Key Insights

The Polish plastic caps and closures market is projected for significant growth, expected to reach $2.27 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.24% through 2033. This expansion is driven by robust demand from key end-use industries, primarily food and beverage, particularly bottled water and carbonated soft drinks. The personal care and cosmetics sector also contributes substantially, with increasing demand for specialized, aesthetically appealing closures. Household chemicals remain a stable demand driver, requiring secure and child-resistant solutions.

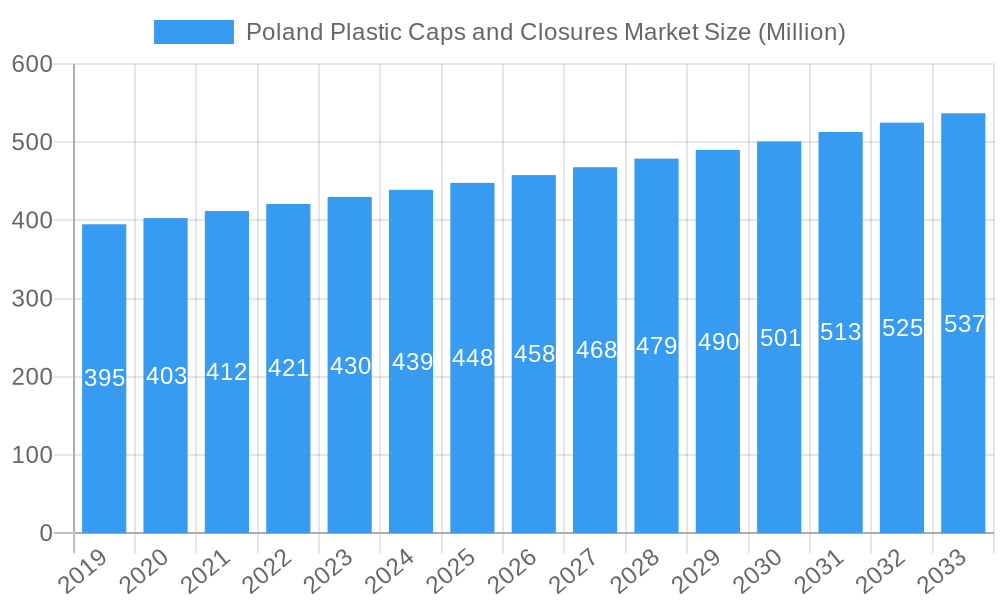

Poland Plastic Caps and Closures Market Market Size (In Billion)

Market dynamics are influenced by advancements in resin technology, including the widespread adoption of recyclable PET and PP. The growing emphasis on consumer safety and product usability is evident in the rising demand for dispensing and child-resistant closures. Leading market participants, such as Berry Global Inc., BERICAP Holding GmbH, and Amcor Group GmbH, are actively innovating their product offerings. Potential market restraints include raw material price volatility, stringent environmental regulations on plastic waste, and intense price competition. Despite these challenges, the sustained need for efficient and secure packaging solutions across various sectors ensures the continued resilience of the Polish plastic caps and closures market.

Poland Plastic Caps and Closures Market Company Market Share

This comprehensive market report offers strategic insights into the dynamic Poland plastic caps and closures market from 2019 to 2033, with a base year of 2025. It provides a detailed analysis of market size, growth drivers, emerging trends, competitive landscape, and future opportunities. Explore market segmentation by resin (PE, PET, PP), product type (threaded, vacuum, dispensing, unthreaded, child-resistant), and end-use industry (food, beverage, personal care, household chemicals). Understand key industry developments, challenges, and strategic outlooks for stakeholders.

Poland Plastic Caps and Closures Market Market Concentration & Dynamics

The Poland plastic caps and closures market exhibits a moderately concentrated landscape, characterized by the presence of both multinational giants and agile local manufacturers. Innovation ecosystems are driven by advancements in material science, sustainable packaging solutions, and smart closure technologies. Regulatory frameworks, particularly those focused on environmental sustainability and food safety, play a crucial role in shaping market strategies and product development. The increasing demand for lightweight, tamper-evident, and recyclable closures is a significant trend. Substitute products, such as metal closures or alternative packaging formats, present a degree of competition, though plastic's versatility and cost-effectiveness maintain its dominance. End-user trends favor convenience, safety, and sustainability, influencing product design and material choices. Mergers and acquisitions (M&A) activities are present, though less frequent, as companies strategically expand their product portfolios and market reach. The market share distribution is influenced by the ability of companies to adapt to these evolving dynamics. For instance, a company with a substantial share in the beverage closure segment might leverage its expertise to enter the household chemicals sector. M&A deal counts are expected to remain moderate, driven by strategic consolidation rather than aggressive market takeover.

Poland Plastic Caps and Closures Market Industry Insights & Trends

The Poland plastic caps and closures market is poised for robust growth, projected to reach XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by several key drivers. The ever-increasing demand for packaged goods across food and beverage, personal care, and household chemicals sectors directly translates into a higher requirement for caps and closures. The beverage industry, in particular, with its sub-segments like bottled water, carbonated soft drinks, alcoholic beverages, and juices, remains a cornerstone of demand. Economic growth and rising disposable incomes in Poland contribute to increased consumer spending on these products, thereby stimulating the plastic caps and closures market.

Technological disruptions are also playing a pivotal role. Innovations in material science are leading to the development of lighter, stronger, and more sustainable plastic materials, including those incorporating recycled content, aligning with global environmental mandates and consumer preferences for eco-friendly packaging. The integration of smart technologies, such as tamper-evident features and dispensing mechanisms, enhances product safety and user convenience, further driving market adoption. Evolving consumer behaviors, marked by a preference for convenience, on-the-go consumption, and a heightened awareness of product safety and hygiene, are compelling manufacturers to develop more sophisticated and user-friendly closure solutions. The growing emphasis on child-resistant closures in the pharmaceutical and household chemical sectors also presents a significant growth avenue. The Polish market's strategic location within the European Union facilitates trade and access to wider consumer bases, further bolstering its growth trajectory. The market size in the base year 2025 is estimated to be XX Million. The historical period (2019–2024) has laid a strong foundation for this projected expansion.

Key Markets & Segments Leading Poland Plastic Caps and Closures Market

The Poland plastic caps and closures market is led by dominant segments within its diverse structure. The Polypropylene (PP) resin segment holds a commanding position, owing to its excellent chemical resistance, heat stability, and cost-effectiveness, making it a preferred choice for a wide array of applications, especially in food and beverage packaging. Polyethylene (PE), particularly High-Density Polyethylene (HDPE), also commands significant market share due to its durability and moisture barrier properties.

Within product types, Threaded - Screw Caps are the most prevalent, owing to their universal application across numerous industries and their reliable sealing capabilities. Dispensing closures, catering to the growing demand for convenience in personal care and household chemicals, are experiencing rapid growth. Child-resistant closures are a critical and expanding segment, driven by stringent safety regulations in the pharmaceutical and certain household chemical applications.

The Food and Beverage end-use industries are the primary revenue generators for the plastic caps and closures market in Poland.

- Beverage Segmentation:

- Bottled Water: A consistently high-volume segment, demanding efficient and reliable closures.

- Carbonated Soft Drinks: Requires closures capable of withstanding internal pressure and maintaining carbonation.

- Alcoholic Beverages: Diverse needs, ranging from screw caps for spirits to specialized closures for wine.

- Juices and Energy Drinks: Growing segments with a focus on convenience and tamper-evidence.

- Personal Care and Cosmetics: This segment is experiencing substantial growth, driven by product innovation and the demand for premium packaging with enhanced functionality.

- Household Chemicals: Safety features like child-resistance are paramount, alongside secure sealing for various product formulations.

The dominance of these segments is driven by several factors:

- Economic Growth: A robust economy fuels consumer spending on packaged goods, directly impacting demand for closures.

- Infrastructure Development: Efficient logistics and distribution networks ensure that packaged products reach consumers, driving the need for secure closures.

- Consumer Preferences: The Polish consumer's increasing demand for convenience, safety, and aesthetically pleasing packaging translates into higher consumption of specialized caps and closures.

- Technological Advancements: The development of specialized closures for specific applications, such as active closures that extend shelf life or dispensing closures for precise application, is driving segment growth.

- Regulatory Compliance: Adherence to safety and environmental regulations, particularly for child-resistant and recyclable closures, further solidifies the market position of compliant segments.

Poland Plastic Caps and Closures Market Product Developments

Product innovation in the Poland plastic caps and closures market is characterized by a strong focus on sustainability, functionality, and user convenience. Companies are actively developing lightweight closures that reduce material usage and associated greenhouse gas emissions. For example, Berry Global's October 2023 introduction of lightweight tube closures in various diameters and orifice sizes, with options for virgin or recycled plastics, exemplifies this trend. UNITED CAPS' March 2023 launch of the 23 H-PAK tethered closure for carton packaging, designed for enhanced recyclability with a tamper-evident band, showcases innovation in reducing packaging waste and improving end-of-life solutions. These advancements aim to provide competitive edges through enhanced product integrity, ease of use, and reduced environmental impact, directly addressing evolving consumer and regulatory demands. The market relevance of these developments lies in their ability to meet the growing call for eco-friendly and high-performance packaging solutions.

Challenges in the Poland Plastic Caps and Closures Market Market

The Poland plastic caps and closures market faces several challenges that can impact its growth trajectory. Regulatory hurdles, particularly evolving environmental legislation concerning plastic waste and single-use plastics, necessitate continuous investment in sustainable material solutions and recycling technologies. Supply chain disruptions, including fluctuations in raw material prices (primarily petrochemical derivatives) and logistical complexities, can affect production costs and delivery timelines. Intense competitive pressures from both domestic and international players, leading to price sensitivity and the need for constant innovation, also present a significant challenge. Furthermore, the growing consumer and regulatory demand for sustainable alternatives requires substantial investment in research and development for biodegradable or compostable materials, which may not yet offer the same performance or cost-effectiveness as traditional plastics. The market size impact of these challenges can be seen in potential price increases for consumers and slower adoption of new technologies if costs are prohibitive.

Forces Driving Poland Plastic Caps and Closures Market Growth

Several key forces are propelling the growth of the Poland plastic caps and closures market. Growing demand from the food and beverage sector, driven by population growth and increasing consumption of packaged goods, is a primary catalyst. The expansion of the personal care and cosmetics industry, with its continuous product launches and demand for sophisticated packaging, also significantly contributes. Technological advancements in materials and manufacturing processes are leading to the development of more efficient, sustainable, and user-friendly closures. Increasing consumer awareness and preference for convenience and safety are driving the adoption of specialized closures like dispensing and child-resistant types. Furthermore, government initiatives and EU regulations promoting a circular economy and sustainable packaging encourage innovation in recyclable and recycled content closures, creating new market opportunities.

Challenges in the Poland Plastic Caps and Closures Market Market

Long-term growth catalysts in the Poland plastic caps and closures market are intrinsically linked to continued innovation in sustainable materials and processes. The development and widespread adoption of truly circular economy solutions, such as advanced recycling technologies and the increased use of high-quality post-consumer recycled (PCR) plastics, will be crucial. Strategic partnerships and collaborations between resin suppliers, closure manufacturers, and brand owners can accelerate the development and market penetration of novel solutions. Furthermore, expansion into emerging end-use industries and the development of smart packaging solutions that offer traceability and enhanced consumer interaction present significant long-term growth potential. Investments in research and development to create closures with improved barrier properties and extended shelf-life capabilities for various product categories will also be a key growth driver.

Emerging Opportunities in Poland Plastic Caps and Closures Market

Emerging opportunities in the Poland plastic caps and closures market are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for sustainable and eco-friendly packaging presents a significant avenue for innovation in biodegradable, compostable, and highly recyclable closures. The rise of e-commerce and direct-to-consumer models is creating opportunities for specialized closures designed for safe and secure transit. Furthermore, the increasing focus on health and wellness is driving demand for closures with enhanced hygiene features and tamper-evident security. The expansion of the pharmaceutical packaging sector, with its strict regulatory requirements for child-resistant and tamper-evident closures, offers a substantial growth area. The potential to integrate smart technologies into closures, enabling features like track-and-trace capabilities or product authentication, also represents a significant emerging trend.

Leading Players in the Poland Plastic Caps and Closures Market Sector

- Berry Global Inc

- BERICAP Holding GmbH

- UNITED CAPS LUXEMBOURG SA

- Amcor Group GmbH

- Guala Closures S p A

- ALPLA Group

- Tecnocap Group

- Politech Sp z o o

- ROSINSKI PACKAGING Limited Liability Company

- Multicaps Sp z o o

Key Milestones in Poland Plastic Caps and Closures Market Industry

- October 2023: Berry Global introduced a lightweight tube closure solution that combines contemporary design and material flexibility while reducing greenhouse gas emissions. The closures are available in 35 mm and 50 mm diameters, offering matt and glossy surface finishes with 3 mm and 5 mm orifices. These closures may be produced using virgin polypropylene (PP) and polyethylene (PE) or with food-safe post-consumer recycled plastic (rPE and rPP) sourced from CleanStream, Berry's internal, closed-loop recycling process. This development underscores the industry's commitment to sustainability and material innovation.

- March 2023: UNITED CAPS, an international manufacturer of caps and closures, introduced a new tethered closure for carton packaging called 23 H-PAK. With patents pending, this innovative closure featured a tamper-evident (TE) band that keeps all components intact, facilitating easier recycling. The design provides an effective and sustainable solution for carton packaging, addressing the growing need for recyclability and waste reduction in the packaging industry.

Strategic Outlook for Poland Plastic Caps and Closures Market Market

The strategic outlook for the Poland plastic caps and closures market is characterized by a strong emphasis on sustainability, innovation, and market expansion. Growth accelerators include the continued adoption of advanced recycling technologies and the integration of recycled content into product offerings, aligning with circular economy principles. Companies that invest in developing lightweight, high-performance closures will gain a competitive advantage. Strategic partnerships with beverage, food, and personal care brands will be crucial for co-developing tailored solutions that meet specific product and consumer needs. Expanding into niche markets, such as specialized closures for pharmaceuticals or nutraceuticals, and leveraging digital technologies for enhanced supply chain efficiency and customer engagement will also be key to future success. The focus will remain on delivering value through innovation that balances performance, cost-effectiveness, and environmental responsibility, ensuring sustained growth in this dynamic market.

Poland Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded - Screw Caps, Vacuum, etc.

- 2.2. Dispensing

- 2.3. Unthread

- 2.4. Child-resistant

-

3. End-use Industry

- 3.1. Food

-

3.2. Beverage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices and Energy Drinks

- 3.2.5. Other Beverages

- 3.3. Personal Care and Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-use Industries

Poland Plastic Caps and Closures Market Segmentation By Geography

- 1. Poland

Poland Plastic Caps and Closures Market Regional Market Share

Geographic Coverage of Poland Plastic Caps and Closures Market

Poland Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Packaged Food and Pharmaceutical Packaging

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Packaged Food and Pharmaceutical Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Plastic Caps and Closures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded - Screw Caps, Vacuum, etc.

- 5.2.2. Dispensing

- 5.2.3. Unthread

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices and Energy Drinks

- 5.3.2.5. Other Beverages

- 5.3.3. Personal Care and Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BERICAP Holding GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UNITED CAPS LUXEMBOURG SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Guala Closures S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ALPLA Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tecnocap Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Politech Sp z o o

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSINSKI PACKAGING Limited Liability Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Multicaps Sp z o o

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: Poland Plastic Caps and Closures Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland Plastic Caps and Closures Market Share (%) by Company 2025

List of Tables

- Table 1: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 2: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Poland Plastic Caps and Closures Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 4: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Resin 2020 & 2033

- Table 6: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Poland Plastic Caps and Closures Market Revenue billion Forecast, by End-use Industry 2020 & 2033

- Table 8: Poland Plastic Caps and Closures Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Plastic Caps and Closures Market?

The projected CAGR is approximately 8.24%.

2. Which companies are prominent players in the Poland Plastic Caps and Closures Market?

Key companies in the market include Berry Global Inc, BERICAP Holding GmbH, UNITED CAPS LUXEMBOURG SA, Amcor Group GmbH, Guala Closures S p A, ALPLA Group, Tecnocap Group, Politech Sp z o o, ROSINSKI PACKAGING Limited Liability Company, Multicaps Sp z o o.

3. What are the main segments of the Poland Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Packaged Food and Pharmaceutical Packaging.

6. What are the notable trends driving market growth?

Polyethylene (PE) Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for Packaged Food and Pharmaceutical Packaging.

8. Can you provide examples of recent developments in the market?

October 2023 - Berry Global introduced a lightweight tube closure solution that combines contemporary design and material flexibility while reducing greenhouse gas emissions. The closures would be available in 35 mm and 50 mm diameters, each offering matt and glossy surface finishes with 3 mm and 5 mm orifices. These closures may be produced using virgin polypropylene (PP) and polyethylene (PE) or with food-safe post-consumer recycled plastic (rPE and rPP) sourced from CleanStream, Berry's internal, closed-loop recycling process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the Poland Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence