Key Insights

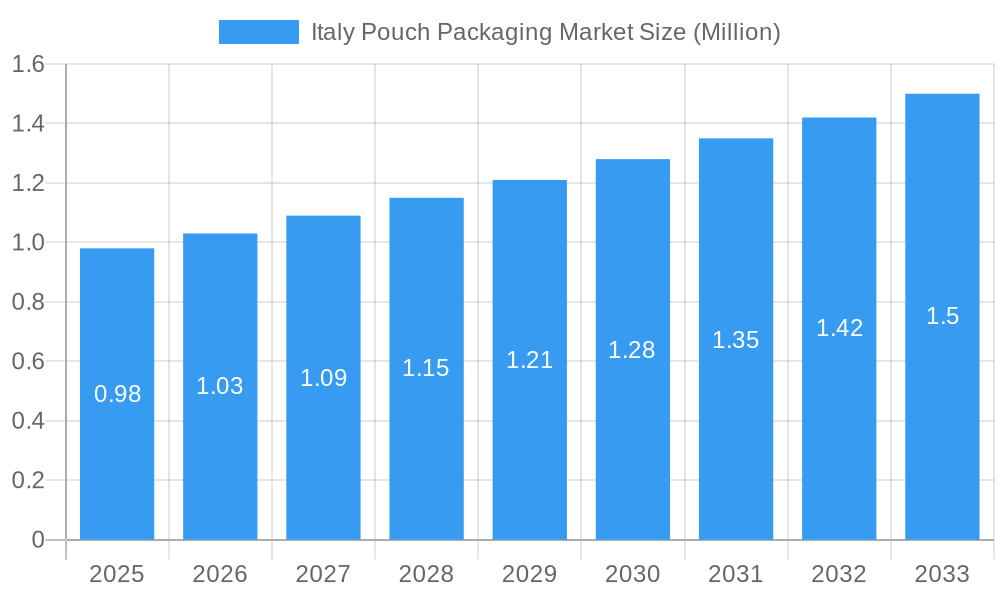

The Italian pouch packaging market is poised for robust growth, driven by an increasing demand for flexible, convenient, and sustainable packaging solutions across various end-user industries. With a current market size estimated at 0.87 Billion and a projected Compound Annual Growth Rate (CAGR) of 5.37% from 2019 to 2033, the sector is expected to expand significantly. The primary drivers for this expansion include the burgeoning food and beverage sector's need for extended shelf-life packaging and portion control, coupled with the rising adoption of pouches in the medical and pharmaceutical industries for sterile product delivery and enhanced safety. Personal care and household care products also contribute to this growth, as consumers increasingly favor lightweight and easy-to-use packaging formats. Emerging trends such as the development of advanced barrier properties, the incorporation of smart packaging features, and a strong emphasis on recyclable and compostable materials are shaping the market landscape. The preference for innovative designs like stand-up pouches, offering superior shelf presence and consumer appeal, further fuels market expansion.

Italy Pouch Packaging Market Market Size (In Million)

The Italian pouch packaging market's dynamics are influenced by a clear segmentation by material, product type, and end-user industry. In terms of materials, plastics, particularly polyethylene (PE), polypropylene (PP), and PET, dominate due to their versatility and cost-effectiveness. However, the growing sustainability imperative is also driving innovation and adoption of paper and aluminum-based pouches. Product-wise, flat pouches (pillow and side-seal) and stand-up pouches are the leading formats, catering to diverse product needs and consumer preferences for convenience and display. The food industry remains the largest consumer, with significant contributions from candy & confectionery, frozen foods, dairy, and dry foods segments. The beverage sector is also a key growth area, embracing pouches for juices, ready-to-drink beverages, and water. While the market benefits from strong demand, certain restraints such as the fluctuating raw material costs and the need for substantial investment in advanced manufacturing technologies can pose challenges. Nevertheless, the overall outlook for the Italian pouch packaging market remains highly positive, with key players like Amcor PLC and Mondi PLC actively investing in innovation and capacity expansion to capitalize on these opportunities.

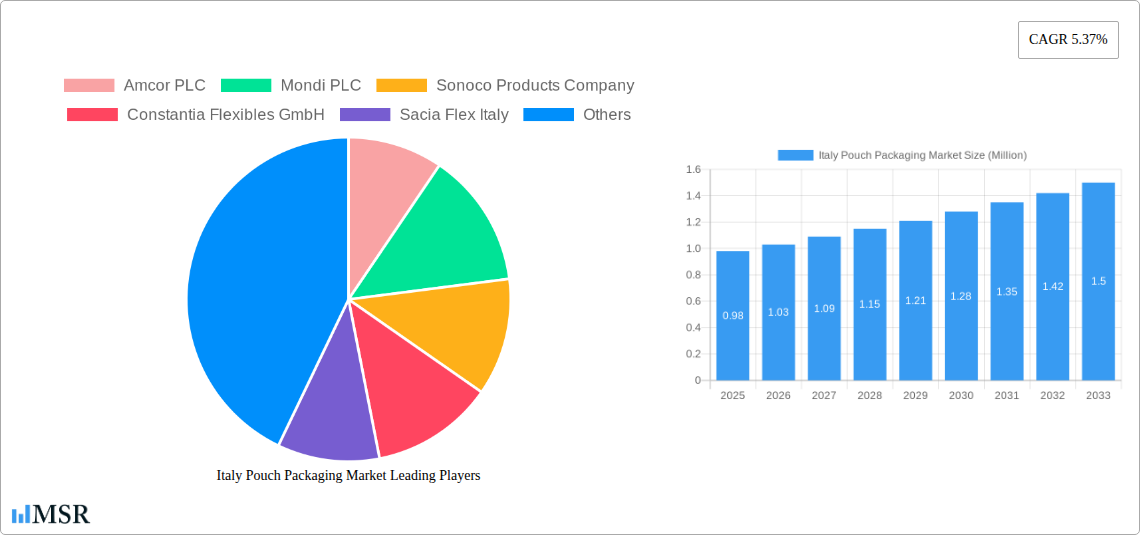

Italy Pouch Packaging Market Company Market Share

Unlock unparalleled insights into the dynamic Italy Pouch Packaging Market with this in-depth report. Discover critical growth drivers, emerging trends, and key opportunities shaping the future of flexible packaging in Italy. This report is essential for packaging manufacturers, material suppliers, brand owners, and investors seeking to navigate the evolving landscape of pouch packaging solutions.

Italy Pouch Packaging Market Market Concentration & Dynamics

The Italy Pouch Packaging Market is characterized by a moderate to high degree of market concentration, with a few dominant players holding significant market share. Key companies such as Amcor PLC, Mondi PLC, Sonoco Products Company, and Constantia Flexibles GmbH are at the forefront of innovation and production. This intense competition fuels a robust innovation ecosystem, driving advancements in material science, barrier technologies, and sustainable packaging solutions. Regulatory frameworks in Italy, including stringent environmental policies and food safety standards, are progressively influencing packaging design and material choices, pushing for eco-friendly and recyclable options. The prevalence of substitute products, such as rigid containers, presents a continuous challenge, yet the inherent flexibility, cost-effectiveness, and shelf-life extension capabilities of pouches are consolidating their market position. End-user trends, particularly the increasing demand for convenience, portion control, and sustainable packaging across food, beverage, and personal care sectors, are significant market shapers. Mergers and acquisitions (M&A) activities, exemplified by CCL Industries Inc.'s acquisition of Pouch Partners s.r.l. in June 2023, indicate a strategic consolidation within the market, aimed at expanding capabilities and market reach.

- Market Share Distribution: Dominated by global leaders and strong regional players.

- Innovation Ecosystem: Focused on sustainability, advanced barrier properties, and smart packaging.

- Regulatory Impact: Emphasis on recyclability, reduced plastic usage, and food safety compliance.

- Substitute Competition: Primarily rigid packaging, countered by pouch advantages.

- End-User Driven Demand: Convenience, premiumization, and eco-consciousness are key.

- M&A Activity: Strategic acquisitions to enhance market position and product portfolios.

Italy Pouch Packaging Market Industry Insights & Trends

The Italy Pouch Packaging Market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and strategic industry developments. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% during the forecast period of 2025–2033, with an estimated market size of over €6,500 million by 2025. This expansion is largely fueled by the escalating demand for flexible packaging solutions that offer superior convenience, extended shelf life, and enhanced product appeal. The food industry, in particular, remains a primary consumer, with growth spurred by the burgeoning popularity of convenience foods, ready-to-eat meals, and snack products, all of which benefit from the versatility and portability of pouches. Technological disruptions are playing a pivotal role, with innovations in multi-layer films, high-barrier materials, and advanced printing techniques enabling manufacturers to meet increasingly sophisticated demands for product protection and visual merchandising. The shift towards sustainability is a significant trend, pushing the adoption of recyclable, compostable, and biodegradable pouch materials. Consumer behaviors are also evolving, with a heightened awareness of environmental impact and a preference for brands that demonstrate a commitment to sustainable practices. This translates into a growing demand for pouches made from post-consumer recycled (PCR) content and mono-material structures that facilitate easier recycling. Furthermore, the medical and pharmaceutical sectors are increasingly adopting pouch packaging for its sterile, lightweight, and protective qualities, especially for single-dose or specialized treatments. The personal care and household care segments also contribute to market expansion, driven by the demand for user-friendly and aesthetically pleasing packaging. The overall market trajectory indicates a sustained upward trend, supported by continuous innovation and a deep understanding of end-user needs.

Key Markets & Segments Leading Italy Pouch Packaging Market

The Italy Pouch Packaging Market exhibits a dynamic segmentation, with specific materials, product types, and end-user industries demonstrating significant leadership and growth potential.

Material Dominance:

- Plastic: Continues to be the dominant material segment, accounting for over 60% of the market share.

- Polyethylene (PE): Its versatility, cost-effectiveness, and excellent sealing properties make it a leading choice across various applications, particularly in food and personal care. The demand for flexible PE pouches for dry foods and confectionery is substantial.

- Polypropylene (PP): Offers superior clarity, strength, and temperature resistance, making it ideal for frozen foods and demanding applications. Its use in stand-up pouches for snacks is on the rise.

- PET (Polyethylene Terephthalate): Provides excellent barrier properties against oxygen and moisture, crucial for extending the shelf life of food products like dairy and ready-to-eat meals.

- EVOH (Ethylene Vinyl Alcohol Copolymer): Incorporated as a barrier layer in multi-layer films to provide exceptional oxygen and aroma protection, essential for high-value food items and medical applications.

- Other Resins: Includes specialized resins tailored for specific barrier and performance requirements.

- Paper: Witnessing a resurgence due to its perceived sustainability and recyclability. While its market share is smaller than plastics, its growth is driven by demand for eco-friendly alternatives in dry food, coffee, and confectionery packaging.

- Aluminum: Primarily used as a barrier layer in multi-laminate structures for its unparalleled protection against light, oxygen, and moisture. Essential for applications requiring extreme shelf stability, such as medical devices and specialty foods.

Product Type Dominance:

- Stand-up Pouches: This format is experiencing the fastest growth, driven by consumer preference for convenience, re-sealability, and excellent shelf presence. They are increasingly adopted across food (snacks, pet food, frozen foods), beverage, and personal care segments.

- Flat Pouches (Pillow & Side-Seal): Remain a staple for a wide range of products, particularly in bulk packaging, dry goods, and single-serve portions. Their cost-effectiveness and high production speeds ensure continued relevance.

End-User Industry Dominance:

- Food: This segment is the largest contributor to the Italy Pouch Packaging Market, driven by diverse sub-segments:

- Candy & Confectionery: Pouches offer portion control, freshness preservation, and appealing visual branding.

- Frozen Foods: High barrier properties of pouches prevent freezer burn and maintain product quality.

- Fresh Produce: Pouches with modified atmosphere packaging (MAP) capabilities extend shelf life and maintain freshness.

- Dairy Products: Pouches are widely used for yogurt, milk, and cheese, offering convenience and extended shelf life.

- Dry Foods: Pasta, rice, grains, and cereal pouches are a significant market segment.

- Meat, Poultry, And Seafood: Pouches provide excellent protection, extended shelf life, and visual appeal.

- Pet Food: Stand-up pouches with re-sealability are highly popular for their convenience and product preservation.

- Beverage: Pouches are gaining traction for single-serve beverages, juices, and powdered drink mixes, offering a lightweight and portable alternative to traditional packaging.

- Medical and Pharmaceutical: The demand for sterile, tamper-evident, and highly protective pouches for medications, medical devices, and diagnostic kits is a growing market.

- Personal Care and Household Care: Pouches are increasingly used for liquid soaps, detergents, cosmetics, and other personal care items, offering convenience and reduced material usage.

Drivers of Dominance:

- Economic Growth & Consumer Spending: A strong Italian economy fuels consumer demand for packaged goods.

- Technological Advancements in Materials: Innovations in barrier films and sustainable materials support growth in specific segments.

- Evolving Consumer Lifestyles: Increasing demand for convenience, portability, and on-the-go consumption favors pouch packaging.

- Retailer & Brand Owner Preferences: Pouches offer excellent branding opportunities, shelf appeal, and supply chain efficiencies.

- Government Initiatives & Sustainability Push: Growing focus on recyclability and waste reduction encourages the adoption of advanced pouch solutions.

Italy Pouch Packaging Market Product Developments

Product innovations in the Italy Pouch Packaging Market are centered on enhancing functionality, sustainability, and consumer appeal. Advancements include the development of mono-material pouches (e.g., PE or PP based) designed for improved recyclability, addressing the growing environmental concerns and regulatory pressures. High-barrier films incorporating advanced polymers and EVOH layers are being engineered to provide superior protection against oxygen, moisture, and light, thereby extending product shelf life for sensitive food items, pharmaceuticals, and medical supplies. Smart packaging technologies, such as integrated indicators for temperature or freshness, are emerging, offering enhanced product safety and consumer confidence. Furthermore, the market is seeing increased adoption of pouches with enhanced dispensing and re-sealing features, catering to the demand for convenience and reduced product waste. These innovations are crucial for maintaining competitive edge and meeting the evolving demands of end-user industries.

Challenges in the Italy Pouch Packaging Market Market

The Italy Pouch Packaging Market faces several challenges that could impede its growth trajectory.

- Regulatory Hurdles: Evolving and sometimes fragmented environmental regulations regarding plastic usage and recyclability can create compliance complexities and increase operational costs for manufacturers.

- Supply Chain Volatility: Fluctuations in raw material prices (polymers, aluminum foil) and global supply chain disruptions can impact production costs and delivery timelines.

- Competitive Pressures: Intense competition from established global players and emerging regional manufacturers necessitates continuous innovation and cost optimization.

- Consumer Perception of Plastic: Despite advancements in recyclability, a segment of consumers still harbors a negative perception of plastic packaging, influencing purchasing decisions and brand choices.

- Infrastructure for Recycling: The effectiveness of recyclable pouch packaging is contingent upon robust and widespread recycling infrastructure, which may vary across different regions within Italy.

Forces Driving Italy Pouch Packaging Market Growth

Several key forces are propelling the growth of the Italy Pouch Packaging Market. The ever-increasing consumer demand for convenience and portability, especially for food, beverages, and personal care products, is a primary driver. Technological advancements in material science, leading to improved barrier properties, enhanced recyclability, and extended shelf life, are making pouches more attractive for a wider range of applications. The growing global emphasis on sustainability and circular economy principles is encouraging the adoption of innovative, eco-friendlier pouch solutions, including those made from recycled content or mono-materials. Furthermore, strategic investments and expansions by major industry players, coupled with favorable demographic trends such as a growing urban population seeking ready-to-eat and on-the-go options, are significantly contributing to market expansion.

Challenges in the Italy Pouch Packaging Market Market

While growth is robust, the Italy Pouch Packaging Market navigates long-term challenges that require strategic foresight. The transition to a fully circular economy for flexible packaging necessitates significant investment in collection, sorting, and recycling technologies, a process that can be slow and capital-intensive. The continuous need for innovation to meet ever-stringent environmental standards and consumer demands for compostable or biodegradable alternatives requires substantial R&D expenditure. Geopolitical instability and economic fluctuations can impact raw material availability and pricing, posing ongoing supply chain risks. Moreover, maintaining brand differentiation and consumer trust in the face of increasing competition and evolving sustainability narratives demands continuous adaptation and effective communication.

Emerging Opportunities in Italy Pouch Packaging Market

Emerging opportunities in the Italy Pouch Packaging Market are abundant, fueled by evolving consumer lifestyles and technological frontiers. The expanding e-commerce sector presents a significant avenue for growth, with the need for robust, lightweight, and tamper-evident packaging solutions. Growth in the premium and specialty food segments, including organic, functional, and gourmet products, offers opportunities for high-value pouch packaging with enhanced aesthetic appeal and barrier properties. The increasing adoption of pouch formats in the medical and pharmaceutical industries for specialized drug delivery systems and sterile packaging represents a significant untapped potential. Furthermore, the development and implementation of advanced recycling technologies, coupled with government support for the circular economy, will unlock new avenues for using recycled materials and creating truly sustainable pouch solutions, attracting environmentally conscious brands.

Leading Players in the Italy Pouch Packaging Market Sector

- Amcor PLC

- Mondi PLC

- Sonoco Products Company

- Constantia Flexibles GmbH

- Sacia Flex Italy

- PackStyle s r l

- Sudpack Holding GmbH

- ACM S p A

Key Milestones in Italy Pouch Packaging Market Industry

- April 2024: Swiss food giant Nestle announced plans to establish a pet food manufacturing facility in northern Italy, with an investment of EUR 472 million (USD 507.92 million). The facility is located in Mantua, approximately 100 miles southeast of Milan, and is slated for completion by 2027. This move emphasizes Nestle's commitment to bolstering its operations in Italy, highlighting its growing significance as a hub for major global corporations, potentially increasing demand for pouch packaging manufacturers across the country.

- June 2023: CCL Industries Inc., a global leader in specialty label, security, and packaging solutions, acquired Pouch Partners s.r.l., based in Italy. This acquisition from Pouch Partners AG (owned by Switzerland-based Capri-Sun Group) led to the rebranding of the entity as CCL Specialty Pouches, integrating it into CCL Label's Food & Beverage division in Europe, thereby consolidating market presence and expanding capabilities in the Italian pouch packaging sector.

Strategic Outlook for Italy Pouch Packaging Market Market

The strategic outlook for the Italy Pouch Packaging Market is overwhelmingly positive, characterized by a strong emphasis on sustainable innovation and market expansion. Growth accelerators include the continued development of advanced recyclable and compostable materials, meeting both regulatory demands and consumer preferences for eco-friendly packaging. Strategic partnerships between material suppliers, packaging manufacturers, and brand owners will be crucial for co-creating tailored solutions and streamlining the adoption of new technologies. Investments in automation and digitalization within the manufacturing process will enhance efficiency and reduce costs, bolstering competitiveness. Furthermore, targeting niche markets such as medical and pharmaceutical applications, alongside capitalizing on the growth of e-commerce and convenience-oriented consumer goods, will offer significant avenues for future market penetration and sustained growth in this dynamic sector.

Italy Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Italy Pouch Packaging Market Segmentation By Geography

- 1. Italy

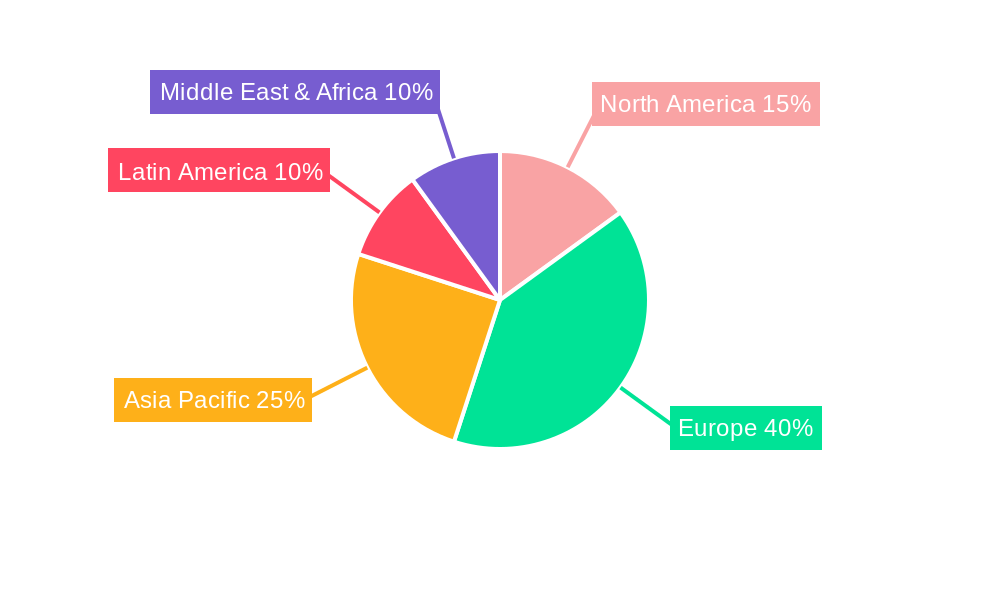

Italy Pouch Packaging Market Regional Market Share

Geographic Coverage of Italy Pouch Packaging Market

Italy Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Easy and Convenient Packaging

- 3.3. Market Restrains

- 3.3.1. Rising Need for Easy and Convenient Packaging

- 3.4. Market Trends

- 3.4.1. Stand-up Pouches to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Pouch Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sonoco Products Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Constantia Flexibles GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sacia Flex Italy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PackStyle s r l

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sudpack Holding GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ACM S p A8 2 Heat Map Analysi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: Italy Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Pouch Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Italy Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 3: Italy Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Italy Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 5: Italy Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Italy Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: Italy Pouch Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Italy Pouch Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Italy Pouch Packaging Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Italy Pouch Packaging Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: Italy Pouch Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Italy Pouch Packaging Market Volume Billion Forecast, by Product 2020 & 2033

- Table 13: Italy Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Italy Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: Italy Pouch Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Italy Pouch Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Pouch Packaging Market?

The projected CAGR is approximately 5.37%.

2. Which companies are prominent players in the Italy Pouch Packaging Market?

Key companies in the market include Amcor PLC, Mondi PLC, Sonoco Products Company, Constantia Flexibles GmbH, Sacia Flex Italy, PackStyle s r l, Sudpack Holding GmbH, ACM S p A8 2 Heat Map Analysi.

3. What are the main segments of the Italy Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Easy and Convenient Packaging.

6. What are the notable trends driving market growth?

Stand-up Pouches to Witness Growth.

7. Are there any restraints impacting market growth?

Rising Need for Easy and Convenient Packaging.

8. Can you provide examples of recent developments in the market?

April 2024: Swiss food giant Nestle announced plans to establish a pet food manufacturing facility in northern Italy, with an investment of EUR 472 million (USD 507.92 million). The facility is located in Mantua, approximately 100 miles southeast of Milan, and is slated for completion by 2027. The move emphasizes Nestle's commitment to bolstering its operations in Italy, highlighting its growing significance as a hub for major global corporations. This might leverage the need for pouch packaging manufacturers across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the Italy Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence