Key Insights

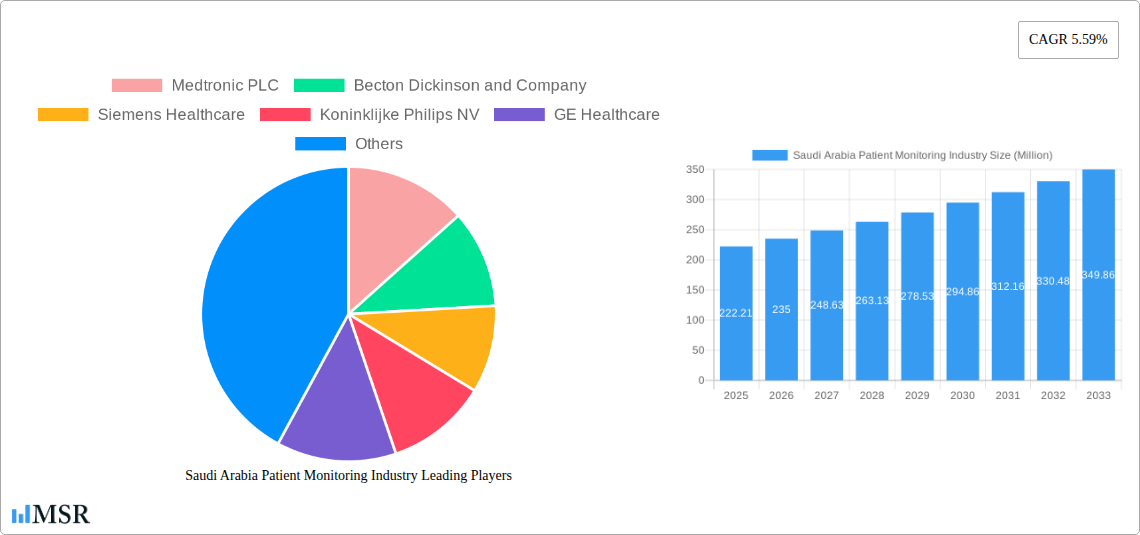

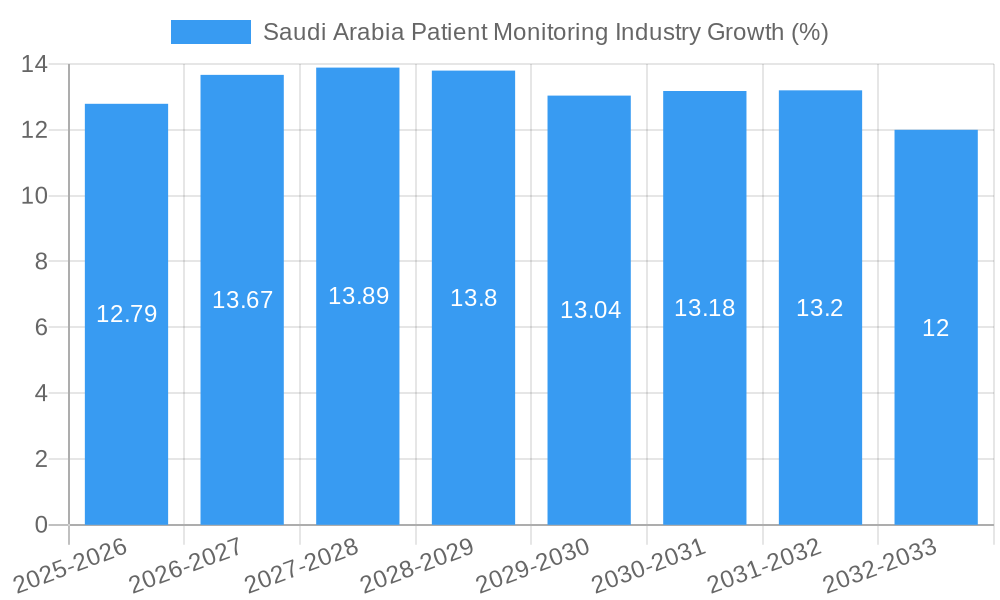

The Saudi Arabian patient monitoring market, valued at $222.21 million in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases, an aging population, and increasing government initiatives to improve healthcare infrastructure. The market's Compound Annual Growth Rate (CAGR) of 5.59% from 2025 to 2033 indicates a steady expansion, fueled by technological advancements in remote patient monitoring, a greater emphasis on preventative care, and the expanding adoption of sophisticated monitoring devices across hospitals and home healthcare settings. Key segments driving this growth include cardiology, neurology, and respiratory monitoring, with home healthcare emerging as a significant end-user segment. This reflects a shift towards decentralized care models and a greater focus on patient convenience and cost-effectiveness. While challenges such as high device costs and the need for skilled professionals to operate and interpret data exist, these are being mitigated by increasing affordability, improved training programs, and the development of user-friendly technologies. The market’s growth trajectory is further bolstered by substantial investments in healthcare infrastructure and the government's focus on enhancing the quality of patient care.

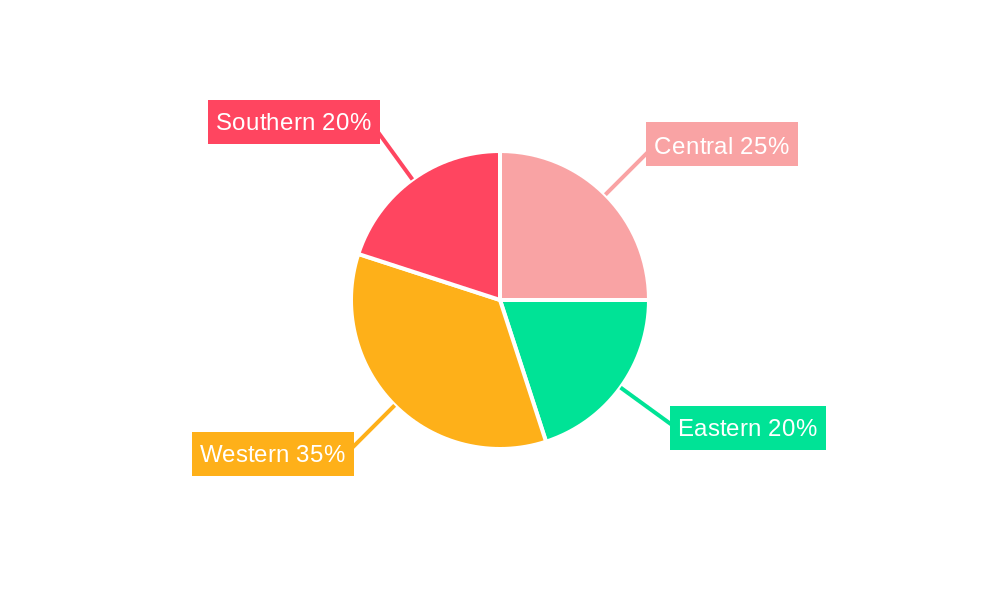

The competitive landscape comprises prominent global players like Medtronic, Becton Dickinson, and Philips, alongside regional players. These companies are actively engaged in strategic initiatives such as product innovation, partnerships, and acquisitions to maintain their market share. The increasing penetration of telehealth and the integration of AI and machine learning in patient monitoring solutions are also reshaping the market dynamics. Future growth will depend on the continued adoption of innovative technologies, successful integration of these technologies into existing healthcare systems, and continued government support for healthcare expansion in Saudi Arabia. Specific regional variations within Saudi Arabia (Central, Eastern, Western, Southern) will likely influence market penetration rates due to variations in healthcare infrastructure and accessibility. Further research into the specific needs and access patterns of each region would refine market estimations and strategies.

Saudi Arabia Patient Monitoring Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia patient monitoring industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025, this report examines market dynamics, key segments, leading players, and future growth potential. The report leverages extensive market research and data analysis to present actionable insights and forecasts for this rapidly evolving sector.

Saudi Arabia Patient Monitoring Industry Market Concentration & Dynamics

The Saudi Arabian patient monitoring market exhibits a moderately concentrated landscape, dominated by multinational corporations such as Medtronic PLC, Becton Dickinson and Company, and Siemens Healthcare. These players hold a significant market share, estimated at xx%, driven by their established brand reputation, extensive product portfolios, and robust distribution networks. However, the market also presents opportunities for smaller, specialized players focusing on niche applications or innovative technologies.

Market Concentration Metrics (2024):

- Top 3 players market share: xx%

- Top 5 players market share: xx%

- Number of M&A deals (2019-2024): xx

Market Dynamics:

- Innovation Ecosystem: The Saudi Arabian government's focus on healthcare modernization and digital transformation is fostering innovation in patient monitoring technologies. Investment in research and development, coupled with supportive regulatory frameworks, is encouraging the adoption of advanced solutions.

- Regulatory Framework: The Saudi Food and Drug Authority (SFDA) plays a crucial role in regulating medical devices, ensuring safety and efficacy. Stringent regulations can present challenges, but they also contribute to market stability and consumer confidence.

- Substitute Products: While patient monitoring is essential, certain aspects, such as basic vital sign monitoring, might be substituted with simpler, less technologically advanced devices. However, the trend is towards sophisticated remote patient monitoring systems.

- End-User Trends: The increasing prevalence of chronic diseases and an aging population are driving demand for patient monitoring devices, especially in home healthcare settings. Hospitals are also adopting advanced monitoring systems to enhance patient care and improve operational efficiency.

- M&A Activities: Consolidation through mergers and acquisitions is expected to continue, with larger companies seeking to expand their product portfolios and market reach.

Saudi Arabia Patient Monitoring Industry Industry Insights & Trends

The Saudi Arabia patient monitoring market is experiencing robust growth, driven by several key factors. The market size in 2024 was estimated at $xx Million, and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by rising healthcare expenditure, technological advancements, expanding healthcare infrastructure, and increased government initiatives to improve healthcare access and quality.

Key growth drivers include:

- Increasing Prevalence of Chronic Diseases: The rising incidence of cardiovascular diseases, diabetes, and respiratory illnesses is significantly boosting the demand for patient monitoring solutions.

- Government Initiatives: The Saudi Vision 2030 initiative emphasizes healthcare modernization, prompting significant investments in healthcare infrastructure and technology.

- Technological Advancements: The development of wireless, remote monitoring systems is transforming patient care, providing continuous monitoring outside traditional healthcare settings.

- Growing Adoption of Telehealth: The COVID-19 pandemic accelerated the adoption of telehealth, increasing the demand for remote patient monitoring solutions.

- Rising Disposable Incomes: The growing disposable incomes of the Saudi Arabian population are increasing healthcare spending, leading to higher adoption of advanced medical devices.

Key Markets & Segments Leading Saudi Arabia Patient Monitoring Industry

The Saudi Arabia patient monitoring market is segmented by application, end-user, and type of device. While all segments are experiencing growth, some are particularly dominant.

Dominant Segments:

- Application: Cardiology holds the largest market share due to the high prevalence of cardiovascular diseases. Respiratory monitoring is also a significant segment, reflecting the rising incidence of respiratory illnesses.

- End-Users: Hospitals constitute the largest end-user segment, followed by home healthcare, reflecting the increasing preference for remote patient monitoring and the rise in chronic disease management.

- Type of Device: Cardiac monitoring devices and respiratory monitoring devices hold significant market share, reflecting the demand for solutions addressing prevalent chronic conditions. Growth in remote monitoring devices is particularly notable.

Drivers for Segment Growth:

- Economic Growth: Strong economic growth in Saudi Arabia is leading to increased healthcare spending.

- Healthcare Infrastructure Development: Ongoing investments in modernizing healthcare infrastructure are supporting market expansion.

- Government Initiatives: Government programs focused on improving healthcare access and quality are driving demand for patient monitoring technologies.

Saudi Arabia Patient Monitoring Industry Product Developments

Recent product innovations have significantly advanced the Saudi Arabian patient monitoring market. Wireless and remote monitoring systems have gained prominence, offering improved patient convenience and enabling continuous monitoring outside of hospital settings. Miniaturization of devices, integration of advanced analytics, and enhanced data connectivity are further key trends. These developments offer improved diagnostic capabilities, enabling early detection of patient deterioration and facilitating timely interventions, thus improving patient outcomes and lowering healthcare costs.

Challenges in the Saudi Arabia Patient Monitoring Industry Market

The Saudi Arabian patient monitoring market faces challenges, including:

- High Initial Investment Costs: Advanced patient monitoring systems can be expensive, potentially limiting adoption in resource-constrained settings.

- Data Security and Privacy Concerns: The increased reliance on data-driven monitoring raises concerns about data security and privacy.

- Regulatory Hurdles: Navigating regulatory approvals for new medical devices can be time-consuming and complex.

- Skilled Personnel Shortage: The shortage of skilled healthcare professionals capable of operating and interpreting data from advanced monitoring systems could hinder market growth. This shortage impacts both the hospital and home healthcare sectors.

Forces Driving Saudi Arabia Patient Monitoring Industry Growth

Several factors are driving growth in the Saudi Arabian patient monitoring market:

- Technological Advancements: Innovations in wireless technology, AI, and data analytics are leading to more sophisticated and user-friendly monitoring systems.

- Economic Growth and Increased Healthcare Spending: Rising disposable incomes and government investments in healthcare are fueling market expansion.

- Government Initiatives: Government programs aimed at promoting telehealth and improving healthcare access are creating favorable market conditions.

- Rising Prevalence of Chronic Diseases: The increasing incidence of chronic conditions necessitates greater use of patient monitoring.

Long-Term Growth Catalysts in Saudi Arabia Patient Monitoring Industry

Long-term growth will be fueled by:

Continued innovation in remote patient monitoring technologies, particularly in areas such as wearable sensors and AI-powered diagnostics. Strategic partnerships between technology companies and healthcare providers will be key to successful market penetration and the development of integrated care pathways. The expansion of telehealth services and the integration of patient monitoring data into electronic health records (EHRs) will further drive market growth.

Emerging Opportunities in Saudi Arabia Patient Monitoring Industry

Emerging opportunities include:

- Growth of Home Healthcare: The increasing demand for home-based care presents a significant opportunity for remote patient monitoring systems.

- Integration of AI and Machine Learning: AI-powered analytics can enhance diagnostic accuracy and enable predictive monitoring, opening new avenues for market expansion.

- Development of Specialized Monitoring Solutions: The creation of devices catering to specific patient populations (e.g., elderly, patients with specific chronic conditions) offers significant potential.

Leading Players in the Saudi Arabia Patient Monitoring Industry Sector

- Medtronic PLC

- Becton Dickinson and Company

- Siemens Healthcare

- Koninklijke Philips NV

- GE Healthcare

- Baxter International Inc

- Dragerwerk AG

- Abbott Laboratories

Key Milestones in Saudi Arabia Patient Monitoring Industry Industry

- June 2022: GE Healthcare launched Portrait Mobile, a new wireless patient monitoring system designed for early detection of patient deterioration. This launch signifies a significant advancement in hospital-based monitoring technology.

- May 2022: A 5-year agreement between Tamer and a leading healthcare distributor introduced Huma's "hospitals at home" remote patient monitoring platform to 34 million residents. This initiative significantly expands access to remote monitoring, particularly for patients with diabetes and heart disease, thereby greatly increasing the demand for remote monitoring devices.

Strategic Outlook for Saudi Arabia Patient Monitoring Industry Market

The Saudi Arabia patient monitoring market is poised for significant growth over the next decade, driven by technological innovation, government initiatives, and the rising prevalence of chronic diseases. Companies focusing on developing cutting-edge remote monitoring solutions, integrating AI and machine learning, and establishing strong partnerships within the healthcare ecosystem will be best positioned to capitalize on the market's potential. The focus on improving healthcare access and affordability will also be critical for driving market penetration and achieving sustainable growth.

Saudi Arabia Patient Monitoring Industry Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Respiratory Monitoring Devices

- 1.5. Remote Monitoring Devices

- 1.6. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End-users

- 3.1. Home Healthcare

- 3.2. Hospitals

- 3.3. Other End Users

Saudi Arabia Patient Monitoring Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Patient Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Cardiology Segment is Expected to Witness Considerable Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Respiratory Monitoring Devices

- 5.1.5. Remote Monitoring Devices

- 5.1.6. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-users

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Central Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Patient Monitoring Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Medtronic PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Becton Dickinson and Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens Healthcare

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips NV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 GE Healthcare

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Baxter International Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dragerwerk AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Abbott Laboratories

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Medtronic PLC

List of Figures

- Figure 1: Saudi Arabia Patient Monitoring Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Patient Monitoring Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 8: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 9: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Central Saudi Arabia Patient Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Central Saudi Arabia Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Eastern Saudi Arabia Patient Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Eastern Saudi Arabia Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Western Saudi Arabia Patient Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Western Saudi Arabia Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Southern Saudi Arabia Patient Monitoring Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southern Saudi Arabia Patient Monitoring Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 22: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 23: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by End-users 2019 & 2032

- Table 26: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by End-users 2019 & 2032

- Table 27: Saudi Arabia Patient Monitoring Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Saudi Arabia Patient Monitoring Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Patient Monitoring Industry?

The projected CAGR is approximately 5.59%.

2. Which companies are prominent players in the Saudi Arabia Patient Monitoring Industry?

Key companies in the market include Medtronic PLC, Becton Dickinson and Company, Siemens Healthcare, Koninklijke Philips NV, GE Healthcare, Baxter International Inc, Dragerwerk AG, Abbott Laboratories.

3. What are the main segments of the Saudi Arabia Patient Monitoring Industry?

The market segments include Type of Device, Application, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD 222.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidences of Chronic Diseases; Growth in Geriatric Population; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Cardiology Segment is Expected to Witness Considerable Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Technology.

8. Can you provide examples of recent developments in the market?

June 2022 : GE Healthcare launched a new wireless patient monitoring system called Portrait Mobile. The new device has been designed to help clinicians detect early patient deterioration and constantly monitor patients' health during their stay at the hospital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Patient Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Patient Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Patient Monitoring Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Patient Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence