Key Insights

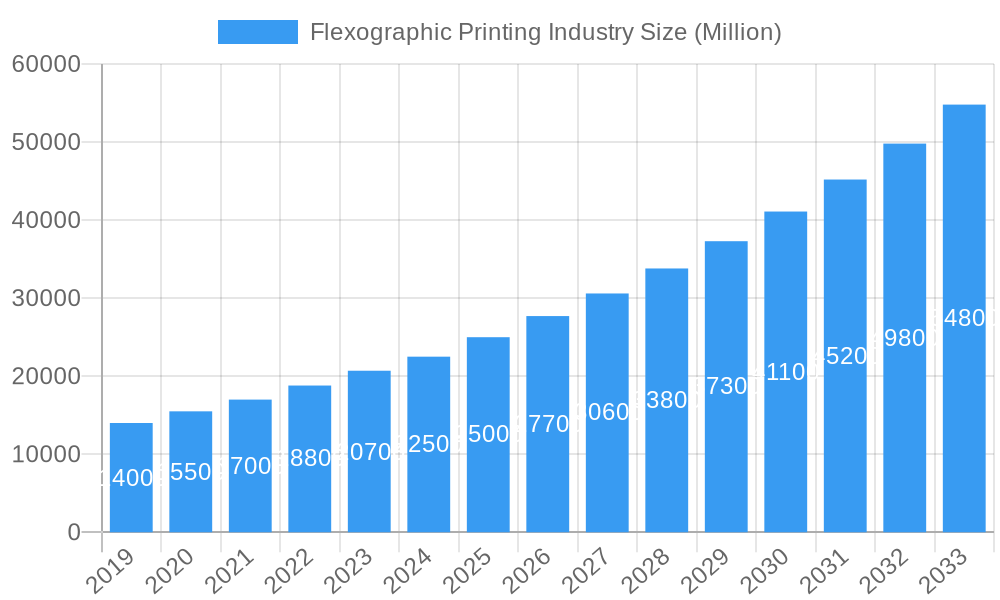

The global flexographic printing market is experiencing robust expansion, projected to reach a substantial market size of approximately $22,500 million by 2025. This growth is propelled by a compelling Compound Annual Growth Rate (CAGR) of 11.30%, indicating sustained demand and innovation within the industry. Key drivers fueling this surge include the increasing demand for sustainable packaging solutions, the need for high-quality, cost-effective printing across diverse industries, and advancements in flexographic printing technology that enhance efficiency and versatility. The market's dynamism is further underscored by trends such as the adoption of water-based and UV-curable inks, the integration of digital technologies for enhanced workflow management, and the rising popularity of customized and short-run packaging. These factors collectively contribute to a vibrant market landscape poised for significant value creation and market penetration.

Flexographic Printing Industry Market Size (In Billion)

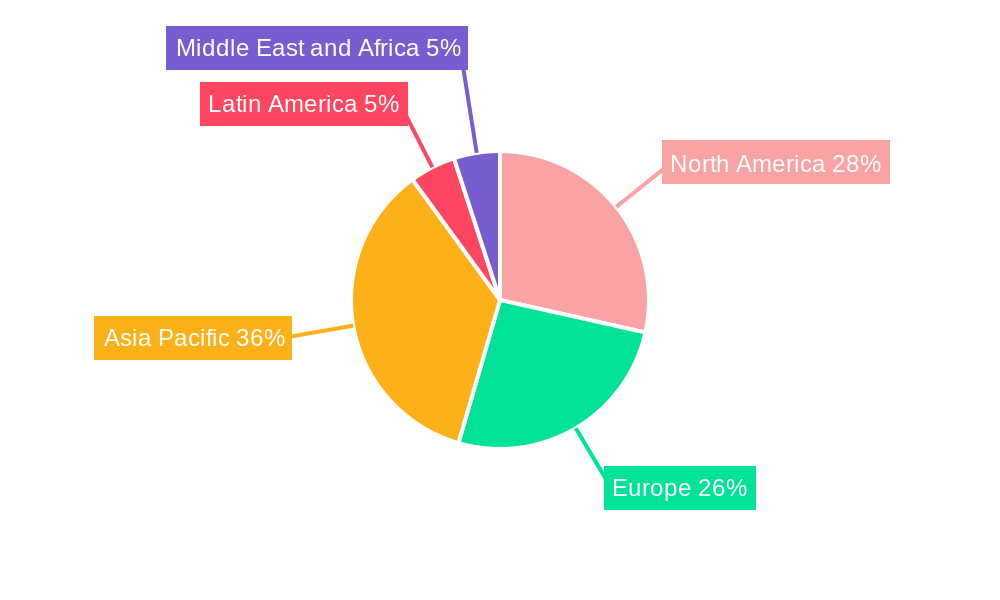

While the flexographic printing industry demonstrates considerable growth potential, certain restraints need to be navigated. The initial investment cost for advanced flexographic printing machinery can be a barrier for smaller enterprises, and the need for skilled labor to operate and maintain these sophisticated systems presents a challenge. However, the industry is actively addressing these through technological innovations that streamline operations and reduce complexity. The market is segmented across various materials like paper, plastic films, metallic films, and corrugated cardboard, catering to a broad spectrum of end-user industries including pharmaceuticals, food & beverage, cosmetics, consumer electronics, logistics, and print media. Regions like North America and Europe are expected to maintain significant market shares due to established infrastructure and high consumer demand, while the Asia Pacific region is anticipated to exhibit the fastest growth due to rapid industrialization and a burgeoning middle class driving packaging consumption.

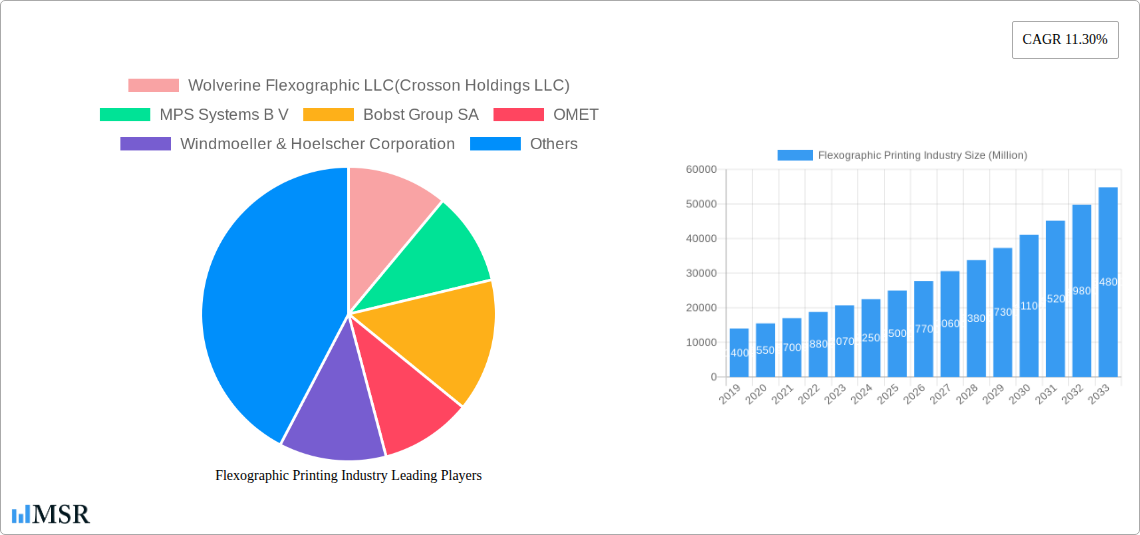

Flexographic Printing Industry Company Market Share

Flexographic Printing Industry Market Report: Driving Innovation and Sustainable Growth (2019-2033)

Report Description:

Dive deep into the dynamic world of flexographic printing, a cornerstone of modern packaging and label production. This comprehensive market research report offers unparalleled insights into the flexographic printing industry, analyzing its intricate market concentration, evolving dynamics, and robust growth trajectory from 2019 to 2033. Leveraging a study period that spans historical performance and a forward-looking forecast, this report provides critical intelligence for packaging converters, brand owners, equipment manufacturers, and material suppliers within the pharmaceutical, food & beverage, cosmetics, consumer electronics, logistics, and print media sectors.

Explore the dominance of key materials like plastic films, corrugated cardboard, and metallic films, and understand their impact on various end-user industries. Uncover groundbreaking industry developments, including advancements in digital flexo printing, sustainable ink technologies, and automation, that are reshaping the market landscape. With a base year of 2025 and an estimated year also of 2025, this report offers a precise snapshot of the present and a reliable projection of future trends. We meticulously analyze market size, CAGR, key market drivers, emerging opportunities, and the strategic outlook for this vital industry. Key players such as Wolverine Flexographic LLC (Crosson Holdings LLC), MPS Systems B V, Bobst Group SA, OMET, Windmoeller & Hoelscher Corporation, Rotatek, Orient Sogyo Co Ltd, Edale UK Limited, Koenig & Bauer AG, Heidelberger Druckmaschinen AG, Comexi, Mark Andy Inc, and Star Flex International are profiled, alongside critical milestones shaping the flexographic printing market. Gain actionable intelligence to navigate challenges, capitalize on opportunities, and drive innovation in the global flexographic printing sector.

Flexographic Printing Industry Market Concentration & Dynamics

The flexographic printing industry exhibits a moderate to high market concentration, with a few dominant players holding significant market share in the printing press and flexo plate segments. The market share is estimated to be around 25 Million for the top 5 companies in 2025. Innovation ecosystems are thriving, driven by investments in research and development, particularly in areas such as high-definition flexography, water-based inks, and extended color gamut (ECG) printing. Regulatory frameworks, especially concerning food packaging safety and environmental sustainability, are increasingly influential, pushing manufacturers towards compliant and eco-friendly solutions. The substitute product landscape is relatively stable, with digital printing offering competition primarily for shorter runs and variable data applications, while gravure printing remains a strong contender for very long runs of high-quality packaging. End-user trends are heavily skewed towards demand for sustainable packaging solutions, extended shelf life, and enhanced brand appeal, directly impacting flexographic printing requirements. Mergers and acquisitions (M&A) activities are notable, with an estimated 15 M&A deals in the historical period 2019-2024, signifying consolidation and strategic expansion among leading entities.

Flexographic Printing Industry Industry Insights & Trends

The flexographic printing industry is poised for substantial growth, projected to reach a global market size of 750 Million by 2033, with a compound annual growth rate (CAGR) of 6.5% during the forecast period of 2025–2033. This robust expansion is fueled by several key market growth drivers. The escalating global demand for packaged goods, particularly within the food & beverage and pharmaceutical sectors, serves as a primary catalyst. As populations grow and urbanization continues, the need for efficiently produced, safe, and visually appealing packaging intensifies, directly benefiting flexography's versatility and cost-effectiveness for high-volume production.

Technological disruptions are actively reshaping the industry. The advent and refinement of digital flexo printing technologies, including advanced CTP (Computer-to-Plate) systems and high-resolution flexo plates, have significantly enhanced print quality, enabling finer detail, smoother vignettes, and vibrant color reproduction. This has allowed flexography to compete more effectively with other printing methods for premium applications. Furthermore, the development of eco-friendly and sustainable inks, such as water-based and UV-LED curable inks, is a major trend. These innovations address growing environmental concerns and regulatory pressures, making flexography a more attractive option for brands committed to sustainability. The increasing adoption of automation and Industry 4.0 principles within flexographic printing workflows, including advanced press controls, inline inspection systems, and data analytics, is improving operational efficiency, reducing waste, and enhancing overall productivity.

Evolving consumer behaviors are also playing a pivotal role. Consumers are increasingly conscious of the environmental impact of their purchases and are actively seeking products with sustainable packaging. This trend is driving brand owners to invest in flexible packaging solutions that are recyclable, compostable, or made from recycled content, areas where flexography excels. Moreover, the desire for visually appealing and informative packaging that stands out on crowded retail shelves is paramount. Flexography's ability to deliver high-quality graphics, vibrant colors, and special effects makes it indispensable for brand differentiation and consumer engagement. The growth of e-commerce also contributes, as durable and protective packaging is essential for product integrity during transit, and flexography is a cost-effective solution for producing such packaging materials at scale.

Key Markets & Segments Leading Flexographic Printing Industry

The Asia Pacific region stands as the dominant market for flexographic printing, driven by rapid economic growth, a burgeoning middle class, and significant investments in manufacturing and infrastructure. Countries like China, India, and Southeast Asian nations are experiencing substantial increases in demand for packaged goods, which directly translates to a higher need for flexographic printing services.

Within the material segments, Plastic Films are leading the charge, constituting an estimated 40% of the total flexographic printing market share in 2025. This dominance is attributed to their versatility, barrier properties, and cost-effectiveness for a wide range of applications, including food packaging, flexible pouches, and labels.

- Drivers for Plastic Films Dominance:

- Growing Food & Beverage Industry: The massive and expanding global food and beverage sector relies heavily on plastic films for packaging due to their ability to extend shelf life and protect products.

- Consumer Electronics Packaging: The increasing production and consumption of consumer electronics necessitate durable and visually appealing packaging, where plastic films are extensively used.

- Cosmetics and Personal Care: The visually driven cosmetics industry utilizes plastic films for their aesthetic appeal, printability, and protective qualities.

- Cost-Effectiveness: Compared to some other packaging materials, plastic films offer a favorable cost-to-performance ratio for high-volume production.

Corrugated Cardboard is another significant segment, particularly crucial for the logistics and consumer electronics industries, accounting for approximately 30% of the market share in 2025. Its strength, recyclability, and printability make it ideal for shipping cartons, retail-ready packaging, and e-commerce solutions.

- Drivers for Corrugated Cardboard Dominance:

- E-commerce Boom: The exponential growth of online retail has dramatically increased the demand for sturdy and reliable shipping containers, a core application for corrugated cardboard.

- Logistics and Supply Chain Efficiency: Corrugated boxes are essential for the efficient movement and storage of goods across global supply chains.

- Sustainability Initiatives: The high recyclability and potential for using recycled content in corrugated board align with growing environmental mandates and consumer preferences.

- Retail-Ready Packaging: Brands are increasingly opting for corrugated displays and packaging that can be directly placed on store shelves, enhancing product visibility and reducing in-store labor.

The Food & Beverage end-user industry represents the largest consumer of flexographic printing services, estimated to account for 35% of the market in 2025. This sector's constant need for high-volume, cost-effective, and visually engaging packaging for a diverse range of products drives the demand for flexographic capabilities.

- Drivers for Food & Beverage Dominance:

- Mass Consumer Appeal: The universal need for food and beverages drives consistent high demand for packaging solutions.

- Shelf Life and Product Protection: Flexographic printed packaging, particularly on plastic films and laminated materials, plays a critical role in preserving food quality and extending shelf life.

- Brand Differentiation and Marketing: In a competitive market, vibrant and informative flexographic printing is essential for brand recognition and attracting consumer attention.

- Regulatory Compliance: Packaging for food and beverages must meet stringent safety and labeling regulations, which flexographic printing can effectively address.

The Pharmaceutical industry also represents a significant and growing segment, estimated at 15% of the market share in 2025. This sector demands high-quality, secure, and tamper-evident packaging, where the precision and consistency of flexography are highly valued.

- Drivers for Pharmaceutical Dominance:

- Patient Safety and Security: Accurate labeling and secure packaging are paramount for pharmaceuticals, and flexography ensures high-quality, consistent printing.

- Brand Protection: Anti-counterfeiting features and high-fidelity graphics are crucial for protecting pharmaceutical brands.

- Regulatory Requirements: The pharmaceutical industry faces strict regulations regarding packaging, which flexographic printing can meet with its precision and consistency.

- Growth in Emerging Markets: Increasing healthcare access and demand for pharmaceuticals in emerging economies are driving packaging needs.

Metallic Films are a niche but growing segment, particularly for the Cosmetics and Pharmaceutical industries, offering premium aesthetics and barrier properties. While smaller in volume, its high-value applications contribute significantly to innovation and market growth.

Flexographic Printing Industry Product Developments

Recent product developments in the flexographic printing industry are centered around enhancing sustainability, improving print quality, and boosting operational efficiency. Innovations include the widespread adoption of water-based and UV-LED curable inks that offer reduced VOC emissions and faster curing times. Furthermore, the development of advanced flexographic plates, such as high-definition plates and digital flexo plates, enables finer print details, smoother tonal transitions, and expanded color gamuts (ECG), rivaling the quality of offset and gravure printing. Automation is also a key focus, with new press designs incorporating intelligent color management systems, inline defect detection, and automated job setup, leading to reduced waste and faster turnaround times. These advancements are making flexography a more versatile and competitive printing technology across various substrates and applications.

Challenges in the Flexographic Printing Industry Market

The flexographic printing industry faces several significant challenges that can impact its growth trajectory. The increasing cost of raw materials, including inks, solvents, and substrates, coupled with fluctuating energy prices, puts pressure on profit margins. Intense competition from digital printing technologies, especially for short-run jobs and variable data printing, requires flexo printers to continuously innovate and optimize their operations. Furthermore, the industry is subject to evolving environmental regulations concerning waste disposal, emissions, and the use of certain chemicals, necessitating ongoing investment in compliant technologies and processes. Supply chain disruptions, as witnessed in recent years, can also lead to material shortages and delayed production schedules.

Forces Driving Flexographic Printing Industry Growth

Several key forces are driving the growth of the flexographic printing industry. The surging demand for flexible packaging across the food & beverage, pharmaceutical, and cosmetics sectors is a primary driver, owing to its ability to extend shelf life, protect products, and enhance consumer appeal. Advancements in digital flexo technology, including improved plate making and ink formulations, are enabling higher print quality and faster job changeovers, making flexography more competitive. The growing global emphasis on sustainable packaging solutions is also a significant factor, as flexographic printing can efficiently utilize eco-friendly inks and substrates. Furthermore, the expansion of e-commerce necessitates robust and cost-effective packaging solutions for shipping, an area where flexography excels.

Challenges in the Flexographic Printing Industry Market

Long-term growth catalysts for the flexographic printing industry lie in its continuous adaptation to evolving market demands. The ongoing development and adoption of advanced sustainable printing technologies, such as biodegradable inks and recyclable substrates, will be crucial for maintaining relevance and meeting regulatory requirements. Further automation and integration of Industry 4.0 principles within flexographic workflows, leading to enhanced efficiency, reduced waste, and improved data analytics, will solidify its competitive edge. Strategic partnerships between ink manufacturers, plate suppliers, and press builders will foster collaborative innovation, driving the development of integrated solutions. Expanding applications into new market segments and geographies, particularly in developing economies, will also serve as a significant growth catalyst.

Emerging Opportunities in Flexographic Printing Industry

Emerging opportunities within the flexographic printing industry are ripe for exploration. The growing demand for personalized and short-run packaging is creating a niche for hybrid printing solutions that combine the strengths of flexography with digital printing capabilities. The increasing focus on circular economy principles presents an opportunity for flexo printers to innovate with recyclable and compostable materials, aligning with consumer and regulatory preferences. Furthermore, the expansion of the pharmaceutical and medical device packaging sector, with its stringent quality and safety requirements, offers a substantial growth avenue for high-precision flexographic printing. The development of smart packaging solutions that integrate RFID tags or sensors, enabled by flexographic printing, also represents a burgeoning area of opportunity.

Leading Players in the Flexographic Printing Industry Sector

- Wolverine Flexographic LLC (Crosson Holdings LLC)

- MPS Systems B V

- Bobst Group SA

- OMET

- Windmoeller & Hoelscher Corporation

- Rotatek

- Orient Sogyo Co Ltd

- Edale UK Limited

- Koenig & Bauer AG

- Heidelberger Druckmaschinen AG

- Comexi

- Mark Andy Inc

- Star Flex International

Key Milestones in Flexographic Printing Industry Industry

- 2019: Increased adoption of Extended Color Gamut (ECG) printing workflows in packaging, enabling brands to achieve consistent color reproduction across different substrates and print runs.

- 2020: Significant advancements in water-based ink formulations, offering improved printability and reduced environmental impact, gaining traction in food-contact applications.

- 2021: Introduction of new high-definition flexo plates with finer anilox engraving and improved ink transfer, leading to enhanced print quality and detail.

- 2022: Greater integration of automation and inline quality control systems on flexographic presses, improving efficiency and reducing waste.

- 2023: Increased focus on sustainable substrates and inks, with a rise in demand for compostable and recyclable flexo-printed packaging solutions.

- 2024: Growing interest in hybrid printing solutions, combining flexo and digital technologies to offer greater flexibility and customization for brand owners.

Strategic Outlook for Flexographic Printing Industry Market

The strategic outlook for the flexographic printing industry is characterized by a strong emphasis on innovation, sustainability, and digital integration. Growth accelerators will include continued investment in high-definition flexo technologies and expanded color gamut printing to meet the evolving demands for premium packaging. The industry's ability to adapt to and lead in the development of eco-friendly inks and substrates will be paramount for long-term success. Strategic partnerships and collaborations will be key to developing comprehensive solutions that address the complex needs of brand owners. Furthermore, the seamless integration of digital workflows and automation will enhance operational efficiencies and unlock new market opportunities, ensuring flexography remains a vital and competitive force in the global printing landscape.

Flexographic Printing Industry Segmentation

-

1. Material

- 1.1. Paper

- 1.2. Plastic Films

- 1.3. Metallic Films

- 1.4. Corrugated Cardboard

-

2. End User Industry

- 2.1. Pharmaceutical

- 2.2. Food & Beverage

- 2.3. Cosmetics

- 2.4. Consumer Electronics

- 2.5. Logistics

- 2.6. Print Media

Flexographic Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Flexographic Printing Industry Regional Market Share

Geographic Coverage of Flexographic Printing Industry

Flexographic Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Need for High Production Speeds

- 3.3. Market Restrains

- 3.3.1. ; Higher initial setup cost

- 3.4. Market Trends

- 3.4.1. Food & Beverages is Expected to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper

- 5.1.2. Plastic Films

- 5.1.3. Metallic Films

- 5.1.4. Corrugated Cardboard

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Pharmaceutical

- 5.2.2. Food & Beverage

- 5.2.3. Cosmetics

- 5.2.4. Consumer Electronics

- 5.2.5. Logistics

- 5.2.6. Print Media

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paper

- 6.1.2. Plastic Films

- 6.1.3. Metallic Films

- 6.1.4. Corrugated Cardboard

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Pharmaceutical

- 6.2.2. Food & Beverage

- 6.2.3. Cosmetics

- 6.2.4. Consumer Electronics

- 6.2.5. Logistics

- 6.2.6. Print Media

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paper

- 7.1.2. Plastic Films

- 7.1.3. Metallic Films

- 7.1.4. Corrugated Cardboard

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Pharmaceutical

- 7.2.2. Food & Beverage

- 7.2.3. Cosmetics

- 7.2.4. Consumer Electronics

- 7.2.5. Logistics

- 7.2.6. Print Media

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paper

- 8.1.2. Plastic Films

- 8.1.3. Metallic Films

- 8.1.4. Corrugated Cardboard

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Pharmaceutical

- 8.2.2. Food & Beverage

- 8.2.3. Cosmetics

- 8.2.4. Consumer Electronics

- 8.2.5. Logistics

- 8.2.6. Print Media

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Latin America Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paper

- 9.1.2. Plastic Films

- 9.1.3. Metallic Films

- 9.1.4. Corrugated Cardboard

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Pharmaceutical

- 9.2.2. Food & Beverage

- 9.2.3. Cosmetics

- 9.2.4. Consumer Electronics

- 9.2.5. Logistics

- 9.2.6. Print Media

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Flexographic Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Paper

- 10.1.2. Plastic Films

- 10.1.3. Metallic Films

- 10.1.4. Corrugated Cardboard

- 10.2. Market Analysis, Insights and Forecast - by End User Industry

- 10.2.1. Pharmaceutical

- 10.2.2. Food & Beverage

- 10.2.3. Cosmetics

- 10.2.4. Consumer Electronics

- 10.2.5. Logistics

- 10.2.6. Print Media

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Wolverine Flexographic LLC(Crosson Holdings LLC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MPS Systems B V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bobst Group SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 OMET

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Windmoeller & Hoelscher Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rotatek

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Orient Sogyo Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Edale UK Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koenig & Bauer AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Heidelberger Druckmaschinen AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Comexi

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mark Andy Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Star Flex International

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Wolverine Flexographic LLC(Crosson Holdings LLC)

List of Figures

- Figure 1: Global Flexographic Printing Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Flexographic Printing Industry Revenue (undefined), by Material 2025 & 2033

- Figure 3: North America Flexographic Printing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Flexographic Printing Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 5: North America Flexographic Printing Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: North America Flexographic Printing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Flexographic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Flexographic Printing Industry Revenue (undefined), by Material 2025 & 2033

- Figure 9: Europe Flexographic Printing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Flexographic Printing Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 11: Europe Flexographic Printing Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Flexographic Printing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Flexographic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Flexographic Printing Industry Revenue (undefined), by Material 2025 & 2033

- Figure 15: Asia Pacific Flexographic Printing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Flexographic Printing Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 17: Asia Pacific Flexographic Printing Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: Asia Pacific Flexographic Printing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Flexographic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Flexographic Printing Industry Revenue (undefined), by Material 2025 & 2033

- Figure 21: Latin America Flexographic Printing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 22: Latin America Flexographic Printing Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 23: Latin America Flexographic Printing Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: Latin America Flexographic Printing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Flexographic Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Flexographic Printing Industry Revenue (undefined), by Material 2025 & 2033

- Figure 27: Middle East and Africa Flexographic Printing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Flexographic Printing Industry Revenue (undefined), by End User Industry 2025 & 2033

- Figure 29: Middle East and Africa Flexographic Printing Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 30: Middle East and Africa Flexographic Printing Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Flexographic Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 3: Global Flexographic Printing Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 5: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 6: Global Flexographic Printing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 9: Global Flexographic Printing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 11: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 12: Global Flexographic Printing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 14: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 15: Global Flexographic Printing Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Flexographic Printing Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 17: Global Flexographic Printing Industry Revenue undefined Forecast, by End User Industry 2020 & 2033

- Table 18: Global Flexographic Printing Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexographic Printing Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Flexographic Printing Industry?

Key companies in the market include Wolverine Flexographic LLC(Crosson Holdings LLC), MPS Systems B V, Bobst Group SA, OMET, Windmoeller & Hoelscher Corporation, Rotatek, Orient Sogyo Co Ltd, Edale UK Limited, Koenig & Bauer AG, Heidelberger Druckmaschinen AG, Comexi, Mark Andy Inc, Star Flex International.

3. What are the main segments of the Flexographic Printing Industry?

The market segments include Material, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Need for High Production Speeds.

6. What are the notable trends driving market growth?

Food & Beverages is Expected to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

; Higher initial setup cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexographic Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexographic Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexographic Printing Industry?

To stay informed about further developments, trends, and reports in the Flexographic Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence