Key Insights

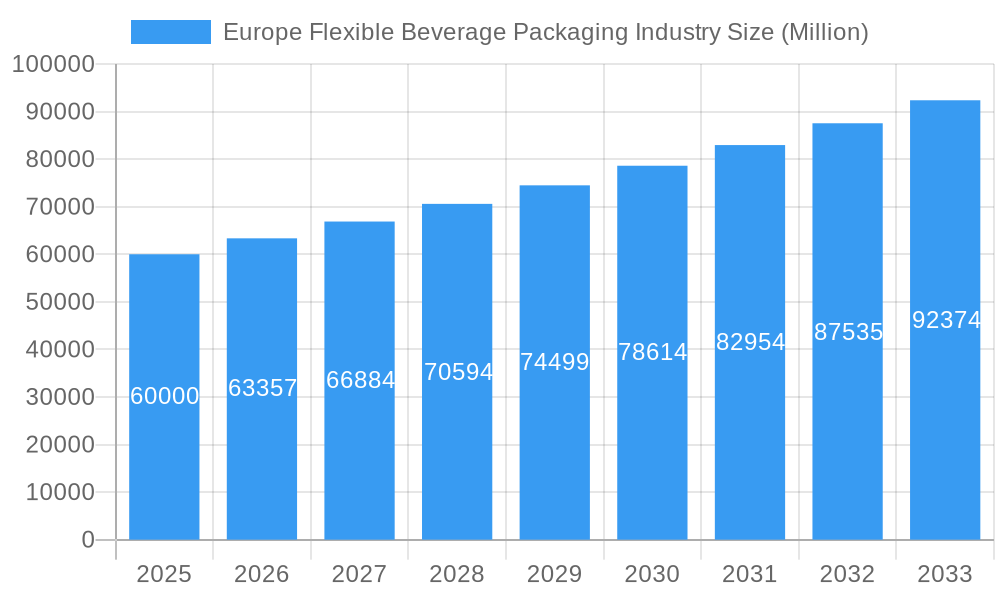

The European flexible beverage packaging market is set for substantial growth, projected to reach 52.96 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 3.75% through 2033. Key growth drivers include increasing demand for convenient, portable, and sustainable packaging solutions, alongside continuous innovation in materials and designs. The industry is shifting towards lighter, adaptable formats that reduce transportation costs and environmental impact. The proliferation of niche beverage segments like plant-based and functional drinks further fuels market vitality. The market is segmented by material, with plastic currently dominating due to its cost-effectiveness and barrier properties, though metal and paperboard are gaining traction for their recyclability. Pouches and cartons are experiencing considerable uptake, suitable for a wide array of beverages.

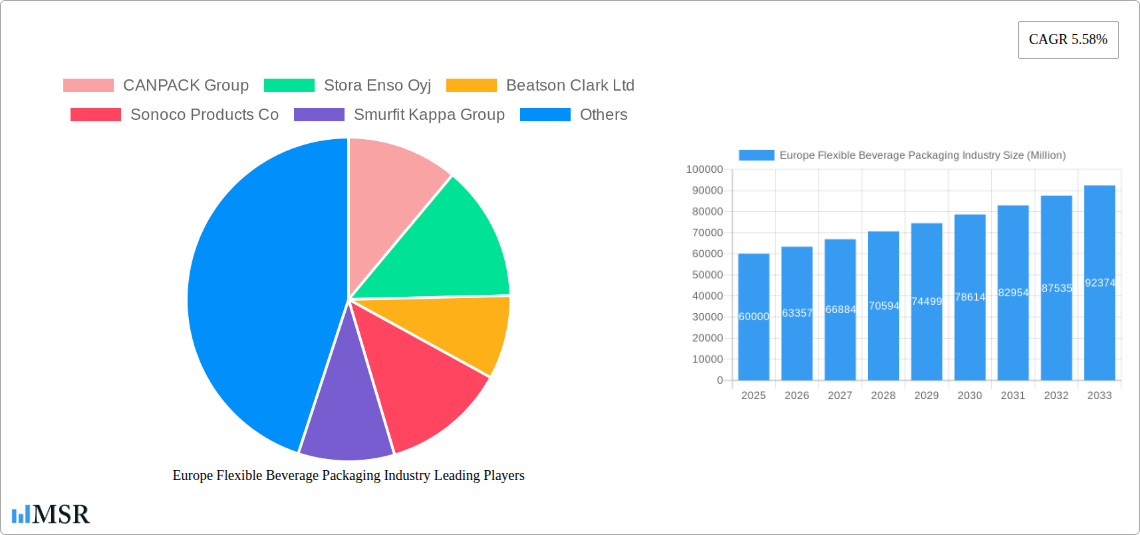

Europe Flexible Beverage Packaging Industry Market Size (In Billion)

While growth is strong, market restraints include regulatory pressures concerning plastic waste and the transition to circular economy principles, necessitating significant investment in recyclable and biodegradable materials. Initial investment costs for sustainable packaging technologies can also pose a challenge. However, growing environmental consciousness among consumers and governments acts as a powerful catalyst for innovation and adoption. Leading players are actively investing in research and development to address challenges and capitalize on emerging opportunities. Europe, with its established beverage industry and strong consumer demand for premium and sustainable products, is a critical and dynamic market for flexible beverage packaging solutions.

Europe Flexible Beverage Packaging Industry Company Market Share

This comprehensive Europe Flexible Beverage Packaging Industry report analyzes market dynamics, growth drivers, challenges, and emerging opportunities from 2019 to 2033, with a base year of 2025. The analysis empowers packaging manufacturers, beverage brands, raw material suppliers, investors, and industry stakeholders with actionable intelligence.

The report details the flexible beverage packaging market size, projecting a future market value of 52.96 billion by 2025, with a CAGR of 3.75%. Segmentation covers Material Type (Plastic, Metal, Paperboard), Product Type (Pouches, Cartons), and Application (Carbonated Drinks, Alcoholic Beverages, Bottled Water, Milk, Fruit and Vegetable Juices, Energy Drinks, Plant-based Drinks, Other Applications).

Key players, including Amcor Plc, Mondi Group Plc, and Tetra Pak International SA, are analyzed in detail. This report is an indispensable resource for understanding the future trajectory of the European beverage packaging sector.

Europe Flexible Beverage Packaging Industry Market Concentration & Dynamics

The Europe Flexible Beverage Packaging Industry exhibits a moderate level of market concentration, with a few dominant players alongside a robust ecosystem of specialized manufacturers. Innovation is a key differentiator, driven by sustainable packaging solutions, advancements in material science, and the integration of smart technologies. Regulatory frameworks, particularly those concerning plastic reduction and recyclability, significantly shape market dynamics. The availability and growing adoption of sustainable packaging materials like paperboard and bioplastics are influencing the competitive landscape, posing challenges to traditional plastic dominance. End-user trends, such as the demand for convenience, portion control, and eco-friendly options, are directly impacting packaging design and material choices. Mergers and acquisitions (M&A) activities, though not at an extreme level, are strategic for expanding market reach, acquiring new technologies, and consolidating market share within specific segments. For instance, the historical period (2019–2024) saw approximately XX M&A deals impacting key sub-segments, signifying a strategic consolidation effort by major players to enhance their portfolio and market penetration. The estimated market share of key players in specific segments varies, with companies like Ball Corp and Smurfit Kappa Group holding substantial positions in their respective areas of expertise.

Europe Flexible Beverage Packaging Industry Industry Insights & Trends

The Europe Flexible Beverage Packaging Industry is poised for significant growth, propelled by a confluence of factors including evolving consumer preferences, technological advancements, and increasing environmental consciousness. The market size for Europe Flexible Beverage Packaging is projected to witness a robust CAGR, reaching an estimated XX Billion Euros by 2025 and continuing its upward trajectory through 2033. Key growth drivers include the escalating demand for convenient and portable packaging solutions that cater to on-the-go consumption, particularly for energy drinks and bottled water. Technological disruptions are playing a pivotal role, with significant investments in lightweighting technologies for plastic and metal packaging, enhancing recyclability, and the development of biodegradable and compostable packaging materials. The emerging market for plant-based drinks is a notable trend, requiring specialized packaging that maintains product integrity and shelf-life. Furthermore, the growing emphasis on circular economy principles is accelerating the adoption of recycled content and the development of mono-material packaging that is easier to recycle. The shift towards premiumization in alcoholic beverages and juices is also driving demand for visually appealing and high-barrier packaging. The forecast period (2025–2033) is expected to witness a surge in innovations focused on reducing the environmental footprint of packaging, including the exploration of novel barrier coatings and advanced recycling technologies. The historical period (2019–2024) has laid the groundwork for these trends, with a notable increase in R&D expenditure by leading companies to develop next-generation packaging solutions. The demand for sustainable packaging is no longer a niche segment but a mainstream requirement, influencing product development across all beverage categories. The integration of digital technologies, such as QR codes for enhanced consumer engagement and supply chain traceability, is also becoming increasingly prevalent.

Key Markets & Segments Leading Europe Flexible Beverage Packaging Industry

The Europe Flexible Beverage Packaging Industry is dominated by a few key regions and segments, driven by strong consumer demand, robust economic conditions, and advanced infrastructure. Within Material Type, Plastic packaging continues to hold a significant market share due to its versatility, cost-effectiveness, and barrier properties, especially for carbonated drinks and bottled water. However, Paperboard is experiencing a substantial growth spurt, driven by sustainability mandates and the increasing popularity of milk and fruit and vegetable juices in cartons. Metal packaging, particularly cans, remains a dominant force for alcoholic beverages and carbonated drinks, owing to its excellent recyclability and shelf-life preservation. Glass continues to be a preferred choice for premium alcoholic beverages and bottled water, offering a perception of quality and taste preservation.

In terms of Product Type, Bottles and Cans are the largest segments, serving a wide array of applications. Pouches are gaining traction for their flexibility and lightweight properties, especially for single-serve portions of juices and milk. Cartons are crucial for shelf-stable beverages like milk and juices. Beer Kegs represent a specialized but important segment for the beverage industry.

By Application, Carbonated Drinks and Bottled Water consistently lead the market. The alcoholic beverages segment also commands a significant share, with a growing demand for innovative packaging designs. Fruit and Vegetable Juices and Milk are other major applications. The emerging market for Plant-based Drinks is a rapidly growing segment, requiring specialized packaging to maintain nutritional value and extend shelf life. Energy Drinks also contribute significantly to the demand for efficient and attractive packaging.

The dominant regions within Europe are Western Europe, characterized by high disposable incomes and strong consumer demand for convenience and premium products. Countries like Germany, the UK, France, and Italy are key markets. Drivers for this dominance include:

- High disposable income and consumer spending power.

- Well-established beverage manufacturing and distribution networks.

- Strong regulatory push towards sustainable packaging solutions.

- High adoption rates of new technologies and packaging innovations.

- Significant market share in key applications like carbonated drinks and bottled water.

Europe Flexible Beverage Packaging Industry Product Developments

Product innovation is a cornerstone of the Europe Flexible Beverage Packaging Industry. Manufacturers are continuously introducing advancements aimed at enhancing sustainability, functionality, and consumer appeal. Notable developments include the widespread adoption of mono-material plastics for improved recyclability, the introduction of lightweight glass bottles that reduce material usage and transportation emissions, and the expansion of paper-based packaging with advanced barrier properties for a wider range of beverages. Innovations in flexible pouches are focusing on enhanced resealability and tamper-evident features. The integration of digital printing technologies allows for more intricate designs and personalized packaging, catering to brand differentiation and marketing campaigns. Furthermore, the development of bio-based and compostable packaging materials is gaining momentum, offering alternatives to conventional plastics and aligning with the growing consumer demand for eco-friendly options.

Challenges in the Europe Flexible Beverage Packaging Industry Market

The Europe Flexible Beverage Packaging Industry faces several critical challenges. Stringent regulatory frameworks related to plastic waste, recyclability, and single-use plastics impose compliance burdens and necessitate significant investment in alternative materials and recycling infrastructure. Volatile raw material prices, particularly for plastics and metals, can impact production costs and profit margins. Supply chain disruptions, exacerbated by geopolitical events and logistics complexities, pose risks to timely delivery and production continuity. Intense competition from both established players and emerging innovators requires continuous investment in R&D and operational efficiency. The collection and recycling infrastructure for various packaging formats, especially in certain regions, remains a significant hurdle to achieving higher recycling rates and a truly circular economy.

Forces Driving Europe Flexible Beverage Packaging Industry Growth

Several powerful forces are propelling the Europe Flexible Beverage Packaging Industry forward. The increasing consumer demand for convenience and portability drives the adoption of smaller formats, ready-to-drink options, and easily transportable packaging like cans and pouches. Growing environmental awareness and the strong regulatory push towards sustainability are significant accelerators, fostering innovation in recycled content, biodegradable materials, and enhanced recyclability. Technological advancements in material science and manufacturing processes enable the development of lighter, stronger, and more resource-efficient packaging solutions. Economic growth in key European markets translates to higher disposable incomes, leading to increased consumption of a wide range of beverages, thereby boosting packaging demand. The emerging trends in health and wellness, including the popularity of plant-based drinks and functional beverages, necessitate specialized packaging to maintain product integrity and appeal.

Challenges in the Europe Flexible Beverage Packaging Industry Market

Long-term growth catalysts for the Europe Flexible Beverage Packaging Industry are deeply intertwined with innovation and strategic market adaptation. The continued development and scaling of advanced recycling technologies, including chemical recycling, will be crucial for meeting sustainability targets and creating a truly circular economy for plastic packaging. Strategic partnerships and collaborations between packaging manufacturers, beverage brands, and waste management companies are essential for establishing robust collection and recycling systems. Market expansions into new geographical areas or niche beverage segments offer untapped potential. Furthermore, the ongoing innovation in material science, leading to the development of high-performance, bio-based, and compostable alternatives, will continue to shape the industry's trajectory. The integration of smart packaging solutions, offering traceability, authentication, and enhanced consumer engagement, presents another significant long-term growth opportunity.

Emerging Opportunities in Europe Flexible Beverage Packaging Industry

Emerging opportunities in the Europe Flexible Beverage Packaging Industry are ripe for exploitation by agile and forward-thinking companies. The rapidly expanding plant-based beverage market presents a significant avenue for growth, requiring specialized packaging that preserves nutritional value and extends shelf life. The increasing consumer preference for smaller, single-serve portions drives demand for pouches and innovative multi-packs. The development of smart packaging solutions that offer enhanced traceability, anti-counterfeiting measures, and direct consumer engagement via QR codes or NFC tags is a rapidly growing area. Furthermore, the circular economy initiatives are creating opportunities for companies specializing in the collection, sorting, and recycling of beverage packaging, as well as those developing innovative reusable packaging systems. The demand for customizable and aesthetically appealing packaging for premium and craft beverages continues to be a strong growth driver.

Leading Players in the Europe Flexible Beverage Packaging Industry Sector

- CANPACK Group

- Stora Enso Oyj

- Beatson Clark Ltd

- Sonoco Products Co

- Smurfit Kappa Group

- Ball Corp

- Mondi Group Plc

- Ardagh Group SA

- Amcor Plc

- Danone SA

- Tetra Pak International SA

- Gerresheimer AG

- Vidrala SA

Key Milestones in Europe Flexible Beverage Packaging Industry Industry

- 2019: Increased adoption of recycled PET (rPET) in beverage bottles by major brands.

- 2020: Launch of innovative paper-based carton solutions with enhanced barrier properties for juices and plant-based drinks.

- 2021: Significant investment by leading companies in advanced chemical recycling technologies.

- 2022: Introduction of new lightweight metal can designs to reduce material usage and carbon footprint.

- 2023: Growing focus on reusable packaging models and infrastructure development across European cities.

- 2024: Expansion of bioplastic and compostable packaging options for niche beverage applications.

Strategic Outlook for Europe Flexible Beverage Packaging Industry Market

The strategic outlook for the Europe Flexible Beverage Packaging Industry is characterized by a strong emphasis on sustainability, innovation, and market adaptation. Companies are focusing on diversifying their material portfolios to include a higher proportion of recycled and bio-based content, driven by both regulatory pressures and consumer demand. Investments in advanced recycling technologies and infrastructure are crucial for achieving circularity. Furthermore, product innovation will remain a key differentiator, with a focus on developing packaging that enhances shelf-life, improves convenience, and offers superior functionality. Strategic partnerships and collaborations across the value chain, from raw material suppliers to waste management entities, will be vital for navigating the complexities of the evolving regulatory landscape and establishing robust supply chains. The industry is expected to witness continued consolidation and strategic alliances aimed at expanding market reach, acquiring technological capabilities, and strengthening competitive positioning in key segments.

Europe Flexible Beverage Packaging Industry Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Metal

- 1.3. Glass

- 1.4. Paperboard

-

2. Product Type

- 2.1. Bottles

- 2.2. Cans

- 2.3. Pouches

- 2.4. Cartons

- 2.5. Beer Kegs

-

3. Application

- 3.1. Carbonated Drinks

- 3.2. Alcoholic Beverages

- 3.3. Bottled Water

- 3.4. Milk

- 3.5. Fruit and Vegetable Juices

- 3.6. Energy Drinks

- 3.7. Plant-based Drinks (Emerging Market)

- 3.8. Other Applications

Europe Flexible Beverage Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

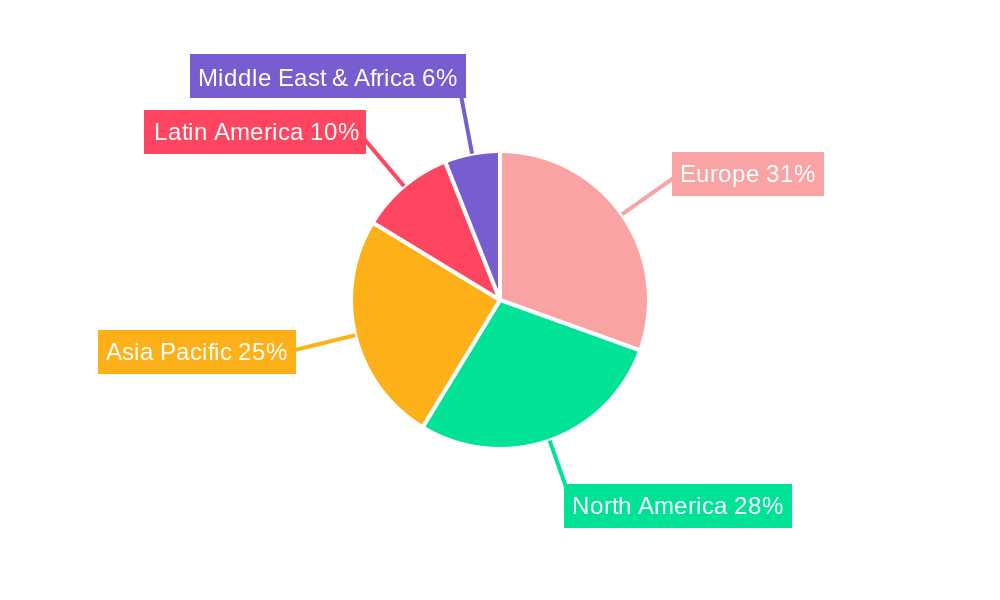

Europe Flexible Beverage Packaging Industry Regional Market Share

Geographic Coverage of Europe Flexible Beverage Packaging Industry

Europe Flexible Beverage Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Technology Offering Better Solutions

- 3.3. Market Restrains

- 3.3.1. Operation and Logistical Concerns

- 3.4. Market Trends

- 3.4.1. Plastic Packaging Significance in Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flexible Beverage Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Metal

- 5.1.3. Glass

- 5.1.4. Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Cans

- 5.2.3. Pouches

- 5.2.4. Cartons

- 5.2.5. Beer Kegs

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Carbonated Drinks

- 5.3.2. Alcoholic Beverages

- 5.3.3. Bottled Water

- 5.3.4. Milk

- 5.3.5. Fruit and Vegetable Juices

- 5.3.6. Energy Drinks

- 5.3.7. Plant-based Drinks (Emerging Market)

- 5.3.8. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CANPACK Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stora Enso Oyj

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Beatson Clark Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smurfit Kappa Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ball Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi Group Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ardagh Group SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor Plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danone SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tetra Pak International SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gerresheimer AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Vidrala SA*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CANPACK Group

List of Figures

- Figure 1: Europe Flexible Beverage Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Flexible Beverage Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Europe Flexible Beverage Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Flexible Beverage Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flexible Beverage Packaging Industry?

The projected CAGR is approximately 3.75%.

2. Which companies are prominent players in the Europe Flexible Beverage Packaging Industry?

Key companies in the market include CANPACK Group, Stora Enso Oyj, Beatson Clark Ltd, Sonoco Products Co, Smurfit Kappa Group, Ball Corp, Mondi Group Plc, Ardagh Group SA, Amcor Plc, Danone SA, Tetra Pak International SA, Gerresheimer AG, Vidrala SA*List Not Exhaustive.

3. What are the main segments of the Europe Flexible Beverage Packaging Industry?

The market segments include Material Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.96 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Technology Offering Better Solutions.

6. What are the notable trends driving market growth?

Plastic Packaging Significance in Beverage Industry.

7. Are there any restraints impacting market growth?

Operation and Logistical Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flexible Beverage Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flexible Beverage Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flexible Beverage Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Flexible Beverage Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence