrance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fragrance Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fragrance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence