Key Insights

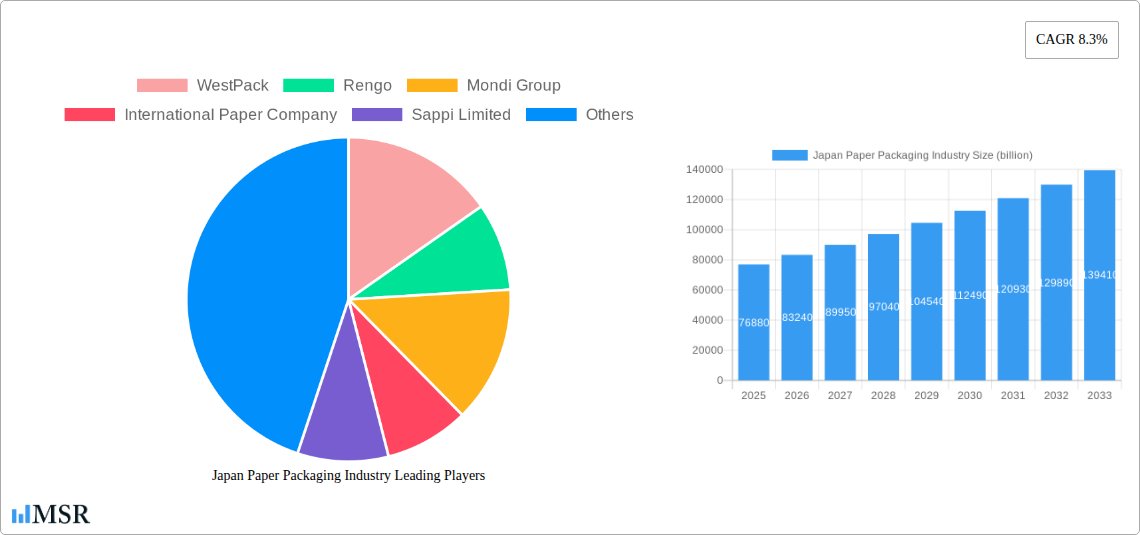

The Japan Paper Packaging Industry is poised for robust expansion, with a projected market size of USD 76.88 billion in 2025. This growth is fueled by a significant Compound Annual Growth Rate (CAGR) of 8.3%, indicating a dynamic and evolving market landscape. Key drivers include the increasing consumer demand for sustainable packaging solutions, a growing preference for paper-based alternatives over plastics, and the strong performance of end-user industries such as Food and Beverage, Personal Care, and Healthcare. The Food and Beverage sector, in particular, is a major contributor, driven by the need for safe, hygienic, and convenient packaging for a wide range of products. Similarly, the burgeoning e-commerce sector is further bolstering demand for efficient and protective paper packaging solutions, especially corrugated boards, which are essential for shipping and logistics.

Japan Paper Packaging Industry Market Size (In Billion)

The industry is experiencing several noteworthy trends, including advancements in paperboard technology, leading to lighter, stronger, and more customizable packaging options. Innovations in printing and finishing techniques are also enhancing the aesthetic appeal and brand visibility of paper packaging. Furthermore, there's a growing emphasis on the circular economy, with a focus on increasing the recyclability and compostability of paper packaging materials. While the market benefits from these positive drivers and trends, potential restraints include fluctuations in raw material prices, particularly for pulp and paper, and stringent environmental regulations that may necessitate significant investment in sustainable manufacturing processes. Despite these challenges, the Japan Paper Packaging Industry demonstrates a clear trajectory of sustained growth, driven by innovation and a strong commitment to environmental responsibility.

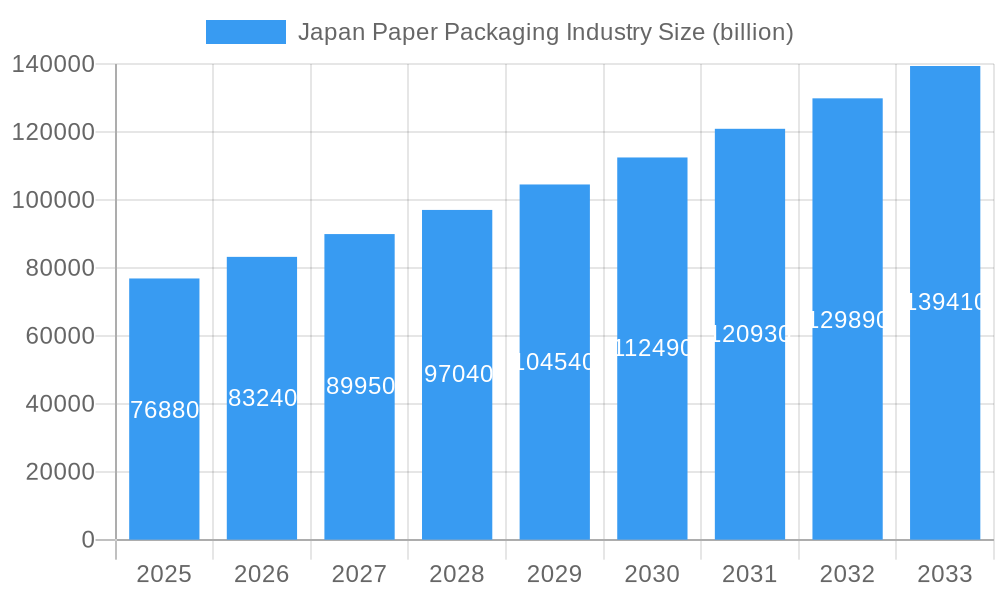

Japan Paper Packaging Industry Company Market Share

Japan Paper Packaging Industry Market Concentration & Dynamics

The Japan paper packaging industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share. Innovation ecosystems are robust, driven by a strong emphasis on sustainability, advanced material science, and functional packaging solutions. Regulatory frameworks, primarily focused on environmental protection, recycling mandates, and food safety standards, play a crucial role in shaping industry practices. Substitute products, such as plastics and flexible packaging materials, pose a constant challenge, necessitating continuous innovation in paper-based alternatives. End-user trends lean towards demand for eco-friendly, lightweight, and high-performance packaging, particularly in the food and beverage, personal care, and e-commerce sectors. Merger and acquisition (M&A) activities, though not as frequent as in some other global markets, are strategically driven, aiming to consolidate market share, acquire new technologies, and expand product portfolios. Key M&A deal counts are estimated to be in the range of 5-10 significant transactions annually within the broader Japanese packaging sector, with paper packaging being a key focus. Market share distribution sees major players like Rengo, Oji Paper, and Amcor PLC holding substantial portions, each estimated to control between 10% and 20% of the domestic market individually, depending on specific product segments.

Japan Paper Packaging Industry Industry Insights & Trends

The Japan paper packaging market is poised for significant growth, driven by a confluence of economic, technological, and societal factors. The estimated market size for the Japanese paper packaging industry is projected to reach approximately $25 billion in 2025, with a Compound Annual Growth Rate (CAGR) of around 4.5% projected for the forecast period of 2025-2033. This expansion is fueled by an escalating demand for sustainable packaging solutions, a direct response to increasing environmental consciousness among consumers and stringent government regulations promoting recyclability and reduced waste. The food and beverage sector, a cornerstone of the Japanese economy, continues to be a primary driver, with a growing preference for convenient, safe, and visually appealing packaging. The e-commerce boom has also significantly boosted the demand for corrugated and paperboard packaging, essential for shipping a vast array of goods. Technological disruptions are playing a pivotal role, with advancements in paper manufacturing processes leading to stronger, lighter, and more water-resistant paper packaging. Innovations such as bio-based coatings and integrated antimicrobial features are also gaining traction, particularly in sensitive sectors like healthcare and personal care. Evolving consumer behaviors, characterized by a heightened awareness of product provenance and a preference for brands demonstrating corporate social responsibility, are pushing manufacturers towards more transparent and eco-friendly packaging materials. The shift away from single-use plastics and the growing emphasis on a circular economy further solidify the position of paper packaging as a preferred choice. The historical period from 2019-2024 saw consistent growth, with market size estimated to have grown from $20 billion to $23 billion, setting a strong foundation for future expansion.

Key Markets & Segments Leading Japan Paper Packaging Industry

The Japanese paper packaging market demonstrates robust performance across several key product and end-user segments.

Dominant Product Segments:

- Corrugated Board: This segment is a leading force, driven by the relentless growth of e-commerce and the need for durable, cost-effective shipping solutions. Its versatility in handling various product sizes and weights makes it indispensable for logistics and retail distribution.

- Drivers: E-commerce expansion, increased domestic and international trade, demand for protective packaging.

- Paperboard: A significant contributor, paperboard packaging is favored for its aesthetic appeal and printability, making it ideal for consumer goods. Its use in folding cartons for food and beverage, personal care, and healthcare products solidifies its market dominance.

- Drivers: Brand differentiation, consumer appeal, growing demand for premium and specialty packaged goods.

- Container Board: Essential for producing corrugated board, this segment's performance is intrinsically linked to the growth of corrugated packaging. Its production and innovation are crucial for meeting the increasing demand for sturdy shipping containers.

- Drivers: Backbone of corrugated packaging production, supporting broader supply chain needs.

- Other Products: This encompasses specialized paper packaging solutions, including flexible paper packaging, labels, and decorative papers, catering to niche applications and specific consumer preferences.

- Drivers: Niche market demand, innovation in specialty applications.

- Corrugated Board: This segment is a leading force, driven by the relentless growth of e-commerce and the need for durable, cost-effective shipping solutions. Its versatility in handling various product sizes and weights makes it indispensable for logistics and retail distribution.

Dominant End-User Industries:

- Food and Beverage: This is the largest and most influential end-user industry for Japan's paper packaging market. The demand for safe, hygienic, and attractive packaging for a wide array of food and beverage products, from everyday staples to premium items, drives consistent growth. The segment benefits from Japan's strong culinary culture and high consumption rates.

- Drivers: High per capita consumption, demand for convenience, evolving dietary trends, stringent food safety regulations.

- Retail: The retail sector, encompassing both traditional brick-and-mortar stores and the rapidly expanding online retail space, is a major consumer of paper packaging. This includes packaging for in-store display, product protection, and e-commerce shipping.

- Drivers: E-commerce growth, omni-channel retail strategies, consumer purchasing habits.

- Personal Care: Driven by innovation in beauty products and hygiene items, the personal care industry relies heavily on paper packaging for its aesthetic appeal and perceived quality.

- Drivers: Growing demand for cosmetics and hygiene products, brand perception, product innovation.

- Home Care: Products like detergents, cleaning supplies, and household goods also contribute significantly to the demand for robust and functional paper packaging.

- Drivers: Consumer demand for household essentials, brand loyalty, functional packaging requirements.

- Healthcare: With an increasing focus on sterile and safe packaging, the healthcare sector is adopting paper-based solutions for pharmaceuticals, medical devices, and personal health products.

- Drivers: Need for sterile and secure packaging, regulatory compliance, increasing health consciousness.

- Food and Beverage: This is the largest and most influential end-user industry for Japan's paper packaging market. The demand for safe, hygienic, and attractive packaging for a wide array of food and beverage products, from everyday staples to premium items, drives consistent growth. The segment benefits from Japan's strong culinary culture and high consumption rates.

The dominance of these segments is a testament to Japan's advanced economy, sophisticated consumer base, and forward-thinking regulatory environment that prioritizes both economic development and environmental sustainability.

Japan Paper Packaging Industry Product Developments

Recent product developments in the Japan paper packaging industry highlight a strong focus on enhanced functionality and sustainability. Nippon Paper Industries' acquisition of SIAA antiviral processing certification for "NPI antiviral paper" marks a significant advancement, offering enhanced safety for applications like mask cases and notebooks. This innovation addresses growing consumer concerns about hygiene. Simultaneously, advancements in papermaking quality, exemplified by Rengo Co. Ltd's collaboration with AMETEK Surface Vision for upgraded production facilities, showcase a commitment to improving the intrinsic quality and performance of paper packaging materials. These developments are crucial for maintaining a competitive edge and meeting evolving market demands for innovative and reliable paper packaging solutions.

Challenges in the Japan Paper Packaging Industry Market

The Japan paper packaging industry faces several significant challenges that impact its growth trajectory.

- Rising Raw Material Costs: Fluctuations in the price of pulp and recycled fiber, the primary raw materials, can significantly affect profit margins.

- Intense Competition: The market experiences strong competition from both domestic and international players, as well as from alternative packaging materials like plastics.

- Environmental Regulations and Sustainability Pressures: While driving innovation, increasingly stringent recycling mandates and a global push for reduced carbon footprints require substantial investment in new technologies and processes.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of essential inputs and the efficient distribution of finished products.

Quantifiable impacts include potential profit margin erosion of 5-10% due to raw material price hikes and the necessity for capital expenditure of 15-25% on new sustainable technologies.

Forces Driving Japan Paper Packaging Industry Growth

Several powerful forces are propelling the growth of the Japan paper packaging industry.

- Growing Environmental Consciousness: A significant surge in consumer and corporate demand for sustainable and eco-friendly packaging solutions is a primary catalyst. This aligns with Japan's strong commitment to environmental protection and circular economy principles.

- E-commerce Expansion: The continuous growth of online retail fuels the demand for corrugated and paperboard packaging required for shipping and logistics.

- Technological Advancements: Innovations in paper manufacturing, including enhanced strength, water resistance, and printability, are expanding the application range of paper packaging.

- Government Support and Regulations: Favorable government policies promoting recycling, waste reduction, and the use of renewable materials provide a supportive ecosystem for the industry.

Challenges in the Japan Paper Packaging Industry Market

The long-term growth of the Japan paper packaging industry hinges on addressing persistent challenges and capitalizing on emerging trends.

- Competition from Advanced Materials: The industry must continuously innovate to counter the performance advantages of alternative materials like advanced plastics and composites, which often offer superior barrier properties or lighter weight.

- Investment in Recycling Infrastructure: Enhancing and expanding efficient collection, sorting, and reprocessing infrastructure for paper packaging is crucial for achieving higher recycling rates and supporting a truly circular economy.

- Global Economic Volatility: Unpredictable global economic shifts can impact consumer spending and industrial demand, indirectly affecting the paper packaging market.

Emerging Opportunities in Japan Paper Packaging Industry

The Japan paper packaging industry is ripe with emerging opportunities, driven by evolving consumer preferences and technological breakthroughs.

- Functional Packaging Innovations: Development of smart packaging, including those with embedded sensors for product freshness monitoring or tamper-evident features, presents a significant growth avenue.

- Bio-based and Compostable Materials: Increased investment in research and development of fully biodegradable and compostable paper packaging will cater to the growing demand for truly sustainable solutions.

- Customization and Personalization: Leveraging digital printing technologies to offer highly customized and personalized packaging for niche markets and premium products.

- Expansion into New Applications: Exploring and developing paper packaging solutions for sectors beyond traditional uses, such as electronics and specialized industrial goods.

Leading Players in the Japan Paper Packaging Industry Sector

- WestPack

- Rengo

- Mondi Group

- International Paper Company

- Sappi Limited

- Oji Paper

- Graphic Packaging International Corporation

- Smurfit Kappa

- DS Smith

- Amcor PLC

- Metsa Group

Key Milestones in Japan Paper Packaging Industry Industry

- December 2021: Nippon Paper Industries, Ltd. obtained SIAA antiviral processing certification for "NPI antiviral paper," marking a significant advancement in hygienic packaging solutions. This certification is the first in the category of "Inorganic materials such as paper and making."

- November 2021: AMETEK Surface Vision partnered with Rengo Co. Ltd to enhance papermaking quality through the installation of its SmartAdvisor system with 12 cameras and the application of the SmartSync tool, integrating advanced video monitoring and quality inspection capabilities.

Strategic Outlook for Japan Paper Packaging Industry Market

The strategic outlook for the Japan paper packaging industry is one of robust expansion, underpinned by a persistent drive towards sustainability and innovation. Key growth accelerators include the increasing adoption of advanced recycled content, the development of high-performance barrier coatings to rival plastics, and the integration of smart packaging technologies that enhance product traceability and consumer engagement. Furthermore, strategic partnerships and collaborations, both domestically and internationally, will be crucial for expanding market reach and accessing cutting-edge research and development. The industry is well-positioned to capitalize on the global shift towards a circular economy, with a significant future market potential driven by stringent environmental regulations and evolving consumer demands for eco-conscious products.

Japan Paper Packaging Industry Segmentation

-

1. Product

- 1.1. Paperboard

- 1.2. Container Board

- 1.3. Corrugated Board

- 1.4. Other Products

-

2. End User Industry

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Home Care

- 2.4. Healthcare

- 2.5. Retail

- 2.6. Other Industry Verticals

Japan Paper Packaging Industry Segmentation By Geography

- 1. Japan

Japan Paper Packaging Industry Regional Market Share

Geographic Coverage of Japan Paper Packaging Industry

Japan Paper Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism

- 3.3. Market Restrains

- 3.3.1. Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries

- 3.4. Market Trends

- 3.4.1. The Processed Food and Beverage Industry to Drive the Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Paper Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Paperboard

- 5.1.2. Container Board

- 5.1.3. Corrugated Board

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Home Care

- 5.2.4. Healthcare

- 5.2.5. Retail

- 5.2.6. Other Industry Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestPack

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rengo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mondi Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 International Paper Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sappi Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji Paper

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Graphic Packaging International Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smurfit Kappa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DS Smith

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Amcor PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Metsa Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 WestPack

List of Figures

- Figure 1: Japan Paper Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Paper Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Paper Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Japan Paper Packaging Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 3: Japan Paper Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Paper Packaging Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Japan Paper Packaging Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 6: Japan Paper Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Paper Packaging Industry?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the Japan Paper Packaging Industry?

Key companies in the market include WestPack, Rengo, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith, Amcor PLC*List Not Exhaustive, Metsa Group.

3. What are the main segments of the Japan Paper Packaging Industry?

The market segments include Product, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 76.88 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Usage of Sustainable and Bio-Degradable Materials such as Paperboard; Demand for Travel and Retail Chains Due to Increase in Tourism.

6. What are the notable trends driving market growth?

The Processed Food and Beverage Industry to Drive the Demand in the Market.

7. Are there any restraints impacting market growth?

Reluctance in Packaging Heavy and Bulk Products; High Initial and Operating Costs of Machineries.

8. Can you provide examples of recent developments in the market?

December 2021: Nippon Paper Industries, Ltd. has obtained SIAA antiviral processing certification established by the Antibacterial Product Technology Council for "NPI antiviral paper." This is the first acquisition in the category of "Inorganic materials such as paper and making. Since this product can be printed and processed in the same way as ordinary printing paper, it is a product that can provide safety and security in various applications. It was launched in September 2020 and is used in mask cases, notebooks, envelopes, etc.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Paper Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Paper Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Paper Packaging Industry?

To stay informed about further developments, trends, and reports in the Japan Paper Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence