Key Insights

The Middle East and Africa (MEA) paper packaging market is set for substantial growth, forecasted to reach 30539.4 million by 2025, driven by a CAGR of 5.1% through 2033. This expansion is fueled by rising consumer demand across food & beverage, personal & home care, and electronics sectors. The surge in e-commerce adoption necessitates robust and sustainable packaging like corrugated boxes and folding cartons for product protection and transit. Growing environmental consciousness promotes paper-based packaging as a preferred eco-friendly alternative. Increasing disposable incomes in developing MEA economies are also boosting demand for packaged goods.

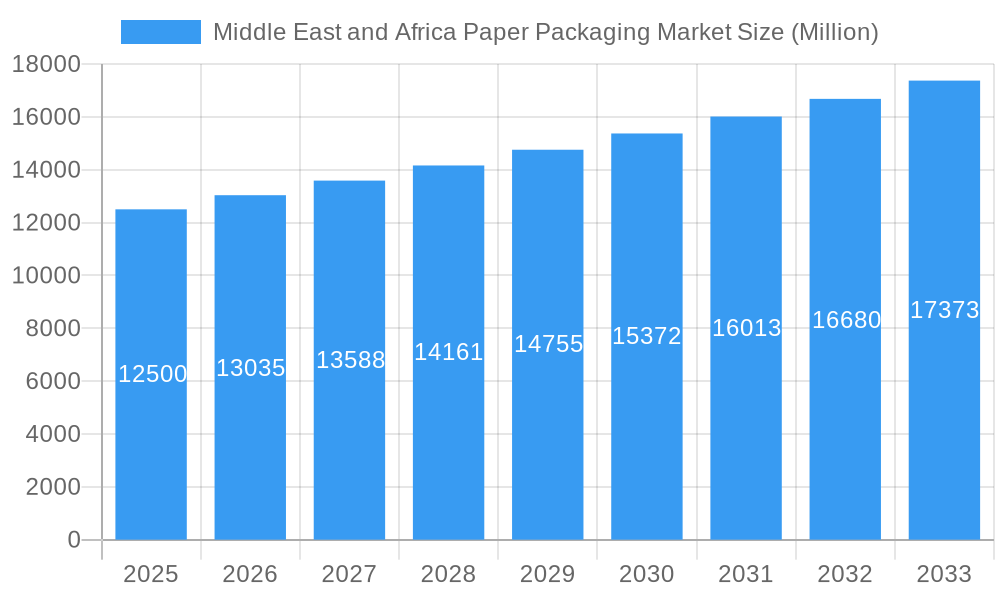

Middle East and Africa Paper Packaging Market Market Size (In Billion)

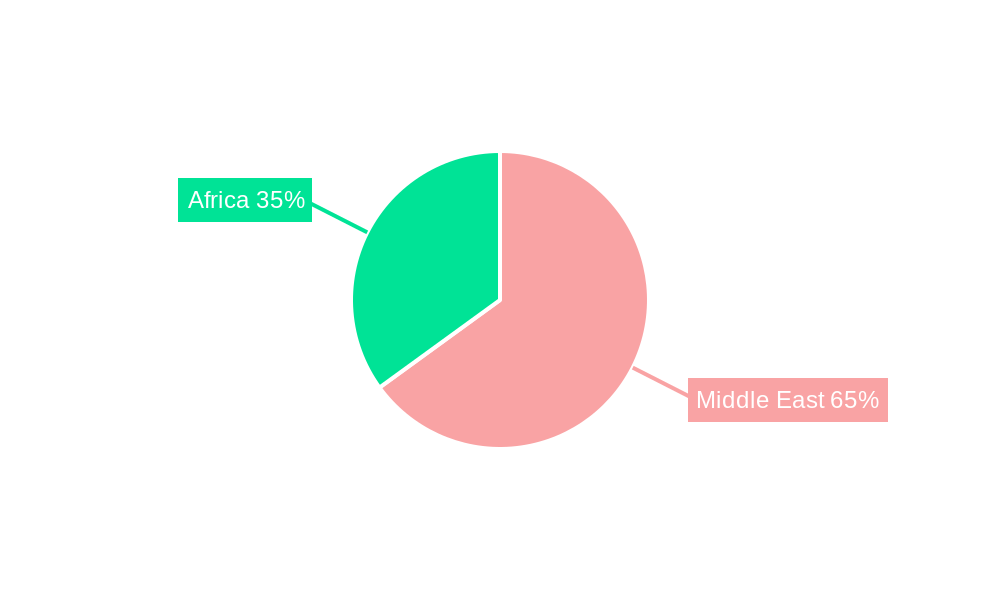

Market challenges include volatile raw material costs, supply chain disruptions, geopolitical instability in parts of Africa, and strict waste management regulations. However, the industry is mitigating these through investments in advanced manufacturing, vertical integration, and the development of sustainable, recyclable solutions. Innovation in customized packaging caters to diverse product needs, enhancing market penetration. The Middle East is expected to spearhead growth due to developed infrastructure and higher consumer spending, while African markets offer significant untapped potential driven by industrialization and a growing middle class. Economic diversification and foreign investment in manufacturing will ensure sustained demand for paper packaging.

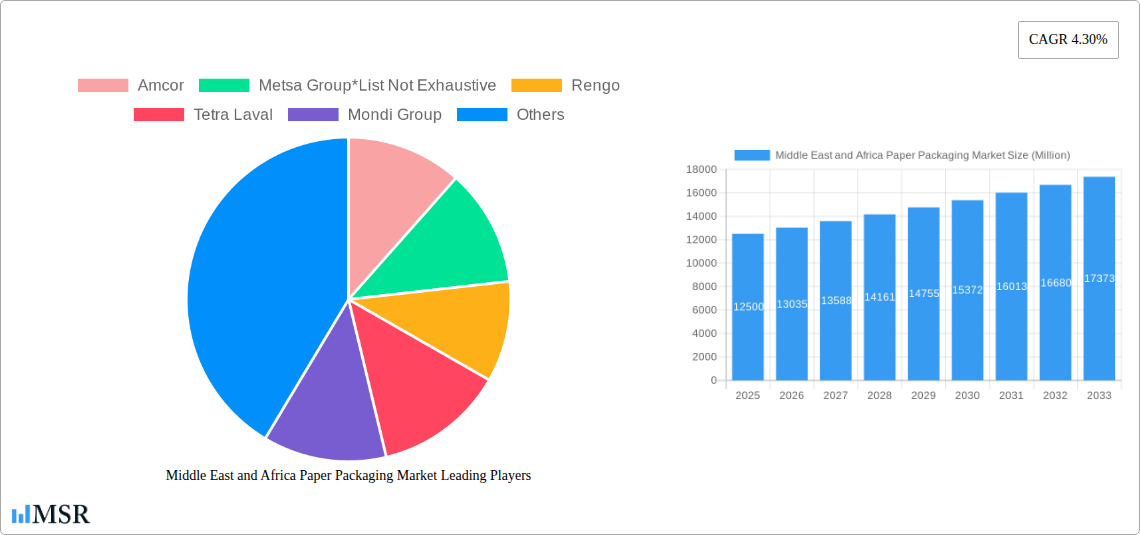

Middle East and Africa Paper Packaging Market Company Market Share

Discover comprehensive insights into the Middle East and Africa Paper Packaging Market with detailed analysis of market size, growth trends, and future forecasts.

Unlocking Growth: Middle East & Africa Paper Packaging Market Report (2019-2033)

Gain unparalleled insights into the dynamic Middle East and Africa Paper Packaging Market with this comprehensive industry analysis. This report provides actionable intelligence on market dynamics, key trends, segment dominance, product innovations, challenges, growth drivers, and emerging opportunities. With a detailed study period from 2019 to 2033, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the region's burgeoning paper packaging sector.

Market Size: Estimated at USD 12,500 Million in 2025, projected to reach USD 18,200 Million by 2033, with a CAGR of 4.9% during the forecast period (2025-2033).

Middle East and Africa Paper Packaging Market Market Concentration & Dynamics

The Middle East and Africa paper packaging market exhibits a moderate to high concentration, with a few dominant global players and several regional manufacturers vying for market share. Innovation ecosystems are gradually developing, driven by a growing demand for sustainable and advanced packaging solutions. Regulatory frameworks are evolving, with an increasing emphasis on environmental compliance and recyclability standards across key markets like the UAE, Saudi Arabia, and South Africa. Substitute products, such as plastics and metal packaging, continue to pose a competitive threat, yet the drive towards eco-friendly alternatives is bolstering the paper packaging segment. End-user trends are significantly influenced by the rapid growth of the e-commerce sector and rising consumer disposable income, particularly in urban centers. Merger and acquisition (M&A) activities are expected to shape the market landscape, as larger companies seek to expand their geographical reach and product portfolios. For instance, the region has witnessed approximately 5-8 significant M&A deals within the past five years, indicating a strategic consolidation phase. Market share distribution shows global leaders holding an estimated 40-50% of the total market value, with regional players occupying the remaining share.

Middle East and Africa Paper Packaging Market Industry Insights & Trends

The Middle East and Africa paper packaging market is on an upward trajectory, fueled by a confluence of robust economic development, expanding consumer bases, and an increasing emphasis on sustainable packaging alternatives. The market size, estimated at USD 12,500 Million in the base year of 2025, is projected to witness substantial growth throughout the forecast period, reaching an estimated USD 18,200 Million by 2033. This represents a compound annual growth rate (CAGR) of 4.9% during 2025-2033.

Several key factors are driving this expansion. Firstly, the burgeoning e-commerce industry across the region necessitates efficient, durable, and visually appealing packaging solutions, with paper packaging emerging as a preferred choice due to its recyclability and customization potential. Secondly, the growing middle class, particularly in countries like Nigeria, Egypt, and Kenya, is leading to increased demand for packaged consumer goods, from food and beverages to personal care products. This surge in consumer spending directly translates into a higher volume requirement for paper packaging.

Technological disruptions are also playing a crucial role. Advances in paper manufacturing techniques, including the development of more sustainable and robust paper grades, are enhancing the performance and appeal of paper packaging. Furthermore, innovations in printing technologies are enabling brand owners to create more engaging and informative packaging designs, thereby strengthening brand identity and consumer connect. The adoption of digital printing and automation in packaging production lines is also improving efficiency and reducing lead times, making paper packaging a more attractive option for businesses.

Evolving consumer behaviors, marked by a heightened awareness of environmental issues, are a significant trend. Consumers are increasingly seeking products from brands that demonstrate a commitment to sustainability, making eco-friendly packaging a competitive differentiator. Paper packaging, being renewable and often recyclable, aligns perfectly with these consumer preferences. This shift is prompting manufacturers to invest in biodegradable and compostable paper packaging solutions, further stimulating market demand.

The historical period (2019-2024) demonstrated a steady growth pattern, with the market size reaching approximately USD 11,800 Million by the end of 2024, reflecting a resilience in demand even amidst global economic fluctuations. This historical performance sets a strong foundation for the accelerated growth anticipated in the forecast period. The increasing adoption of paper-based alternatives to single-use plastics is a particularly strong trend that will continue to shape the market.

Key Markets & Segments Leading Middle East and Africa Paper Packaging Market

The Middle East and Africa paper packaging market is characterized by a dynamic interplay of regional economic growth, diverse industrial needs, and evolving consumer preferences. Dominance is observed in several key areas:

Leading Geographic Markets:

- United Arab Emirates (UAE): This market leads due to its robust economy, significant investments in logistics and retail infrastructure, and a strong focus on sustainability initiatives and regulations promoting eco-friendly packaging. The high concentration of multinational corporations and a growing expatriate population contribute to sustained demand across all end-user industries.

- Saudi Arabia: Driven by Vision 2030, which emphasizes economic diversification and infrastructure development, Saudi Arabia presents substantial growth opportunities. The expansion of the food and beverage sector, coupled with increasing disposable incomes, fuels the demand for paper packaging.

- South Africa: As a more mature market in the region, South Africa benefits from established industrial sectors and a well-developed retail network. Its significant manufacturing base, particularly in food and beverages, and growing e-commerce penetration make it a key player.

Dominant Product Segments:

- Corrugated Boxes: This segment holds the largest market share due to its versatility, durability, and cost-effectiveness.

- Drivers: Essential for e-commerce fulfillment, logistics, and shipping of a wide range of goods, from consumer electronics to manufactured products. High demand from the food and beverage industry for secondary and tertiary packaging.

- Dominance Analysis: Their structural integrity makes them ideal for protecting goods during transit across the vast geographical distances in the region. The increasing volume of trade and movement of goods necessitates a consistent and high demand for corrugated boxes.

- Folding Cartons: These are widely used for primary and secondary packaging of consumer goods.

- Drivers: Crucial for branding and shelf appeal in the retail environment. Growing demand from the food and beverage, personal care, and home care sectors.

- Dominance Analysis: Their printability and ability to showcase branding effectively make them indispensable for consumer product packaging, contributing significantly to market value.

Dominant End-User Industries:

- Food: This sector is the largest consumer of paper packaging.

- Drivers: Expanding food processing industry, increasing demand for packaged convenience foods, and rising popularity of ready-to-eat meals.

- Dominance Analysis: Stringent food safety regulations necessitate reliable and hygienic packaging, which paper packaging increasingly offers. The sheer volume of food products consumed in the region makes this industry a consistent and significant driver of paper packaging demand.

- Beverage: Another major sector with high demand for paper packaging, particularly for secondary and multipack solutions.

- Drivers: Growing consumption of packaged beverages, including juices, soft drinks, and water. Increasing market for alcoholic beverages in certain countries.

- Dominance Analysis: The need for multipacks and attractive consumer-facing packaging for beverages drives significant volume for paperboard-based solutions.

Other Contributing Factors:

- Economic Growth: Rising GDP in several Middle Eastern and African nations translates to increased consumer spending and demand for packaged goods.

- Infrastructure Development: Investments in logistics, warehousing, and retail infrastructure facilitate the efficient distribution of packaged products.

- Government Initiatives: Support for local manufacturing and promotion of sustainable practices can boost the paper packaging sector.

- E-commerce Expansion: The rapid growth of online retail significantly drives the demand for shipping and product packaging solutions.

Middle East and Africa Paper Packaging Market Product Developments

Innovations in paper packaging are rapidly transforming the Middle East and Africa market. Manufacturers are focusing on developing enhanced barrier properties for food packaging, extending shelf life and improving food safety. Advancements in sustainable materials, including recycled content and biodegradable coatings, are gaining traction, aligning with growing environmental consciousness. The application of high-graphic printing techniques and specialty finishes on folding cartons and other paperboard formats are elevating brand aesthetics and consumer engagement. These technological advancements are not only meeting the evolving demands of end-user industries but also providing manufacturers with a competitive edge in a dynamic marketplace.

Challenges in the Middle East and Africa Paper Packaging Market Market

Despite robust growth, the Middle East and Africa paper packaging market faces several hurdles. Regulatory complexities and varying standards across different countries can complicate market entry and compliance for manufacturers. Supply chain disruptions, including raw material availability and logistics inefficiencies, pose significant challenges, particularly in less developed regions. Intense competition from alternative packaging materials like plastics and flexible packaging remains a constant pressure point. Furthermore, limited access to advanced technology and skilled labor in some sub-regions can hinder innovation and production efficiency, impacting overall market growth potential.

Forces Driving Middle East and Africa Paper Packaging Market Growth

Several powerful forces are propelling the growth of the Middle East and Africa paper packaging market. The burgeoning e-commerce sector is a primary driver, necessitating efficient and reliable shipping and product packaging. Rising disposable incomes and an expanding middle class across key nations are fueling consumer demand for packaged goods, particularly in the food, beverage, and personal care segments. Increasing consumer awareness and regulatory pressure for sustainable and eco-friendly packaging solutions are significantly favoring paper-based alternatives over plastics. Additionally, government initiatives promoting local manufacturing and economic diversification are creating a more conducive environment for the paper packaging industry to thrive.

Challenges in the Middle East and Africa Paper Packaging Market Market

The long-term growth of the Middle East and Africa paper packaging market will be shaped by its ability to overcome specific challenges. The fluctuating costs of raw materials, particularly pulp and paper, can impact profitability and pricing strategies. Ensuring consistent quality and standardization of paper packaging products across diverse regional markets remains a challenge. Furthermore, addressing the environmental impact of paper production, including water and energy consumption, will be crucial for long-term sustainability. Overcoming these barriers will require strategic investments in technology, supply chain optimization, and a commitment to circular economy principles.

Emerging Opportunities in Middle East and Africa Paper Packaging Market

Emerging opportunities within the Middle East and Africa paper packaging market are abundant and varied. The increasing adoption of premiumization in packaging, driven by evolving consumer preferences for higher quality and aesthetically pleasing products, presents a significant avenue for growth. The expansion of the pharmaceutical sector across the region is creating demand for specialized paper packaging solutions that meet stringent safety and regulatory standards. Furthermore, the growing focus on biodegradable and compostable paper packaging aligns with global sustainability trends and offers substantial potential. Innovations in smart packaging solutions, incorporating QR codes or other track-and-trace functionalities, are also poised to gain traction, particularly in supply chain management.

Leading Players in the Middle East and Africa Paper Packaging Market Sector

- Amcor

- Mondi Group

- International Paper Company

- Sappi Limited

- Oji Paper

- Graphic Packaging International Corporation

- Smurfit Kappa

- DS Smith

- Tetra Laval

- Rengo

- Metsa Group

Key Milestones in Middle East and Africa Paper Packaging Market Industry

- 2019: Increased investment in sustainable packaging technologies across GCC nations, driven by environmental awareness.

- 2020: Significant surge in demand for corrugated boxes due to the rapid growth of e-commerce amidst the pandemic.

- 2021: Major paper manufacturers announce expansion plans in North and East Africa, targeting growing consumer markets.

- 2022: Introduction of stricter regulations on single-use plastics in several African countries, boosting demand for paper alternatives.

- 2023: Key players invest in advanced printing and finishing capabilities to enhance the appeal of folding cartons.

- 2024: Consolidation activities observed with strategic acquisitions aimed at expanding market reach and product portfolios.

- 2025 (Estimated): Increased focus on developing specialized paper packaging for the growing pharmaceutical and healthcare sectors.

- 2026-2033 (Forecast): Continued innovation in biodegradable and compostable paper packaging materials.

Strategic Outlook for Middle East and Africa Paper Packaging Market Market

The strategic outlook for the Middle East and Africa paper packaging market is highly optimistic, driven by a combination of factors. The continued expansion of e-commerce and the growing middle class will sustain demand for efficient and versatile packaging solutions. A key growth accelerator will be the increasing adoption of sustainable and eco-friendly paper packaging, supported by both consumer preference and evolving regulatory landscapes. Strategic opportunities lie in investing in advanced manufacturing technologies, developing specialized packaging for high-growth sectors like pharmaceuticals and processed foods, and expanding into underserved African markets. Collaboration and partnerships will be crucial for navigating market complexities and capitalizing on the region's immense growth potential.

Middle East and Africa Paper Packaging Market Segmentation

-

1. Product

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Slotted Containers

- 1.4. Die Cut Container

- 1.5. Five Panel Folder Boxes

- 1.6. Setup Boxes

- 1.7. Other Product Types

-

2. End-User Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care and Home Care

- 2.4. Electrical Goods

- 2.5. Other End-user Industries

Middle East and Africa Paper Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Paper Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Paper Packaging Market

Middle East and Africa Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Strong Demand from the Food and Beverage Sector

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Slotted Containers

- 5.1.4. Die Cut Container

- 5.1.5. Five Panel Folder Boxes

- 5.1.6. Setup Boxes

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care and Home Care

- 5.2.4. Electrical Goods

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Metsa Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rengo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Laval

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Paper Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sappi Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oji Paper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graphic Packaging International Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smurfit Kappa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DS Smith

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Paper Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Paper Packaging Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Middle East and Africa Paper Packaging Market?

Key companies in the market include Amcor, Metsa Group*List Not Exhaustive, Rengo, Tetra Laval, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith.

3. What are the main segments of the Middle East and Africa Paper Packaging Market?

The market segments include Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 30539.4 million as of 2022.

5. What are some drivers contributing to market growth?

; Strong Demand from the Food and Beverage Sector.

6. What are the notable trends driving market growth?

Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging.

7. Are there any restraints impacting market growth?

; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence