Key Insights

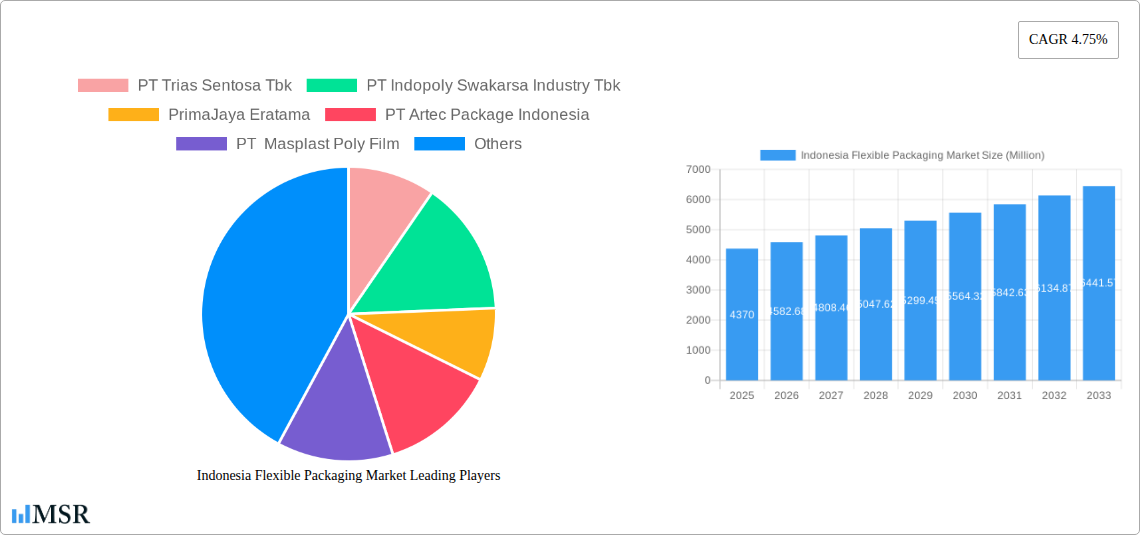

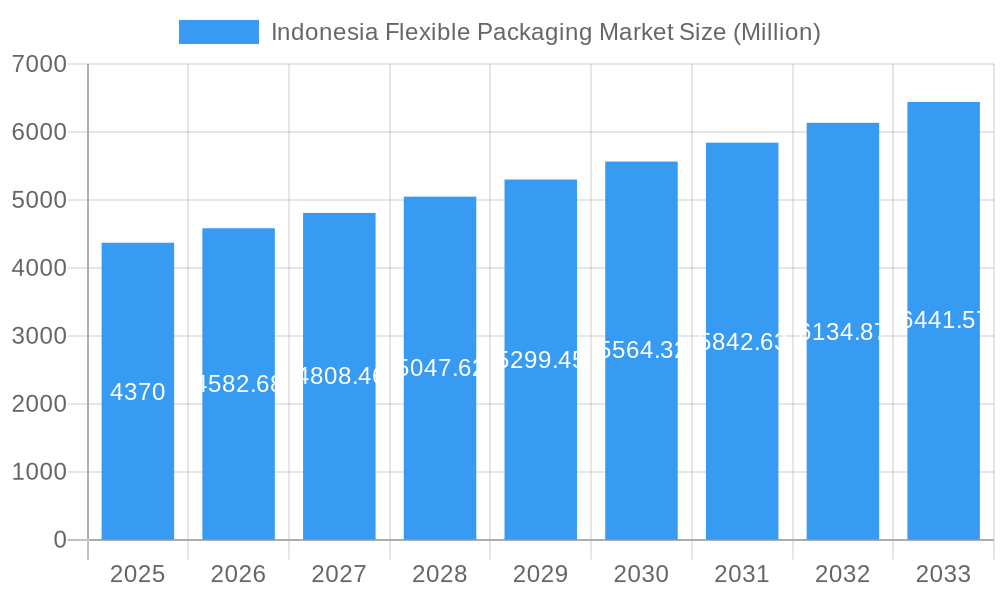

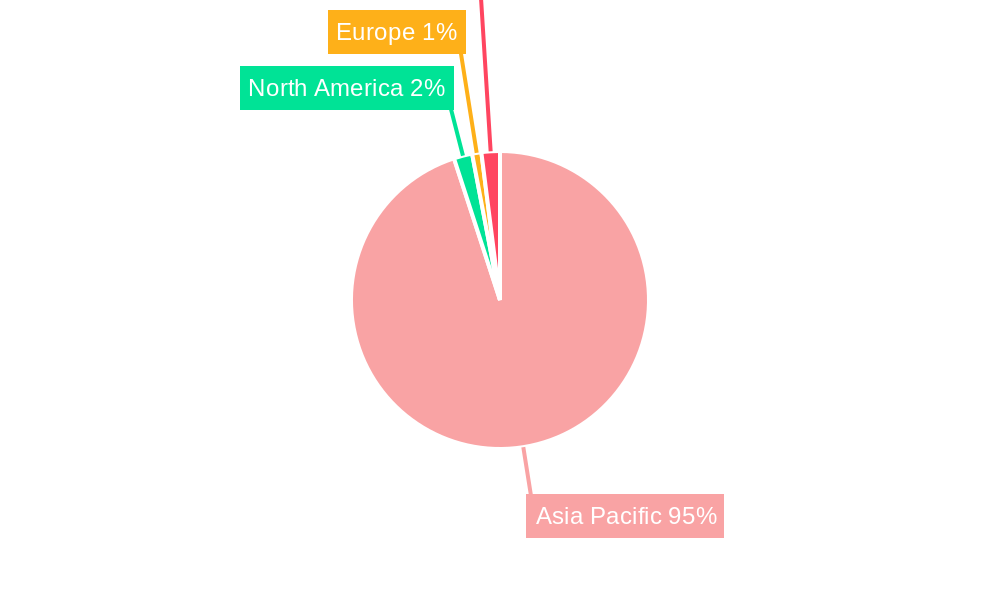

The Indonesia flexible packaging market, valued at $4.37 billion in 2025, is projected to experience robust growth, driven by a burgeoning food and beverage sector, rising e-commerce adoption fueling demand for convenient packaging solutions, and a growing pharmaceutical and personal care industry. The market's Compound Annual Growth Rate (CAGR) of 4.75% from 2025 to 2033 indicates a significant expansion over the forecast period. Key growth drivers include increasing consumer preference for convenient and shelf-stable packaged goods, coupled with advancements in packaging technology, such as sustainable and recyclable materials. The dominance of plastic in the material type segment is expected to continue, although the increasing focus on environmental sustainability will likely stimulate growth within the paper and metal segments in the coming years. Pouches remain the most prevalent structure, given their versatility and cost-effectiveness, followed by bags and wraps. Competition is relatively high, with both domestic and international players vying for market share. Leading companies like PT Trias Sentosa Tbk and PT Indopoly Swakarsa Industry Tbk are establishing strong positions, while international players are expanding their presence through strategic partnerships and investments. The Asia-Pacific region, particularly Indonesia, is a key growth area due to its rapidly expanding economy and rising consumer spending.

Indonesia Flexible Packaging Market Market Size (In Billion)

The market segmentation reveals further insights. The food and beverage application holds the largest share, driven by strong demand for packaged foods and beverages. The pharmaceutical and personal care segments are also exhibiting significant growth, propelled by heightened health consciousness and increasing disposable incomes. However, challenges remain, including fluctuating raw material prices, stringent regulatory compliance requirements, and the evolving consumer preference towards sustainable packaging. Companies are actively addressing these challenges by investing in innovative packaging solutions, embracing circular economy principles, and expanding their product portfolios to cater to diverse consumer needs. This dynamic interplay of drivers and restraints will shape the future trajectory of the Indonesia flexible packaging market.

Indonesia Flexible Packaging Market Company Market Share

Indonesia Flexible Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia flexible packaging market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033 and a base year of 2025. The report meticulously examines market dynamics, key segments, leading players, and emerging opportunities within this rapidly growing sector. Expect detailed analysis of market size (valued in Millions USD) and CAGR, supported by data and forecasts.

Indonesia Flexible Packaging Market Market Concentration & Dynamics

The Indonesian flexible packaging market exhibits a moderately concentrated landscape, with a handful of large players alongside numerous smaller, regional firms. Market share is largely determined by production capacity, technological advancements, and established distribution networks. The market is witnessing increasing consolidation through mergers and acquisitions (M&A) activities, particularly among companies seeking to expand their product portfolios and geographic reach.

Market Concentration Metrics (2024 Estimates):

- Top 5 players: xx% market share

- Top 10 players: xx% market share

Innovation Ecosystem: Innovation is driven by both domestic and international players, focusing on sustainable materials (e.g., biodegradable plastics), improved barrier properties, and advanced printing technologies. The regulatory framework, while evolving, increasingly emphasizes sustainability and food safety standards. Substitute products, such as rigid packaging, face competition from flexible packaging's cost-effectiveness and versatility. End-user trends reflect a growing preference for convenient, tamper-evident, and environmentally friendly packaging.

M&A Activity (2019-2024):

- Total M&A deals: xx

- Average deal value: xx Million USD

Indonesia Flexible Packaging Market Industry Insights & Trends

The Indonesian flexible packaging market is experiencing robust growth, driven by several key factors. The expanding food and beverage sector, coupled with rising disposable incomes and changing consumer preferences, is a major catalyst. Technological advancements, such as the adoption of flexible packaging films with enhanced barrier properties and sustainable materials, further contribute to market expansion. The market size reached xx Million USD in 2024, and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period. Evolving consumer behaviors, particularly the increased demand for convenience and eco-friendly packaging options, are reshaping the market landscape. This is leading to innovative product development and increased investment in sustainable packaging solutions. Furthermore, growth is further supported by improving infrastructure, facilitating efficient transportation and distribution of packaged goods across the archipelago.

Key Markets & Segments Leading Indonesia Flexible Packaging Market

The Indonesian flexible packaging market is segmented by material type (plastic, paper, metal), structure (pouches, bags, wraps), and application (food and beverage, pharmaceuticals, personal care, industrial).

Dominant Segments:

- Material Type: Plastic dominates, driven by its versatility, cost-effectiveness, and barrier properties. However, increasing demand for sustainable alternatives is fueling growth in paper-based and bio-based flexible packaging.

- Structure: Pouches and bags represent the largest segments, catering to diverse applications across various industries.

- Application: The food and beverage sector is the largest application segment, followed by personal care and pharmaceuticals.

Drivers by Segment:

- Food & Beverage: Rising consumption of processed foods and beverages, increasing urbanization, and a growing middle class.

- Pharmaceuticals: Stringent regulatory requirements for drug packaging and a growing healthcare sector.

- Personal Care: Rising demand for convenient and attractively packaged personal care products.

Indonesia Flexible Packaging Market Product Developments

Significant product innovations are observed, with a strong emphasis on sustainable materials, enhanced barrier properties, and advanced printing technologies. Companies are increasingly focusing on developing flexible packaging solutions that meet the evolving needs of consumers and brands, including retort pouches for extended shelf life, stand-up pouches for convenience, and flexible packaging with improved recyclability. These advancements offer significant competitive advantages in the market.

Challenges in the Indonesia Flexible Packaging Market Market

The Indonesian flexible packaging market faces several challenges, including fluctuating raw material prices, dependence on imported materials, stringent environmental regulations, and intense competition. Supply chain disruptions, particularly related to logistics and transportation within the archipelago, can also impact market growth. The competitive landscape is further characterized by the presence of both established multinational corporations and dynamic local players.

Forces Driving Indonesia Flexible Packaging Market Growth

Key growth drivers include the burgeoning food and beverage sector, increasing demand for convenient and attractive packaging, rising disposable incomes, expanding e-commerce, and government initiatives promoting industrial development. Technological advancements, such as the adoption of sustainable materials and advanced printing technologies, further enhance market growth. Favorable economic conditions and infrastructure development also contribute positively to the market's expansion.

Challenges in the Indonesia Flexible Packaging Market Market

Long-term growth hinges on adapting to evolving consumer preferences, embracing sustainable practices, and strengthening supply chains. Further expansion requires strategic partnerships, investments in research and development, and expansion into new market segments, such as e-commerce. Companies are increasingly adopting automation and technology to improve efficiency and meet growing demand.

Emerging Opportunities in Indonesia Flexible Packaging Market

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging options, the expansion of the e-commerce sector, and the increasing popularity of ready-to-eat meals and convenient food products. The adoption of smart packaging technologies, allowing for improved product traceability and consumer engagement, also presents significant opportunities.

Leading Players in the Indonesia Flexible Packaging Market Sector

- PT Trias Sentosa Tbk

- PT Indopoly Swakarsa Industry Tbk

- PrimaJaya Eratama

- PT Artec Package Indonesia

- PT Masplast Poly Film

- Mondi Group

- PT Karuniatama Polypack

- PT Indonesia Toppan Group

- PT Polidayaguna Perkasa

- PT Dinakara Putra

- PT ePac Flexibles Indonesia

- PT Argha Prima Industry

- PT Lotte Packaging

Key Milestones in Indonesia Flexible Packaging Market Industry

- September 2022: Toyobo's USD 71 Million investment in a new polyester packaging film factory in Indonesia through a joint venture with PT Trias Sentosa, signifying a significant commitment to expanding local production capacity and meeting rising demand for sustainable packaging solutions. Expected operational start: Late 2025.

- May 2022: Lamipak's USD 193.04 Million investment in a new Indonesian aseptic packaging factory, representing a major expansion in the country's aseptic packaging capabilities and highlighting the growing demand for advanced packaging technologies within the food and beverage sector.

Strategic Outlook for Indonesia Flexible Packaging Market Market

The Indonesian flexible packaging market holds significant long-term growth potential, driven by continued economic expansion, rising consumer demand, and the increasing adoption of innovative packaging solutions. Strategic opportunities lie in focusing on sustainable materials, enhancing supply chain efficiency, and exploring partnerships to tap into new markets and technologies. The focus on eco-friendly and convenient packaging will be pivotal for future success in this dynamic market.

Indonesia Flexible Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Flexible Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Flexible Packaging Market Regional Market Share

Geographic Coverage of Indonesia Flexible Packaging Market

Indonesia Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift Toward Light Weight and Smaller Pack Types to aid the Demand for Flexible Packaging; Packaging Films are Expected to Register Strong Growth in the Food and Pharmaceutical Sector

- 3.3. Market Restrains

- 3.3.1. Lack of a Defined Recycling Plans Coupled with Environmental Challenges

- 3.4. Market Trends

- 3.4.1. Packaging Films to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Trias Sentosa Tbk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Indopoly Swakarsa Industry Tbk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PrimaJaya Eratama

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Artec Package Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Masplast Poly Film

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Karuniatama Polypack

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Indonesia Toppan Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Polidayaguna Perkasa*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Dinakara Putra

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT ePac Flexibles Indonesia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Argha Prima Industry

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT Lotte Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 PT Trias Sentosa Tbk

List of Figures

- Figure 1: Indonesia Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Flexible Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Flexible Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Flexible Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Flexible Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Flexible Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Indonesia Flexible Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Flexible Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Flexible Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Flexible Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Flexible Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Flexible Packaging Market?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Indonesia Flexible Packaging Market?

Key companies in the market include PT Trias Sentosa Tbk, PT Indopoly Swakarsa Industry Tbk, PrimaJaya Eratama, PT Artec Package Indonesia, PT Masplast Poly Film, Mondi Group, PT Karuniatama Polypack, PT Indonesia Toppan Group, PT Polidayaguna Perkasa*List Not Exhaustive, PT Dinakara Putra, PT ePac Flexibles Indonesia, PT Argha Prima Industry, PT Lotte Packaging.

3. What are the main segments of the Indonesia Flexible Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Shift Toward Light Weight and Smaller Pack Types to aid the Demand for Flexible Packaging; Packaging Films are Expected to Register Strong Growth in the Food and Pharmaceutical Sector.

6. What are the notable trends driving market growth?

Packaging Films to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Lack of a Defined Recycling Plans Coupled with Environmental Challenges.

8. Can you provide examples of recent developments in the market?

September 2022 - Toyobo, a Japanese textile and fiber manufacturer, announced plans to build a polyester packaging film factory in Indonesia. To address the rising demand for environmentally friendly film products, the factory will be situated at Pt Trias Toyobo Astria (TTA), a joint venture (JV) established by Toyobo and Indonesian (plastic) filmmaker PT Trias Sentosa (Trias). The project will receive an investment from Toyobo of about JPY 10 billion (USD 71 million), and work is expected to start in early 2024. According to the firm, the investment will increase TTA's production capacity and is anticipated to be operational by late 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence