Key Insights

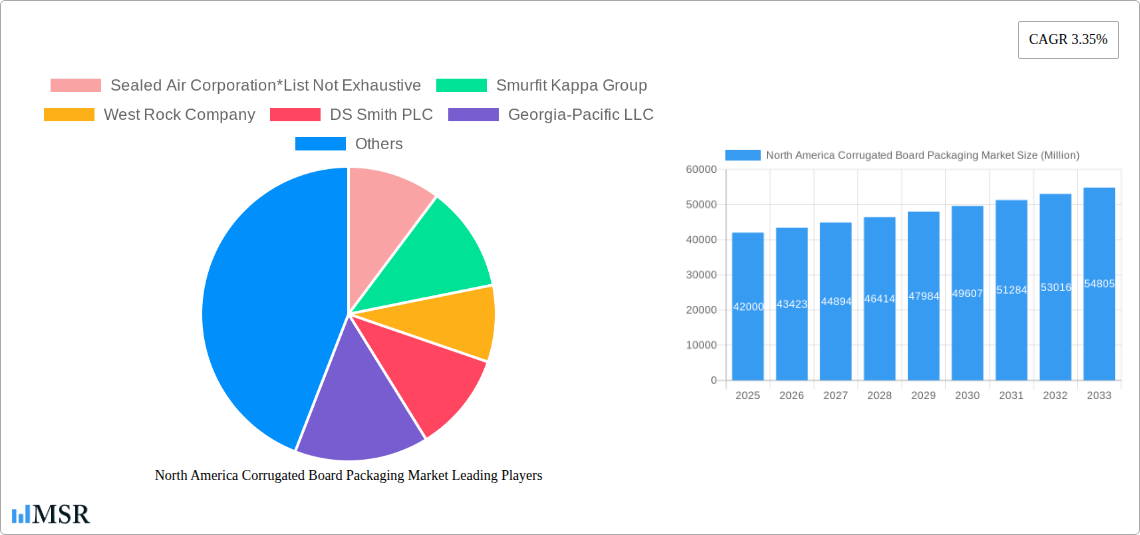

The North American corrugated board packaging market is poised for steady expansion, demonstrating a market size of $42.00 million in 2025 and is projected to grow at a CAGR of 3.35% throughout the forecast period of 2025-2033. This growth is propelled by a confluence of factors, primarily driven by the burgeoning e-commerce sector and the increasing demand for sustainable and recyclable packaging solutions. The convenience and cost-effectiveness of corrugated packaging continue to make it a preferred choice for a wide array of industries, including food and beverage, retail, healthcare, and industrial goods. Furthermore, evolving consumer preferences towards eco-friendly products are compelling manufacturers to invest in innovative, lighter-weight, and high-strength corrugated materials, thereby enhancing performance and reducing environmental impact. The robust supply chain infrastructure within North America, coupled with advancements in printing and finishing technologies, also contributes to the market's upward trajectory.

North America Corrugated Board Packaging Market Market Size (In Billion)

Despite the positive outlook, the market faces certain challenges. Fluctuations in raw material prices, particularly for pulp and recycled paper, can impact manufacturing costs and subsequently affect profit margins. Intense competition among established players and the emergence of new entrants necessitate continuous innovation and strategic pricing to maintain market share. The logistical complexities associated with transporting bulky corrugated products across a vast continent also present a hurdle. However, the industry's adaptability, coupled with a strong focus on circular economy principles and the development of advanced packaging designs that optimize space and reduce waste, are expected to mitigate these restraints. The market is segmented across production, consumption, import/export dynamics, and price trends, each offering distinct opportunities and insights into the overall health and direction of the North American corrugated board packaging landscape.

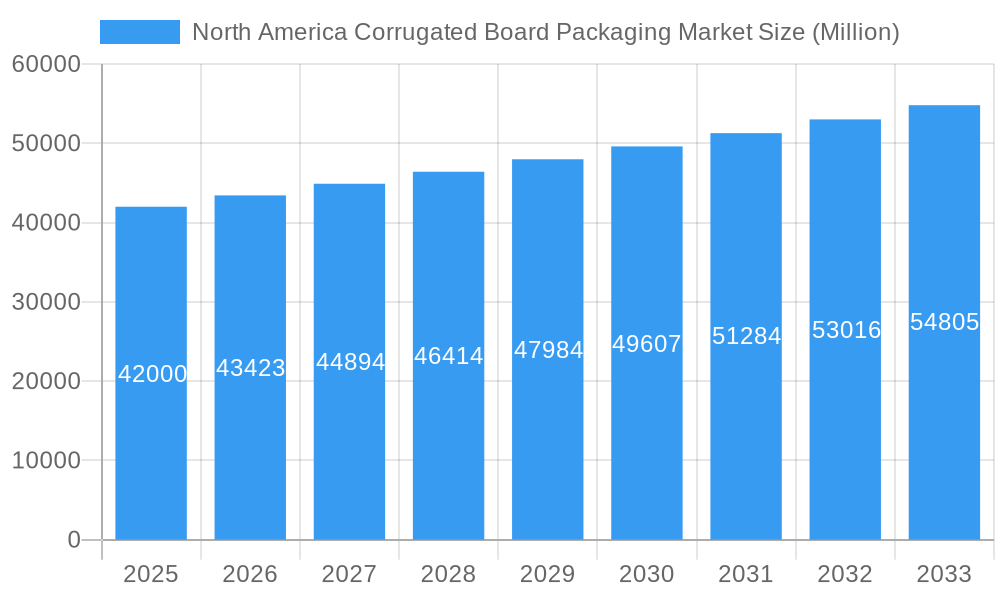

North America Corrugated Board Packaging Market Company Market Share

This in-depth report provides a definitive analysis of the North America Corrugated Board Packaging Market, offering crucial insights for manufacturers, suppliers, investors, and industry stakeholders. Covering the historical period of 2019-2024, a base year of 2025, and a robust forecast period of 2025-2033, this research delves deep into market dynamics, key trends, and future growth trajectories. Discover market size estimations, CAGR projections, competitive landscapes, and strategic opportunities within this vital sector.

North America Corrugated Board Packaging Market Market Concentration & Dynamics

The North America corrugated board packaging market exhibits a moderate to high concentration, with a handful of dominant players controlling a significant market share. Innovation ecosystems are robust, driven by a continuous pursuit of enhanced sustainability, improved performance characteristics, and cost-efficiency. Regulatory frameworks, particularly concerning environmental impact and waste management, are increasingly shaping product development and operational strategies. Substitute products, primarily plastics and other flexible packaging materials, present ongoing competition, yet corrugated board's inherent recyclability and biodegradability offer a distinct advantage. End-user trends are shifting towards e-commerce, demanding lighter, more durable, and customizable packaging solutions. Mergers and acquisitions (M&A) activity plays a crucial role in market consolidation and strategic expansion. For instance, recent M&A deal counts indicate a trend towards acquiring smaller, specialized producers to enhance product portfolios or geographical reach. Key players like West Rock Company and Smurfit Kappa Group have been active in strategic acquisitions to bolster their market positions.

North America Corrugated Board Packaging Market Industry Insights & Trends

The North America corrugated board packaging market is poised for significant growth, projected to reach USD XXX Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand from the e-commerce sector, which necessitates robust, reliable, and cost-effective shipping solutions. The increasing consumer preference for sustainable packaging solutions is another major growth driver, as corrugated board is highly recyclable and biodegradable, aligning with global environmental initiatives and corporate social responsibility goals. Technological disruptions are continuously shaping the industry, with advancements in paper manufacturing processes leading to lighter yet stronger board grades, optimized for reducing material usage and transportation costs. Innovations in printing and finishing technologies are also enhancing the aesthetic appeal and brand visibility of corrugated packaging, making it a preferred choice for retail-ready displays. Evolving consumer behaviors, including a greater emphasis on unpackaging experiences and product protection during transit, further propel the demand for high-quality corrugated packaging. The expansion of food and beverage, pharmaceuticals, and personal care industries, all heavily reliant on efficient and safe packaging, also contributes to the market's upward trajectory. Furthermore, the growing emphasis on circular economy principles is encouraging manufacturers to invest in recycled fiber procurement and develop innovative recycling programs, solidifying corrugated board's position as a sustainable packaging material. The market size for corrugated board packaging in North America was estimated at USD XXX Million in 2025, highlighting its substantial economic significance.

Key Markets & Segments Leading North America Corrugated Board Packaging Market

The United States stands as the dominant region in the North America corrugated board packaging market, driven by its colossal consumer base, robust e-commerce infrastructure, and a strong manufacturing sector.

- Production Analysis: The US leads in production capacity due to the presence of major integrated paper and packaging manufacturers, with significant output concentrated in the Southeast and Midwest regions, leveraging proximity to raw material sources and key consumption hubs. Economic growth and industrial output are primary drivers of this segment.

- Consumption Analysis: The e-commerce boom in the US is the paramount driver of consumption, with online retail sales dictating the need for efficient shipping packaging. Growing demand from the food and beverage sector, a cornerstone of the US economy, also significantly contributes.

- Import Market Analysis (Value & Volume): While North America is largely self-sufficient, imports play a role in niche markets or for specialized board grades. Mexico and Canada are key import partners, primarily for finished packaging products or specific paper grades not readily available domestically. Trade agreements and fluctuating currency exchange rates influence import values.

- Export Market Analysis (Value & Volume): North America, particularly the US, is a significant exporter of corrugated board packaging, especially to Latin American countries and increasingly to Europe, driven by the demand for sustainable and high-performance packaging solutions. The volume of exports is influenced by global trade policies and the competitiveness of North American producers.

- Price Trend Analysis: Price trends are primarily influenced by the cost of raw materials such as pulpwood and recycled paper, as well as energy costs. Fluctuations in these input prices directly impact the pricing of corrugated board packaging. Economic cycles and supply-demand dynamics also play a crucial role.

North America Corrugated Board Packaging Market Product Developments

Product developments in the North America corrugated board packaging market are heavily focused on enhanced sustainability and performance. Innovations include the introduction of high-strength, lightweight corrugated boards derived from advanced pulping techniques, reducing material usage and transportation emissions. advancements in barrier coatings are enabling corrugated packaging to effectively protect sensitive goods like fresh produce and pharmaceuticals, expanding its application scope. Furthermore, the market is witnessing a surge in designs optimized for e-commerce, featuring improved cushioning properties, tamper-evident features, and user-friendly unboxing experiences. Smart packaging integration, incorporating QR codes or RFID tags for enhanced supply chain traceability and consumer engagement, is also gaining traction.

Challenges in the North America Corrugated Board Packaging Market Market

The North America corrugated board packaging market faces several challenges. Fluctuating raw material costs, particularly for pulp and recycled paper, can impact profitability and price stability. Increasing regulatory pressures related to sustainability and waste management, while driving innovation, can also lead to higher compliance costs. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of essential inputs. Furthermore, intense competition from alternative packaging materials, such as plastics, necessitates continuous innovation and cost optimization to maintain market share.

Forces Driving North America Corrugated Board Packaging Market Growth

Several forces are driving the growth of the North America corrugated board packaging market. The exponential growth of e-commerce is a primary catalyst, requiring vast quantities of durable and cost-effective shipping packaging. The increasing global emphasis on sustainability and the circular economy strongly favors corrugated board due to its recyclability and biodegradability. Technological advancements in paper manufacturing and printing are leading to improved product performance and aesthetic appeal, expanding its applications. Economic recovery and expansion in key end-use industries like food and beverage, pharmaceuticals, and consumer goods further boost demand.

Challenges in the North America Corrugated Board Packaging Market Market

Long-term growth catalysts for the North America corrugated board packaging market lie in strategic investments in sustainable innovation and circular economy initiatives. Continued research and development into advanced bio-based barrier coatings and water-resistant treatments will expand corrugated board's applicability in challenging environments. Furthermore, strategic partnerships with e-commerce giants to develop bespoke packaging solutions optimized for their specific logistics networks will be crucial. Market expansion into emerging applications, such as specialized industrial packaging and personalized consumer goods packaging, presents significant long-term growth potential. Embracing digital transformation to enhance supply chain efficiency and customer service will also be key.

Emerging Opportunities in North America Corrugated Board Packaging Market

Emerging opportunities in the North America corrugated board packaging market are multifaceted. The growing demand for customizable and on-demand packaging solutions for direct-to-consumer (DTC) brands presents a significant avenue for growth. Innovations in digital printing technology allow for highly personalized and short-run packaging, catering to niche markets. The increasing focus on reducing food waste is driving demand for specialized corrugated packaging with enhanced freshness preservation capabilities. Furthermore, the development of smart corrugated packaging, incorporating sensors for temperature monitoring or product authentication, offers a promising frontier for value-added solutions. Exploring opportunities in biodegradable and compostable corrugated board formulations will also align with evolving consumer and regulatory preferences.

Leading Players in the North America Corrugated Board Packaging Market Sector

- Sealed Air Corporation

- Smurfit Kappa Group

- West Rock Company

- DS Smith PLC

- Georgia-Pacific LLC

- Mondi PLC

- Oji Holdings Corporation

- International Paper Company

- Nippon Paper Industries Co Ltd

- Packaging Corporation of America

- Cascades Inc

Key Milestones in North America Corrugated Board Packaging Market Industry

- 2019: Increased focus on lightweighting technologies to reduce shipping costs and environmental impact.

- 2020: Surge in demand for e-commerce packaging due to the COVID-19 pandemic.

- 2021: Major investments in recycled fiber infrastructure to meet sustainability goals.

- 2022: Introduction of advanced barrier coatings for extended shelf life in food packaging.

- 2023: Growing adoption of digital printing for personalized and on-demand packaging solutions.

- 2024: Increased M&A activity focused on acquiring companies with specialized sustainable packaging technologies.

Strategic Outlook for North America Corrugated Board Packaging Market Market

The strategic outlook for the North America corrugated board packaging market is overwhelmingly positive, driven by synergistic trends in e-commerce expansion and sustainability mandates. Future growth will be accelerated by the continued adoption of advanced manufacturing techniques that enhance board performance while minimizing environmental footprint. Strategic opportunities lie in developing innovative, value-added packaging solutions that address specific end-user needs, such as enhanced product protection, improved unboxing experiences, and integrated traceability features. Collaboration across the value chain, from raw material suppliers to end consumers, will be crucial for fostering a truly circular economy for corrugated board, ensuring its continued dominance as a preferred packaging material.

North America Corrugated Board Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Corrugated Board Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Corrugated Board Packaging Market Regional Market Share

Geographic Coverage of North America Corrugated Board Packaging Market

North America Corrugated Board Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations

- 3.3. Market Restrains

- 3.3.1. Strict Environmental Regulation Regarding Deforestation

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Corrugated Board Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smurfit Kappa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 West Rock Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Georgia-Pacific LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippon Paper Industries Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Packaging Corporation of America

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cascades Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sealed Air Corporation*List Not Exhaustive

List of Figures

- Figure 1: North America Corrugated Board Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Corrugated Board Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Corrugated Board Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Corrugated Board Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Corrugated Board Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Corrugated Board Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Corrugated Board Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Corrugated Board Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Corrugated Board Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Corrugated Board Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Corrugated Board Packaging Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the North America Corrugated Board Packaging Market?

Key companies in the market include Sealed Air Corporation*List Not Exhaustive, Smurfit Kappa Group, West Rock Company, DS Smith PLC, Georgia-Pacific LLC, Mondi PLC, Oji Holdings Corporation, International Paper Company, Nippon Paper Industries Co Ltd, Packaging Corporation of America, Cascades Inc.

3. What are the main segments of the North America Corrugated Board Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Demand from the E-commerce Sector; Growing Adoption of Light Weighting Materials and Scope for Printing Innovations.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

Strict Environmental Regulation Regarding Deforestation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Corrugated Board Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Corrugated Board Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Corrugated Board Packaging Market?

To stay informed about further developments, trends, and reports in the North America Corrugated Board Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence