Key Insights

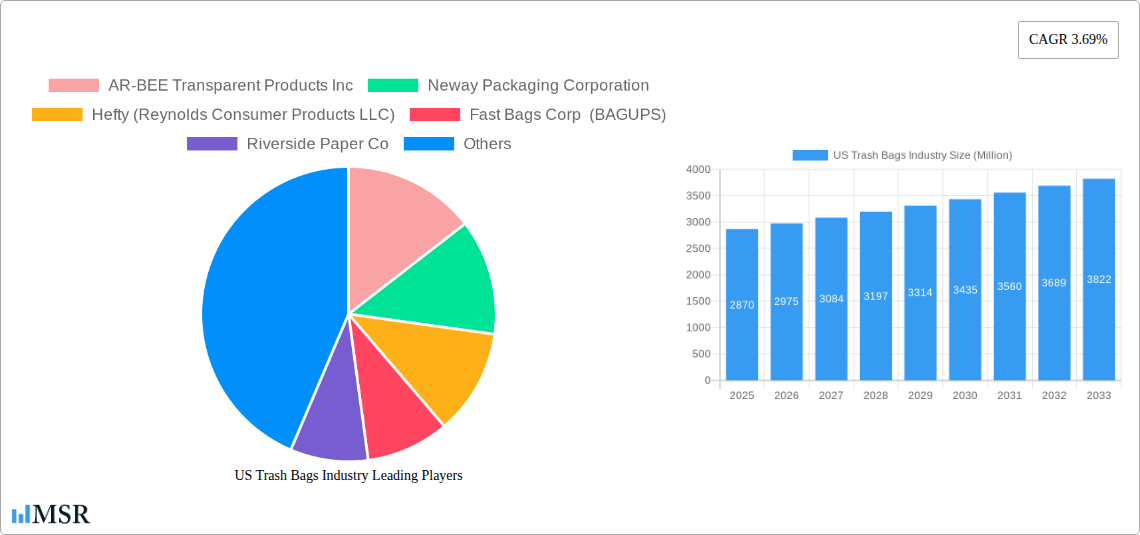

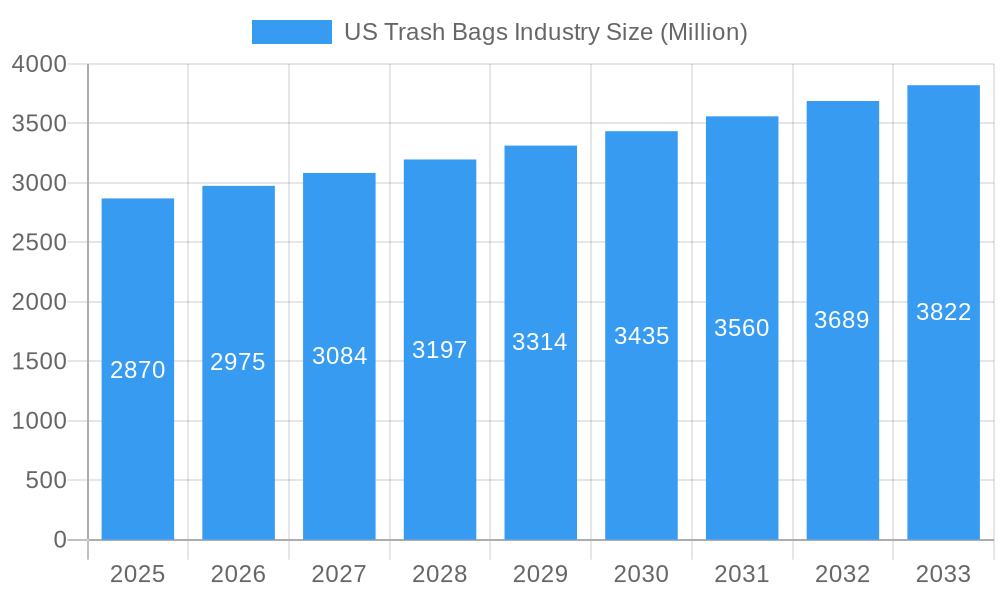

The US trash bags market is poised for steady expansion, projected to reach \$2.87 million in value. This growth is fueled by a consistent CAGR of 3.69%, indicating a healthy and developing industry. A primary driver for this market's advancement is the increasing global focus on waste management and sanitation, particularly in urban and developing areas where proper disposal is becoming a priority. Consumer awareness regarding hygiene and environmental responsibility also plays a significant role, encouraging higher adoption rates of disposable trash bags across various end-user segments. The residential sector, driven by evolving lifestyle choices and a demand for convenience, remains a cornerstone of this market. Simultaneously, the commercial and industrial segments are experiencing growth due to stringent regulatory requirements for waste disposal and the increasing emphasis on maintaining clean and safe working environments. Advancements in material science leading to stronger, more eco-friendly, and specialized trash bag options are also contributing to market dynamism, addressing specific needs like leak resistance and odor control.

US Trash Bags Industry Market Size (In Billion)

Looking ahead, the US trash bags market is expected to witness a positive trajectory. Emerging trends like the development of biodegradable and compostable trash bags are gaining traction, driven by growing environmental consciousness and regulatory pressures. The convenience offered by various bag types, including drawstring and heavy-duty options, continues to underpin demand in the residential sector. However, the market also faces certain restraints, primarily the fluctuating prices of raw materials, particularly polyethylene, which can impact manufacturing costs and profit margins. Additionally, a growing concern around plastic waste and potential bans or limitations on single-use plastics in certain regions could present challenges. Despite these hurdles, the market's inherent demand, coupled with innovation in product offerings and a continued emphasis on hygiene and waste management, suggests a robust outlook for the US trash bags industry. Key players are actively engaged in product development and strategic expansions to capitalize on these evolving market dynamics.

US Trash Bags Industry Company Market Share

Here is an SEO-optimized, engaging report description for the US Trash Bags Industry, incorporating high-ranking keywords and adhering to your specified structure and content requirements.

US Trash Bags Industry Market Analysis, Trends, Opportunities & Forecast to 2033

Gain unparalleled insights into the dynamic US Trash Bags Industry with this comprehensive report. Delve into market concentration, growth drivers, emerging trends, and a detailed forecast through 2033. This report is essential for manufacturers, distributors, investors, and stakeholders seeking to understand the competitive landscape, technological advancements, and burgeoning opportunities within the multi-billion dollar US trash bag market. Discover key market share data, M&A activities, and the impact of sustainability initiatives on the US trash bag market.

US Trash Bags Industry Market Concentration & Dynamics

The US trash bags industry exhibits moderate market concentration, characterized by the presence of both large, established players and a growing number of specialized manufacturers focusing on eco-friendly trash bags and biodegradable trash bags. Innovation ecosystems are robust, driven by a push for sustainable materials and advanced dispensing technologies. Regulatory frameworks, particularly those concerning plastic waste reduction and recycling mandates, significantly influence product development and market access. Substitute products, such as reusable bin liners and compostable alternatives, present a growing challenge, compelling manufacturers to invest in differentiation. End-user trends reveal increasing demand for high-capacity, durable, and odor-controlling solutions. Mergers & Acquisitions (M&A) activities, while moderate, are strategic, aimed at consolidating market share, acquiring innovative technologies, and expanding product portfolios. For instance, the acquisition of smaller sustainable packaging firms by larger corporations highlights this trend. Market share data indicates that the top 5-7 players command approximately 60-70% of the market. M&A deal counts have averaged 3-5 significant transactions annually over the historical period.

US Trash Bags Industry Industry Insights & Trends

The US trash bags industry is poised for significant growth, projected to reach an estimated market size of over $8,000 Million by 2033, with a Compound Annual Growth Rate (CAGR) of approximately 4.5% from the base year of 2025. This expansion is propelled by several key market growth drivers, including rising urbanization and population growth, which directly translate to increased waste generation and, consequently, higher demand for trash bags across residential, commercial, and industrial sectors. Technological disruptions are playing a pivotal role, with advancements in material science leading to the development of stronger, more durable, and increasingly sustainable biodegradable trash bags and compostable trash bags. These innovations address growing environmental concerns and comply with evolving regulations. Evolving consumer behaviors, characterized by a heightened awareness of environmental impact and a preference for products that align with sustainable lifestyles, are further fueling the demand for eco-friendly options. The increasing adoption of smart waste management systems also presents opportunities for specialized trash bag solutions designed for efficiency and data collection. Furthermore, the robust growth in e-commerce has indirectly boosted the demand for packaging and shipping, leading to a greater volume of waste that necessitates effective disposal. The industrial sector's continuous need for heavy-duty and specialized waste containment solutions remains a stable contributor to market growth. The forecast period (2025–2033) anticipates sustained demand driven by these fundamental economic and societal shifts.

Key Markets & Segments Leading US Trash Bags Industry

The US trash bags industry is primarily dominated by the Commercial segment, which consistently represents the largest share of the market. This dominance is fueled by robust economic activity, the expansion of service industries, and stringent waste management regulations in commercial settings such as restaurants, hospitals, office buildings, and retail establishments.

- Commercial Segment Drivers:

- High Volume Waste Generation: Commercial entities, by their nature, produce substantial volumes of waste daily, necessitating a continuous supply of trash bags.

- Hygiene and Sanitation Standards: Strict hygiene protocols in sectors like healthcare and food service mandate the regular use of effective trash bags to prevent the spread of germs and maintain a clean environment.

- Regulatory Compliance: Municipal and federal regulations concerning waste disposal and recycling in commercial spaces often dictate the type and quantity of trash bags required.

- Cost-Effectiveness: While sustainability is a growing concern, the commercial sector also prioritizes cost-effective solutions for managing large waste streams.

The Residential segment follows, driven by household consumption and the increasing adoption of premium features such as drawstring closures, odor control, and larger capacities in kitchen trash bags. The Industrial segment, while smaller in volume compared to commercial, demands highly specialized and heavy-duty trash bags designed for hazardous waste, manufacturing byproducts, and large-scale disposal needs. Growth in this segment is tied to the performance of manufacturing and industrial output. Geographically, the US market itself is the leading region, with significant demand concentrated in densely populated urban and suburban areas across all segments.

US Trash Bags Industry Product Developments

Product development in the US trash bags industry is rapidly evolving, driven by a strong emphasis on sustainability and enhanced functionality. Innovations include the widespread adoption of recycled content, leading to the introduction of recycled trash bags, and the increasing availability of biodegradable and compostable trash bags that address environmental concerns. Advanced features such as reinforced drawstrings, superior tear resistance, and enhanced odor-neutralizing technologies are becoming standard, offering competitive edges. The introduction of specialized dispensing systems, like the Bagups system, is a significant advancement, improving user convenience and reducing waste.

Challenges in the US Trash Bags Industry Market

The US trash bags industry faces several challenges that impact its growth trajectory. Regulatory hurdles, particularly evolving plastic waste reduction policies and increasing landfill taxes in certain states, can increase operational costs and necessitate product reformulation. Supply chain issues, including raw material price volatility for plastics and transportation disruptions, can affect production efficiency and pricing strategies. Intense competitive pressures from both established brands and new entrants offering niche or sustainable products also pose a significant challenge, requiring constant innovation and effective marketing. The cost of implementing advanced sustainable technologies can also be a barrier for smaller manufacturers.

Forces Driving US Trash Bags Industry Growth

Several forces are driving the growth of the US trash bags industry. Technological advancements in material science are enabling the production of more durable, leak-proof, and environmentally friendly trash bags, including biodegradable trash bags and those made from recycled content. Growing consumer awareness and preference for sustainable products are creating a robust demand for eco-friendly alternatives, pushing manufacturers to innovate. Favorable regulatory frameworks that promote recycling and waste reduction can also indirectly boost the market by encouraging the use of compliant and efficient waste disposal solutions. Economic growth and increasing urbanization, leading to higher waste generation, remain fundamental drivers.

Challenges in the US Trash Bags Industry Market

Long-term growth catalysts for the US trash bags industry are rooted in continued innovation and market expansion. The increasing global focus on circular economy principles will drive the development and adoption of truly recyclable and compostable trash bag solutions. Strategic partnerships between raw material suppliers, manufacturers, and waste management companies can optimize the supply chain for sustainable materials and enhance product circularity. Market expansion into under-penetrated segments or regions, coupled with the development of advanced product features that cater to evolving consumer needs (e.g., smart trash bags with integrated sensors), will also be critical for sustained growth.

Emerging Opportunities in US Trash Bags Industry

Emerging opportunities in the US trash bags industry lie in the growing demand for specialized and sustainable products. The niche market for industrial trash bags designed for specific hazardous materials and the burgeoning demand for kitchen trash bags with superior odor control and durability present significant growth avenues. The development of innovative dispensing systems and smart trash bags that integrate with waste management technologies offers further potential. Consumer preference for eco-friendly trash bags, including biodegradable and compostable options, continues to expand, creating a strong market for manufacturers investing in sustainable material sourcing and production. Furthermore, government initiatives promoting waste reduction and recycling can incentivize the adoption of advanced trash bag solutions.

Leading Players in the US Trash Bags Industry Sector

- AR-BEE Transparent Products Inc

- Neway Packaging Corporation

- Hefty (Reynolds Consumer Products LLC)

- Fast Bags Corp (BAGUPS)

- Riverside Paper Co

- International Plastics Inc

- Novolex

- Berry Global Inc

- Inteplast Group

- Universal Plastic Bag Co

Key Milestones in US Trash Bags Industry Industry

- January 2024: Recircle Brands launched Bagups, an innovative trash bag dispensing system utilizing biodegradable materials to reduce plastic waste and carbon footprint, marking a significant step in user convenience and environmental consciousness within the trash bag industry.

Strategic Outlook for US Trash Bags Industry Market

The strategic outlook for the US trash bags industry is positive, driven by a confluence of factors including sustained demand from residential, commercial, and industrial sectors, coupled with a growing imperative for sustainable solutions. Key growth accelerators include continued investment in R&D for biodegradable trash bags, compostable trash bags, and bags made from recycled content. Strategic partnerships focused on supply chain optimization for sustainable materials and innovations in waste management integration will be crucial. Manufacturers that can effectively balance cost-effectiveness with environmental responsibility, while also offering enhanced product features like superior durability and odor control, are well-positioned for significant market expansion and sustained profitability in the coming years.

US Trash Bags Industry Segmentation

-

1. End User

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

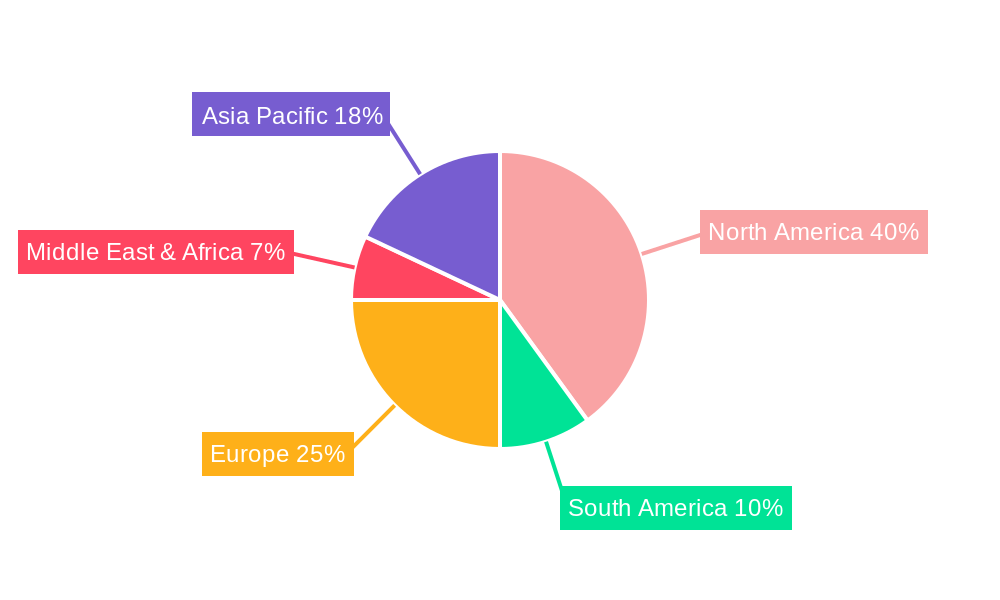

US Trash Bags Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Trash Bags Industry Regional Market Share

Geographic Coverage of US Trash Bags Industry

US Trash Bags Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Compostable and Oxo-biodegradable Bags; Growing Awareness About Hygiene Among People

- 3.3. Market Restrains

- 3.3.1. Unforeseen Consequences of Reusing Plastic Packaging and Health Related Concerns

- 3.4. Market Trends

- 3.4.1. The Residential Sector Holds the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. South America US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Europe US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Middle East & Africa US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Asia Pacific US Trash Bags Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 AR-BEE Transparent Products Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Neway Packaging Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hefty (Reynolds Consumer Products LLC)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fast Bags Corp (BAGUPS)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Riverside Paper Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 International Plastics Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Novolex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berry Global Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inteplast Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Universal Plastic Bag Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 AR-BEE Transparent Products Inc

List of Figures

- Figure 1: Global US Trash Bags Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Trash Bags Industry Revenue (Million), by End User 2025 & 2033

- Figure 3: North America US Trash Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America US Trash Bags Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America US Trash Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Trash Bags Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: South America US Trash Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: South America US Trash Bags Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America US Trash Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Trash Bags Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe US Trash Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe US Trash Bags Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe US Trash Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Trash Bags Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Middle East & Africa US Trash Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Middle East & Africa US Trash Bags Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Trash Bags Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Trash Bags Industry Revenue (Million), by End User 2025 & 2033

- Figure 19: Asia Pacific US Trash Bags Industry Revenue Share (%), by End User 2025 & 2033

- Figure 20: Asia Pacific US Trash Bags Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific US Trash Bags Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Global US Trash Bags Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global US Trash Bags Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global US Trash Bags Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global US Trash Bags Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global US Trash Bags Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global US Trash Bags Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 33: Global US Trash Bags Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Trash Bags Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Trash Bags Industry?

The projected CAGR is approximately 3.69%.

2. Which companies are prominent players in the US Trash Bags Industry?

Key companies in the market include AR-BEE Transparent Products Inc, Neway Packaging Corporation, Hefty (Reynolds Consumer Products LLC), Fast Bags Corp (BAGUPS), Riverside Paper Co, International Plastics Inc, Novolex, Berry Global Inc, Inteplast Group, Universal Plastic Bag Co.

3. What are the main segments of the US Trash Bags Industry?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Compostable and Oxo-biodegradable Bags; Growing Awareness About Hygiene Among People.

6. What are the notable trends driving market growth?

The Residential Sector Holds the Largest Market Share.

7. Are there any restraints impacting market growth?

Unforeseen Consequences of Reusing Plastic Packaging and Health Related Concerns.

8. Can you provide examples of recent developments in the market?

January 2024: Recircle Brands, a visionary company in the eco-friendly products sector, announced the launch of Bagups, a groundbreaking trash bag dispensing system. Its unique design ensures that a new bag is always ready for use, eliminating the inconvenience of traditional trash bag replacement. The product's environmental impact is significantly reduced by using biodegradable materials, minimizing plastic waste, and reducing the overall carbon footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Trash Bags Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Trash Bags Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Trash Bags Industry?

To stay informed about further developments, trends, and reports in the US Trash Bags Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence