Key Insights

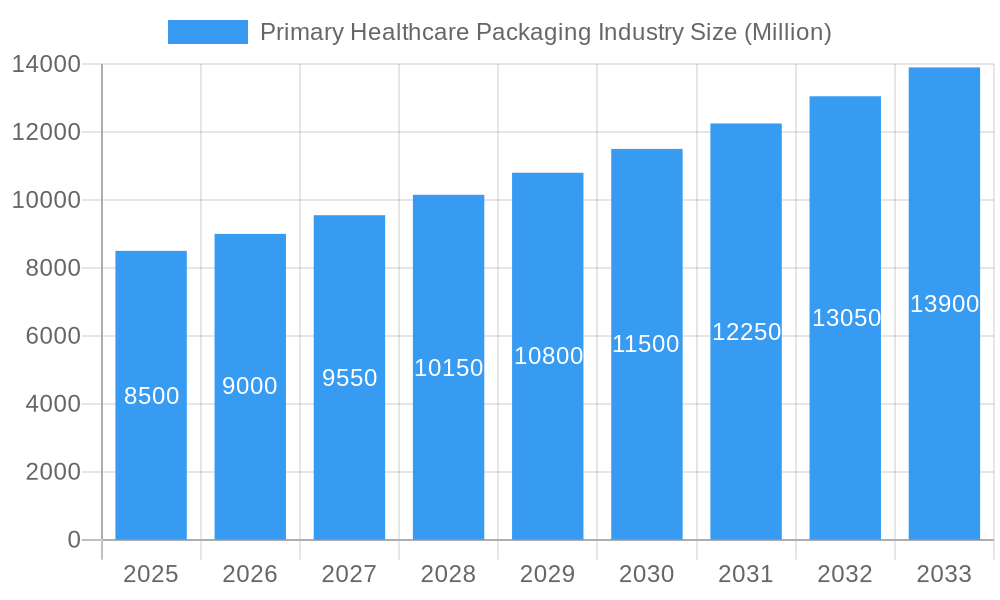

The global Primary Healthcare Packaging market is poised for significant expansion, projected to reach an estimated 153.79 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.9% from 2025 to 2033. This growth is propelled by escalating demand for secure, sterile, and compliant packaging for pharmaceuticals and medical devices. Key growth drivers include the expanding global healthcare sector, the increasing incidence of chronic diseases requiring advanced drug delivery, and stringent regulatory requirements for product integrity and patient safety. The market is increasingly adopting innovative materials and designs for improved shelf-life, tamper-evidence, and user convenience. A growing emphasis on sustainable packaging, driven by environmental concerns and regulatory shifts, is fostering the adoption of recyclable and biodegradable materials. Furthermore, substantial investments in R&D for novel drug formulations, particularly biologics and complex therapeutics, are augmenting the demand for specialized primary packaging.

Primary Healthcare Packaging Industry Market Size (In Billion)

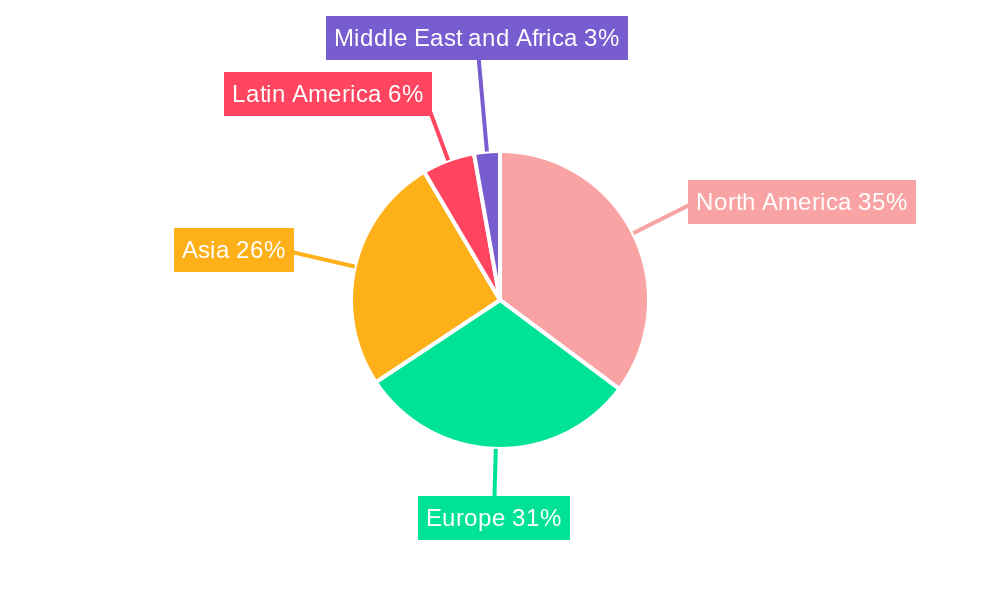

The market is segmented by materials, product types, and end-use verticals. Glass, a traditional leader, maintains a strong presence due to its inertness and barrier properties, essential for sensitive medications. However, advancements in plastic technology are yielding lighter, more durable, and cost-effective alternatives. Key product segments include bottles and containers, vials and ampoules, and cartridges and prefilled syringes, driven by the growth in pharmaceutical and biotechnology industries. The pharmaceutical sector remains the largest end-user, driven by continuous demand for effective and secure drug packaging. The medical device sector is also a significant contributor, requiring specialized packaging for instruments, implants, and diagnostic kits. Geographically, North America and Europe lead in adopting advanced packaging technologies, while the Asia Pacific region presents a high-growth opportunity due to its developing healthcare infrastructure, rising disposable incomes, and expanding pharmaceutical manufacturing capabilities.

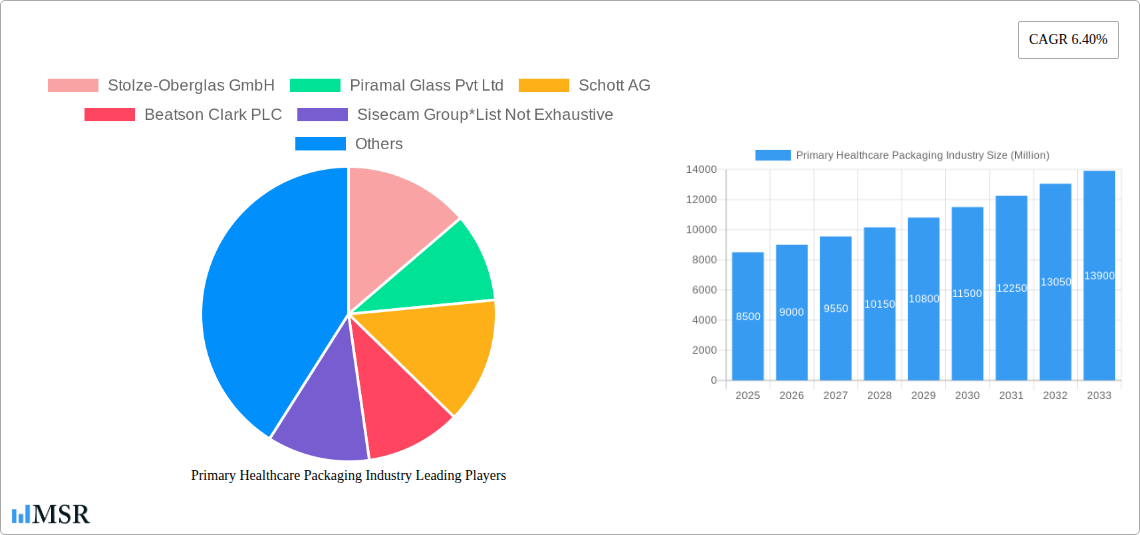

Primary Healthcare Packaging Industry Company Market Share

Comprehensive Report: Primary Healthcare Packaging Industry Market Analysis 2019-2033

This in-depth report provides a definitive analysis of the global Primary Healthcare Packaging Industry, a critical sector underpinning pharmaceutical and medical device supply chains. Covering the period 2019–2033, with a Base Year of 2025, this research offers unparalleled insights into market dynamics, growth drivers, challenges, and future opportunities. Our comprehensive Market Size estimations and CAGR projections, based on rigorous data analysis, are essential for pharmaceutical packaging manufacturers, medical device companies, packaging material suppliers, and investment firms seeking to navigate this evolving landscape. Discover actionable intelligence on glass primary packaging, plastic primary packaging, sterile packaging solutions, drug delivery systems, and patient safety packaging.

Primary Healthcare Packaging Industry Market Concentration & Dynamics

The Primary Healthcare Packaging Industry exhibits a moderate to high market concentration, with key players dominating significant market shares. Innovation ecosystems are thriving, fueled by a constant drive for enhanced drug stability, patient safety, and compliance with stringent regulatory frameworks like FDA and EMA guidelines. The threat of substitute products is present but often mitigated by the unique material properties and stringent validation requirements inherent in healthcare packaging. End-user trends, particularly the increasing demand for biologics and specialized therapeutics, are significantly shaping packaging requirements. Mergers and acquisitions (M&A) activities remain a notable aspect of market dynamics, reflecting strategic consolidations and expansions. M&A deal counts are expected to continue their upward trajectory as companies seek to broaden their product portfolios and geographic reach. Key players like Gerresheimer AG and Schott AG consistently invest in R&D and strategic acquisitions to maintain their competitive edge.

- Market Concentration: Dominated by a mix of large multinational corporations and specialized regional players.

- Innovation Ecosystems: Focused on advanced barrier properties, tamper-evident features, and sustainable materials.

- Regulatory Frameworks: Strict adherence to cGMP, USP, and ISO standards is paramount for market access.

- Substitute Products: While alternatives exist, specific applications demand specialized primary healthcare packaging materials.

- End-User Trends: Growing demand for prefilled syringes, vials for biologics, and patient-centric drug delivery devices.

- M&A Activities: Strategic acquisitions to enhance product offerings, expand manufacturing capacity, and gain market share.

Primary Healthcare Packaging Industry Industry Insights & Trends

The Primary Healthcare Packaging Industry is poised for robust growth, driven by an expanding global population, the rising incidence of chronic diseases, and increasing healthcare expenditure. The market size is projected to reach an estimated USD 100 Billion by 2025, with a healthy CAGR of 7.5% forecasted for the Forecast Period of 2025–2033. Technological disruptions are at the forefront, with advancements in material science leading to the development of novel plastic primary packaging and improved glass primary packaging solutions. The integration of smart packaging technologies, offering real-time monitoring of temperature and humidity, is also gaining traction. Evolving consumer behaviors, particularly the preference for convenient and user-friendly drug delivery systems, are influencing product design and innovation. The increasing focus on sustainability is also a significant trend, pushing manufacturers to explore eco-friendly materials and manufacturing processes for pharmaceutical primary packaging. The growth in biologics, vaccines, and personalized medicine necessitates highly specialized and sterile primary healthcare packaging solutions. The Base Year of 2025 reflects a significant recovery and growth phase post-pandemic, with continued momentum expected. The Historical Period of 2019–2024 provides context for these evolving trends and market shifts.

Key Markets & Segments Leading Primary Healthcare Packaging Industry

The Pharmaceutical end-use vertical overwhelmingly dominates the Primary Healthcare Packaging Industry, accounting for an estimated 80% of the market share in 2025. Within this segment, Bottles and Containers and Vials and Ampoules are the leading product types, driven by their widespread use in oral solid dosages, liquids, and injectable formulations. The Glass material segment holds a substantial market share due to its excellent inertness, barrier properties, and established regulatory acceptance for sensitive pharmaceuticals. However, Plastic is rapidly gaining ground, particularly in applications requiring lightweight, shatter-resistant, and customizable solutions, contributing to its projected market share of 35% in 2025. Key growth drivers for the Pharmaceutical segment include:

- Economic Growth: Rising disposable incomes in emerging economies translate to increased healthcare spending and demand for packaged pharmaceuticals.

- Infrastructure Development: Improved healthcare infrastructure and distribution networks facilitate wider access to medicines, boosting packaging demand.

- R&D Investments: Significant investments in pharmaceutical R&D lead to new drug discoveries requiring specialized primary healthcare packaging.

- Aging Population: The global aging demographic increases the prevalence of chronic diseases, driving demand for long-term medication packaging.

The Medical Devices end-use vertical, while smaller, is a significant growth area, particularly for Cartridges and Prefilled Syringes and Tubes. The increasing complexity and volume of medical procedures globally are fueling demand for sterile, safe, and efficient packaging solutions. The Plastic segment is particularly strong here due to its versatility and cost-effectiveness for a wide range of medical device packaging needs.

Primary Healthcare Packaging Industry Product Developments

Recent product innovations in the Primary Healthcare Packaging Industry are revolutionizing drug delivery and patient care. A prime example is the May 2022 announcement by SGD SA Pharma of their Type I 100mL Ready-to-Use (RTU) molded glass vials. This groundbreaking solution, available in an EZ-Fill tray configuration, significantly accelerates time-to-market for pharmaceutical companies developing high-volume parenteral medicines by providing aseptic filling and finishing capabilities. Similarly, Gerresheimer AG’s May 2022 expansion of its Indian production capacity, including a new high-quality plastic containers and closures plant and sustainable furnace technology for glass production, highlights the industry's commitment to meeting increasing demand and ensuring continuous supply for critical healthcare facilities. These developments underscore a trend towards enhanced convenience, sterility, and supply chain reliability in healthcare packaging solutions.

Challenges in the Primary Healthcare Packaging Industry Market

The Primary Healthcare Packaging Industry faces several challenges that could impede growth. Navigating complex and ever-evolving regulatory hurdles across different global markets requires significant investment in compliance and validation. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production timelines and costs. Intense competitive pressures among established players and new entrants can lead to price erosion, particularly for commoditized packaging types.

- Regulatory Compliance: Meeting diverse and stringent regulations (e.g., serialization, track-and-trace) across regions.

- Supply Chain Vulnerabilities: Dependence on global supply chains for raw materials and manufacturing can lead to disruptions.

- Cost Pressures: Intense competition and pressure from pharmaceutical companies to reduce packaging costs.

- Sustainability Demands: Balancing environmental concerns with the need for high-performance, sterile packaging.

Forces Driving Primary Healthcare Packaging Industry Growth

Several powerful forces are propelling the Primary Healthcare Packaging Industry forward. The escalating global demand for pharmaceuticals, driven by an aging population and rising chronic disease rates, directly translates to increased need for robust packaging. Technological advancements, such as the development of advanced barrier materials and innovative drug delivery systems, are creating new market opportunities. Furthermore, increasing investments in healthcare infrastructure and access to medicines in emerging economies are significantly expanding the market for pharmaceutical primary packaging.

- Rising Healthcare Expenditure: Global increases in healthcare spending fuel demand for medicines and their packaging.

- Biologics and Biosimilars Growth: The expanding market for complex biological drugs requires specialized and high-barrier packaging.

- Technological Innovations: Advancements in materials and design enable enhanced drug stability and patient compliance.

- Emerging Market Penetration: Growing healthcare access and pharmaceutical consumption in developing nations.

Challenges in the Primary Healthcare Packaging Industry Market

Addressing long-term growth catalysts within the Primary Healthcare Packaging Industry requires a proactive approach to innovation and market adaptation. The continuous evolution of drug formulations, particularly for biologics and gene therapies, necessitates the development of packaging solutions with superior inertness and stability. Strategic partnerships between packaging manufacturers and pharmaceutical companies are crucial for co-developing tailored solutions. Furthermore, expanding manufacturing capabilities in key growth regions and investing in sustainable packaging technologies will be pivotal for sustained market leadership.

Emerging Opportunities in Primary Healthcare Packaging Industry

Emerging opportunities in the Primary Healthcare Packaging Industry are diverse and promising. The burgeoning market for personalized medicine and the increasing adoption of at-home healthcare solutions are creating demand for smaller, more convenient, and user-friendly packaging formats. The integration of advanced technologies like anti-counterfeiting features and digital tracking within packaging presents significant growth potential. Furthermore, a growing consumer preference for sustainable and eco-friendly packaging is opening avenues for manufacturers who can offer innovative biodegradable or recyclable primary healthcare packaging options.

- Personalized Medicine: Demand for smaller, specialized, and patient-specific packaging.

- Smart Packaging: Integration of sensors for temperature monitoring and authentication.

- Sustainable Packaging Solutions: Development of eco-friendly materials and recycling initiatives.

- Emerging Geographies: Untapped potential in developing nations with expanding healthcare access.

Leading Players in the Primary Healthcare Packaging Industry Sector

- Stolze-Oberglas GmbH

- Piramal Glass Pvt Ltd

- Schott AG

- Beatson Clark PLC

- Sisecam Group

- Nipro Corporation

- Arab Pharmaceutical Glass Co

- Bormioli Pharma SRL

- Shandong Medicinal Glass Co Ltd

- SGD SA

- Gerresheimer AG

- Corning Incorporated

Key Milestones in Primary Healthcare Packaging Industry Industry

- May 2022 - SGD SA Pharma announces the launch of Type I 100mL Ready-to-Use (RTU) molded glass vials for aseptic filling and finishing of parenteral medicines. This solution is groundbreaking as it is the first product of its kind in an EZ-Fill tray configuration, enabling global companies to accelerate time-to-market for high-quality parenteral medicines with high-volume, suitable RTU primary packaging solutions.

- May 2022 - Gerresheimer AG significantly expands India's glass and plastic production capacity. A new modern plant for producing high-quality plastic containers and closures has been built in Cosambasite, and glass production has received new sustainable furnace technology. Gerresheimer will secure continuous supply to critical pharmaceutical and healthcare facilities and support the increasing demand for packaging and public health by expanding production capacity in India.

Strategic Outlook for Primary Healthcare Packaging Industry Market

The Primary Healthcare Packaging Industry is set for continued expansion, driven by an unyielding demand for safe, effective, and convenient healthcare solutions. Future market potential will be unlocked through strategic investments in R&D for advanced materials, sustainable packaging alternatives, and smart technologies. Collaborations between packaging manufacturers and pharmaceutical companies will be crucial for anticipating and meeting the evolving needs of drug development. Focus on emerging markets and the increasing demand for biologics and specialized therapeutics will provide substantial growth accelerators, solidifying the industry's vital role in global health.

Primary Healthcare Packaging Industry Segmentation

-

1. Material

- 1.1. Glass

- 1.2. Plastic

- 1.3. Other Materials (Paper and Metal)

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials and Ampoules

- 2.3. Cartridges and Prefilled Syringes

- 2.4. Pouches and Bags

- 2.5. Blister Packs

- 2.6. Tubes

- 2.7. Paper Board Boxes

- 2.8. Caps and Closures

- 2.9. Labels

- 2.10. Other Product Types

-

3. End-use Vertical

- 3.1. Pharmaceutical

- 3.2. Medical Devices

Primary Healthcare Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. United Arab Emirates

Primary Healthcare Packaging Industry Regional Market Share

Geographic Coverage of Primary Healthcare Packaging Industry

Primary Healthcare Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Convenience and Environmental Issues; Rise In Medicine Counterfeiting Leading to Advanced Packaging and Labeling

- 3.3. Market Restrains

- 3.3.1. Increased Relevance of Alternate Material

- 3.4. Market Trends

- 3.4.1. Blister Packs are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Glass

- 5.1.2. Plastic

- 5.1.3. Other Materials (Paper and Metal)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials and Ampoules

- 5.2.3. Cartridges and Prefilled Syringes

- 5.2.4. Pouches and Bags

- 5.2.5. Blister Packs

- 5.2.6. Tubes

- 5.2.7. Paper Board Boxes

- 5.2.8. Caps and Closures

- 5.2.9. Labels

- 5.2.10. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 5.3.1. Pharmaceutical

- 5.3.2. Medical Devices

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Glass

- 6.1.2. Plastic

- 6.1.3. Other Materials (Paper and Metal)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles and Containers

- 6.2.2. Vials and Ampoules

- 6.2.3. Cartridges and Prefilled Syringes

- 6.2.4. Pouches and Bags

- 6.2.5. Blister Packs

- 6.2.6. Tubes

- 6.2.7. Paper Board Boxes

- 6.2.8. Caps and Closures

- 6.2.9. Labels

- 6.2.10. Other Product Types

- 6.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 6.3.1. Pharmaceutical

- 6.3.2. Medical Devices

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Glass

- 7.1.2. Plastic

- 7.1.3. Other Materials (Paper and Metal)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles and Containers

- 7.2.2. Vials and Ampoules

- 7.2.3. Cartridges and Prefilled Syringes

- 7.2.4. Pouches and Bags

- 7.2.5. Blister Packs

- 7.2.6. Tubes

- 7.2.7. Paper Board Boxes

- 7.2.8. Caps and Closures

- 7.2.9. Labels

- 7.2.10. Other Product Types

- 7.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 7.3.1. Pharmaceutical

- 7.3.2. Medical Devices

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Glass

- 8.1.2. Plastic

- 8.1.3. Other Materials (Paper and Metal)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles and Containers

- 8.2.2. Vials and Ampoules

- 8.2.3. Cartridges and Prefilled Syringes

- 8.2.4. Pouches and Bags

- 8.2.5. Blister Packs

- 8.2.6. Tubes

- 8.2.7. Paper Board Boxes

- 8.2.8. Caps and Closures

- 8.2.9. Labels

- 8.2.10. Other Product Types

- 8.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 8.3.1. Pharmaceutical

- 8.3.2. Medical Devices

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Glass

- 9.1.2. Plastic

- 9.1.3. Other Materials (Paper and Metal)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles and Containers

- 9.2.2. Vials and Ampoules

- 9.2.3. Cartridges and Prefilled Syringes

- 9.2.4. Pouches and Bags

- 9.2.5. Blister Packs

- 9.2.6. Tubes

- 9.2.7. Paper Board Boxes

- 9.2.8. Caps and Closures

- 9.2.9. Labels

- 9.2.10. Other Product Types

- 9.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 9.3.1. Pharmaceutical

- 9.3.2. Medical Devices

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Primary Healthcare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Glass

- 10.1.2. Plastic

- 10.1.3. Other Materials (Paper and Metal)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles and Containers

- 10.2.2. Vials and Ampoules

- 10.2.3. Cartridges and Prefilled Syringes

- 10.2.4. Pouches and Bags

- 10.2.5. Blister Packs

- 10.2.6. Tubes

- 10.2.7. Paper Board Boxes

- 10.2.8. Caps and Closures

- 10.2.9. Labels

- 10.2.10. Other Product Types

- 10.3. Market Analysis, Insights and Forecast - by End-use Vertical

- 10.3.1. Pharmaceutical

- 10.3.2. Medical Devices

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stolze-Oberglas GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Piramal Glass Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schott AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beatson Clark PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sisecam Group*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nipro Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arab Pharmaceutical Glass Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bormioli Pharma SRL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shandong Medicinal Glass Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SGD SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Gerresheimer AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Corning Incorporated

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Stolze-Oberglas GmbH

List of Figures

- Figure 1: Global Primary Healthcare Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 3: North America Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 5: North America Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 7: North America Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 8: North America Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 11: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 13: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: Europe Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 15: Europe Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 16: Europe Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 19: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Asia Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 23: Asia Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 24: Asia Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 27: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 29: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 31: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 32: Latin America Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Material 2025 & 2033

- Figure 35: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by End-use Vertical 2025 & 2033

- Figure 39: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by End-use Vertical 2025 & 2033

- Figure 40: Middle East and Africa Primary Healthcare Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Primary Healthcare Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 4: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 8: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 12: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 14: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 20: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 22: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 23: China Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: India Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Australia and New Zealand Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 28: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 30: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Mexico Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Brazil Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by End-use Vertical 2020 & 2033

- Table 36: Global Primary Healthcare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: South Africa Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Saudi Arabia Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Primary Healthcare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Primary Healthcare Packaging Industry?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Primary Healthcare Packaging Industry?

Key companies in the market include Stolze-Oberglas GmbH, Piramal Glass Pvt Ltd, Schott AG, Beatson Clark PLC, Sisecam Group*List Not Exhaustive, Nipro Corporation, Arab Pharmaceutical Glass Co, Bormioli Pharma SRL, Shandong Medicinal Glass Co Ltd, SGD SA, Gerresheimer AG, Corning Incorporated.

3. What are the main segments of the Primary Healthcare Packaging Industry?

The market segments include Material, Product Type, End-use Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Convenience and Environmental Issues; Rise In Medicine Counterfeiting Leading to Advanced Packaging and Labeling.

6. What are the notable trends driving market growth?

Blister Packs are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increased Relevance of Alternate Material.

8. Can you provide examples of recent developments in the market?

May 2022 - SGD SA Pharma announces the launch of Type I 100mL Ready-to-Use (RTU) molded glass vials for aseptic filling and finishing of parenteral medicines. Neville and More recognize that this solution is groundbreaking as it is the first product of its kind in an EZ-Fill tray configuration. This enables global companies to accelerate time-to-market for high-quality parenteral medicines with high-volume, suitable RTU primary packaging solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Primary Healthcare Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Primary Healthcare Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Primary Healthcare Packaging Industry?

To stay informed about further developments, trends, and reports in the Primary Healthcare Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence