Key Insights

The Asia-Pacific pharmaceutical plastic packaging market is experiencing robust growth, driven by factors such as the rising prevalence of chronic diseases, increasing demand for pharmaceutical products, and the growing preference for convenient and safe packaging solutions. The market size in 2025 is estimated at $14.6 billion, exhibiting a Compound Annual Growth Rate (CAGR) of 7.36% from 2019 to 2033. This expansion is fueled by several key trends, including the increasing adoption of advanced packaging technologies like blister packs and modified atmosphere packaging (MAP) to enhance product shelf life and prevent contamination. Furthermore, stringent regulatory requirements regarding drug safety and traceability are pushing manufacturers to invest in innovative and compliant packaging solutions. The growing pharmaceutical industry in countries like India and China, coupled with rising disposable incomes and healthcare expenditure, are significant contributors to market growth. However, challenges such as fluctuating raw material prices and environmental concerns related to plastic waste pose potential restraints. The market is segmented by packaging type (e.g., bottles, vials, blister packs), material (e.g., PET, HDPE, PVC), and application (e.g., tablets, capsules, injectables). Major players, including Gerresheimer AG, Amcor PLC, and Berry Global Group Inc., are focusing on expanding their product portfolios and geographical reach to capitalize on the market opportunities. This competitive landscape fosters innovation and drives the development of sustainable packaging options.

The forecast period from 2025 to 2033 anticipates continued market expansion, with a projected increase in demand primarily driven by the increasing adoption of pharmaceutical products across various therapeutic areas. The market's growth trajectory will be significantly influenced by government regulations promoting sustainable practices within the pharmaceutical industry and technological advancements in packaging materials offering enhanced barrier properties and improved patient convenience. While challenges exist, the overall market outlook remains optimistic, with significant opportunities for players focused on innovation, sustainability, and meeting the evolving needs of the pharmaceutical sector in the Asia-Pacific region. The market's continued growth trajectory reflects both the expanding pharmaceutical industry and a growing focus on product safety and efficacy.

Asia-Pacific Pharmaceutical Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Pharmaceutical Plastic Packaging Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities within this rapidly evolving sector. The report features detailed analysis of key players including Gerresheimer AG, Amcor PLC, Berry Global Group Inc., and more.

Asia-Pacific Pharmaceutical Plastic Packaging Market Concentration & Dynamics

The Asia-Pacific pharmaceutical plastic packaging market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller companies and regional players fosters a dynamic competitive environment. Innovation is a key differentiator, with companies investing heavily in R&D to develop advanced materials, sustainable packaging solutions, and improved tamper-evident features. Stringent regulatory frameworks, varying across countries in the region, significantly influence packaging design and material selection. Substitute products, such as glass and aluminum, present ongoing competition, though plastic maintains its dominance due to cost-effectiveness and versatility. End-user trends toward convenience, safety, and sustainability are driving demand for innovative packaging solutions. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, primarily focused on expanding market reach and enhancing product portfolios. Market share distribution reveals that the top 5 players collectively account for approximately xx% of the market, leaving ample space for growth and consolidation.

Asia-Pacific Pharmaceutical Plastic Packaging Market Industry Insights & Trends

The Asia-Pacific pharmaceutical plastic packaging market is experiencing robust growth, driven by factors including rising healthcare expenditure, increasing pharmaceutical production, and a growing aging population requiring more medication. The market size was valued at approximately $xx Million in 2024 and is projected to reach $xx Million by 2033, exhibiting a CAGR of xx%. Technological advancements, such as the integration of smart packaging technologies and the development of sustainable, biodegradable plastics, are reshaping the industry. Evolving consumer preferences towards convenience, safety, and environmentally friendly products influence packaging design and material selection. This shift presents a significant opportunity for manufacturers who embrace sustainable practices and innovate their offerings. Growing demand for specialized drug delivery systems and personalized medicine further fuels market expansion.

Key Markets & Segments Leading Asia-Pacific Pharmaceutical Plastic Packaging Market

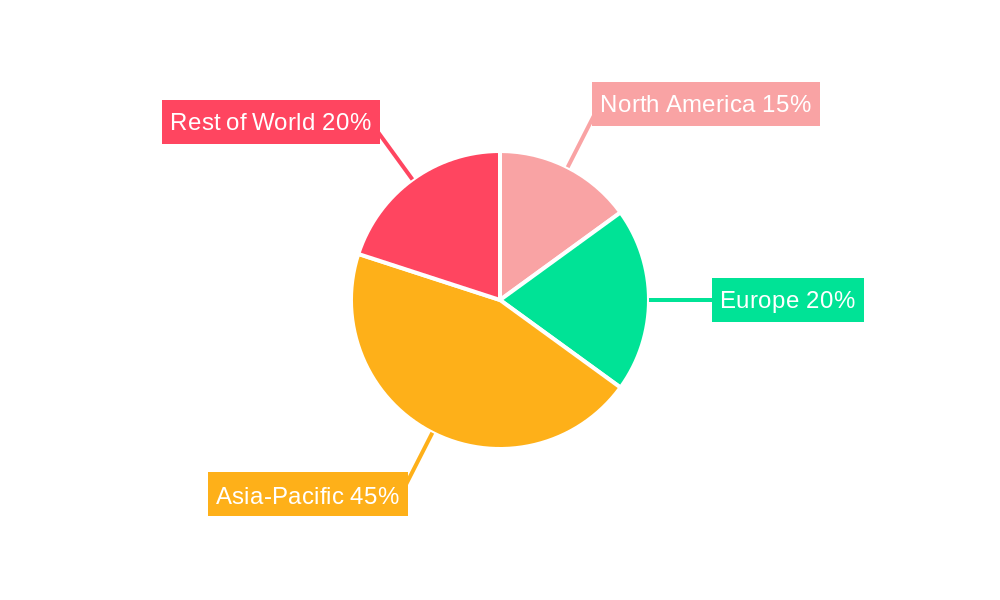

China and India are the dominant markets in the Asia-Pacific region, accounting for a combined xx% of the total market share in 2024.

- China: Robust pharmaceutical industry growth, expanding healthcare infrastructure, and increasing disposable incomes fuel high demand for pharmaceutical packaging.

- India: Large population, rising healthcare awareness, and government initiatives promoting pharmaceutical manufacturing significantly contribute to market expansion.

- Other Key Markets: Japan, South Korea, Australia, and Singapore also demonstrate significant growth potential, driven by factors such as aging populations, rising healthcare expenditure, and technological advancements.

Drivers for market dominance in these regions include:

- Economic Growth: Increasing disposable incomes and robust healthcare spending contribute to higher demand.

- Improved Healthcare Infrastructure: Expanding hospital networks and improved healthcare access drive pharmaceutical consumption.

- Government Initiatives: Regulatory support for pharmaceutical manufacturing and quality standards boosts market growth.

- Technological Advancements: Adoption of innovative packaging solutions and manufacturing technologies contributes to improved efficiency and product quality.

Asia-Pacific Pharmaceutical Plastic Packaging Market Product Developments

Recent product innovations focus on enhancing safety, convenience, and sustainability. Child-resistant closures with advanced digital technologies are gaining traction, addressing concerns related to medication adherence and accidental ingestion. The development of eco-friendly, biodegradable plastics is gaining momentum as a response to environmental concerns. Furthermore, advancements in tamper-evident packaging and customized solutions for specialized drug delivery systems are improving the overall market offering and competitive landscape.

Challenges in the Asia-Pacific Pharmaceutical Plastic Packaging Market

The Asia-Pacific pharmaceutical plastic packaging market faces several challenges, including stringent regulatory compliance requirements, complex supply chains prone to disruptions, and intense competition from established players and new entrants. These factors can lead to increased costs, production delays, and challenges in maintaining market share. For instance, non-compliance with regulatory standards can result in significant penalties and product recalls, impacting profitability and brand reputation. Furthermore, supply chain vulnerabilities can be exacerbated by geopolitical instability, natural disasters, and pandemics. Quantifiable impacts may include xx% increase in production costs due to supply chain disruptions and xx% loss of revenue due to product recalls.

Forces Driving Asia-Pacific Pharmaceutical Plastic Packaging Market Growth

Key growth drivers include rising healthcare expenditure, expanding pharmaceutical production, technological advancements (such as smart packaging and sustainable materials), and favorable government regulations promoting domestic manufacturing. The growing prevalence of chronic diseases and an aging population further fuels demand for innovative packaging solutions that enhance medication adherence and patient safety. For example, the increasing adoption of blister packs and unit-dose packaging reflects the trend towards convenient and safe medication dispensing.

Long-Term Growth Catalysts in the Asia-Pacific Pharmaceutical Plastic Packaging Market

Long-term growth in this market will be driven by continued innovation in materials and technologies, strategic partnerships between packaging manufacturers and pharmaceutical companies, and expansion into emerging markets within the Asia-Pacific region. The increasing adoption of advanced packaging technologies such as active and intelligent packaging systems, which provide enhanced product protection and traceability, will create substantial opportunities for growth. Collaboration between manufacturers and pharmaceutical companies will lead to the development of customized packaging solutions tailored to specific drug formulations and patient needs.

Emerging Opportunities in Asia-Pacific Pharmaceutical Plastic Packaging Market

Emerging opportunities lie in the growing adoption of sustainable packaging solutions, the increasing demand for specialized drug delivery systems (e.g., inhalers, injectables), and expansion into new markets within the Asia-Pacific region. The demand for tamper-evident and counterfeit-resistant packaging is also creating opportunities for innovation and growth.

Leading Players in the Asia-Pacific Pharmaceutical Plastic Packaging Market Sector

- Gerresheimer AG

- Amcor PLC

- Berry Global Group Inc

- Klockner Pentaplast Group

- NIPRO EUROPE GROUP COMPANIES

- Bormioli Pharma (Shanghai) Trading Co Ltd (Bormioli Pharma SpA)

- Cole-Parmer Instrument Company LLC

- Taisei Medical Co Ltd

- Shandong Pharmaceutical Glass Co LTD

- Lifelong Meditech Private Limited

- Hi-Tech Syringes

- Cartel Healthcare Pvt Ltd

- Parekhplast India Limited

- JSK Plastic Industries

- ALPLA Group

- Nathan Healthcare Pvt Ltd

- *List Not Exhaustive

Key Milestones in Asia-Pacific Pharmaceutical Plastic Packaging Market Industry

- March 2024: Berry Global Group Inc. celebrated the first anniversary of its groundbreaking child-resistant closure equipped with cutting-edge digital technology, enhancing medication adherence. This signals a significant advancement in packaging security and patient safety.

- February 2024: Shriji Polymers (India) Limited's investment in Parekhplast India Limited strengthens its position in the rigid plastic packaging market, indicating a strategic move towards consolidating market share.

Strategic Outlook for Asia-Pacific Pharmaceutical Plastic Packaging Market

The Asia-Pacific pharmaceutical plastic packaging market is poised for substantial growth in the coming years, driven by a confluence of factors including rising healthcare spending, technological advancements, and increasing demand for safe and sustainable packaging solutions. Companies that invest in R&D, embrace sustainable practices, and establish strategic partnerships will be well-positioned to capitalize on emerging opportunities and achieve long-term success in this dynamic market. The focus on innovative, sustainable, and patient-centric packaging solutions will be crucial for future market leadership.

Asia-Pacific Pharmaceutical Plastic Packaging Market Segmentation

-

1. Raw Material

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Low Density Polyethylene (LDPE)

- 1.4. High Density Polyethylene (HDPE)

- 1.5. Other Raw Materials

-

2. Product Type**

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Pouches

- 2.7. Vials and Ampoules

- 2.8. Cartridges

- 2.9. Syringes

- 2.10. Caps and Closure

- 2.11. Other Product Types

Asia-Pacific Pharmaceutical Plastic Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Pharmaceutical Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Diabetic Patients in the Region Aids the Sales of Disposable Pharmaceutical Plastic Packaging Solutions; Rise in Number of Pharmaceutical Companies in the Region and Easy Availability of Raw Material

- 3.3. Market Restrains

- 3.3.1. Increasing Number of Diabetic Patients in the Region Aids the Sales of Disposable Pharmaceutical Plastic Packaging Solutions; Rise in Number of Pharmaceutical Companies in the Region and Easy Availability of Raw Material

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Rates Propel Growth in Pharmaceutical Plastic Packaging Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Pharmaceutical Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Low Density Polyethylene (LDPE)

- 5.1.4. High Density Polyethylene (HDPE)

- 5.1.5. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type**

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Pouches

- 5.2.7. Vials and Ampoules

- 5.2.8. Cartridges

- 5.2.9. Syringes

- 5.2.10. Caps and Closure

- 5.2.11. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Gerresheimer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Klockner Pentaplast Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 NIPRO EUROPE GROUP COMPANIES

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bormioli Pharma (Shanghai) Trading Co Ltd (Bormioli Pharma SpA)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cole-Parmer Instrument Company LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Taisei Medical Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shandong Pharmaceutical Glass Co LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lifelong Meditech Private Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hi-Tech Syringes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Cartel Healthcare Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Parekhplast India Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 JSK Plastic Industries

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 ALPLA Group

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Nathan Healthcare Pvt Ltd*List Not Exhaustive

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Gerresheimer AG

List of Figures

- Figure 1: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Pharmaceutical Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 4: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2019 & 2032

- Table 5: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2019 & 2032

- Table 6: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2019 & 2032

- Table 7: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 10: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2019 & 2032

- Table 11: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2019 & 2032

- Table 12: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2019 & 2032

- Table 13: Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia-Pacific Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: China Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: New Zealand Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Malaysia Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Singapore Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Thailand Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Thailand Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Vietnam Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Vietnam Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Philippines Asia-Pacific Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Philippines Asia-Pacific Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Pharmaceutical Plastic Packaging Market?

The projected CAGR is approximately 7.36%.

2. Which companies are prominent players in the Asia-Pacific Pharmaceutical Plastic Packaging Market?

Key companies in the market include Gerresheimer AG, Amcor PLC, Berry Global Group Inc, Klockner Pentaplast Group, NIPRO EUROPE GROUP COMPANIES, Bormioli Pharma (Shanghai) Trading Co Ltd (Bormioli Pharma SpA), Cole-Parmer Instrument Company LLC, Taisei Medical Co Ltd, Shandong Pharmaceutical Glass Co LTD, Lifelong Meditech Private Limited, Hi-Tech Syringes, Cartel Healthcare Pvt Ltd, Parekhplast India Limited, JSK Plastic Industries, ALPLA Group, Nathan Healthcare Pvt Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Pharmaceutical Plastic Packaging Market?

The market segments include Raw Material, Product Type**.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Diabetic Patients in the Region Aids the Sales of Disposable Pharmaceutical Plastic Packaging Solutions; Rise in Number of Pharmaceutical Companies in the Region and Easy Availability of Raw Material.

6. What are the notable trends driving market growth?

Rising Diabetes Rates Propel Growth in Pharmaceutical Plastic Packaging Market.

7. Are there any restraints impacting market growth?

Increasing Number of Diabetic Patients in the Region Aids the Sales of Disposable Pharmaceutical Plastic Packaging Solutions; Rise in Number of Pharmaceutical Companies in the Region and Easy Availability of Raw Material.

8. Can you provide examples of recent developments in the market?

March 2024: Berry Global Group Inc. celebrated the first anniversary of its groundbreaking child-resistant closure. This closure, equipped with cutting-edge digital technology, is tailored for drug development, clinical trials, research, and academic studies, significantly enhancing medication adherence.February 2024: Shriji Polymers (India) Limited, a prominent player in rigid plastic packaging solutions for the pharmaceutical sector, commemorated a year since its investment in Parekhplast India Limited. This strategic move is poised to bolster Shriji's foothold in the rigid plastic packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Pharmaceutical Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Pharmaceutical Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Pharmaceutical Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Pharmaceutical Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence