Key Insights

The Italian container glass market is projected for robust expansion, anticipated to reach 5.75 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 2.07% through 2033. This growth is propelled by strong demand from key sectors. The beverage industry, encompassing alcoholic (beer, wine, spirits) and non-alcoholic (soft drinks, juices, water) beverages, significantly drives demand due to glass's premium perception and sustainability benefits. The food sector also contributes, as consumers increasingly prefer glass for its perceived health advantages and reusability. Additionally, the cosmetics and pharmaceutical industries rely on glass for product integrity and sophisticated presentation. Key growth catalysts include a rising preference for sustainable packaging, driven by environmental awareness and regulatory mandates, alongside demand for lightweight glass and innovative designs that enhance brand appeal.

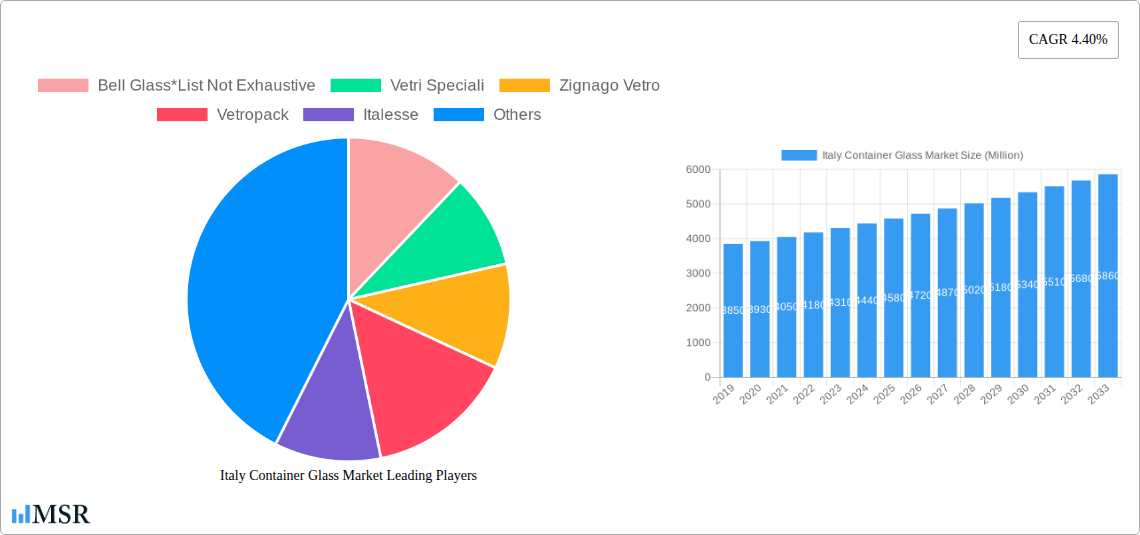

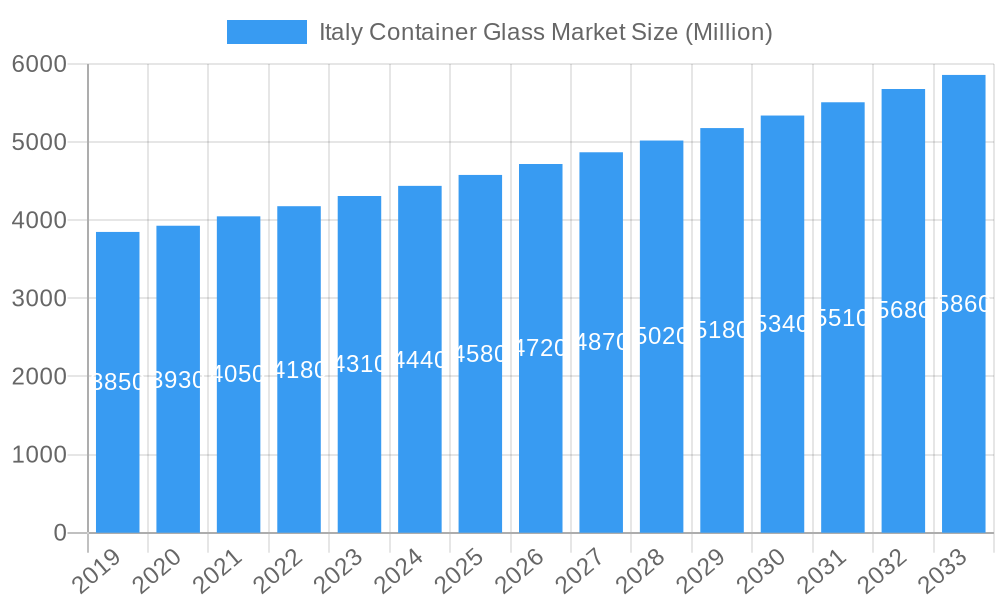

Italy Container Glass Market Market Size (In Million)

Potential market restraints include raw material price volatility, impacting manufacturing costs. Intense competition and the emergence of alternative packaging materials also pose challenges. However, glass's inherent recyclability, inertness, and aesthetic qualities provide a competitive advantage. Leading companies such as Bell Glass, Vetri Speciali, Zignago Vetro, Vetropack, and Italesse are investing in advanced manufacturing and sustainable practices to meet evolving market demands. The Italian market is characterized by a strong domestic production capacity and a discerning consumer base prioritizing quality and environmental responsibility in packaging.

Italy Container Glass Market Company Market Share

Gain comprehensive insights into the dynamic Italy container glass market. This report, analyzing trends from 2019–2033 with a base year of 2025, offers critical intelligence for glass manufacturers, packaging suppliers, beverage producers, and cosmetic brands. Strategic analysis for the Italian glass packaging industry and the broader European glass container market is provided for the forecast period 2025–2033, detailing market size, growth drivers, and emerging opportunities for informed decision-making.

Italy Container Glass Market Market Concentration & Dynamics

The Italy container glass market exhibits a moderate to high concentration, characterized by a few dominant players and a significant number of smaller, specialized manufacturers. Innovation ecosystems are driven by a strong emphasis on sustainability and technological advancements in glass production, particularly concerning energy efficiency and emission reduction. Regulatory frameworks, influenced by the European Union's directives on packaging and environmental protection, play a crucial role in shaping market strategies. Substitute products, primarily plastic and aluminum, present ongoing competition, necessitating a focus on the inherent advantages of glass, such as its inertness and recyclability. End-user trends highlight a growing demand for premium and aesthetically appealing glass packaging, especially within the beverages and cosmetics sectors. Merger and acquisition (M&A) activities are strategic, often aimed at consolidating market share, expanding product portfolios, or acquiring new technologies. The market share of key players is closely watched, with recent M&A deal counts indicating a trend towards consolidation and vertical integration within the Italian glass packaging sector. Understanding these dynamics is paramount for navigating the competitive landscape of the Italian glass container industry.

Italy Container Glass Market Industry Insights & Trends

The Italy container glass market is poised for robust growth, driven by a confluence of factors including expanding end-user industries and an increasing consumer preference for sustainable packaging solutions. The market size is projected to reach an estimated value of XXX Million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. A significant growth driver is the ever-increasing demand from the beverages sector, encompassing both alcoholic beverages like wine, spirits, beer, and cider, as well as non-alcoholic options such as juices, water, and carbonated soft drinks. The food sector also contributes substantially to this growth, with a rising need for high-quality, preserved food products packaged in glass. Technological disruptions are playing a pivotal role, with advancements in lightweighting techniques, enhanced durability, and innovative designs contributing to the market's expansion. Evolving consumer behaviors, characterized by a heightened awareness of environmental impact and a desire for premium product presentation, further bolster the demand for container glass. The pharmaceutical and cosmetics industries are also key contributors, relying on glass for its inertness, barrier properties, and aesthetic appeal, further solidifying the container glass market in Italy.

Key Markets & Segments Leading Italy Container Glass Market

The beverages sector undeniably stands as the leading segment driving the Italy container glass market. This dominance is fueled by the strong Italian culture surrounding wine and spirits, alongside a growing market for premium beers and ciders. Within non-alcoholic beverages, the demand for bottled water, juices, and flavored drinks in glass packaging continues to surge.

- Beverages (Alcoholi):

- Wine and Spirits: Italy's renowned wine and spirits production, coupled with export markets, creates a consistent and significant demand for specialized glass bottles. Economic growth and an increasing disposable income further fuel the consumption of premium alcoholic beverages.

- Beer and Cider: The burgeoning craft beer and cider market in Italy is increasingly opting for glass bottles, appreciating their aesthetic appeal and perceived higher quality.

- Beverages (Non-Alco):

- Water: The demand for premium and flavored bottled water in glass containers is on an upward trajectory, driven by health consciousness and a preference for sustainable options.

- Juices: High-quality, natural juices are increasingly being packaged in glass to preserve freshness and appeal to health-conscious consumers.

- Carbonated Soft Drinks: While plastic remains a significant competitor, premium and artisanal soft drinks are opting for glass bottles for enhanced brand perception.

- Dairy Based Drinks & Flavored Drinks: Growing consumer interest in novel and healthy dairy-based and flavored beverages is translating into increased demand for glass packaging.

The food sector emerges as the second most influential segment, driven by the demand for preserved foods, condiments, and gourmet products. The perceived inertness and recyclability of glass make it an ideal choice for maintaining food quality and safety.

The cosmetics and pharmaceutical sectors also represent crucial, albeit smaller, segments. Cosmetics leverage glass for its premium appearance and chemical inertness, while pharmaceuticals rely on it for its high barrier properties and sterility. The Other End-user Verticals, encompassing niche applications, also contribute to the overall market diversification.

Italy Container Glass Market Product Developments

Innovation in the Italy container glass market is primarily focused on enhancing sustainability and functionality. Manufacturers are actively developing lighter-weight glass bottles, reducing material usage and transportation emissions without compromising on strength. Advancements in decorative techniques, such as advanced printing and embossing, are allowing brands to create visually striking packaging that resonates with consumer trends for premiumization. Furthermore, the development of glass with improved barrier properties is crucial for extending the shelf life of various products, particularly in the food and beverage sectors. The exploration of recycled content integration and energy-efficient manufacturing processes underscores the industry's commitment to environmental responsibility.

Challenges in the Italy Container Glass Market Market

The Italy container glass market faces several challenges that could impede its growth trajectory. Intense competition from alternative packaging materials like plastic and aluminum, often perceived as cheaper and lighter, remains a significant barrier. Fluctuations in raw material prices, particularly for soda ash and silica sand, can impact production costs and profitability. Additionally, the energy-intensive nature of glass manufacturing, coupled with rising energy prices and stringent environmental regulations, poses a substantial operational challenge. Navigating complex and evolving regulatory landscapes concerning recycling rates and environmental impact also demands continuous adaptation and investment.

Forces Driving Italy Container Glass Market Growth

Several powerful forces are propelling the growth of the Italy container glass market. A fundamental driver is the increasing consumer preference for sustainable and eco-friendly packaging options, where glass excels due to its recyclability and inert nature. The growing demand for premium and aesthetically pleasing packaging across the beverages, food, and cosmetics sectors is another significant catalyst, as glass offers superior visual appeal and perceived quality. Technological advancements in glass manufacturing, leading to lighter-weight bottles and improved durability, are enhancing the competitiveness of glass packaging. Furthermore, supportive government initiatives and regulations promoting circular economy principles and reducing single-use plastics are creating a more favorable market environment for glass containers.

Challenges in the Italy Container Glass Market Market

Looking towards the long term, the Italy container glass market faces challenges that necessitate strategic adaptation. The industry's reliance on energy and the associated carbon footprint remain a concern, driving the need for further investment in energy-efficient technologies and renewable energy sources. The ongoing competition from alternative materials requires continuous innovation to highlight the unique benefits of glass. Furthermore, ensuring a consistent and high-quality supply of recycled glass cullet is crucial for sustainable production and cost management. Global supply chain disruptions and geopolitical uncertainties can also impact the availability and cost of raw materials and finished goods, requiring robust risk management strategies.

Emerging Opportunities in Italy Container Glass Market

Emerging opportunities in the Italy container glass market are abundant, driven by evolving consumer preferences and technological advancements. The growing trend towards premiumization in beverages and food presents a significant opportunity for high-end glass packaging solutions. The increasing demand for sustainable and reusable packaging offers scope for innovation in refillable glass bottle systems. The expanding e-commerce sector also opens avenues for specialized glass packaging designed for safe and efficient shipping. Furthermore, advancements in smart packaging technologies, such as embedded sensors for tracking and authentication, could unlock new applications and market segments for glass containers. The focus on decarbonization, as exemplified by the 'Divina' project, presents a significant opportunity for companies investing in green technologies and sustainable production methods.

Leading Players in the Italy Container Glass Market Sector

- Bell Glass

- Vetri Speciali

- Zignago Vetro

- Vetropack

- Italesse

- Vetroelite

- SAIDA Group

- Vetro Plastica Laziale

- COVIM

- VDGlass

- Vetreria Etrusca

Key Milestones in Italy Container Glass Market Industry

- July 2021: An Italian consortium, including glass manufacturers like Bormioli Luigi and Bormioli Rocco, furnace suppliers, and energy companies, initiated the 'Divina' project. This collaboration aims to significantly reduce glass industry emissions by exploring the use of hydrogen in the melting stage, which accounts for over 50% of total energy consumption. This landmark initiative underscores a strong commitment to sustainability and decarbonization within the Italian glass container sector.

- February 2021: Ardagh Group launched Absolut's limited-edition 'Absolut Movement' vodka bottle. This innovative frosted blue glass bottle, featuring a distinctive upward spiral design, symbolizes inclusivity and continuous social growth, showcasing the creative potential and marketing impact of glass packaging in the premium spirits market.

Strategic Outlook for Italy Container Glass Market Market

The strategic outlook for the Italy container glass market is one of sustained growth and innovation. Key accelerators include continued investment in sustainable production methods, such as increasing the use of recycled glass and exploring alternative energy sources like hydrogen, to meet environmental targets and consumer demand. Companies that focus on developing lightweight yet durable glass packaging will gain a competitive edge. Furthermore, strategic partnerships and collaborations across the value chain, from raw material suppliers to end-users, will be crucial for fostering innovation and expanding market reach. The ability to adapt to evolving consumer preferences for premium, safe, and aesthetically appealing packaging will be paramount for long-term success in the Italian glass packaging industry.

Italy Container Glass Market Segmentation

-

1. End-user Vertical

-

1.1. Beverages*

-

1.1.1. Alcoholi

- 1.1.1.1. Beer and Cider

- 1.1.1.2. Wine and Spirits

-

1.1.2. Non-Alco

- 1.1.2.1. Carbonated Soft Drinks

- 1.1.2.2. Juices

- 1.1.2.3. Water

- 1.1.2.4. Dairy Based Drinks

- 1.1.2.5. Flavored Drinks

-

1.1.1. Alcoholi

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceutical

- 1.5. Other End-user Verticals

-

1.1. Beverages*

Italy Container Glass Market Segmentation By Geography

- 1. Italy

Italy Container Glass Market Regional Market Share

Geographic Coverage of Italy Container Glass Market

Italy Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Wine Production in Italy; Increasing Adoption of Glass Container Packaging in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Availablity of the Substitute can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Growing Wine Consumption and Increasing Adoption of Glass Packaging in Food and Condiment Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Beverages*

- 5.1.1.1. Alcoholi

- 5.1.1.1.1. Beer and Cider

- 5.1.1.1.2. Wine and Spirits

- 5.1.1.2. Non-Alco

- 5.1.1.2.1. Carbonated Soft Drinks

- 5.1.1.2.2. Juices

- 5.1.1.2.3. Water

- 5.1.1.2.4. Dairy Based Drinks

- 5.1.1.2.5. Flavored Drinks

- 5.1.1.1. Alcoholi

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceutical

- 5.1.5. Other End-user Verticals

- 5.1.1. Beverages*

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bell Glass*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vetri Speciali

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zignago Vetro

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vetropack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Italesse

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vetroelite

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAIDA Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vetro Plastica Laziale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 COVIM

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VDGlass

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vetreria Etrusca

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bell Glass*List Not Exhaustive

List of Figures

- Figure 1: Italy Container Glass Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Italy Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Container Glass Market Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 2: Italy Container Glass Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Italy Container Glass Market Revenue million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Italy Container Glass Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Container Glass Market?

The projected CAGR is approximately 2.07%.

2. Which companies are prominent players in the Italy Container Glass Market?

Key companies in the market include Bell Glass*List Not Exhaustive, Vetri Speciali, Zignago Vetro, Vetropack, Italesse, Vetroelite, SAIDA Group, Vetro Plastica Laziale, COVIM, VDGlass, Vetreria Etrusca.

3. What are the main segments of the Italy Container Glass Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.75 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Wine Production in Italy; Increasing Adoption of Glass Container Packaging in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Growing Wine Consumption and Increasing Adoption of Glass Packaging in Food and Condiment Sector.

7. Are there any restraints impacting market growth?

Availablity of the Substitute can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

July 2021 - An Italian group comprising glass manufacturers, furnace suppliers, and energy companies has begun a collaboration to reduce glass industry emissions through hydrogen.The group consists of Snam, RINA, Bormioli Luigi, Bormioli Rocco, Stara Glass, UNI.GE, Stazione Sperimentale del Vetro, IFRF Italia, SGRPRO and RJC SOFT. The 'Divina' project (Decarbonisation of the Glass Industry: Hydrogen and New Equipment), coordinated by Snam, RINA, and Bormioli, aims to reduce emissions in the glass melting stage, which accounts for more than 50% of total energy consumption throughout the production process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Container Glass Market?

To stay informed about further developments, trends, and reports in the Italy Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence