Key Insights

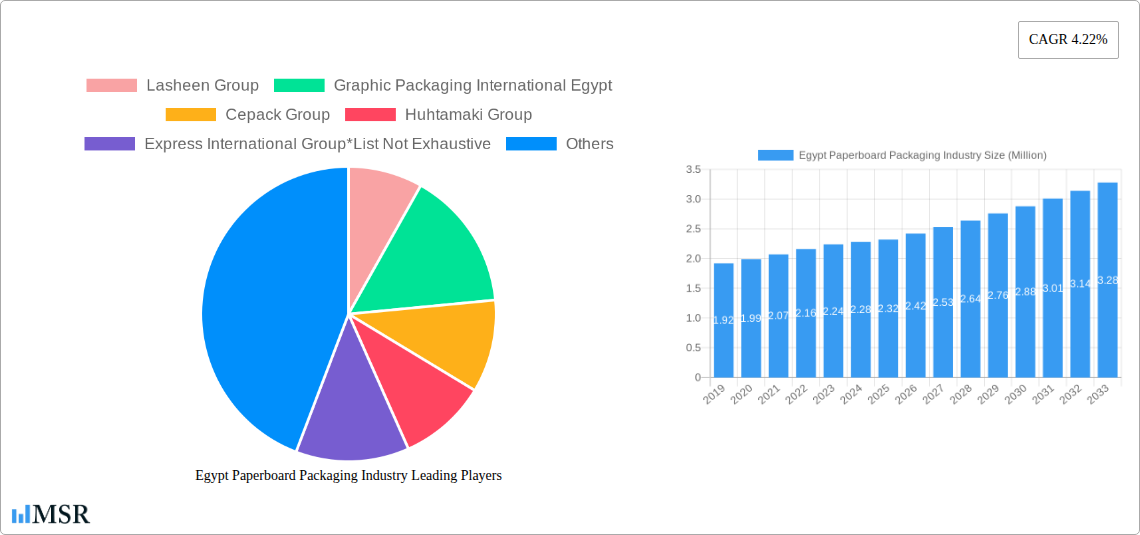

The Egypt Paperboard Packaging Industry is poised for robust growth, projected to reach a market size of USD 2.32 million by 2025, with a Compound Annual Growth Rate (CAGR) of 4.22% anticipated through 2033. This expansion is primarily driven by a burgeoning consumer base, increasing disposable incomes, and a growing demand for packaged goods across various sectors. Key drivers include the expanding food and beverage industry, which relies heavily on paperboard for its diverse packaging needs, and the burgeoning e-commerce sector, necessitating reliable and sustainable packaging solutions. The healthcare and pharmaceutical sectors are also contributing significantly, with a rising need for sterile and protective packaging. Moreover, growing consumer awareness regarding the environmental impact of packaging materials is boosting the preference for paperboard, a recyclable and biodegradable option, over plastics. This trend aligns with global sustainability initiatives and governmental pushes towards a circular economy, further bolstering the market's trajectory.

Egypt Paperboard Packaging Industry Market Size (In Million)

The industry's segmentation reveals a strong performance in both Corrugated and Solid Fiber Boxes, and Folding Cartons, catering to a wide array of product types. The Food & Beverage sector continues to be the largest end-user industry, followed by Household and Personal Care, and Healthcare & Pharmaceuticals. Emerging trends include the adoption of innovative printing techniques and sustainable barrier coatings to enhance product appeal and shelf life, alongside the increasing use of lightweight yet durable paperboard materials. However, the industry faces challenges such as fluctuating raw material costs and intense competition, necessitating strategic investments in technology and operational efficiency. Key players like Lasheen Group, Graphic Packaging International Egypt, and Cepack Group are actively engaged in expanding their capacities and product portfolios to capitalize on these growth opportunities, ensuring Egypt's paperboard packaging market remains dynamic and competitive.

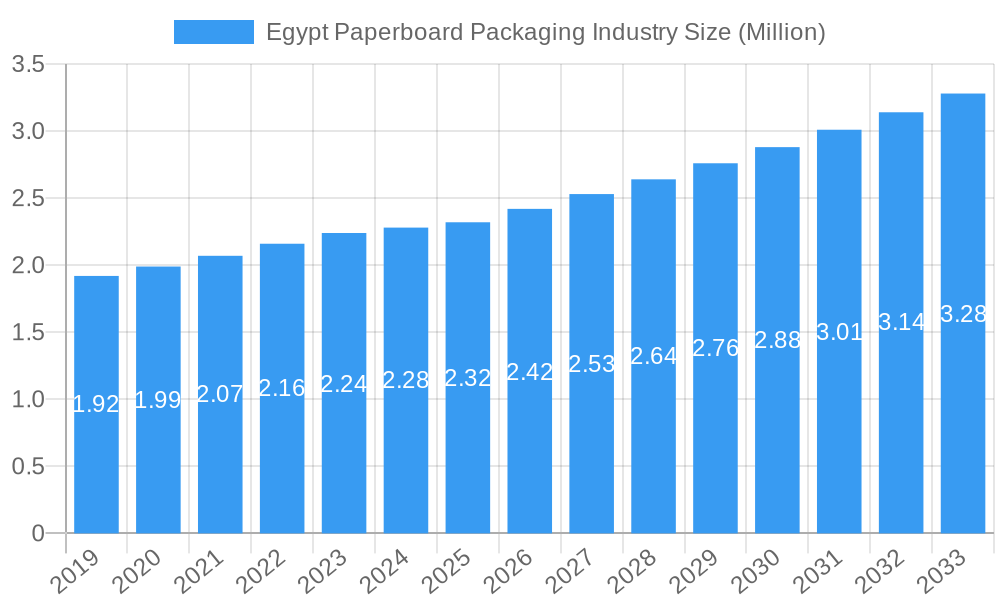

Egypt Paperboard Packaging Industry Company Market Share

This in-depth report provides a crucial analysis of the Egypt paperboard packaging market, offering unparalleled insights into its dynamics, trends, and future trajectory. Spanning the historical period of 2019-2024 and projecting through the forecast period of 2025-2033, this research is an indispensable resource for industry stakeholders, investors, and decision-makers seeking to capitalize on the burgeoning opportunities within Egypt's packaging sector. With the base year set at 2025, this study meticulously examines market concentration, leading companies, product innovations, and the intricate challenges and drivers shaping this vital industry.

Egypt Paperboard Packaging Industry Market Concentration & Dynamics

The Egypt paperboard packaging market exhibits a moderate level of concentration, with a mix of large multinational players and agile local manufacturers. Key companies like Lasheen Group, Graphic Packaging International Egypt, Cepack Group, Huhtamaki Group, Express International Group (List Not Exhaustive), National Bag Company, Amcor Limited, and Indevco Group are actively shaping the competitive landscape. Innovation ecosystems are steadily developing, driven by a growing demand for sustainable packaging solutions and advanced printing technologies. Regulatory frameworks are evolving to support industry growth and environmental compliance. Substitute products, such as plastic packaging, continue to pose competition, but paperboard's eco-friendly profile is a significant advantage. End-user trends favor recyclable and compostable materials, particularly within the Food, Beverage, Healthcare and Pharmaceutical, and Household and Personal Care segments. Mergers and acquisitions (M&A) activities, though not extensively documented in public domain for recent years, are anticipated to increase as larger players seek to consolidate market share and expand their capabilities. The market share distribution is dynamic, with corrugated and solid fiber boxes holding a substantial portion due to their versatility and strength, followed by folding cartons catering to a wide range of consumer goods.

Egypt Paperboard Packaging Industry Industry Insights & Trends

The Egypt paperboard packaging industry is poised for substantial growth, projected to witness a significant market size increase and a healthy Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is primarily fueled by robust economic development, increasing disposable incomes, and a burgeoning middle class that drives consumption across various end-user industries. Technological disruptions are playing a pivotal role, with advancements in machinery, printing techniques, and material science enabling the production of more sophisticated and cost-effective paperboard packaging. The rise of e-commerce has created a sustained demand for durable and protective shipping cartons, a segment where corrugated boxes excel. Evolving consumer behaviors are increasingly emphasizing sustainability and environmental responsibility. Consumers are actively seeking products with minimal environmental impact, pushing manufacturers to adopt greener packaging alternatives. This trend is a significant driver for the adoption of recycled content and biodegradable paperboard solutions. The Food and Beverage sector remains a dominant end-user, driven by population growth and changing dietary habits. The Healthcare and Pharmaceutical industry's demand for sterile and secure packaging is also a consistent growth catalyst. Furthermore, the Household and Personal Care segment is witnessing innovation in visually appealing and functional folding cartons. The overall market is experiencing a positive trajectory, with an anticipated market size of [Insert Market Size Value Here] Million in 2025, growing at a CAGR of [Insert CAGR Value Here]% during the forecast period.

Key Markets & Segments Leading Egypt Paperboard Packaging Industry

The Egypt paperboard packaging industry is characterized by the dominance of specific segments and end-user industries, propelled by distinct growth drivers.

Product Type Dominance:

- Corrugated and Solid Fiber Boxes: This segment holds the largest market share, driven by its versatility, durability, and cost-effectiveness. Its dominance is fueled by the rapidly expanding e-commerce sector, requiring robust shipping solutions, and the consistent demand from the Food and Beverage industry for primary and secondary packaging. Infrastructure development also plays a role, facilitating the efficient distribution of goods.

- Folding Cartons: This segment follows closely, driven by the needs of the Household and Personal Care and Food and Beverage sectors for attractive and informative retail packaging. Economic growth and rising consumer spending directly impact the demand for premium and convenience products, which often utilize folding cartons.

- Other Product Types: While smaller, this category includes specialized packaging like paper tubes and cores, serving niche industrial applications.

End-user Industry Dominance:

- Food and Beverage: This is the leading end-user industry, accounting for the largest share of paperboard packaging consumption. Factors contributing to this dominance include Egypt's large and growing population, increasing urbanization, and the demand for packaged food and beverages for convenience and preservation.

- Household and Personal Care: This segment is a significant contributor, driven by rising disposable incomes and evolving consumer lifestyles, leading to increased demand for cosmetics, toiletries, and cleaning products.

- Healthcare and Pharmaceutical: The demand for sterile, tamper-evident, and compliant packaging makes this a crucial and steadily growing segment. Stringent regulations and a focus on patient safety further solidify its importance.

- Other End-user Industries: This broad category encompasses sectors like electronics, automotive, and textiles, which also utilize paperboard packaging for protection and transport.

The overarching economic growth in Egypt, coupled with investments in infrastructure and manufacturing, creates a fertile ground for the expansion of these key markets and segments within the paperboard packaging industry.

Egypt Paperboard Packaging Industry Product Developments

Recent product developments in the Egypt paperboard packaging industry are increasingly focused on enhanced functionality, sustainability, and visual appeal. Innovations include the development of specialized coatings for improved barrier properties against moisture and grease, crucial for the Food and Beverage sector. Advancements in printing technologies, such as high-definition digital printing, allow for more intricate designs and personalization, catering to premium Household and Personal Care products. The market is also witnessing a surge in the use of recycled and sustainably sourced paperboard, aligning with growing environmental consciousness. Furthermore, smart packaging solutions, incorporating QR codes or NFC tags for product authentication and consumer engagement, are beginning to emerge, offering a competitive edge in various end-user industries. These developments are crucial for manufacturers looking to meet evolving market demands and regulatory requirements.

Challenges in the Egypt Paperboard Packaging Industry Market

The Egypt paperboard packaging market faces several challenges that could impede its growth trajectory. Regulatory hurdles, particularly concerning import duties on raw materials and evolving environmental standards, can impact manufacturing costs and competitiveness. Supply chain issues, including fluctuations in the availability and price of virgin pulp and recycled fiber, present a significant constraint. The presence of informal sector players and intense price competition can also affect profitability. Furthermore, the ongoing need for significant investment in modern machinery and sustainable technologies requires access to capital.

Forces Driving Egypt Paperboard Packaging Industry Growth

Several powerful forces are propelling the Egypt paperboard packaging industry forward. Economic growth and rising consumer spending are fundamental drivers, increasing demand across all end-user sectors. The burgeoning e-commerce market necessitates efficient and robust packaging solutions, heavily favoring paperboard. Growing environmental awareness among consumers and businesses is a significant catalyst, driving the adoption of sustainable and recyclable paperboard alternatives over less eco-friendly options. Technological advancements in manufacturing and printing are enhancing product quality and reducing costs. Supportive government initiatives aimed at promoting local manufacturing and exports also contribute to the industry's positive outlook.

Challenges in the Egypt Paperboard Packaging Industry Market

While growth is evident, long-term sustainability in the Egypt paperboard packaging industry hinges on addressing persistent challenges. The reliance on imported raw materials, particularly certain grades of pulp, exposes the market to global price volatility and supply chain disruptions. Continued investment in research and development is essential to innovate and meet increasingly stringent international sustainability standards. Furthermore, developing a skilled workforce capable of operating advanced machinery and implementing new packaging technologies is crucial for long-term competitiveness. Addressing these factors proactively will ensure the industry's continued evolution and success.

Emerging Opportunities in Egypt Paperboard Packaging Industry

Emerging opportunities within the Egypt paperboard packaging industry are diverse and ripe for exploitation. The increasing consumer demand for sustainable and eco-friendly packaging presents a prime opportunity for manufacturers to invest in and market recycled and biodegradable paperboard solutions. The expansion of the pharmaceutical and healthcare sectors, driven by a growing population and advancements in medical services, offers significant potential for specialized, high-barrier paperboard packaging. Furthermore, the growth of niche food product categories, such as organic and artisanal foods, creates demand for premium and visually appealing paperboard packaging. The development of innovative, value-added packaging formats that offer enhanced convenience and functionality for consumers will also be a key differentiator.

Leading Players in the Egypt Paperboard Packaging Industry Sector

- Lasheen Group

- Graphic Packaging International Egypt

- Cepack Group

- Huhtamaki Group

- Express International Group

- National Bag Company

- Amcor Limited

- Indevco Group

Key Milestones in Egypt Paperboard Packaging Industry Industry

- October 2022: Tetra Pak, a multinational provider of food processing and packaging solutions, declared that it would establish a joint venture with Egyptian paper board producer Uniboard to recycle used beverage cartons (UBC) in Egypt for a sum of EUR 2.5 million (USD 2.59 million). When the plant reaches full capacity in five years, it will recycle 8,000 tonnes of UBC yearly after beginning the first operation the next year. This initiative significantly boosts the circular economy within the Egyptian packaging sector, focusing on sustainable resource management.

- June 2022: The Board of Directors of the paper and cardboard division of the Chamber of Printing & Packaging Industries of the Federation of Egyptian Industries (FEI), led by the division's head Jamal Al-Saudi, prepared a case study on strategies to develop the paper and cardboard industry and the challenges it faces, for submission to the responsible authorities for their timely action. Al-Saudi pointed out that the study contains 15 recommendations for solving all the major problems faced by the paper and cardboard industry in Egypt and ways to develop them and increase the sector's exports. This proactive measure aims to address systemic issues and foster industry-wide improvement and export growth.

Strategic Outlook for Egypt Paperboard Packaging Industry Market

The strategic outlook for the Egypt paperboard packaging market is overwhelmingly positive, driven by a confluence of robust economic growth, increasing consumer demand for sustainable products, and ongoing technological advancements. Key growth accelerators include strategic investments in advanced manufacturing technologies to enhance efficiency and product quality, coupled with a strong focus on developing and promoting eco-friendly paperboard solutions. Collaborations and partnerships between local manufacturers and international players are expected to foster innovation and expand market reach. Furthermore, the government's continued support for the manufacturing sector and its emphasis on export promotion will provide a conducive environment for sustained growth. The market is poised to capitalize on its strategic location and growing domestic consumption, presenting significant opportunities for both established and emerging businesses.

Egypt Paperboard Packaging Industry Segmentation

-

1. Product Type

- 1.1. Corrugated and Solid Fiber Boxes

- 1.2. Folding Cartons

- 1.3. Other Product Types

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare and Pharmaceutical

- 2.4. Household and Personal Care

- 2.5. Other End-user Industries

Egypt Paperboard Packaging Industry Segmentation By Geography

- 1. Egypt

Egypt Paperboard Packaging Industry Regional Market Share

Geographic Coverage of Egypt Paperboard Packaging Industry

Egypt Paperboard Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising demand for paper-based packaging products in the Food industry in Egypt; Growth in the e-commerce segment; Increasing awareness on the use of sustainable packaging aided by changing regulatory landscape

- 3.3. Market Restrains

- 3.3.1. ; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Folding Cartons is Expected to Grow at a Significant Rate Throughout the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Paperboard Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Corrugated and Solid Fiber Boxes

- 5.1.2. Folding Cartons

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare and Pharmaceutical

- 5.2.4. Household and Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lasheen Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Graphic Packaging International Egypt

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cepack Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Express International Group*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 National Bag Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amcor Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Indevco Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Lasheen Group

List of Figures

- Figure 1: Egypt Paperboard Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Paperboard Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Egypt Paperboard Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Paperboard Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Egypt Paperboard Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Egypt Paperboard Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Egypt Paperboard Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Egypt Paperboard Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Paperboard Packaging Industry?

The projected CAGR is approximately 4.22%.

2. Which companies are prominent players in the Egypt Paperboard Packaging Industry?

Key companies in the market include Lasheen Group, Graphic Packaging International Egypt, Cepack Group, Huhtamaki Group, Express International Group*List Not Exhaustive, National Bag Company, Amcor Limited, Indevco Group.

3. What are the main segments of the Egypt Paperboard Packaging Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising demand for paper-based packaging products in the Food industry in Egypt; Growth in the e-commerce segment; Increasing awareness on the use of sustainable packaging aided by changing regulatory landscape.

6. What are the notable trends driving market growth?

Folding Cartons is Expected to Grow at a Significant Rate Throughout the Forecast Period.

7. Are there any restraints impacting market growth?

; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

October 2022 - Tetra Pak, a multinational provider of food processing and packaging solutions, declared that it would establish a joint venture with Egyptian paper board producer Uniboard to recycle used beverage cartons (UBC) in Egypt for a sum of EUR 2.5 million (USD 2.59 million). When the plant reaches full capacity in five years, it will recycle 8,000 tonnes of UBC yearly after beginning the first operation the next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Paperboard Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Paperboard Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Paperboard Packaging Industry?

To stay informed about further developments, trends, and reports in the Egypt Paperboard Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence