Key Insights

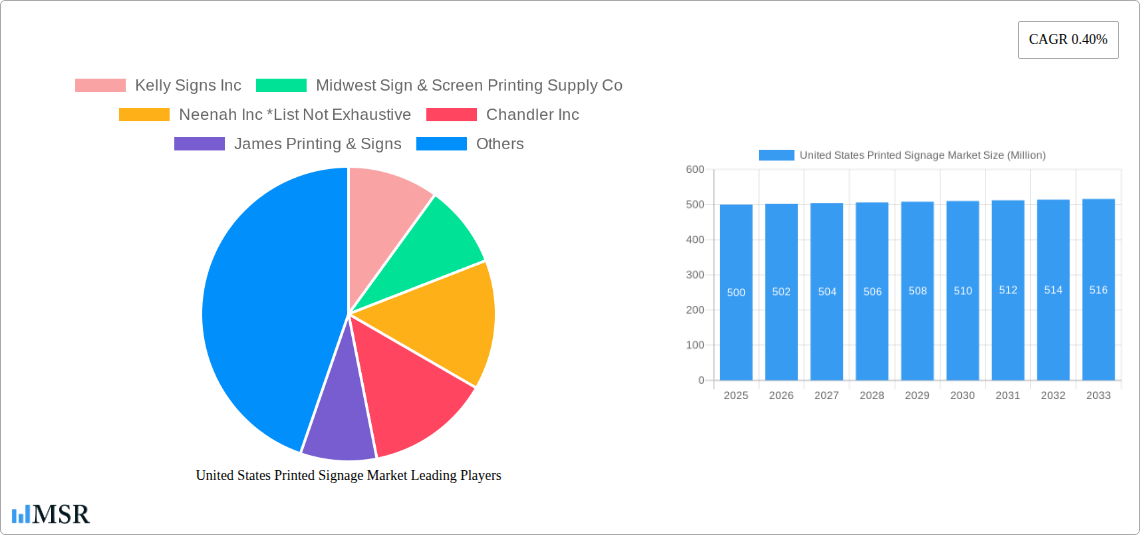

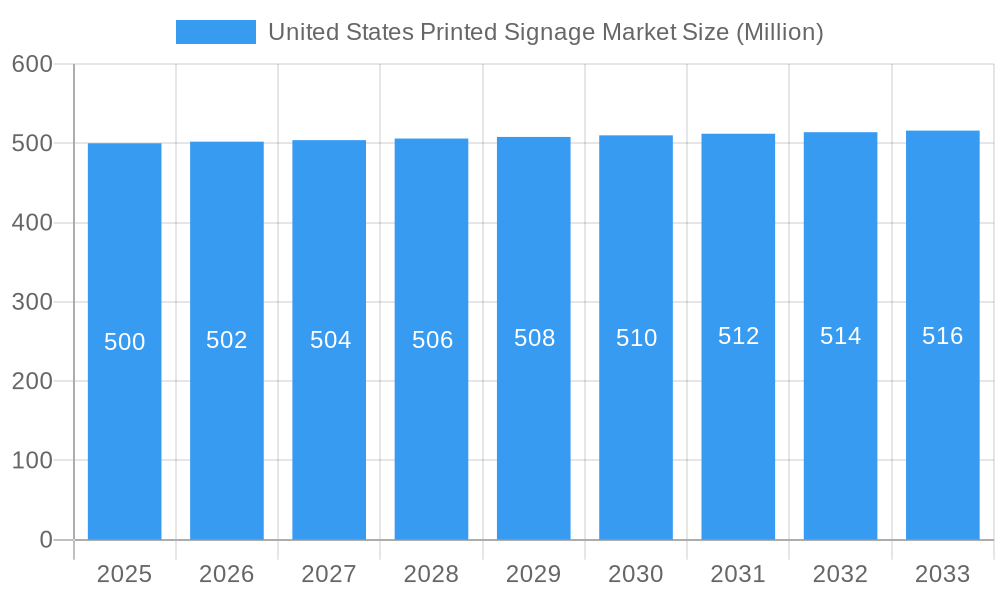

The United States Printed Signage Market is poised for a period of steady, albeit modest, expansion, with a projected Compound Annual Growth Rate (CAGR) of 0.40% during the forecast period of 2025-2033. The market, estimated to be valued at XX million in 2025, is driven by a confluence of factors. The enduring need for visual communication across various industries, coupled with the constant evolution of printing technologies, continues to fuel demand. Businesses are increasingly leveraging printed signage for brand promotion, customer engagement, and wayfinding. The "Retail" and "Entertainment" verticals are anticipated to remain significant contributors, with a growing emphasis on creating immersive and engaging customer experiences. Furthermore, advancements in materials and printing techniques are enabling the creation of more durable, visually appealing, and sustainable signage solutions, further bolstering market growth.

United States Printed Signage Market Market Size (In Million)

Key trends shaping the U.S. Printed Signage Market include a pronounced shift towards customized and experiential signage, where brands seek to differentiate themselves through unique designs and interactive elements. The "Backlit Displays" and "Pop Displays" segments are expected to witness healthy growth as businesses invest in dynamic and eye-catching marketing materials. Moreover, there is a growing demand for eco-friendly printing options and sustainable materials, reflecting a broader consumer and corporate consciousness towards environmental responsibility. While the market is characterized by a fragmented landscape with numerous players, including established entities like Vistaprint (Cimpress plc) and Avery Dennison Corporation, alongside specialized local providers, the moderate CAGR suggests a mature market where innovation and targeted strategies will be crucial for sustained success. Potential restraints may include economic uncertainties and the increasing adoption of digital display technologies in certain applications, although printed signage continues to offer distinct advantages in terms of cost-effectiveness and broad visibility.

United States Printed Signage Market Company Market Share

United States Printed Signage Market: Comprehensive Growth Analysis & Forecast (2019-2033)

This in-depth report delivers unparalleled insights into the dynamic United States Printed Signage Market, encompassing a comprehensive analysis from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. Discover critical market dynamics, emerging trends, key player strategies, and future growth catalysts shaping this vital industry. Market Size: Estimated USD 7,500 Million in 2025, projected to reach USD 11,250 Million by 2033, exhibiting a CAGR of 5.2% during the forecast period. Uncover actionable intelligence for businesses seeking to capitalize on the burgeoning opportunities within the U.S. printed signage sector.

United States Printed Signage Market Market Concentration & Dynamics

The United States Printed Signage Market is characterized by a moderate to high level of concentration, with a mix of large, established corporations and numerous small to medium-sized enterprises (SMEs) catering to diverse regional and niche demands. Innovation is a key differentiator, driven by advancements in printing technologies, materials science, and digital integration. The innovation ecosystem is fueled by companies investing in R&D for more sustainable printing solutions, enhanced durability for outdoor printed signage, and interactive elements for pop displays. Regulatory frameworks, including zoning laws, safety standards, and environmental regulations, play a significant role in shaping market entry and operational strategies, particularly for billboards and large-format banners. Substitute products, such as digital signage and alternative advertising mediums, present a competitive pressure, compelling printed signage providers to focus on value-added services, superior quality, and cost-effectiveness. End-user trends, such as the increasing demand for experiential marketing and personalized branding, are driving the adoption of custom-designed and visually compelling printed signage across various end-user verticals like Retail, Sports & Leisure, and Entertainment. Merger and acquisition (M&A) activities are observed as companies seek to expand their geographical reach, diversify their product portfolios, and gain a competitive edge. For instance, strategic acquisitions of smaller, specialized printing firms by larger players can consolidate market share and enhance service offerings. The market has witnessed approximately 15-20 significant M&A deals in the historical period (2019-2024), with deal values ranging from USD 5 Million to USD 50 Million, indicating consolidation and strategic growth.

United States Printed Signage Market Industry Insights & Trends

The United States Printed Signage Market is experiencing robust growth, propelled by a confluence of economic, technological, and behavioral factors. The market size, estimated at USD 7,500 Million in 2025, is projected to ascend to USD 11,250 Million by 2033, demonstrating a compound annual growth rate (CAGR) of 5.2%. This expansion is significantly influenced by the resurgence of in-person experiences and the persistent need for tangible branding and communication tools. Economic growth in key sectors like Retail, which is projected to contribute over 25% of the market revenue, and the Entertainment industry, experiencing a post-pandemic boom, are major demand drivers. Technological disruptions are continuously reshaping the industry. Advancements in digital printing technology, including UV-LED printing and latex printing, offer faster turnaround times, higher print quality, and the ability to print on a wider range of substrates. These innovations are crucial for producing vibrant backlit displays and durable flags and backdrops. The increasing adoption of eco-friendly printing materials and sustainable practices is a significant trend, driven by growing environmental consciousness among consumers and businesses. This includes the use of recyclable vinyl, biodegradable inks, and energy-efficient printing processes, appealing to a segment of the market that prioritizes sustainability. Evolving consumer behaviors are also playing a pivotal role. The demand for highly personalized and engaging visual experiences is on the rise. Businesses are leveraging printed signage for eye-catching in-store displays, promotional pop displays, and impactful outdoor advertising to capture consumer attention in a crowded marketplace. The growth of e-commerce, paradoxically, is also bolstering the demand for physical signage, as brands invest in creating compelling brand experiences at physical touchpoints and for shipping and logistics. The need for clear directional and informational signage in the Transportation & Logistics sector and for safety and branding in the Healthcare industry further underpins market expansion. The integration of augmented reality (AR) with printed signage is an emerging trend, offering interactive experiences that enhance brand engagement and provide additional information, thus creating new avenues for market growth. The demand for high-quality, durable, and visually appealing corporat signage for branding and identity is also a constant contributor to market stability.

Key Markets & Segments Leading United States Printed Signage Market

The Retail sector stands as a dominant force in the United States Printed Signage Market, consistently driving demand for a wide array of signage solutions. This dominance is fueled by the sector's inherent need for constant visual merchandising, promotional campaigns, and brand reinforcement to attract and retain customers. Economic growth and consumer spending directly correlate with the health of the retail sector, translating into increased investment in eye-catching pop displays, vibrant banners, and informative flags and backdrops. The expansion of both brick-and-mortar stores and the integration of omnichannel retail strategies necessitate effective in-store and exterior signage.

The Outdoor Printed Signage segment is another significant leader, encompassing billboards, vehicle wraps, and building wraps. This segment benefits from its broad reach and impact in public spaces, serving as crucial advertising mediums for a variety of industries, including automotive, consumer goods, and entertainment. Infrastructure development and urban expansion projects often lead to increased opportunities for large-format outdoor signage. The durability and weather-resistance of materials used in outdoor signage are critical factors driving innovation and market value in this segment.

Within the Product category, Billboards and Banners command substantial market share due to their widespread use in advertising and event promotion. Pop Displays are crucial for point-of-purchase marketing, driving sales and product visibility within retail environments. Flags and Backdrops are essential for events, trade shows, and corporate branding, contributing to brand recognition and creating immersive experiences.

The End-user Vertical analysis reveals BFSI (Banking, Financial Services, and Insurance) also represents a substantial segment, requiring professional and informative signage for branch locations, ATMs, and promotional materials. The Sports & Leisure and Entertainment industries consistently require dynamic and engaging signage for venues, events, and marketing campaigns. The Transportation & Logistics sector utilizes signage for wayfinding, branding, and safety, particularly for fleet management and operational efficiency. Healthcare facilities rely on clear, professional signage for patient navigation, branding, and regulatory compliance.

The Type of signage, Indoor Printed Signage, is driven by the needs of retail, corporate offices, and exhibitions, emphasizing visual appeal and brand consistency. Outdoor Printed Signage, as mentioned, leverages its broad visibility and impact.

Drivers of Dominance within these Segments:

- Retail:

- Constant need for promotional campaigns and seasonal advertising.

- Growth of experiential retail demanding engaging visual displays.

- Expansion of e-commerce driving brand visibility at physical touchpoints.

- Outdoor Printed Signage:

- High visibility and broad reach for mass advertising.

- Increasing urban development and infrastructure projects.

- Demand for durable and weather-resistant advertising solutions.

- Billboards:

- Cost-effectiveness for reaching large audiences.

- Strategic placement in high-traffic areas.

- Banners:

- Versatility for events, promotions, and temporary signage.

- Relatively low cost and ease of deployment.

- Pop Displays:

- Effective point-of-purchase marketing to influence buying decisions.

- Customization to highlight specific products or promotions.

- Indoor Printed Signage:

- Brand consistency and customer experience within businesses.

- Requirement for high-quality graphics and finishes.

- Outdoor Printed Signage:

- Brand awareness and visibility in public spaces.

- Need for durable and weather-resistant materials.

- BFSI:

- Professional branding and customer trust building.

- Regulatory compliance and informative displays.

- Sports & Leisure:

- Creating exciting atmospheres and promoting events.

- Fan engagement and sponsorship visibility.

- Entertainment:

- Promoting shows, movies, and attractions.

- Creating immersive visual experiences.

- Transportation & Logistics:

- Clear wayfinding and operational efficiency.

- Fleet branding and safety signage.

- Healthcare:

- Patient navigation and facility identification.

- Branding and creating a welcoming environment.

United States Printed Signage Market Product Developments

Product innovation in the United States Printed Signage Market is primarily focused on enhancing visual impact, durability, and sustainability. Advancements in printing technology, such as high-resolution digital printing with UV-cured inks, enable the creation of exceptionally vibrant and detailed graphics for backlit displays and pop displays. The development of new substrate materials, including eco-friendly and recyclable vinyl, and durable, weather-resistant fabrics for banners and flags, addresses market demand for sustainable and long-lasting signage solutions. Integration with digital technologies, such as QR codes for enhanced consumer interaction and AR-compatible prints, is also a growing trend, offering a bridge between traditional and digital marketing. These innovations allow businesses to create more engaging, informative, and environmentally responsible signage, providing a significant competitive edge in a visually driven market.

Challenges in the United States Printed Signage Market Market

The United States Printed Signage Market faces several challenges. Regulatory hurdles, including zoning restrictions and permitting processes for outdoor signage, can delay or prohibit installations, particularly for large-format billboards and corporat signage. Fluctuations in the cost of raw materials, such as vinyl and ink, can impact profit margins and necessitate price adjustments for consumers. Intense competitive pressures from both established players and new entrants, especially those offering lower-cost alternatives, require continuous innovation and value-added services to maintain market share. The increasing adoption of digital signage also presents a competitive threat, demanding that printed signage providers emphasize their unique benefits like cost-effectiveness and permanence for certain applications. Furthermore, supply chain disruptions can lead to delays in material procurement and production, affecting delivery times and customer satisfaction. These factors collectively contribute to market volatility and require strategic planning to overcome.

Forces Driving United States Printed Signage Market Growth

Several key forces are driving the growth of the United States Printed Signage Market. The economic recovery and expansion across various sectors, particularly Retail, Entertainment, and Healthcare, directly translates into increased demand for promotional and informational signage. Technological advancements in digital printing, including faster speeds, higher quality output, and the ability to print on diverse substrates, are making printed signage more versatile and cost-effective. The growing emphasis on brand visibility and experiential marketing compels businesses to invest in eye-catching visual communications, from vibrant pop displays to impactful billboards. Furthermore, the persistent need for clear wayfinding and safety signage in sectors like Transportation & Logistics and Healthcare provides a stable demand base. The increasing consumer preference for sustainable products is also driving the adoption of eco-friendly printing materials and practices, opening new market segments.

Challenges in the United States Printed Signage Market Market

Long-term growth catalysts for the United States Printed Signage Market are deeply intertwined with continuous innovation and strategic market adaptation. The ongoing evolution of printing technologies, such as advancements in eco-friendly inks and recyclable materials, will enable companies to cater to a growing segment of environmentally conscious clients, thereby expanding their market reach. Furthermore, the integration of smart technologies, such as embedded QR codes or NFC tags that link printed signage to digital content and augmented reality experiences, will unlock new interactive possibilities and enhance brand engagement, creating unique selling propositions. Strategic partnerships between printing companies and digital marketing agencies can also foster innovative solutions, blending the tangible impact of print with the dynamic reach of digital platforms. The expansion into underserved or niche markets, such as specialized industrial signage or highly customized event branding, presents further avenues for sustainable growth.

Emerging Opportunities in United States Printed Signage Market

Emerging opportunities in the United States Printed Signage Market are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for sustainable and eco-friendly signage solutions presents a significant opportunity for companies utilizing recycled materials and low-VOC inks, appealing to environmentally conscious businesses. The integration of augmented reality (AR) with printed signage is creating interactive experiences that enhance brand engagement and provide a competitive edge. Opportunities also lie in the expansion of large-format printing for diverse applications, including vehicle wraps, fleet graphics, and architectural graphics, catering to the increasing need for impactful branding. The growth of the e-commerce sector is paradoxically fueling demand for physical signage for point-of-purchase displays, in-store promotions, and delivery packaging branding. Furthermore, the increasing need for clear and effective signage in rapidly growing sectors like healthcare and logistics offers consistent revenue streams. The development of specialized signage for temporary applications, such as event branding and construction site graphics, also presents a growing market segment.

Leading Players in the United States Printed Signage Market Sector

- Kelly Signs Inc

- Midwest Sign & Screen Printing Supply Co

- Neenah Inc

- Chandler Inc

- James Printing & Signs

- Sabre Digital Marketing

- Vistaprint ( Cimpress plc)

- AJ Printing & Graphics Inc

- Avery Dennison Corporation

- RJ Courtney LLC

- Southwest Printing Co

- 3A Composites USA Inc

Key Milestones in United States Printed Signage Market Industry

- 2019: Increased adoption of UV-LED printing technology, enabling faster curing times and improved print quality for outdoor applications.

- 2020: Surge in demand for safety signage and directional graphics due to the global pandemic, impacting the Healthcare and Transportation & Logistics sectors.

- 2021: Growing focus on sustainable printing materials and practices, with an increase in demand for recyclable vinyl and eco-friendly inks.

- 2022: Expansion of digital printing capabilities by key players, allowing for more customization and shorter runs for pop displays and promotional items.

- 2023: Rise in the integration of QR codes and AR-compatible features within printed signage to enhance consumer engagement and brand interaction.

- 2024: Strategic partnerships and acquisitions aimed at expanding service offerings and market reach within the Retail and Entertainment sectors.

Strategic Outlook for United States Printed Signage Market Market

The strategic outlook for the United States Printed Signage Market is one of continued innovation and expansion, driven by the inherent value of tangible visual communication. Companies will focus on leveraging advanced printing technologies to offer higher quality, faster turnaround times, and more sustainable options for indoor printed signage and outdoor printed signage. The integration of digital elements, such as AR capabilities and QR codes, will become increasingly crucial for creating engaging and interactive customer experiences. Strategic diversification into high-growth end-user verticals like healthcare and transportation & logistics, alongside continued focus on the dominant retail and entertainment sectors, will be key. Furthermore, investing in eco-friendly materials and processes will not only meet market demand but also create a competitive advantage. Consolidation through strategic M&A activities is also expected to continue, allowing for greater market penetration and broader service portfolios. The future success of businesses in this market hinges on their ability to adapt to evolving technological landscapes and cater to the increasing demand for visually compelling, sustainable, and interactive signage solutions.

United States Printed Signage Market Segmentation

-

1. Product

- 1.1. Billboards

- 1.2. Backlit Displays

- 1.3. Pop Displays

- 1.4. Banners, Flags, and Backdrops

- 1.5. Corporat

- 1.6. Others Products

-

2. Type

- 2.1. Indoor Printed Signage

- 2.2. Outdoor Printed Signage

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Sports & Leisure

- 3.4. Entertainment

- 3.5. Transportation & Logistics

- 3.6. Healthcare

- 3.7. Other end-user verticals

United States Printed Signage Market Segmentation By Geography

- 1. United States

United States Printed Signage Market Regional Market Share

Geographic Coverage of United States Printed Signage Market

United States Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Effectiveness of Printed Signage

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Printed Billboards are Expected to Witness Downfall

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Billboards

- 5.1.2. Backlit Displays

- 5.1.3. Pop Displays

- 5.1.4. Banners, Flags, and Backdrops

- 5.1.5. Corporat

- 5.1.6. Others Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Printed Signage

- 5.2.2. Outdoor Printed Signage

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Sports & Leisure

- 5.3.4. Entertainment

- 5.3.5. Transportation & Logistics

- 5.3.6. Healthcare

- 5.3.7. Other end-user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kelly Signs Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midwest Sign & Screen Printing Supply Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neenah Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chandler Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Printing & Signs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sabre Digital Marketing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistaprint ( Cimpress plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJ Printing & Graphics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avery Dennison Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RJ Courtney LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Southwest Printing Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3A Composites USA Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kelly Signs Inc

List of Figures

- Figure 1: United States Printed Signage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Printed Signage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: United States Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Printed Signage Market?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the United States Printed Signage Market?

Key companies in the market include Kelly Signs Inc, Midwest Sign & Screen Printing Supply Co, Neenah Inc *List Not Exhaustive, Chandler Inc, James Printing & Signs, Sabre Digital Marketing, Vistaprint ( Cimpress plc), AJ Printing & Graphics Inc, Avery Dennison Corporation, RJ Courtney LLC, Southwest Printing Co, 3A Composites USA Inc.

3. What are the main segments of the United States Printed Signage Market?

The market segments include Product, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Effectiveness of Printed Signage.

6. What are the notable trends driving market growth?

Printed Billboards are Expected to Witness Downfall.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Printed Signage Market?

To stay informed about further developments, trends, and reports in the United States Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence