Key Insights

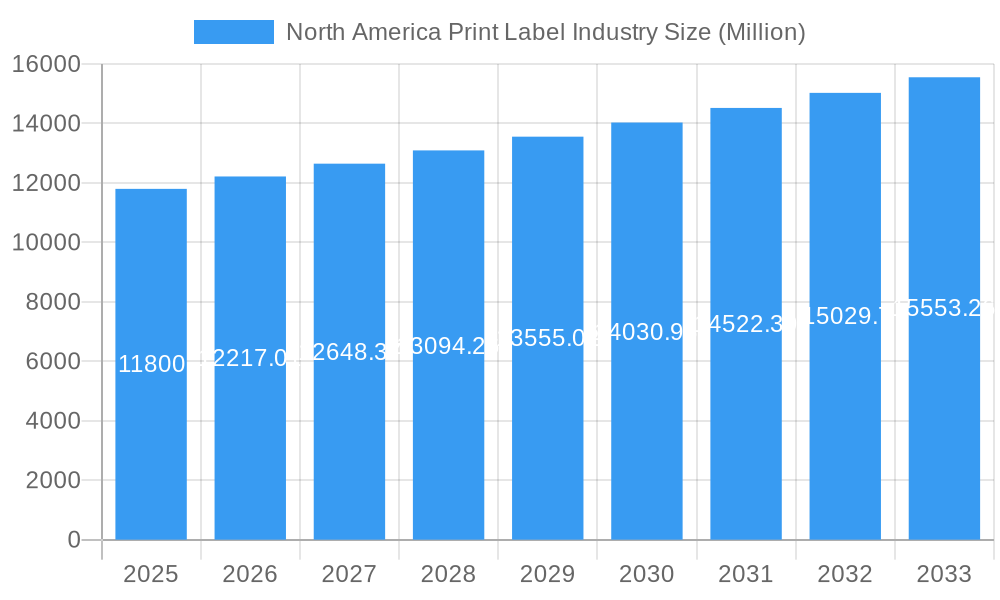

The North America print label industry is poised for robust growth, projected to reach an estimated market size of approximately $11.8 billion by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.53% through 2033. This expansion is fueled by a confluence of factors, including the increasing demand for product differentiation across diverse consumer goods sectors like food, beverages, and healthcare. Advancements in printing technologies, such as the ongoing adoption of high-speed inkjet and sophisticated flexography, are enabling manufacturers to produce more intricate and visually appealing labels efficiently. Furthermore, the growing consumer preference for sustainable packaging solutions is driving innovation in eco-friendly label materials and printing processes, presenting significant opportunities for market players. The rise of e-commerce and the subsequent need for detailed product tracking and supply chain visibility also contribute to the demand for specialized label types like multi-part tracking labels and shrink sleeves.

North America Print Label Industry Market Size (In Billion)

Key drivers propelling this market forward include the escalating need for brand visibility and consumer engagement in a highly competitive marketplace. Manufacturers are increasingly leveraging labels not just for product information but as a critical element of their branding strategy. While the market is experiencing strong upward momentum, certain restraints, such as fluctuating raw material costs and the increasing complexity of regulatory compliance for labeling in different end-user industries, could pose challenges. However, the prevailing trends of customization, personalization, and the adoption of digital printing technologies are expected to offset these potential hurdles. The industry is witnessing a significant shift towards more sustainable and intelligent labeling solutions, indicating a dynamic and evolving landscape where innovation and adaptability will be paramount for success.

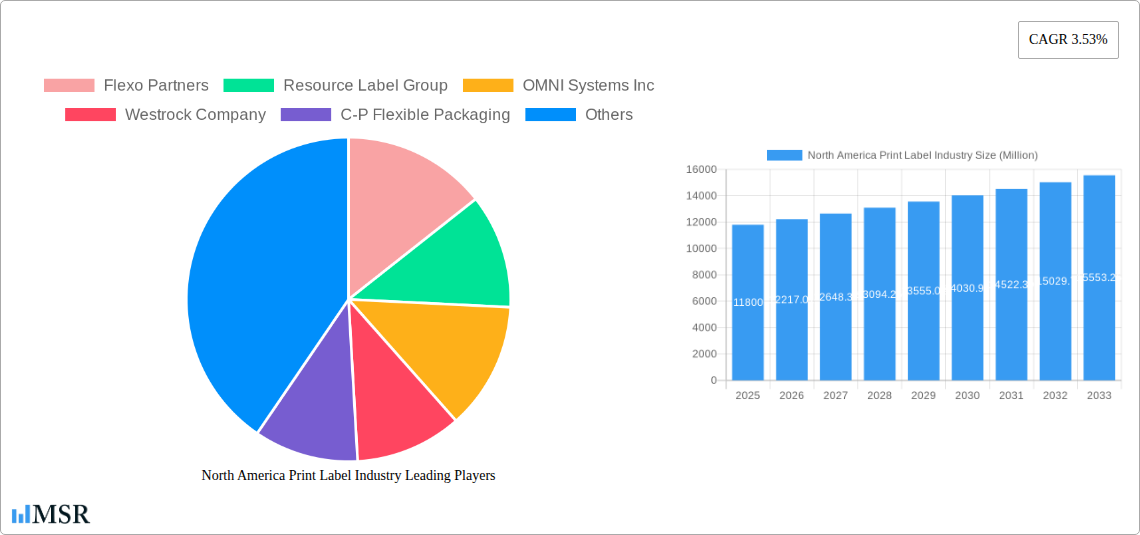

North America Print Label Industry Company Market Share

North America Print Label Industry Market Report: Unveiling Growth, Innovation, and Strategic Dynamics

This comprehensive report offers an in-depth analysis of the North America Print Label Industry, covering the historical period from 2019 to 2024, a base year of 2025, and a robust forecast period extending to 2033. Delve into market concentration, intricate industry insights, key segment dominance, product developments, challenges, growth drivers, emerging opportunities, leading players, crucial milestones, and a strategic outlook designed for industry stakeholders seeking to navigate and capitalize on this dynamic market.

North America Print Label Industry Market Concentration & Dynamics

The North America Print Label Industry exhibits a moderate market concentration, with key players like Avery Dennison Corporation, Multi-Color Corporation, and Westrock Company holding significant market shares. The innovation ecosystem is thriving, fueled by advancements in printing technologies and material science, particularly in pressure-sensitive and linerless labels. Regulatory frameworks, primarily focused on product safety, environmental impact, and traceability, influence product development and market entry strategies. Substitute products, such as direct printing and digital marking, pose a growing challenge but are yet to fully displace the versatility and cost-effectiveness of traditional printed labels. End-user trends are leaning towards sustainable materials, enhanced brand storytelling, and intelligent labeling solutions that offer supply chain visibility. Merger and acquisition (M&A) activities are a constant feature, with xx M&A deals recorded in the historical period, indicating a strategic consolidation and expansion drive. Key M&A activities include Resource Label Group's aggressive acquisition strategy, exemplified by the QSX Labels acquisition in January 2022, and Avery Dennison's strategic investment in linerless label technology in March 2022. These activities underscore a competitive landscape where scale, technological integration, and regional presence are paramount for market leadership.

North America Print Label Industry Industry Insights & Trends

The North America Print Label Industry is poised for substantial growth, projected to reach $XXX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX.X% from 2025 to 2033. This growth is primarily propelled by the escalating demand from the food and beverage sector, which consistently requires high-quality, visually appealing, and informative labeling for product differentiation and regulatory compliance. The healthcare industry is another significant contributor, with an increasing need for tamper-evident, trackable, and sterile labels for pharmaceuticals and medical devices. Technological disruptions, such as the widespread adoption of digital printing technologies (Inkjet, Electrophotography), are revolutionizing short-run label production, enabling greater personalization and faster turnaround times. The shift towards sustainable packaging solutions is also a major trend, driving demand for eco-friendly inks, adhesives, and recyclable label materials. Evolving consumer behaviors, including a preference for brands that demonstrate transparency and sustainability, are further influencing label design and functionality. The market size in the base year 2025 is estimated at $XXX Million. The continuous innovation in label types, like linerless and in-mold labels, coupled with advancements in printing techniques, are creating new avenues for market expansion. The industry is also witnessing a growing integration of smart labeling features, offering consumers and businesses enhanced product information and traceability.

Key Markets & Segments Leading North America Print Label Industry

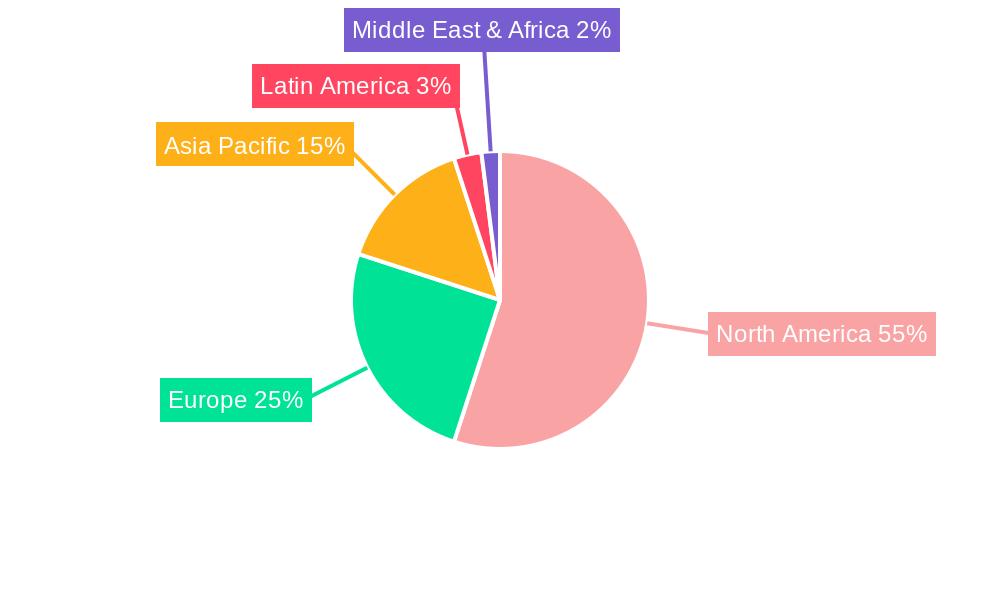

The North American region, particularly the United States, stands as the dominant market within the North America Print Label Industry. This dominance is attributed to a robust and diversified economy, significant manufacturing output across various sectors, and a strong consumer base with a high demand for packaged goods.

Printing Technology Dominance:

- Flexography: Continues to be a leading technology due to its versatility, cost-effectiveness for medium to long print runs, and suitability for a wide range of substrates, especially in the packaging industry.

- Inkjet: Experiencing rapid growth, driven by its capabilities in digital printing, enabling variable data printing, customization, and on-demand production, crucial for sectors like e-commerce and personalized products.

- Electrophotography: Also a key player in digital printing, offering high-quality graphics and fast turnaround times for shorter print runs, especially favored in shorter-run specialty label applications.

Label Type Dominance:

- Pressure-sensitive Labels: This segment is the largest and most dynamic, driven by their ease of application, versatility across numerous end-user industries, and continuous innovation in adhesive and face stock technologies.

- Shrink and Stretch Sleeves: Gaining significant traction, especially in the beverage and cosmetic industries, due to their ability to provide 360-degree branding and their suitability for oddly shaped containers.

- Linerless Labels: An emerging segment with strong growth potential, offering environmental benefits by eliminating the liner waste, and enhanced efficiency in application.

End-User Industry Dominance:

- Food: The largest end-user industry, characterized by high volume demand, strict regulatory requirements for food safety and ingredient information, and a constant need for appealing branding to capture consumer attention.

- Beverage: A consistently strong segment, encompassing alcoholic and non-alcoholic beverages, requiring durable, eye-catching labels that can withstand various storage and handling conditions.

- Healthcare: A high-value segment driven by the necessity for precise labeling of pharmaceuticals, medical devices, and diagnostic kits, emphasizing features like tamper-evidence, serialization, and compliance with stringent regulations.

- Household: This sector utilizes labels for a wide array of products, from cleaning supplies to personal care items, where branding and product differentiation are key.

The economic growth in North America, coupled with substantial infrastructure development and a high disposable income among consumers, directly fuels the demand for packaged goods, thereby driving the print label market. The increasing adoption of e-commerce also necessitates efficient and informative labeling for shipping and product identification.

North America Print Label Industry Product Developments

Recent product developments in the North America Print Label Industry focus on enhancing functionality and sustainability. Avery Dennison Corporation's acquisition of Catchpoint Ltd's linerless label technology in March 2022 highlights a strategic move towards offering waste-reducing and efficient labeling solutions. This innovation addresses growing environmental concerns and operational efficiencies for businesses. Concurrently, advancements in smart labeling, incorporating RFID or NFC technology, are enabling better inventory management and enhanced consumer engagement. The development of specialized inks and coatings for improved durability, chemical resistance, and scannability continues to push the boundaries of what print labels can achieve, catering to niche applications within the healthcare and industrial sectors.

Challenges in the North America Print Label Industry Market

The North America Print Label Industry faces several challenges. Fluctuations in raw material prices, particularly for paper, film, and inks, can significantly impact profit margins. Stringent environmental regulations regarding waste disposal and the use of certain chemicals necessitate ongoing investment in sustainable practices and compliant materials. Intense price competition among a fragmented market also pressures profitability. Furthermore, the integration of new digital technologies requires significant capital investment and workforce retraining. Supply chain disruptions, as witnessed in recent years, can lead to delays and increased costs for critical inputs. The estimated impact of these challenges could potentially reduce the projected market growth by XX% if not effectively managed.

Forces Driving North America Print Label Industry Growth

Several key forces are driving the growth of the North America Print Label Industry. The continuous expansion of the e-commerce sector fuels demand for customized and variable data printing for shipping and product identification. Increasing consumer awareness regarding product information and brand authenticity necessitates sophisticated and informative labeling solutions. Technological advancements in digital printing, including inkjet and electrophotography, are enabling greater flexibility, faster turnaround times, and cost-effectiveness for shorter print runs. The growing emphasis on sustainability is creating a demand for eco-friendly label materials and processes. Furthermore, the expanding healthcare sector, with its stringent labeling requirements for pharmaceuticals and medical devices, is a significant growth catalyst.

Challenges in the North America Print Label Industry Market

Long-term growth catalysts in the North America Print Label Industry are rooted in innovation and market expansion. The ongoing development of advanced materials, such as biodegradable films and recycled content face stocks, caters to the increasing demand for sustainable packaging. Strategic partnerships and collaborations between label manufacturers, technology providers, and end-user industries are fostering the creation of integrated labeling solutions. Market expansion into emerging niches, like smart packaging with embedded functionalities, offers significant growth potential. Furthermore, the increasing demand for traceability solutions across various supply chains, driven by regulatory mandates and consumer expectations, will continue to propel the market forward.

Emerging Opportunities in North America Print Label Industry

Emerging opportunities in the North America Print Label Industry lie in the burgeoning demand for smart labels that offer enhanced traceability, anti-counterfeiting measures, and consumer interaction through QR codes and NFC tags. The growing trend of personalized consumer goods is creating a niche for on-demand, short-run label printing services. Furthermore, the increasing focus on supply chain transparency and regulatory compliance, particularly in the food and pharmaceutical sectors, presents a significant opportunity for specialized labeling solutions. The development and adoption of advanced printing technologies, such as those enabling unique tactile effects and vibrant color reproduction, will also unlock new avenues for premium product branding. The sustained growth of the e-commerce market continues to drive demand for efficient and informative shipping labels.

Leading Players in the North America Print Label Industry Sector

- Flexo Partners

- Resource Label Group

- OMNI Systems Inc

- Westrock Company

- C-P Flexible Packaging

- Cenveo Corporation

- IMS Inc

- Mondi Group

- Blue Label Packaging Company

- Avery Dennison Corporation

- Derksen Co

- Multi-Color Corporation

- Traco Packaging

- Brady Corporation

- Ahlstrom-munksjo Oyj

- Brandmark Inc

- Inovar

Key Milestones in North America Print Label Industry Industry

- March 2022: Avery Dennison Corporation acquired the linerless label technology developed by Catchpoint Ltd, enhancing its portfolio with innovative, waste-reducing solutions.

- January 2022: Resource Label Group LLC acquired QSX Labels, strengthening its regional presence in New England and underscoring its aggressive M&A strategy with its 23rd acquisition.

Strategic Outlook for North America Print Label Industry Market

The strategic outlook for the North America Print Label Industry remains highly positive, fueled by ongoing technological innovation, evolving consumer preferences, and expanding end-user industries. Key growth accelerators include the continued adoption of digital printing technologies for enhanced flexibility and customization, the increasing demand for sustainable and eco-friendly labeling solutions, and the integration of smart technologies for greater supply chain visibility and consumer engagement. Companies that invest in R&D, focus on developing specialized labeling solutions for high-growth sectors like healthcare and e-commerce, and prioritize sustainable practices are best positioned to capitalize on future market potential and achieve sustained competitive advantage. The strategic imperative for industry players will be to adapt to the digital transformation and embrace a circular economy approach.

North America Print Label Industry Segmentation

-

1. Printing Technology

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Electrophotography

- 1.7. Inkjet

-

2. Label Type

- 2.1. Wet-glue Labels

- 2.2. Pressure-sensitive Labels

- 2.3. Linerless Labels

- 2.4. Multi-part Tracking Labels

- 2.5. In-mold Labels

- 2.6. Shrink and Stretch Sleeves

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industri

- 3.7. Logistics

- 3.8. Other End-user Industries

North America Print Label Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Print Label Industry Regional Market Share

Geographic Coverage of North America Print Label Industry

North America Print Label Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetics Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Food and Allied Products Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Print Label Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Technology

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Electrophotography

- 5.1.7. Inkjet

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glue Labels

- 5.2.2. Pressure-sensitive Labels

- 5.2.3. Linerless Labels

- 5.2.4. Multi-part Tracking Labels

- 5.2.5. In-mold Labels

- 5.2.6. Shrink and Stretch Sleeves

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industri

- 5.3.7. Logistics

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Printing Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flexo Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Resource Label Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OMNI Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Westrock Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 C-P Flexible Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cenveo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMS Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mondi Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blue Label Packaging Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avery Dennison Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Derksen Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Multi-Color Corporation*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Traco Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Brady Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ahlstrom-munksjo Oyj

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Brandmark Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Inovar

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Flexo Partners

List of Figures

- Figure 1: North America Print Label Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Print Label Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Print Label Industry Revenue Million Forecast, by Printing Technology 2020 & 2033

- Table 2: North America Print Label Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: North America Print Label Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Print Label Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Print Label Industry Revenue Million Forecast, by Printing Technology 2020 & 2033

- Table 6: North America Print Label Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: North America Print Label Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Print Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Print Label Industry?

The projected CAGR is approximately 3.53%.

2. Which companies are prominent players in the North America Print Label Industry?

Key companies in the market include Flexo Partners, Resource Label Group, OMNI Systems Inc, Westrock Company, C-P Flexible Packaging, Cenveo Corporation, IMS Inc, Mondi Group, Blue Label Packaging Company, Avery Dennison Corporation, Derksen Co, Multi-Color Corporation*List Not Exhaustive, Traco Packaging, Brady Corporation, Ahlstrom-munksjo Oyj, Brandmark Inc, Inovar.

3. What are the main segments of the North America Print Label Industry?

The market segments include Printing Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetics Segment.

6. What are the notable trends driving market growth?

Food and Allied Products Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

March 2022 - Avery Dennison Corporation, a global materials science company specializing in the design and manufacture of a wide variety of labeling and functional materials, acquired the linerless label technology developed by Catchpoint Ltd, a UK company based in Yorkshire, England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Print Label Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Print Label Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Print Label Industry?

To stay informed about further developments, trends, and reports in the North America Print Label Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence