Key Insights

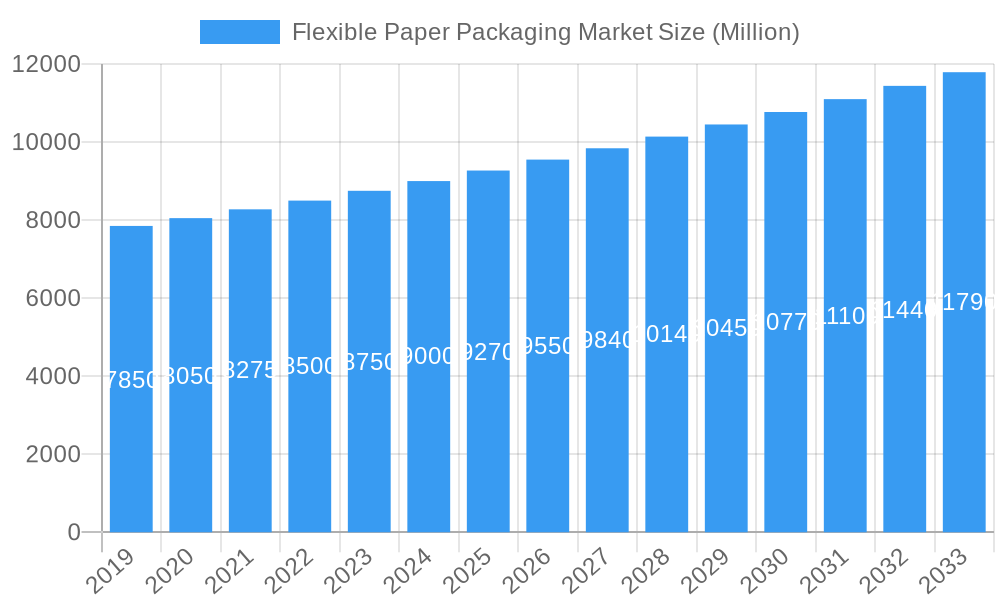

The global flexible paper packaging market is poised for robust growth, projected to reach a significant market size and expand at a Compound Annual Growth Rate (CAGR) of 3.89% from 2019 to 2033. This sustained expansion underscores the increasing demand for sustainable and versatile packaging solutions across a multitude of industries. The market's value, currently estimated to be substantial, is driven by a confluence of factors, including the rising consumer preference for eco-friendly alternatives to plastics, stringent government regulations promoting recyclable materials, and the inherent functional benefits of paper-based packaging, such as its biodegradability and compostability. Furthermore, advancements in paper technology, leading to enhanced barrier properties and durability, are further fueling adoption.

Flexible Paper Packaging Market Market Size (In Billion)

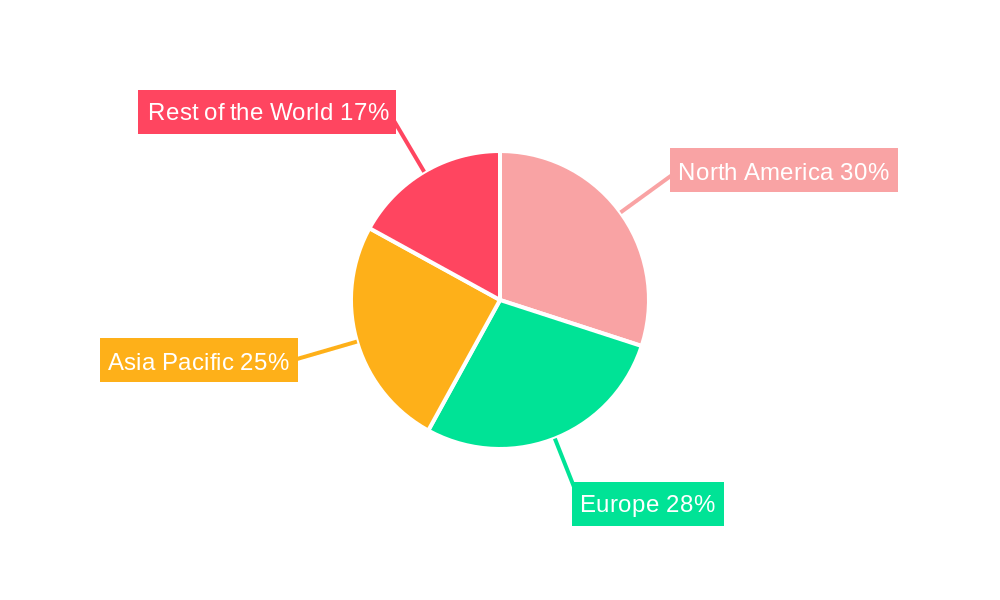

Key segments within this market showcase diverse applications and packaging types. The Food & Beverages sector stands out as a primary consumer, leveraging flexible paper packaging for its ability to preserve freshness and extend shelf life, coupled with its appealing visual presentation. The Healthcare and Beauty & Personal Care industries also represent significant growth areas, driven by a need for safe, hygienic, and environmentally conscious packaging. Pouches and roll stock are anticipated to dominate the packaging type segment due to their adaptability and cost-effectiveness. Geographically, North America and Europe are expected to lead market adoption, owing to established sustainability initiatives and strong consumer awareness. However, the Asia Pacific region is exhibiting particularly strong growth potential, fueled by rapid industrialization and a burgeoning middle class with increasing disposable incomes and a growing concern for environmental issues. Despite these positive trends, the market faces restraints such as the higher cost of some sustainable paper alternatives compared to conventional plastics and challenges in achieving the same level of moisture and oxygen barrier properties for certain highly sensitive products. Nonetheless, ongoing innovation and increasing industry collaboration are expected to mitigate these challenges, paving the way for continued market expansion.

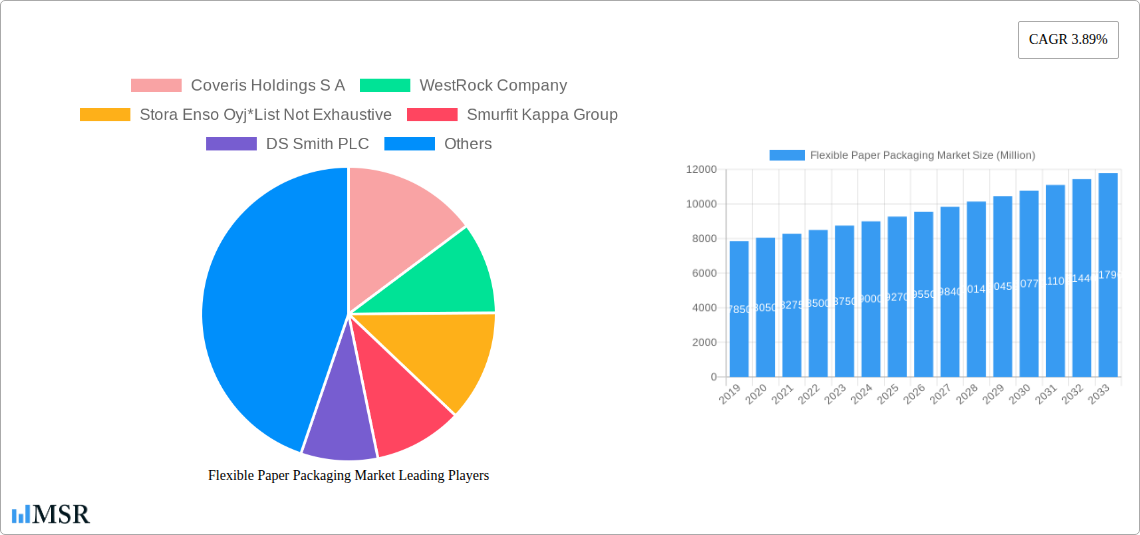

Flexible Paper Packaging Market Company Market Share

Unlocking Sustainable Solutions: Flexible Paper Packaging Market Report 2025-2033

Gain a comprehensive understanding of the flexible paper packaging market with this in-depth analysis covering the period from 2019 to 2033. This report provides crucial insights into market dynamics, industry trends, key segments, and leading players shaping the future of sustainable packaging solutions. With an estimated market size of $xx Billion in 2025, this report is an indispensable resource for industry stakeholders seeking to capitalize on the growing demand for eco-friendly packaging alternatives.

Flexible Paper Packaging Market Market Concentration & Dynamics

The flexible paper packaging market exhibits a moderate level of concentration, with key players actively pursuing innovation and strategic expansions. Leading companies are investing in research and development to enhance the performance and functionality of paper-based solutions, addressing the need for improved barrier properties and recyclability. The innovation ecosystem is driven by a strong focus on material science and advanced manufacturing techniques. Regulatory frameworks, particularly those promoting the circular economy and reducing plastic waste, are increasingly influencing market dynamics, pushing for greater adoption of sustainable materials. Substitute products, primarily traditional plastics, continue to pose a competitive challenge, but the growing consumer preference for eco-friendly packaging is shifting the balance. End-user trends reveal a significant demand from the food & beverages and beauty & personal care sectors for packaging that is both functional and environmentally responsible. Mergers and acquisitions (M&A) activities are also present, though at a moderate pace, as companies seek to consolidate their market position and expand their product portfolios. For instance, the market has seen several strategic partnerships aimed at developing advanced paper barrier technologies.

- Key Players: Coveris Holdings S.A., WestRock Company, Stora Enso Oyj, Smurfit Kappa Group, DS Smith PLC, Mondi Group, International Paper Company, Amcor Limited, Sealed Air Corporation, Huhtamaki Oyj.

- M&A Deal Counts: xx deals (historical average)

- Market Share Drivers: Sustainability initiatives, regulatory support, consumer demand for eco-friendly products.

Flexible Paper Packaging Market Industry Insights & Trends

The flexible paper packaging market is experiencing robust growth, projected to reach $xx Billion in 2025 with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is primarily fueled by increasing environmental consciousness among consumers and stringent government regulations worldwide aimed at curbing plastic pollution. The growing demand for sustainable packaging across various end-use industries, including food & beverages, healthcare, and beauty & personal care, is a significant growth driver. Technological disruptions are playing a pivotal role, with advancements in paper coating, lamination, and barrier technologies enabling paper packaging to rival the performance of traditional plastic alternatives in terms of moisture resistance, grease barrier, and shelf life. For example, the development of high-barrier functional papers is opening up new applications previously dominated by plastics. Evolving consumer behaviors, such as a preference for brands demonstrating strong environmental responsibility, are further accelerating the adoption of recyclable paper packaging. The shift towards e-commerce has also created new opportunities for lightweight, durable, and easily customizable flexible paper packaging solutions. The industry is witnessing a concerted effort towards developing fully compostable and biodegradable paper-based packaging to meet future sustainability goals and address end-of-life concerns.

- Market Size (Estimated 2025): $xx Billion

- CAGR (2025–2033): xx%

- Key Growth Drivers: Environmental regulations, consumer demand for sustainability, e-commerce growth, technological innovations in barrier properties.

Key Markets & Segments Leading Flexible Paper Packaging Market

The flexible paper packaging market is experiencing significant traction across various regions and segments, with the Food & Beverages application leading the charge due to the sector's substantial demand for safe, sustainable, and visually appealing packaging. Within this segment, pouches and roll stock are particularly dominant, offering versatility for products ranging from snacks and convenience foods to frozen goods. The growing global population and increasing disposable incomes in emerging economies are key drivers for this segment's growth, boosting the demand for packaged food and beverages.

In terms of Packaging Type, pouches continue to hold a commanding market share, driven by their reclosability, portability, and excellent branding opportunities. Roll stock is another crucial segment, widely used in automated packaging lines for various food products and other consumer goods. The Healthcare application is also a rapidly growing segment, with an increasing demand for sterile, tamper-evident, and sustainable packaging for pharmaceuticals and medical devices. Here, specialized wraps and barrier-coated roll stock are gaining prominence. The Beauty & Personal Care sector is increasingly opting for flexible paper packaging that offers an aesthetic appeal and a premium feel, aligning with consumer preferences for luxury and sustainability. This often translates to the use of shrink sleeves for distinctive product shapes and aesthetically pleasing bags and envelopes for smaller items.

- Dominant Application: Food & Beverages

- Drivers: Growing consumer awareness of health and sustainability, demand for convenience, extended shelf-life requirements.

- Sub-segments: Snacks, ready-to-eat meals, dry goods, beverages.

- Dominant Packaging Type: Pouches

- Drivers: Versatility, resealability, excellent printability for branding, portability.

- Sub-segments: Stand-up pouches, flat-bottom pouches, pillow bags.

- Growing Segment: Healthcare

- Drivers: Stringent regulatory requirements for sterile and tamper-evident packaging, increasing demand for disposable medical supplies.

- Applications: Pharmaceutical packaging, medical device packaging.

Flexible Paper Packaging Market Product Developments

Recent product innovations in the flexible paper packaging market are centered on enhancing sustainability and functionality. Companies are developing paper-based solutions with improved barrier properties against moisture, oxygen, and grease, making them suitable for a wider range of food products previously reliant on plastic. For example, the development of compostable and biodegradable barrier coatings is a significant technological advancement. Furthermore, the introduction of paper packaging with enhanced tactile properties, like Flair Flexible's Real Touch Paper, offers a premium and artisanal feel, catering to niche markets and premium product branding. The integration of paper packaging into automated e-commerce fulfillment systems, as demonstrated by Mondi's collaboration with beck packautomaten, highlights the adaptability and convenience of these materials. These developments are not only driving market growth but also solidifying the competitive edge of paper-based alternatives over traditional plastics.

Challenges in the Flexible Paper Packaging Market Market

The flexible paper packaging market faces several challenges that could impede its growth trajectory. Regulatory hurdles, while generally favoring sustainable options, can sometimes be complex and vary significantly across regions, creating compliance challenges for global manufacturers. Supply chain issues, including the availability and price volatility of raw materials like sustainably sourced pulp and specialized barrier coatings, can impact production costs and lead times. Furthermore, competitive pressures from established plastic packaging manufacturers and the continuous innovation in plastic alternatives require ongoing investment in R&D. Achieving the same level of barrier performance as certain high-performance plastics for extremely sensitive products remains a technical challenge, requiring continuous innovation. The cost-competitiveness of some advanced paper solutions compared to conventional plastics can also be a barrier to widespread adoption, especially in price-sensitive markets.

- Key Barriers:

- Achieving high-barrier properties comparable to specific plastics.

- Cost-competitiveness against established plastic packaging.

- Variations in international regulations and recycling infrastructure.

- Ensuring consistent and sustainable raw material supply.

Forces Driving Flexible Paper Packaging Market Growth

Several key forces are propelling the flexible paper packaging market forward. The escalating global concern for environmental sustainability and the urgent need to reduce plastic waste are primary drivers, influencing both consumer choices and government policies. Stringent regulations and bans on single-use plastics in numerous countries are creating a significant push towards alternatives. Technological advancements in paper manufacturing and coating technologies are enabling the creation of flexible paper packaging with enhanced barrier properties, printability, and durability, making them viable substitutes for traditional plastic packaging across a wider array of applications, particularly in the food & beverages sector. The growing e-commerce landscape, with its demand for efficient, lightweight, and customizable shipping solutions, is also a significant growth accelerator. Furthermore, the increasing preference of consumers for brands that demonstrate a commitment to eco-friendly practices is compelling manufacturers to adopt sustainable packaging options.

Challenges in the Flexible Paper Packaging Market Market

While the future looks promising, the flexible paper packaging market must navigate persistent challenges to achieve its full potential. Long-term growth hinges on continued innovation in functional barrier papers that can effectively compete with the performance of specialized plastics in terms of moisture and oxygen permeability, especially for shelf-stable products. Expanding the recyclability infrastructure globally to effectively handle a wider variety of paper-based packaging, including those with advanced coatings, is crucial. Further research and development into biodegradable and compostable solutions that offer a comparable cost-benefit analysis to conventional packaging will be vital for widespread adoption. Addressing consumer perception and educating them on the proper disposal of different types of flexible paper packaging will also be essential. Overcoming these challenges will pave the way for sustained growth and a significant market shift towards paper-based solutions.

Emerging Opportunities in Flexible Paper Packaging Market

The flexible paper packaging market is ripe with emerging opportunities driven by evolving consumer preferences and technological advancements. The increasing demand for sustainable and compostable packaging presents a significant opportunity for manufacturers to innovate and capture market share. The growth of the e-commerce sector continues to fuel demand for lightweight, durable, and easily customizable paper-based shipping solutions. Opportunities also lie in developing specialized flexible paper packaging for niche markets, such as premium food products, organic goods, and ethical beauty brands, where sustainability and aesthetics are paramount. Furthermore, advancements in digital printing and customization technologies for paper packaging open doors for personalized and on-demand packaging solutions. Collaborations between paper manufacturers, converters, and brands are crucial to co-create innovative solutions that meet specific product protection needs while adhering to environmental standards. The potential for flexible paper packaging in replacing plastic across an even broader range of applications, including hygiene products and medical supplies, is substantial.

Leading Players in the Flexible Paper Packaging Market Sector

- Coveris Holdings S.A.

- WestRock Company

- Stora Enso Oyj

- Smurfit Kappa Group

- DS Smith PLC

- Mondi Group

- International Paper Company

- Amcor Limited

- Sealed Air Corporation

- Huhtamaki Oyj

Key Milestones in Flexible Paper Packaging Market Industry

- May 2022: Mondi partnered with beck packautomaten to launch a strong, flexible paper-based packaging solution dedicated to the eCommerce industry. The solution uses 95% paper and is recyclable across all European paper waste streams. Together both launched the Functional Barrier Paper solution dedicated to automated eCommerce packaging. Functional Barrier Paper enables online retailers to continue reducing the use of unnecessary plastic.

- May 2022: Klabin, Brazil's largest producer and exporter of packaging paper, launched EkoFlex, its first paper for flexible packaging. EkoFlex is produced from softwood (pine), resulting in an extensible paper with lower grammage, which offers better performance and more excellent resistance. It has applications in diverse market segments, especially in flexible packaging options such as pillow bags, flow packs, stand-up pouches, and box pouches.

- March 2022: Flair Flexible launched new Real Touch, Paper tactile packaging. Packaging solutions provider Flair Flexible has expanded its tactile packaging program by adding a new product, Real Touch, Paper. The company claims that paper tactile solutions are entirely customizable, with additional options to choose between styles like kraft & rice paper classic styles or distinctive ones such as parchment or newsprint for an artisanal feel.

Strategic Outlook for Flexible Paper Packaging Market Market

The strategic outlook for the flexible paper packaging market is exceptionally positive, driven by an accelerating global shift towards sustainability. Key growth accelerators include continued investment in research and development to enhance barrier properties and broaden the application range of paper-based solutions, thereby challenging traditional plastic dominance. Strategic partnerships between raw material suppliers, packaging converters, and end-users will be crucial for co-creating innovative and customized solutions. Market expansion into emerging economies, where environmental awareness is rapidly growing and regulatory pressures are increasing, presents significant opportunities. Furthermore, leveraging digital technologies for enhanced customization and traceability within the paper packaging supply chain will be a key differentiator. The focus on developing fully circular economy-compatible packaging, including robust collection and recycling systems, will be paramount for long-term market success and widespread consumer acceptance of eco-friendly packaging.

Flexible Paper Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Pouches

- 1.2. Roll Stock

- 1.3. Shrink Sleeves

- 1.4. Wraps

- 1.5. Others (Bags, Envelopes)

-

2. Application

- 2.1. Food & Beverages

- 2.2. Healthcare

- 2.3. Beauty & Personal Care

- 2.4. Other Applications

Flexible Paper Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Flexible Paper Packaging Market Regional Market Share

Geographic Coverage of Flexible Paper Packaging Market

Flexible Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumers Preference for Sustainable Packaging; Increasing E-Commerce Sales and Demand from End User Verticals

- 3.3. Market Restrains

- 3.3.1. Availablity of Substitute in the Market

- 3.4. Market Trends

- 3.4.1. Consumers’ Preference for Sustainable Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Pouches

- 5.1.2. Roll Stock

- 5.1.3. Shrink Sleeves

- 5.1.4. Wraps

- 5.1.5. Others (Bags, Envelopes)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food & Beverages

- 5.2.2. Healthcare

- 5.2.3. Beauty & Personal Care

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. North America Flexible Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. Pouches

- 6.1.2. Roll Stock

- 6.1.3. Shrink Sleeves

- 6.1.4. Wraps

- 6.1.5. Others (Bags, Envelopes)

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food & Beverages

- 6.2.2. Healthcare

- 6.2.3. Beauty & Personal Care

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Europe Flexible Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. Pouches

- 7.1.2. Roll Stock

- 7.1.3. Shrink Sleeves

- 7.1.4. Wraps

- 7.1.5. Others (Bags, Envelopes)

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food & Beverages

- 7.2.2. Healthcare

- 7.2.3. Beauty & Personal Care

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Asia Pacific Flexible Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. Pouches

- 8.1.2. Roll Stock

- 8.1.3. Shrink Sleeves

- 8.1.4. Wraps

- 8.1.5. Others (Bags, Envelopes)

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food & Beverages

- 8.2.2. Healthcare

- 8.2.3. Beauty & Personal Care

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Rest of the World Flexible Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9.1.1. Pouches

- 9.1.2. Roll Stock

- 9.1.3. Shrink Sleeves

- 9.1.4. Wraps

- 9.1.5. Others (Bags, Envelopes)

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food & Beverages

- 9.2.2. Healthcare

- 9.2.3. Beauty & Personal Care

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Packaging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Coveris Holdings S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 WestRock Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stora Enso Oyj*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Smurfit Kappa Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DS Smith PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mondi Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 International Paper Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Amcor Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sealed Air Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Huhtamaki Oyj

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Coveris Holdings S A

List of Figures

- Figure 1: Global Flexible Paper Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 3: North America Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 4: North America Flexible Paper Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Flexible Paper Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Flexible Paper Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Flexible Paper Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 9: Europe Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 10: Europe Flexible Paper Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Flexible Paper Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Flexible Paper Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Flexible Paper Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 15: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 16: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Flexible Paper Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Flexible Paper Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 21: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Flexible Paper Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Flexible Paper Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Flexible Paper Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 5: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 11: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Flexible Paper Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Flexible Paper Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Flexible Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Paper Packaging Market?

The projected CAGR is approximately 3.89%.

2. Which companies are prominent players in the Flexible Paper Packaging Market?

Key companies in the market include Coveris Holdings S A, WestRock Company, Stora Enso Oyj*List Not Exhaustive, Smurfit Kappa Group, DS Smith PLC, Mondi Group, International Paper Company, Amcor Limited, Sealed Air Corporation, Huhtamaki Oyj.

3. What are the main segments of the Flexible Paper Packaging Market?

The market segments include Packaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumers Preference for Sustainable Packaging; Increasing E-Commerce Sales and Demand from End User Verticals.

6. What are the notable trends driving market growth?

Consumers’ Preference for Sustainable Packaging.

7. Are there any restraints impacting market growth?

Availablity of Substitute in the Market.

8. Can you provide examples of recent developments in the market?

May 2022 - Mondi partnered with beck packautomaten to launch a strong, flexible paper-based packaging solution dedicated to the eCommerce industry. The solution uses 95% paper and is recyclable across all European paper waste streams. Together both launched the Functional Barrier Paper solution dedicated to automated eCommerce packaging. Functional Barrier Paper enables online retailers to continue reducing the use of unnecessary plastic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Flexible Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence