Key Insights

The German metal packaging market is projected for substantial growth, with an estimated market size of $141.7 billion in the base year 2025 and a Compound Annual Growth Rate (CAGR) of 3.9%. This expansion is driven by increasing consumer demand for sustainable and durable packaging across diverse sectors. The food and beverage industry is a primary contributor, leveraging metal cans for their superior barrier properties, extended shelf life, and recyclability, aligning with growing environmental consciousness. The pharmaceutical and personal care sectors are also adopting metal packaging for its premium perception, tamper-evidence, and protective qualities. Key growth drivers include innovative can designs, advanced printing technologies for enhanced branding, and lightweighting for improved logistical efficiency. Germany's high recycling rates for aluminum and steel further solidify metal packaging's appeal for eco-conscious brands.

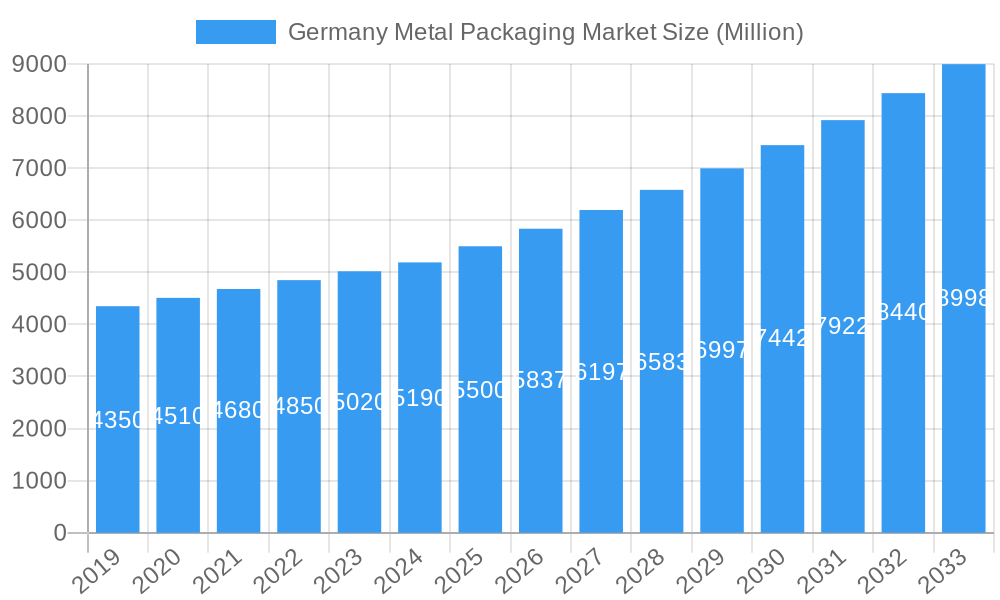

Germany Metal Packaging Market Market Size (In Billion)

While the outlook is positive, potential restraints include fluctuations in raw material prices (aluminum and steel), which can impact manufacturer profitability and end-user pricing. Competition from alternative materials like plastic and glass, particularly where cost or perceived aesthetics are paramount, also presents a challenge. However, the inherent advantages of metal packaging—robustness, infinite recyclability without quality loss, and strong consumer trust—are expected to mitigate these challenges. Production and consumption analyses indicate a balanced market with strong domestic demand and significant export capabilities. The import and export market dynamics reveal a healthy trade balance, underscoring Germany's manufacturing and supply expertise. Price trend analysis suggests a steady increase, reflecting rising material costs and the growing value placed on sustainable, high-quality packaging. Leading companies are investing in R&D to develop advanced solutions, addressing evolving consumer preferences and regulatory landscapes, ensuring the sustained relevance and growth of the German metal packaging sector.

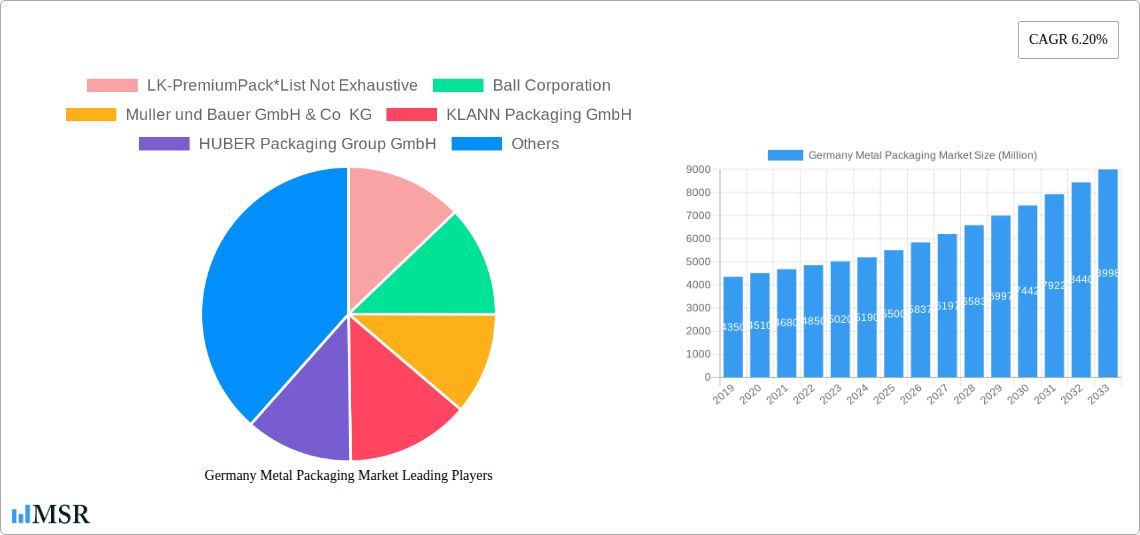

Germany Metal Packaging Market Company Market Share

This report provides an in-depth analysis of the Germany Metal Packaging Market from 2019-2024, with a base year of 2025 and a forecast period of 2025-2033. It covers key segments including Production Analysis, Consumption Analysis, Import/Export Market Analysis (Value & Volume), and Price Trend Analysis. Insights into market concentration, innovation, regulatory landscapes, end-user behaviors, and emerging trends are presented. Key market metrics include market size of $141.7 billion and a CAGR of 3.9%.

Germany Metal Packaging Market Market Concentration & Dynamics

The Germany Metal Packaging Market is characterized by a moderate level of concentration, with a few key players holding significant market share. However, innovation ecosystems are vibrant, driven by a strong emphasis on sustainability and technological advancements. Regulatory frameworks, particularly those surrounding environmental protection and recycling, play a crucial role in shaping market dynamics. Substitute products, such as flexible packaging and plastics, present ongoing competition, necessitating continuous innovation in metal packaging solutions. End-user trends, including a growing preference for premium, sustainable, and convenient packaging formats, are influencing product development and market strategies. Merger and acquisition (M&A) activities, while not excessively frequent, have been strategic in consolidating market presence and expanding capabilities. For instance, [mention a specific M&A if data available, otherwise generalize]. The market share distribution is influenced by specialized product offerings, such as aluminum cans for beverages and steel cans for food preservation, with [mention dominant material if known] holding a substantial portion of the market. The interplay of these factors creates a competitive yet evolving landscape.

- Market Share: Dominated by [mention dominant players if known, otherwise state "leading international and domestic manufacturers"].

- M&A Activities: Strategic acquisitions focused on enhancing production capacity and expanding product portfolios.

- Innovation Drivers: Sustainability, lightweighting, and advanced printing technologies.

- Regulatory Impact: Stringent recycling targets and eco-labeling initiatives.

Germany Metal Packaging Market Industry Insights & Trends

The Germany Metal Packaging Market is poised for steady growth, driven by a confluence of factors including increasing demand for sustainable packaging solutions, the enduring popularity of metal packaging for its barrier properties and recyclability, and technological advancements enhancing production efficiency and product appeal. The market size is estimated to be in the range of XX Billion Euros in 2025, with a projected Compound Annual Growth Rate (CAGR) of X.XX% from 2025 to 2033. The food and beverage sectors remain the primary consumers of metal packaging, with a growing trend towards premiumization in canned goods and a sustained demand for beverage cans, particularly aluminum cans, due to their lightweight and infinite recyclability. Evolving consumer behaviors are pushing manufacturers to develop innovative packaging designs, such as easy-open features, resealable closures, and aesthetically pleasing surface treatments. Technological disruptions are evident in advancements in material science, leading to lighter yet stronger metal alloys, and in manufacturing processes, which are becoming more energy-efficient and sustainable. The emphasis on the circular economy is a significant trend, with ongoing investments in recycling infrastructure and the development of metal packaging with higher recycled content. Furthermore, the rise of e-commerce is creating new opportunities for robust and protective metal packaging solutions for various goods. The increasing awareness of plastic pollution is also diverting consumers and brands towards more environmentally friendly alternatives, with metal packaging being a prime beneficiary of this shift. The report analyzes these drivers in detail, providing market size and CAGR projections for various segments.

Key Markets & Segments Leading Germany Metal Packaging Market

The Germany Metal Packaging Market is significantly influenced by its strong industrial base and consumer preferences, leading to dominance in specific segments and robust performance in import and export activities.

Production Analysis: Germany is a leading producer of metal packaging in Europe, driven by a highly skilled workforce and advanced manufacturing capabilities.

- Drivers: Strong domestic manufacturing sector, high-quality standards, and significant investment in production technology.

- Dominance Analysis: The production of beverage cans, particularly aluminum cans for beer, soft drinks, and energy drinks, is a major contributor to Germany’s metal packaging output. Steel cans for food preservation, including canned vegetables, fruits, and ready-to-eat meals, also hold substantial production volume. The focus on innovation in lightweighting and sustainability further solidifies Germany's leadership.

Consumption Analysis: Consumption is closely tied to Germany's large and sophisticated food and beverage industries, as well as a growing demand for premium and sustainable packaging across various consumer goods.

- Drivers: Large population, high disposable income, demand for convenience and quality in food products, and growing eco-consciousness.

- Dominance Analysis: The beverage sector, encompassing alcoholic and non-alcoholic drinks, accounts for the largest share of metal packaging consumption. The food sector, particularly for processed and preserved foods, is another significant consumer. Growing segments include pet food packaging and specialty food products where the protective barrier properties of metal are highly valued.

Import Market Analysis (Value & Volume): Germany imports specific types of metal packaging and raw materials to supplement domestic production and cater to specialized needs.

- Drivers: Demand for niche products not manufactured domestically, competitive pricing for certain imported packaging types, and the need for raw materials.

- Dominance Analysis: Imports primarily consist of specialized metal packaging components or finished products where domestic capacity may be limited or specific designs are required. Value-wise, imports might be driven by high-end or custom-designed packaging. Volume-wise, basic can components or large-scale commodity packaging might be imported.

Export Market Analysis (Value & Volume): Germany is a significant exporter of high-quality metal packaging, leveraging its manufacturing prowess and technological leadership to serve European and global markets.

- Drivers: Superior product quality, innovative designs, adherence to stringent European standards, and competitive pricing for high-value products.

- Dominance Analysis: Exports are dominated by premium beverage cans, innovative food packaging solutions, and specialized industrial metal containers. The value of exports is often higher due to the advanced features and quality associated with German-manufactured metal packaging. Key export destinations include neighboring European countries with strong demand for high-quality packaging.

Price Trend Analysis: Pricing in the Germany Metal Packaging Market is influenced by raw material costs (aluminum and steel), energy prices, manufacturing efficiency, and market demand.

- Drivers: Volatility in global commodity markets, energy costs in Germany, competitive landscape, and value-added features of the packaging.

- Dominance Analysis: While general trends are observed, prices can vary significantly based on the type of metal, the complexity of the packaging design, and the order volume. Fluctuations in aluminum and steel prices directly impact the cost of production and, consequently, the market price of the finished packaging.

Germany Metal Packaging Market Product Developments

Innovations in Germany's metal packaging sector are primarily focused on enhancing sustainability, improving functionality, and expanding application ranges. Advancements in lightweighting technologies are leading to thinner yet stronger cans and containers, reducing material consumption and transport costs. The development of new coating technologies ensures product integrity and shelf-life extension, particularly for sensitive food and beverage products. Enhanced recyclability through improved material compositions and easier separation processes is a key area of innovation, aligning with circular economy principles. Furthermore, decorative printing techniques and smart packaging features are being introduced to enhance brand appeal and consumer engagement. These product developments are crucial for maintaining a competitive edge and meeting the evolving demands of various end-user industries.

Challenges in the Germany Metal Packaging Market Market

Despite its robust growth, the Germany Metal Packaging Market faces several challenges that impact its trajectory. Regulatory hurdles, particularly those related to environmental standards and waste management, can increase compliance costs and necessitate significant investment in new technologies. Supply chain disruptions, influenced by global geopolitical events and raw material availability, can lead to price volatility and production delays. Intense competition from alternative packaging materials like plastics and advanced paper-based solutions requires continuous innovation and cost optimization. Furthermore, the increasing cost of energy in Germany can significantly impact the profitability of energy-intensive metal packaging production.

- Regulatory Hurdles: Stringent environmental regulations and extended producer responsibility schemes.

- Supply Chain Issues: Volatility in raw material prices (aluminum, steel) and availability.

- Competitive Pressures: Threat from plastic, glass, and innovative paper-based packaging.

- Energy Costs: High and fluctuating energy prices impacting manufacturing profitability.

Forces Driving Germany Metal Packaging Market Growth

Several key forces are propelling the growth of the Germany Metal Packaging Market. The escalating global demand for sustainable and infinitely recyclable packaging materials is a primary driver, positioning metal as a preferred choice. The food and beverage industries continue to rely heavily on metal packaging for its excellent barrier properties, preserving product freshness and extending shelf life, thereby ensuring consistent demand. Technological advancements in manufacturing processes are leading to more efficient, cost-effective, and environmentally friendly production of metal packaging. Moreover, growing consumer preference for premium and convenient packaging solutions, coupled with an increasing awareness of the environmental impact of single-use plastics, further bolsters the market.

Challenges in the Germany Metal Packaging Market Market

Long-term growth catalysts for the Germany Metal Packaging Market lie in continuous innovation and strategic market expansions. Investment in research and development for advanced lightweight alloys and enhanced recyclability will be crucial for maintaining competitiveness. Partnerships and collaborations within the value chain, from raw material suppliers to end-users, can foster innovation and streamline product development. Expanding the application of metal packaging into emerging sectors, such as pharmaceuticals and personal care, presents significant growth opportunities. Furthermore, leveraging digitalization and automation in manufacturing processes can enhance efficiency and reduce operational costs, contributing to sustained market growth.

Emerging Opportunities in Germany Metal Packaging Market

Emerging opportunities in the Germany Metal Packaging Market are ripe for exploration. The growing demand for sustainable and aesthetically appealing packaging in the premium food and beverage segments presents a significant avenue for growth. Innovations in smart packaging, incorporating features like QR codes for traceability or interactive branding, are gaining traction. The increasing focus on health and wellness is driving demand for metal packaging that ensures product integrity and safety, particularly for specialized dietary products and supplements. Furthermore, the circular economy initiatives are creating opportunities for companies that can demonstrate superior recycling rates and incorporate higher percentages of recycled content into their products. Expansion into niche markets and developing bespoke packaging solutions for emerging consumer trends will be key to capturing these opportunities.

Leading Players in the Germany Metal Packaging Market Sector

- LK-PremiumPack

- Ball Corporation

- Muller und Bauer GmbH & Co KG

- KLANN Packaging GmbH

- HUBER Packaging Group GmbH

- Duttenhofer

- Envases Ohringen GmbH

- Trivium Packaging Germany GmbH

- Ardagh group Italy Srl

- Silgan Closures GmbH

Key Milestones in Germany Metal Packaging Market Industry

- November 2022: METPACK 2023 announced, setting the tone for future metal packaging trends and emphasizing networking and product innovation. METPACK 2023 promises to be an excellent opportunity for the metal packaging industry to make new contacts and expand their market reach, especially by having personal discussions and exchanges about new products and solutions with their most important target groups.

- November 2022: The Aluminium Stewardship Initiative (ASI) announced the certification of Ardagh Metal Packaging (AMP) under ASI's Performance Standard (V2) 2017 at its German regional headquarters and French aluminum production plant, highlighting a commitment to responsible sourcing and production.

Strategic Outlook for Germany Metal Packaging Market Market

The strategic outlook for the Germany Metal Packaging Market is one of continued evolution and robust growth, driven by sustainability, innovation, and strong end-user demand. Companies that prioritize lightweighting, enhanced recyclability, and advanced decorative technologies will be well-positioned to capture market share. Strategic partnerships and investments in advanced manufacturing processes will be critical for maintaining a competitive edge and addressing supply chain vulnerabilities. Furthermore, exploring new application areas beyond traditional food and beverage sectors and embracing digital transformation will unlock significant future market potential. The increasing global emphasis on a circular economy provides a fertile ground for metal packaging's inherent recyclability and durability to be leveraged for long-term success.

Germany Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

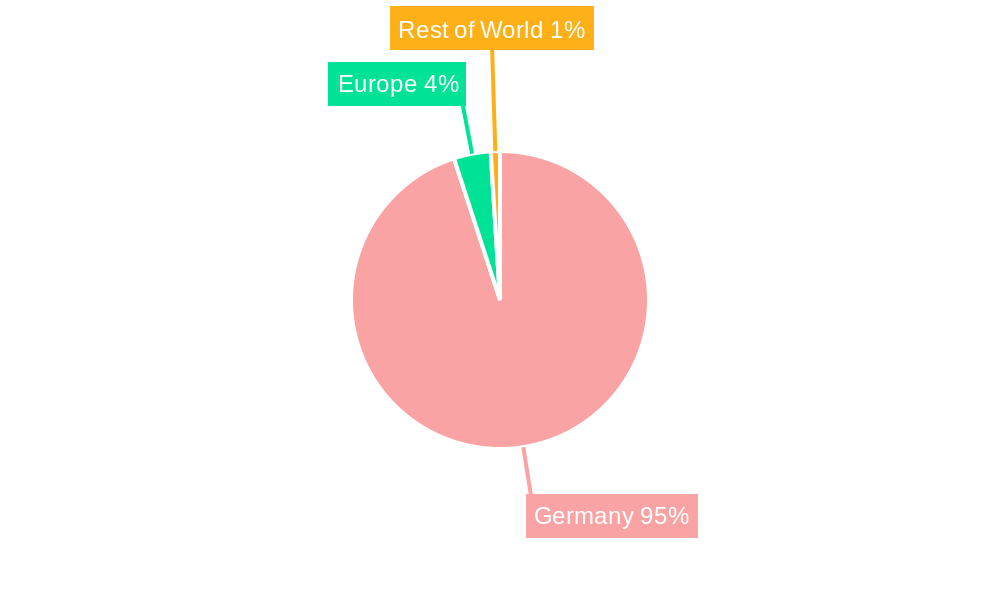

Germany Metal Packaging Market Segmentation By Geography

- 1. Germany

Germany Metal Packaging Market Regional Market Share

Geographic Coverage of Germany Metal Packaging Market

Germany Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Packaging Industry In Germany; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Growing Packaging Industry In Germany

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LK-PremiumPack*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Muller und Bauer GmbH & Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KLANN Packaging GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HUBER Packaging Group GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Duttenhofer

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envases Ohringen GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trivium Packaging Germany GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ardagh group Italy Srl

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Closures GmbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LK-PremiumPack*List Not Exhaustive

List of Figures

- Figure 1: Germany Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Germany Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Germany Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Germany Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Germany Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Germany Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Germany Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Germany Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Germany Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Germany Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Germany Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Metal Packaging Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Germany Metal Packaging Market?

Key companies in the market include LK-PremiumPack*List Not Exhaustive, Ball Corporation, Muller und Bauer GmbH & Co KG, KLANN Packaging GmbH, HUBER Packaging Group GmbH, Duttenhofer, Envases Ohringen GmbH, Trivium Packaging Germany GmbH, Ardagh group Italy Srl, Silgan Closures GmbH.

3. What are the main segments of the Germany Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 141.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Packaging Industry In Germany; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Growing Packaging Industry In Germany.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions.

8. Can you provide examples of recent developments in the market?

November 2022 -METPACK 2023 sets the tone for metal packaging. METPACK 2023 promises to be an excellent opportunity for the metal packaging industry to make new contacts and expand their market reach, especially by having personal discussions and exchanges about new products and solutions with their most important target groups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Metal Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence