Key Insights

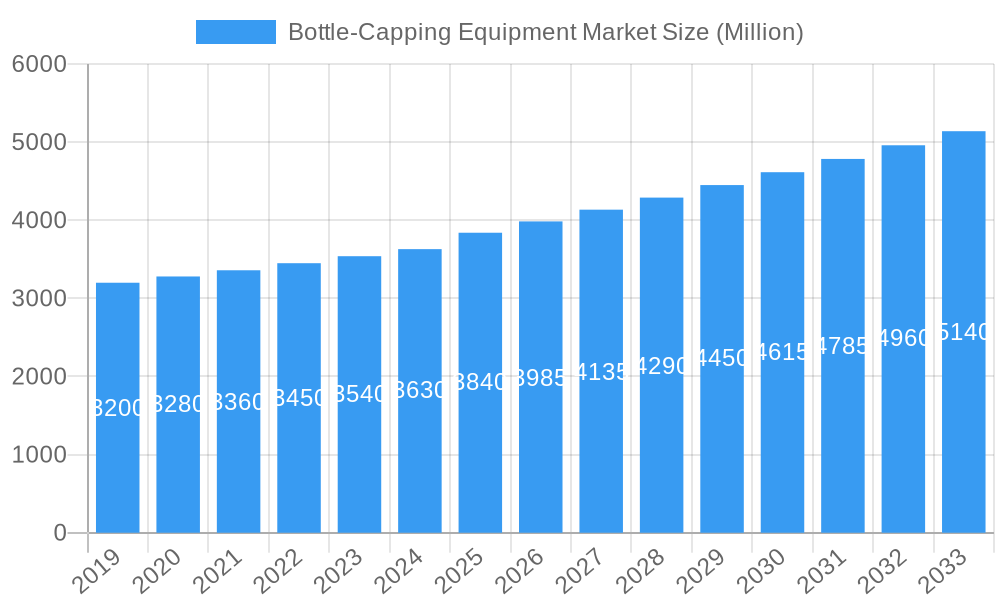

The global bottle-capping equipment market is poised for steady expansion, projected to reach an estimated USD 3.84 million by 2025 with a Compound Annual Growth Rate (CAGR) of 3.63% during the forecast period of 2025-2033. This growth is primarily driven by the escalating demand for packaged goods across diverse industries, including pharmaceuticals, food and beverage, and personal care. The pharmaceutical sector, in particular, is a significant contributor due to stringent regulations for product integrity and safety, necessitating advanced and reliable capping solutions. Similarly, the burgeoning processed food and beverage industry, fueled by evolving consumer lifestyles and a preference for convenience, is creating substantial opportunities for high-speed and automated capping machinery. The increasing focus on product shelf-life extension and tamper-evident sealing further amplifies the need for sophisticated capping technologies. Moreover, technological advancements leading to the development of more efficient, precise, and cost-effective automatic and semi-automatic capping machines are key enablers of market growth. Innovations in robotics and artificial intelligence are also being integrated into capping equipment, enhancing operational efficiency and reducing human error.

Bottle-Capping Equipment Market Market Size (In Billion)

While the market benefits from robust demand drivers, certain restraints could influence its trajectory. The initial high capital investment required for advanced automatic capping systems can be a barrier for small and medium-sized enterprises. Additionally, the complexity of maintaining and operating highly automated equipment may necessitate specialized training, posing a challenge for some end-users. Nevertheless, the overwhelming trend towards automation and the adoption of ROPP caps, screw caps, and snap-on caps across various applications, driven by their superior sealing capabilities and tamper-evidence features, is expected to outweigh these challenges. Emerging economies, particularly in the Asia Pacific region, are anticipated to witness significant growth due to rapid industrialization and increasing disposable incomes, leading to a higher consumption of packaged goods. Key players like Sidel Group (Tetra Laval Group), Krones AG, and ProMach Inc. are actively investing in research and development to introduce innovative solutions that cater to the evolving needs of the market, further stimulating its expansion.

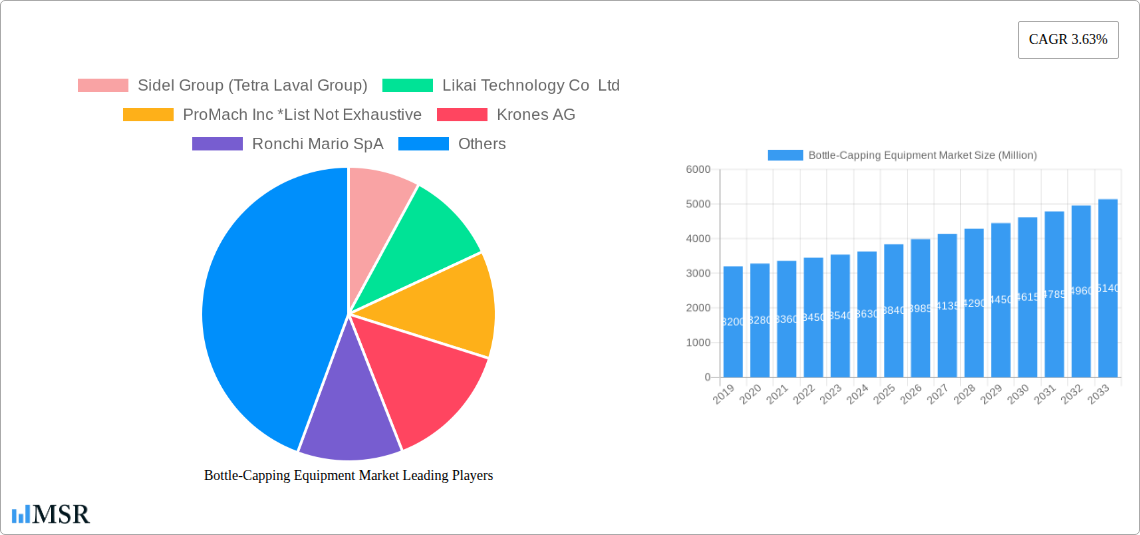

Bottle-Capping Equipment Market Company Market Share

Unlocking Efficiency: In-depth Analysis of the Global Bottle-Capping Equipment Market (2025-2033)

This comprehensive report delves into the dynamic global bottle-capping equipment market, a critical component of the packaging industry. From high-speed automatic capping machines to versatile semi-automatic solutions, this analysis provides an unparalleled deep dive into market size, growth trajectories, technological innovations, and competitive landscapes. We dissect the market by cap type, including ROPP caps, screw caps, snap-on caps, and corks, and segment by key end-user industries such as pharmaceuticals, personal care and cosmetics, food and beverage, chemicals, and the automotive sector. With a rigorous study period from 2019 to 2033, a base year of 2025, and an estimated year also of 2025, this report offers precise forecasts for the forecast period 2025–2033 and historical insights from 2019–2024. Discover actionable intelligence to navigate this evolving market, optimize your packaging operations, and capitalize on emerging opportunities.

Bottle-Capping Equipment Market Market Concentration & Dynamics

The global bottle-capping equipment market exhibits a moderately concentrated landscape, characterized by the presence of established global players and a growing number of regional specialists. Innovation ecosystems are robust, driven by the continuous demand for increased production efficiency, enhanced product safety, and reduced operational costs across diverse industries. Regulatory frameworks, particularly in the pharmaceutical and food & beverage sectors, play a significant role in dictating equipment specifications and quality standards, fostering a demand for reliable and compliant capping solutions. Substitute products, such as alternative sealing mechanisms, exist but are generally not as cost-effective or versatile as traditional bottle caps for a wide range of applications. End-user trends, including the rise of e-commerce and the demand for child-resistant and tamper-evident closures, are reshaping product development priorities. Mergers & Acquisition (M&A) activities, while not dominant, are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, acquisitions aim to integrate advanced robotics or specialized capping technologies into broader packaging solutions. The market share distribution is influenced by the technological sophistication and production capacity of leading manufacturers, with a significant portion held by companies offering integrated packaging line solutions.

Bottle-Capping Equipment Market Industry Insights & Trends

The bottle-capping equipment market is poised for substantial growth, projected to reach approximately USD 3,000 million by 2025 and expand to over USD 4,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 5.5% during the forecast period 2025–2033. This expansion is propelled by several key drivers. The burgeoning food and beverage industry, particularly the demand for packaged beverages and processed foods, remains a primary growth engine. Similarly, the pharmaceutical sector's increasing output and the stringent requirements for sterile and tamper-proof packaging fuel the adoption of advanced capping technologies. The personal care and cosmetics industry is another significant contributor, with growing product diversity and consumer preference for visually appealing and functionally superior packaging. Technological disruptions are at the forefront, with a strong trend towards automatic capping machines that offer high speed, precision, and reduced labor costs. Innovations in robotics integration, AI-powered quality control, and smart connectivity (IoT) are enhancing the capabilities of capping equipment, enabling real-time monitoring and predictive maintenance. Evolving consumer behaviors, such as the demand for sustainable packaging solutions and innovative dispensing mechanisms, are also influencing equipment design and functionality. The shift towards smaller, single-serve packaging formats in beverages and the need for specialized closures for medical devices are further shaping market demands. The chemicals sector, with its diverse range of products requiring robust sealing, also contributes steadily to market growth. The overall market is experiencing a positive trajectory, driven by industrial automation, evolving consumer needs, and advancements in packaging technology, creating a fertile ground for bottling line manufacturers and packaging solution providers.

Key Markets & Segments Leading Bottle-Capping Equipment Market

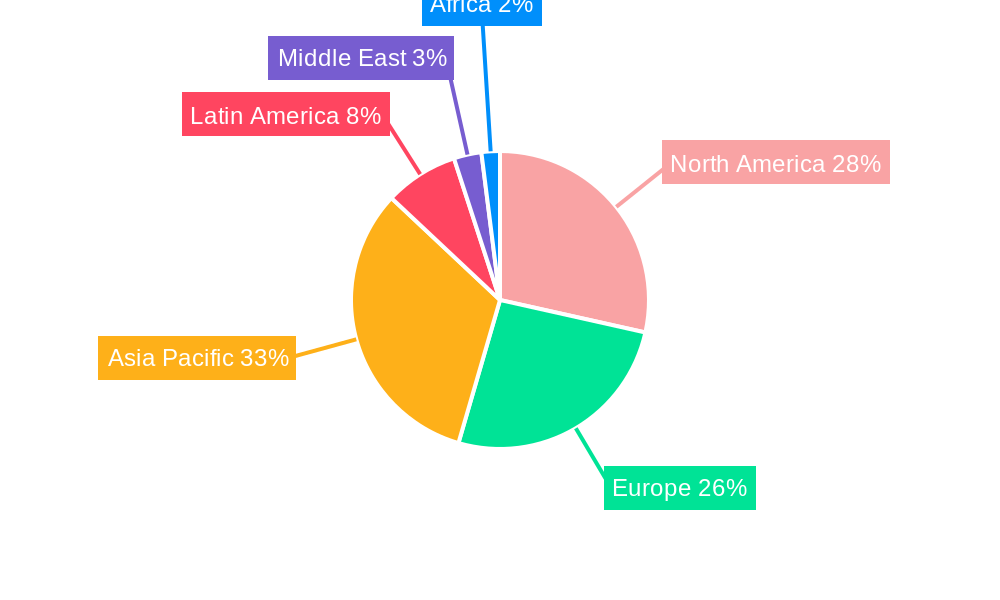

The global bottle-capping equipment market is significantly led by Asia Pacific due to robust industrialization, a large manufacturing base, and growing domestic consumption across its key economies like China, India, and Southeast Asian nations. Within this region, China stands out as a dominant market, fueled by its extensive food and beverage, pharmaceuticals, and personal care and cosmetics manufacturing sectors.

Technology Segment Dominance:

Automatic Capping Machines: This segment holds the largest market share and is expected to continue its dominance.

- Drivers: High production volumes, demand for efficiency in large-scale manufacturing, labor cost reduction, and superior precision in sealing.

- Dominance Analysis: Industries like food and beverage, pharmaceuticals, and mass-produced consumer goods heavily rely on the speed and consistency of automatic cappers, making them indispensable for large production runs. The increasing investment in advanced manufacturing facilities further bolsters their adoption.

Semi-automatic Capping Machines: These cater to medium-scale production and specialized applications.

- Drivers: Flexibility for lower volume runs, ease of operation, and lower initial investment costs compared to fully automatic systems.

- Dominance Analysis: Emerging businesses, contract manufacturers, and companies with diverse product lines requiring frequent changeovers find semi-automatic machines to be an optimal choice. They are particularly relevant in niche markets within pharmaceuticals and specialty chemicals.

Cap Type Segment Dominance:

Screw Caps: This is the most prevalent cap type globally.

- Drivers: Versatility, cost-effectiveness, ease of use, and suitability for a wide array of product types and container sizes.

- Dominance Analysis: The sheer volume of products utilizing screw caps in the food and beverage (e.g., water bottles, soft drinks, sauces) and personal care (e.g., shampoos, lotions) industries ensures their leading position. The availability of advanced screw capping machinery further solidifies this segment.

ROPP Caps (Roll-On Pilfer Proof): Experiencing significant growth, especially in specific sectors.

- Drivers: Enhanced tamper evidence, security features, and aesthetic appeal, crucial for brand protection and consumer confidence.

- Dominance Analysis: The pharmaceutical industry heavily favors ROPP caps for prescription medications and over-the-counter drugs due to their inviolable seal. The growing demand for premium beverages and spirits in the food and beverage sector also contributes to their increasing adoption.

Snap-on Caps and Corks: These cater to more specific applications.

- Drivers: Convenience for frequent access (snap-on) and traditional/premium appeal (corks).

- Dominance Analysis: Snap-on caps are common in food and beverage (e.g., condiments, some dairy products) and chemical packaging. Corks, while facing a declining trend in some mass markets, remain dominant in premium wine and spirit segments within the food and beverage industry.

End User Segment Dominance:

Food and Beverage: This sector is the largest consumer of bottle-capping equipment.

- Drivers: High-volume production, diverse product range (liquids, solids, powders), and increasing demand for packaged goods globally.

- Dominance Analysis: The ubiquity of bottled and canned beverages, processed foods, and sauces necessitates high-efficiency capping solutions.

Pharmaceuticals: A critical and growing segment.

- Drivers: Stringent regulatory requirements, demand for sterile and tamper-evident seals, and the expanding global healthcare market.

- Dominance Analysis: The need for product integrity and patient safety makes pharmaceutical applications a high-value segment, driving innovation in specialized capping technologies.

The personal care and cosmetics and chemicals sectors also represent significant and growing markets, driven by product innovation and industrial demand, respectively.

Bottle-Capping Equipment Market Product Developments

Product development in the bottle-capping equipment market is characterized by a relentless pursuit of automation, precision, and adaptability. Manufacturers are integrating advanced robotics for intricate cap handling and application, as seen with Shemesh's TKS-C60, a comprehensive robotics-enhanced packaging line for cosmetics capable of seamless feeding, filling, capping, labeling, case packing, and palletizing at 60 bottles per minute. Innovations also focus on energy efficiency and reduced material waste. For instance, Marchesini Group's COMPACT 24 monobloc machine for filling and capping bottles for tablets exemplifies the trend towards integrated solutions that optimize space and production flow. The market is also witnessing the development of specialized capping machinery for unique container types and closure materials, such as Wallaby's investment in machinery for wide-mouth ROPP aluminum closures to cap their resealable aluminum water containers, enabling a line capacity of 14 million units annually. These advancements aim to enhance line efficiency, ensure product integrity, and cater to evolving consumer demands for sustainable and user-friendly packaging.

Challenges in the Bottle-Capping Equipment Market Market

The bottle-capping equipment market faces several challenges that can temper growth. Supply chain disruptions, particularly for specialized components and electronic parts, can lead to extended lead times and increased manufacturing costs. Intensifying global competition from both established players and emerging manufacturers puts pressure on pricing and profit margins. Evolving regulatory landscapes, especially concerning food safety, pharmaceutical integrity, and environmental standards, require continuous adaptation and investment in compliance, which can be costly. Furthermore, the high initial capital investment for advanced automatic capping systems can be a barrier for small and medium-sized enterprises (SMEs) in certain regions. Lastly, skilled labor shortages for operating and maintaining sophisticated packaging machinery can impact operational efficiency.

Forces Driving Bottle-Capping Equipment Market Growth

Several forces are propelling the growth of the bottle-capping equipment market. The overarching trend of industrial automation and the pursuit of operational efficiency across all manufacturing sectors is a primary driver. Increasing global demand for packaged goods, particularly in the food and beverage and pharmaceuticals industries, directly correlates with the need for robust and high-speed capping solutions. Technological advancements, such as the integration of robotics, AI, and IoT, are enhancing the capabilities of capping equipment, offering greater precision, flexibility, and data-driven insights. The growing emphasis on product safety, tamper evidence, and shelf-life extension necessitates advanced sealing technologies, driving the adoption of specialized caps and capping machinery. Favorable economic conditions in developing regions are also fueling investment in manufacturing infrastructure, which in turn boosts demand for packaging equipment.

Challenges in the Bottle-Capping Equipment Market Market

The long-term growth of the bottle-capping equipment market is underpinned by several key catalysts. The continuous pursuit of innovation in packaging materials and designs by end-users creates a sustained demand for new and adapted capping solutions. Strategic partnerships and collaborations between equipment manufacturers and their clients, particularly in the pharmaceuticals and cosmetics sectors, foster the co-development of highly specialized and efficient systems. Market expansion into emerging economies with growing consumer bases and expanding manufacturing sectors presents significant opportunities for increased adoption of automated capping technologies. Furthermore, the increasing focus on sustainability, leading to the development of recyclable and reusable packaging solutions, will drive the need for capping equipment that can effectively handle these new materials and designs. The ongoing digitization of manufacturing processes, or Industry 4.0, will also spur the adoption of smart and connected capping machines.

Emerging Opportunities in Bottle-Capping Equipment Market

Emerging opportunities in the bottle-capping equipment market are shaped by evolving consumer preferences and technological advancements. The surge in demand for personalized and smaller batch production in cosmetics and niche food & beverage products presents opportunities for flexible and quick-changeover capping solutions. The growing awareness and adoption of sustainable packaging, including biodegradable and compostable materials, require innovative capping technologies that can ensure seal integrity without compromising environmental goals. The expansion of the e-commerce sector is driving demand for robust, tamper-evident, and easy-to-open capping solutions that can withstand the rigors of shipping. Furthermore, advancements in smart packaging, which can integrate sensors or indicators, may lead to the development of capping equipment capable of incorporating these technologies. Opportunities also lie in providing customized solutions for highly specialized applications in sectors like biotechnology and medical devices, where stringent sealing requirements are paramount.

Leading Players in the Bottle-Capping Equipment Market Sector

- Sidel Group (Tetra Laval Group)

- Likai Technology Co Ltd

- ProMach Inc

- Krones AG

- Ronchi Mario SpA

- Accutek Packaging Equipment Companies Inc

- Barry-Wehmiller Companies Inc

- Phoenix Dison Tec LLC

- Tetra Pak International SA (Tetra Laval Group)

- E-PAK Machinery Inc

Key Milestones in Bottle-Capping Equipment Market Industry

- January 2023: Shemesh launched TKS-C60, a robotics-enhanced packaging line for cosmetics, capable of handling the entire packaging process at 60 bottles per minute, demonstrating significant advancements in automated cosmetic packaging.

- December 2022: Wallaby invested AUD 500,000 (USD 349,550) in specialized capping machinery and wide-mouth ROPP 38 mm aluminum closures to introduce a new resealable aluminum container for canned water, enabling a manufacturing capacity of 120 bottles per minute and an annual line capacity of 14 million units.

- May 2022: Marchesini Group showcased innovations in pharmaceutical product production and packaging at its Open Door Pharma event, highlighting advancements in sustainable materials and presenting machinery like the COMPACT 24, a monobloc machine for filling and capping bottles for tablets, capsules, or pills, signaling future trends in integrated packaging solutions.

Strategic Outlook for Bottle-Capping Equipment Market Market

The strategic outlook for the bottle-capping equipment market is exceptionally positive, driven by continued demand for automation, efficiency, and product integrity across a wide spectrum of industries. Key growth accelerators include the ongoing expansion of the global food and beverage and pharmaceuticals sectors, necessitating advanced capping solutions. Strategic opportunities lie in developing and marketing equipment that adheres to increasingly stringent sustainability regulations and consumer preferences for eco-friendly packaging. Investment in research and development to integrate cutting-edge technologies like AI and advanced robotics into capping machines will be crucial for maintaining a competitive edge. Furthermore, expanding market reach into emerging economies and focusing on providing customized solutions for niche applications will unlock significant future market potential. The integration of Industry 4.0 principles will also be vital, offering smart connectivity and data analytics for optimized production processes.

Bottle-Capping Equipment Market Segmentation

-

1. Technology

- 1.1. Automatic

- 1.2. Semi-automatic

-

2. Cap Type

- 2.1. ROPP Caps

- 2.2. Screw Caps

- 2.3. Snap-on-Caps

- 2.4. Corks

-

3. End User

- 3.1. Pharmaceuticals

- 3.2. Personal Care and Cosmetics

- 3.3. Food and Beverage

- 3.4. Chemicals

- 3.5. Automotive

- 3.6. Other End Users

Bottle-Capping Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East

Bottle-Capping Equipment Market Regional Market Share

Geographic Coverage of Bottle-Capping Equipment Market

Bottle-Capping Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from Pharmaceutical and Chemical Industries; Innovations in Technology Driving the Demand for Automated Capping Machines

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Solutions and High Initial Investments

- 3.4. Market Trends

- 3.4.1. Increased Demand from Pharmaceutical and Chemical Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.2. Market Analysis, Insights and Forecast - by Cap Type

- 5.2.1. ROPP Caps

- 5.2.2. Screw Caps

- 5.2.3. Snap-on-Caps

- 5.2.4. Corks

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceuticals

- 5.3.2. Personal Care and Cosmetics

- 5.3.3. Food and Beverage

- 5.3.4. Chemicals

- 5.3.5. Automotive

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Automatic

- 6.1.2. Semi-automatic

- 6.2. Market Analysis, Insights and Forecast - by Cap Type

- 6.2.1. ROPP Caps

- 6.2.2. Screw Caps

- 6.2.3. Snap-on-Caps

- 6.2.4. Corks

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceuticals

- 6.3.2. Personal Care and Cosmetics

- 6.3.3. Food and Beverage

- 6.3.4. Chemicals

- 6.3.5. Automotive

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Automatic

- 7.1.2. Semi-automatic

- 7.2. Market Analysis, Insights and Forecast - by Cap Type

- 7.2.1. ROPP Caps

- 7.2.2. Screw Caps

- 7.2.3. Snap-on-Caps

- 7.2.4. Corks

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceuticals

- 7.3.2. Personal Care and Cosmetics

- 7.3.3. Food and Beverage

- 7.3.4. Chemicals

- 7.3.5. Automotive

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Automatic

- 8.1.2. Semi-automatic

- 8.2. Market Analysis, Insights and Forecast - by Cap Type

- 8.2.1. ROPP Caps

- 8.2.2. Screw Caps

- 8.2.3. Snap-on-Caps

- 8.2.4. Corks

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceuticals

- 8.3.2. Personal Care and Cosmetics

- 8.3.3. Food and Beverage

- 8.3.4. Chemicals

- 8.3.5. Automotive

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Latin America Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Automatic

- 9.1.2. Semi-automatic

- 9.2. Market Analysis, Insights and Forecast - by Cap Type

- 9.2.1. ROPP Caps

- 9.2.2. Screw Caps

- 9.2.3. Snap-on-Caps

- 9.2.4. Corks

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceuticals

- 9.3.2. Personal Care and Cosmetics

- 9.3.3. Food and Beverage

- 9.3.4. Chemicals

- 9.3.5. Automotive

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Middle East Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Automatic

- 10.1.2. Semi-automatic

- 10.2. Market Analysis, Insights and Forecast - by Cap Type

- 10.2.1. ROPP Caps

- 10.2.2. Screw Caps

- 10.2.3. Snap-on-Caps

- 10.2.4. Corks

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceuticals

- 10.3.2. Personal Care and Cosmetics

- 10.3.3. Food and Beverage

- 10.3.4. Chemicals

- 10.3.5. Automotive

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. United Arab Emirates Bottle-Capping Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Automatic

- 11.1.2. Semi-automatic

- 11.2. Market Analysis, Insights and Forecast - by Cap Type

- 11.2.1. ROPP Caps

- 11.2.2. Screw Caps

- 11.2.3. Snap-on-Caps

- 11.2.4. Corks

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pharmaceuticals

- 11.3.2. Personal Care and Cosmetics

- 11.3.3. Food and Beverage

- 11.3.4. Chemicals

- 11.3.5. Automotive

- 11.3.6. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Sidel Group (Tetra Laval Group)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Likai Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ProMach Inc *List Not Exhaustive

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Krones AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ronchi Mario SpA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Accutek Packaging Equipment Companies Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Barry-Wehmiller Companies Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Phoenix Dison Tec LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Tetra Pak International SA (Tetra Laval Group)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 E-PAK Machinery Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sidel Group (Tetra Laval Group)

List of Figures

- Figure 1: Global Bottle-Capping Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 5: North America Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 6: North America Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 11: Europe Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 13: Europe Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 14: Europe Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 19: Asia Pacific Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 21: Asia Pacific Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 22: Asia Pacific Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 27: Latin America Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Latin America Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 29: Latin America Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 30: Latin America Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 37: Middle East Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 38: Middle East Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Bottle-Capping Equipment Market Revenue (Million), by Technology 2025 & 2033

- Figure 43: United Arab Emirates Bottle-Capping Equipment Market Revenue Share (%), by Technology 2025 & 2033

- Figure 44: United Arab Emirates Bottle-Capping Equipment Market Revenue (Million), by Cap Type 2025 & 2033

- Figure 45: United Arab Emirates Bottle-Capping Equipment Market Revenue Share (%), by Cap Type 2025 & 2033

- Figure 46: United Arab Emirates Bottle-Capping Equipment Market Revenue (Million), by End User 2025 & 2033

- Figure 47: United Arab Emirates Bottle-Capping Equipment Market Revenue Share (%), by End User 2025 & 2033

- Figure 48: United Arab Emirates Bottle-Capping Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 49: United Arab Emirates Bottle-Capping Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 3: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 7: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 13: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 20: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 21: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 29: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Mexico Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Latin America Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 35: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 36: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 37: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 39: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Cap Type 2020 & 2033

- Table 40: Global Bottle-Capping Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 41: Global Bottle-Capping Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Saudi Arabia Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East Bottle-Capping Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bottle-Capping Equipment Market?

The projected CAGR is approximately 3.63%.

2. Which companies are prominent players in the Bottle-Capping Equipment Market?

Key companies in the market include Sidel Group (Tetra Laval Group), Likai Technology Co Ltd, ProMach Inc *List Not Exhaustive, Krones AG, Ronchi Mario SpA, Accutek Packaging Equipment Companies Inc, Barry-Wehmiller Companies Inc, Phoenix Dison Tec LLC, Tetra Pak International SA (Tetra Laval Group), E-PAK Machinery Inc.

3. What are the main segments of the Bottle-Capping Equipment Market?

The market segments include Technology, Cap Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from Pharmaceutical and Chemical Industries; Innovations in Technology Driving the Demand for Automated Capping Machines.

6. What are the notable trends driving market growth?

Increased Demand from Pharmaceutical and Chemical Industries.

7. Are there any restraints impacting market growth?

Presence of Alternative Solutions and High Initial Investments.

8. Can you provide examples of recent developments in the market?

January 2023 - Shemesh, a packaging automation company, launched TKS-C60, a complete robotics-enhanced packaging line for cosmetics that can feed, fill, cap, label, case pack, and palletize cosmetic products of different shapes and sizes. It is also intended to handle the entire packaging process. At 60 bottles per minute, the TKS-C60 guarantees a smooth, continuous bottling line for various goods, from creams and cosmetics to perfumes and nail paint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bottle-Capping Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bottle-Capping Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bottle-Capping Equipment Market?

To stay informed about further developments, trends, and reports in the Bottle-Capping Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence