Key Insights

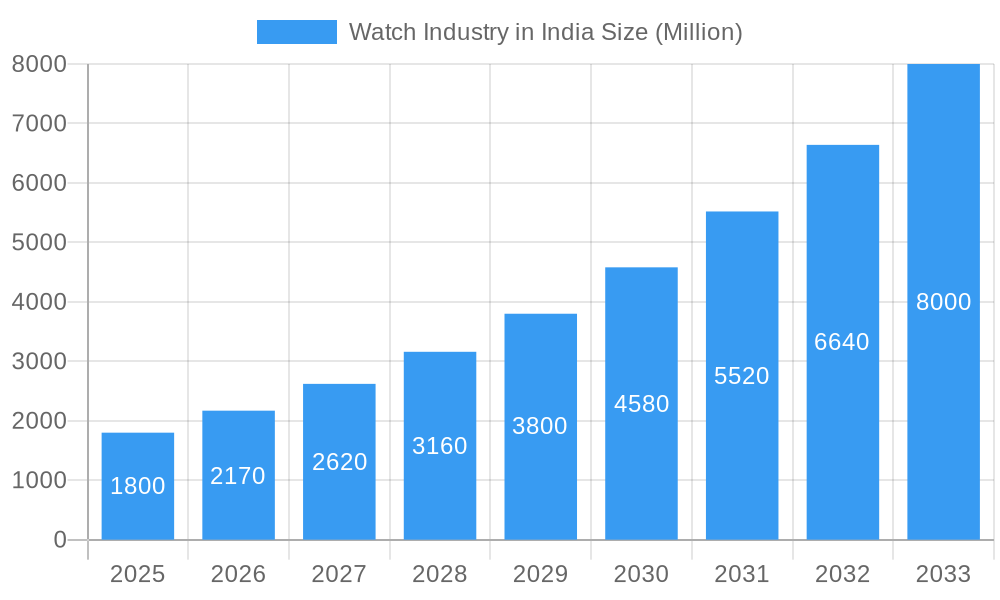

The Indian watch market, characterized by a fusion of heritage and innovation, is poised for substantial expansion. Fueled by increasing disposable incomes, a youthful, style-conscious demographic, and the accelerating adoption of smartwatches, the market is projected to achieve a significant Compound Annual Growth Rate (CAGR). With an estimated market size of 4.19 billion in the base year of 2025, the CAGR is anticipated to be 10.79%. Key growth drivers include smartwatches, appealing to the tech-savvy youth, and quartz watches, maintaining appeal through affordability and reliability. The growing preference for online retail channels mirrors India's broader e-commerce penetration, presenting both opportunities and challenges for traditional businesses. Brand loyalty remains a critical factor, with established brands like Titan (The Tata Group) maintaining a strong market position, alongside global players such as Samsung, Apple, and Fossil. However, increased competition from Chinese brands like Xiaomi and BBK Electronics, offering competitive pricing and advanced features, is notable. Market restraints include currency fluctuations impacting import costs and potential economic slowdowns affecting consumer expenditure.

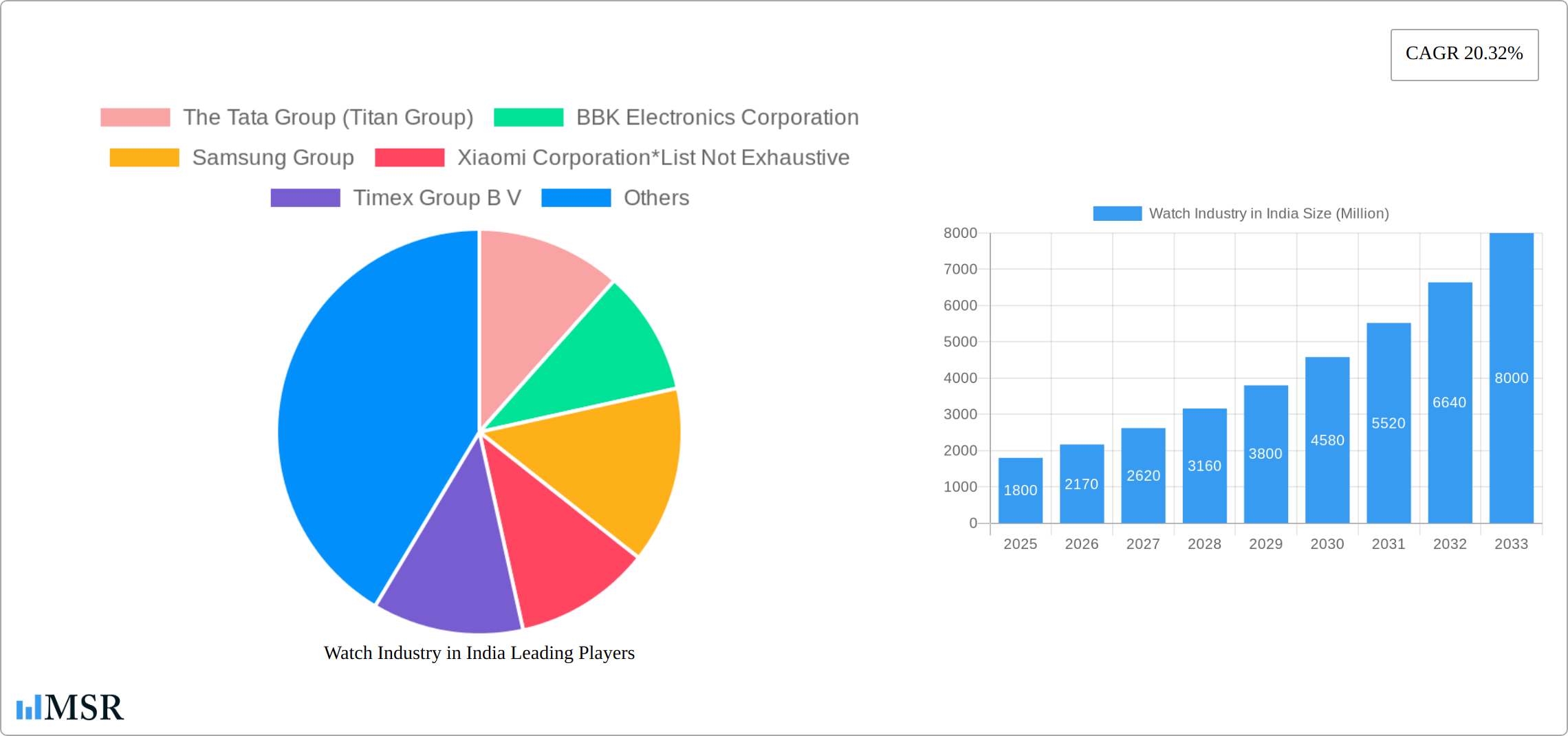

Watch Industry in India Market Size (In Billion)

The future outlook for the Indian watch market depends on several key factors. Sustained economic growth, the continued expansion of e-commerce, and advancements in smartwatch technology will be pivotal. Brands must prioritize product differentiation, targeted marketing strategies for diverse consumer segments, and efficient supply chain management to thrive in this competitive environment. Innovation in health and fitness tracking, connectivity, and aesthetic design will be essential for capturing a market increasingly seeking sophisticated and visually appealing timepieces. Focusing on affordability, accessibility, and cultivating brand loyalty will be crucial for capitalizing on the significant growth prospects within this market.

Watch Industry in India Company Market Share

Watch Industry in India: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indian watch industry, covering market dynamics, key players, emerging trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is an indispensable resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market.

Watch Industry in India Market Concentration & Dynamics

The Indian watch market exhibits a moderately concentrated structure, dominated by a mix of established international brands and rapidly growing domestic players. The market share of the top five players accounts for approximately xx% of the total revenue. This concentration is influenced by strong brand recognition, established distribution networks, and significant marketing investments. The Indian watch industry is characterized by a vibrant innovation ecosystem, with continuous product launches and technological advancements. However, regulatory frameworks, particularly those related to import duties and product standards, present certain challenges. Substitute products, primarily smartphones with integrated timekeeping and fitness tracking features, pose a considerable competitive threat.

- Market Share: Top 5 players – xx% (2024)

- M&A Activity: xx deals in the last 5 years (2019-2024)

- Innovation: Focus on smartwatches, hybrid models, and technologically advanced features.

- Regulatory Framework: Moderate impact on market growth.

- Substitute Products: Smartphones represent a key competitive threat.

- End-User Trends: Increasing preference for smartwatches and stylish designs.

Watch Industry in India Industry Insights & Trends

The Indian watch market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a burgeoning young population with a penchant for fashion and technology. The market size was estimated at xx Million USD in 2024 and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, particularly the rise of smartwatches with advanced health and fitness features, are reshaping consumer preferences. The market is witnessing a gradual shift from traditional analog watches toward smartwatches and digital watches. Evolving consumer behaviour, including a growing preference for online channels and a demand for personalized experiences, further shapes industry dynamics.

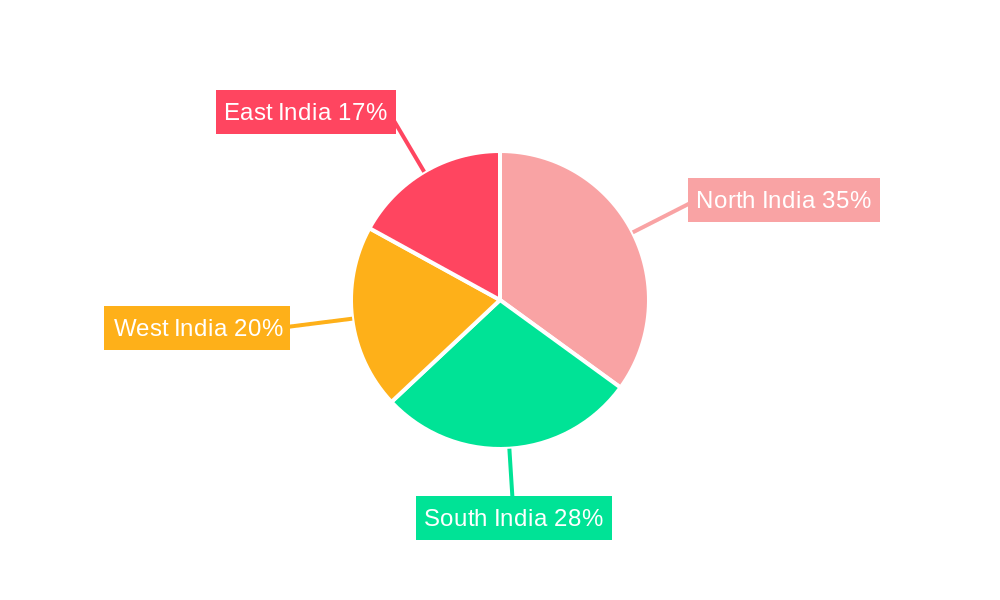

Key Markets & Segments Leading Watch Industry in India

The Indian watch market exhibits remarkable geographic diversity, with robust demand spanning major metropolitan areas and extending significantly into Tier-II cities. While demand is widespread, urban centers, characterized by higher purchasing power, contribute most substantially to overall market volume. The market's dynamism is further underscored by evolving consumer preferences and technological advancements.

Dominant Segments:

- Product Type: The smartwatch segment is experiencing explosive growth, driven by technological innovation and increasing consumer demand for fitness tracking and smart features. While smartwatches are rapidly gaining traction, traditional quartz watches continue to hold a substantial market share, demonstrating their enduring appeal. Digital watches cater to a niche but loyal consumer base.

- Distribution Channel: Offline retail stores remain the primary distribution channel, leveraging established relationships and in-person product experiences. However, the online retail sector is expanding at a rapid pace, offering consumers greater convenience and access to a wider selection of brands and products. Omnichannel strategies, integrating both online and offline channels, are becoming increasingly important for success.

- End Users: Men traditionally constitute a larger portion of the market, yet the women's segment is witnessing significant growth, reflecting changing social dynamics and increasing female participation in the workforce. The unisex segment is also emerging as a key contributor, driven by the increasing popularity of gender-neutral designs and styles.

Key Market Drivers:

- Economic Growth & Rising Disposable Incomes: A burgeoning middle class with increased disposable income fuels demand for premium and luxury watches, signaling a shift towards aspirational purchases.

- Technological Advancements & Smartwatch Features: The integration of advanced technology into smartwatches, including fitness tracking, contactless payments, and mobile notifications, is a major driver of growth in this segment.

- Urbanization & Increased Consumer Spending: Rapid urbanization leads to higher concentrations of population in urban areas with greater consumer spending power and increased exposure to global trends.

- Fashion Trends & Status Symbol: Watches are increasingly viewed not only as functional timekeeping devices but also as important fashion accessories and status symbols, influencing purchasing decisions.

- Government Initiatives & Policy Support (where applicable): Include any relevant government policies promoting domestic manufacturing or investment in the watch industry.

Watch Industry in India Product Developments

The Indian watch industry is witnessing rapid product innovation, driven by the integration of advanced technologies like heart rate monitoring, GPS tracking, contactless payments, and AMOLED displays into smartwatches. These advancements enhance the functionality and appeal of watches, fostering increased consumer engagement and market expansion. Competition is fostering a constant race to incorporate cutting-edge features, resulting in a diverse range of models catering to different consumer preferences and price points.

Challenges in the Watch Industry in India Market

The Indian watch market navigates a complex landscape of challenges. Intense competition from both established international brands and emerging domestic players creates a highly dynamic and competitive environment. Supply chain disruptions, coupled with fluctuations in raw material costs, impact production timelines and pricing strategies. Furthermore, regulatory hurdles related to imports and distribution add another layer of complexity. The prevalence of counterfeit products poses a significant threat, undermining the revenue streams of legitimate brands and impacting consumer trust. The fluctuating value of the Indian Rupee against major global currencies introduces further volatility into the market.

Forces Driving Watch Industry in India Growth

Several factors converge to propel growth within the Indian watch industry. The widespread adoption of smartwatches, fueled by continuous technological advancements, is a key driver. Economic growth, resulting in higher disposable incomes, allows consumers to allocate more spending towards discretionary items like watches. Supportive government policies focused on promoting domestic manufacturing contribute to increased production and job creation. The expansion of e-commerce platforms enhances market reach, improving access for consumers across the country, irrespective of geographic location. This confluence of positive factors strongly positions the Indian watch industry for sustained expansion and evolution.

Long-Term Growth Catalysts in the Watch Industry in India

Long-term growth hinges on sustained innovation in smartwatch technologies, strategic partnerships between domestic and international players, and expansion into untapped market segments. The development of highly customized and personalized products catering to niche consumer interests is also crucial. Building stronger supply chain resilience to mitigate external shocks will be vital for sustained growth.

Emerging Opportunities in Watch Industry in India

Emerging opportunities include the expansion into rural markets, the development of affordable smartwatches targeted at price-sensitive consumers, and the creation of specialized watches for specific activities or professions. Focus on sustainable and ethically sourced materials aligns with rising consumer consciousness. Leveraging the growing popularity of fitness and health tracking to integrate wellness features will enhance market penetration.

Leading Players in the Watch Industry in India Sector

- The Tata Group (Titan Group)

- BBK Electronics Corporation

- Samsung Group

- Xiaomi Corporation

- Timex Group B V

- Citizen Watch Co ltd

- The Swatch Group Ltd

- Seiko Holding Corporation

- Casio Computer Co Ltd

- Fossil Group Inc

- Apple Inc

Key Milestones in Watch Industry in India Industry

- December 2021: Titan's launch of its new smartwatch series marked a significant expansion into the rapidly growing smartwatch segment.

- September 2022: OnePlus introduced its Nord smartwatch series, highlighting advanced health and fitness tracking capabilities and appealing to tech-savvy consumers.

- September 2022: Realme's launch of the Realme Watch 3 Pro broadened its presence in the competitive smartwatch market, offering a value-driven option.

- Add more recent and relevant milestones here. Include brand launches, significant partnerships, technological breakthroughs, or other noteworthy events.

Strategic Outlook for Watch Industry in India Market

The Indian watch market presents a compelling growth opportunity, characterized by favorable demographics, a burgeoning middle class with increasing disposable incomes, and the continuous integration of cutting-edge technology. Companies adopting a strategic approach that prioritizes innovation, establishes strategic partnerships, cultivates robust supply chains, and implements effective marketing strategies are well-positioned to secure significant market share. A crucial element of this strategy involves expanding into niche segments, catering to specific consumer preferences and lifestyles, and leveraging the considerable potential of e-commerce channels to maximize market reach and enhance brand visibility. Adaptability to evolving consumer trends and proactive management of the challenges outlined above will be critical for sustained long-term success.

Watch Industry in India Segmentation

-

1. Product Type

- 1.1. Quartz Watch

- 1.2. Digital Watch

- 1.3. Smart Watch

-

2. Distribution Channel

- 2.1. Online Retail Stores

-

2.2. Offline Retail Stores

- 2.2.1. Specialty Stores

- 2.2.2. Supermarkets/Hypermarkets

- 2.2.3. Other Offline Retail Stores

-

3. End Users

- 3.1. Women

- 3.2. Men

- 3.3. Unisex

Watch Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Watch Industry in India Regional Market Share

Geographic Coverage of Watch Industry in India

Watch Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus

- 3.4. Market Trends

- 3.4.1. Consumer Inclination Toward Luxury Watches

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Quartz Watch

- 5.1.2. Digital Watch

- 5.1.3. Smart Watch

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail Stores

- 5.2.2. Offline Retail Stores

- 5.2.2.1. Specialty Stores

- 5.2.2.2. Supermarkets/Hypermarkets

- 5.2.2.3. Other Offline Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Women

- 5.3.2. Men

- 5.3.3. Unisex

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Quartz Watch

- 6.1.2. Digital Watch

- 6.1.3. Smart Watch

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail Stores

- 6.2.2. Offline Retail Stores

- 6.2.2.1. Specialty Stores

- 6.2.2.2. Supermarkets/Hypermarkets

- 6.2.2.3. Other Offline Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Women

- 6.3.2. Men

- 6.3.3. Unisex

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Quartz Watch

- 7.1.2. Digital Watch

- 7.1.3. Smart Watch

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail Stores

- 7.2.2. Offline Retail Stores

- 7.2.2.1. Specialty Stores

- 7.2.2.2. Supermarkets/Hypermarkets

- 7.2.2.3. Other Offline Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Women

- 7.3.2. Men

- 7.3.3. Unisex

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Quartz Watch

- 8.1.2. Digital Watch

- 8.1.3. Smart Watch

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail Stores

- 8.2.2. Offline Retail Stores

- 8.2.2.1. Specialty Stores

- 8.2.2.2. Supermarkets/Hypermarkets

- 8.2.2.3. Other Offline Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Women

- 8.3.2. Men

- 8.3.3. Unisex

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Quartz Watch

- 9.1.2. Digital Watch

- 9.1.3. Smart Watch

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail Stores

- 9.2.2. Offline Retail Stores

- 9.2.2.1. Specialty Stores

- 9.2.2.2. Supermarkets/Hypermarkets

- 9.2.2.3. Other Offline Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Women

- 9.3.2. Men

- 9.3.3. Unisex

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Watch Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Quartz Watch

- 10.1.2. Digital Watch

- 10.1.3. Smart Watch

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail Stores

- 10.2.2. Offline Retail Stores

- 10.2.2.1. Specialty Stores

- 10.2.2.2. Supermarkets/Hypermarkets

- 10.2.2.3. Other Offline Retail Stores

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Women

- 10.3.2. Men

- 10.3.3. Unisex

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Tata Group (Titan Group)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BBK Electronics Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi Corporation*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Timex Group B V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Citizen Watch Co ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Swatch Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seiko Holding Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Casio Computer Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fossil Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 The Tata Group (Titan Group)

List of Figures

- Figure 1: Global Watch Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 7: North America Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: South America Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 15: South America Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 16: South America Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Europe Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 23: Europe Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Europe Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 31: Middle East & Africa Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East & Africa Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Watch Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Watch Industry in India Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Watch Industry in India Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Watch Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Watch Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Watch Industry in India Revenue (billion), by End Users 2025 & 2033

- Figure 39: Asia Pacific Watch Industry in India Revenue Share (%), by End Users 2025 & 2033

- Figure 40: Asia Pacific Watch Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Watch Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 4: Global Watch Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 8: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 15: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 22: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 35: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Watch Industry in India Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Watch Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Watch Industry in India Revenue billion Forecast, by End Users 2020 & 2033

- Table 45: Global Watch Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Watch Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Watch Industry in India?

The projected CAGR is approximately 10.79%.

2. Which companies are prominent players in the Watch Industry in India?

Key companies in the market include The Tata Group (Titan Group), BBK Electronics Corporation, Samsung Group, Xiaomi Corporation*List Not Exhaustive, Timex Group B V, Citizen Watch Co ltd, The Swatch Group Ltd, Seiko Holding Corporation, Casio Computer Co Ltd, Fossil Group Inc, Apple Inc.

3. What are the main segments of the Watch Industry in India?

The market segments include Product Type, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Snus as Harmless Cigerette Substitute; Availability of Variety of Flavors.

6. What are the notable trends driving market growth?

Consumer Inclination Toward Luxury Watches.

7. Are there any restraints impacting market growth?

Stringent Government Regulations in Some Countries; Risks Associated with Over Consumption of Snus.

8. Can you provide examples of recent developments in the market?

In September 2022, BBK Electronics Corporation subsidiary OnePlus announced the launch of its smartwatch series 'Nord' in India. The OnePlus Nord Watch has a 1.78-inch AMOLED display with a refresh rate of 60Hz. It boasts a peak brightness of 500 nits. The smartwatch features 105 different sports modes. The device's key features are monitoring blood level, stress, and heart rate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Watch Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Watch Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Watch Industry in India?

To stay informed about further developments, trends, and reports in the Watch Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence