Key Insights

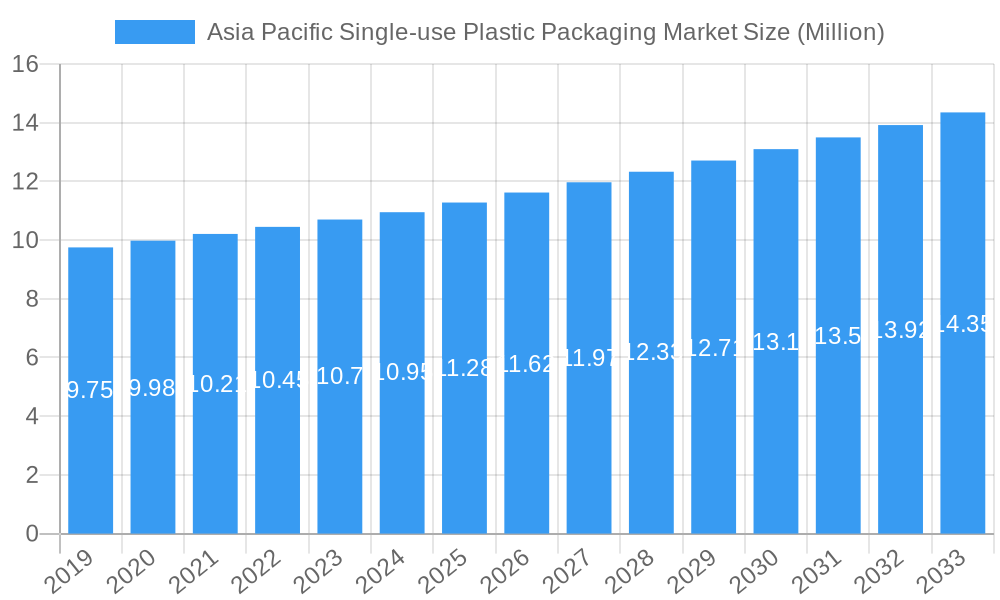

The Asia Pacific single-use plastic packaging market is poised for significant growth, with an estimated market size of USD 11.28 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.25% through 2033. This robust expansion is primarily driven by the burgeoning food service industry, particularly quick-service restaurants (QSRs) and full-service restaurants, which are heavily reliant on disposable packaging for convenience and hygiene. The increasing disposable incomes and evolving lifestyles across the region, especially in rapidly developing economies like China and India, further fuel the demand for convenient food solutions and, consequently, single-use plastic packaging. Furthermore, the retail sector's growing emphasis on product presentation and single-serving convenience in packaged goods also contributes to market expansion. While regulatory pressures and growing environmental concerns are pushing for sustainable alternatives, the sheer volume of consumption and the cost-effectiveness of traditional plastics continue to underpin market growth in the short to medium term.

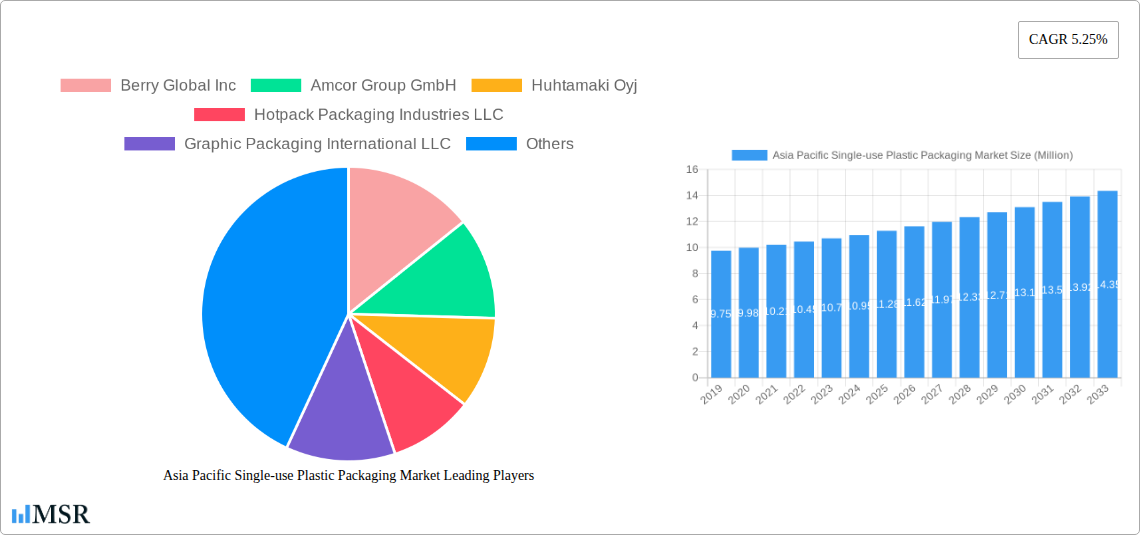

Asia Pacific Single-use Plastic Packaging Market Market Size (In Million)

Key trends shaping the Asia Pacific single-use plastic packaging market include a notable shift towards more eco-friendly material options like Polylactic Acid (PLA), alongside continued reliance on established materials such as Polyethylene Terephthalate (PET) and Polyethylene (PE) due to their cost-efficiency and performance characteristics. Within product types, bottles, bags & pouches, and cups & lids are expected to dominate, driven by their widespread application in food and beverage consumption. The "Other Types of Materials" segment is likely to witness a faster growth rate as innovation in bioplastics and recycled content gains traction. However, challenges such as stringent government regulations on plastic waste management, fluctuating raw material prices, and increasing consumer awareness about plastic pollution pose significant restraints. Despite these hurdles, the substantial market size, coupled with a consistent growth trajectory, indicates that Asia Pacific will remain a critical and dynamic region for the single-use plastic packaging industry for the foreseeable future, with ongoing adaptation to sustainability demands.

Asia Pacific Single-use Plastic Packaging Market Company Market Share

Here is an SEO-optimized and engaging report description for the Asia Pacific Single-use Plastic Packaging Market, incorporating all your specified requirements:

Unlock unparalleled insights into the dynamic Asia Pacific Single-use Plastic Packaging Market with this definitive research report. Spanning the historical period of 2019–2024 and projecting through 2033, this report offers a deep dive into market size, CAGR, segmentation analysis, competitive landscape, and future growth trajectories. Discover the pivotal trends, technological innovations, and regulatory shifts shaping the demand for single-use plastic packaging solutions across key Asian economies. Ideal for stakeholders seeking to understand plastic packaging market share, sustainable packaging innovations, and emerging food packaging trends in the region. This report provides actionable intelligence on the PET packaging market, PLA packaging applications, and the increasing adoption of recycled plastic packaging.

Asia Pacific Single-use Plastic Packaging Market Market Concentration & Dynamics

The Asia Pacific single-use plastic packaging market exhibits a moderate to high concentration, characterized by the presence of global giants and agile local players. Innovation ecosystems are thriving, driven by advancements in material science and a growing demand for enhanced product functionality and convenience. Regulatory frameworks are evolving rapidly, with an increasing emphasis on waste reduction, recycling initiatives, and the phasing out of problematic single-use plastics, although enforcement and adoption vary significantly across countries. Substitute products, such as biodegradable and compostable packaging alternatives, are gaining traction, posing a competitive challenge and pushing incumbents towards more sustainable material development. End-user trends are heavily influenced by the burgeoning middle class, rapid urbanization, and the exponential growth of e-commerce and the food service industry, particularly Quick Service Restaurants (QSRs) and full-service dining establishments. Mergers and acquisitions (M&A) activities are expected to remain a key strategy for market consolidation and expansion, with companies seeking to acquire innovative technologies, expand their geographical reach, and strengthen their product portfolios. The market share distribution will likely see continued competition between established players and emerging regional leaders, with M&A deal counts anticipated to reflect strategic moves towards vertical integration and diversification into sustainable packaging.

Asia Pacific Single-use Plastic Packaging Market Industry Insights & Trends

The Asia Pacific single-use plastic packaging market is experiencing robust growth, projected to reach an estimated market size of $XX Billion in 2025 and expand at a compound annual growth rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is primarily fueled by escalating consumer demand for convenience, the rapid growth of the food and beverage industry, and the expanding e-commerce sector, all of which rely heavily on effective and cost-efficient packaging solutions. Technological disruptions are playing a crucial role, with significant investments in advanced manufacturing processes that enhance the durability, functionality, and recyclability of plastic packaging. The development and adoption of advanced materials, including innovative grades of polyethylene terephthalate (PET), polyethylene (PE), and the increasing exploration of bio-based alternatives like polylactic acid (PLA), are pivotal. Evolving consumer behaviors are a significant driver; while environmental concerns are rising, the convenience and hygiene offered by single-use packaging, especially in densely populated urban areas, continue to outweigh these concerns for a substantial segment of the population. Furthermore, the increasing disposable incomes across emerging economies are translating into higher consumption of packaged goods, thereby stimulating the demand for a wide array of single-use plastic packaging products. The shift towards smaller, single-serving portion sizes, driven by changing lifestyle dynamics, also contributes to the increased consumption of individual packaging units. Regulatory pressures, while pushing for sustainability, also indirectly fuel innovation within the existing plastic packaging framework, encouraging the use of recycled content and improved recyclability. The market's growth is intrinsically linked to the overall economic development and industrial output of the Asia Pacific region, making it a critical indicator of regional economic health.

Key Markets & Segments Leading Asia Pacific Single-use Plastic Packaging Market

The Asia Pacific single-use plastic packaging market is dominated by several key regions and segments, each propelled by distinct growth drivers.

Dominant Region: The Asia Pacific region itself, encompassing countries like China, India, and Southeast Asian nations, represents the largest and fastest-growing market for single-use plastic packaging.

- Drivers:

- Economic Growth & Urbanization: Rapid industrialization and a burgeoning middle class in these nations lead to increased disposable incomes and higher consumption of packaged goods.

- Infrastructure Development: Expanding retail networks, cold chain logistics, and food processing facilities create a greater need for efficient packaging.

- Population Density: High population density translates into higher demand for convenient, hygienic, and portion-controlled food and beverage packaging.

- E-commerce Boom: The unprecedented growth of online retail in the region necessitates vast quantities of durable and protective packaging for product shipment.

- Drivers:

Dominant Product Type: Bottles and Bags & Pouches are leading product categories, driven by their widespread application across beverages, food, personal care, and consumer goods.

- Bottles: Primarily PET, these are essential for beverages (water, soft drinks, juices) and personal care items. Their dominance is fueled by the immense volume of beverage consumption and the demand for safe, transparent, and recyclable containers.

- Bags & Pouches: Including stand-up pouches, flat bags, and retort pouches, these are highly versatile and cost-effective, finding extensive use in snack foods, confectionery, dry goods, and increasingly in flexible packaging for ready-to-eat meals and frozen foods. Their lightweight nature and shelf-appeal are significant advantages.

Dominant Material: Polyethylene Terephthalate (PET) continues to be a cornerstone material due to its excellent barrier properties, clarity, strength, and recyclability. Polyethylene (PE), encompassing HDPE and LDPE, also holds significant market share, particularly for films, bags, and certain rigid containers, owing to its flexibility, durability, and cost-effectiveness.

- PET: Its widespread adoption in the beverage industry and the increasing demand for 100% recycled PET (rPET) bottles position it for continued dominance. The material's inherent recyclability aligns with growing environmental regulations and consumer preferences for sustainable options.

- PE: Crucial for flexible packaging applications such as films for food packaging, industrial sacks, and carrier bags, PE's versatility and lower cost make it indispensable in numerous end-use sectors. The development of specialized PE grades with enhanced properties further solidifies its market position.

Dominant End User: Quick Service Restaurants (QSRs) and Retail sectors are the primary end-users driving demand for single-use plastic packaging.

- QSRs: The rapid expansion of fast-food chains across Asia Pacific necessitates a constant supply of disposable packaging for meals, drinks, and takeaway orders, including cups, lids, trays, and clamshells. Hygiene and speed of service are paramount.

- Retail: This broad category encompasses supermarkets, convenience stores, and hypermarkets, where packaged consumer goods, fresh produce, and ready-to-eat meals are staples. Packaging plays a critical role in product preservation, shelf appeal, and consumer information.

Asia Pacific Single-use Plastic Packaging Market Product Developments

Product innovation in the Asia Pacific single-use plastic packaging market is intensely focused on enhancing sustainability and functionality. Advancements in material science are yielding lighter yet stronger plastics, reducing raw material consumption. The significant push towards circular economy principles is driving the development of packaging made from higher percentages of recycled content, particularly for PET bottles, as exemplified by initiatives from major beverage companies. Innovations also include improved barrier properties for extended shelf life, enhanced tamper-evident features for consumer safety, and user-friendly designs for convenience. The development of specialized plastic films with antimicrobial properties for food packaging and biodegradable/compostable alternatives for specific applications are also key areas of focus, aiming to balance environmental responsibility with performance requirements and competitive market demands.

Challenges in the Asia Pacific Single-use Plastic Packaging Market Market

The Asia Pacific single-use plastic packaging market faces significant challenges, including stringent and evolving government regulations concerning plastic waste management and bans on certain single-use items, which necessitate costly adaptation. Supply chain disruptions, fluctuating raw material prices (especially for petrochemicals), and geopolitical uncertainties can impact production costs and availability. Intense competition among numerous local and international players leads to price pressures and reduced profit margins. Furthermore, a lack of standardized recycling infrastructure across many developing nations hinders effective waste collection and processing, creating a persistent environmental burden and impacting the viability of closed-loop systems. Consumer perception regarding the environmental impact of plastics, coupled with growing demand for eco-friendly alternatives, presents a reputational challenge for traditional plastic packaging manufacturers.

Forces Driving Asia Pacific Single-use Plastic Packaging Market Growth

Several key forces are propelling the growth of the Asia Pacific single-use plastic packaging market. The rapidly expanding middle class across the region, coupled with increasing urbanization, is leading to a surge in demand for packaged consumer goods, ready-to-eat meals, and convenient food and beverage options. The exponential growth of e-commerce necessitates protective and efficient packaging solutions for product delivery. Technological advancements in material science and manufacturing processes are enabling the production of more sustainable, functional, and cost-effective plastic packaging. Furthermore, the food and beverage industry's continued reliance on single-use plastics for hygiene, preservation, and shelf appeal, particularly in emerging markets, remains a significant growth accelerator. Supportive government policies, focused on promoting domestic manufacturing and consumption, also contribute to market expansion.

Challenges in the Asia Pacific Single-use Plastic Packaging Market Market

The long-term growth of the Asia Pacific single-use plastic packaging market hinges on navigating significant hurdles. The escalating global and regional pressure to reduce plastic waste and pollution is leading to stricter environmental regulations, potential bans, and increased taxes on virgin plastics, forcing companies to invest heavily in R&D for sustainable alternatives and recycled content. Shifting consumer preferences towards eco-friendly and reusable packaging options, driven by heightened environmental awareness, poses a direct threat to traditional single-use models. The development and scaling of effective and widespread recycling infrastructure across the diverse economies of Asia Pacific remain a complex and capital-intensive challenge. Moreover, volatility in crude oil prices, the primary feedstock for most plastics, can impact production costs and profit margins, necessitating strategic hedging and diversification.

Emerging Opportunities in Asia Pacific Single-use Plastic Packaging Market

Emerging opportunities within the Asia Pacific single-use plastic packaging market are diverse and promising. The growing demand for lightweight and high-performance packaging in the booming e-commerce sector presents significant potential. Innovation in biodegradable and compostable plastics, driven by consumer demand and regulatory push, offers a substantial growth avenue. The increasing adoption of recycled PET (rPET) and other recycled plastic materials, supported by major brands' sustainability commitments, opens up new markets for recycled plastic packaging solutions. Furthermore, the development of smart packaging technologies, offering enhanced traceability, shelf-life monitoring, and consumer engagement features, represents a frontier for value-added products. Expanding into underserved rural markets and catering to niche product segments with tailored packaging solutions also presents untapped potential for growth and market penetration.

Leading Players in the Asia Pacific Single-use Plastic Packaging Market Sector

- Berry Global Inc

- Amcor Group GmbH

- Huhtamaki Oyj

- Hotpack Packaging Industries LLC

- Graphic Packaging International LLC

- Celebration Packaging Limited

- Detpak - Detmold Group

- Sonoco Products Company

- Oji Holdings Corporation

- Zhejiang Pando EP Technology Co

Key Milestones in Asia Pacific Single-use Plastic Packaging Market Industry

- April 2024: The Coca-Cola Company unveiled its latest sustainability initiative in Hong Kong, introducing 500 ml bottles crafted entirely from recycled plastic for its iconic soda. This move underscores the company's commitment to shrinking its environmental impact. In a groundbreaking step, the renowned beverage corporation transitioned all 500 ml bottles of Coca-Cola Original, Coca-Cola No Sugar, and Coca-Cola Plus in Hong Kong to be exclusively made from 100% recycled polyethylene terephthalate (rPET), marking a pioneering adoption of this material in China. This initiative significantly boosts the market perception and adoption of rPET in a crucial Asian market.

- October 2023: Coca-Cola India introduced a line of carbonated beverages in fully recycled PET bottles. The iconic Coca-Cola brand was made available in 100% recycled PET (rPET) bottles in 250 ml and 750 ml variants. Coca-Cola's bottling partners, Moon Beverages Ltd and SLMG Beverages Ltd, crafted these sustainable bottles. This development highlights the growing commitment of major beverage players to integrate recycled content into their product packaging across key Asian markets, driving demand for rPET and influencing competitor strategies.

Strategic Outlook for Asia Pacific Single-use Plastic Packaging Market Market

The strategic outlook for the Asia Pacific single-use plastic packaging market points towards continued innovation in sustainable materials and circular economy solutions. Companies that successfully integrate higher percentages of recycled content, develop advanced biodegradable alternatives, and invest in robust recycling partnerships will be well-positioned for long-term growth. The increasing consumer and regulatory demand for reduced environmental impact will drive strategic shifts away from virgin plastics towards more circular models. Furthermore, leveraging digital technologies for supply chain optimization, enhanced product traceability, and improved consumer engagement will be crucial for gaining a competitive edge. Expansion into emerging economies within the region, coupled with a focus on developing localized solutions that address specific market needs and regulatory landscapes, will be key growth accelerators. Collaborations with governments and NGOs to improve waste management infrastructure will also be vital for sustainable market development.

Asia Pacific Single-use Plastic Packaging Market Segmentation

-

1. Material

- 1.1. Polylactic Acid (PLA)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polyethylene (PE)

- 1.4. Other Types of Materials

-

2. Product Type

- 2.1. Bottles

- 2.2. Bags & Pouches

- 2.3. Clamshells

- 2.4. Trays, Cups & Lids

- 2.5. Other Product Types

-

3. End User

- 3.1. Quick Service Restaurants

- 3.2. Full Service Restaurants

- 3.3. Institutional

- 3.4. Retail

- 3.5. Other End-users

Asia Pacific Single-use Plastic Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Single-use Plastic Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Single-use Plastic Packaging Market

Asia Pacific Single-use Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Trend of Online Food Delivery Services; Increasing Number of Quick-Service Restaurants

- 3.3. Market Restrains

- 3.3.1. Ongoing Trend of Online Food Delivery Services; Increasing Number of Quick-Service Restaurants

- 3.4. Market Trends

- 3.4.1. Bottles are Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Single-use Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polylactic Acid (PLA)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polyethylene (PE)

- 5.1.4. Other Types of Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Bags & Pouches

- 5.2.3. Clamshells

- 5.2.4. Trays, Cups & Lids

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Quick Service Restaurants

- 5.3.2. Full Service Restaurants

- 5.3.3. Institutional

- 5.3.4. Retail

- 5.3.5. Other End-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Huhtamaki Oyj

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hotpack Packaging Industries LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Graphic Packaging International LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Celebration Packaging Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Detpak - Detmold Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sonoco Products Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oji Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zhejiang Pando EP Technology Co *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: Asia Pacific Single-use Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Single-use Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Asia Pacific Single-use Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Single-use Plastic Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia Pacific Single-use Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia Pacific Single-use Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Single-use Plastic Packaging Market?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Asia Pacific Single-use Plastic Packaging Market?

Key companies in the market include Berry Global Inc, Amcor Group GmbH, Huhtamaki Oyj, Hotpack Packaging Industries LLC, Graphic Packaging International LLC, Celebration Packaging Limited, Detpak - Detmold Group, Sonoco Products Company, Oji Holdings Corporation, Zhejiang Pando EP Technology Co *List Not Exhaustive.

3. What are the main segments of the Asia Pacific Single-use Plastic Packaging Market?

The market segments include Material, Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Trend of Online Food Delivery Services; Increasing Number of Quick-Service Restaurants.

6. What are the notable trends driving market growth?

Bottles are Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Ongoing Trend of Online Food Delivery Services; Increasing Number of Quick-Service Restaurants.

8. Can you provide examples of recent developments in the market?

April 2024: The Coca-Cola Company unveiled its latest sustainability initiative in Hong Kong, introducing 500 ml bottles crafted entirely from recycled plastic for its iconic soda. This move underscores the company's commitment to shrinking its environmental impact. In a groundbreaking step, the renowned beverage corporation transitioned all 500 ml bottles of Coca-Cola Original, Coca-Cola No Sugar, and Coca-Cola Plus in Hong Kong to be exclusively made from 100% recycled polyethylene terephthalate (rPET), marking a pioneering adoption of this material in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Single-use Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Single-use Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Single-use Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Single-use Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence